estimated short-run marginal costs - American Public Power ...

estimated short-run marginal costs - American Public Power ...

estimated short-run marginal costs - American Public Power ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A COMPARATIVE ANALYSIS OF ACTUAL LOCATIONAL<br />

MARGINAL PRICES IN THE PJM MARKET AND<br />

ESTIMATED SHORT-RUN MARGINAL COSTS: 2003-2006<br />

<br />

prepared by London Economics International LLC<br />

Julia Frayer, Amr Ibrahim, Serkan Bahçeci, Sanela Pecenkovic<br />

717 Atlantic Avenue, Unit 1A<br />

Boston, MA 02111<br />

January 31, 2007

About the Authors<br />

Julia Frayer, as Managing Director, co-leads the firm’s market analysis and quantitative business<br />

practice area, which involves economic analysis and evaluation of infrastructure assets, detailed<br />

modeling of electricity markets, and price forecasting. She has worked extensively in the power<br />

sector (covering all aspects of the value chain), as well as other infrastructure industries such as the<br />

natural gas sector and the water sector. On regulatory front, she has specialized in areas related to<br />

market power mitigation, auction design, and performance-based ratemaking. Dr. Amr Ibrahim is a<br />

Senior Consultant with LEI specializing in restructuring, market design, regulation, and operation of<br />

wholesale and retail energy markets in the US, Canada, and South America. Dr. Serkan Bahçeci is a<br />

Consultant with LEI specializing in empirical analysis and applied econometrics to electricity<br />

markets. He has worked extensively on engagements involving generation market power and<br />

strategic bidding. Sanela Pecenkovic is a consultant with LEI, providing research and analytical<br />

support to market analysis-related engagements in the power sector for markets across North<br />

America.<br />

Notice<br />

This study has been produced by London Economics International LLC (“LEI”), an independent consulting firm<br />

specializing in economic analysis for the infrastructure industries. The study was funded by <strong>American</strong> <strong>Public</strong> <strong>Power</strong><br />

Association (“APPA”) and the National Rural Electric Cooperative Association (“NRECA”). APPA and NRECA make<br />

no warranty, express or implied, and assume no legal liability for the information in this report; nor does any party<br />

represent that the uses of this information will not infringe upon privately owned rights.

Executive summary<br />

In 2006, the <strong>American</strong> <strong>Public</strong> <strong>Power</strong> Association (“APPA”) launched the Electric Market Reform<br />

Initiative (“EMRI”) to investigate the challenges facing wholesale electricity markets. The first phase of<br />

this initiative entails a series of detailed studies of wholesale electricity markets in the United States.<br />

One of these studies, and the focus of this report by London Economics International LLC (“LEI”), is an<br />

assessment of the relationship between the actual locational <strong>marginal</strong> prices (LMPs) for energy in the<br />

PJM market and the <strong>short</strong>-<strong>run</strong> <strong>marginal</strong> cost (“SRMC”) of producing electricity. The main task for this<br />

study was to estimate the effective prices (we refer to them as<br />

modeled LMPs through this report) assuming generators are<br />

offering their output exactly at SRMCs. Once <strong>short</strong>-<strong>run</strong> <strong>marginal</strong><br />

cost-based prices are <strong>estimated</strong>, they can then be compared<br />

against actual historical LMPs and can be used to calculate a<br />

price-cost markup index.<br />

The study involves a two-stage process: (i) a simulation-based<br />

estimate of prices that would result if all generators in PJM Classic<br />

were bidding their SRMC and (ii) a comparison of those<br />

simulated (modeled) LMPs to actual market clearing prices in the<br />

Day-Ahead energy market.<br />

The ultimate analytical objective of this study is to estimate the<br />

price-cost markup index 1 for the PJM Classic market area for the<br />

43-month period, January 2003 through July 2006. The “cost”<br />

element of the price-cost markup index is specifically the <strong>short</strong><strong>run</strong><br />

<strong>marginal</strong> cost of the price-setting generator, which in the<br />

aggregate includes all <strong>costs</strong> that are variable across output levels<br />

in the <strong>short</strong> <strong>run</strong> 2 , such as fuel <strong>costs</strong>, variable operations and<br />

maintenance expenses, and emissions allowance purchase <strong>costs</strong>.<br />

The definition of SRMC used in this study focuses on physical<br />

operating <strong>costs</strong>, whereas some practitioners may also include<br />

opportunity <strong>costs</strong>. Indeed, PJM, in its implicit definition of<br />

reasonable <strong>marginal</strong> <strong>costs</strong> for purposes of bid mitigation also<br />

includes an adder for the recovery of other going forward <strong>costs</strong>.<br />

Perfect competition requires that the<br />

following five parameters be fulfilled.<br />

• firms and consumers are price<br />

takers;<br />

• the commodity is homogenous, i.e.,<br />

there is no product<br />

differentiation;<br />

• there is perfect and complete<br />

information, all firms and<br />

consumers know the prices set by<br />

all firms;<br />

• resources (including information)<br />

are perfectly mobile, so all firms<br />

have equal access to production<br />

technologies and capital; and<br />

• there are no barriers to entry, any<br />

firm may enter or exit the market<br />

as it wishes.<br />

If all the above conditions are present,<br />

then in such a market, prices would<br />

instantaneously move to an<br />

equilibrium, where firms make zero<br />

economic profits (only covering their<br />

<strong>costs</strong>, including their fixed and<br />

opportunity cost) and social welfare is<br />

optimized. In reality, however, many<br />

of the above conditions do not apply<br />

and therefore most markets depart to<br />

some degree from the theoretical<br />

premise of perfect competition.<br />

The empirical analysis of this study can be characterized as<br />

comparing actual market dynamics to a theoretical benchmark based on the neo-classical economic<br />

theory of perfect competition. The basic tenets of economic theory predict that prices must equal SRMC<br />

under perfect competition (albeit in a hypothetical environment, because of the requirements<br />

1 Price-cost markup index is defined as the ratio of the difference between actual LMP and <strong>estimated</strong> SRMC over the<br />

actual LMP. See Section 3.6 for further details and discussion.<br />

2 In this context, “<strong>short</strong> <strong>run</strong>” is defined as the period of time over which the plant’s capacity and capital stock is fixed<br />

(i.e., prior to entire major maintenance changes or capital investments that could change the operating efficiency of<br />

the plant).<br />

- 3 -<br />

London Economics International LLC<br />

717 Atlantic Avenue, Suite 1A<br />

Boston, MA 02111<br />

www.londoneconomics.com

enumerated in the textbox to the right). Indeed, the complexity of the electricity industry with its<br />

barriers to entry and high fixed capital <strong>costs</strong> requirements may result in a situation that is not wholly<br />

congruent with the theory of perfect competition. Therefore, in the real world, the fact that prices will<br />

need to be above the <strong>short</strong>-<strong>run</strong> <strong>marginal</strong> <strong>costs</strong> so that firms can recover the minimum necessary going<br />

forward <strong>costs</strong> is a well accepted paradigm for energy-only markets. (Although it is important to note<br />

that PJM is not an energy-only market and operates other product markets, from which some<br />

generators can earn additional revenues.) From a policy perspective, the important question to ask is<br />

whether the observed markups above SRMC reported in this empirical study are adequate, too high, or<br />

too low to sustain the market. Although such policy applications are beyond the scope of the study,<br />

the results of this study provide important, statistically significant results that can be applied to think<br />

through and address such questions.<br />

Section 2 of the report provides a general overview of the PJM market place, and primarily describes<br />

the “Energy Market”. Section 2 also highlights the details of the other product markets that PJM<br />

administers. A basic understanding of these other markets, namely, “Capacity” and the “Ancillary<br />

Services,” is relevant to the study, because these other markets are a potential source of additional<br />

revenues for generators and therefore are important to understand from the prospect of analyzing the<br />

levels of the markups against fixed <strong>costs</strong>, and addressing questions of market efficiency, generator<br />

profitability, investment, and sustainability. Section 4 reviews the day-ahead locational <strong>marginal</strong> prices<br />

in their historical perspective within the modeled regions. Actual regional LMP is a basic component of<br />

the price-cost markup index; therefore it is important to understand the historical and geographical<br />

trends of these price series.<br />

Scope, methodology, and data<br />

As part of the scope of work, LEI proposed an analysis spanning a three and a half year timeframe<br />

starting from January 2003 through July 2006, coupled with a static geographical coverage area of PJM<br />

Classic (the original PJM service area). The selected timeframe is long enough to allow us to identify<br />

and study established trends in target variables. At the same time, the use of a static geographic<br />

designation permitted the results to be comparable across the timeframe and subject to direct contrast.<br />

In order to make the study computationally tractable, we selected a sample of days within each<br />

calendar year, representing the variations in load, seasons, and peak versus off-peak periods. Our<br />

sample size represents approximately 55% of the days in our timeframe leaving very small room for<br />

information loss that can otherwise occur with a small or biased sample. Given a sampled day, all 24<br />

hours are simulated so that we get a full picture of daily variation of demand and supply of electricity<br />

across the day.<br />

In order to simulate SRMC-based prices, we needed first to estimate SRMCs, and then to simulate the<br />

price-setting process in PJM under the assumption of SRMC-based bidding by all generators. Section 3<br />

describes the basic assumptions and methods used, including a description of the simulation model.<br />

Section 5 of this report explains how we <strong>estimated</strong> the <strong>short</strong> <strong>run</strong> <strong>marginal</strong> <strong>costs</strong> of the generating<br />

plants. In order to build the model, we gathered historical data that described market conditions at<br />

each hourly interval over the study timeframe. For example, we compiled actual load data for the<br />

selected PJM zones, as well as imports to and exports from the zones in question, transmission flows<br />

and limits through major transmission interfaces, fuel prices and other operating <strong>short</strong> <strong>run</strong> <strong>costs</strong> of the<br />

generating units, as well as detailed production data for major plants located in PJM Classic. We relied<br />

- 4 -<br />

London Economics International LLC<br />

717 Atlantic Avenue, Suite 1A<br />

Boston, MA 02111<br />

www.londoneconomics.com

on data in the public domain as well as general accepted, industry sources to develop the SRMC-based<br />

bids and other necessary assumptions for the simulation modeling, such as the technical data on<br />

generating plants, published in FERC Form 1, FERC 423, EIA 906, IEA 423, U.S. EPA CEMS, U.S. EPA<br />

Clean Air Markets unit characteristics databases, collated and provided by Velocity Suite of Global<br />

Energy Decisions, actual zonal load data, hourly transmission limits, interchanges (imports/exports)<br />

from PJM, and historical spot market fuel price data from Bloomberg.<br />

The transmission constraints data (thermal limits and actual historical flows between transmission<br />

zones), which is crucial to determine the network topology, is not readily available publicly and was<br />

not provided by PJM. PJM, in contrast to other ISOs, also does not decompose its LMPs into an energy<br />

and congestion component (instead, PJM provides shadow-prices of constrained elements). Therefore,<br />

we had to rely on data on actual flows and limits on the major interfaces to construct our model’s<br />

topology assumptions. The availability of data and PJM’s own practices to monitor only the major<br />

interfaces led us to model PJM Classic as a five-region network.<br />

Summary of results<br />

Our results, which are discussed in Section 6, starting at page 43, show that for most of the months in<br />

the studied timeframe the price-cost markup indices, especially for peak periods, are significantly<br />

higher than zero 3 , indicating that actual average LMPs were higher than he modeled LMPs (which are<br />

based on <strong>estimated</strong> SRMC bidding). This is not surprising given the realities of market dynamics. PJM<br />

has acknowledged that it also believes that there is a positive markup above SRMC embedded in actual<br />

LMPs. However, the results of this study are interesting for the more subtle observations that are not<br />

apparent in PJM’s markup indices. For example, the index levels vary significantly based on location<br />

(region), and time of day (peak versus off-peak) as well as across time. As expected, the peak period<br />

markup indices were almost always higher than the off-peak period markup indices for each region.<br />

This is intuitive given the differences in supply-demand balance during peak versus off-peak periods,<br />

and the types of resources that are price-setting as we move from off-peak demand levels to peak<br />

demand levels (and peaking resources’ need for above-<strong>marginal</strong> cost bidding to recover going forward<br />

<strong>costs</strong>).<br />

Monthly markup indices for each region are quite volatile – standard deviations of indices for each<br />

region and year are close to half of the average indices for all periods and almost the same magnitude<br />

as the actual indices for the off-peak periods. 4 For example, the average monthly markup index in the<br />

Delmarva peninsula area (region D) for peak periods is 10% with a standard deviation of 5%, and for<br />

off-peak periods the average is 6%, again with a 5% standard deviation over the study timeframe. In<br />

another example, the average monthly markup index in the service area of Pennsylvania Electric<br />

Company (region P) is 14% and 5% for peak and off-peak periods, respectively, both with a standard<br />

deviation of 4%. This volatility has a number of important implications. First, there is no apparent<br />

trend which correlates markup index levels with seasons or months. Therefore, other variables need to<br />

3 In statistical jargon, most indices are statistically significant at the chosen 95% confidence level.<br />

4 In statistics, volatility of a variable is sometimes measured by the ratio of standard deviation and mean. If that ratio is<br />

higher than one third, the variable is considered “volatile” in statistical conventions, although volatility is an ordinal<br />

concept, used to compare variables rather than labeling them.<br />

- 5 -<br />

London Economics International LLC<br />

717 Atlantic Avenue, Suite 1A<br />

Boston, MA 02111<br />

www.londoneconomics.com

e explored to understand or explain the timing and levels of markup indices. Leaving aside potential<br />

structural changes in the market, since the magnitudes of standard deviations can be so close to the<br />

averages, any estimation of the markup index value outside of the studied timeframe (i.e. extrapolation<br />

to the future) faces a high degree of uncertainty. Therefore, we cannot conclude whether such markups<br />

are going to be repeated in the future from this historical backcast.<br />

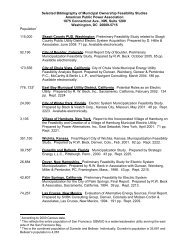

Figure 1, below, portrays the range of monthly average 5 price-cost markup indices for different periods<br />

across each of the years in our study timeframe (based on the sample days) and across modeled regions<br />

in PJM Classic. 6 The difference between the market price and the <strong>short</strong> <strong>run</strong> <strong>marginal</strong> cost of the<br />

generating unit is called the price-cost markup, and the markup divided by the market price is called<br />

the price-cost markup index. Price-cost markup is measured in dollar terms, so it is difficult to compare<br />

two markup values, if the underlying prices are different. The price-cost markup index, in contrast, is<br />

free of units, and so allows temporal or across markets comparisons even though the underlying prices<br />

are different. 7 We have focused on the markup index in this report, but have also augmented the<br />

discussions in Section 6 with the dollar-denominated markup levels (or differences) between actual<br />

LMPs and modeled LMPs, based on SRMC-bidding.<br />

The figure below shows the variation between peak and off-peak periods as well as a snapshot of the<br />

differences across regions within the same year. As discussed above and elaborated further in Section 6<br />

of this report, these types of trends are (at least partially) explained by the supply and demand<br />

conditions within each region and across time. However, further analysis is required in order to<br />

robustly and exhaustively document the causes of explanatory variables of observed markups.<br />

The average on-peak monthly indices by region rarely exceed 20% over the study timeframe, with the<br />

range more typically below 10%, as seen below. Taking into account the forecast error of the model,<br />

some months’ results become statistically insignificant at a 95% confidence level, and those are<br />

demarcated in the figure below with an asterisk. 8<br />

5 Throughout the report, unless it is explicitly stated otherwise, each period (hour, day, etc.) is weighed equally in<br />

calculating monthly averages, consistent with the Latin hypercube sampling method.<br />

6 See Section 3.4 for a detailed discussion of modeling PJM Classic topology. In <strong>short</strong>, PJM Classic has ten transmission<br />

zones based on the service areas of the local electric distribution companies. Given the transmission constraints in<br />

PJM Classic, we grouped them in five regions as follows: Region P: Pennsylvania Electric Company (“PENELEC”);<br />

Region M: 69% of the load of Metropolitan Edison Company (“METED”) and PPL Electric Utilities Corporation<br />

(“PPL”); Region B: the remaining part of METED, Baltimore Gas and Electric Company (“BG&E”) and Potomac<br />

Electric <strong>Power</strong> Company (“PEPCO”); Region E: <strong>American</strong> Electric <strong>Power</strong> Co., Inc. (“AECO”), <strong>Public</strong> Service Electric<br />

and Gas Company (“PSEG”), Jersey Central <strong>Power</strong> and Light Company (“JCPL”) and PECO Energy Company<br />

(“PECO”); and Region D: Delmarva <strong>Power</strong> and Light Company (“DPL”).<br />

7 For example, consider two hypothetical electricity markets, one with a $100/MWh market price and a $90/MWh<br />

SRMC; and the other with $50/MWh price and $40/MWh SRMC. The price-cost markups in both markets are<br />

$10/MWh but the price-cost markup indices would be 10% and 20%, respectively (L.C. Section 3.6 at page 27 for the<br />

formula and discussion on price-cost markup index.).<br />

8 Note that Figure 1 only shows the range of markup indices with minimum and maximum values; detailed discussion<br />

of the statistical significance of monthly index values can be found in Section 6.<br />

- 6 -<br />

London Economics International LLC<br />

717 Atlantic Avenue, Suite 1A<br />

Boston, MA 02111<br />

www.londoneconomics.com

Figure 1. Annual ranges of the monthly averages of the price-cost markup indices for peak, off-peak<br />

and all periods across the modeled regions in PJM Classic<br />

Peak Off-Peak All<br />

Note: 2006 is a partial calendar year (January – July 2006, only)<br />

Region D Region E Region B Region M Region P<br />

2003 8% to 16% 2%* to 8% 7% to 12%<br />

2004 9% to 20% 1%* to 16% 6% to 15%<br />

2005 8% to 25% -3%* to 14% 3%* to 19%<br />

2006 13% to 23% -1%* to 4%* 7% to 13%<br />

2003 2%* to 13% 0%* to 5%* 1%* to 8%<br />

2004 2%* to 15% 0%* to 9% 1%* to 13%<br />

2005 6% to 15% -1%* to 12% 2%* to 14%<br />

2006 7% to 12% 0%* to 5%* 4% to 7%<br />

2003 4%* to 10% 0%* to 8% 3%* to 7%*<br />

2004 5% to 12% 1%* to 11% 3% to 10%<br />

2005 7% to 17% -1%* to 11% 6% to 13%<br />

2006 7% to 16% 1%* to 6% 5% to 11%<br />

2003 2%* to 14% -1%* to 5%* 2%* to 6%<br />

2004 7% to 17% 3%* to 14% 5%* to 16%<br />

2005 8% to 19% 3%* to 14% 7% to 13%<br />

2006 5% to 15% 1%* to 4%* 3% to 10%<br />

2003 1%* to 15% -1%* to 4%* 0%* to 8%<br />

2004 1%* to 17% 0%* to 13% 1%* to 15%<br />

2005 8% to 26% 2%* to 14% 5%* to 19%<br />

2006 8% to 16% 0%* to 5%* 4%* to 11%<br />

At the same time, due to the forecast error, which is region and time-specific, the average values that<br />

are computed in the study (and reported below) may in fact be higher (or lower) because at a 95%<br />

confidence level; there will be a higher bound (as well as a lower bound). In other words, a 11%<br />

markup index value for peak periods in January 2003 for region M with a 6% forecast error,<br />

corresponds to a confidence interval between 5% and 17%, hence we conclude the index in January<br />

2003 for region M would take a value between 5% and 17% with a 95% probability (confidence level).<br />

The index value for the same month and region for off-peak periods is 2.5% and the forecast error is<br />

5.5%, giving a confidence interval between -3% and 8%. Since the resulting confidence interval<br />

straddles 0%, we must conclude that off-peak index is not significantly different than zero (or<br />

statistically insignificant), and we cannot claim that there was a positive markup in that month for offpeak<br />

periods or average.<br />

Consideration of potential modeling critiques<br />

Modeling historical events in a region as large as PJM is a difficult task in and of itself, but is further<br />

complicated by the confidentiality or unavailability of primary data on transmission, technical<br />

operating constraints and generation plant characteristics over time. Because of the unavailability of<br />

detailed data on the transmission system (namely thermal transfer limits between the ten transmission<br />

- 7 -<br />

London Economics International LLC<br />

717 Atlantic Avenue, Suite 1A<br />

Boston, MA 02111<br />

www.londoneconomics.com

zones in PJM Classic and congestion cost decomposition of LMPs), we simplified the topology and<br />

modeled a five region system within PJM Classic (plus all the interconnections with external markets<br />

and regions outside PJM Classic). This is an abstraction of the real world, as we are not modeling<br />

directly the internal congestion within each region or the entire nodal system. Nevertheless, we are<br />

calibrating generation and inter-regional flows to actual levels in order to offset the effects of this<br />

simplifying assumption. The magnitude of any possible bias is further minimized within each of our<br />

regions since we determine the boundaries of the regions carefully using the physical layout of the<br />

major transmission interfaces vis-à-vis generation and historical zonal price analysis (i.e., the zones<br />

with closer prices are grouped together in the same region). In summary, with careful preparation of<br />

regional designation points and calibration of modeling results, we believe that the simplifying<br />

assumption on transmission topology had limited effect on modeling results and the loss of<br />

information was minimized.<br />

A second simplification in the modeling relates to the generating unit characteristics. The key<br />

parameters were typically <strong>estimated</strong> hourly (for example, availability) or daily (spot fuel prices).<br />

However, we have also used monthly data (for hydroelectric production) or in some cases annual<br />

averages (for example, heat rates of individual plants) in our model. For plants where hourly<br />

generation data is unavailable, we have used generic technology based outage rates from North<br />

<strong>American</strong> Reliability Corporation’s Generating Availability Data System (GADS) 9 to project availability<br />

across the year. Though use of averages and generic industry data is not optimal, the operating<br />

parameters and technical characteristics for which we used monthly or annual data inputs do not<br />

fluctuate much typically and are not major drivers of the results.<br />

One possible critique of the modeling is that we did not model every day in the selected timeframe but<br />

only the selected days. The process of sampling almost always leads to some information leakage. In<br />

order to minimize problems, we used a very large sample size of 55%, and a robust statistical sampling<br />

technique to ensure that the sampled days represent the entire timeframe as closely as possible. In<br />

addition, we reviewed the days which were not sampled to understand if they had exhibited patterns<br />

of bias because they were outliers we did not cover. Based on an ex post examination of the load and<br />

LMP data, we have not excluded interesting periods, such as the hours with the lowest or highest<br />

actual LMPs.<br />

One other issue is the technical operating constraints faced by PJM controllers and system operators,<br />

which we did not take into account due to data unavailability. Many dynamic operating constraints,<br />

however, usually produce localized results and do not affect the average LMPs across the day or the<br />

regional aggregates. We did not account for certain plant-level operating parameters (for example, we<br />

did not consider ramp rates explicitly, although our proprietary power market simulation program,<br />

POOLMod, 10 does have an ability to optimize dispatch through low-demand periods and so forth). In<br />

addition, partial outages and certain fixed <strong>costs</strong> (such as start up <strong>costs</strong> and no load heat <strong>costs</strong>) were not<br />

incorporated in the modeling, as we felt that they were already represented in the calibration process or<br />

were outside the scope of our definition of SRMC. Lastly, we also did not take into account actual<br />

9 See http://www.nerc.com/~gads/ for more information on GADS.<br />

10 See Section 8.3 for a detailed description of POOLMod.<br />

- 8 -<br />

London Economics International LLC<br />

717 Atlantic Avenue, Suite 1A<br />

Boston, MA 02111<br />

www.londoneconomics.com

hourly hydro production (because data at such a granular level is not available) but rather let<br />

POOLMod schedule the hydro subject to a daily energy budget and profit maximizing rules.<br />

There is also a methodological difference between our simulation modeling (and selection of the pricesetting<br />

unit) and PJM’s mechanism in determining the LMPs. PJM’s Security Constrained Economic<br />

Dispatch (“SCED”) procedures use shadow prices – effectively the lowest undispatched bid price – in<br />

setting actual LMPs, while our proprietary simulation model looks at the highest dispatched price to<br />

set the modeled LMP. Theoretically, the difference between those two can be quite high, if the supply<br />

stack has big gaps. However, in a market as large as PJM Classic, the gaps in the supply stack tend to<br />

be smaller and thus negligible. Figure 59 through Figure 62 in Section 8.6 present the cumulative<br />

supply curves and demonstrate the fact that the gaps are indeed small.<br />

How to interpret the results<br />

Every model, by definition, is an abstraction of complex, real systems; and therefore the results from<br />

any modeling require careful consideration, interpretation, and application to real world problems and<br />

policymaking. The fact that prices may depart from SRMC is not itself unusual or an indication of<br />

market dysfunction. Rather, it is a signal that further study and analysis is necessary before conclusions<br />

can be drawn about the efficiency of the market system in PJM. A closer look at the extent to which<br />

LMPs exceed <strong>marginal</strong> <strong>costs</strong> and an analysis of other income streams’ contribution to fixed cost<br />

recovery is warranted to better understand how the markups relate to price levels necessary to<br />

motivate investment, and how the overall price levels relate to the long <strong>run</strong> <strong>marginal</strong> cost of the sector,<br />

or the break-even cost that is necessary to motivate investment and security of supply. Do markups<br />

exceed commercially reasonable profit levels for the sector and are they sustainable over a significant<br />

period of time, without erosion by new entrants Do these price-cost markups indicate patterns in<br />

bidding behavior that demonstrate the potential for market power This study does not attempt to<br />

answer all these complex questions, but rather provides the reader with the empirical basis for further<br />

examination.<br />

- 9 -<br />

London Economics International LLC<br />

717 Atlantic Avenue, Suite 1A<br />

Boston, MA 02111<br />

www.londoneconomics.com