Ensure Brochure Oct 2011

Ensure Brochure Oct 2011

Ensure Brochure Oct 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

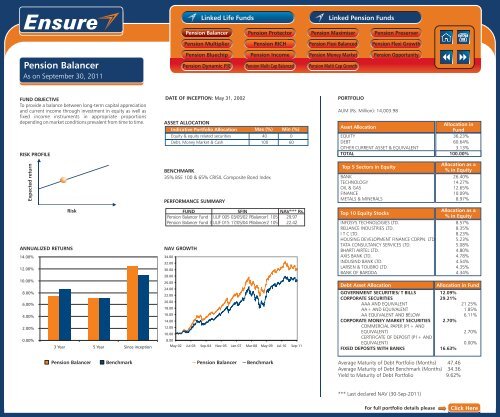

Pension Balancer<br />

As on September 30, <strong>2011</strong><br />

FUND OBJECTIVE<br />

To provide a balance between long-term capital appreciation<br />

and current income through investment in equity as well as<br />

fixed income instruments in appropriate proportions<br />

depending on market conditions prevalent from time to time.<br />

RISK PROFILE<br />

Expected return<br />

Risk<br />

ANNUALIZED RETURNS<br />

14.00%<br />

12.00%<br />

10.00%<br />

8.00%<br />

6.00%<br />

4.00%<br />

2.00%<br />

0.00%<br />

3 Year 5 Year Since inception<br />

Pension Balancer Benchmark<br />

DATE OF INCEPTION: May 31, 2002<br />

BENCHMARK<br />

35% BSE 100 & 65% CRISIL Composite Bond Index<br />

PERFORMANCE SUMMARY<br />

FUND SFIN NAV*** Rs.<br />

Pension Balancer Fund ULIF 005 03/05/02 PBalancer1 105 29.97<br />

Pension Balancer Fund II ULIF 015 17/05/04 PBalancer2 105 22.42<br />

NAV GROWTH<br />

34.00<br />

32.00<br />

30.00<br />

28.00<br />

26.00<br />

24.00<br />

22.00<br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

Linked Life Funds Linked Pension Funds<br />

Pension Balancer<br />

Pension Multiplier<br />

Pension Bluechip<br />

Pension Dynamic P/E<br />

Pension Protector<br />

Pension RICH<br />

Pension Income<br />

Pension Multi Cap Balanced<br />

ASSET ALLOCATION<br />

Indicative Portfolio Allocation Max (%) Min (%)<br />

Equity & equity related securities 40 0<br />

Debt, Money Market & Cash 100 60<br />

May-02 Jul-03 Sep-04 Nov-05 Jan-07 Mar-08 May-09 Jul-10 Sep-11<br />

Pension Balancer Benchmark<br />

Pension Maximiser<br />

Pension Flexi Balanced<br />

Pension Money Market<br />

Pension Multi Cap Growth<br />

PORTFOLIO<br />

Pension Preserver<br />

Pension Flexi Growth<br />

Pension Opportunity<br />

AUM (Rs. Million): 14,003.98<br />

Asset Allocation<br />

Allocation in<br />

Fund<br />

EQUITY 36.23%<br />

DEBT 60.64%<br />

OTHER CURRENT ASSET & EQUIVALENT 3.13%<br />

TOTAL 100.00%<br />

Top 5 Sectors in Equity<br />

Allocation as a<br />

% in Equity<br />

BANK 26.40%<br />

TECHNOLOGY 14.27%<br />

OIL & GAS 12.65%<br />

FINANCE 10.09%<br />

METALS & MINERALS 8.97%<br />

Top 10 Equity Stocks<br />

Allocation as a<br />

% in Equity<br />

INFOSYS TECHNOLOGIES LTD. 8.57%<br />

RELIANCE INDUSTRIES LTD. 8.35%<br />

I T C LTD. 8.23%<br />

HOUSING DEVELOPMENT FINANCE CORPN. LTD 5.23%<br />

TATA CONSULTANCY SERVICES LTD. 5.08%<br />

BHARTI AIRTEL LTD. 4.80%<br />

AXIS BANK LTD. 4.78%<br />

INDUSIND BANK LTD. 4.54%<br />

LARSEN & TOUBRO LTD. 4.35%<br />

BANK OF BARODA 4.34%<br />

Debt Asset Allocation Allocation in Fund<br />

GOVERNMENT SECURITIES/ T BILLS 12.09%<br />

CORPORATE SECURITIES 29.21%<br />

AAA AND EQUIVALENT 21.25%<br />

AA+ AND EQUIVALENT 1.85%<br />

AA EQUIVALENT AND BELOW 6.11%<br />

CORPORATE MONEY MARKET SECURITIES 2.70%<br />

COMMERCIAL PAPER (P1+ AND<br />

EQUIVALENT) 2.70%<br />

CERTIFICATE OF DEPOSIT (P1+ AND<br />

EQUIVALENT) 0.00%<br />

FIXED DEPOSITS WITH BANKS 16.63%<br />

Average Maturity of Debt Portfolio (Months) 47.46<br />

Average Maturity of Debt Benchmark (Months) 34.36<br />

Yield to Maturity of Debt Portfolio 9.62%<br />

*** Last declared NAV (30-Sep-<strong>2011</strong>)<br />

For full portfolio details please<br />

Click Here