2010 - Monterey Regional Water Pollution Control Agency

2010 - Monterey Regional Water Pollution Control Agency

2010 - Monterey Regional Water Pollution Control Agency

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MONTEREY REGIONAL WATER POLLUTION CONTROL AGENCY<br />

NOTES TO FINANCIAL STATEMENTS<br />

JUNE 30, <strong>2010</strong> AND 2009<br />

California Asset Management Program (CAMP)<br />

The <strong>Agency</strong> participates in the California Asset Management Program (CAMP), a joint powers authority established<br />

in 1989 under the provisions of the California Government Code Sections 6500 et. seq., to meet local government<br />

investment needs in a manner and cost determined by the members of the program. The <strong>Agency</strong> maintains its own<br />

separate account and directs its investments in conjunction with an investment advisor. Safekeeping of all securities<br />

is maintained by Bank of New York.<br />

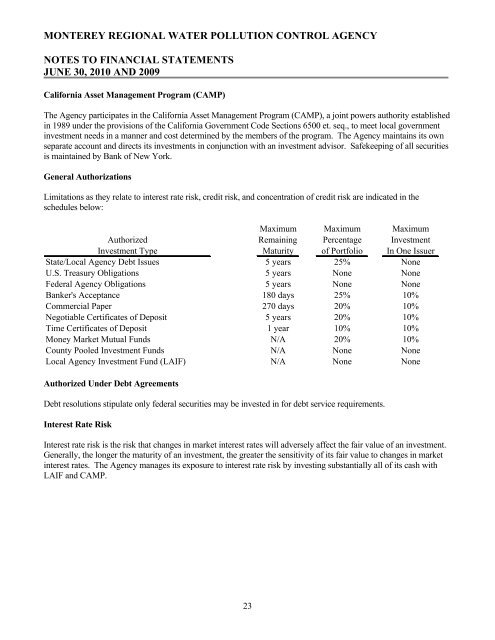

General Authorizations<br />

Limitations as they relate to interest rate risk, credit risk, and concentration of credit risk are indicated in the<br />

schedules below:<br />

Maximum Maximum Maximum<br />

Authorized Remaining Percentage Investment<br />

Investment Type Maturity of Portfolio In One Issuer<br />

State/Local <strong>Agency</strong> Debt Issues 5 years 25% None<br />

U.S. Treasury Obligations 5 years None None<br />

Federal <strong>Agency</strong> Obligations 5 years None None<br />

Banker's Acceptance 180 days 25% 10%<br />

Commercial Paper 270 days 20% 10%<br />

Negotiable Certificates of Deposit 5 years 20% 10%<br />

Time Certificates of Deposit 1 year 10% 10%<br />

Money Market Mutual Funds N/A 20% 10%<br />

County Pooled Investment Funds N/A None None<br />

Local <strong>Agency</strong> Investment Fund (LAIF) N/A None None<br />

Authorized Under Debt Agreements<br />

Debt resolutions stipulate only federal securities may be invested in for debt service requirements.<br />

Interest Rate Risk<br />

Interest rate risk is the risk that changes in market interest rates will adversely affect the fair value of an investment.<br />

Generally, the longer the maturity of an investment, the greater the sensitivity of its fair value to changes in market<br />

interest rates. The <strong>Agency</strong> manages its exposure to interest rate risk by investing substantially all of its cash with<br />

LAIF and CAMP.<br />

23