2010 Instruction 1120-S Schedule K-1 - Internal Revenue Service

2010 Instruction 1120-S Schedule K-1 - Internal Revenue Service

2010 Instruction 1120-S Schedule K-1 - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

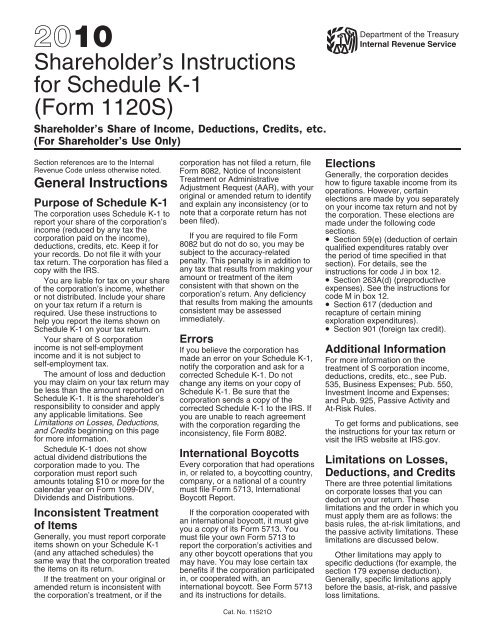

<strong>2010</strong><br />

Shareholder’s <strong>Instruction</strong>s<br />

for <strong>Schedule</strong> K-1<br />

(Form <strong>1120</strong>S)<br />

Shareholder’s Share of Income, Deductions, Credits, etc.<br />

(For Shareholder’s Use Only)<br />

Department of the Treasury<br />

<strong>Internal</strong> <strong>Revenue</strong> <strong>Service</strong><br />

Section references are to the <strong>Internal</strong> corporation has not filed a return, file Elections<br />

<strong>Revenue</strong> Code unless otherwise noted.<br />

Form 8082, Notice of Inconsistent<br />

Treatment or Administrative<br />

Generally, the corporation decides<br />

how to figure taxable income from its<br />

General <strong>Instruction</strong>s Adjustment Request (AAR), with your operations. However, certain<br />

original or amended return to identify<br />

elections are made by you separately<br />

Purpose of <strong>Schedule</strong> K-1 and explain any inconsistency (or to on your income tax return and not by<br />

The corporation uses <strong>Schedule</strong> K-1 to note that a corporate return has not the corporation. These elections are<br />

report your share of the corporation’s been filed).<br />

made under the following code<br />

income (reduced by any tax the<br />

sections.<br />

corporation paid on the income), If you are required to file Form • Section 59(e) (deduction of certain<br />

deductions, credits, etc. Keep it for 8082 but do not do so, you may be<br />

qualified expenditures ratably over<br />

your records. Do not file it with your subject to the accuracy-related the period of time specified in that<br />

tax return. The corporation has filed a penalty. This penalty is in addition to section). For details, see the<br />

copy with the IRS. any tax that results from making your instructions for code J in box 12.<br />

You are liable for tax on your share<br />

amount or treatment of the item • Section 263A(d) (preproductive<br />

of the corporation’s income, whether consistent with that shown on the expenses). See the instructions for<br />

or not distributed. Include your share corporation’s return. Any deficiency code M in box 12.<br />

on your tax return if a return is that results from making the amounts • Section 617 (deduction and<br />

required. Use these instructions to consistent may be assessed<br />

recapture of certain mining<br />

help you report the items shown on immediately.<br />

exploration expenditures).<br />

<strong>Schedule</strong> K-1 on your tax return.<br />

• Section 901 (foreign tax credit).<br />

Your share of S corporation<br />

Errors<br />

income is not self-employment If you believe the corporation has Additional Information<br />

income and it is not subject to made an error on your <strong>Schedule</strong> K-1,<br />

self-employment tax.<br />

For more information on the<br />

notify the corporation and ask for a treatment of S corporation income,<br />

The amount of loss and deduction corrected <strong>Schedule</strong> K-1. Do not deductions, credits, etc., see Pub.<br />

you may claim on your tax return may change any items on your copy of 535, Business Expenses; Pub. 550,<br />

be less than the amount reported on <strong>Schedule</strong> K-1. Be sure that the Investment Income and Expenses;<br />

<strong>Schedule</strong> K-1. It is the shareholder’s corporation sends a copy of the and Pub. 925, Passive Activity and<br />

responsibility to consider and apply corrected <strong>Schedule</strong> K-1 to the IRS. If At-Risk Rules.<br />

any applicable limitations. See you are unable to reach agreement<br />

Limitations on Losses, Deductions, with the corporation regarding the To get forms and publications, see<br />

and Credits beginning on this page inconsistency, file Form 8082. the instructions for your tax return or<br />

for more information.<br />

visit the IRS website at IRS.gov.<br />

<strong>Schedule</strong> K-1 does not show<br />

actual dividend distributions the International Boycotts<br />

Every corporation that had operations<br />

Limitations on Losses,<br />

corporation made to you. The<br />

corporation must report such<br />

in, or related to, a boycotting country, Deductions, and Credits<br />

amounts totaling $10 or more for the company, or a national of a country There are three potential limitations<br />

calendar year on Form 1099-DIV, must file Form 5713, International on corporate losses that you can<br />

Dividends and Distributions. Boycott Report. deduct on your return. These<br />

limitations and the order in which you<br />

Inconsistent Treatment If the corporation cooperated with must apply them are as follows: the<br />

an international boycott, it must give basis rules, the at-risk limitations, and<br />

of Items you a copy of its Form 5713. You the passive activity limitations. These<br />

Generally, you must report corporate must file your own Form 5713 to limitations are discussed below.<br />

items shown on your <strong>Schedule</strong> K-1 report the corporation’s activities and<br />

(and any attached schedules) the any other boycott operations that you Other limitations may apply to<br />

same way that the corporation treated may have. You may lose certain tax specific deductions (for example, the<br />

the items on its return. benefits if the corporation participated section 179 expense deduction).<br />

If the treatment on your original or in, or cooperated with, an<br />

Generally, specific limitations apply<br />

amended return is inconsistent with international boycott. See Form 5713 before the basis, at-risk, and passive<br />

the corporation’s treatment, or if the and its instructions for details. loss limitations.<br />

Cat. No. 11521O

Basis Rules<br />

reported on <strong>Schedule</strong> K-1 adjusted, if To make the election, attach a<br />

Generally, the deduction for your<br />

the corporation made a charitable statement to your timely filed original<br />

share of aggregate losses and contribution of property, by<br />

or amended return that states you<br />

deductions reported on <strong>Schedule</strong> K-1 subtracting the property’s fair market agree to the carryover rule of<br />

is limited to the basis of your stock value and adding the property’s Regulations section 1.1367-1(g) and<br />

(determined with regard to<br />

adjusted basis.<br />

the name of the S corporation to<br />

distributions received during the tax<br />

which the rule applies. Once made,<br />

year) and loans from you to the<br />

the election applies to the year for<br />

corporation. For details and<br />

You may elect to decrease your which it is made and all future tax<br />

exceptions, see section 1366(d). The<br />

basis under (4) prior to decreasing years for that S corporation, unless<br />

basis of your stock is generally your basis under (3). If you make this the IRS agrees to revoke your<br />

figured at the end of the corporation’s election, any amount described under election.<br />

tax year. Any losses and deductions (3) that exceeds the basis of your The basis of each share of stock<br />

not allowed this year because of the stock and debt owed to you by the is increased or decreased (but not<br />

basis limit can be carried forward corporation is treated as an amount below zero) based on its pro rata<br />

indefinitely and deducted in a later described under (3) for the following share of the above adjustments. If the<br />

year subject to the basis limit for that tax year.<br />

total decreases in basis attributable to<br />

year.<br />

You are responsible for keeping<br />

the information needed to figure the<br />

basis of your stock in the corporation. Worksheet for Figuring a Shareholder’s<br />

<strong>Schedule</strong> K-1 provides information to Stock Basis Keep for Your Records<br />

help you figure your stock basis at the<br />

end of each corporate tax year. The<br />

basis of your stock (generally, its<br />

1. Your stock basis at the beginning of the year ........... 1.<br />

cost) is adjusted as follows and, Increases:<br />

except as noted, in the order listed. In<br />

addition, basis may be adjusted<br />

2. Money and your adjusted basis in property contributed to<br />

under other provisions of the <strong>Internal</strong><br />

the corporation ................................ 2.<br />

<strong>Revenue</strong> Code. You can generally<br />

3. Your share of the corporation’s income (including<br />

use the Worksheet for Figuring a<br />

tax-exempt income) reduced by any amount included in<br />

Shareholder’s Stock Basis to figure<br />

income with respect to clean renewable energy, Midwestern<br />

your aggregate stock basis. tax credit, or (for bonds issued before October 4, 2008)<br />

1. Basis is increased by (a) all qualified zone academy bonds ..................... 3.<br />

income (including tax-exempt<br />

income) reported on <strong>Schedule</strong> K-1<br />

4. Other increases to basis, including your share of the excess<br />

and (b) the excess of the deduction<br />

of the deductions for depletion (other than oil and gas<br />

for depletion (other than oil and gas<br />

depletion) over the basis of the property subject to depletion 4.<br />

depletion) over the basis of the Decreases:<br />

property subject to depletion.<br />

5. Distributions of money and the fair market value of property<br />

You must report on your<br />

(excluding dividend distributions reportable on Form<br />

! return (if you are required to<br />

1099-DIV and distributions in excess of basis (the sum of<br />

CAUTION<br />

file one) any amount required<br />

lines 1 through 4)) .............................. 5. ( )<br />

to be included in gross income for it<br />

to increase your basis.<br />

6. Enter: (a) your share of the corporation’s nondeductible<br />

expenses and the depletion deduction for any oil and gas<br />

Basis is not increased by<br />

property held by the corporation (but only to the extent your<br />

! income from discharge of your share of the property’s adjusted basis exceeds the<br />

CAUTION<br />

indebtedness in the S<br />

depletion deduction) or (b) if the election under Regulations<br />

corporation (nor by any amount<br />

section 1.1367-1(g) applies, your share of the corporation’s<br />

included in income with respect to<br />

deductions and losses (include your entire share of the<br />

clean renewable energy, Midwestern<br />

section 179 expense deduction even if your allowable<br />

tax credit, or (for bonds issued before section 179 expense deduction is smaller) adjusted, if the<br />

October 4, 2008) qualified zone<br />

corporation made a charitable contribution of property, by<br />

academy bonds).<br />

subtracting your share of the fair market value of the<br />

2. Basis is decreased by (a) contributed property and adding your share of the<br />

property distributions (including cash) property’s adjusted basis ......................... 6. ( )<br />

made by the corporation reported on<br />

<strong>Schedule</strong> K-1, box 16, code D, minus 7. If the election under Regulations section 1.1367-1(g)<br />

(b) the amount of such distributions in applies, enter the amount from 6(a) above. Otherwise enter<br />

excess of the basis in your stock.<br />

the amount from 6(b) ............................ 7. ( )<br />

3. Basis is decreased by (a) 8. Enter the smaller of (a) the excess, as of the beginning of<br />

nondeductible expenses and (b) the<br />

the tax year, of the amount you are owed for loans you<br />

depletion deduction for any oil and<br />

made to the corporation over your basis in those loans or<br />

gas property held by the corporation,<br />

(b) the sum of lines 1 through 7. This amount increases<br />

but only to the extent your share of your loan basis ................................ 8. ( )<br />

the property’s adjusted basis exceeds<br />

that deduction.<br />

4. Basis is decreased by all<br />

deductible losses and deductions<br />

9. Your stock basis in the corporation at the end of the year.<br />

Combine lines 1 through 8 ........................ 9.<br />

-2- <strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)

a share exceed that share’s basis, of holding mineral property does not 1. Trade or business activities in<br />

the excess reduces (but not below qualify for this exception. The which you materially participated.<br />

zero) the remaining bases of all other corporation should identify on an 2. Rental real estate activities in<br />

shares of stock in proportion to the attachment to <strong>Schedule</strong> K-1 any which you materially participated if<br />

remaining basis of each of those losses that are not subject to the you were a real estate professional<br />

shares. at-risk limitations. for the tax year. You were a real<br />

Basis of loans. The basis of your Generally, you are not at risk for estate professional only if you met<br />

loans to the corporation is generally amounts such as the following. both of the following conditions.<br />

the balance the corporation owes • The basis of your stock in the a. More than half of the personal<br />

you, adjusted for any reductions and corporation or the basis of your loans services you performed in trades or<br />

restorations of loan basis (see the to the corporation if the cash or other businesses were performed in real<br />

instructions for box 16, code E). Any property used to purchase the stock property trades or businesses in<br />

amounts described in (3) and (4) on or make the loans was from a source which you materially participated and<br />

page 2 not used to offset amounts in (a) covered by nonrecourse b. You performed more than 750<br />

(1) on page 2, or reduce your stock indebtedness (except for certain hours of services in real property<br />

basis, are used to reduce your loan qualified nonrecourse financing, as trades or businesses in which you<br />

basis (to the extent of such basis defined in section 465(b)(6)); (b) materially participated.<br />

prior to such reduction).<br />

protected against loss by a<br />

For purposes of this rule, each<br />

When determining your basis<br />

guarantee, stop-loss agreement, or<br />

interest in rental real estate is a<br />

in loans to the corporation,<br />

other similar arrangement; or (c) that<br />

!<br />

separate activity, unless you elect to<br />

CAUTION<br />

remember that:<br />

is covered by indebtedness from a<br />

treat all interests in rental real estate<br />

• Distributions do not reduce loan<br />

person who has an interest in the<br />

as one activity. For details on making<br />

basis, and<br />

activity or from a person related to a<br />

this election, see the <strong>Instruction</strong>s for<br />

• Loans that a shareholder<br />

person (except you) having such an<br />

<strong>Schedule</strong> E (Form 1040).<br />

guarantees or co-signs are not part of<br />

interest, other than a creditor.<br />

• Any cash or property contributed to If you are married filing jointly,<br />

a shareholder’s loan basis.<br />

a corporate activity, or your interest in either you or your spouse must<br />

See section 1367 and its<br />

the corporate activity, that is (a) separately meet both of the above<br />

regulations for more details.<br />

covered by nonrecourse<br />

conditions, without taking into<br />

Worksheet instructions. For lines indebtedness (except for certain account services performed by the<br />

6 and 7, do not enter more than the qualified nonrecourse financing, as other spouse.<br />

aggregate sum of the preceding lines. defined in section 465(b)(6)); (b) A real property trade or business is<br />

Any excess of the amounts that protected against loss by a<br />

any real property development,<br />

would otherwise be entered on lines 6 guarantee, stop-loss agreement, or redevelopment, construction,<br />

and 7 without regard to this limit over other similar arrangement; or (c) that reconstruction, acquisition,<br />

the amounts actually entered on is covered by indebtedness from a conversion, rental, operation,<br />

those lines is a reduction to your person who has an interest in the management, leasing, or brokerage<br />

basis, if any, in loans you made to the activity or from a person related to a trade or business. <strong>Service</strong>s you<br />

corporation (to the extent of such person (except you) having such an performed as an employee are not<br />

basis). Any portion of the excess not interest, other than a creditor. treated as performed in a real<br />

used to reduce your basis in stock<br />

Any loss from a section 465<br />

property trade or business unless you<br />

and loans is not deductible in the<br />

activity not allowed for this tax year<br />

owned more than 5% of the stock (or<br />

current year and is carried over to<br />

will be treated as a deduction<br />

more than 5% of the capital or profits<br />

next year and subject to that year’s<br />

allocable to the activity in the next tax<br />

interest) in the employer.<br />

basis limit. See the preceding<br />

year.<br />

3. The rental of a dwelling unit any<br />

instructions for more details.<br />

shareholder used for personal<br />

You should get a separate<br />

At-Risk Limitations<br />

purposes during the year for more<br />

statement of income, expenses, etc.,<br />

than the greater of 14 days or 10% of<br />

Generally, you will have to complete for each activity from the corporation.<br />

the number of days that the residence<br />

Form 6198, At-Risk Limitations, to<br />

Passive Activity Limitations was rented at fair rental value.<br />

figure your allowable loss, if you<br />

Section 469 provides rules that limit 4. Activities of trading personal<br />

have:<br />

the deduction of certain losses and property for the account of owners of<br />

• A loss or other deduction from any<br />

credits. These rules apply to<br />

interests in the activities.<br />

activity carried on by the corporation<br />

as a trade or business or for the shareholders who:<br />

production of income, and<br />

• Are individuals, estates, or trusts, If you have a passive activity loss<br />

• Amounts in the activity for which and<br />

or credit, use Form 8582, Passive<br />

you are not at risk.<br />

• Have a passive activity loss or Activity Loss Limitations, to figure<br />

credit for the tax year.<br />

your allowable passive losses and<br />

The at-risk rules generally limit the<br />

Form 8582-CR, Passive Activity<br />

amount of loss and other deductions Generally, passive activities<br />

Credit Limitations, to figure your<br />

that you can claim to the amount you include:<br />

allowable passive credits. See the<br />

could actually lose (your economic 1. Trade or business activities in instructions for these forms for<br />

loss) in the activity. These losses and which you did not materially details.<br />

deductions include a loss on the participate and<br />

disposition of assets and the section 2. Activities that meet the<br />

If the corporation had more than<br />

179 expense deduction. However, if definition of rental activities under one activity, it will attach a statement<br />

you acquired your stock before 1987, Temporary Regulations section to your <strong>Schedule</strong> K-1 that identifies<br />

the at-risk rules do not apply to losses 1.469-1T(e)(3) and Regulations each activity (trade or business<br />

from an activity of holding real section 1.469-1(e)(3).<br />

activity, rental real estate activity,<br />

property placed in service before<br />

rental activity other than rental real<br />

1987 by the corporation. The activity Passive activities do not include: estate, etc.) and specifies the income<br />

<strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)<br />

-3-

(loss), deductions, and credits from engineering, architecture, accounting, activity, report the income,<br />

each activity. actuarial science, performing arts, deductions, and losses from the<br />

Material participation. You must consulting, or any other trade or activity as indicated in these<br />

determine if you materially<br />

business in which capital is not a instructions.<br />

participated (a) in each trade or material income-producing factor. 2. If you have an overall loss (the<br />

business activity held through the 7. Based on all the facts and excess of deductions and losses,<br />

corporation and (b) if you were a real circumstances, you participated in the including any prior year unallowed<br />

estate professional (defined on page activity on a regular, continuous, and loss, over income) or credits from a<br />

3), in each rental real estate activity substantial basis during the tax year. passive activity, report the income,<br />

held through the corporation. All<br />

deductions, losses, and credits from<br />

Work counted toward material<br />

determinations of material<br />

all passive activities using the<br />

participation. Generally, any work<br />

participation are based on your<br />

<strong>Instruction</strong>s for Form 8582 or Form<br />

that you or your spouse does in<br />

participation during the corporation’s<br />

8582-CR, to see if your deductions,<br />

connection with an activity held<br />

tax year.<br />

losses, and credits are limited under<br />

through an S corporation (where you the passive activity rules.<br />

Material participation standards for own your stock at the time the work is<br />

shareholders who are individuals are done) is counted toward material Special allowance for a rental real<br />

listed below. Special rules apply to participation. However, work in estate activity. If you actively<br />

certain retired or disabled farmers connection with the activity is not participated in a rental real estate<br />

and to the surviving spouses of counted toward material participation activity, you may be able to deduct up<br />

farmers. See the <strong>Instruction</strong>s for if either of the following applies. to $25,000 of the loss (or credit<br />

Form 8582 for details.<br />

1. The work is not the type of work equivalent to a $25,000 deduction)<br />

Individuals. If you are an that owners of the activity would from the activity from nonpassive<br />

individual, you materially participated usually do and one of the principal income. This “special allowance” is<br />

in an activity only if one or more of purposes of the work that you or your an exception to the general rule<br />

the following apply.<br />

spouse does is to avoid the passive disallowing losses in excess of<br />

loss or credit limitations.<br />

income from passive activities. The<br />

1. You participated in the activity<br />

2. You do the work in your special allowance is not available if<br />

for more than 500 hours during the<br />

capacity as an investor and you are you were married, file a separate<br />

tax year.<br />

not directly involved in the day-to-day return for the year, and did not live<br />

2. Your participation in the activity<br />

operations of the activity. Examples apart from your spouse at all times<br />

for the tax year constituted<br />

of work done as an investor that during the year.<br />

substantially all the participation in<br />

the activity of all individuals (including would not count toward material<br />

Only individuals can actively<br />

individuals who are not owners of participation include:<br />

participate in a rental real estate<br />

interests in the activity).<br />

a. Studying and reviewing activity. However, a decedent’s estate<br />

3. You participated in the activity financial statements or reports on (including a qualified revocable trust<br />

for more than 100 hours during the operations of the activity,<br />

for which a section 645 election has<br />

tax year, and your participation in the b. Preparing or compiling been made) is treated as actively<br />

activity for the tax year was not less summaries or analyses of the participating for its tax years ending<br />

than the participation in the activity of finances or operations of the activity less than 2 years after the decedent’s<br />

any other individual (including for your own use, and<br />

death, if the decedent would have<br />

individuals who were not owners of c. Monitoring the finances or satisfied the active participation<br />

interests in the activity) for the tax operations of the activity in a<br />

requirement for the activity for the tax<br />

year.<br />

nonmanagerial capacity.<br />

year the decedent died.<br />

4. The activity was a significant<br />

Effect of determination. Income You are not considered to actively<br />

participation activity for the tax year,<br />

(loss), deductions, and credits from participate in a rental real estate<br />

and you participated in all significant<br />

an activity are nonpassive if you activity if, at any time during the tax<br />

participation activities (including<br />

determine that:<br />

year, your interest (including your<br />

activities outside the corporation) • You materially participated in a spouse’s interest) in the activity was<br />

during the year for more than 500<br />

trade or business activity of the less than 10% (by value) of all<br />

hours. A significant participation<br />

corporation, or<br />

interests in the activity.<br />

activity is any trade or business • You were a real estate professional<br />

activity in which you participated for<br />

Active participation is a less<br />

(defined on page 3) in a rental real<br />

more than 100 hours during the year<br />

stringent requirement than material<br />

estate activity of the corporation.<br />

and in which you did not materially<br />

participation. You may be treated as<br />

participate under any of the material If you determine that you did not actively participating if you<br />

participation tests (other than this materially participate in a trade or participated, for example, in making<br />

test).<br />

business activity of the corporation or management decisions or arranging<br />

5. You materially participated in if you have income (loss), deductions, for others to provide services (such<br />

the activity for any 5 tax years or credits from a rental activity of the as repairs) in a significant and bona<br />

(whether or not consecutive) during corporation (other than a rental real fide sense. Management decisions<br />

the 10 tax years that immediately estate activity in which you materially that can count as active participation<br />

precede the tax year.<br />

participated as a real estate<br />

include approving new tenants,<br />

6. The activity was a personal professional), the amounts from that deciding rental terms, approving<br />

service activity and you materially activity are passive. Report passive capital or repair expenditures, and<br />

participated in the activity for any 3 income (losses), deductions, and other similar decisions.<br />

tax years (whether or not<br />

credits as follows.<br />

Modified adjusted gross income<br />

consecutive) preceding the tax year. 1. If you have an overall gain (the limitation. The maximum special<br />

A personal service activity involves excess of income over deductions allowance that single individuals and<br />

the performance of personal services and losses, including any prior year married individuals filing a joint return<br />

in the fields of health, law, unallowed loss) from a passive can qualify for is $25,000. The<br />

-4- <strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)

maximum is $12,500 for married the corporation will identify the activity 4. Any other limitations that must<br />

individuals who file separate returns and all amounts relating to it on be taken into account at the<br />

and who lived apart at all times during <strong>Schedule</strong> K-1 or on an attachment. shareholder level in figuring taxable<br />

the year. The maximum special<br />

If you have net income subject to<br />

income (for example, the section 179<br />

allowance for which an estate can<br />

recharacterization under Temporary<br />

expense limitation).<br />

qualify is $25,000 reduced by the<br />

Regulations section 1.469-2T(f) and<br />

special allowance for which the<br />

For information on these<br />

Regulations section 1.469-2(f), report<br />

surviving spouse qualifies.<br />

provisions, see Limitations on<br />

such amounts according to the Losses, Deductions, and Credits<br />

If your modified adjusted gross <strong>Instruction</strong>s for Form 8582. beginning on page 1.<br />

income (defined below) is $100,000<br />

or less ($50,000 or less if married If you have net income (loss), If you are an individual, and the<br />

filing separately), your loss is<br />

deductions, or credits from either of above limitations do not apply to the<br />

deductible up to the maximum special the following activities, treat such amounts shown on your <strong>Schedule</strong><br />

allowance referred to in the preceding amounts as nonpassive and report K-1, take the amounts shown and<br />

paragraph. If your modified adjusted them as indicated in these<br />

report them on the lines of your tax<br />

gross income is more than $100,000 instructions.<br />

return as indicated in the summarized<br />

(more than $50,000 if married filing 1. The rental of a dwelling unit any reporting information shown on page<br />

separately), the special allowance is shareholder used for personal 2 of the <strong>Schedule</strong> K-1. If any of the<br />

limited to 50% of the difference purposes during the year for more above limitations apply, adjust the<br />

between $150,000 ($75,000 if than the greater of 14 days or 10% of amounts on <strong>Schedule</strong> K-1 before you<br />

married filing separately) and your the number of days that the residence report them on your return.<br />

modified adjusted gross income. was rented at fair rental value.<br />

When applicable, the passive<br />

When modified adjusted gross<br />

2. Trading personal property for activity limitations on losses are<br />

income is $150,000 or more ($75,000 the account of owners of interests in applied after the limitations on losses<br />

or more if married filing separately), the activity.<br />

for a shareholder’s basis in stock and<br />

there is no special allowance.<br />

debt and the shareholder’s at-risk<br />

Self-charged interest. The<br />

Modified adjusted gross income is<br />

amount.<br />

corporation will report any<br />

your adjusted gross income figured<br />

“self-charged” interest income or The line numbers in the<br />

without taking into account the<br />

expense that resulted from loans summarized reporting information on<br />

following amounts, if applicable.<br />

between you and the corporation (or page 2 of <strong>Schedule</strong> K-1 are<br />

• Any passive activity loss.<br />

between the corporation and another references to forms in use for<br />

• Any rental real estate loss allowed<br />

S corporation or partnership if both calendar year <strong>2010</strong>. If you file your<br />

under section 469(c)(7) to real estate<br />

entities have the same owners with tax return on a calendar year basis,<br />

professionals (defined on page 3).<br />

the same proportional interest in each but the corporation files a return for a<br />

• Any overall loss from a<br />

entity). If there was more than one fiscal year, report the amounts on<br />

publicly-traded partnership.<br />

activity, the corporation will provide a your tax return for the year in which<br />

• Any taxable social security or<br />

statement allocating the interest the corporation’s fiscal year ends. For<br />

equivalent railroad retirement<br />

income or expense with respect to example, if the corporation’s tax year<br />

benefits.<br />

each activity. The self-charged ends in February 2011, report the<br />

• Any deductible contributions to an<br />

interest rules do not apply to your amounts on your 2011 tax return.<br />

IRA or certain other qualified<br />

interest in the S corporation if the If you have losses, deductions, or<br />

retirement plans under section 219.<br />

corporation made an election under credits from a prior year that were not<br />

• The domestic production activities<br />

Regulations section 1.469-7(g) to deductible or usable because of<br />

deduction.<br />

avoid the application of these rules. certain limitations, such as the basis<br />

• The student loan interest<br />

See the <strong>Instruction</strong>s for Form 8582 rules or the at-risk limitations, take<br />

deduction.<br />

for details.<br />

them into account in determining your<br />

• The tuition and fees deduction.<br />

income, loss, or credits for this year.<br />

• The deduction for one-half of<br />

However, except for passive activity<br />

self-employment taxes.<br />

losses and credits, do not combine<br />

• The exclusion from income of Specific <strong>Instruction</strong>s the prior-year amounts with any<br />

interest from Series EE or I U.S.<br />

amounts shown on this <strong>Schedule</strong> K-1<br />

Savings Bonds used to pay higher<br />

Part III. Shareholder’s to get a net figure to report on your<br />

education expenses.<br />

return. Instead, report the amounts on<br />

• The exclusion of amounts received Share of Current Year<br />

your return on a year-by-year basis.<br />

under an employer’s adoption<br />

assistance program. Income, Deductions,<br />

If you have amounts other<br />

Credits, and Other Items<br />

than those shown on<br />

Commercial revitalization<br />

CAUTION<br />

deduction. The special $25,000 The amounts shown in boxes 1<br />

<strong>Schedule</strong> K-1 to report on<br />

allowance for the commercial<br />

through 17 reflect your share of <strong>Schedule</strong> E (Form 1040), enter each<br />

revitalization deduction from rental income, loss, deductions, credits, item separately on line 28 of<br />

real estate activities is not subject to etc., from corporate business or <strong>Schedule</strong> E (Form 1040).<br />

the active participation rules or rental activities without reference to Codes. In box 10 and boxes 12<br />

modified adjusted gross income limits limitations on losses, credits, or other through 17, the corporation will<br />

discussed above. See the instructions items that may have to be adjusted identify each item by entering a code<br />

for box 12, code N for more<br />

because of:<br />

in the column to the left of the dollar<br />

information.<br />

1. The adjusted basis of your amount entry space. These codes are<br />

Special rules for certain other stock and debt in the corporation, identified on page 2 of <strong>Schedule</strong> K-1<br />

activities. If you have net income 2. The at-risk limitations,<br />

and in these instructions.<br />

(loss), deductions, or credits from any 3. The passive activity limitations, Attached statements. The<br />

activity to which special rules apply, or corporation will enter an asterisk (*)<br />

<strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)<br />

-5-<br />

!

after the code, if any, in the column to determine where to report a box 2 Portfolio Income<br />

the left of the dollar amount entry amount.<br />

Portfolio income or loss (shown in<br />

space for each item for which it has 1. If you have a loss from a boxes 4 through 8b and in box 10,<br />

attached a statement providing passive activity in box 2 and you code A) is not subject to the passive<br />

additional information. For those meet all the following conditions, activity limitations. Portfolio income<br />

informational items that cannot be report the loss on <strong>Schedule</strong> E (Form includes income (not derived in the<br />

reported as a single dollar amount, 1040), line 28, column (f). ordinary course of a trade or<br />

the corporation will enter an asterisk<br />

a. You actively participated in the business) from interest, ordinary<br />

in the left column and enter “STMT” in<br />

corporate rental real estate activities. dividends, annuities, or royalties, and<br />

the dollar amount entry space to<br />

See Special allowance for a rental gain or loss on the sale of property<br />

indicate the information is provided<br />

real estate activity on page 4. that produces such income or is held<br />

on an attached statement.<br />

b. Rental real estate activities with for investment.<br />

active participation were your only<br />

Income (Loss)<br />

passive activities.<br />

Box 4. Interest Income<br />

c. You have no prior year<br />

Report interest income on line 8a of<br />

Box 1. Ordinary Business unallowed losses from these<br />

Form 1040.<br />

Income (Loss) activities. Box 5a. Ordinary Dividends<br />

The amount reported in box 1 is your d. Your total loss from the rental<br />

share of the ordinary income (loss) real estate activities was not more<br />

Report ordinary dividends on line 9a<br />

from trade or business activities of than $25,000 (not more than $12,500<br />

of Form 1040.<br />

the corporation. Generally, where you if married filing separately and you<br />

report this amount on Form 1040<br />

Box 5b. Qualified Dividends<br />

lived apart from your spouse all year).<br />

depends on whether the amount is Report any qualified dividends on line<br />

e. If you are a married person<br />

from an activity that is a passive<br />

9b of Form 1040.<br />

filing separately, you lived apart from<br />

activity to you. If you are an individual your spouse all year.<br />

Note. Qualified dividends are<br />

shareholder filing a <strong>2010</strong> Form 1040,<br />

f. You have no current or prior<br />

excluded from investment income,<br />

find your situation below and report<br />

year unallowed credits from a passive<br />

but you may elect to include part or<br />

your box 1 income (loss) as<br />

activity.<br />

all of these amounts in investment<br />

instructed after applying the basis<br />

income. See the instructions for line<br />

and at-risk limitations on losses. If the g. Your modified adjusted gross 4g of Form 4952, Investment Interest<br />

corporation had more than one trade income was not more than $100,000 Expense Deduction, for important<br />

or business activity, it will attach a (not more than $50,000 if married information on making this election.<br />

statement identifying the income or filing separately and you lived apart<br />

loss from each activity.<br />

from your spouse all year).<br />

Box 6. Royalties<br />

1. Report box 1 income (loss) 2. If you have a loss from a Report royalties on <strong>Schedule</strong> E (Form<br />

from corporate trade or business passive activity in box 2 and you do 1040), line 4.<br />

activities in which you materially not meet all the conditions in 1 above,<br />

participated on <strong>Schedule</strong> E (Form follow the <strong>Instruction</strong>s for Form 8582 Box 7. Net Short-Term<br />

1040), line 28, column (h) or (j). to figure how much of the loss you Capital Gain (Loss)<br />

2. Report box 1 income (loss) can report on <strong>Schedule</strong> E (Form Report the net short-term capital gain<br />

from corporate trade or business 1040), line 28, column (f).<br />

(loss) on <strong>Schedule</strong> D (Form 1040),<br />

activities in which you did not 3. If you were a real estate line 5.<br />

materially participate, as follows. professional and you materially<br />

a. If income is reported in box 1, participated in the activity, report box Box 8a. Net Long-Term<br />

report the income on <strong>Schedule</strong> E 2 income (loss) on <strong>Schedule</strong> E (Form Capital Gain (Loss)<br />

(Form 1040), line 28, column (g). 1040), line 28, column (h) or (j).<br />

Report the net long-term capital gain<br />

b. If a loss is reported in box 1, 4. If you have income from a (loss) on <strong>Schedule</strong> D (Form 1040),<br />

follow the <strong>Instruction</strong>s for Form 8582 passive activity in box 2, report the line 12.<br />

to figure how much of the loss can be income on <strong>Schedule</strong> E (Form 1040),<br />

reported on <strong>Schedule</strong> E (Form 1040), line 28, column (g). Box 8b. Collectibles (28%)<br />

line 28, column (f).<br />

Gain (Loss)<br />

Box 3. Other Net Rental Report collectibles gain or loss on line<br />

Box 2. Net Rental Real Estate Income (Loss)<br />

4 of the 28% Rate Gain<br />

Income (Loss) Worksheet—Line 18 in the<br />

The amount in box 3 is a passive <strong>Instruction</strong>s for <strong>Schedule</strong> D (Form<br />

Generally, the income (loss) reported activity amount for all shareholders. If 1040).<br />

in box 2 is a passive activity amount the corporation had more than one<br />

for all shareholders. However, the rental activity, it will attach a Box 8c. Unrecaptured<br />

income (loss) in box 2 is not from a statement identifying the income or Section 1250 Gain<br />

passive activity if you were a real loss from each activity. Report the<br />

estate professional (defined on page income or loss as follows.<br />

There are three types of<br />

3) and you materially participated in unrecaptured section 1250 gain.<br />

1. If box 3 is a loss, follow the<br />

the activity. If the corporation had Report your share of this<br />

<strong>Instruction</strong>s for Form 8582 to figure<br />

more than one rental real estate unrecaptured gain on the<br />

how much of the loss can be reported<br />

activity, it will attach a statement Unrecaptured Section 1250 Gain<br />

on <strong>Schedule</strong> E (Form 1040), line 28,<br />

identifying the income or loss from Worksheet—Line 19 in the<br />

column (f).<br />

each activity.<br />

<strong>Instruction</strong>s for <strong>Schedule</strong> D (Form<br />

2. If income is reported in box 3, 1040) as follows.<br />

If you are filing a <strong>2010</strong> Form 1040, report the income on <strong>Schedule</strong> E • Report unrecaptured section 1250<br />

use the following instructions to (Form 1040), line 28, column (g). gain from the sale or exchange of the<br />

-6- <strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)

corporation’s business assets on line statement will also report your share extent of winnings on <strong>Schedule</strong> A<br />

5. of any “excess inclusion” that you (Form 1040), line 28.<br />

• Report unrecaptured section 1250 report on <strong>Schedule</strong> E (Form 1040), 2. If the corporation was engaged<br />

gain from the sale or exchange of an line 38, column (c), and your share of in the trade or business of gambling,<br />

interest in a partnership on line 10. section 212 expenses that you report (a) report gambling winnings on line<br />

• Report unrecaptured section 1250 on <strong>Schedule</strong> E (Form 1040), line 38, 28 of <strong>Schedule</strong> E (Form 1040) and<br />

gain from an estate, trust, regulated column (e). If you itemize your (b) deduct gambling losses (to the<br />

investment company (RIC), or real deductions on <strong>Schedule</strong> A (Form extent of winnings) on <strong>Schedule</strong> E<br />

estate investment trust (REIT) on line 1040), you may also deduct these (Form 1040), line 28, column (h).<br />

11. section 212 expenses as a • Gain (loss) from the disposition of<br />

If the corporation reports only miscellaneous deduction subject to an interest in oil, gas, geothermal, or<br />

unrecaptured section 1250 gain from the 2% limit on <strong>Schedule</strong> A (Form other mineral properties. The<br />

the sale or exchange of its business 1040), line 23.<br />

corporation will attach a statement<br />

assets, it will enter a dollar amount in Code B. Involuntary conversions. that provides a description of the<br />

box 8c. If it reports the other two This is your net loss from involuntary property, your share of the amount<br />

types of unrecaptured gain, it will conversions due to casualty or theft. realized from the disposition, your<br />

provide an attached statement that The corporation will give you a share of the corporation’s adjusted<br />

shows the amount for each type of schedule that shows the amounts to basis in the property (for other than<br />

unrecaptured section 1250 gain. be reported on Form 4684, oil or gas properties), and your share<br />

Casualties and Thefts, line 37, of the total intangible drilling costs,<br />

Box 9. Net Section 1231 Gain columns (b)(i), (b)(ii), and (c). development costs, and mining<br />

(Loss)<br />

If there was a gain (loss) from a<br />

exploration costs (section 59(e)<br />

The amount in box 9 is generally casualty or theft to property not used<br />

expenditures) passed through for the<br />

passive if it is from a:<br />

in a trade or business or for<br />

property. You must figure your gain or<br />

• Rental activity, or<br />

income-producing purposes, the loss from the disposition by<br />

• Trade or business activity in which corporation will provide you with the increasing your share of the adjusted<br />

you did not materially participate. information you need to complete basis by the intangible drilling costs,<br />

However, an amount from a rental Form 4684.<br />

development costs, or mine<br />

real estate activity is not from a<br />

exploration costs for the property that<br />

Code C. Section 1256 contracts<br />

passive activity if you were a real<br />

you capitalized (that is, costs that you<br />

and straddles. The corporation will<br />

estate professional (defined on page<br />

did not elect to deduct under section<br />

report any net gain or loss from<br />

3) and you materially participated in<br />

59(e)). Report a loss in Part I of Form<br />

section 1256 contracts. Report this<br />

the activity.<br />

4797. Report a gain in Part III of<br />

amount on Form 6781, Gains and Form 4797 in accordance with the<br />

If the amount is either (a) a loss Losses From Section 1256 Contracts instructions for line 28. See<br />

that is not from a passive activity or and Straddles.<br />

Regulations section 1.1254-4 for<br />

(b) a gain, report it on Form 4797, line Code D. Mining exploration costs details.<br />

2, column (g). Do not complete recapture. The corporation will give • Net short-term capital gain (loss)<br />

columns (b) through (f) on line 2 of you a schedule that shows the and net long-term capital gain (loss)<br />

Form 4797. Instead, enter “From information needed to recapture from <strong>Schedule</strong> D (Form <strong>1120</strong>S) that<br />

<strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)” across certain mining exploration costs is not portfolio income. An example is<br />

these columns. (section 617). See Pub. 535 for gain or loss from the disposition of<br />

If the amount is a loss from a details. nondepreciable personal property<br />

passive activity, see Passive Loss<br />

Code E. Other income (loss). used in a trade or business activity of<br />

Limitations in the <strong>Instruction</strong>s for<br />

Amounts with code E are other items the corporation. Report total net<br />

Form 4797. Report the loss following<br />

of income, gain, or loss not included short-term gain (loss) on <strong>Schedule</strong> D<br />

the <strong>Instruction</strong>s for Form 8582 to<br />

in boxes 1 through 9 or in box 10 (Form 1040), line 5. Report the total<br />

figure how much of the loss is<br />

using codes A through D. The net long-term gain (loss) on <strong>Schedule</strong><br />

allowed on Form 4797. If the<br />

corporation should give you a D (Form 1040), line 12.<br />

corporation had net section 1231 gain<br />

description and the amount of your • Current year section 108(i)<br />

(loss) from more than one activity, it<br />

share for each of these items. cancellation of debt income. The<br />

will attach a statement that will<br />

corporation will provide your share of<br />

identify the section 1231 gain (loss) Report loss items that are passive the deferred amount that you must<br />

from each activity.<br />

activity amounts to you following the<br />

include in income in the current tax<br />

<strong>Instruction</strong>s for Form 8582.<br />

Box 10. Other Income (Loss)<br />

year under section 108(i)(1) or<br />

Code E items may include the section 108(i)(5)(D)(i) or (ii).<br />

Code A. Other portfolio income following. • Gain from the sale or exchange of<br />

(loss). The corporation will report • Income from recoveries of tax qualified small business (QSB) stock<br />

portfolio income other than interest, benefit items. A tax benefit item is an (as defined in the <strong>Instruction</strong>s for<br />

ordinary dividend, royalty, and capital amount you deducted in a prior tax <strong>Schedule</strong> D (Form 1040)) eligible for<br />

gain (loss) income, and attach a year that reduced your income tax. the partial section 1202 exclusion.<br />

statement to tell you what kind of Report this amount on Form 1040, The corporation should also give you<br />

portfolio income is reported. line 21, to the extent it reduced your (a) the name of the corporation that<br />

If the corporation held a residual tax.<br />

issued the QSB stock, (b) your share<br />

interest in a real estate mortgage • Gambling gains and losses. of the corporation’s adjusted basis<br />

investment conduit (REMIC), it will 1. If the corporation was not and sales price of the QSB stock, and<br />

report on the statement your share of engaged in the trade or business of (c) the dates the QSB stock was<br />

REMIC taxable income (net loss) that gambling, (a) report gambling bought and sold. The following<br />

you report on <strong>Schedule</strong> E (Form winnings on Form 1040, line 21 and additional limitations apply at the<br />

1040), line 38, column (d). The (b) deduct gambling losses to the shareholder level.<br />

<strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)<br />

-7-

1. You must have held an interest date the QSB stock was sold by the 50% AGI limitation, on line 16 of<br />

in the corporation when the corporation. <strong>Schedule</strong> A (Form 1040).<br />

corporation acquired the QSB stock See the <strong>Instruction</strong>s for <strong>Schedule</strong> Code B. Cash contributions (30%).<br />

and at all times thereafter until the D (Form 1040) for details on how to Report this amount, subject to the<br />

corporation disposed of the QSB report the gain and the amount of the 30% AGI limitation, on line 16 of<br />

stock. allowable postponed gain. <strong>Schedule</strong> A (Form 1040).<br />

2. Your share of the eligible<br />

Code C. Noncash contributions<br />

section 1202 gain cannot exceed the Deductions<br />

(50%). If property other than cash is<br />

amount that would have been<br />

contributed, and if the claimed<br />

allocated to you based on your Box 11. Section 179 deduction for one item or group of<br />

interest in the corporation at the time Deduction similar items of property exceeds<br />

the QSB stock was acquired.<br />

Use this amount, along with the total $5,000, the corporation must give you<br />

See the <strong>Instruction</strong>s for <strong>Schedule</strong><br />

cost of section 179 property placed in a copy of Form 8283, Noncash<br />

D (Form 1040) for details on how to<br />

service during the year from other Charitable Contributions, to attach to<br />

report the gain and the amount of the<br />

sources, to complete Part I of Form your tax return. Do not deduct the<br />

allowable exclusion.<br />

4562, Depreciation and Amortization. amount shown on Form 8283. It is the<br />

• Gain eligible for section 1045 The corporation will report on an corporation’s contribution. Instead,<br />

rollover (replacement stock<br />

attached statement your share of the deduct the amount identified by code<br />

purchased by the corporation). The cost of any qualified enterprise zone, C, box 12, subject to the 50% AGI<br />

corporation should also give you (a) renewal community, qualified section limitation, on line 17 of <strong>Schedule</strong> A<br />

the name of the corporation that 179 Recovery Assistance, qualified (Form 1040).<br />

issued the qualified small business section 179 disaster assistance, or<br />

(QSB) stock, (b) your share of the<br />

If the corporation provides you with<br />

qualified real property it placed in<br />

corporation’s adjusted basis and<br />

information that the contribution was<br />

service during the tax year. Report<br />

sales price of the QSB stock, and (c)<br />

property other than cash and does<br />

the amount from line 12 of Form 4562<br />

the dates the QSB stock was bought<br />

not give you a Form 8283, see the<br />

allocable to a passive activity using<br />

and sold. To qualify for the section<br />

<strong>Instruction</strong>s for Form 8283 for filing<br />

the <strong>Instruction</strong>s for Form 8582. If the<br />

1045 rollover:<br />

requirements. Do not file Form 8283<br />

amount is not a passive activity unless the total claimed deduction for<br />

1. You must have held an interest deduction, report it on <strong>Schedule</strong> E all contributed items of property<br />

in the corporation during the entire (Form 1040), line 28, column (i). exceeds $500.<br />

period in which the corporation held<br />

the QSB stock (more than 6 months Box 12. Other Deductions Food inventory contributions.<br />

prior to the sale), and The corporation will report on an<br />

Contributions. Codes A through G.<br />

2. Your share of the gain eligible<br />

attached statement your share of<br />

The corporation will give you a<br />

for the section 1045 rollover cannot<br />

qualified food inventory contributions.<br />

schedule that shows charitable<br />

exceed the amount that would have<br />

The food inventory contribution is not<br />

contributions subject to the 100%,<br />

been allocated to you based on your<br />

included in the amount reported in<br />

50%, 30%, and 20% adjusted gross<br />

interest in the corporation at the time<br />

box 12 using code C. The corporation<br />

income limitations.<br />

the QSB stock was acquired.<br />

will also report your share of the<br />

If the corporation made a property corporation’s net income from the<br />

See the <strong>Instruction</strong>s for <strong>Schedule</strong><br />

contribution, it will report on an business activities that made the food<br />

D (Form 1040) for details on how to<br />

attached statement your share of inventory contribution(s). Your<br />

report the gain and the amount of the<br />

both the fair market value and deduction for food inventory<br />

allowable postponed gain.<br />

adjusted basis of the property. Use contributions cannot exceed 10% of<br />

• Gain eligible for section 1045 these amounts to adjust your stock your aggregate net income for the tax<br />

rollover (replacement stock not basis (see page 2). If the corporation year from the business activities from<br />

purchased by the corporation). The made a qualified conservation which the food inventory contribution<br />

corporation should also give you (a) contribution, it will report the fair was made (including your share of<br />

the name of the corporation that market value of the underlying net income from partnership or S<br />

issued the qualified small business property before and after the<br />

corporation businesses that made<br />

(QSB) stock, (b) your share of the donation, the type of legal interest food inventory contributions). Report<br />

corporation’s adjusted basis and contributed, and a description of the the deduction, subject to the 50% AGI<br />

sales price of the QSB stock, and (c) conservation purpose furthered by limitation, on line 17 of <strong>Schedule</strong> A<br />

the dates the QSB stock was bought the donation. If the corporation made (Form 1040).<br />

and sold. To qualify for the section a contribution of real property located<br />

1045 rollover:<br />

Code D. Noncash contributions<br />

in a registered historic district, it will (30%). Report this amount, subject<br />

1. You must have held an interest report any information you will need to the 30% AGI limitation, on line 17<br />

in the corporation during the entire to take a deduction. of <strong>Schedule</strong> A (Form 1040).<br />

period in which the corporation held<br />

the QSB stock (more than 6 months<br />

For more details, see Pub. 526, Code E. Capital gain property to a<br />

prior to the sale),<br />

Charitable Contributions, and the 50% organization (30%). Report<br />

<strong>Instruction</strong>s for <strong>Schedule</strong> A (Form<br />

2. Your share of the gain eligible<br />

this amount, subject to the 30% AGI<br />

1040). If your contributions are<br />

for the section 1045 rollover cannot<br />

limitation, on line 17 of <strong>Schedule</strong> A<br />

subject to more than one of the AGI<br />

exceed the amount that would have<br />

(Form 1040). See Special 30% Limit<br />

limitations, see Pub. 526.<br />

been allocated to you based on your<br />

for Capital Gain Property in Pub. 526.<br />

interest in the corporation at the time Charitable contribution deductions Code F. Capital gain property<br />

the QSB stock was acquired, and are not taken into account in figuring (20%). Report this amount, subject<br />

3. You must purchase other QSB your passive activity loss for the year. to the 20% AGI limitation, on line 17<br />

stock (as defined in the <strong>Instruction</strong>s Do not enter them on Form 8582. of <strong>Schedule</strong> A (Form 1040).<br />

for <strong>Schedule</strong> D (Form 1040)) during Code A. Cash contributions (50%). Code G. Contributions (100%).<br />

the 60-day period that began on the Report this amount, subject to the The corporation will report your share<br />

-8- <strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)

of qualified conservation contributions costs can be amortized over a Code O. Reforestation expense<br />

of property used in agriculture or 10-year period. Intangible drilling and deduction. The corporation will<br />

livestock production. This contribution development costs can be amortized provide a statement that describes<br />

is not included in the amount reported over a 60-month period. The<br />

the qualified timber property for these<br />

in box 12 using code C. If you are a amortization periods begin with the reforestation expenses. The expense<br />

farmer or rancher, you qualify for a month in which such costs were paid deduction is limited to $10,000<br />

100% AGI limitation for this or incurred.<br />

($5,000 if married filing separately)<br />

contribution. Otherwise, your<br />

for each qualified timber property,<br />

deduction for this contribution is<br />

Make the election on Form 4562. including your share of the<br />

subject to a 50% AGI limitation. If you make the election, report the corporation’s expense and any<br />

Report this deduction on line 17 of current year amortization of section reforestation expenses you<br />

<strong>Schedule</strong> A (Form 1040). See Pub. 59(e) expenditures from Part VI of separately paid or incurred during the<br />

526 for more information on qualified Form 4562 on line 28 of <strong>Schedule</strong> E tax year.<br />

conservation contributions.<br />

(Form 1040). If you do not make the<br />

election, report the section 59(e)(2) If you did not materially participate<br />

Code H. Investment interest expenditures on line 28 of <strong>Schedule</strong> in the activity, use Form 8582 to<br />

expense. Enter this amount on E (Form 1040) and figure the<br />

figure the amount to report on<br />

Form 4952, line 1.<br />

resulting adjustment or tax preference <strong>Schedule</strong> E (Form 1040), line 28. If<br />

If the corporation has investment item (see Form 6251, Alternative you materially participated in the<br />

income or other investment expense, Minimum Tax—Individuals). Whether reforestation activity, report the<br />

it will report your share of these items you deduct the expenditures or elect deduction on line 28, column (h), of<br />

in box 17 using codes A and B. to amortize them, report the amount <strong>Schedule</strong> E (Form 1040).<br />

Include investment income and on a separate line in column (h) of Code P. Domestic production<br />

expenses from other sources to figure line 28 if you materially participated in activities information. The<br />

how much of your total investment the activity. If you did not materially corporation will provide you with a<br />

interest is deductible.<br />

participate, follow the <strong>Instruction</strong>s for statement with information that you<br />

For more information on the Form 8582 to figure how much of the must use to figure the domestic<br />

special provisions that apply to deduction can be reported in column production activities deduction. Use<br />

investment interest expense, see (f).<br />

Form 8903, Domestic Production<br />

Form 4952 and Pub. 550. Activities Deduction, to figure this<br />

Code K. Deductions—portfolio deduction. For details, see the<br />

Code I. Deductions—royalty (2% floor). Amounts entered with <strong>Instruction</strong>s for Form 8903.<br />

income. Enter deductions allocable code K are deductions that are clearly<br />

to royalties on <strong>Schedule</strong> E (Form and directly allocable to portfolio Code Q. Qualified production<br />

1040), line 18. For this type of income (other than investment activities income (QPAI). Report<br />

expense, enter “From <strong>Schedule</strong> K-1 interest expense and section 212 the QPAI reported to you by the<br />

(Form <strong>1120</strong>S).”<br />

expenses from a REMIC). Generally, corporation (in box 12 of <strong>Schedule</strong><br />

you should report these amounts on K-1) on line 7b of Form 8903. Report<br />

These deductions are not taken<br />

<strong>Schedule</strong> A (Form 1040), line 23. See any portion of QPAI attributable to<br />

into account in figuring your passive<br />

the <strong>Instruction</strong>s for <strong>Schedule</strong> A (Form oil-related activities (identified on an<br />

activity loss for the year. Do not enter<br />

1040), lines 23 and 28, for details. attached statement) on line 7a.<br />

them on Form 8582.<br />

Code R. Employer’s Form W-2<br />

Code J. Section 59(e)(2) These deductions are not taken wages. Report the portion of Form<br />

expenditures. The corporation will into account in figuring your passive W-2 wages reported to you by the<br />

show on an attached statement the activity loss for the year. Do not enter corporation (in box 12 of <strong>Schedule</strong><br />

type and the amount of qualified them on Form 8582. K-1) on line 17 of Form 8903.<br />

expenditures for which you may make<br />

a section 59(e) election. The<br />

Code L. Deductions—portfolio Code S. Other deductions.<br />

statement will also identify the (other). Generally, you should report Amounts with this code may include:<br />

property for which the expenditures these amounts on <strong>Schedule</strong> A (Form • Itemized deductions that Form<br />

were paid or incurred. If there is more 1040), line 28. See the <strong>Instruction</strong>s 1040 filers report on <strong>Schedule</strong> A<br />

than one type of expenditure, the for <strong>Schedule</strong> A (Form 1040), lines 23 (Form 1040).<br />

amount of each type will also be and 28, for details.<br />

• Soil and water conservation and<br />

listed. endangered species recovery<br />

These deductions are not taken expenditures. See section 175 for<br />

If you deduct these expenditures in into account in figuring your passive limitations on the amount you are<br />

full in the current year, they are activity loss for the year. Do not enter allowed to deduct.<br />

treated as adjustments or tax them on Form 8582. • Expenditures for the removal of<br />

preference items for purposes of<br />

Code M. Preproductive period architectural and transportation<br />

alternative minimum tax. However,<br />

expenses. You may be able to barriers to the elderly and disabled<br />

you may elect to amortize these<br />

deduct these expenses currently or that the corporation elected to treat<br />

expenditures over the number of<br />

you may need to capitalize them as a current expense. The deductions<br />

years in the applicable period rather<br />

under section 263A. See Pub. 225, are limited by section 190(c) to<br />

than deduct the full amount in the<br />

Farmer’s Tax Guide, and Regulations $15,000 per year from all sources.<br />

current year. If you make this<br />

section 1.263A-4 for details. • Interest expense allocated to<br />

election, these items are not treated<br />

debt-financed distributions. The<br />

as adjustments or tax preference Code N. Commercial revitalization manner in which you report such<br />

items. deduction from rental real estate interest expense depends on your<br />

Under the election, you can deduct activities. Follow the <strong>Instruction</strong>s use of the distributed debt proceeds.<br />

circulation expenditures ratably over for Form 8582 to figure how much of If the proceeds were used in a trade<br />

a 3-year period. Research and the deduction can be reported on or business activity, report the<br />

experimental expenditures and <strong>Schedule</strong> E (Form 1040), line 28, interest on line 28 of <strong>Schedule</strong> E<br />

mining exploration and development column (f).<br />

(Form 1040). In column (a) enter the<br />

<strong>Instruction</strong>s for <strong>Schedule</strong> K-1 (Form <strong>1120</strong>S)<br />

-9-

name of the corporation and “interest If the corporation is an eligible <strong>Instruction</strong>s for Form 3468 for details.<br />

expense.” If you materially<br />

small business, the general business If the corporation is reporting<br />

participated in the trade or business credits you receive from the<br />

expenditures from more than one<br />

activity, enter the interest expense in corporation may be available to offset activity, the attached statement will<br />

column (h). If you did not materially tentative minimum tax and qualify for separately identify the expenditures<br />

participate in the activity, follow the a 5-year carryback. See the<br />

from each activity.<br />

<strong>Instruction</strong>s for Form 8582 to figure attachment for box 17, code U, to find<br />

out if the corporation is an eligible<br />

Combine the expenditures (for<br />

the interest expense you can report in<br />

small business. For details, see the<br />

Form 3468 reporting) from box 13,<br />

column (f). See page 4 for a definition<br />

<strong>Instruction</strong>s for Form 3800.<br />

code E, and from box 17, code C.<br />

of material participation. If the<br />

The expenditures related to rental<br />

proceeds were used in an investment<br />

In general, shareholders real estate activities (box 13, code E)<br />

activity, report the interest on Form<br />

TIP whose only source for credits are reported on <strong>Schedule</strong> K-1<br />

4952. If the proceeds are used for<br />

listed only on page 1 of Form separately from other qualified<br />

personal purposes, the interest is<br />

3800 are from pass-through entities rehabilitation expenditures (box 17,<br />

generally not deductible.<br />

are not required to complete the code C) because they are subject to<br />

• Contributions to a capital<br />

source credit form or attach it to Form different passive activity limitation<br />

construction fund (CCF). The<br />

3800. Instead, you can report this rules. See the <strong>Instruction</strong>s for Form<br />

deduction for a CCF investment is not credit directly on page 1 of Form 8582-CR for details.<br />

taken on <strong>Schedule</strong> E (Form 1040). 3800. However, when applicable, all<br />

Instead, you subtract the deduction<br />

Code F. Other rental real estate<br />

shareholders must complete and<br />

from the amount that would normally<br />

credits. The corporation will identify<br />

attach the following credit forms to<br />

be entered as taxable income on line the type of credit and any other<br />

Form 3800.<br />

43 of Form 1040. In the margin to the information you need to figure these<br />

• Form 3468, Investment Credit (line<br />

left of line 43, enter ‘‘CCF’’ and the credits from rental real estate<br />

1a of Form 3800).<br />

amount of the deduction.<br />

activities (other than the low-income<br />

• Form 8864, Biodiesel and<br />

• Penalty on early withdrawal of<br />

housing credit and qualified<br />

Renewable Diesel Fuels Credit (line<br />

savings. Report this amount on Form rehabilitation expenditures). These<br />

1l of Form 3800).<br />

1040, line 30.<br />

credits may be limited by the passive<br />

Codes A, B, C, and D. Low-income activity limitations. If the credits are<br />

• Film and television production housing credit. If section 42(j)(5) from more than one activity, the<br />

expenses. The corporation will applies, the corporation will report corporation will identify the credits<br />

provide a statement that describes your share of the low-income housing from each activity on an attached<br />

the film or television production credit using code A or code C, statement. See Passive Activity<br />

generating these expenses. depending on the date the building Limitations on page 3 and the<br />

Generally, if the aggregate cost of the was placed in service. If section <strong>Instruction</strong>s for Form 8582-CR for<br />

production exceeds $15 million, you 42(j)(5) does not apply, your share of details.<br />

are not entitled to the deduction. The the credit will be reported using code<br />

limitation is $20 million for<br />

B or code D, depending on the date Code G. Other rental credits. The<br />

productions in certain areas (see the building was placed in service. corporation will identify the type of<br />

section 181 for details). If you did not Any allowable low-income housing credit and any other information you<br />

materially participate in the activity, credit reported using code A or code need to figure these rental credits.<br />

use Form 8582 to determine the B is reported on line 4 of Form 8586, These credits may be limited by the<br />

amount that can be reported on Low-Income Housing Credit, or line passive activity limitations. If the<br />

<strong>Schedule</strong> E (Form 1040), line 28, 1d of Form 3800 (see TIP on this credits are from more than one<br />

column (f). If you materially<br />

page). Any allowable low-income activity, the corporation will identify<br />

participated in the production activity, housing credit reported using code C the credits from each activity on an<br />

report the deduction on <strong>Schedule</strong> E or code D is reported on line 11 of attached statement. See Passive<br />

(Form 1040), line 28, column (h). Form 8586.<br />

Activity Limitations on page 3 and the<br />

• Current year section 108(i) original<br />

<strong>Instruction</strong>s for Form 8582-CR for<br />

Keep a separate record of the<br />

issue discount deduction. The<br />

details.<br />

low-income housing credit from each<br />

corporation will provide your share of<br />

separate source so that you can Code H. Undistributed capital<br />

the corporation’s original issue<br />

correctly figure any recapture of gains credit. Code H represents<br />

discount deduction deferred under<br />

low-income housing credit that may taxes paid on undistributed capital<br />

section 108(i)(2)(A)(i) that is<br />

result from the disposition of all or gains by a regulated investment<br />

allowable as a deduction in the<br />

part of your stock in the corporation. company or real estate investment<br />

current tax year under section<br />

For more information on recapture, trust. Report these taxes on line 71 of<br />

108(i)(2)(A)(ii) or section<br />

see the instructions for Form 8611, Form 1040, check box “a” for Form<br />

108(i)(5)(D)(i) or (ii).<br />

Recapture of Low-Income Housing 2439, and enter “Form <strong>1120</strong>S.”<br />

Credit.<br />

Reduce the basis of your stock by<br />

The corporation will give you a<br />

Code E. Qualified rehabilitation<br />

this tax.<br />

description and the amount of your<br />

share for each of these items. expenditures (rental real estate). Code I. Alcohol and cellulosic<br />

The corporation will report your share biofuel fuels credit. If this credit<br />