Property Tax Reform in Developing and Transition Countries

Property Tax Reform in Developing and Transition Countries

Property Tax Reform in Developing and Transition Countries

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fortunately, there is a way forward with property tax reform. Furthermore, this is a road worth tak<strong>in</strong>g,<br />

because of the significant advantages of the property tax as a source of f<strong>in</strong>anc<strong>in</strong>g decentralized local<br />

government service delivery. This study ends with a list of several “avenues” for reform that could lead<br />

to a significant ratchet<strong>in</strong>g up of revenues <strong>and</strong> an improved fairness <strong>in</strong> the tax. Of course, the necessary<br />

condition for success with this advice is the political will of governments to implement—<strong>and</strong> ultimately<br />

ma<strong>in</strong>ta<strong>in</strong>—a stronger property tax.<br />

1. Make a decision about the role the property tax will play <strong>in</strong> national development policy, e.g., a tax on<br />

property wealth, a stimulus for the better use of l<strong>and</strong>, an <strong>in</strong>tegral part of a fiscal decentralization<br />

strategy, etc. The government should beg<strong>in</strong> the effort by do<strong>in</strong>g a thorough analysis of the present<br />

property tax <strong>and</strong> of the reform directions that might be taken. If the goal is to support fiscal<br />

decentralization, then an overall strategy should be put <strong>in</strong> place to give local governments more<br />

<strong>in</strong>centive to make <strong>in</strong>tensive use of the property tax. This might be done by reduc<strong>in</strong>g the availability of<br />

<strong>in</strong>tergovernmental transfers to those with significant unrealized property tax revenue potential.<br />

Alternatively, it might be done by provid<strong>in</strong>g a significant reward <strong>in</strong> the transfer system for those local<br />

governments that <strong>in</strong>crease property tax effort.<br />

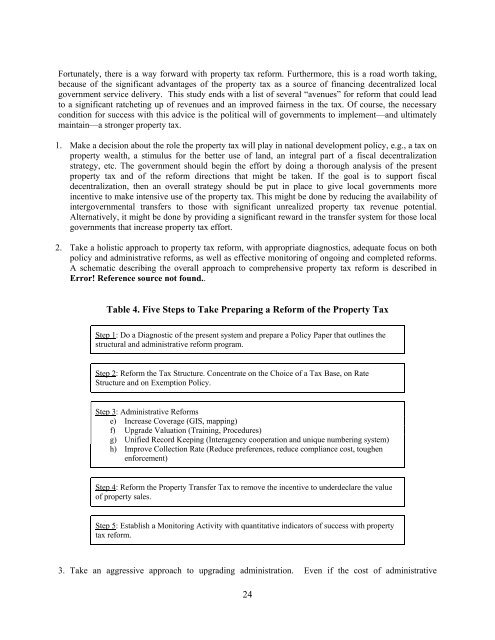

2. Take a holistic approach to property tax reform, with appropriate diagnostics, adequate focus on both<br />

policy <strong>and</strong> adm<strong>in</strong>istrative reforms, as well as effective monitor<strong>in</strong>g of ongo<strong>in</strong>g <strong>and</strong> completed reforms.<br />

A schematic describ<strong>in</strong>g the overall approach to comprehensive property tax reform is described <strong>in</strong><br />

Error! Reference source not found..<br />

Table 4. Five Steps to Take Prepar<strong>in</strong>g a <strong>Reform</strong> of the <strong>Property</strong> <strong>Tax</strong><br />

Step 1: Do a Diagnostic of the present system <strong>and</strong> prepare a Policy Paper that outl<strong>in</strong>es the<br />

structural <strong>and</strong> adm<strong>in</strong>istrative reform program.<br />

Step 2: <strong>Reform</strong> the <strong>Tax</strong> Structure. Concentrate on the Choice of a <strong>Tax</strong> Base, on Rate<br />

Structure <strong>and</strong> on Exemption Policy.<br />

Step 3: Adm<strong>in</strong>istrative <strong>Reform</strong>s<br />

e) Increase Coverage (GIS, mapp<strong>in</strong>g)<br />

f) Upgrade Valuation (Tra<strong>in</strong><strong>in</strong>g, Procedures)<br />

g) Unified Record Keep<strong>in</strong>g (Interagency cooperation <strong>and</strong> unique number<strong>in</strong>g system)<br />

h) Improve Collection Rate (Reduce preferences, reduce compliance cost, toughen<br />

enforcement)<br />

Step 4: <strong>Reform</strong> the <strong>Property</strong> Transfer <strong>Tax</strong> to remove the <strong>in</strong>centive to underdeclare the value<br />

of property sales.<br />

Step 5: Establish a Monitor<strong>in</strong>g Activity with quantitative <strong>in</strong>dicators of success with property<br />

tax reform.<br />

3. Take an aggressive approach to upgrad<strong>in</strong>g adm<strong>in</strong>istration. Even if the cost of adm<strong>in</strong>istrative<br />

24