2012 CAFR - Pickerington Local School District

2012 CAFR - Pickerington Local School District

2012 CAFR - Pickerington Local School District

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PICKERINGTON LOCAL SCHOOL DISTRICT<br />

FAIRFIELD COUNTY, OHIO<br />

NOTES TO THE BASIC FINANCIAL STATEMENTS<br />

FOR THE FISCAL YEAR ENDED JUNE 30, <strong>2012</strong><br />

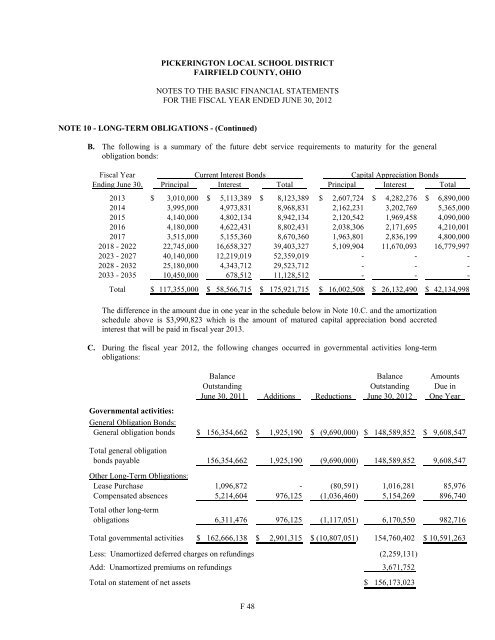

NOTE 10 - LONG-TERM OBLIGATIONS - (Continued)<br />

B. The following is a summary of the future debt service requirements to maturity for the general<br />

obligation bonds:<br />

Fiscal Year Current Interest Bonds Capital Appreciation Bonds<br />

Ending June 30, Principal Interest Total Principal Interest Total<br />

2013 $ 3,010,000 $ 5,113,389 $ 8,123,389 $ 2,607,724 $ 4,282,276 $ 6,890,000<br />

2014 3,995,000 4,973,831 8,968,831 2,162,231 3,202,769 5,365,000<br />

2015 4,140,000 4,802,134 8,942,134 2,120,542 1,969,458 4,090,000<br />

2016 4,180,000 4,622,431 8,802,431 2,038,306 2,171,695 4,210,001<br />

2017 3,515,000 5,155,360 8,670,360 1,963,801 2,836,199 4,800,000<br />

2018 - 2022 22,745,000 16,658,327 39,403,327 5,109,904 11,670,093 16,779,997<br />

2023 - 2027 40,140,000 12,219,019 52,359,019 - - -<br />

2028 - 2032 25,180,000 4,343,712 29,523,712 - - -<br />

2033 - 2035 10,450,000 678,512 11,128,512 - - -<br />

Total $ 117,355,000 $ 58,566,715 $ 175,921,715 $ 16,002,508 $ 26,132,490 $ 42,134,998<br />

The difference in the amount due in one year in the schedule below in Note 10.C. and the amortization<br />

schedule above is $3,990,823 which is the amount of matured capital appreciation bond accreted<br />

interest that will be paid in fiscal year 2013.<br />

C. During the fiscal year <strong>2012</strong>, the following changes occurred in governmental activities long-term<br />

obligations:<br />

Balance Balance Amounts<br />

Outstanding Outstanding Due in<br />

June 30, 2011 Additions Reductions June 30, <strong>2012</strong> One Year<br />

Governmental activities:<br />

General Obligation Bonds:<br />

General obligation bonds $ 156,354,662 $ 1,925,190 $ (9,690,000) $ 148,589,852 $ 9,608,547<br />

Total general obligation<br />

bonds payable 156,354,662 1,925,190 (9,690,000) 148,589,852 9,608,547<br />

Other Long-Term Obligations:<br />

Lease Purchase 1,096,872 - (80,591) 1,016,281 85,976<br />

Compensated absences 5,214,604 976,125 (1,036,460) 5,154,269 896,740<br />

Total other long-term<br />

obligations 6,311,476 976,125 (1,117,051) 6,170,550 982,716<br />

Total governmental activities $ 162,666,138 $ 2,901,315 $ (10,807,051) 154,760,402 $ 10,591,263<br />

Less: Unamortized deferred charges on refundings (2,259,131)<br />

Add: Unamortized premiums on refundings 3,671,752<br />

Total on statement of net assets $ 156,173,023<br />

F 48