Republic of AustRiA Debt MAnAgeMent - Austrian Federal ...

Republic of AustRiA Debt MAnAgeMent - Austrian Federal ...

Republic of AustRiA Debt MAnAgeMent - Austrian Federal ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Republic</strong> <strong>of</strong> Austria<br />

<strong>Debt</strong> Management<br />

Annual Review 2008<br />

<strong>Austrian</strong> <strong>Federal</strong> Financing Agency<br />

Mai 2009

Foreword<br />

© BMLFUW / Bernhard Kern<br />

© BMF / HBF<br />

2008 was a turbulent and challenging year for the global economy.<br />

As a reaction to the world-wide economic crisis the government <strong>of</strong><br />

the <strong>Republic</strong> <strong>of</strong> Austria has reacted promptly and has successfully defended<br />

the stability <strong>of</strong> the financial system by a number <strong>of</strong> measures.<br />

As the global economy continues to experience significant strains, the<br />

fundamentals <strong>of</strong> the <strong>Austrian</strong> economy remain sound. According to<br />

recent stress tests, Austria is among the most resistant countries and is<br />

well prepared to weather the current economic crisis. The AAA ratings<br />

from all major rating agencies confirm this view and reflect the degree<br />

<strong>of</strong> trust into the economic and financial strength <strong>of</strong> the <strong>Republic</strong>.<br />

In order to ensure a continuation <strong>of</strong> the economic growth and budgetary<br />

stability the current <strong>Austrian</strong> government’s budgetary policy<br />

is built on three cornerstones. Firstly, the government targets a balanced<br />

budget over the economic cycle. Secondly, growth and employment<br />

will be promoted by investments in R&D, infrastructure,<br />

education and universities as well as in social affairs. Lastly, savings<br />

from structural reforms will be passed on to the citizens.<br />

I am convinced that this publication’s information on the general<br />

government debt and on the fundamentals <strong>of</strong> the <strong>Austrian</strong> economy<br />

will be received with interest and will yield further contribution<br />

to the strong confidence in the fundamentals <strong>of</strong> the <strong>Republic</strong> <strong>of</strong><br />

Austria.<br />

Over the past months, we have held numerous meetings with investors<br />

from many different countries and regions. The current turmoil<br />

on the financial markets has been an ongoing topic when discussing<br />

the general economic developments.<br />

Referring to the government bond market, a flight to liquidity and<br />

a concentration towards large issuers occurred as a reaction to the<br />

global financial crisis. This situation has created opportunities for<br />

fundamentally oriented investors seeking quality at attractive yields.<br />

We noticed an increased demand for information in a condensed<br />

format. I am delighted to present this annual review and I am confident<br />

that it will help to satisfy the increased demand for data. I<br />

invite you to contact us for any further information you may require.<br />

Yours faithfully,<br />

Martha Oberndorfer, CFA<br />

Managing Director <strong>of</strong> the <strong>Austrian</strong> <strong>Federal</strong> Financing Agency,<br />

<strong>Debt</strong> Management Office <strong>of</strong> the <strong>Republic</strong> <strong>of</strong> Austria<br />

Yours faithfully,<br />

Josef Pröll<br />

Minister <strong>of</strong> Finance<br />

Spanish Riding School, Vienna<br />

© Österreich Werbung / H. Graf<br />

2 | Annual Review 2008

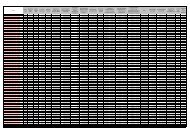

Economic and Budgetary Key Data for 2008<br />

In 2008, the <strong>Austrian</strong> economy continued to grow. Real Gross Domestic<br />

Product increased by 1.8% and reached EUR 282.2 bn. This<br />

compares favourably to the Eurozone average <strong>of</strong> 1.1% 1 . During the<br />

second half <strong>of</strong> the year, the <strong>Austrian</strong> economy slowed down, which<br />

is expected to continue in 2009. Recent forecasts for 2009 expect a<br />

2.2% decline <strong>of</strong> <strong>Austrian</strong> GDP, reflecting the ongoing contraction in<br />

the global economy. GDP per capita reached 31,300 in 2008 which<br />

is 24.7% above the EU-27 average. 2<br />

Key Economic Figures<br />

Real GDP Growth 2006 2007 2008 2009 2010<br />

Austria 3.4% 3.1% 1.8% -2.2% 0.5%<br />

Eurozone 3.0% 2.6% 0.7% -4.1% -0.3%<br />

United States 2.8% 2.0% 1.1% -4.0% 0.0%<br />

Japan 2.0% 2.4% -0.6% -6.6% -0.5%<br />

OECD average 3.1% 2.7% 0.9% -4.3% -0.1%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

-6%<br />

Austria<br />

Eurozone<br />

United States<br />

Japan<br />

Real GDP Growth<br />

Unemployment Rate 2006 2007 2008 2009 2010<br />

Austria 4.8% 4.4% 3.8% 5.0% 5.8%<br />

Eurozone 8.2% 7.1% 7.5% 10.1% 11.7%<br />

Inflation Rate 2006 2007 2008 2009 2010<br />

Austria 1.7% 2.2% 3.2% 0.6% 1.1%<br />

Eurozone 2.2% 2.3% 3.3% 0.6% 0.7%<br />

Fiscal Balance 2006 2007 2008 2009 2010<br />

Austria -1.5% -0.4% -0.4% -3.5% -4.7%<br />

OECD average -1.3% -1.4% -3.0% -7.2% -8.7%<br />

<strong>Debt</strong> Portfolio 2006 2007 2008 2009 2010<br />

Austria 159.5 161.0 176.4 191.9 207.2<br />

GDP Austria (bn EUR) 257.3 270.8 282.2 280.1 283.9<br />

-8%<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

<strong>Debt</strong>/GDP 2006 2007 2008 2009 2010<br />

Austria 62% 59% 63% 69% 73%<br />

Eurozone 75% 71% 71% 78% 84%<br />

GDP per Capita<br />

Source: OECD, WIFO and Ministry <strong>of</strong> Finance, March 09<br />

80,000<br />

70,000<br />

60,000<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

Luxembourg<br />

United States<br />

Switzerland<br />

Netherlands<br />

Austria<br />

Denmark<br />

Belgium<br />

United Kingdom<br />

Germany<br />

Finland<br />

Japan<br />

Spain<br />

EU (27 countries)<br />

Czech <strong>Republic</strong><br />

Portugal<br />

Hungary<br />

Romania<br />

Bulgaria<br />

Austria is among the few countries which run a sustainable current<br />

account surplus. The current account balance reached 2.9% <strong>of</strong> GDP<br />

in 2008, after 3.2% in 2007 3 . Since 1995, <strong>Austrian</strong> exports increased<br />

by an average 7% rate per annum, which is one <strong>of</strong> the highest rates<br />

across Europe. The competitiveness <strong>of</strong> the <strong>Austrian</strong> economy has<br />

been improving continuously, due to a favourable development <strong>of</strong><br />

labor unit costs (average real growth rate <strong>of</strong> labor unit costs since<br />

2000: Austria -0.8%, Eurozone 0.3%), accompanied by ambitious<br />

economic and fiscal reforms.<br />

1<br />

Source: OECD, WIFO March 2009<br />

2<br />

Source: EuroStat forecast, GDP per capita at market prices, comparison to EU-27 average<br />

based on purchasing power parity<br />

3<br />

Source: WIFO, March 2009<br />

Children at a creek<br />

© Österreich Werbung / Fankhauser<br />

Annual Review 2008 | 3

16<br />

inflation in 2008<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Latvia<br />

Iceland<br />

Bulgaria<br />

Lithunia<br />

Estonia<br />

Turkey<br />

Romania<br />

Czech <strong>Republic</strong><br />

Hungary<br />

Slovenia<br />

Malta<br />

Belgium<br />

Cyprus<br />

Greece<br />

Poland<br />

Spain<br />

Luxembourg<br />

Slovakia<br />

Finland<br />

United States<br />

European Union<br />

Denmark<br />

United Kingdom<br />

Italy<br />

Norway<br />

Euro area<br />

Sweden<br />

France<br />

Austria<br />

Ireland<br />

Germany<br />

Portugal<br />

Switzerland<br />

Netherlands<br />

Japan<br />

The inflation data on Austria for 2008 show a well-contained rate <strong>of</strong><br />

3.2% which is slightly below the Eurozone average <strong>of</strong> 3.3%.<br />

The rate <strong>of</strong> unemployment is low compared to other EU countries.<br />

In 2008, it reached 3.8%, down from 4.4% in 2007. Due to the<br />

continuing contractions <strong>of</strong> the global economies, it is expected to<br />

rise to around 5% in 2009, which is about half <strong>of</strong> the expected the<br />

size <strong>of</strong> the Eurozone average unemployment rate. 4<br />

The fiscal balance is expected to come in at -0.4% for 2008 and<br />

lies considerably below the Maastricht-threshold <strong>of</strong> 3%. The level<br />

<strong>of</strong> total debt is expected to increase to 62.5% in 2008 from 59.5%<br />

in 2007 5 . The increase in the debt level is mainly due to measures,<br />

the <strong>Austrian</strong> government has taken to stabilize the financial market.<br />

The long-term chart <strong>of</strong> the development <strong>of</strong> the <strong>Austrian</strong> central government<br />

debt level provides evidence for the prudent fiscal policy<br />

and the conservative management <strong>of</strong> the debt portfolio. Over the<br />

past ten years, the debt level relative to GDP has been stabilizing, as<br />

well as the interest burden. The interest expense actually declined<br />

from 3.5% <strong>of</strong> GDP to a ratio <strong>of</strong> below 2.5% <strong>of</strong> GDP as <strong>of</strong> end 2008.<br />

4<br />

Source: WIFO, March 2009<br />

5<br />

Maastricht-Definition, preliminary figures for 2008<br />

comment: over the past 10 years, the absolute level <strong>of</strong> interest<br />

payments remained more or less stable. Relative to GDP, the interest<br />

burden declined from 3.5% to below 2.5% as <strong>of</strong> end 2008.<br />

200,000<br />

180,000<br />

160,000<br />

140,000<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

Central Government <strong>Debt</strong> 1970 – 2010<br />

EUR Million<br />

Central Government <strong>Debt</strong><br />

interest payment<br />

% <strong>of</strong> GDP<br />

1970<br />

1972<br />

1974<br />

1976<br />

1978<br />

1980<br />

1982<br />

1984<br />

1986<br />

1988<br />

1990<br />

1992<br />

1994<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

comment: in the period <strong>of</strong> 1998 - 2008, the debt level has been stabilizing<br />

9,000<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

EUR Million<br />

Interest Burden 1970 – 2010<br />

1970<br />

1972<br />

1974<br />

1976<br />

1978<br />

1980<br />

1982<br />

1984<br />

1986<br />

1988<br />

1990<br />

1992<br />

1994<br />

% GDP<br />

0 0,0<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

1996<br />

%<br />

2010f<br />

2010f<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

4,0<br />

3,5<br />

3,0<br />

2,5<br />

2,0<br />

1,5<br />

1,0<br />

0,5<br />

Girl in Styrian traditional costume<br />

© Österreich Werbung / H. Wiesenh<strong>of</strong>er<br />

4 | Annual Review 2008

Credit Ratings<br />

Austria is rated AAA with stable outlook by all major rating agencies.<br />

Credit Ratings for Austria<br />

short-term long-term outlook<br />

Fitch Ratings F1+ AAA stable<br />

Moody’s P-1 Aaa stable<br />

Standard & Poor’s A-1+ AAA stable<br />

Measures to strengthen the financial system<br />

In October 2008, the <strong>Austrian</strong> Parliament passed two new laws: the<br />

Interbank Market Support Act (IBSG) and the Financial Market Stability<br />

Act (FinStaG).<br />

The central aspects <strong>of</strong> the <strong>Austrian</strong> measures encompass four main<br />

topics: stimulation <strong>of</strong> the interbank market (IBSG), equity-strengthening<br />

measures for banks (FinStaG), restoring confidence in financial<br />

markets and strengthening supervision. 6<br />

«The ratings continue to reflect Standard & Poor’s opinion on the<br />

country’s wealthy, modern and competitive economy, flexible labor<br />

and goods markets and moderate wage policies that support<br />

growth, competitiveness and employment. We believe these factors,<br />

as well as the absence <strong>of</strong> significant asset or credit bubbles<br />

should help Austria to weather the current economic crisis comparatively<br />

well.»<br />

(Standard & Poor’s, January 13, 2009)<br />

Fitch and Moody’s also put Austria into the category <strong>of</strong> the most<br />

resistant countries, after having applied stringent stress scenarios<br />

on the economy and the banking sector.<br />

EUR 75 bln<br />

Government Guaranteed<br />

Bank Issues<br />

EURO 100 bln Total Package<br />

EUR 15 bln<br />

Capital Injections for<br />

Financial Institutions<br />

6<br />

Further details: http://english.bmf.gv.at/Ministry/_start.htm.<br />

EUR 10 bln<br />

Deposit<br />

Guarantee Scheme<br />

<strong>Debt</strong> Management and Markets<br />

The <strong>Austrian</strong> <strong>Federal</strong> Financing Agency is the government debt management<br />

<strong>of</strong>fice, acting in the name and on behalf <strong>of</strong> the <strong>Republic</strong> <strong>of</strong><br />

Austria. Its mission includes to secure the government’s funding at<br />

all times at the lowest possible cost while avoiding excessive risk.<br />

In addition, it takes care <strong>of</strong> the ongoing debt portfolio and liquidity<br />

management. Furthermore, advisory functions for sub-sovereign<br />

entities and government-owned bodies are being provided. The tasks<br />

are laid down in the <strong>Austrian</strong> <strong>Federal</strong> Financing Act. 7<br />

Primary and secondary markets<br />

The biggest part <strong>of</strong> the funding is executed through government<br />

bond auctions, which take place in regular intervals. The auction<br />

process is implemented on the ADAS platform. 8 In addition to the<br />

auctions, the <strong>Republic</strong> <strong>of</strong> Austria launches one or two syndicated<br />

issues a year. Other funding instruments include the Medium Term<br />

Note Program, the <strong>Austrian</strong> Treasury Bills (ATB) and transactions in<br />

loan- and Schuldscheinformat.<br />

25<br />

20<br />

15<br />

10<br />

2009<br />

2011<br />

2013<br />

2015<br />

2017<br />

2019<br />

2021<br />

2023<br />

2025<br />

5<br />

0<br />

in billion EUR<br />

2027<br />

2029<br />

2031<br />

2033<br />

2035<br />

2037<br />

2039<br />

2041<br />

2043<br />

2045<br />

2047<br />

2049<br />

End 2007<br />

End 2008<br />

7<br />

<strong>Federal</strong> Act as <strong>of</strong> December 4, 1992, <strong>Federal</strong> Legal Gazette Number 763/1992 as amended<br />

8<br />

https://adas.oekb.at<br />

Maturity Pr<strong>of</strong>ile <strong>of</strong> the <strong>Republic</strong><br />

<strong>of</strong> Austria’s <strong>Debt</strong> Portfolio<br />

Museum <strong>of</strong> Contemporary Art Graz<br />

© Zepp-Cam, 2004<br />

Annual Review 2008 | 5

In 2008, 23 Dealers have been selected as primary dealers for <strong>Austrian</strong><br />

Government bonds (RAGBs). The tasks <strong>of</strong> the primary dealers<br />

include an active and lively participation in the primary market as<br />

well as in the secondary market.<br />

In 2008, ten bond auctions have been carried out, resulting in an<br />

issuance amount <strong>of</strong> EUR 10.17 bln. 9<br />

The overall funding amounted to EUR 19.98 bn in 2008.<br />

Bond<br />

Auctions for RAGBs in 2008<br />

Auction<br />

Date<br />

Issue<br />

Amount<br />

EUR<br />

Average<br />

Accepted<br />

Yield<br />

3.9% RAGB 2005-2020/1/144A 09-Dec-2008 1,100,000,000 4.022%<br />

3.5% RAGB 2005-2015/2/144A 07-Oct-2008 550,230,000 3.902%<br />

4.15% RAGB 2007-2037/1/144A 02-Sep-2008 604,759,000 4.707%<br />

4.350% RAGB 2008-2019/1/144A 08-Jul-2008 550,000,000 4.694%<br />

4.65% RAGB 2003-2018/1/144A 03-Jun-2008 550,000,000 4.505%<br />

4.350% RAGB 2008-2019/1/144A 06-May-2008 550,000,000 4.395%<br />

4.350% RAGB 2008-2019/1/144A 01-Apr-2008 550,000,000 4.237%<br />

4.3% RAGB 2007-2017/2/144A 04-Mar-2008 1,100,000,000 3.980%<br />

4.3% RAGB 2007-2017/2/144A 05-Feb-2008 614,279,000 3.985%<br />

4.35% RAGB 2008-2019/1/144A 08-Jan-2008 4,000,000,000 4.360%<br />

Top 10 primary dealers for RAGBs in 2008<br />

1. Morgan Stanley<br />

2. BNP Paribas<br />

3. HSBC<br />

4. Goldman Sachs<br />

5. Merrill Lynch<br />

6. Nomura<br />

7. Citigroup<br />

8. UBS<br />

9. Dresdner Bank<br />

10. Bank <strong>of</strong> America<br />

1. Citigroup<br />

2. Bank <strong>of</strong> America<br />

3. UBS AG<br />

4. Credit Suisse<br />

5. Goldman Sachs<br />

6. Deutsche Bank AG<br />

<strong>Austrian</strong> Treasury Bills<br />

Most Active Dealers in 2008<br />

The programme also includes a «dealer <strong>of</strong> the day»-option. ATBs<br />

are available in different currencies and are issued on a daily basis.<br />

There are no fixed auction dates for <strong>Austrian</strong> Treasury Bills, the terms<br />

and conditions are negotiated on a tailor-made basis.<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

10 year austrian benchmark yield and<br />

spreads versus Germany<br />

Yield in %<br />

AT benchmark yield (lefthand scale)<br />

10y government-spreads<br />

BE FR IT AT<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

annual average spread in bp<br />

2006<br />

2007<br />

2008<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

9<br />

for the latest statistics see also http://www.oebfa.co.at<br />

Hohensalzburg Fortress, Salzburg<br />

© Tourismus Salzburg<br />

6 | Annual Review 2008

Funding Strategy <strong>of</strong> the <strong>Republic</strong> <strong>of</strong> Austria in 2009<br />

After the budget 2009-2010 release on April 21, 2009, the projected<br />

total issuance volume for 2009 amounts to 28 – 34 EUR bn. This<br />

figure includes all funding instruments.<br />

A major part <strong>of</strong> the funding is realized through monthly auctions.<br />

The auction calendar <strong>of</strong> 2009 is outlined as follows:<br />

Date Value Date Volume<br />

January 8 January 15 EUR 3 bln syndicated issue RAGB Oct 2014<br />

February 10 February 13 EUR 1.79 bn increase <strong>of</strong> RAGB July 2020<br />

March 10 March 13 EUR 1.72 bn incease <strong>of</strong> RAGB Oct 2014<br />

April 7 April 14 EUR 0.89 bn increase <strong>of</strong> RAGB 2019<br />

and EUR 0.60 bn increase <strong>of</strong> RAGB 2037<br />

May 5 May 8 EUR 0.96 bn increase <strong>of</strong> RAGB 2019<br />

and EUR 1.14 bn increase <strong>of</strong> RAGB 2014<br />

June 9 June 12<br />

July 7 July 10<br />

Volumes and tenors are announced<br />

(August 4) (August 7)*<br />

one week prior to the auction date<br />

September 1 September 4<br />

Oktober 6 Oktober 9<br />

November 3 November 6<br />

December 1 December 4<br />

<br />

*) Reserve auction date<br />

As <strong>of</strong> End-April 2009, about 45% <strong>of</strong> the plan has been completed.<br />

Austria has a prestigious panel <strong>of</strong> primary dealers consisting <strong>of</strong> 15<br />

international and 6 domestic banks. The ranking depends on a variety<br />

<strong>of</strong> factors and takes volume as well as qualitative factors into<br />

account.<br />

For 2009, the selection <strong>of</strong> primary dealers includes the following<br />

banks:<br />

Dealers for RAGBs<br />

Barclays<br />

BAWAG P.S.K.<br />

BNP Paribas<br />

Calyon<br />

Citigroup<br />

Credit Suisse<br />

Deutsche Bank<br />

Dresdner Bank / Commerzbank<br />

Erste Bank<br />

Goldman Sachs<br />

HSBC France<br />

J.P. Morgan<br />

Merrill Lynch<br />

Morgan Stanley<br />

Nomura<br />

Oberbank<br />

Volksbank<br />

Royal Bank <strong>of</strong> Scotland<br />

RLB OÖ<br />

RZB<br />

UBS<br />

Diversity has always been a key element in the <strong>Republic</strong> <strong>of</strong> Austria’s<br />

funding strategy. The mix <strong>of</strong> investors is well diversified across geographic<br />

regions and investor categories. The investor base is a mix <strong>of</strong><br />

around 30% domestic and around 70% international accounts. Central<br />

banks, supranational organizations and other high-investment grade<br />

investors are the key holders <strong>of</strong> <strong>Austrian</strong> government debt.<br />

Funding sources include a variety <strong>of</strong> instruments, including state<strong>of</strong>-the-art<br />

electronic auctions <strong>of</strong> government bonds, Treasury<br />

bills, and standardized formats like EMTN-Programs and loan formats.<br />

The documents are available for download on the website<br />

http://www.oebfa.co.at/d/8/index.htm.<br />

The <strong>Austrian</strong> Treasury Bill (ATB) program is active in different currencies<br />

and maturities:<br />

Austria is a rare issuer. Typically, one or two deals are syndicated per<br />

year, complementing the monthly auctions. Market share <strong>of</strong> issuance<br />

within the Eurozone is in the range <strong>of</strong> 2 to 3%.<br />

Liquidity <strong>of</strong> <strong>Austrian</strong> government paper is enhanced by increasing<br />

the size <strong>of</strong> outstanding issues on a regular basis.<br />

List <strong>of</strong> <strong>Austrian</strong> government<br />

benchmark bonds<br />

Benchmark Bond<br />

Maturity<br />

4% RAGB 1999-2009/2 15-Jul-2009<br />

5.5% RAGB 1999-2010/4 15-Jan-2010<br />

5.25% RAGB 2001-2011/1 04-Jan-2011<br />

5% RAGB 2002-2012/1/144A 15-Jul-2012<br />

3.8% RAGB 2003-2013/2/144A 20-Oct-2013<br />

4.3% RAGB 2004-2014/1/144A 15-Jul-2014<br />

3.5% RAGB 2005-2015/2/144A 15-Jul-2015<br />

4% RAGB 2006-2016/2/144A 15-Sep-2016<br />

4.3% RAGB 2007-2017/2/144A 15-Sep-2017<br />

4.35% RAGB 2008-2019/1/144A 15-Mar-2019<br />

3.9% RAGB 2005-2020/1/144A 15-Jul-2020<br />

3.5% RAGB 2006-2021/1/144A 15-Sep-2021<br />

6.25% RAGB 1997-2027/6 15-Jul-2027<br />

4.15% RAGB 2007-2037/1/144A 15-Mar-2037<br />

Bank <strong>of</strong> America<br />

BAWAG P.S.K.<br />

Barclays Capital<br />

Citigroup<br />

Credit Suisse<br />

Dealers for ATBs<br />

Deutsche Bank AG<br />

Goldman Sachs<br />

RZB<br />

UBS AG<br />

UniCredit Group Bank Austria<br />

The debt portfolio <strong>of</strong> the republic <strong>of</strong> Austria consists <strong>of</strong> 95% fixed<br />

rate and 5% floating rate debt, with a typical duration <strong>of</strong> between<br />

5 and 6 and an average tenor <strong>of</strong> 8 to 9 years. In that way, the refinancing<br />

risks and the rollover ratio compared to GDP are among the<br />

lowest within the Eurozone countries.<br />

Two Skiers<br />

© Österreich Werbung / J. Mallaun<br />

Annual Review 2008 | 7

Contact<br />

<strong>Austrian</strong> <strong>Federal</strong> Financing Agency, Austria - 1015 Vienna, Seilerstaette 24, Phone: +43 1 512 25 11-0, Fax: +43 1 513 99 94,<br />

Web Site: www.oebfa.co.at/e/index.htm, Reuters: AFFA01…07, Bloomberg: RAGB, AUST<br />

Martha Oberndorfer, CFA<br />

Managing Director,<br />

Treasury <strong>Republic</strong> <strong>of</strong> Austria<br />

+43 1 512 25 11-14<br />

Kurt Sumper, MBA<br />

Managing Director,<br />

Back Office & Risk Management<br />

+43 1 512 25 11-30<br />

Treasury Contact<br />

Markus Stix, mstix@oebfa.co.at, +43 1 512 25 11-22<br />

Niklas Pax, npax@oebfa.co.at, +43 1 512 25 11-37<br />

Guenther Wahl, gwahl@oebfa.co.at, +43 1 512 25 11-16<br />

Links<br />

❚ www.bmf.gv.at<br />

❚ www.staatsschuldenausschuss.at/en/jahresberichte/annual_reports.jsp<br />

❚ www.oenb.at<br />

❚ www.wifo.at<br />

❚ www.ihs.ac.at<br />

❚ www.statistik.at<br />

❚ www.oekb.at/en/capital-market/government-bonds/pages/default.aspx<br />

Imprint:<br />

<strong>Austrian</strong> <strong>Federal</strong> Financing Agency, Treasury <strong>of</strong> the <strong>Republic</strong> <strong>of</strong> Austria. AFFA acts in the name and on behalf <strong>of</strong> the <strong>Republic</strong> <strong>of</strong> Austria<br />

Concept: Menedetter PR Graphics & Layout: spreitzerdrei Werbeagentur GmbH, A-1030 Wien Print: <strong>Federal</strong> Ministry <strong>of</strong> Finance<br />

Cover illustrations: Row 1 (left to right): Museum <strong>of</strong> Contemporary Art Graz / © Zepp-Cam, 2004; Children at a creek / © Österreich Werbung / Fankhauser; Haas-House and St. Stephen’s<br />

Cathedral, Vienna / © Österreich Werbung / G. Popp; Row 2: Fuschl am See / © Salzburg Land Tourismus; Spanish Riding School, Vienna / © Österreich Werbung / H. Graf; Cosi: Salzburg<br />

Festival / © Franz Neumayr; Row 3: Girl in Styrian traditional costume / © Österreich Werbung / H. Wiesenh<strong>of</strong>er; Hohensalzburg Fortress, Salzburg / © Tourismus Salzburg; Two Skiers /<br />

© Österreich Werbung / J. Mallaun