Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

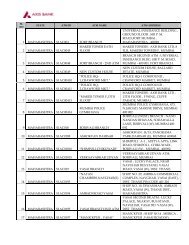

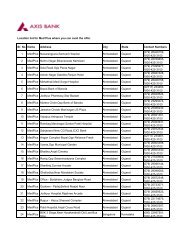

Eighteenth Annual Report 2011-12<br />

<strong>AXIS</strong> <strong>BANK</strong> <strong>LIMITED</strong><br />

NOTICE<br />

NOTICE is hereby given that the Eighteenth Annual General Meeting of the members of Axis Bank Limited will be held<br />

on Friday, the 22 nd June, 2012 at 10.00 a.m. at J. B. Auditorium, Ahmedabad Management Association, AMA Complex,<br />

ATIRA, Dr. Vikram Sarabhai Marg, Ahmedabad 380 015 to transact the following business:<br />

ORDINARY BUSINESS:<br />

1. To receive, consider and adopt the Balance Sheet as at 31 st March, 2012, Profit & Loss Account and Cash flow<br />

statement for the year ended 31 st March, 2012 and the reports of Directors and Auditors thereon.<br />

2. To appoint a Director in place of Smt. Rama Bijapurkar, who retires by rotation and, being eligible, offers herself for<br />

re-appointment as a Director.<br />

3. To appoint a Director in place of Shri V. R. Kaundinya, who retires by rotation and, being eligible, offers himself for<br />

re-appointment as a Director.<br />

4. To declare a dividend on the Equity Shares of the Bank.<br />

5. To consider and pass with or without modifications, the following resolution as a Special Resolution:<br />

“RESOLVED THAT pursuant to the provisions of Section 224A and other applicable provisions, if any, of the<br />

Companies Act, 1956 and the Banking Regulation Act, 1949, M/s. Deloitte Haskins & Sells, Chartered Accountants,<br />

Ahmedabad, ICAI Registration Number 117365W, be and are hereby appointed as the Statutory Auditors of the Bank<br />

to hold office from the conclusion of the Eighteenth Annual General Meeting until the conclusion of the Nineteenth<br />

Annual General Meeting, on such remuneration as may be approved by the Audit Committee of the Board.”<br />

SPECIAL BUSINESS:<br />

6. To consider and pass with or without modifications, the following resolution, as an Ordinary Resolution:<br />

“RESOLVED THAT Prof. Samir K. Barua, who was appointed as an Additional Director at the meeting of the Board of<br />

Directors held on 22 nd July, 2011 and who holds office as such upto the date of this Annual General Meeting and in<br />

respect of whom notice under Section 257 of the Companies Act, 1956 has been received from a member signifying<br />

his intention to propose Prof. Samir K. Barua as a candidate for the office of Director of the Bank is hereby appointed<br />

as a Director of the Bank, liable to retire by rotation.”<br />

7. To consider and pass with or without modifications, the following resolution, as an Ordinary Resolution:<br />

“RESOLVED THAT Shri A. K. Dasgupta, who was appointed as an Additional Director at the meeting of the Board<br />

of Directors held on 5 th September, 2011 and who holds office as such upto the date of this Annual General Meeting<br />

and in respect of whom notice under Section 257 of the Companies Act, 1956 has been received from a member<br />

signifying his intention to propose Shri A. K. Dasgupta as a candidate for the office of Director of the Bank is hereby<br />

appointed as a Director of the Bank, liable to retire by rotation.”<br />

8. To consider and pass with or without modifications, the following resolution, as an Ordinary Resolution:<br />

“RESOLVED THAT Shri Som Mittal, who was appointed as an Additional Director at the meeting of the Board of<br />

Directors held on 22 nd October, 2011 and who holds office as such upto the date of this Annual General Meeting<br />

and in respect of whom notice under Section 257 of the Companies Act, 1956 has been received from a member<br />

signifying his intention to propose Shri Som Mittal as a candidate for the office of Director of the Bank is hereby<br />

appointed as a Director of the Bank, liable to retire by rotation.”<br />

9. To consider and pass with or without modifications, the following resolution, as an Ordinary Resolution:<br />

“RESOLVED THAT subject to the applicable provisions of the Companies Act, 1956 and the Banking Regulation Act,<br />

1949 and subject to the provisions of the Articles of Association of the Bank, approval of the members of the Bank<br />

1

2<br />

Eighteenth Annual Report 2011-12<br />

is hereby given for re-appointment of Smt. Shikha Sharma as the Managing Director & CEO of the Bank for a period<br />

of 3 years effective 1 st June, 2012.”<br />

“RESOLVED FURTHER THAT subject to the approval by the Reserve Bank of India, Smt. Shikha Sharma be paid<br />

remuneration by way of salary, allowances and perquisites as Managing Director & CEO of the Bank as per the<br />

following terms and conditions with effect from 1 st June, 2012:<br />

Salary : `1,78,20,000 p.a.<br />

Leave Fare Concession : `11,15,000 p.a.<br />

Perquisites<br />

Upkeep allowance (for Bank’s<br />

owned/leased accommodation) : NIL<br />

Utility Bills : To be reimbursed at actual upto a limit of `3,00,000 p.a.<br />

Furnishing Allowance : At actual upto a limit of `16 lacs once in a period of 3 years.<br />

Provident Fund : 12% of basic pay with equal contribution by the Bank or as may be decided<br />

upon by the Board/Trustees from time to time.<br />

Gratuity : One month’s salary for each completed year of service or part thereof.<br />

Superannuation : 10% of basic pay p.a.<br />

Travelling Allowance : As per Bank’s Policy.<br />

Medical benefits : (i) Group mediclaim facility as available to other employees of the Bank.<br />

(ii) Reimbursement of full medical expenses for self and family.<br />

Club fees : Membership of two clubs (excluding life membership fees). All official<br />

expenses in connection with such membership incurred would be reimbursed<br />

by the Bank.<br />

House Rent Allowance<br />

(in lieu of Bank’s owned/leased<br />

accommodation) : `59,52,000 p.a.<br />

Conveyance & Telephone : Free use of Bank’s car with driver and telephone facilities.<br />

Personal Insurance : Shall be covered under the Group Savings Linked Insurance Scheme (GSLI)<br />

and the Personal Accident Policy as per the Bank’s rules.<br />

Newspapers & Periodicals : As per requirement.<br />

Leave : As per the Bank’s rules.<br />

Entertainment : Expenditure on official entertainment would be on the Bank’s account.<br />

Stock Options : As may be decided by the HR and Remuneration Committee/Board from time<br />

to time, subject to approval of Reserve Bank of India.<br />

Variable Pay : As may be decided by the HR and Remuneration Committee/Board from time<br />

to time subject to approval of Reserve Bank of India.<br />

Loans : Loan facilities at existing limits, at the rate of interest applicable to other<br />

employees.<br />

Other terms : As per the Bank’s Staff Rules and as may be agreed by the Board, from time<br />

to time.<br />

“RESOLVED FURTHER THAT the Board of Directors of the Bank is hereby authorised to do all such acts, deeds and<br />

things and to execute any document or instruments etc. as may be required to give effect to this resolution.”

Eighteenth Annual Report 2011-12<br />

“RESOLVED FURTHER THAT the Company Secretary of the Bank is hereby authorised to file necessary forms with<br />

the Registrar of Companies/other Regulatory Authorities under his signature and to take all further action in the<br />

matter including signing of any other applications, deeds, documents, forms, certificates, as may be necessary under<br />

the provisions of the Companies Act, 1956 and the Banking Regulation Act, 1949.”<br />

10. To consider and pass with or without modifications, the following resolution, as an Ordinary Resolution:<br />

“RESOLVED THAT subject to approval by the Reserve Bank of India and such other statutory authorities as may be<br />

required, approval of the members of the Bank is hereby given for revising the remuneration payable to Dr. Adarsh<br />

Kishore, Chairman of the Bank as under:<br />

a. Expenses for office maintenance be increased to `100,000 per month from `75,000 per month with effect from<br />

1 st April, 2011 and thereafter be increased to ` 125,000 per month with effect from 1 st April, 2012.<br />

b. All other terms and conditions to remain unchanged.”<br />

11. To consider and pass with or without modifications, the following resolution as an Ordinary Resolution:<br />

“RESOLVED THAT Shri Somnath Sengupta, in respect of whom notice under Section 257 of the Companies Act,<br />

1956 has been received from a member signifying his intention to propose Shri Somnath Sengupta as a candidate<br />

for the office of Director of the Bank is hereby appointed as a Director of the Bank, not liable to retire by rotation,<br />

effective from the date from which his appointment as Whole-time Director will be approved by Reserve Bank of India<br />

till 31 st May, 2015, the last day of the month in which he reaches the age of superannuation.”<br />

12. To consider and pass with or without modifications, the following resolution as an Ordinary Resolution:<br />

“RESOLVED THAT subject to the applicable provisions of the Companies Act, 1956 and the Banking Regulation Act,<br />

1949 and subject to the provisions of the Articles of Association of the Bank, approval of the members of the Bank<br />

is hereby given for appointment of Shri Somnath Sengupta as the Whole-time Director of the Bank effective from<br />

the date from which his appointment as Whole-time Director will be approved by Reserve Bank of India till 31 st May,<br />

2015, the last day of the month in which he reaches the age of superannuation”.<br />

“RESOLVED FURTHER THAT subject to the approval by the Reserve Bank of India, Shri Somnath Sengupta be paid<br />

remuneration by way of salary, allowances and perquisites as Whole-time Director of the Bank as per the following<br />

terms and conditions effective from the date from which his appointment as Whole-time Director will be approved<br />

by Reserve Bank of India:<br />

Salary : `1,11,48,000 p.a.<br />

Leave Fare Concession : `5,00,000 p.a.<br />

Perquisites<br />

House Rent Allowance : `26,88,000 p.a. (in lieu of accommodation provided by the Bank).<br />

Residence : Leased accommodation to be provided by the Bank.<br />

Provident Fund : 12% of basic pay with equal contribution by the Bank or as may be decided<br />

upon by the Board/Trustees from time to time.<br />

Gratuity : One month’s salary for each completed year of service or part thereof (on<br />

pro-rata basis).<br />

Superannuation : 10% of Basic Pay p.a.<br />

Travelling Allowance : As per Bank’s Policy.<br />

Medical Benefits : (i) Group mediclaim facility as available to other employees of the Bank.<br />

(ii) Reimbursement of full medical expenses for self and family.<br />

Club Fees : Membership of one club (excluding life membership fees). All official expenses<br />

in connection with such membership incurred would be reimbursed by the<br />

Bank.<br />

3

4<br />

Eighteenth Annual Report 2011-12<br />

Conveyance & Telephone : Free use of the Bank’s car with a Driver and telephone facilities.<br />

Personal Insurance : Shall be covered under the Group Savings Linked Insurance Scheme (GSLI)<br />

and the Group Term Life Insurance Policy as per the Bank’s policy.<br />

Newspapers & periodicals : As per requirements.<br />

Entertainment : Expenditure on official entertainment would be on the Bank’s account.<br />

Utility Bills : At actuals upto a limit of `1,20,000 p.a.<br />

Furnishing Allowance : At actuals upto a limit of `10 lacs during his tenure as Whole-time Director.<br />

Leave : As per the Bank’s rules.<br />

Employees Stock Options (ESOP) : As may be decided by the HR and Remuneration Committee/ Board from time<br />

to time, subject to approval of Reserve Bank of India.<br />

Variable Pay : As may be decided by the HR and Remuneration Committee/Board, subject<br />

to approval of the Reserve Bank of India.<br />

Loans : Loan facilities at existing limits, at the rate of interest applicable to other<br />

employees.<br />

Other terms : As per the Bank’s Staff Rules and as may be agreed by the Board, from time<br />

to time.<br />

“RESOLVED FURTHER THAT the Board of Directors of the Bank is hereby authorised to do all such acts, deeds and<br />

things and to execute any document or instruments etc. as may be required to give effect to this resolution.”<br />

“RESOLVED FURTHER THAT the Company Secretary of the Bank is hereby authorised to file necessary forms with<br />

the Registrar of Companies/other Regulatory Authorities under his signature and to take all further action in the<br />

matter including signing of any other applications, deeds, documents, forms, certificates, as may be necessary under<br />

the provisions of the Companies Act, 1956 and the Banking Regulation Act, 1949.”<br />

13. To consider and pass with or without modifications, the following resolution as an Ordinary Resolution:<br />

“RESOLVED THAT Shri V. Srinivasan, in respect of whom notice under Section 257 of the Companies Act, 1956 has<br />

been received from a member signifying his intention to propose Shri V. Srinivasan as a candidate for the office of<br />

Director of the Bank is hereby appointed as a Director of the Bank, not liable to retire by rotation, effective from the<br />

date from which his appointment as Whole-time Director will be approved by Reserve Bank of India.”<br />

14. To consider and pass with or without modifications, the following resolution as an Ordinary Resolution:<br />

“RESOLVED THAT subject to the applicable provisions of the Companies Act, 1956 and the Banking Regulation Act,<br />

1949 and subject to the provisions of the Articles of Association of the Bank, approval of the members of the Bank<br />

is hereby given for appointment of Shri V. Srinivasan as the Whole-time Director of the Bank for a period of 3 years<br />

effective from the date from which his appointment as Whole-time Director will be approved by Reserve Bank of<br />

India.”<br />

“RESOLVED FURTHER THAT subject to the approval by the Reserve Bank of India, Shri V. Srinivasan be paid<br />

remuneration by way of salary, allowances and perquisites as Whole-time Director of the Bank as per the following<br />

terms and conditions effective from the date from which his appointment as Whole-time Director will be approved<br />

by Reserve Bank of India:<br />

Salary : `1,25,70,600 p.a.<br />

Leave Fare Concession : `5,00,000 p.a.<br />

Perquisites<br />

House Rent Allowance : `26,88,000 p.a. (in lieu of accommodation provided by the Bank).<br />

Residence : Leased accommodation to be provided by the Bank.

Eighteenth Annual Report 2011-12<br />

Provident Fund : 12% of basic pay with equal contribution by the Bank or as may be decided<br />

upon by the Board/Trustees from time to time.<br />

Gratuity : One month’s salary for each completed year of service or part thereof (on<br />

pro-rata basis).<br />

Superannuation : 10% of Basic Pay p.a.<br />

Travelling Allowance : As per Bank’s policy.<br />

Medical Benefits : (i) Group mediclaim facility as available to other employees of the Bank.<br />

(ii) Reimbursement of full medical expenses for self and family.<br />

Club Fees : Membership of one club (excluding life membership fees). All official expenses<br />

in connection with such membership incurred would be reimbursed by the<br />

Bank.<br />

Conveyance & Telephone : Free use of the Bank’s car with a Driver and telephone facilities.<br />

Personal Insurance : Shall be covered under the Group Savings Linked Insurance Scheme (GSLI)<br />

and the Group Term Life Insurance Policy as per the Bank’s policy.<br />

Newspapers & periodicals : As per requirements.<br />

Entertainment : Expenditure on official entertainment would be on the Bank’s account.<br />

Utility Bills : At actuals upto a limit of `1,20,000 p.a.<br />

Furnishing Allowance : At actuals upto a limit of `10 lacs during his tenure as Whole-time Director.<br />

Leave : As per the Bank’s rules.<br />

Employees Stock Options (ESOP) : As may be decided by the HR and Remuneration Committee/ Board from time<br />

to time, subject to approval of Reserve Bank of India.<br />

Variable Pay : As may be decided by the HR and Remuneration Committee/Board, subject<br />

to approval of the Reserve Bank of India.<br />

Loans : Loan facilities at existing limits, at the rate of interest applicable to other<br />

employees.<br />

Other terms : As per the Bank’s Staff Rules and as may be agreed by the Board, from time<br />

to time.<br />

“RESOLVED FURTHER THAT the Board of Directors of the Bank is hereby authorised to do all such acts, deeds and<br />

things and to execute any document or instruments etc. as may be required to give effect to this resolution.”<br />

“RESOLVED FURTHER THAT the Company Secretary of the Bank is hereby authorised to file necessary forms with<br />

the Registrar of Companies/other Regulatory Authorities under his signature and to take all further action in the<br />

matter including signing of any other applications, deeds, documents, forms, certificates, as may be necessary under<br />

the provisions of the Companies Act, 1956 and the Banking Regulation Act, 1949.”<br />

Place : Mumbai By order of the Board<br />

Date : 17 th May, 2012<br />

P. J. Oza<br />

Company Secretary &<br />

Senior Vice President (Law)<br />

5

6<br />

Notes:<br />

Eighteenth Annual Report 2011-12<br />

1. A MEMBER ENTITLED TO ATTEND AND VOTE AT THE MEETING IS ENTITLED TO APPOINT A PROXY TO<br />

ATTEND AND VOTE INSTEAD OF HIMSELF AND A PROXY NEED NOT BE A MEMBER. PROXIES IN ORDER TO<br />

BE VALID AND EFFECTIVE MUST BE DELIVERED AT THE REGISTERED OFFICE OF THE <strong>BANK</strong> NOT LATER THAN<br />

FORTY-EIGHT HOURS BEFORE THE COMMENCEMENT OF THE MEETING.<br />

2. The relevant explanatory statement pursuant to the provisions of Section 173(2) of the Companies Act, 1956 in<br />

respect of item Nos. 5 to 14, is annexed hereto.<br />

3. The Register of Members and the Share Transfer Books of the Bank will remain closed from Saturday, the 16 th day of<br />

June, 2012 to Friday, the 22 nd day of June, 2012 (both days inclusive).<br />

4. The Dividend would be paid to the shareholders whose names stand on the Register of Members on the close of<br />

business hours of 15 th June, 2012. ECS credit/dispatch of the dividend warrants would commence on 23 rd June, 2012<br />

and is expected to be completed on or before 2 nd July, 2012.<br />

5. a) The Bank is arranging to print the details of your Bank Account on the dividend warrants thereby ensuring that<br />

the proceeds of the dividend warrants are credited to your account. We therefore request you to send to our<br />

Registrar and Share Transfer Agents, M/s. Karvy Computershare Private Limited, Hyderabad or to the Registered<br />

Office of the Bank, the following particulars so as to reach them on or before 15 th June, 2012.<br />

• Name of the Bank, Branch and Place with PIN code No., where the account is maintained.<br />

• Bank Account No.<br />

b) The Bank has also decided to offer the facility of ECS/NECS in centres wherever available. The ECS Mandate Form<br />

is annexed. This facility could also be used by the shareholders instead of the Bank Mandate System, for receiving<br />

the credit of dividends.<br />

6. Shareholders may now avail of the Nomination Facility under Section 109A of the Companies Act, 1956. The relevant<br />

Nomination Form is annexed.<br />

7. Shareholders seeking any information with regard to accounts are requested to write to the Bank at an early date to<br />

enable the Management to keep the information ready.<br />

8. SEBI has made it mandatory for every participant in the securities/capital market to furnish the details of Income tax<br />

Permanent Account Number (PAN). Accordingly, all the shareholders holding shares in physical form are requested to<br />

submit their details of PAN along with a photocopy of both sides of the PAN card, duly attested, to the Registrar and<br />

Share Transfer Agents of the Bank.<br />

9. The Ministry of Corporate Affairs (MCA) has launched a “Green Initiatives in the Corporate Governance” by allowing<br />

paperless compliances by the companies. MCA has issued circulars stating that the services of a notice/document by<br />

a company to its shareholders can now be made through electronic mode. In view of the above, the Annual Report<br />

(Audited Financial Statements, Directors Report, Auditors Report etc.) is being sent to the shareholders in electronic<br />

form to the email address registered with their Depository Participant (in case of electronic shareholding)/the Bank’s<br />

Registrar and Share Transfer Agents (in case of physical shareholding).<br />

We, therefore request and encourage you to register your email ID in the records of your Depository Participant<br />

(in case of electronic holding)/the Bank’s Registrar and Share Transfer Agents (in case of physical shareholding)<br />

mentioning your folio no./demat account details.<br />

However, in case you wish to receive the above shareholder communication in paper form, you may write to the<br />

Bank’s Registrar and Share Transfer Agents, M/s. Karvy Computershare Private Limited, Unit: Axis Bank Limited,<br />

Plot No. 17 to 24, Vithalrao Nagar, Madhapur, Hyderabad – 500 081, or send an email at axisgogreen@karvy.com<br />

mentioning your folio no./demat account details.

Eighteenth Annual Report 2011-12<br />

The Shareholders are requested to write to the Company Secretary or to the Registrar and Share Transfer Agent<br />

regarding transfer of shares and for resolving grievances at the below address.<br />

The Company Secretary<br />

Axis Bank Limited<br />

Registered Office : ‘Trishul’, 3rd Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad – 380 006.<br />

Email: p.oza@axisbank.com or rajendra.swaminarayan@axisbank.com<br />

M/s. Karvy Computershare Private Limited<br />

Unit: Axis Bank Limited<br />

Plot No. 17 to 24, Vithalrao Nagar, Madhapur, Hyderabad – 500 081.<br />

Phone No. 040-23420815 to 23420824<br />

Fax No. 040-23420814<br />

Email: einward.ris@karvy.com<br />

Contact Persons: Shri V. K. Jayaraman, GM (RIS)/Ms. Varalakshmi, Sr. Manager (RIS)<br />

10. Information regarding Directors retiring by rotation:<br />

i) Smt. Rama Bijapurkar has an Honours Degree in Science and a Post Graduate Diploma in Management from the<br />

Indian Institute of Management, Ahmedabad. She is an Independent Management Consultant, specialising in<br />

market strategy. She has 30 years of experience in market research and market strategy and serves or has served<br />

on the boards of several of India’s leading companies. As on 31 st March, 2012, she is the Chairperson of HR and<br />

Remuneration Committee and member of Nomination Committee and Acquisitions, Divestments and Mergers<br />

Committee of the Bank’s Board. She does not hold any equity share of the Bank.<br />

ii) Shri V. R. Kaundinya is a Graduate in Agriculture from AP Agricultural University, Hyderabad. He also holds<br />

PGDM with specialization in Agriculture from Indian Institute of Management, Ahmedabad. Shri Kaundinya has<br />

been working in the field of agriculture since 1979. His work includes dealing with the farmers, scientists, policy<br />

makers, input industry, trade and other stakeholders who are involved in agriculture in India and abroad. He has<br />

specifically worked in the areas of crop protection, seeds, other agronomic practices and farmers economics.<br />

He was a member of the Dr. Swaminathan Committee to develop the Biotech Policy in India. He held various<br />

leadership positions in industry associations like the Indian Crop Protection Association, Association of Seed<br />

Industry and All India Crop Biotech Association. He is currently the Chairman of the Agriculture Group in the<br />

Association of Biotech Led Enterprises (ABLE). He has developed case studies and took Agricultural Marketing<br />

and Rural Developments classes at various management institutes including IIM, Ahmedabad. As on 31 st March,<br />

2012, he is member of Audit Committee, Nomination Committee, Special Committee of the Board of Directors<br />

for Monitoring of Large Value Frauds and Acquisitions, Divestments and Mergers Committee of the Bank’s<br />

Board. He does not hold any equity share of the Bank.<br />

Place : Mumbai By order of the Board<br />

Date : 17 th May, 2012<br />

P. J. Oza<br />

Company Secretary &<br />

Senior Vice President (Law)<br />

7

8<br />

Eighteenth Annual Report 2011-12<br />

ANNEXURE TO NOTICE<br />

EXPLANATORY STATEMENT U/S 173(2) OF THE COMPANIES ACT, 1956<br />

Item No. 5:<br />

Section 224A of the Companies Act, 1956 provides that in case of companies in which not less than 25 percent of<br />

the subscribed share capital is held, whether singly or in combination, by public financial institutions, banks, insurance<br />

companies, Government companies, Central Government or State Government(s), the appointment of an Auditor of<br />

the Company shall be made by a Special Resolution. The Administrator of the Specified Undertaking of the Unit Trust of<br />

India (erstwhile Unit Trust of India), Life Insurance Corporation of India, General Insurance Corporation and its erstwhile<br />

subsidiaries, constitute public financial institutions in terms of Section 4A of the Companies Act, 1956, and hold more<br />

than 25 percent of the subscribed equity share capital of the Bank. Hence, a Special Resolution is proposed for the<br />

appointment of M/s. Deloitte Haskins & Sells, Chartered Accountants, as the Bank’s Statutory Auditors to hold office from<br />

the conclusion of this meeting upto the conclusion of the next Annual General Meeting.<br />

As required, M/s. Deloitte Haskins & Sells have forwarded a certificate to the Bank stating that their appointment, if made,<br />

will be within the limit specified in Sub-Section (1B) of Section 224 of the Companies Act, 1956.<br />

The Directors recommend the appointment of M/s. Deloitte Haskins & Sells, Chartered Accountants, as the Statutory<br />

Auditors of the Bank.<br />

None of the Directors is in any way concerned with or interested in the resolution at Item No. 5 of the Notice.<br />

Item No. 6:<br />

Prof. Samir K. Barua was appointed as an Additional Director of the Bank w.e.f. 22nd July, 2011. Under Section 260 of<br />

the Companies Act, 1956, read with Article 91 of the Articles of Association of the Bank, he continues to hold office as<br />

a Director until the conclusion of the ensuing Annual General Meeting. However, as required under Section 257 of the<br />

Companies Act, 1956, the Bank has received a notice from a member signifying his intention to propose Prof. Barua as<br />

a candidate for the office of Director of the Bank and the requisite deposit of `500 has also been received by the Bank<br />

along with such notice. It is proposed that Prof. Barua will be liable to retire by rotation. He does not hold any equity<br />

share of the Bank.<br />

Prof. Samir K. Barua has a Master’s degree in technology from the Indian Institute of Technology, Kanpur and a Doctorate<br />

in management (Fellow Programme in Management) from the Indian Institute of Management, Ahmedabad. He has<br />

been on the faculty of Indian Institute of Management, Ahmedabad, for the past 30 years and having held various<br />

administrative positions, is currently, the Director of Indian Institute of Management, Ahmedabad. Prof. Barua brings<br />

considerable expertise in financial markets and risk management. He is an independent director on the board of corporates<br />

such as Bharat Petroleum Corporation Limited, STCI Finance Limited, Coal India Limited, Torrent Power Limited and IOT<br />

Infrastructure and Energy Services Limited.<br />

As on 31st March, 2012, Prof. Barua is a member of Audit Committee, Risk Management Committee and Customer<br />

Service Committee.<br />

The Directors recommend approval of the resolution.<br />

Except for Prof. Samir K. Barua, no other Director of the Bank is in any way concerned with or interested in the resolution<br />

at Item No. 6 of the Notice.<br />

Item No. 7:<br />

Shri A. K. Dasgupta, Nominee of LIC, was appointed as an Additional Director of the Bank w.e.f. 5th September, 2011.<br />

Under Section 260 of the Companies Act, 1956, read with Article 91 of the Articles of Association of the Bank, he<br />

continues to hold office as a Director until the conclusion of the ensuing Annual General Meeting. However, as required<br />

under Section 257 of the Companies Act, 1956, the Bank has received a notice from a member signifying his intention<br />

to propose Shri Dasgupta as a candidate for the office of Director of the Bank and the requisite deposit of `500 has also<br />

been received by the Bank along with such notice. It is proposed that Shri Dasgupta will be liable to retire by rotation. He<br />

does not hold any equity share of the Bank.<br />

Shri A. K. Dasgupta is B.Sc. (Hons.) and has done Diploma in Personnel Management & Labour Welfare from Punjab<br />

University and is a Licentiate from Federation of Insurance Institute. Shri A. K. Dasgupta, took charge as the Managing<br />

Director of Life Insurance Corporation of India on 3 rd April, 2007. Apart from being associated with many organizational

Eighteenth Annual Report 2011-12<br />

development programmes in LIC, he was also involved in introducing many new initiatives. He was associated with many<br />

initiatives taken by the Corporation to meet the challenges of the future. He retired from the services of LIC with effect<br />

from 31st January, 2012. He is also a Director on the board of corporates such as ABB Limited and Grasim Industries<br />

Limited.<br />

The Directors recommend approval of the resolution.<br />

Except for Shri A. K. Dasgupta, no other Director of the Bank is in any way concerned with or interested in the resolution<br />

at Item No. 7 of the Notice.<br />

Item No. 8:<br />

Shri Som Mittal was appointed as an Additional Director of the Bank w.e.f. 22nd October, 2011. Under Section 260 of<br />

the Companies Act, 1956, read with Article 91 of the Articles of Association of the Bank, he continues to hold office as<br />

a Director until the conclusion of the ensuing Annual General Meeting. However, as required under Section 257 of the<br />

Companies Act, 1956, the Bank has received a notice from a member signifying his intention to propose Shri Mittal as<br />

a candidate for the office of Director of the Bank and the requisite deposit of `500 has also been received by the Bank<br />

along with such notice. It is proposed that Shri Mittal will be liable to retire by rotation. He does not hold any equity share<br />

of the Bank.<br />

Shri Som Mittal is President of NASSCOM, the premier trade body for the IT-BPO Industry in India. Shri Mittal has more<br />

than 23 years of experience in IT industry and has handled both domestic and international operations and is familiar with<br />

leveraging of technology in Corporations. He has worked with Wipro for 5 years from 1989-1994 as Chief Executive of<br />

their PC Server and Services Division. From 1994-1999 he was MD of Digital Equipment India Ltd., a company engaged in<br />

providing Technology Solutions to Corporations including Banks and Financial Institutions. During 1999-2006 he was the<br />

M.D. for Digital Global Soft (HP subsidiary), a software services company providing global solutions. From 2006-2007, he<br />

was Senior Vice President, Asia Pacific and Japan, in HP.<br />

As on 31st March, 2012, Shri Som Mittal is the Chairman of the IT Strategy Committee of the Board.<br />

The Directors recommend approval of the resolution.<br />

Except for Shri Som Mittal, no other Director of the Bank is in any way concerned with or interested in the resolution at<br />

Item No. 8 of the Notice.<br />

Item No. 9:<br />

The Board of Directors at their meeting held on 1st June, 2009 had appointed Smt. Shikha Sharma as the Managing<br />

Director & CEO for a period of three years with effect from 1st June, 2009. The term of Smt. Shikha Sharma will therefore<br />

end on 31st May, 2012. In view of the above, the HR and Remuneration Committee considered the re-appointment<br />

of Smt. Shikha Sharma and had recommended her re-appointment for a further period of three years effective<br />

1st June, 2012. The Board of Directors at their meeting held on 13th February, 2012 also approved her re-appointment<br />

for a further period of three years effective 1st June, 2012. The Bank had made an application to Reserve Bank of India<br />

for its approval to the above re-appointment which has been approved vide RBI letter dated 10th May, 2012. Further, the<br />

Board at its meeting held on 27th April, 2012 approved the revised compensation payable to Smt. Shikha Sharma effective<br />

1st June, 2012. The Bank will approach RBI for its approval for payment of revised compensation.<br />

During the tenure of Smt. Shikha Sharma, the Bank has shown all-round progress in terms of business growth, profitability,<br />

branch expansion, ATM network expansion and improved brand equity. Total deposits have increased from `1,17,374<br />

crores at 31st March, 2009 to `2,20,104 crores at 31st March, 2012. Total advances have also increased from `81,557<br />

crores at 31st March, 2009 to `169,760 crores at 31st March, 2012. Net profit of the Bank for the year ended 31st March,<br />

2012 was `4,242 crores, as against `1,815 crores for the year ended 31st March, 2009. The branch network (branches<br />

and extension counters) of the Bank increased from 792 at 31st March, 2009 to 1,622 at 31st March, 2012.<br />

Smt. Shikha Sharma has done her B.A. (Hons.) in Economics and completed her PGDBM from the Indian Institute of<br />

Management, Ahmedabad in 1980. She has a Post Graduate Diploma in Software Technology, from the National Centre<br />

for Software Technology, Mumbai.<br />

Smt. Sharma began her career with the ICICI group where she has worked across various verticals like Project Finance,<br />

Retail Banking and Investment Banking. Her last assignment was as Managing Director & CEO of ICICI Prudential Life<br />

Insurance Company, a leading life insurance company in the private sector.<br />

9

10<br />

Eighteenth Annual Report 2011-12<br />

Smt. Sharma’s achievements in the financial sector have received wide recognition. She is a recipient of many business<br />

awards notably; ‘Transformational Business Leader of the Year’ at AIMA’s Managing India Awards - 2012, ‘Woman Leader<br />

of the year’ at Bloomberg-UTV Financial Leadership Awards - 2012. She has also been listed in prominent publications<br />

such as Forbes List of Asia’s 50 Power Business Women - 2012, Indian Express Most Powerful Indians - 2012, India Today<br />

Power List of 25 Most Influential Women - 2012.<br />

As on 31st March, 2012, Smt. Sharma is Chairperson of the Special Committee of the Board of Directors for Monitoring<br />

of Large Value Frauds and Committee of Whole-time Directors. She is also a member of the Committee of Directors,<br />

Risk Management Committee, Customer Service Committee, Acquisitions, Divestments and Mergers Committee and IT<br />

Strategy Committee. She is the Chairperson of Axis Asset Management Company Limited and Axis U.K. Limited and also<br />

a Director of Axis Private Equity Limited, the subsidiaries of the Bank. She holds 15,000 equity shares of the Bank allotted<br />

to her under ESOP scheme of the Bank.<br />

The Directors recommend approval of the resolution.<br />

Except for Smt. Shikha Sharma, no other Director of the Bank is in any way concerned with or interested in the resolution<br />

at Item No. 9 of the Notice.<br />

Item No. 10:<br />

Dr. Adarsh Kishore was appointed as the Chairman of the Bank for a period of three years from 8th March, 2010. The<br />

Board of Directors of the Bank at its meeting held on 22nd April, 2011 had approved the revision in remuneration and<br />

increase in the reimbursement of expenses for office maintenance to Dr. Adarsh Kishore with effect from 1st April, 2011<br />

from `75,000 per month to `1,00,000 per month. Shareholders approval to the revision in remuneration was obtained<br />

by way of an ordinary resolution at the Annual General Meeting of the Bank held on 17th June, 2011. The Reserve Bank<br />

of India has approved revision in remuneration and increase in reimbursement of expenses for office maintenance to Dr.<br />

Adarsh Kishore from `75,000 to `1,00,000 per month effective 1st April, 2011. It is now proposed to obtain shareholders<br />

approval for reimbursement of expenses for office maintenance to Dr. Adarsh Kishore upto `1,00,000 per month with<br />

effect from 1st April, 2011.<br />

During the year ended 31 st March, 2012, the Bank has grown and progressed under the guidance of Dr. Adarsh Kishore.<br />

In view of this, the HR and Remuneration Committee of the Board, which met on 20 th April, 2012, examined the<br />

remuneration of Dr. Adarsh Kishore, in comparison with the remuneration of the Chairmen of the other peer group<br />

banks and recommended a revision in the reimbursement of expenses for office maintenance to `125,000 per month to<br />

Dr. Adarsh Kishore. The Board of Directors of the Bank at its meeting held on 17 th May, 2012 has approved the above<br />

revision to Dr. Adarsh Kishore with effect from 1 st April, 2012.<br />

The Directors recommend approval of the resolution.<br />

Except for Dr. Adarsh Kishore, no other Director of the Bank is in any way concerned with or interested in the resolution<br />

at Item No. 10 of the Notice.<br />

Item Nos. 11 and 12:<br />

The Board of Directors at its meeting held on 27th April, 2012 approved the proposal for appointment of Shri Somnath<br />

Sengupta as a whole-time Director of the Bank effective from the date from which his appointment as Whole-time<br />

Director will be approved by Reserve Bank of India till 31st May, 2015, the last day of the month in which he reaches the<br />

age of superannuation. The Bank has received a notice under Section 257 of the Companies Act, 1956, from a member<br />

signifying his intention to propose Shri Somnath Sengupta as a candidate for the office of Director of the Bank and the<br />

requisite deposit of `500 has also been received by the Bank along with such notice. It is proposed that Shri Somnath<br />

Sengupta will not be liable to retire by rotation.<br />

Shri Somnath Sengupta has a degree in Economics Honours from the University of Delhi. He has over 35 years of banking<br />

experience including nearly 20 years with the State Bank group. He joined the Bank in 1996. He has all-round experience<br />

in banking operations with extensive experience in foreign exchange and treasury operations. Shri Somnath Sengupta has<br />

headed the finance function since 2003 and has been the Executive Director & CFO of the Bank w.e.f. 1st October, 2009.<br />

Shri Somnath Sengupta is a director of Axis U.K. Limited, the subsidiary of the Bank. He is a member of Committee of<br />

Directors and Audit & Compliance Committee of Axis U.K. Limited. He holds 46,707 equity shares of the Bank allotted to<br />

him under ESOP scheme of the Bank.

Eighteenth Annual Report 2011-12<br />

The Directors recommend approval of the resolutions.<br />

No Director of the Bank is in any way concerned with or interested in the resolutions at Item Nos. 11 and 12 of the Notice.<br />

Item Nos. 13 and 14:<br />

The Board of Directors at its meeting held on 27th April, 2012 approved the proposal for appointment of Shri V. Srinivasan<br />

as a whole-time Director of the Bank for a period of three years effective from the date from which his appointment as<br />

Whole-time Director will be approved by Reserve Bank of India. The Bank has received a notice under Section 257 of the<br />

Companies Act, 1956, from a member signifying his intention to propose Shri V. Srinivasan as a candidate for the office<br />

of Director of the Bank and the requisite deposit of `500 has also been received by the Bank along with such notice. It is<br />

proposed that Shri V. Srinivasan will not be liable to retire by rotation.<br />

Shri V. Srinivasan is a qualified engineer from the College of Engineering, Anna University, Chennai and completed his<br />

PGDBM from the Indian Institute of Management, Calcutta in 1990. He began his career in the financial services industry<br />

with ICICI Ltd., in its Merchant Banking Division, in 1990. He was a part of the start-up team of ICICI Securities and<br />

Finance Co. Ltd (I-Sec), the joint venture between ICICI and J.P. Morgan and headed the Fixed Income business there.<br />

Since 1999, Shri V. Srinivasan was working with J.P. Morgan, India and in his last assignment he was their Managing<br />

Director and Head of Markets. He was CEO of J.P. Morgan Chase Bank, Mumbai Branch as well as Chairman, J.P. Morgan<br />

Securities (I) Pvt. Ltd. at the time he left J.P. Morgan. He has served on various RBI Committees such as the Technical<br />

Advisory Committee of RBI, Committee of Repos, STRIPS etc. He has also served as a Chairman of FIMMDA, the key selfregulatory<br />

body for bond and money markets and PDAI, the self-regulatory organization for Primary Dealers. He joined<br />

the Bank in September, 2009 as the Executive Director (Corporate Banking).<br />

Shri V. Srinivasan is Chairman of Axis Trustee Services Limited and a director in Axis U.K. Limited, the subsidiaries of the<br />

Bank. He is Chairman of Human Resources, Remuneration & Nomination Committee and member of Committee of<br />

Directors and Risk Management Committee of Axis U.K. Limited. He does not hold any equity share of the Bank.<br />

The Directors recommend approval of the resolutions.<br />

No Director of the Bank is in any way concerned with or interested in the resolutions at Item Nos. 13 and 14 of the Notice.<br />

Place : Mumbai By order of the Board<br />

Date : 17 th May, 2012<br />

P. J. Oza<br />

Company Secretary &<br />

Senior Vice President (Law)<br />

11

www.sapprints.com

Eighteenth Annual Report 2011-12<br />

<strong>AXIS</strong> <strong>BANK</strong> <strong>LIMITED</strong><br />

Registered Office: Trishul, 3 rd Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad – 380 006<br />

PROXY FORM<br />

I/We, ____________________________________________________________________________________, of ___________________<br />

in the district of ___________________________________ being a member/members of Axis Bank Limited hereby appoint<br />

Shri/Smt. _________________________________________________________________________________ of _____________________<br />

in the district of __________________________ or failing him Shri/Smt. _____________________________________________________<br />

of ___________________________ in the district of __________________________________________ as my/our proxy to attend and<br />

vote for me/us/our behalf at the 18 th Annual General Meeting of the Bank to be held on Friday, the 22 nd June, 2012<br />

at 10.00 a.m. at J. B. Auditorium, Ahmedabad Management Association, AMA Complex, ATIRA, Dr. Vikram Sarabhai Marg,<br />

Ahmedabad 380 015 and at any adjournment thereof.<br />

Signed this ______ day of ____________, 2012<br />

Signature : __________________________________________________________________<br />

Address : __________________________________________________________________<br />

: __________________________________________________________________<br />

Folio No./CL ID/DP ID No. : ____________________________________ No. of Shares held : _____________________________<br />

N.B. : 1. The Proxy need not be a member.<br />

2. The Proxy Form duly signed and stamped should reach the Bank’s Registered Office at least 48 hours before the time of<br />

Meeting.<br />

ATTENDANCE SLIP<br />

Affix<br />

15 Paise<br />

Revenue<br />

Stamp<br />

PLEASE BRING THIS ATTENDANCE SLIP TO THE MEETING HALL AND HAND IT OVER AT THE ENTRANCE<br />

I/We hereby record my/our presence at the 18 th Annual General Meeting of Axis Bank Limited held at J. B. Auditorium,<br />

Ahmedabad Management Association, AMA Complex, ATIRA, Dr. Vikram Sarabhai Marg, Ahmedabad 380 015 on Friday, the<br />

22 nd June, 2012 at 10.00 a.m.<br />

Name of the Shareholder : _________________________________________________________________<br />

Ledger Folio No./CL ID/DP ID No. : _________________________________________________________________<br />

Number of shares held : _________________________________________________________________<br />

Name of the Proxy/Representative, if any : _________________________________________________________________<br />

Signature of the Member/s/Proxy : _________________________________________________________________<br />

Signature of the Representative : _________________________________________________________________<br />

<strong>AXIS</strong> <strong>BANK</strong> <strong>LIMITED</strong><br />

Registered Office: Trishul, 3rd Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad – 380 006.

NOMINATION FORM<br />

FORM 2B<br />

(See rules 4CCC and 5D)<br />

(To be filled in by individual(s) applying singly or jointly)<br />

I/We ____________________________________________________________________________________________________________ and<br />

_________________________________________________________________________________________________________________ and<br />

______________________________________________________________________________________ the holders of shares bearing<br />

numbers of Axis Bank Limited wish to make a nomination and do hereby nominate the following person(s) in whom all rights of transfer<br />

and/or amount payable in respect of shares shall vest in the event of my or our death.<br />

Name(s) and Address(s) of Nominee(s) : ____________________________________________________________________<br />

Folio No. : ____________________________________________________________________<br />

Address : ____________________________________________________________________<br />

____________________________________________________________________<br />

____________________________________________________________________<br />

Date of Birth* : ____________________________________________________________________<br />

*(To be furnished in case the nominee is a minor)<br />

**The Nominee is minor whose guardian is<br />

Name : ________________________________________________________________________________________________________<br />

Address : ________________________________________________________________________________________________________<br />

________________________________________________________________________________________________________<br />

(**To be deleted if not applicable)<br />

Signature : 1. _________________________________ 2. _________________________________ 3. _______________________________<br />

Name : 1. _________________________________ 2. _________________________________ 3. _______________________________<br />

Address : ________________________________________________________________________________________________________<br />

________________________________________________________________________________________________________<br />

Date : _________ / ________ /2012<br />

Address, Name and Signature of witness :<br />

___________________________________________________________ _____________________________________________________<br />

(Name and Address) Signature with Date<br />

1. ___________________________________________________________ 1. ___________________________________________________<br />

2. ___________________________________________________________ 2. ___________________________________________________<br />

Instructions :<br />

1. The Nomination can be made by individuals only applying/holding shares on their own behalf singly or jointly. Non-individual including society, trust,<br />

body corporate, partnership firm, Karta of HUF, holder of power of attorney cannot nominate. If the shares are held jointly, all joint holders will sign<br />

the nomination form. Space is provided as a specimen, if there are more joint holders more sheets can be added for signatures of holders of shares and<br />

witness.<br />

2. A minor can be nominated by a holder of shares and in that event the name and address of the Guardian shall be given by the holder.<br />

3. The nominee shall not be a trust, society, body corporate, partnership firm, Karta of HUF, or a power of attorney holder. A non-resident Indian can be<br />

a nominee on re-patriable basis.<br />

4. Nomination stands rescinded upon transfer of shares.<br />

5. Transfer of shares in favour of a nominee shall be a valid discharge by a Company against the legal heir.<br />

6. The intimation regarding Nomination/Nomination form shall be filed in duplicate with Company/Registrar and Share Transfer Agents of the Company<br />

who will return one copy thereof to the shareholder.

To<br />

M/s. Karvy Computershare Private Limited<br />

Unit : Axis Bank Limited<br />

Plot No. 17 to 24, Vithalrao Nagar<br />

Madhapur, Hyderabad - 500 081<br />

Eighteenth Annual Report 2011-12<br />

ECS MANDATE FORM<br />

FOR SHARES HELD IN PHYSICAL MODE<br />

Please complete this form and send it to<br />

M/s. Karvy Computershare Private Limited, Hyderabad<br />

SHAREHOLDERS HOLDING SHARES IN DEMAT MODE<br />

should inform their DPs directly<br />

I hereby consent to have the amount of dividend on my equity shares credited through the National Electronic Clearing<br />

Service (Credit Clearing) - (NECS). The particulars are:<br />

1. Folio No. ________________________________________________________________________________<br />

2. Name of 1 st Registered holder ________________________________________________________________________________<br />

3. Bank Details : ________________________________________________________________________________<br />

• Name of Bank ________________________________________________________________________________<br />

• Full address of the Branch ________________________________________________________________________________<br />

• Account Number ________________________________________________________________________________<br />

• Bank Ledger No. ________________________________________________________________________________<br />

• Account Type : (Please tick the relevant box for Savings Bank Account, Current Account or Cash Credit A/c)<br />

10 - Savings 11 -Current 12 - Cash Credit<br />

• 9 Digit Code number of the Bank and branch appearing on the MICR cheque issued by the Bank (Please attach a<br />

photocopy of a cheque for verifying the accuracy of the code number):<br />

I hereby declare that the particulars given above are correct and complete. If the transaction is delayed because of incomplete<br />

or incorrect information, I will not hold the Company responsible.<br />

(Signature of the 1 st Registered holder as per<br />

the specimen signature with the Company)<br />

Name : _________________________________________<br />

Address : _________________________________________<br />

_________________________________________<br />

Date : _______ / _______ /2012 _________________________________________