HP Motor Vehicle Taxation Act,1972 - Himachal Pradesh

HP Motor Vehicle Taxation Act,1972 - Himachal Pradesh

HP Motor Vehicle Taxation Act,1972 - Himachal Pradesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

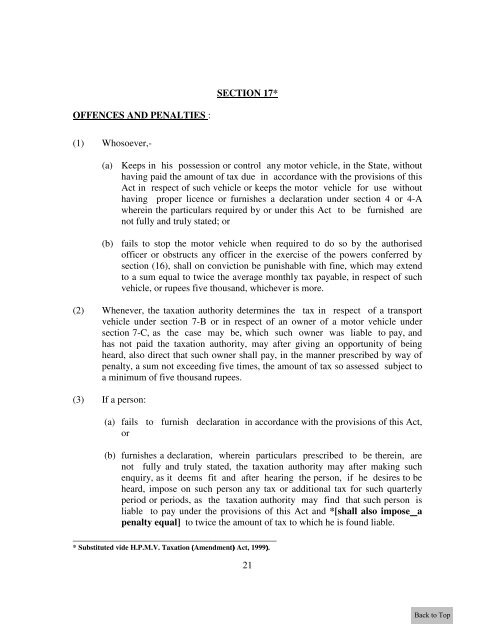

SECTION 17*<br />

OFFENCES AND PENALTIES :<br />

(1) Whosoever,-<br />

(a) Keeps in his possession or control any motor vehicle, in the State, without<br />

having paid the amount of tax due in accordance with the provisions of this<br />

<strong>Act</strong> in respect of such vehicle or keeps the motor vehicle for use without<br />

having proper licence or furnishes a declaration under section 4 or 4-A<br />

wherein the particulars required by or under this <strong>Act</strong> to be furnished are<br />

not fully and truly stated; or<br />

(b) fails to stop the motor vehicle when required to do so by the authorised<br />

officer or obstructs any officer in the exercise of the powers conferred by<br />

section (16), shall on conviction be punishable with fine, which may extend<br />

to a sum equal to twice the average monthly tax payable, in respect of such<br />

vehicle, or rupees five thousand, whichever is more.<br />

(2) Whenever, the taxation authority determines the tax in respect of a transport<br />

vehicle under section 7-B or in respect of an owner of a motor vehicle under<br />

section 7-C, as the case may be, which such owner was liable to pay, and<br />

has not paid the taxation authority, may after giving an opportunity of being<br />

heard, also direct that such owner shall pay, in the manner prescribed by way of<br />

penalty, a sum not exceeding five times, the amount of tax so assessed subject to<br />

a minimum of five thousand rupees.<br />

(3) If a person:<br />

(a) fails to furnish declaration in accordance with the provisions of this <strong>Act</strong>,<br />

or<br />

(b) furnishes a declaration, wherein particulars prescribed to be therein, are<br />

not fully and truly stated, the taxation authority may after making such<br />

enquiry, as it deems fit and after hearing the person, if he desires to be<br />

heard, impose on such person any tax or additional tax for such quarterly<br />

period or periods, as the taxation authority may find that such person is<br />

liable to pay under the provisions of this <strong>Act</strong> and *[shall also impose a<br />

penalty equal] to twice the amount of tax to which he is found liable.<br />

__________________________________________<br />

* Substituted vide H.P.M.V. <strong>Taxation</strong> (Amendment) <strong>Act</strong>, 1999).<br />

21