Remuneration Report 2011 - Arcadis

Remuneration Report 2011 - Arcadis

Remuneration Report 2011 - Arcadis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual <strong>Report</strong> <strong>2011</strong><br />

56 <strong>Remuneration</strong> report<br />

<strong>Remuneration</strong> <strong>Report</strong><br />

This report has been prepared by the Selection and <strong>Remuneration</strong> Committee of the Supervisory Board.<br />

Early <strong>2011</strong>, both the remuneration of the Executive Board and of the Supervisory Board were reviewed.<br />

This was in line with the policy to do this every three years. In its meeting on 18 May <strong>2011</strong>, the General<br />

Meeting of Shareholders (GMS) adopted the revised remuneration policy for the Executive Board and<br />

the revised remuneration for the members of the Supervisory Board. Within the framework of the policy<br />

as adopted by the GMS, compensation of the Executive Board members is determined by the<br />

Supervisory Board, based on advice of the Selection and <strong>Remuneration</strong> Committee.<br />

<strong>Remuneration</strong> Executive Board<br />

The review of the remuneration policy for the Executive Board was<br />

done by the Selection and <strong>Remuneration</strong> Committee, based on a<br />

benchmark analysis performed by an external advisor. It was<br />

concluded that the labor market reference group needed to be<br />

adjusted, to reflect the changed size and positioning of ARCADIS,<br />

but that the remuneration structure could be maintained.<br />

<strong>Remuneration</strong> policy<br />

Compensation in line with median level of reference group<br />

The remuneration policy is aimed at attracting, motivating and<br />

retaining qualified management for an international company<br />

of ARCADIS’ size and complexity. The remuneration for<br />

Executive Board members consists of a fixed base salary, a<br />

short-term variable remuneration (cash bonus), a long-term<br />

variable remuneration (shares and options) and a pension plan<br />

and other fringe benefits. Variable remuneration is an important<br />

part of the total package and is based on performance criteria<br />

that incentivize value creation in the short and longer term.<br />

The remuneration policy aims at compensation in line with the<br />

median level of primarily the Dutch part of a selected labor<br />

market reference group.<br />

Labor market reference group<br />

The adjusted labor market reference group consists of Dutch<br />

companies, as well as a number of European industry peers, both<br />

of comparable size and complexity. It includes: CSM (NL),<br />

Nutreco (NL), Aalberts (NL), USG People (NL), Heymans (NL),<br />

Imtech (NL), Draka (NL), Fugro (NL), Boskalis (NL), Grontmij<br />

(NL), Atkins (UK), Pöyry (Fin), WSP (U.K.), RPS (U.K.) and<br />

Sweco (S).<br />

Fixed base salary<br />

The benchmark analysis showed that the fixed annual base<br />

salary of the members of the Executive Board was clearly below<br />

the median level of the Dutch part of the reference group.<br />

The Supervisory Board therefore proposed to increase the fixed<br />

annual salary to the median level as of 1 July <strong>2011</strong>, which was<br />

approved by the GMS. Although the use of a reference group<br />

may inflate the remuneration of directors in general, the<br />

Supervisory Board considered the raise justified as ARCADIS<br />

had become much bigger and more international. Moreover, in<br />

filling vacancies in the Executive Board, it became apparent that<br />

raises were necessary in order to attract candidates with the<br />

required qualifications. This resulted in the following annual<br />

base salaries as of 1 July <strong>2011</strong>.<br />

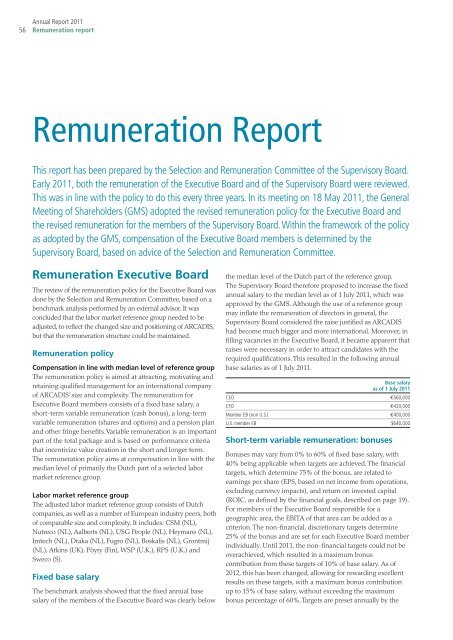

Base salary<br />

as of 1 July <strong>2011</strong><br />

CEO €560,000<br />

CFO €420,000<br />

Member EB (non U.S.) €400,000<br />

U.S. member EB $640,000<br />

Short-term variable remuneration: bonuses<br />

Bonuses may vary from 0% to 60% of fixed base salary, with<br />

40% being applicable when targets are achieved. The financial<br />

targets, which determine 75% of the bonus, are related to<br />

earnings per share (EPS, based on net income from operations,<br />

excluding currency impacts), and return on invested capital<br />

(ROIC, as defined by the financial goals, described on page 19).<br />

For members of the Executive Board responsible for a<br />

geographic area, the EBITA of that area can be added as a<br />

criterion. The non-financial, discretionary targets determine<br />

25% of the bonus and are set for each Executive Board member<br />

individually. Until <strong>2011</strong>, the non-financial targets could not be<br />

overachieved, which resulted in a maximum bonus<br />

contribution from these targets of 10% of base salary. As of<br />

2012, this has been changed, allowing for rewarding excellent<br />

results on these targets, with a maximum bonus contribution<br />

up to 15% of base salary, without exceeding the maximum<br />

bonus percentage of 60%. Targets are preset annually by the