B481/S98/NOTES/Grabbe-5 FORWARDS, SWAPS, AND INTEREST ...

B481/S98/NOTES/Grabbe-5 FORWARDS, SWAPS, AND INTEREST ...

B481/S98/NOTES/Grabbe-5 FORWARDS, SWAPS, AND INTEREST ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

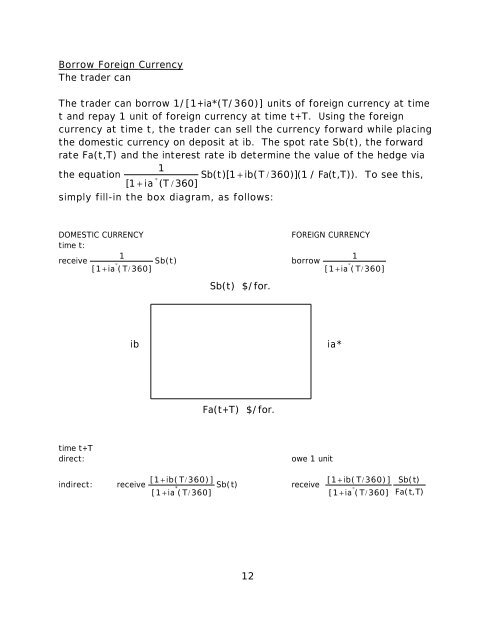

Borrow Foreign Currency<br />

The trader can<br />

The trader can borrow 1/[1+ia*(T/360)] units of foreign currency at time<br />

t and repay 1 unit of foreign currency at time t+T. Using the foreign<br />

currency at time t, the trader can sell the currency forward while placing<br />

the domestic currency on deposit at ib. The spot rate Sb(t), the forward<br />

rate Fa(t,T) and the interest rate ib determine the value of the hedge via<br />

1<br />

the equation<br />

Sb( t )[ 1 + ib( T / 360) ]( 1 / Fa( t , T )). To see this,<br />

[ 1 + ia ∗ ( T / 360]<br />

simply fill-in the box diagram, as follows:<br />

DOMESTIC CURRENCY<br />

FOREIGN CURRENCY<br />

time t:<br />

1<br />

receive<br />

[ 1 + ia ∗ ( T / 360] Sb(t) borrow 1<br />

[ 1 + ia ∗ ( T / 360]<br />

Sb(t) $/for.<br />

ib<br />

ia*<br />

Fa(t+T) $/for.<br />

time t+T<br />

direct:<br />

indirect: receive<br />

[ 1 + ib( T / 360) ]<br />

[ 1 + ia * ( T / 360]<br />

owe 1 unit<br />

Sb( t ) receive<br />

[ 1 + ib( T / 360) ]<br />

[ 1 + ia ∗ ( T / 360]<br />

Sb( t )<br />

Fa( t , T )<br />

12