COURSE TITLE BASIC ACCOUNTING (Asas Perakaunan ...

COURSE TITLE BASIC ACCOUNTING (Asas Perakaunan ...

COURSE TITLE BASIC ACCOUNTING (Asas Perakaunan ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Faculty of Economics and Business, UNIMAS<br />

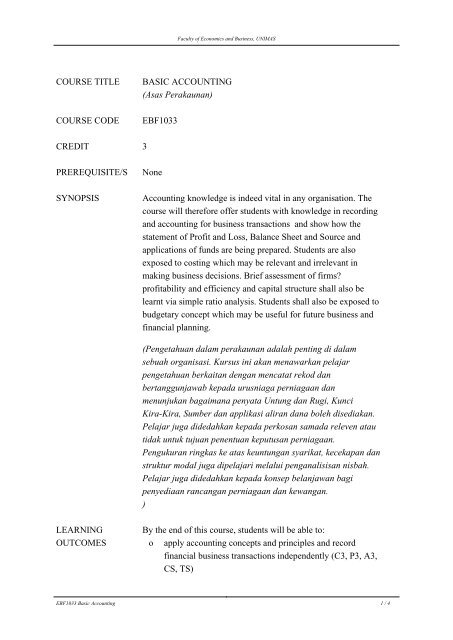

<strong>COURSE</strong> <strong>TITLE</strong><br />

<strong>COURSE</strong> CODE<br />

<strong>BASIC</strong> <strong>ACCOUNTING</strong><br />

(<strong>Asas</strong> <strong>Perakaunan</strong>)<br />

EBF1033<br />

CREDIT 3<br />

PREREQUISITE/S<br />

SYNOPSIS<br />

None<br />

Accounting knowledge is indeed vital in any organisation. The<br />

course will therefore offer students with knowledge in recording<br />

and accounting for business transactions and show how the<br />

statement of Profit and Loss, Balance Sheet and Source and<br />

applications of funds are being prepared. Students are also<br />

exposed to costing which may be relevant and irrelevant in<br />

making business decisions. Brief assessment of firms<br />

profitability and efficiency and capital structure shall also be<br />

learnt via simple ratio analysis. Students shall also be exposed to<br />

budgetary concept which may be useful for future business and<br />

financial planning.<br />

(Pengetahuan dalam perakaunan adalah penting di dalam<br />

sebuah organisasi. Kursus ini akan menawarkan pelajar<br />

pengetahuan berkaitan dengan mencatat rekod dan<br />

bertanggunjawab kepada urusniaga perniagaan dan<br />

menunjukan bagaimana penyata Untung dan Rugi, Kunci<br />

Kira-Kira, Sumber dan applikasi aliran dana boleh disediakan.<br />

Pelajar juga didedahkan kepada perkosan samada releven atau<br />

tidak untuk tujuan penentuan keputusan perniagaan.<br />

Pengukuran ringkas ke atas keuntungan syarikat, kecekapan dan<br />

struktur modal juga dipelajari melalui penganalisisan nisbah.<br />

Pelajar juga didedahkan kepada konsep belanjawan bagi<br />

penyediaan rancangan perniagaan dan kewangan.<br />

)<br />

LEARNING<br />

OUTCOMES<br />

By the end of this course, students will be able to:<br />

o apply accounting concepts and principles and record<br />

financial business transactions independently (C3, P3, A3,<br />

CS, TS)<br />

EBF1033 Basic Accounting 1 / 4

Faculty of Economics and Business, UNIMAS<br />

o<br />

o<br />

o<br />

o<br />

Prepare financial statement and abide by accounting rules,<br />

regulation and ethics. (C5, P6, A5, CS, EM)<br />

analyse profitability and performance of an organisation<br />

(C4, P3, A5, CS, CT)<br />

apply costing principles and differentiate various element<br />

of cost for decision making. (C5, P4, A4, CS, CT)<br />

prepare and apply simple budget and computerised<br />

accounting system. (C3, P3, A3, CS, LL, ES, LS)<br />

STUDENT<br />

LEARNING<br />

HOURS<br />

Lectures<br />

Self-Study<br />

Quizzes, Tests, & Examinations<br />

Total<br />

42 Hour/s<br />

70 Hour/s<br />

8 Hour/s<br />

120 Hour/s<br />

LEARNING<br />

UNITS<br />

Supervised<br />

Learning Hours<br />

1. Introduction<br />

Accounting and Finance scope<br />

Type of business organisations<br />

Usage of Financial Statement<br />

Term Definition<br />

Accounting Rules and Cycle<br />

3<br />

2. Manual Accounting Recording System<br />

Journal and ledger<br />

Asset, Liabilities and Equity<br />

Last minute Adjustment<br />

Bank Reconciliation<br />

9<br />

3. Final Accounts<br />

Trial Balance<br />

Trading and Profit and Loss<br />

Balance Sheet<br />

Cash Flows<br />

6<br />

4. Partnership, Corporate and Non-Profit Organisation<br />

Equity Presentation<br />

Society and Club<br />

Cash Accounting vs. Accrual Basis<br />

3<br />

5. Financial Ratio Analysis<br />

6<br />

EBF1033 Basic Accounting 2 / 4

Faculty of Economics and Business, UNIMAS<br />

Liquidity<br />

Profitability<br />

Market<br />

Efficiency<br />

6. Costing<br />

Element, Definition and category of costs<br />

Overhead distribution<br />

Production cost system<br />

Pricing Decision<br />

3<br />

7. Organisational Budgeting<br />

6<br />

Master budget and operational Budget<br />

Importance in planning and control<br />

8. Accounting Ethics and Cases<br />

3<br />

9. Computerised Accounting Application<br />

Receivables<br />

Payment<br />

Cash and Bank<br />

3<br />

ASSESSMENT Assigment 1<br />

20 %<br />

Assignment 2<br />

20 %<br />

Mid Term test<br />

25 %<br />

Final Test<br />

35 %<br />

Total<br />

100 %<br />

REFERENCES 1. Dyson J R, (2007), Accounting for Non-Accounting<br />

Students, FT Prentice Hall, Seventh Edition<br />

2. Jane Lazaar (2006) Accounting and Finance for<br />

Non-Accountants.<br />

(2ed) Leeds Publication. KL.<br />

3. Wood F, (2005) Business Accounting 1, FT Prentice Hall,<br />

Tenth Edition<br />

4. Wood F, (2005) Business Accounting 2, FT Prentice Hall,<br />

Tenth Edition<br />

5. Black G, (2005) Introductio to accounting , FT Prentice<br />

Hall, ist Ed.<br />

EBF1033 Basic Accounting 3 / 4

Faculty of Economics and Business, UNIMAS<br />

6. Shaari Isa (2007), Prinsip <strong>Perakaunan</strong> , Prentice Hall, 2nd<br />

ed<br />

7. Thomas A, (2006), Introduction to Financial Accounting,<br />

5th edition, McGraw Hill.<br />

Last updated: July 15, 2010, Thu, 10:21 AM<br />

EBF1033 Basic Accounting 4 / 4