Milk Protein Products and Related Government Policy Issues

Milk Protein Products and Related Government Policy Issues

Milk Protein Products and Related Government Policy Issues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

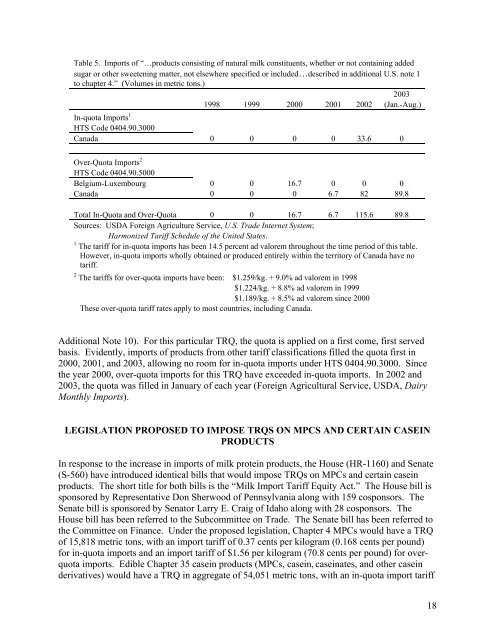

Table 5. Imports of “…products consisting of natural milk constituents, whether or not containing added<br />

sugar or other sweetening matter, not elsewhere specified or included…described in additional U.S. note 1<br />

to chapter 4.” (Volumes in metric tons.)<br />

2003<br />

1998 1999 2000 2001 2002 (Jan.-Aug.)<br />

In-quota Imports 1<br />

HTS Code 0404.90.3000<br />

Canada 0 0 0 0 33.6 0<br />

Over-Quota Imports 2<br />

HTS Code 0404.90.5000<br />

Belgium-Luxembourg 0 0 16.7 0 0 0<br />

Canada 0 0 0 6.7 82 89.8<br />

Total In-Quota <strong>and</strong> Over-Quota 0 0 16.7 6.7 115.6 89.8<br />

Sources: USDA Foreign Agriculture Service, U.S. Trade Internet System;<br />

Harmonized Tariff Schedule of the United States.<br />

1 The tariff for in-quota imports has been 14.5 percent ad valorem throughout the time period of this table.<br />

However, in-quota imports wholly obtained or produced entirely within the territory of Canada have no<br />

tariff.<br />

2 The tariffs for over-quota imports have been: $1.259/kg. + 9.0% ad valorem in 1998<br />

$1.224/kg. + 8.8% ad valorem in 1999<br />

$1.189/kg. + 8.5% ad valorem since 2000<br />

These over-quota tariff rates apply to most countries, including Canada.<br />

Additional Note 10). For this particular TRQ, the quota is applied on a first come, first served<br />

basis. Evidently, imports of products from other tariff classifications filled the quota first in<br />

2000, 2001, <strong>and</strong> 2003, allowing no room for in-quota imports under HTS 0404.90.3000. Since<br />

the year 2000, over-quota imports for this TRQ have exceeded in-quota imports. In 2002 <strong>and</strong><br />

2003, the quota was filled in January of each year (Foreign Agricultural Service, USDA, Dairy<br />

Monthly Imports).<br />

LEGISLATION PROPOSED TO IMPOSE TRQS ON MPCS AND CERTAIN CASEIN<br />

PRODUCTS<br />

In response to the increase in imports of milk protein products, the House (HR-1160) <strong>and</strong> Senate<br />

(S-560) have introduced identical bills that would impose TRQs on MPCs <strong>and</strong> certain casein<br />

products. The short title for both bills is the “<strong>Milk</strong> Import Tariff Equity Act.” The House bill is<br />

sponsored by Representative Don Sherwood of Pennsylvania along with 159 cosponsors. The<br />

Senate bill is sponsored by Senator Larry E. Craig of Idaho along with 28 cosponsors. The<br />

House bill has been referred to the Subcommittee on Trade. The Senate bill has been referred to<br />

the Committee on Finance. Under the proposed legislation, Chapter 4 MPCs would have a TRQ<br />

of 15,818 metric tons, with an import tariff of 0.37 cents per kilogram (0.168 cents per pound)<br />

for in-quota imports <strong>and</strong> an import tariff of $1.56 per kilogram (70.8 cents per pound) for overquota<br />

imports. Edible Chapter 35 casein products (MPCs, casein, caseinates, <strong>and</strong> other casein<br />

derivatives) would have a TRQ in aggregate of 54,051 metric tons, with an in-quota import tariff<br />

18