Product Disclosure Statement - PSS

Product Disclosure Statement - PSS

Product Disclosure Statement - PSS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5. How we invest<br />

your money<br />

Preserved and associate members have the<br />

option of investing in either the Default Fund or<br />

Cash Investment Option. There is no investment<br />

choice for contributing members. Contributing<br />

members have their accumulation component<br />

(i.e. member contributions, productivity contributions,<br />

transfer amounts and co-contributions) invested in<br />

the Default Fund.<br />

When choosing an investment option you<br />

must consider:<br />

> > the amount of time your money will be invested<br />

before you need it for retirement<br />

> > the likely investment performance<br />

> > the level of risk and fluctuation in the value of<br />

your investment that you can tolerate.<br />

Default Fund<br />

Preserved and associate members that do not choose<br />

an investment option will have their super invested in<br />

our default option called the Default Fund. This is a<br />

‘pre-mixed’ investment option, investing across a range of<br />

asset classes, and having a medium- to high-level of risk.<br />

The objective of the Default Fund is to outperform the<br />

consumer price index (CPI) by 3.5% per annum over the<br />

medium- to long-term.<br />

The Default Fund is designed to invest in different types<br />

of investments that tend to perform independently of<br />

each other. By diversifying in this way, the Default Fund<br />

reduces its reliance on equity market returns and aims to<br />

provide a smoother pattern of long-term returns.<br />

This investment option is intended for those investors<br />

prepared to take more risk in exchange for potentially<br />

higher returns on their investment over the medium- to<br />

long-term, and willing to accept moderate- to higherlevels<br />

of volatility and periods of negative returns.<br />

Such investors tend to have a medium- to long-term<br />

investment horizon. The minimum suggested timeframe<br />

for holding this option is ten (10) years.<br />

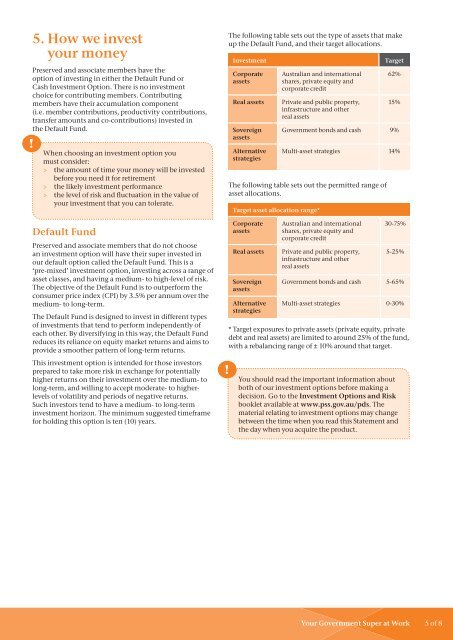

The following table sets out the type of assets that make<br />

up the Default Fund, and their target allocations.<br />

Investment<br />

Corporate<br />

assets<br />

Real assets<br />

Sovereign<br />

assets<br />

Alternative<br />

strategies<br />

Australian and international<br />

shares, private equity and<br />

corporate credit<br />

Private and public property,<br />

infrastructure and other<br />

real assets<br />

Target<br />

62%<br />

15%<br />

Government bonds and cash 9%<br />

Multi-asset strategies 14%<br />

The following table sets out the permitted range of<br />

asset allocations.<br />

Target asset allocation range*<br />

Corporate<br />

assets<br />

Real assets<br />

Sovereign<br />

assets<br />

Alternative<br />

strategies<br />

Australian and international<br />

shares, private equity and<br />

corporate credit<br />

Private and public property,<br />

infrastructure and other<br />

real assets<br />

30-75%<br />

5-25%<br />

Government bonds and cash 5-65%<br />

Multi-asset strategies 0-30%<br />

* Target exposures to private assets (private equity, private<br />

debt and real assets) are limited to around 25% of the fund,<br />

with a rebalancing range of ± 10% around that target.<br />

You should read the important information about<br />

both of our investment options before making a<br />

decision. Go to the Investment Options and Risk<br />

booklet available at www.pss.gov.au/pds. The<br />

material relating to investment options may change<br />

between the time when you read this <strong>Statement</strong> and<br />

the day when you acquire the product.<br />

Your Government Super at Work 5 of 8