Remuneration Report 2011 - Arcadis

Remuneration Report 2011 - Arcadis

Remuneration Report 2011 - Arcadis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual <strong>Report</strong> <strong>2011</strong><br />

60 <strong>Remuneration</strong> report<br />

For more information on remuneration and share ownership<br />

of Supervisory Board members, please refer to Notes 44 and 46<br />

of the Financial Statements in this report.<br />

Other information<br />

The company has not granted any loans, advances or guarantees<br />

to Executive or Supervisory Board members. In 2005, ARCADIS<br />

NV provided Executive Board members an indemnification for all<br />

costs and expenses from and against any claim, action or lawsuit<br />

related to actions and/or omissions in their function as Executive<br />

Board members. As approved by the GMS in 2005, a similar<br />

indemnification was provided to Supervisory Board members.<br />

On behalf of the Selection and <strong>Remuneration</strong> Committee<br />

Rijnhard W.F. van Tets, Chairman<br />

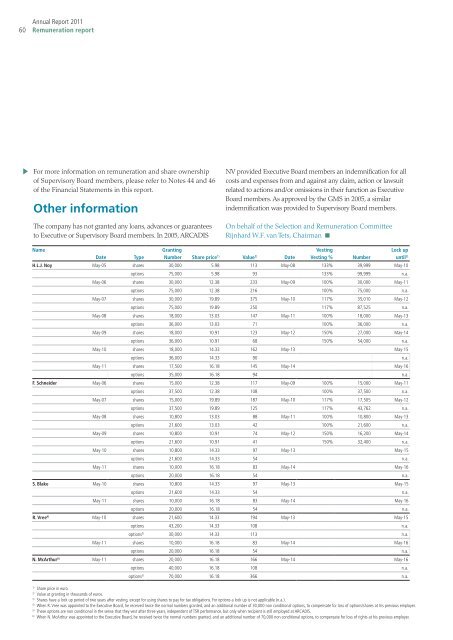

Name granting vesting lock up<br />

Date type number share price 1) value 2) date vesting % number until 3)<br />

H.L.J. Noy May-05 shares 30,000 5.98 113 May-08 133% 39,999 May-10<br />

options 75,000 5.98 93 133% 99,999 n.a.<br />

May-06 shares 30,000 12.38 233 May-09 100% 30,000 May-11<br />

options 75,000 12.38 216 100% 75,000 n.a.<br />

May-07 shares 30,000 19.89 375 May-10 117% 35,010 May-12<br />

options 75,000 19.89 250 117% 87,525 n.a.<br />

May-08 shares 18,000 13.03 147 May-11 100% 18,000 May-13<br />

options 36,000 13.03 71 100% 36,000 n.a.<br />

May-09 shares 18,000 10.91 123 May-12 150% 27,000 May-14<br />

options 36,000 10.91 68 150% 54,000 n.a.<br />

May-10 shares 18,000 14.33 162 May-13 May-15<br />

options 36,000 14.33 90 n.a.<br />

May-11 shares 17,500 16.18 145 May-14 May-16<br />

options 35,000 16.18 94 n.a.<br />

F. Schneider May-06 shares 15,000 12.38 117 May-09 100% 15,000 May-11<br />

options 37,500 12.38 108 100% 37,500 n.a.<br />

May-07 shares 15,000 19.89 187 May-10 117% 17,505 May-12<br />

options 37,500 19.89 125 117% 43,762 n.a.<br />

May-08 shares 10,800 13.03 88 May-11 100% 10,800 May-13<br />

options 21,600 13.03 42 100% 21,600 n.a.<br />

May-09 shares 10,800 10.91 74 May-12 150% 16,200 May-14<br />

options 21,600 10.91 41 150% 32,400 n.a.<br />

May-10 shares 10,800 14.33 97 May-13 May-15<br />

options 21,600 14.33 54 n.a.<br />

May-11 shares 10,000 16.18 83 May-14 May-16<br />

options 20,000 16.18 54 n.a.<br />

S. Blake May-10 shares 10,800 14.33 97 May-13 May-15<br />

options 21,600 14.33 54 n.a.<br />

May-11 shares 10,000 16.18 83 May-14 May-16<br />

options 20,000 16.18 54 n.a.<br />

R. Vree 4) May-10 shares 21,600 14.33 194 May-13 May-15<br />

options 43,200 14.33 108 n.a.<br />

options 5) 30,000 14.33 113 n.a.<br />

May-11 shares 10,000 16.18 83 May-14 May-16<br />

options 20,000 16.18 54 n.a.<br />

N. McArthur 6) May-11 shares 20,000 16.18 166 May-14 May-16<br />

options 40,000 16.18 108 n.a.<br />

options 5) 70,000 16.18 366 n.a.<br />

1)<br />

Share price in euro.<br />

2)<br />

Value at granting in thousands of euros.<br />

3)<br />

Shares have a lock up period of two years after vesting, except for using shares to pay for tax obligations. For options a lock up is not applicable (n.a.).<br />

4)<br />

When R. Vree was appointed to the Executive Board, he received twice the normal numbers granted, and an additional number of 30,000 non conditional options, to compensate for loss of options/shares at his previous employer.<br />

5)<br />

These options are non conditional in the sense that they vest after three years, independent of TSR performance, but only when recipient is still employed at ARCADIS.<br />

6)<br />

When N. McArthur was appointed to the Executive Board, he received twice the normal numbers granted, and an additional number of 70,000 non conditional options, to compensate for loss of rights at his previous employer.