RBI FUNCTIONS.pdf

RBI FUNCTIONS.pdf

RBI FUNCTIONS.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

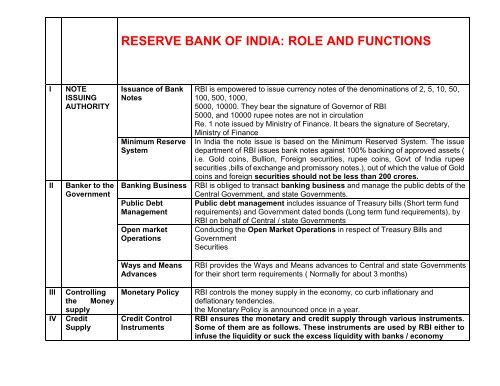

RESERVE BANK OF INDIA: ROLE AND <strong>FUNCTIONS</strong><br />

I<br />

II<br />

NOTE<br />

ISSUING<br />

AUTHORITY<br />

Banker to the<br />

Government<br />

Issuance of Bank<br />

Notes<br />

Minimum Reserve<br />

System<br />

Banking Business<br />

Public Debt<br />

Management<br />

Open market<br />

Operations<br />

<strong>RBI</strong> is empowered to issue currency notes of the denominations of 2, 5, 10, 50,<br />

100, 500, 1000,<br />

5000, 10000. They bear the signature of Governor of <strong>RBI</strong><br />

5000, and 10000 rupee notes are not in circulation<br />

Re. 1 note issued by Ministry of Finance. It bears the signature of Secretary,<br />

Ministry of Finance<br />

In India the note issue is based on the Minimum Reserved System. The issue<br />

department of <strong>RBI</strong> issues bank notes against 100% backing of approved assets (<br />

i.e. Gold coins, Bullion, Foreign securities, rupee coins, Govt of India rupee<br />

securities ,bills of exchange and promissory notes.), out of which the value of Gold<br />

coins and foreign securities should not be less than 200 crores.<br />

<strong>RBI</strong> is obliged to transact banking business and manage the public debts of the<br />

Central Government, and state Governments.<br />

Public debt management includes issuance of Treasury bills (Short term fund<br />

requirements) and Government dated bonds (Long term fund requirements), by<br />

<strong>RBI</strong> on behalf of Central / state Governments<br />

Conducting the Open Market Operations in respect of Treasury Bills and<br />

Government<br />

Securities<br />

Ways and Means<br />

Advances<br />

<strong>RBI</strong> provides the Ways and Means advances to Central and state Governments<br />

for their short term requirements ( Normally for about 3 months)<br />

III<br />

IV<br />

Controlling<br />

the Money<br />

supply<br />

Credit<br />

Supply<br />

Monetary Policy<br />

Credit Control<br />

Instruments<br />

<strong>RBI</strong> controls the money supply in the economy, co curb inflationary and<br />

deflationary tendencies.<br />

the Monetary Policy is announced once in a year.<br />

<strong>RBI</strong> ensures the monetary and credit supply through various instruments.<br />

Some of them are as follows. These instruments are used by <strong>RBI</strong> either to<br />

infuse the liquidity or suck the excess liquidity with banks / economy

Bank Rate<br />

CRR<br />

It is the rate at which <strong>RBI</strong> rediscounts the Bills of commercial banks. Presently it<br />

is 8%<br />

Cash Reserve Ratio: It specifies the cash balances required to be maintained by<br />

banks <strong>RBI</strong> as a specific percentage on their adjusted net demand and time<br />

liabilities.CRR is hiked by <strong>RBI</strong> to curb the inflation. Presently it is 4%<br />

SLR<br />

Statutory Liquidity Ratio. It specifies the minimum investment by a Bank in the<br />

approved securities. It is mentioned as a percentage of adjusted demand and time<br />

liabilities of a Bank. Presently it is 22%. . A higher percentage may be specified<br />

by <strong>RBI</strong> (Presently the maximum is 40%), to curb the excess liquidity with a Bank.<br />

V<br />

Banker to<br />

Banks<br />

Open Market<br />

Operations<br />

Selective Credit<br />

Control<br />

Market<br />

stabilization<br />

scheme<br />

Fixation of<br />

Inventory Norms<br />

Directed Lending<br />

Control over<br />

Interest rates<br />

Licensing<br />

Authority<br />

Scheduled Bank<br />

Status to banks<br />

Refinance<br />

Open market operations include the buying and selling of government securities.<br />

When the economy is having the excess liquidity <strong>RBI</strong> sells government securities<br />

at attractive rate of interest, so that people having excess money invest money in<br />

these securities there by excess liquidity in the economy is removed.<br />

This is a Qualitative Control. <strong>RBI</strong> stipulates higher margin and rate of interest in<br />

respect of loans and advances against essential commodities and some other<br />

selected items to ensure hoarding of stock and black marketing.<br />

Normally <strong>RBI</strong> borrows funds from whenever required by Government. Sometimes<br />

<strong>RBI</strong> resorts to public borrowing to suck the excess liquidity in the economy.<br />

Whenever required <strong>RBI</strong> fixes the Inventory norms for banks finance Eg: Tandon<br />

Commiittee norms, Chore Committee norms, Nayak committee norms.<br />

<strong>RBI</strong> specifies the targets to be achieved by banks in respect of certain sector. Eg:<br />

Priority sector advances. 40% to priority sectors, 18% to weaker sections etc<br />

Even though the deposit interest rates and lending rates are deregulated , certain<br />

interest rates like interest rate on S.B a/c (4%),Inte4rest rates on export credit etc<br />

are regulated by <strong>RBI</strong><br />

A bank should comply with the minimum stipulations of <strong>RBI</strong> to do banking<br />

business<br />

A bank whose name is entered in the second schedule to the BR Act is called a<br />

scheduled bank<br />

Finance against the long term loans to the borrowers

Rediscounting of<br />

Bill<br />

Liquidity<br />

Adjustment<br />

Facility<br />

Lender of last<br />

resort<br />

Liquidity to banks against the bills discounted by them to their clients<br />

Repo and Reverse Repo both put together is called Liquidity adjustment facility.<br />

<strong>RBI</strong> finances to banks against purchase of securities upon a condition that such<br />

securities are sold back by <strong>RBI</strong> to concerned bank on repayment of the loan.<br />

Presently the Repo rate is 8%.<br />

Reverse repo facilitates the banks to park their excess funds with <strong>RBI</strong>. Now the<br />

Reverse Repo rate is 7%<br />

Banks look towards <strong>RBI</strong> as a lender of last resort.<br />

VI<br />

Regulator of<br />

Financial<br />

system<br />

VII Management<br />

of Forex<br />

Reserves<br />

VIII Improvement<br />

of Customer<br />

service in<br />

Bank<br />

Regulation of<br />

Financial Markets<br />

Rating System for<br />

Banks<br />

Issuance of<br />

directions to<br />

commercial banks<br />

Regulator of<br />

Payment and<br />

settlement system<br />

Forex reserves<br />

Institution of<br />

customer service<br />

committees<br />

Ombudsman<br />

scheme<br />

Reserve Bank of India is the regulator of money market,Credit market and Forex<br />

Markets<br />

<strong>RBI</strong> adopts CAMELS rating for rating the performance of Banks<br />

<strong>RBI</strong> as per the powers derived from B.R.Act issues guidelines to banks in respect<br />

of certain key areas of operations. Like IRAC nors , CAR etc.<br />

Payment systems like EFT, RTGS are effected through <strong>RBI</strong><br />

<strong>RBI</strong> controls the forex reserves as per the powers drawn from FEMA<br />

Committees like Talwar committee, FGoiporia committee are instituted for<br />

framing guidelines for customer service<br />

Ombudsman scheme is instituted to redress the grievances of customers against<br />

the banks