Speaker Bios - Alumni - Cornell University

Speaker Bios - Alumni - Cornell University

Speaker Bios - Alumni - Cornell University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The 5th <strong>Cornell</strong> Asia <strong>Alumni</strong> Leadership Conference<br />

March 16-18, 2012<br />

The Mira Hotel Hong Kong<br />

118 Nathan Road, Tsimshatsui, Kowloon, Hong Kong<br />

<strong>Speaker</strong> <strong>Bios</strong><br />

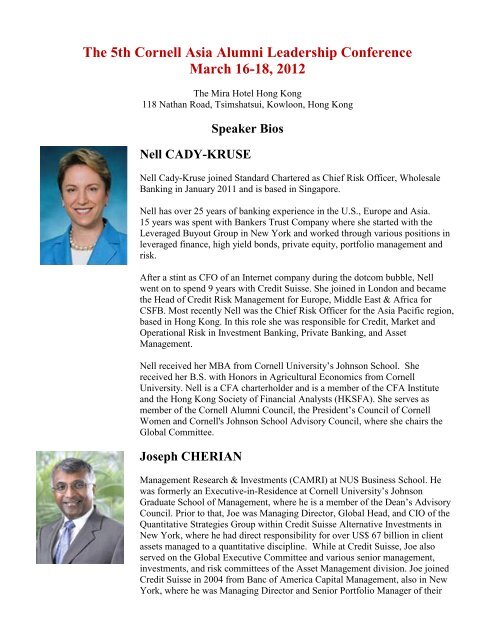

Nell CADY-KRUSE<br />

Nell Cady-Kruse joined Standard Chartered as Chief Risk Officer, Wholesale<br />

Banking in January 2011 and is based in Singapore.<br />

Nell has over 25 years of banking experience in the U.S., Europe and Asia.<br />

15 years was spent with Bankers Trust Company where she started with the<br />

Leveraged Buyout Group in New York and worked through various positions in<br />

leveraged finance, high yield bonds, private equity, portfolio management and<br />

risk.<br />

After a stint as CFO of an Internet company during the dotcom bubble, Nell<br />

went on to spend 9 years with Credit Suisse. She joined in London and became<br />

the Head of Credit Risk Management for Europe, Middle East & Africa for<br />

CSFB. Most recently Nell was the Chief Risk Officer for the Asia Pacific region,<br />

based in Hong Kong. In this role she was responsible for Credit, Market and<br />

Operational Risk in Investment Banking, Private Banking, and Asset<br />

Management.<br />

Nell received her MBA from <strong>Cornell</strong> <strong>University</strong>’s Johnson School. She<br />

received her B.S. with Honors in Agricultural Economics from <strong>Cornell</strong><br />

<strong>University</strong>. Nell is a CFA charterholder and is a member of the CFA Institute<br />

and the Hong Kong Society of Financial Analysts (HKSFA). She serves as<br />

member of the <strong>Cornell</strong> <strong>Alumni</strong> Council, the President’s Council of <strong>Cornell</strong><br />

Women and <strong>Cornell</strong>'s Johnson School Advisory Council, where she chairs the<br />

Global Committee.<br />

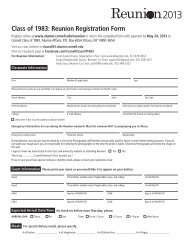

Joseph CHERIAN<br />

Management Research & Investments (CAMRI) at NUS Business School. He<br />

was formerly an Executive-in-Residence at <strong>Cornell</strong> <strong>University</strong>’s Johnson<br />

Graduate School of Management, where he is a member of the Dean’s Advisory<br />

Council. Prior to that, Joe was Managing Director, Global Head, and CIO of the<br />

Quantitative Strategies Group within Credit Suisse Alternative Investments in<br />

New York, where he had direct responsibility for over US$ 67 billion in client<br />

assets managed to a quantitative discipline. While at Credit Suisse, Joe also<br />

served on the Global Executive Committee and various senior management,<br />

investments, and risk committees of the Asset Management division. Joe joined<br />

Credit Suisse in 2004 from Banc of America Capital Management, also in New<br />

York, where he was Managing Director and Senior Portfolio Manager of their

asset allocation funds. Previously, he was an Associate Professor of Finance at<br />

Boston <strong>University</strong>. He has authored numerous articles for financial journals, and<br />

serves on the Scientific Advisory Board of Orissa Group, a pioneer in the<br />

development and dissemination of liquidity-based data and analytical products<br />

across multiple asset classes. He formerly served as a review board member of<br />

the Research Foundation of the CFA Institute, and on the Scientific Advisory<br />

Boards of netDecide Corp. and SKG Inc. Joe holds a B.S. in Electrical<br />

Engineering from MIT, and M.S. and Ph.D. degrees in Finance from <strong>Cornell</strong><br />

<strong>University</strong>.<br />

Ming HUANG<br />

Professor of Finance, Johnson School of Management<br />

<strong>Cornell</strong> <strong>University</strong><br />

Professor Huang's academic research interests have focused mainly on<br />

behavioral finance and, in particular, the applications of cognitive psychology to<br />

understanding the pricing of financial assets. He has also worked on credit risk<br />

and derivatives, on the effects of illiquidity on asset prices, and on the<br />

application of auction theory to takeovers. He has published in the Journal of<br />

Political Economy, the Quarterly Journal of Economics, the American Economic<br />

Review, the Journal of Economic Theory, and the Journal of Finance, and has<br />

won awards for both research and teaching. Prior to coming to Johnson, Huang<br />

taught at the Stanford <strong>University</strong> Graduate School of Business and at the<br />

Graduate School of Business at the <strong>University</strong> of Chicago. In recent years,<br />

Professor Huang has also conducted in-depth research on financial markets and<br />

corporate finance in China.<br />

Andrew KAROLYI<br />

Faculty Co-Director of Emerging Markets Institute<br />

<strong>Alumni</strong> Professor in Asset Management<br />

Professor of Finance, Johnson School of Management<br />

<strong>Cornell</strong> <strong>University</strong><br />

Professor Karolyi is an internationally-known scholar in the area of investment<br />

management, with a specialization in the study of international financial<br />

markets. He has published extensively in journals in finance and economics,<br />

including the Journal of Finance, Journal of Financial Economics and Review of<br />

Financial Studies, and has published several books and monographs. His<br />

research has been covered extensively in print and electronic media, including<br />

The Wall Street Journal, Financial Times, The Economist, Time, New York<br />

Times, Washington Post, Forbes, BusinessWeek, and CNBC.<br />

Karolyi currently serves as editor of the Review of Financial Studies, one of the<br />

top-tier journals in finance. He is also an associate editor for a variety of<br />

journals, including the Journal of Financial Economics, Journal of Empirical<br />

Finance, Journal of Banking and Finance, Review of Finance and the Pacific<br />

Basin Finance Journal. He is a recipient of the Fama/DFA Prize for Capital<br />

Markets and Asset Pricing (2005), the William F. Sharpe Award for Scholarship<br />

in Finance (2001), the Journal of Empirical Finance's Biennial Best Paper Prize

(2006), the Fisher College of Business' Pace Setter Awards for Excellence in<br />

Research and Graduate Teaching and the Johnson School’s Prize for Excellence<br />

in Research in 2010.<br />

He joined Johnson in 2009, after teaching for 19 years at the Fisher College of<br />

Business of The Ohio State <strong>University</strong>. He leads various executive education<br />

programs in the U.S., Canada, Europe, and Asia, and is actively involved in<br />

consulting with corporations, banks, investment firms, stock exchanges, and law<br />

firms. He has been elected to serve in 2011-2012 as President of the Financial<br />

Management Association International, an association of more than 4,000<br />

academics and practitioners worldwide.<br />

Karolyi received his BA (Honors) in economics from McGill <strong>University</strong> in 1983<br />

and worked at the Bank of Canada for several years in its research department.<br />

He subsequently earned his MBA and PhD degrees in finance at the Graduate<br />

School of Business of the <strong>University</strong> of Chicago.<br />

Geoffrey LIM, MBA ’00<br />

Geoffrey Lim, MBA '00, is director of CLSA Capital Partners, the alternative<br />

investment arm of CLSA Asia-Pacific Markets. Previously, Mr. Lim was<br />

managing director and chief representative of Founder China Partners, a Beijingbased<br />

private equity firm sponsored by the Founder Group, one of China's<br />

largest state-owned conglomerates. Prior to that, he was vice president of<br />

Lombard Investments and was based in Hong Kong, where he helped to manage<br />

the firm's investments in China and other Asian markets. Mr. Lim started his<br />

career in private equity with Cowen & Company's Private Equity Group in New<br />

York. He received his BA from Hunter College, City <strong>University</strong> of New York,<br />

and his MBA from Johnson School, <strong>Cornell</strong> <strong>University</strong>.<br />

Joseph THOMAS<br />

Anne and Elmer Lindseth Dean<br />

Professor of Operations Management, Johnson School of Management<br />

Dean Thomas is the 10th dean of the Samuel Curtis Johnson Graduate School of<br />

Management at <strong>Cornell</strong> <strong>University</strong>. He brings more than 30 years of experience<br />

as a <strong>Cornell</strong> <strong>University</strong> faculty member to his post as dean. Most recently, he<br />

was associate dean for academic affairs, responsible for all faculty-related<br />

matters at Johnson. He has also served as director of the doctoral program, and<br />

director of executive education. Dean Thomas is an award-winning teacher,<br />

having twice won the Stephen Russell Distinguished Teaching Award. This<br />

award is voted upon by members of the five-year reunion class. The award is<br />

given to a faculty member whose teaching and example have continued to<br />

influence graduates five years into their post-MBA careers.<br />

Dean Thomas' teaching and research focus on topics in operations management<br />

and supply-chain management. He has consulted for and led managementeducation<br />

programs for several Fortune-100 companies, including Osram (and<br />

Osram-Sylvania), Accenture, and Sanofi-Aventis (Rhone-Poulenc Rorer).

With degrees in Chemical Engineering (BS) and Operations Research (PhD) and<br />

a long history of academic scholarship and publishing, Dean Thomas is one the<br />

nation's foremost experts in operations management and manufacturing.<br />

His work has been widely published on a variety of topics, including redesign of<br />

global manufacturing and supply networks, manufacturing strategy, inventory<br />

systems, human resources management, and worker motivation. He has also<br />

studied models for managing complex production-distribution systems and their<br />

effective implementation.<br />

Dean Thomas has written four books and more than 50 articles in journals such<br />

as Management Science, Operations Research, Manufacturing and Services<br />

Operations Management, and Journal of Manufacturing and Operations<br />

Management. He was a departmental editor of Management Science for six<br />

years and has served on many editorial boards and committees for professional<br />

organizations.