Reform of Severance Pay Law in Austria - mutual learning programme

Reform of Severance Pay Law in Austria - mutual learning programme

Reform of Severance Pay Law in Austria - mutual learning programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DISCUSSION PAPER<br />

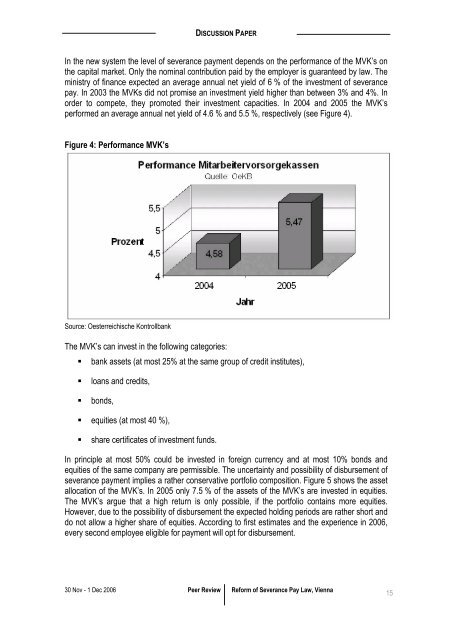

In the new system the level <strong>of</strong> severance payment depends on the performance <strong>of</strong> the MVK’s on<br />

the capital market. Only the nom<strong>in</strong>al contribution paid by the employer is guaranteed by law. The<br />

m<strong>in</strong>istry <strong>of</strong> f<strong>in</strong>ance expected an average annual net yield <strong>of</strong> 6 % <strong>of</strong> the <strong>in</strong>vestment <strong>of</strong> severance<br />

pay. In 2003 the MVKs did not promise an <strong>in</strong>vestment yield higher than between 3% and 4%. In<br />

order to compete, they promoted their <strong>in</strong>vestment capacities. In 2004 and 2005 the MVK’s<br />

performed an average annual net yield <strong>of</strong> 4.6 % and 5.5 %, respectively (see Figure 4).<br />

Figure 4: Performance MVK’s<br />

Source: Oesterreichische Kontrollbank<br />

The MVK’s can <strong>in</strong>vest <strong>in</strong> the follow<strong>in</strong>g categories:<br />

• bank assets (at most 25% at the same group <strong>of</strong> credit <strong>in</strong>stitutes),<br />

• loans and credits,<br />

• bonds,<br />

• equities (at most 40 %),<br />

• share certificates <strong>of</strong> <strong>in</strong>vestment funds.<br />

In pr<strong>in</strong>ciple at most 50% could be <strong>in</strong>vested <strong>in</strong> foreign currency and at most 10% bonds and<br />

equities <strong>of</strong> the same company are permissible. The uncerta<strong>in</strong>ty and possibility <strong>of</strong> disbursement <strong>of</strong><br />

severance payment implies a rather conservative portfolio composition. Figure 5 shows the asset<br />

allocation <strong>of</strong> the MVK’s. In 2005 only 7.5 % <strong>of</strong> the assets <strong>of</strong> the MVK’s are <strong>in</strong>vested <strong>in</strong> equities.<br />

The MVK’s argue that a high return is only possible, if the portfolio conta<strong>in</strong>s more equities.<br />

However, due to the possibility <strong>of</strong> disbursement the expected hold<strong>in</strong>g periods are rather short and<br />

do not allow a higher share <strong>of</strong> equities. Accord<strong>in</strong>g to first estimates and the experience <strong>in</strong> 2006,<br />

every second employee eligible for payment will opt for disbursement.<br />

30 Nov - 1 Dec 2006 Peer Review <strong>Reform</strong> <strong>of</strong> <strong>Severance</strong> <strong>Pay</strong> <strong>Law</strong>, Vienna<br />

15