The fall and fall of Air Deccan - Orient Aviation

The fall and fall of Air Deccan - Orient Aviation

The fall and fall of Air Deccan - Orient Aviation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

October 2008<br />

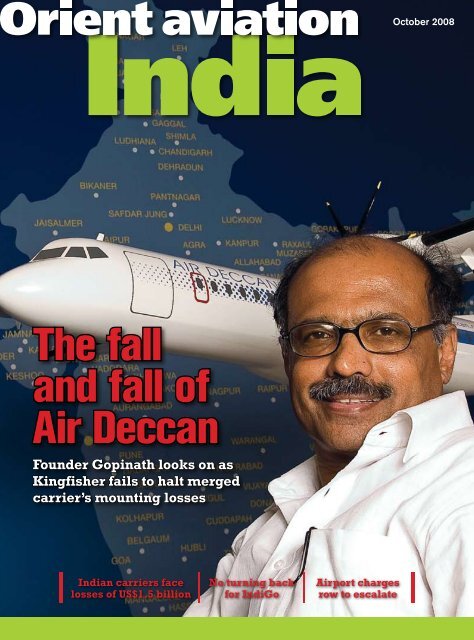

<strong>The</strong> <strong>fall</strong><br />

<strong>and</strong> <strong>fall</strong> <strong>of</strong><br />

<strong>Air</strong> <strong>Deccan</strong><br />

Founder Gopinath looks on as<br />

Kingfisher fails to halt merged<br />

carrier’s mounting losses<br />

Indian carriers face<br />

losses <strong>of</strong> US$1.5 billion<br />

No turning back<br />

for IndiGo<br />

<strong>Air</strong>port charges<br />

row to escalate

comment<br />

Chickens coming home to roost<br />

As the director general <strong>and</strong> CEO <strong>of</strong> the<br />

International <strong>Air</strong> Transport Association<br />

(IATA), Giovanni Bisignani, issued a grim<br />

warning for Indian aviation in September, three<br />

carriers announced substantial staff cuts.<br />

Mumbai-based low-cost carrier, Go <strong>Air</strong>, was the first to take<br />

action. A total <strong>of</strong> 150 staff have been re-trenched by the airline,<br />

including seven senior level executives, since June this year.<br />

JetLite, the wholly-owned subsidiary <strong>of</strong> Jet <strong>Air</strong>ways, has<br />

announced intentions <strong>of</strong> laying <strong>of</strong>f one third <strong>of</strong> its 2,300 staff,<br />

mostly former Sahara <strong>Air</strong>lines employees, the carrier Jet<br />

bought in 2006.<br />

Meanwhile, Kingfisher <strong>Air</strong>lines (KFA), which last year<br />

acquired <strong>and</strong> merged with <strong>Air</strong> <strong>Deccan</strong> has <strong>of</strong>fered severance<br />

packages to 300 <strong>of</strong> its <strong>Deccan</strong> employees. Sources say many<br />

more <strong>of</strong> the 3,100-plus <strong>Deccan</strong> staff - the carrier has been<br />

renamed Kingfisher Red - are expected to follow in coming<br />

months.<br />

This does not bode well for the future <strong>of</strong> Indian aviation.<br />

Bisignani said the global crisis, resulting from high oil prices<br />

<strong>and</strong> declining traffic, was hitting India hard.<br />

He said growth had slowed from 33% in 2007 to 7.5% for<br />

the first six months <strong>of</strong> this year. <strong>The</strong> last two months had seen<br />

negative growth. Indian carriers were facing losses <strong>of</strong> US$1.5<br />

billion in 2008, the largest outside the U.S.<br />

<strong>The</strong> IATA chief said reducing costs, improving infrastructure<br />

<strong>and</strong> adopting global st<strong>and</strong>ards were priorities for<br />

India. He pointed out it was 58% more expensive to buy fuel<br />

for domestic flights in Mumbai than it was for international<br />

flights in Singapore. “Excise duties, throughput fees charged<br />

by airport operators <strong>and</strong> state taxes <strong>of</strong> up to 30% for domestic<br />

flights result in a cost structure that cannot support a competitive<br />

industry,” he said.<br />

<strong>The</strong>se points are well known by the airlines, but up to now<br />

too little has been done elsewhere to redress the balance. Let’s<br />

hope the recently announced US$1 billion rescue package by<br />

government, which could include cuts in airport charges <strong>and</strong><br />

excise duty on fuel, is put into operation soon <strong>and</strong> is not too<br />

little too late.<br />

Bisignani said India’s decision-making is too slow. It’s true.<br />

Our airlines have been dem<strong>and</strong>ing cuts in taxes for way too<br />

long. <strong>The</strong> chickens are now coming home to roost. <strong>The</strong> question<br />

is: how many more redundancies or failed airlines will it take<br />

before India’s airline industry gets up to speed. ■<br />

ANJULI BHARGAVA<br />

Contributing Editor<br />

CONTENTS<br />

6 Relief, but the red ink still flows<br />

OA INDIA<br />

10 <strong>Air</strong> <strong>Deccan</strong>: the lost dream<br />

14 No turning back for IndiGo<br />

18 <strong>Air</strong>port charges row to escalate<br />

20 At last, some order at Delhi <strong>Air</strong>port<br />

22 India finds experienced home-grown<br />

pilots in short supply<br />

PUBLISHED BY<br />

WILSON PRESS HK LTD<br />

GPO Box 11435 Hong Kong<br />

Tel: Editorial (852) 2865 1013<br />

Fax: Editorial (852) 2865 3966<br />

Chief Executive<br />

Barry Grindrod<br />

E-mail orientav@netvigator.com<br />

october 2008 ORIENT AVIATION INDIA

main story<br />

As the oil price <strong>fall</strong>s its ….<br />

Relief, but the<br />

red ink still flows<br />

By Anjuli Bhargava<br />

As oi l p r ic e s<br />

climbed down<br />

marginally in<br />

Se ptember f rom t hei r<br />

incredibly high highs, one<br />

could almost hear the collective sigh <strong>of</strong> relief<br />

heaved by the Indian aviation industry.<br />

Things may not have changed dramatically,<br />

but there is some respite from what<br />

seemed an endless increase in fuel prices<br />

<strong>and</strong> a relentless rise in their financial losses<br />

week-on-week for the carriers.<br />

While airline CEOs are not yet uncorking<br />

the champagne - domestic carriers face losses<br />

to the tune <strong>of</strong> US$1.5 billion in the current<br />

financial year - there’s little doubt the arrest<br />

in oil prices has lightened the load on many<br />

a shoulder.<br />

All this, however, is not yet reflecting in<br />

fares on the domestic sectors. “<strong>The</strong> <strong>fall</strong> is too<br />

little as yet. I would say for airlines to feel any<br />

sense <strong>of</strong> real relief, prices must <strong>fall</strong> consistently<br />

for two or three months,” said Bruce<br />

Ashby, the CEO <strong>of</strong> IndiGo <strong>Air</strong>lines, which<br />

according to newspaper reports last week,<br />

overtook erstwhile <strong>Air</strong> <strong>Deccan</strong> to become the<br />

largest low-cost carrier in India.<br />

Ashby said that since September is <strong>of</strong>f<br />

peak season anyway, many airlines want<br />

to see what route oil prices take before they<br />

change their pricing strategies. “However, I<br />

don’t think it’s credible to say that fares will<br />

not <strong>fall</strong> if oil prices stay contained. <strong>The</strong>y<br />

certainly will in due course,” he added.<br />

Not only are fares high, it is not very clear<br />

what kind <strong>of</strong> pricing strategies airlines have<br />

devised. Said Prasanto K. Roy, a gold card<br />

member on Jet <strong>Air</strong>ways <strong>and</strong> Kingfisher <strong>and</strong><br />

president at CyberMedia: “It’s weird: airlines<br />

are suddenly fine with flying empty rather<br />

than <strong>of</strong>fer flexible fares. I’ve just flown Delhi-<br />

Mumbai on two nearly empty IndiGo flights,<br />

with the fares frozen for weeks at Rs 10,650<br />

(US$230) for the round trip,” he said.<br />

“I am also surprised to find exactly the<br />

<strong>Air</strong> India: Estimates <strong>of</strong> the national carrier’s losses have moved from the<br />

sublime to the ridiculous<br />

same fare for round trips to Bangalore,<br />

Chennai <strong>and</strong> Kolkata from Delhi - Rs 2,000<br />

plus taxes, or Rs 5,325, per flight whether you<br />

fly tomorrow or three months later.”<br />

Loads have been lighter in more ways than<br />

one. Almost all airlines have seen a substantial<br />

<strong>fall</strong> in loads since they raised fares. With most<br />

carriers, loads are running almost 10%-15%<br />

lower than at the same time last year.<br />

<strong>The</strong> decline means that fewer passengers<br />

are being carried every month <strong>and</strong> this is<br />

being clearly reflected in traffic data. Official<br />

data released for August 2008 showed it<br />

was the third consecutive month <strong>of</strong> negative<br />

growth. <strong>The</strong> domestic market slumped<br />

17.45% during the month, the sharpest <strong>fall</strong><br />

triggered by high fares.<br />

This trend has continued for the entire<br />

calendar year as the <strong>Air</strong>ports Authority <strong>of</strong><br />

India data shows. <strong>The</strong> number <strong>of</strong> passengers<br />

passing through Indian airports grew at about<br />

‘Civil aviation ministry<br />

sources say some airlines are<br />

losing about Rs5 crore a day<br />

(more than US$1 million) <strong>and</strong><br />

collectively they are losing<br />

around US$8 million a day’<br />

11% in the first quarter <strong>of</strong> the year. This is<br />

against the near 28% growth recorded in the<br />

first three months <strong>of</strong> 2007.<br />

To counter the dropping load factors<br />

<strong>and</strong> passengers carried, many airlines have<br />

resorted to promotions when the loads<br />

rendered a flight unviable. For certain weeks<br />

in August, for instance, the Delhi-Mumbai<br />

route – otherwise one <strong>of</strong> the busiest – had seen<br />

a sharp <strong>fall</strong> in dem<strong>and</strong> across carriers.<br />

Several flights on the Delhi-Mumbai<br />

sector were flying at 40%-50% <strong>and</strong> for afternoon<br />

flights (<strong>of</strong>f peak hours), the loads have<br />

been lighter still with just around a third <strong>of</strong><br />

the aircraft filled. So for a few days one could<br />

pay one rupee in terms <strong>of</strong> fare <strong>and</strong> effectively<br />

be paying just the taxes <strong>and</strong> surcharges. In<br />

other words, one could fly return to Mumbai<br />

for around Rs7,000, which has now gone up<br />

to roughly Rs10,000-11,000.<br />

<strong>Air</strong>lines say they believe that at times it is<br />

better to raise fares <strong>and</strong> see loads <strong>fall</strong> a little<br />

rather than keep fares very low just to fill up<br />

the aircraft. “It works out to more or less the<br />

same thing, but we found our revenue per seat<br />

kilometre has been higher when we have kept<br />

fares higher even if it means sacrificing some<br />

load,” said an <strong>Air</strong> India <strong>of</strong>ficial.<br />

His argument is that sometimes keeping<br />

fares high works better for the airline because<br />

ORIENT AVIATION INDIA october 2008

main story<br />

at least those who must fly have to pay the<br />

higher amount <strong>and</strong> fly anyway. “What<br />

we tend to lose is the very price sensitive<br />

passenger who may or may not travel by<br />

air depending on the fare. This is a smaller<br />

segment as <strong>of</strong> now. Company executives<br />

<strong>and</strong> small businessmen have to fly anyway,<br />

whatever the fare may be,” he said.<br />

Cost increases have also forced a decline<br />

in service levels. Said Gopal Sarma, managing<br />

director <strong>of</strong> Feedback Ventures, a gold card<br />

member on Kingfisher <strong>Air</strong>lines (KFA) <strong>and</strong><br />

platinum on Jet <strong>Air</strong>ways: “Fares have gone<br />

up very rapidly. I have also seen that loads in<br />

both economy <strong>and</strong> business are much lower<br />

than even six to eight months back.<br />

“Also, airlines, even full fare/service<br />

ones, are cutting back on the service package.<br />

Kingfisher First today is a very different<br />

product from when it was launched, or even<br />

say 12 -15 months back.”<br />

And although loads may have <strong>fall</strong>en,<br />

passengers at times complain <strong>of</strong> no seats.<br />

Said Roy K. Cherian, CEO <strong>of</strong> Bangalorebased<br />

analysts, Marketelligent: “People<br />

are used to flying certain routes <strong>and</strong> then<br />

suddenly, because <strong>of</strong> rationalisation, there<br />

are not enough seats on some <strong>of</strong> the short-haul<br />

sectors. Recently I tried for a ticket from<br />

Cochin to Bangalore on a Monday afternoon<br />

<strong>and</strong> there were no tickets available until<br />

Wednesday morning.”<br />

However, many feel that while pruning the<br />

quality <strong>of</strong> service by not serving a hot meal<br />

or selling products on board does reduce the<br />

‘With most carriers, loads<br />

are running almost 10%-15%<br />

lower than at the same time<br />

last year’<br />

costs marginally, it’s more cosmetic than real.<br />

Said IndiGo’s Ashby: “I find it more amusing<br />

than anything else when airlines say they<br />

will serve one mint instead <strong>of</strong> two”, making<br />

light <strong>of</strong> the impact such steps can have on<br />

overall costs.<br />

Yet airlines have resisted cutting fares<br />

possibly with the realization that it was the<br />

fare bloodbath that they were all caught in<br />

that weakened their balance sheets in the<br />

first place. Without exception, all the Indian<br />

airlines have been chalking up impressive<br />

losses. While this has been true since 2005-<br />

06, in most cases the problem has intensified<br />

in the current financial year.<br />

Meanwhile, revenue has risen since many<br />

airlines have stopped unpr<strong>of</strong>itable flights<br />

<strong>and</strong> given up frequencies to bolster loads.<br />

Domestic airlines scrapped more than 2,000<br />

weekly flights in July alone, nearly one-fifth<br />

the number they operate. More cuts were<br />

introduced in August.<br />

However, it may well be a while before the<br />

red ink on the balance sheet dries up.<br />

Civil aviation ministry sources say some<br />

airlines like KFA are losing about Rs5 crore<br />

a day (over US$1 million) <strong>and</strong> collectively<br />

they are haemorrhaging around US$8 million<br />

a day.<br />

Estimates <strong>of</strong> national carrier <strong>Air</strong> India’s<br />

losses have moved from the sublime to the<br />

ridiculous with company insiders <strong>and</strong> civil<br />

aviation ministry sources saying that losses<br />

<strong>of</strong> just under US$1 billion this year cannot<br />

be ruled out. ■<br />

Smart Thinking.<br />

ILSmart Thinking.<br />

Paul’s job is to keep his airline’s fl eet<br />

fl ying. That takes the right parts being<br />

in the right place at the right time.<br />

ILS can help Paul manage his inventory,<br />

analyze supply <strong>and</strong> dem<strong>and</strong> trends<br />

in the aftermarket, quickly address<br />

AOG situations, <strong>and</strong> even turn surplus<br />

into cash. He can also cut costs,<br />

increase operational readiness, <strong>and</strong><br />

make the supply chain more effi cient.<br />

That’s smart.<br />

That’s ILSmart.<br />

More Than <strong>The</strong> Sum Of <strong>The</strong> Parts<br />

I L S m a r t . c o m<br />

ILS <strong>Orient</strong>Av half pg 2color.indd 1<br />

ORIENT AVIATION INDIA october 2008<br />

12/20/07 4:54:10 PM

Never miNd 20:20<br />

our visioN goes<br />

beyoNd 20:40.<br />

A visionary partnership was formed in the 1970’s. GE <strong>and</strong><br />

Snecma created CFM International * . With eyes clearly focused<br />

on tomorrow, that highly successful partnership has now been<br />

extended through 2040. We look forward to the future. To<br />

setting industry-leading reductions in fuel burn <strong>and</strong> emissions.<br />

To delivering the next-generation engine for narrow-body<br />

aircraft. Be far-sighted. Visit www.cfm56.com/agreement now.<br />

*CFM, CFM56 <strong>and</strong> the CFM logo are all trademarks <strong>of</strong> CFM International, a 50/50 joint company <strong>of</strong> Snecma <strong>and</strong> General Electric Co.

news backgrounder<br />

<strong>The</strong> lost<br />

dream<br />

<strong>Air</strong> <strong>Deccan</strong> founder Gopinath<br />

helpless as Kingfisher tries to<br />

kick-start the re-invented carrier.<br />

But the losses keep growing<br />

<strong>Air</strong> <strong>Deccan</strong> founder,<br />

Capt. G. R. Gopinath:<br />

too much <strong>of</strong> an idealist<br />

Anjuli Bhargava reports<br />

In 2004, Capt. G. R. Gopinath<br />

launched <strong>Air</strong> <strong>Deccan</strong> with one<br />

ATR turboprop <strong>and</strong> a dream that<br />

he would “give wings to millions<br />

<strong>of</strong> Indians who had never flown<br />

before”.<br />

By 2007, Bangalore-based <strong>Air</strong> <strong>Deccan</strong><br />

had a fleet <strong>of</strong> 19 A320s <strong>and</strong> 23 ATRs <strong>and</strong> was<br />

“giving wings” to over four million Indians<br />

a year as it became the country’s largest<br />

low-cost carrier with close to 22% market<br />

share in the country.<br />

But it was losing money. Lots <strong>of</strong> it. <strong>The</strong><br />

fact it had two aircraft types <strong>and</strong> was <strong>of</strong>fering<br />

unrealistically low rates on non-viable routes<br />

simply because he wanted every Indian to<br />

fly, contributed to his down<strong>fall</strong>. “He was too<br />

much <strong>of</strong> an idealist,” said one source.<br />

As bankruptcy loomed in stepped the<br />

ambitious founder <strong>and</strong> chairman <strong>of</strong> another<br />

Bangalore carrier, Kingfisher <strong>Air</strong>lines, Vijay<br />

Mallya, <strong>and</strong> made Gopinath an <strong>of</strong>fer he could<br />

hardly refuse.<br />

He decided to sell. It was hard. For those<br />

who know “Gopi”, as he is known, <strong>Air</strong><br />

<strong>Deccan</strong> was more than a business. It was a<br />

labour <strong>of</strong> love.<br />

For this reason, he had three wishes<br />

when he agreed to merge <strong>Air</strong> <strong>Deccan</strong> with<br />

Kingfisher. He wanted to protect the jobs<br />

<strong>of</strong> his employees <strong>and</strong> the low-cost nature<br />

<strong>of</strong> “the common man’s carrier”. Finally,<br />

he wanted to remain associated with the<br />

airline.<br />

But those wishes are in tatters today.<br />

Times are changing for <strong>Deccan</strong>. Today,<br />

its known as Kingfisher Red, a move by<br />

Kingfisher to give the airline a new image<br />

<strong>and</strong> to change people’s poor perception <strong>of</strong><br />

the carrier.<br />

<strong>The</strong>n, in late September, Gopinath’s<br />

worst fears were founded when 300 <strong>of</strong> the<br />

3,100 employees <strong>of</strong> the former <strong>Air</strong> <strong>Deccan</strong><br />

were made redundant. Hundreds more are<br />

expected to follow soon.<br />

“Well, things have really come a full<br />

circle,” said a former senior <strong>Air</strong> <strong>Deccan</strong><br />

<strong>of</strong>ficial “One <strong>of</strong> the main things the Captain<br />

[Gopinath] had hoped to protect – the<br />

employees - is no longer safe.” He added that<br />

it had been a tense <strong>and</strong> rather aimless eight<br />

to 10 months for Kingfisher Red/<strong>Air</strong> <strong>Deccan</strong><br />

employees, who <strong>of</strong>ten described their carrier<br />

as rudderless.<br />

Today Gopinath remains on the Kingfisher<br />

board <strong>and</strong> is vice-chairman <strong>of</strong> the company.<br />

To date he has steadfastly refused to publicly<br />

make his personal feelings known about what<br />

has happened to his beloved airline.<br />

Those close to him say he has found it<br />

hard to take <strong>and</strong> say his involvement with<br />

Kingfisher has diminished daily.<br />

But Gopinath is not taking defeat<br />

lying down <strong>and</strong> indeed is working on his<br />

“next revolution”.<br />

While he can still be found at Kingfisher’s<br />

head <strong>of</strong>fice in Bangalore’s busy Cunningham<br />

Road, his attention <strong>and</strong> time is now on his<br />

new venture, <strong>Deccan</strong> Express Logistics. <strong>The</strong><br />

company website calls the cargo company<br />

Gopinath’s “next revolution”.<br />

It already employs close to 150 people <strong>and</strong><br />

Gopinath claims the company will change the<br />

way deliveries are made all over the country.<br />

“We have got used to delays <strong>and</strong> excuses.<br />

<strong>The</strong>re is no way to track what we send <strong>and</strong><br />

the situation is even worse in small towns,”<br />

he said.<br />

Just as <strong>Air</strong> <strong>Deccan</strong> was to change the<br />

way small towns in India travelled, <strong>Deccan</strong><br />

Express will change the way small towns<br />

receive express freight.<br />

Many <strong>of</strong> his employees, who bought his<br />

dream in the airline, are firmly backing him<br />

in his new venture.<br />

Will he disappoint them Will cargo <strong>and</strong><br />

logistics manage to stir the same kind <strong>of</strong><br />

passion in a man who believes in giving his<br />

all to what he believes in And has Gopinath<br />

chosen the right moment to move on Time<br />

alone will tell. ■<br />

Next page:<br />

➤ From bad to far worse<br />

➤ Kingfisher losing more than US$1<br />

million a day<br />

10 ORIENT AVIATION INDIA october 2008

Repair beats<br />

replacement!<br />

Your advantage is our goal.<br />

See us at<br />

MRO Asia<br />

October 14 - 16, 2008<br />

Singapore<br />

Booth # G33/H33<br />

<strong>The</strong> MTU Maintenance group is renowned for excellentvalue<br />

engine maintenance. For a quarter <strong>of</strong> a century,<br />

the company has been a reliable partner <strong>of</strong> many<br />

airlines, <strong>of</strong>fering a compelling choice <strong>of</strong> customized<br />

service packages.<br />

We aim to repair rather than replace, using the very<br />

latest inspection, maintenance <strong>and</strong> repair technologies.<br />

Forget about expensive replacement parts <strong>and</strong><br />

keep costs down. Expect us to provide outst<strong>and</strong>ing<br />

repairs <strong>and</strong> short <strong>of</strong>f-wing times – worldwide <strong>and</strong> at<br />

affordable prices.<br />

www.mtu.de

news backgrounder<br />

From bad to far worse<br />

Those who held a large chunk<br />

<strong>of</strong> <strong>Deccan</strong> <strong>Aviation</strong> shares, the<br />

erstwhile parent company <strong>of</strong> <strong>Air</strong><br />

<strong>Deccan</strong> <strong>and</strong> now listed under Kingfisher<br />

<strong>Air</strong>lines (KFA)on the bourses, had better<br />

re-think if they thought a new management<br />

would bring a new lease <strong>of</strong> life to their<br />

investment.<br />

<strong>Aviation</strong> experts <strong>and</strong> analysts in India are<br />

unable to underst<strong>and</strong> the strategy adopted<br />

by KFA, which bought <strong>Air</strong> <strong>Deccan</strong> last year<br />

<strong>and</strong> has now merged the carrier with its own<br />

company.<br />

“As I see it, the airline [<strong>Air</strong> <strong>Deccan</strong>] has<br />

been wrecked <strong>and</strong> well, what can I say - for<br />

us, that’s only good news,” said the CEO <strong>of</strong><br />

a competing airline.<br />

In June last year when KFA bought<br />

<strong>Deccan</strong> (the decision to merge was made in<br />

December), the latter held around 22% <strong>of</strong><br />

the domestic market. Today, the figure has<br />

slumped to 10.2%, marginally lower than<br />

IndiGo at 10.3%.<br />

Recently renamed Kingfisher Red,<br />

<strong>Deccan</strong> has cut routes <strong>and</strong> flights <strong>and</strong> is<br />

carrying roughly half the passengers per day<br />

as it was when it was bought by Kingfisher.<br />

“Passenger numbers are down from around<br />

7 lakh (700,000) a day to around 3 to 3.5 lakh<br />

per day,” said a senior airline source, who<br />

wouldn’t be named.<br />

Also, Kingfisher Red/<strong>Deccan</strong>, which at<br />

one point enjoyed the highest passenger<br />

load factor (PLF) in India, has seen its PLF<br />

plummet to 39%, the lowest in the industry.<br />

<strong>The</strong> intriguing part is that all this has<br />

been accompanied with a doubling <strong>of</strong> losses.<br />

According to airline sources, the airline at<br />

the time <strong>of</strong> sale was losing around Rs1-1.5<br />

crore a day (US$250,000).<br />

Kingfisher took charge, changed the<br />

identity, look, feel <strong>and</strong> various other<br />

service parameters <strong>of</strong> the airline.About<br />

a year ago, Kingfisher’s chief financial<br />

<strong>of</strong>ficer, A. Raghunathan, told this reporter<br />

he was expecting the struggling carrier to<br />

break even well before his own airline. He<br />

had said with better revenue management<br />

<strong>and</strong> improvement in yields, Kingfisher<br />

Red/<strong>Deccan</strong> should be able to break even<br />

by the last quarter <strong>of</strong> the financial year<br />

(January-March).<br />

Kingfisher chairman, Vijay Mallya:<br />

achieved merger synergies<br />

He couldn’t have anticipated the rise in<br />

oil prices at that time, but his calculations<br />

certainly appear to have gone haywire in<br />

more ways than one.<br />

When questioned by email by <strong>Orient</strong><br />

<strong>Aviation</strong> India, KFA chairman, Vijay<br />

Mallya, said: “I have spoken to the finance<br />

team <strong>and</strong> checked with some members <strong>of</strong><br />

the leadership team. Your impressions are<br />

exaggerated. In fact, we have achieved<br />

merger synergies <strong>of</strong> over US$65 million <strong>and</strong><br />

the losses are much lower.<br />

“If ATF [aviation turbine fuel] prices had<br />

not spiked up, we would have broken even.”<br />

He added that was all he was willing to say<br />

at the moment. ■<br />

As more <strong>Deccan</strong> staff face the axe …<br />

Kingfisher ‘losing more than US$1m a day’’<br />

Kingfisher <strong>Air</strong>lines (KFA) is<br />

reportedly losing more than US$1<br />

million a day. Despite this the carrier<br />

still launched its international services<br />

in September, a move analysts felt would<br />

only multiply its losses several times over.<br />

KFA itself has been reeling from big<br />

losses since it began operations in 2005,<br />

but it has been particularly badly hit since<br />

the rise in the oil price. <strong>The</strong> airline has cut<br />

flights by about 20%, has deferred deliveries<br />

<strong>of</strong> 32 A320 aircraft <strong>and</strong> is hoping to sell two<br />

A340-500s it has on order.<br />

Not only has KFA’s own performance<br />

been a cause for worry, but low-cost carrier<br />

<strong>Air</strong> <strong>Deccan</strong> (now renamed Kingfisher Red),<br />

which it bought last year, already had huge<br />

accumulated losses, which have increased<br />

in the last 12 months.<br />

Three hundred <strong>of</strong> <strong>Air</strong> <strong>Deccan</strong>’s 3,100<br />

employees were re-trenched in September as<br />

KFA consolidated its merger with the LCC.<br />

Many more <strong>Deccan</strong> workers face the axe in<br />

coming months.<br />

Kingfisher <strong>Air</strong>lines: an A350-500 at the <strong>Air</strong>bus delivery centre in Toulouse.<br />

A KFA statement read: “We examined<br />

the complete organizational structure <strong>of</strong><br />

the airline [<strong>Deccan</strong>/Kingfisher Red] <strong>and</strong><br />

mapped the skill sets <strong>of</strong> the existing talent<br />

pool with the projected talent requirements<br />

<strong>of</strong> the company.”<br />

As a result <strong>of</strong> the exercise, 300 employees,<br />

mostly in areas like security, flight operations<br />

<strong>and</strong> engineering <strong>and</strong> maintenance, were<br />

asked to leave. <strong>The</strong> severance packages are<br />

expected to cost KFA about US$500,000.<br />

According to a senior former <strong>Air</strong> <strong>Deccan</strong><br />

employee, many <strong>of</strong> the senior executives<br />

have already left the airline. Several <strong>of</strong><br />

them have joined <strong>Air</strong> <strong>Deccan</strong> founder, G.R.<br />

Gopinath’s new cargo <strong>and</strong> logistics venture,<br />

<strong>Deccan</strong> Express Logistics.<br />

<strong>The</strong> pruning <strong>of</strong> <strong>Deccan</strong>/Kingfisher<br />

Red staff follows a similar announcement<br />

by Jet <strong>Air</strong>ways’ fully-owned subsidiary,<br />

JetLite, that it was downsizing its staff by<br />

at least 750. ■<br />

12 ORIENT AVIATION INDIA october 2008

Share our Expertise.<br />

Our airport know-how travels the globe.<br />

Fraport <strong>of</strong>fers extensive airport expertise – from global hubs to low-cost operations. We are involved<br />

in nine airports worldwide <strong>and</strong> our subsidiaries are active on four continents. We provide complete<br />

one-source airport management <strong>and</strong> consulting services: everything from ground h<strong>and</strong>ling, flight<br />

<strong>and</strong> terminal management to retail <strong>and</strong> real estate management. When may we welcome you as one<br />

<strong>of</strong> our valued customers<br />

Contact us at: marketing@fraport.com, www.fraport.com<br />

Fraport. <strong>The</strong> <strong>Air</strong>port Managers.

EXECUTIVE INTERVIEW<br />

No turning back<br />

Times are tough, but IndiGo will take delivery <strong>of</strong> its 100 A320s<br />

ANJULI BHARGAVA,<br />

in Delhi, reports<br />

Like all the airlines in India,<br />

IndiGo, one <strong>of</strong> the largest<br />

low-cost carriers today, has<br />

been through its share <strong>of</strong> pain<br />

during the recent oil crisis. It<br />

has reduced flights, given up some slots <strong>and</strong><br />

lowered its expectations about when it may<br />

become pr<strong>of</strong>itable.<br />

But unlike many <strong>of</strong> its rivals, IndiGo<br />

remains stubbornly committed to becoming<br />

the largest (recent news reports say that it has<br />

overtaken what was formerly known as <strong>Air</strong><br />

<strong>Deccan</strong> to become the largest LCC) <strong>and</strong> most<br />

efficient low-cost carrier in India.<br />

<strong>The</strong> airline, which started two years<br />

ago, shocked the aviation industry when it<br />

confirmed an order for 100 A320 aircraft,<br />

worth US$6 billion, before it even launched<br />

at the 2005 Paris <strong>Air</strong> Show. <strong>The</strong> aircraft will<br />

be introduced over a 10-year-period.<br />

<strong>The</strong> airline is owned jointly by US-based<br />

Rakesh Gangwal, who has spent more than<br />

20 years in senior management positions at<br />

United <strong>Air</strong>lines, <strong>Air</strong> France <strong>and</strong> US <strong>Air</strong>ways<br />

<strong>and</strong> Rahul Bhatia, CEO <strong>of</strong> Delhi-based<br />

Interglobe group, a US$1 billion enterprise<br />

with varied business interests.<br />

<strong>The</strong> airline is based out <strong>of</strong> Delhi <strong>and</strong> operates<br />

on all the major trunk routes; Mumbai,<br />

Hyderabad, Chennai, Bangalore <strong>and</strong> Kolkata,<br />

<strong>and</strong> a few second-tier cities. It has built up a<br />

10.3% market share in two years.<br />

Its ambitious aircraft delivery schedule - it<br />

currently has 19 A320s - remains unchanged<br />

<strong>and</strong> so does its expansion <strong>and</strong> growth plan. It<br />

is not changing its business model or looking<br />

at merging with anyone.<br />

Its chief executive, Bruce Ashby, who<br />

joined IndiGo in August 2005, has 20 years<br />

experience in aviation <strong>and</strong> was executive<br />

vice-president, marketing <strong>and</strong> planning,<br />

<strong>of</strong> US <strong>Air</strong>ways before he came to India.<br />

Previously, Ashby held executive positions<br />

at Delta <strong>Air</strong>lines <strong>and</strong> United <strong>Air</strong>lines.<br />

Ashby, who leaves at the end <strong>of</strong> the year<br />

<strong>and</strong> will return to the U.S., is tight-lipped on<br />

his next project. Meanwhile, IndiGo’s reins<br />

will be passed to president, Aditya Ghosh.<br />

‘We are not deferring,<br />

selling, merging, changing,<br />

renovating, re-doing,<br />

undoing, re-scheduling<br />

– nothing’<br />

Bruce Ashby<br />

Chief Executive<br />

IndiGo<br />

Why do the Indian carriers seem to<br />

be having a particularly bad time right<br />

now, more so than other carriers in the<br />

region<br />

Ashby: I’m not sure that Indian carriers<br />

are doing worse than others. But we do have<br />

some distinct disadvantages here. Taxation<br />

on fuel in India is very high. Unlike the U.S.<br />

<strong>and</strong> [other countries] where the majority<br />

<strong>of</strong> taxes are on income, in India there are<br />

service taxes, customs <strong>and</strong> other duties that<br />

add up <strong>and</strong> make input costs very high. So,<br />

the input costs to the airlines [outside India]<br />

are much less. [For example], they buy fuel<br />

for 30% less than it costs in India.<br />

Here we pay a service tax on insurance.<br />

We pay service tax for many other services<br />

we buy. In the U.S. if you don’t make money,<br />

you don’t pay tax so it’s less revenue for the<br />

government, but it’s better for the airline. In<br />

India, if the government started charging<br />

income tax instead <strong>of</strong> other taxes, the<br />

industry would look that much healthier.<br />

<strong>Air</strong>port costs here, too, are kind <strong>of</strong> high for<br />

the value you get.<br />

And many airports want to increase<br />

charges<br />

Ashby: Private airports run by private<br />

developers are now seeking to charge fees<br />

for all kinds <strong>of</strong> services <strong>and</strong>, in many cases,<br />

we feel the proposed fees are exorbitant;<br />

overpriced services that cost 10 times<br />

what they ought to cost <strong>and</strong>, in some cases,<br />

unwarranted services we see no value<br />

in. We are pretty unhappy about it. For<br />

instance, Internet connectivity costs far<br />

more than it should. It is a small thing, but<br />

they add up.<br />

[Delhi <strong>Air</strong>port] wants to install a<br />

terminal system that many international<br />

airlines [would] use, but the airport wants<br />

to charge all the airlines a high price to use<br />

this special kind <strong>of</strong> terminal connected to a<br />

special network. If you are British <strong>Air</strong>ways<br />

it could be <strong>of</strong> value to you, but we don’t<br />

need it. Our customers will get no value<br />

from it.<br />

Passengers might be willing to pay for<br />

something that allowed them to check in 10<br />

times faster or reach the airport quicker, but<br />

these services [being <strong>of</strong>fered] don’t provide<br />

any kind <strong>of</strong> visible value <strong>and</strong> they cost more<br />

than the old ones.<br />

Have your loads <strong>fall</strong>en substantially,<br />

like your rivals<br />

Ashby: Loads <strong>of</strong> all the airlines have<br />

<strong>fall</strong>en because we have raised prices. But<br />

the revenue per seat kilometre is better as<br />

14 ORIENT AVIATION INDIA october 2008

Totally flexible.<br />

Totally innovative.<br />

Totally satisfying.<br />

15 years <strong>of</strong> Lufthansa Technik<br />

Total Support Services for you.<br />

Now: Total Technical Support TTS ®<br />

Relaunch with<br />

Technical Operations Management.<br />

In 1993, we had the vision <strong>of</strong> a completely<br />

integrated service portfolio. Our goal was to<br />

relieve airlines <strong>of</strong> the burden <strong>of</strong> maintenance<br />

as much as possible to enable them to<br />

concentrate on their core tasks.<br />

We called this vision Total Technical Support,<br />

or TTS ® . Today, it’s clear: with this step,<br />

Lufthansa Technik wrote a new chapter in<br />

the history <strong>of</strong> aircraft maintenance.<br />

Meanwhile, our vision has grown to become<br />

a service portfolio that is successful all over<br />

the world.<br />

As early as 2005, we signed a contract for<br />

the 1000 th aircraft to be maintained under<br />

Total Support. And now we’re adding even<br />

more value to the original—with Technical<br />

Operations Management (TOM) for fleet<br />

<strong>and</strong> contract management, a service that<br />

makes us a genuine strategic partner to<br />

our customer airlines. You see, we can<br />

make even “total” more complete!<br />

Interested Let’s talk about it.<br />

Lufthansa Technik AG, Marketing & Sales<br />

E-mail: marketing.sales@lht.dlh.de<br />

Visit us at www.lufthansa-technik.com<br />

Call us: +49-40-5070-5553<br />

More mobility for the world

EXECUTIVE INTERVIEW<br />

a result <strong>of</strong> that move. <strong>The</strong> revenue per seat<br />

kilometre has increased substantially since<br />

we took the summer actions <strong>of</strong> raising fares<br />

<strong>and</strong> reducing capacity.<br />

This is an <strong>of</strong>f peak time <strong>and</strong> this time<br />

last year we would have had a 70%-72%<br />

load factor. Currently, it’s around 61%-62%.<br />

We have also reduced flights <strong>and</strong> given<br />

up some slots. We tried to hold on to the<br />

scarcer ones.<br />

We went from 120 flights to 95 flights<br />

between July 20th <strong>and</strong> September 30th.<br />

We put four flights back in service in<br />

mid-September <strong>and</strong> we may put a few back<br />

in winter now that the price <strong>of</strong> fuel has<br />

<strong>fall</strong>en a bit.<br />

Is your aircraft delivery schedule on<br />

course or will you make changes to your<br />

expansion plans<br />

Ashby: No, we haven’t rescheduled<br />

anything. We are not deferring, selling,<br />

merging, changing, renovating, re-doing,<br />

undoing, re-scheduling – nothing. We are<br />

boringly committed to our plan.<br />

One <strong>of</strong> our goals was to have a larger<br />

number <strong>of</strong> aircraft than cities covered. We<br />

achieved that earlier this year. We now<br />

have 19 aircraft flying to 17 cities. We want<br />

to increase frequencies to the same cities<br />

rather than having fewer aircraft flying all<br />

over the place. We feel it’s wiser to have<br />

more flights to the same airport rather than<br />

fewer flights to a lot <strong>of</strong> airports. Once we<br />

have around 20-25 aircraft, economies <strong>of</strong><br />

scale begin to kick in <strong>and</strong> our costs per ask<br />

(available seat kilometre) will come down<br />

substantially. That is what we are working<br />

towards. So, we are in no hurry to exp<strong>and</strong><br />

<strong>and</strong> add cities. We are exploring one or two<br />

new cities but there’s no rush.<br />

<strong>The</strong>re’s been talk that fares won’t<br />

come down despite oil prices doing so<br />

Ashby: It really depends on how much<br />

oil prices come down. We held back on<br />

raising fares, but when we did we held our<br />

surcharges down quite a bit.<br />

<strong>The</strong> fuel price has <strong>fall</strong>en but it’s too early<br />

to say whether prices will come down. But<br />

it’s not credible to say that fares will not<br />

<strong>fall</strong> henceforth.<br />

<strong>Air</strong>lines - all <strong>of</strong> us - reduced capacity to<br />

some extent, more than we had originally<br />

planned. IndiGo <strong>and</strong> SpiceJet probably cut<br />

back slightly more than the full service<br />

airlines like Jet <strong>and</strong> Kingfisher. So, if you<br />

look at passenger numbers, you will see the<br />

full service carriers reduced fewer seats<br />

<strong>and</strong> therefore fewer passengers. This meant<br />

the media concluded the passenger share<br />

had shifted to the full service carriers <strong>and</strong><br />

LCCs in India were dead, which was rather<br />

premature.<br />

We are not particularly bothered about<br />

market share in a period <strong>of</strong> a couple <strong>of</strong><br />

months. We are more interested in making<br />

money. <strong>The</strong> price <strong>of</strong> fuel was so high that the<br />

flights that used to be marginally pr<strong>of</strong>itable<br />

became unpr<strong>of</strong>itable. What we the LCCs did<br />

was smart. It saved us a lot <strong>of</strong> money <strong>and</strong><br />

didn’t hurt the passenger. We didn’t cut out<br />

cities. We just said for the summer let’s fly a<br />

little less <strong>and</strong> save ourselves some money.<br />

Some companies have told their<br />

executives they must take the lower fare<br />

when they fly if there is a difference <strong>of</strong> Rs<br />

1,000 (US$22) or more.<br />

Ashby: Yes, economic downturns can<br />

be good for low-cost carriers.<br />

But when they do that they can find the low-cost carrier<br />

flights are cancelled without any explanation <strong>and</strong> they begin<br />

to rethink.<br />

Ashby: We rarely, rarely cancel flights suddenly. But I won’t<br />

deny that it has happened a couple <strong>of</strong> times this year. All the airlines<br />

have been seeing a lot <strong>of</strong> bird activity near the runways. As a result,<br />

things like this may have happened.<br />

Maybe 0.02% <strong>of</strong> flights since we started two years ago have<br />

been cancelled at such short notice. We almost always <strong>of</strong>fer some<br />

kind <strong>of</strong> back-up.<br />

At one point you had the lowest costs per ask. How does<br />

that st<strong>and</strong> now<br />

Ashby: Well, the cost per ASK has changed significantly<br />

because the cost <strong>of</strong> fuel is so high. Fuel is close to 57% <strong>of</strong> our operating<br />

expenses. It is higher than most airlines because everything else<br />

we do is pretty efficient. Our non-fuel costs per ASK are running a<br />

little better than we had hoped when we planned the airline.<br />

For those airlines with fuel at 40% <strong>of</strong> their costs, it is because<br />

the rest <strong>of</strong> their costs are high. <strong>The</strong>re are a lot <strong>of</strong> stories in the Indian<br />

press about olives being taken <strong>of</strong>f the airplane or an airline giving<br />

only one mint instead <strong>of</strong> three. This is not going to make up for<br />

the price <strong>of</strong> fuel. We have no choice but to lower capacity, reduce<br />

flights <strong>and</strong> minimize the damage while we wait for fuel to come<br />

down. <strong>The</strong>n we will find a new equilibrium.<br />

We were committed to being the lowest cost airline in India,<br />

but not in a cheap way. We have br<strong>and</strong> new planes. <strong>The</strong>y are very<br />

clean. <strong>The</strong>y have whatever a passenger needs. We run on time <strong>and</strong><br />

we <strong>of</strong>fer an efficient service.<br />

But your fares are not much lower than other airlines.<br />

Ashby: We have raised fares. But our fares have never been<br />

higher than any <strong>of</strong> our competitors. ■<br />

16 ORIENT AVIATION INDIA october 2008

MAYBE SOMEDAY. POSSIBLY ONE DAY.<br />

DEFINITELY THIS YEAR.<br />

Pratt & Whitney Canada’s PW308 turb<strong>of</strong>an<br />

engine is going to space in 2008. It’s poised to<br />

power Virgin Galactic’s WhiteKnightTwo, the<br />

mother ship that will launch the first commercial<br />

passenger spaceship ever. This innovation alone<br />

makes the dream <strong>of</strong> space travel real for aspiring<br />

astronauts around the world. <strong>The</strong>ir dreams<br />

depend on this mission. And this mission<br />

depends on our innovation.<br />

WWW.PWC.CA/GALACTIC-19

airports<br />

At last, some order at Delhi<br />

By Anjuli Bhargava<br />

Ever since the Indira Gh<strong>and</strong>i<br />

International <strong>Air</strong>port (IGIA)<br />

in Delhi was h<strong>and</strong>ed over to<br />

private parties <strong>of</strong> the developing<br />

consor tium, DIAL,<br />

in May-June 2006, it has been receiving<br />

more complaints than passengers. <strong>Air</strong>port<br />

Authority <strong>of</strong> India’s management <strong>of</strong> the<br />

facility left a lot to be desired in any case, but<br />

what really compounded the problem was an<br />

unprecedented surge in air traffic fuelled by<br />

low fares <strong>and</strong> new carriers.<br />

For the last year, the management <strong>and</strong><br />

public relations department <strong>of</strong> the private<br />

firm that took on the task <strong>of</strong> managing the<br />

airport has been fire-fighting with furious,<br />

harried <strong>and</strong> helpless passengers, surly staff,<br />

exhausted air traffic controllers, frustrated<br />

airline staff, fed-up service providers, a hostile<br />

press, w<strong>and</strong>ering stray dogs, stubborn birds<br />

<strong>and</strong> countless mishaps <strong>and</strong> problems on a<br />

daily basis.<br />

Finally, however, some semblance <strong>of</strong> order<br />

is beginning to creep into the daily running<br />

<strong>of</strong> the airport, as some <strong>of</strong> the actions taken by<br />

the management begin to finally show results,<br />

<strong>of</strong> which the most visible are, so far, at the<br />

international terminal <strong>of</strong> the airport.<br />

<strong>The</strong> airport is still a far cry from what<br />

passengers take for granted in most countries<br />

in the Asia-Pacific region, but it’s a marked<br />

improvement over the pathetic services<br />

Indians are used to. Flying in <strong>and</strong> out <strong>of</strong> India<br />

from most cities in the last two <strong>and</strong> a half<br />

years has been a harrowing experience for<br />

foreigners <strong>and</strong> Indians, but Delhi was by far<br />

amongst the most dreaded spots.<br />

For one, desperately needed space has<br />

been provided at the international terminal.<br />

In the departure check-in area, an additional<br />

2,500 sq. metres <strong>of</strong> floor space has been added<br />

to increase the number <strong>of</strong> check-in counters.<br />

<strong>The</strong> terminal now has 100 check-in counters,<br />

up from 78, easing some <strong>of</strong> the endless queues<br />

<strong>of</strong> passengers.<br />

A new baggage h<strong>and</strong>ling system has eliminated<br />

another huge headache for travellers; the<br />

torture <strong>of</strong> st<strong>and</strong>ing in interminable queues for<br />

check-in baggage to be X-rayed by machines<br />

which, more <strong>of</strong>ten than not, did not work.<br />

At the more crowded airports <strong>of</strong> Delhi,<br />

Hyderabad, Bangalore <strong>and</strong> Mumbai the<br />

queues would <strong>of</strong>ten wind their way outside<br />

the entry gates <strong>of</strong> the airports.<br />

<strong>The</strong> remaining airports in the country<br />

still use the old, antiquated machines, but<br />

at the private airports at least things have<br />

improved.<br />

Only a few months ago, entry into the<br />

international terminal for night flights used to<br />

be a challenge. At times it could take over 60<br />

minutes to enter the terminal building at Delhi,<br />

so the increase in entry gates from four to eight<br />

is likely to be met with frenzied joy, especially<br />

by travellers with small children.<br />

Leaving Indian shores promises to be<br />

an even happier event with counters in the<br />

departure area up from 28 to 52. And even<br />

returning to the capital promises to be a<br />

International<br />

cooperation<br />

DIAL is a consortium led by the<br />

GMR Group – one <strong>of</strong> India’s<br />

leading infrastructure developers.<br />

Other partners in the consortium<br />

include German company Fraport AG,<br />

Eraman Malaysia, India Development<br />

Fund <strong>and</strong> <strong>Air</strong>ports Authority <strong>of</strong> India.<br />

DIAL was awarded the m<strong>and</strong>ate for the<br />

modernization <strong>and</strong> restructuring <strong>of</strong> IGI<br />

<strong>Air</strong>port after an international competitive<br />

bid in January 2006.<br />

<strong>The</strong> airport, with traffic throughput<br />

<strong>of</strong> 24 million passengers last year, is the<br />

second busiest airport in the country.<br />

Currently, it is served by nearly 70<br />

domestic <strong>and</strong> international airlines<br />

connecting more than 110 destinations<br />

locally <strong>and</strong> internationally. ■<br />

New third runway<br />

at Delhi <strong>Air</strong>port<br />

more joyful occasion with more space, more<br />

immigration counters (from 28 to 38 <strong>and</strong><br />

another 10 on the way) <strong>and</strong> slightly more alert<br />

<strong>of</strong>ficers manning them.<br />

Security <strong>and</strong> baggage reclaim have also<br />

improved with an increase in the number <strong>of</strong><br />

security lanes, additional X-ray machines for<br />

h<strong>and</strong> baggage inspection <strong>and</strong> a lengthening <strong>of</strong><br />

the baggage reclaim belts.<br />

In August, the Delhi airport also inaugurated<br />

its third runway, making it India’s first<br />

<strong>and</strong> among the very few civilian airports in<br />

Asia to have three runways. <strong>The</strong> new runway<br />

became fully operational in September.<br />

Although the stray dogs managed to access<br />

it before most <strong>of</strong> the airlines, the 75 metre<br />

wide runway is among the longest in Asia at<br />

4, 430 metres. It is capable <strong>of</strong> h<strong>and</strong>ling new<br />

generation large aircraft such as the <strong>Air</strong>bus<br />

A380 <strong>and</strong> will increase the airport’s ability to<br />

h<strong>and</strong>le aircraft movements.<br />

It will allow aircraft to l<strong>and</strong> when visibility<br />

is as low as 50 metres <strong>and</strong> will have a sensor<br />

system to track the movement <strong>of</strong> the aircraft<br />

along the runway. <strong>The</strong> latter is quite a critical<br />

feature at Indian airports where pilots need<br />

to be more alert on the ground than in the<br />

air <strong>and</strong> where all manner <strong>of</strong> life - stray dogs,<br />

blue bulls, jackals <strong>and</strong> even peacocks - have<br />

been known to surface within the operational<br />

premises <strong>and</strong> are a force to contend with.<br />

On the anvil are better arrival <strong>and</strong><br />

departure terminals for domestic flights,<br />

but the changes here are not very visible<br />

as yet. Eventually, the DIAL management<br />

dangles the carrot <strong>of</strong> a world-class integrated<br />

passenger terminal building in time for the<br />

2010 Commonwealth Games to be held in the<br />

city, but cynical passengers are unwilling to<br />

believe it unless they see it. ■<br />

18 ORIENT AVIATION INDIA october 2008

global approach<br />

World-class support anywhere in the world.<br />

<strong>The</strong>re are 49,024 airports worldwide. But no<br />

matter where you l<strong>and</strong>, as a global supplier <strong>of</strong><br />

innovative systems, products <strong>and</strong> services,<br />

Honeywell helps you stay on schedule, keep<br />

flying <strong>and</strong> operate more efficiently. We have the<br />

equipment, worldwide service <strong>and</strong> support, <strong>and</strong> expertise to protect your investment,<br />

optimize your operations <strong>and</strong> enhance your performance.<br />

To learn how Honeywell can help you make your numbers, visit our website at www.honeywell.com/approach<br />

©2007 Honeywell International Inc.

airports<br />

<strong>Air</strong>lines versus airports<br />

Charges row to escalate<br />

By Anjuli Bhargava<br />

<strong>Air</strong>lines in India are finding<br />

the going tough in more<br />

ways than one. Not only<br />

have they been reeling<br />

under the shock <strong>of</strong> high oil<br />

prices, but now airport charges in India are<br />

threatening to escalate.<br />

<strong>The</strong> government-run <strong>Air</strong>port Authority<br />

<strong>of</strong> India (AAI) controlled all airports for<br />

several years <strong>and</strong> fees remained steady. But<br />

that has changed.<br />

Private airports in India are a new<br />

phenomenon <strong>and</strong> as services improve<br />

the airports are threatening to impose<br />

ever-higher charges on the airlines for the<br />

improved services they are <strong>of</strong>fering.<br />

Not only do the airports want to increase<br />

l<strong>and</strong>ing, parking <strong>and</strong> navigation charges,<br />

they also want to impose higher rentals for<br />

various improved terminal facilities, which<br />

have been upgraded by the new airport<br />

developers.<br />

Said Ashok Chawla, secretary, civil<br />

aviation for the government <strong>of</strong> India: “It<br />

is a matter <strong>of</strong> timing really. Already, the<br />

airlines are reeling under high fuel costs.<br />

So this is not the ideal time to increase<br />

airport <strong>and</strong> other charges.”<br />

<strong>The</strong> government has, in fact, recently<br />

rejected a dem<strong>and</strong> by Delhi <strong>and</strong> Mumbai<br />

airports to increase charges by 10% across<br />

the board.<br />

However, in the last few weeks, as oil<br />

prices fell marginally, airport operators<br />

have been raising their dem<strong>and</strong>s again.<br />

“We feel we should now be allowed to<br />

increase airport charges as we have to<br />

raise up to Rs3,500 crore (US$770 million)<br />

from the market for further development<br />

<strong>and</strong> modernisation <strong>of</strong> the airport,” said<br />

an <strong>of</strong>ficial <strong>of</strong> Mumbai’s development<br />

company, GVK. A 10% increase in airport<br />

charges would add about Rs30 crore a year<br />

to the airport’s total revenue.<br />

As per the agreement between the<br />

government <strong>and</strong> developers at Mumbai<br />

<strong>and</strong> Delhi, the airport operator is allowed<br />

to increase airport charges after two years,<br />

provided it has completed the first phase <strong>of</strong><br />

expansion ending March 2010.<br />

<strong>Air</strong>ports such as Mumbai typically<br />

charge about Rs31,000 (US$680) for<br />

route navigation facility charges, terminal<br />

navigation l<strong>and</strong>ing charges <strong>and</strong> l<strong>and</strong>ing<br />

<strong>and</strong> parking charges for an A320 plane,<br />

besides a Rs225 airport usage fee per<br />

passenger. Delhi airport, which is being<br />

extensively upgraded by private developer,<br />

‘We feel we should now be<br />

allowed to increase airport<br />

charges as we have to raise<br />

up to Rs3,500 crore (US$770<br />

million) from the market’<br />

Mumbai <strong>Air</strong>port developer, GVK<br />

GMR Infrastructure, has also been seeking<br />

permission to raise charges.<br />

In addition, airports in cities like<br />

Hyderabad <strong>and</strong> Bangalore are charging a<br />

passenger user development fee (UDF).<br />

<strong>Air</strong>lines in India have refused to collect<br />

the UDF arguing that airports must collect<br />

their own fees as passengers perceive the<br />

extra charge as a fare hike.<br />

In recent months, the Bangalore <strong>and</strong><br />

Hyderabad airports have been allowed to<br />

levy a UDF from departing international<br />

passengers <strong>of</strong> Rs1,070 <strong>and</strong> Rs1,000, respectively;<br />

domestic passengers in Hyderabad<br />

are levied Rs375 each.<br />

But the battle between airlines <strong>and</strong><br />

airports is not only related to UDF fees<br />

<strong>and</strong> user charges for services like l<strong>and</strong>ing<br />

<strong>and</strong> parking. <strong>Air</strong>lines say that airports<br />

like Delhi <strong>and</strong> Mumbai want to charge<br />

exorbitant amounts for services that are<br />

not necessary to the carriers.<br />

Low-cost airline <strong>of</strong>ficials argue the<br />

same services could be sourced very<br />

cheaply from outside sources. Said a JetLite<br />

<strong>of</strong>ficial: “For example, the airports want<br />

to charge five or 10 times the amount for,<br />

say, a wheel chair or for ramp h<strong>and</strong>ling<br />

than I can get it done from the market. We<br />

don’t see any reason to pay these unfair<br />

amounts.”<br />

Internet connectivity is another issue<br />

where new private airports are proposing to<br />

charge at higher rates than what is generally<br />

available.<br />

Said Bruce Ashby, chief executive<br />

<strong>of</strong>ficer <strong>of</strong> IndiGo, one <strong>of</strong> India’s largest<br />

low-cost carriers: “<strong>The</strong> airlines want to<br />

charge high prices for services from which<br />

we don’t get any value. Or they want to<br />

charge 10 times what a service ought to cost<br />

for services where we do get value.”<br />

Battles <strong>and</strong> confrontations between<br />

airlines <strong>and</strong> airports that have taken place<br />

in the past few months could have been<br />

avoided if the government had had the<br />

foresight to put in place a regulator for the<br />

sector, an issue much discussed, but not<br />

acted upon.<br />

<strong>The</strong> Federation <strong>of</strong> Indian <strong>Air</strong>lines has<br />

stressed to government the importance <strong>of</strong><br />

having a regulator <strong>and</strong> one with teeth so<br />

that tussles like these can be prevented.<br />

<strong>The</strong> long delayed Aera (<strong>Air</strong>ports<br />

Economic Regulator y Authority <strong>of</strong><br />

India) bill is likely to be introduced in the<br />

forthcoming session <strong>of</strong> Parliament, but<br />

experts predict the regulator will not be in<br />

place before early next year.<br />

So, the dust raised about charges<br />

between the airlines <strong>and</strong> the airport operators<br />

may take a while to settle. ■<br />

<strong>Orient</strong> <strong>Aviation</strong> is available on<br />

<br />

www.orientaviation.com<br />

20 ORIENT AVIATION INDIA october 2008

training<br />

By Anjuli Bhargava<br />

<strong>The</strong> four years from 2004 to 2008<br />

were a god-send for Indian<br />

pilots. Ever since the low-cost<br />

airline boom started in India<br />

(spurred by <strong>Air</strong> <strong>Deccan</strong> <strong>and</strong><br />

then the launch <strong>of</strong> Go <strong>Air</strong>, Indigo <strong>and</strong> SpiceJet,<br />

among others), pilots saw their salaries double<br />

<strong>and</strong> even triple compared with the late 1990s.<br />

<strong>The</strong>y were in dem<strong>and</strong> like never before <strong>and</strong><br />

were raking it in like never before.<br />

However, with the launch <strong>of</strong> Kingfisher<br />

<strong>Air</strong>lines <strong>and</strong> Jet <strong>Air</strong>ways international services,<br />

an acute shortage <strong>of</strong> experienced pilots<br />

has developed <strong>and</strong> subsequently almost all the<br />

airlines have started “importing” their pilots.<br />

<strong>The</strong> aviation ministry had earlier increased<br />

the maximum age <strong>of</strong> pilots from 60 to 65 <strong>and</strong><br />

given permission to employ expatriate pilots,<br />

something previously not permitted.<br />

Kingfisher, which started international<br />

flights in September has hired primarily<br />

international pilots <strong>and</strong> hostesses for its foray<br />

overseas.<br />

Although the popular perception is that<br />

pilots, in general, are in short supply, this<br />

is not true. <strong>The</strong>re is a severe shortage <strong>of</strong><br />

experienced pilots, particularly comm<strong>and</strong>ers.<br />

Said Ishan Kalsia, a senior captain with <strong>Air</strong><br />

India: “<strong>The</strong> shortage is not at the entry level.<br />

It’s experience that is short.”<br />

In keeping with the closed environment<br />

in the country <strong>and</strong> the previous fairly low<br />

dem<strong>and</strong> for pilots, pilot training had never<br />

developed as one <strong>of</strong> India’s strengths. <strong>The</strong><br />

Indra G<strong>and</strong>hi Rashtriya Udaan Academy<br />

(IGRUA), the main government-run academy,<br />

trained only around 30 pilots a year. Now this<br />

has been increased to 50 <strong>and</strong> is expected to<br />

double by next year. IGRUA is buying new<br />

planes (six Czech Zlins), simulators <strong>and</strong><br />

building new classrooms.<br />

India finds experienced<br />

home-grown pilots<br />

in short supply<br />

<strong>Air</strong> India: recruiting <strong>and</strong> training<br />

cockpit crews from the colleges<br />

Aware that this was just a drop in the<br />

ocean, the government announced the opening<br />

<strong>of</strong> a new academy in Gondia near Nagpur<br />

in Maharashtra.<br />

<strong>The</strong> academy – a joint venture between<br />

the government-run <strong>Air</strong>port Authority <strong>of</strong><br />

India (AAI) <strong>and</strong> a private foreign partner<br />

(three have been short listed) – will be set<br />

up at a cost <strong>of</strong> around Rs125 crore (US$30<br />

million). In addition to the AAI <strong>and</strong> the<br />

foreign private partner, who will be a trainer<br />

<strong>and</strong> will organize the syllabus <strong>and</strong> provide the<br />

equipment, private airlines could take a stake<br />

in the academy.<br />

<strong>The</strong>re is an ab<strong>and</strong>oned airfield in Gondia,<br />

which the ministry is resurfacing to make<br />

it operational <strong>and</strong> will then add the training<br />

facilities. To start, the new academy will<br />

train 50 pilots with the yearly capacity to be<br />

increased to 100.<br />

<strong>The</strong> ministry has also roped in the Aero<br />

Club <strong>of</strong> India to identify a number <strong>of</strong> private<br />

flying schools, several <strong>of</strong> which had <strong>fall</strong>en<br />

into disuse. Ten to12 <strong>of</strong> these schools will be<br />

given trainer aircraft <strong>and</strong> some assistance to<br />

reinvent themselves.<br />

<strong>Air</strong> India has started an initiative to<br />

recruit fresh graduates out <strong>of</strong> colleges <strong>and</strong><br />

train them at the airline’s expense. <strong>The</strong> pilots<br />

would then be employed with the airline for<br />

the period it takes for them to pay back the<br />

cost <strong>of</strong> training.<br />

Similarly, the airlines that contribute equity<br />

to the new Gondia pilot academy will be given<br />

the right to recruit from the academy as <strong>and</strong><br />

when the pilots complete their training.<br />

<strong>The</strong> ministry has also gone on a drive to<br />

increase the number <strong>of</strong> air traffic controllers<br />

(ATCs) – a very contentious issue in<br />

India for the last few years <strong>and</strong> one where<br />

the public began to feel safety was being<br />

compromised.<br />

In 2005, 70 new ATCs were recruited.<br />

In 2006-07, another 100 were taken on for<br />

training at the institute in Allahabad, the main<br />

government-run training facility in India.<br />

<strong>The</strong> ministry is hoping private institutions<br />

can supply basic training before sending them<br />

to Allahabad for equipment <strong>and</strong> h<strong>and</strong>s-on<br />

training. Some ATCs are being sent overseas<br />

to work at busy airports like Sydney <strong>and</strong><br />

Amsterdam’s Schipol <strong>Air</strong>port. ■<br />

<strong>The</strong> learning centres <strong>of</strong> false hope<br />

<strong>Aviation</strong> may be going through a slump here in India, but the<br />

number <strong>of</strong> cabin crew training academies springing up – quite<br />

independent <strong>of</strong> airlines - would have you believe otherwise.<br />

Even in many small towns there are branches or franchisees <strong>of</strong><br />

such institutes <strong>of</strong>fering young aspirants incredible career options<br />

in aviation. How credible these options are is, however, less than<br />

certain since many <strong>of</strong> the institutes are charging hopeful young men<br />

<strong>and</strong> women high fees, but are unable to provide them with jobs at the<br />

end <strong>of</strong> the courses.<br />

With the present slump there’s a total freeze on hiring at most<br />

carriers, with some <strong>of</strong> them severely downsizing their staff numbers.<br />

In late 2007 <strong>and</strong> 2008 alone, close to six new cabin crew training<br />

academies have emerged, most <strong>of</strong> which are independent entities.<br />

<strong>The</strong> institutes are usually affiliated to foreign academies, but the<br />

quality <strong>of</strong> programmes <strong>of</strong>fered is dubious as there is no regulation<br />

or st<strong>and</strong>ardization.<br />

However, government <strong>of</strong>ficials say they are unable to regulate the<br />

quality <strong>of</strong> programmes <strong>of</strong>fered by such institutes. Said a senior civil<br />

aviation ministry <strong>of</strong>ficial, who did not wish to be named: “We have<br />

not managed to put in place a regulator who can oversee airline <strong>and</strong><br />

airport practices here in India. Crew training academies are not even<br />

on our radar as <strong>of</strong> now.” ■<br />

22 ORIENT AVIATION INDIA october 2008

<strong>The</strong><br />

CRJ NextGen Family<br />

with the all-new NextGen interior<br />

70-100 seats<br />

in our all-new cabin<br />

up to15% advantage<br />

in operating costs<br />

versus the competition<br />

up to 30% greener<br />

with reduced emissions<br />

compared to older<br />

generation aircraft<br />

larger bins<br />

bigger windows<br />

brighter lighting<br />

For your passengers, we enhanced the ergonomics.<br />

For you, once again we improved the economics.<br />

For all <strong>of</strong> us, we have reduced the emissions.<br />

www.crjnextgen.com<br />

Technical <strong>and</strong> comparative data is based on<br />

available research <strong>and</strong> Bombardier’s estimates<br />

<strong>of</strong> flight characteristics under specific conditions.<br />

This advertisement does not intend to convey<br />

any guarantees or warranties <strong>of</strong> performance.

![OAMag-V7N4-Cover [Converted] - Orient Aviation](https://img.yumpu.com/48598575/1/190x255/oamag-v7n4-cover-converted-orient-aviation.jpg?quality=85)