Product Disclosure Statement - PSS

Product Disclosure Statement - PSS

Product Disclosure Statement - PSS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6. Fees and costs<br />

Did you know<br />

Small differences in both investment performance<br />

and fees and costs can have a substantial impact on<br />

your long-term returns.<br />

For example, total annual fees and costs of 2% of<br />

your fund balance rather than 1% could reduce<br />

your return by up to 20% over a 30-year period<br />

(for example, reduce it from $100,000 to $80,000).<br />

You should consider whether features such as<br />

superior investment performance or the provision of<br />

better member services justify higher fees and costs.<br />

You may be able to negotiate to pay lower contribution<br />

fees and management costs where applicable.* Ask the<br />

fund or your financial adviser.<br />

To find out more<br />

If you would like to find out more, or see the impact<br />

of the fees based on your own circumstances, the<br />

Australian Securities and Investments Commission<br />

(ASIC) website (www.moneysmart.gov.au) has a<br />

superannuation calculator to help you check out<br />

different fee options.<br />

* We are required by law to provide you with the above<br />

information. As you are not charged contribution fees for<br />

the <strong>PSS</strong> and the only management costs are the investment<br />

management costs recovered from the fund as a whole, you<br />

cannot negotiate contribution fees and management costs<br />

with the <strong>PSS</strong>. The calculator on the ASIC website can be used<br />

to calculate the effect of fees and costs on account balances.<br />

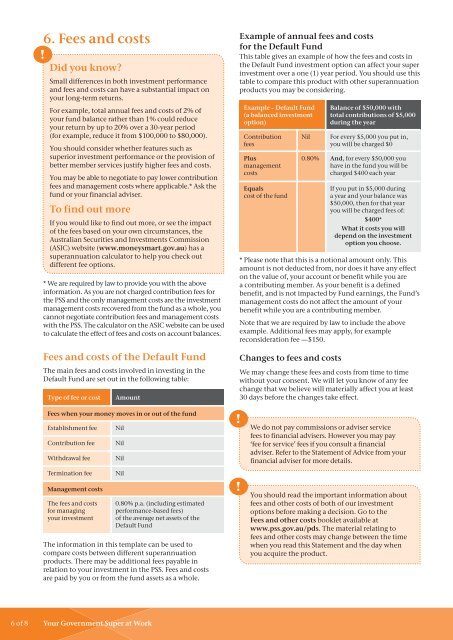

Fees and costs of the Default Fund<br />

The main fees and costs involved in investing in the<br />

Default Fund are set out in the following table:<br />

Type of fee or cost<br />

Amount<br />

Example of annual fees and costs<br />

for the Default Fund<br />

This table gives an example of how the fees and costs in<br />

the Default Fund investment option can affect your super<br />

investment over a one (1) year period. You should use this<br />

table to compare this product with other superannuation<br />

products you may be considering.<br />

Example – Default Fund<br />

(a balanced investment<br />

option)<br />

Contribution<br />

fees<br />

Plus<br />

management<br />

costs<br />

Equals<br />

cost of the fund<br />

Nil<br />

Balance of $50,000 with<br />

total contributions of $5,000<br />

during the year<br />

For every $5,000 you put in,<br />

you will be charged $0<br />

0.80% And, for every $50,000 you<br />

have in the fund you will be<br />

charged $400 each year<br />

If you put in $5,000 during<br />

a year and your balance was<br />

$50,000, then for that year<br />

you will be charged fees of:<br />

$400*<br />

What it costs you will<br />

depend on the investment<br />

option you choose.<br />

* Please note that this is a notional amount only. This<br />

amount is not deducted from, nor does it have any effect<br />

on the value of, your account or benefit while you are<br />

a contributing member. As your benefit is a defined<br />

benefit, and is not impacted by Fund earnings, the Fund’s<br />

management costs do not affect the amount of your<br />

benefit while you are a contributing member.<br />

Note that we are required by law to include the above<br />

example. Additional fees may apply, for example<br />

reconsideration fee —$150.<br />

Changes to fees and costs<br />

We may change these fees and costs from time to time<br />

without your consent. We will let you know of any fee<br />

change that we believe will materially affect you at least<br />

30 days before the changes take effect.<br />

Fees when your money moves in or out of the fund<br />

Establishment fee<br />

Contribution fee<br />

Withdrawal fee<br />

Termination fee<br />

Nil<br />

Nil<br />

Nil<br />

Nil<br />

We do not pay commissions or adviser service<br />

fees to financial advisers. However you may pay<br />

‘fee for service’ fees if you consult a financial<br />

adviser. Refer to the <strong>Statement</strong> of Advice from your<br />

financial adviser for more details.<br />

Management costs<br />

The fees and costs<br />

for managing<br />

your investment<br />

0.80% p.a. (including estimated<br />

performance-based fees)<br />

of the average net assets of the<br />

Default Fund<br />

The information in this template can be used to<br />

compare costs between different superannuation<br />

products. There may be additional fees payable in<br />

relation to your investment in the <strong>PSS</strong>. Fees and costs<br />

are paid by you or from the fund assets as a whole.<br />

You should read the important information about<br />

fees and other costs of both of our investment<br />

options before making a decision. Go to the<br />

Fees and other costs booklet available at<br />

www.pss.gov.au/pds. The material relating to<br />

fees and other costs may change between the time<br />

when you read this <strong>Statement</strong> and the day when<br />

you acquire the product.<br />

6 of 8<br />

Your Government Super at Work