Receipts and Payments Account Format Of Zilla Parishad…….. For ...

Receipts and Payments Account Format Of Zilla Parishad…….. For ...

Receipts and Payments Account Format Of Zilla Parishad…….. For ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Model<br />

<strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong> <strong><strong>For</strong>mat</strong><br />

<strong>Of</strong><br />

<strong>Zilla</strong> <strong>Parishad……</strong>..<br />

<strong>For</strong> the Year ……<br />

Comptroller & Auditor General of India

Model<br />

<strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong> <strong><strong>For</strong>mat</strong><br />

<strong>Of</strong><br />

<strong>Zilla</strong> <strong>Parishad……</strong>..<br />

<strong>For</strong> the Year ……<br />

Comptroller & Auditor General of India

PANCHAYATI RAJ INSTITUTIONS<br />

GUIDELINES FOR PREPARATION OF RECEIPT & PAYMENT ACCOUNTS<br />

1. Panchayati Raj Institutions (PRIs) accounting practices are, by <strong>and</strong> large, akin to the accounting practices followed by the State<br />

Governments which are based on generally accepted accounting practices <strong>and</strong> traditions. The principal laws governing the financial affairs of the<br />

PRIs include Constitution (73 rd Amendment) Act, 1992 <strong>and</strong> Panchayat Act enacted by the respective States. Each institution i.e. District<br />

Panchayat/<strong>Zilla</strong> Parishad, Intermediate/Block Samiti <strong>and</strong> Village/Gram Panchayat is an accounting entity. The PRIs are required to adopt an<br />

Annual Report, which includes financial statements in the form of Receipt & Payment accounts <strong>and</strong> accompanying subsidiary statements. The<br />

purpose of Annual Report is to compare the Institutions actual performance for the year against the forecast in the annual plan as passed by the<br />

general body of the PRI.<br />

2. There is a strong relationship between accounting <strong>and</strong> budgeting <strong>and</strong> the accounting system provides the basis for appropriate budgetary<br />

control. The institutions are not required to prepare a balance sheet <strong>and</strong> the details of assets are kept in the subsidiary registers <strong>and</strong> records of the<br />

PRI. The <strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong>s to be prepared by the PRIs would incorporate all the receipts <strong>and</strong> payments, both revenue <strong>and</strong> capital,<br />

deposits, loans <strong>and</strong> advances <strong>and</strong> remittances. The formats have been designed to keep them as simple as possible so that these can be maintained<br />

easily.<br />

3. Cash Basis of <strong>Account</strong>s<br />

The accounts are prepared on cash basis i.e. a transaction is only recorded when cash is received or paid. As a consequence, accruals of amounts<br />

due to or owing by Panchayats are not shown in the financial statements, but are kept track of by way of institutional records <strong>and</strong> Subsidiary<br />

Registers. Cash based information has the advantage of being relatively simple <strong>and</strong> readily verifiable.<br />

4. Period of accounts<br />

Period of accounts is a financial year. A financial year is defined as a period of 12 months ending 31 st March in any year. The financial year in<br />

respect of which the financial statements are prepared covers the period 1 st April to 31 st March.<br />

i

5. Financial Statements<br />

5.1 Annual <strong>Account</strong>s<br />

<strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong> is drawn up annually. It shows the amount received <strong>and</strong> paid in the period of account, classified functionally as<br />

also the opening balance <strong>and</strong> the balance on the last day of account. The <strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong> also incorporates the Appropriation<br />

<strong>Account</strong>s which show the amounts spent in the period of account on various functions upto the primary unit of appropriation, as compared with<br />

the amount granted through the annual budget <strong>and</strong> statement of variances. The columns of Budget Estimates for the year in the <strong>Receipts</strong> <strong>and</strong><br />

<strong>Payments</strong> accounts <strong>and</strong> progressive total column depict the amounts appropriated for the year.<br />

5.2 Monthly <strong>Account</strong>s<br />

The monthly Receipt & Payment <strong>Account</strong>s shall be prepared by each PRI, major head wise in a summary form, alongwith a monthly bank<br />

reconciliation statement.<br />

5.3 Additional Statements (These form part of annual accounts <strong>and</strong> are common for all 3 levels of PRIs. <strong><strong>For</strong>mat</strong>s from Sl. No. 8 to 16 in the contents list will be subsidiary records)<br />

Besides drawing up an annual statement of <strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong>, the following statements are to be prepared annually:<br />

(i) Statement of Capital Expenditure(scheme-wise) showing expenditure for the year <strong>and</strong> progressive expenditure upto the end of the<br />

year.<br />

(ii) Detailed statement of receivables <strong>and</strong> payables at the end of the year.<br />

(iii) Statement of balances in various Deposit <strong>Account</strong>s at the end of the year.<br />

(iv) Statement of Provident Funds etc. if these are administered by PRIs at the end of the year.<br />

6. Currency in which accounts are kept<br />

The accounts of the PRIs are kept in Indian currency i.e. rupees.<br />

7. <strong>Account</strong>ing of Works Expenditure<br />

7.1 The accounting rules <strong>and</strong> other general instructions followed by the works departments in the State Government for works expenditure,<br />

except where these are inconsistent with the provision of PRIs Act or codes/manuals, are to be followed by PRIs.<br />

ii

iii<br />

Detailed instructions on the maintenance of these accounts, subsidiary registers/records would have to be issued by the State Government<br />

under the accounting rules.<br />

7.2 <strong>For</strong> transfer of funds to the PRIs new minor heads have been prescribed. In case funds are transferred from <strong>Zilla</strong> Parishads to Panchayat<br />

Samitis/Village Panchayats for implementation of various schemes, these transfers are to be shown as deduct receipts under the head Grants-in-aid<br />

<strong>and</strong> contributions on the receipt side of the <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong>s of the <strong>Zilla</strong> Parishad.<br />

7.3 The funds received under various schemes are to be shown under Grants-in-aid & contributions, scheme-wise on the receipt side.<br />

However, on the payment side, the expenditure against each scheme would have to be shown under the relevant functional head, below the minor<br />

head. (Please refer to para 2.3 <strong>and</strong> para 2.4 of the List of Codes for Functions, Programmes & Activities of PRIs, for detailed explanation)<br />

7.4 The Object heads for the sake of uniformity across the State have been st<strong>and</strong>ardised. The list of Object heads with the proposed st<strong>and</strong>ard<br />

code for each head is enclosed to be used across the State. Item-wise details of Object head expenditure like dearness allowance, house rent<br />

allowance etc. under salaries may be kept outside accounts, if required.<br />

7.5 The <strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong> is prepared on the basis of figures in the Consolidated Abstract. Expenditure of a capital nature is<br />

distinguished from revenue expenditure with plan <strong>and</strong> non-plan classification. Non-plan expenditure is in the nature of continuance of earlier<br />

schemes.<br />

8. Only one main cash book in each PRI may be maintained incorporating balances from all subsidiary cash books, which are to be kept as<br />

necessary.<br />

9. On the basis of these model formats, the State Governments may formulate Budgeting/<strong>Account</strong>ing rules <strong>and</strong> manuals for keeping of<br />

budget/accounts for Panchayati Raj Institutions in consultation with the State <strong>Account</strong>ants General.<br />

K.N.Kh<strong>and</strong>elwal<br />

Deputy Comptroller & Auditor General of India<br />

New Delhi<br />

16 October 2002

CONTENTS<br />

Sl. No. Subject Page No.<br />

1. <strong><strong>For</strong>mat</strong> of Annual Receipt <strong>and</strong> Payment <strong>Account</strong> of Zila Parishad 1<br />

2. <strong><strong>For</strong>mat</strong> of Statements of Capital Expenditure (Scheme wise) at Year end 15<br />

3. <strong><strong>For</strong>mat</strong> of Statement of Receivables & Payables at Year end 16<br />

4. <strong><strong>For</strong>mat</strong> of Statement of Balances under Deposits, Advances & Loans <strong>Account</strong> at Year end 17<br />

5. <strong><strong>For</strong>mat</strong> of Statement of Provident Funds etc. showing balance at Year end 18<br />

6. <strong><strong>For</strong>mat</strong> of Monthly <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong>s of ZP/ PS/ VP 21<br />

7. <strong><strong>For</strong>mat</strong> of Monthly Reconciliation Statement 26<br />

8. <strong><strong>For</strong>mat</strong> of Cash Book 27<br />

9. <strong><strong>For</strong>mat</strong> of Register of Immovable Property 28<br />

10. <strong><strong>For</strong>mat</strong> of Register of Dem<strong>and</strong>, Collection <strong>and</strong> Balance 29<br />

11. <strong><strong>For</strong>mat</strong> of Register of Moveable Property 30<br />

12. <strong><strong>For</strong>mat</strong> of Compilation Sheet 31<br />

13. <strong><strong>For</strong>mat</strong> of Register of Stock Book 32<br />

14. <strong><strong>For</strong>mat</strong> of Consolidated Abstract 33<br />

15. <strong><strong>For</strong>mat</strong> of Register of Roads 34<br />

16. <strong><strong>For</strong>mat</strong> of Register of L<strong>and</strong>s 35

Annual<br />

<strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong><br />

of<br />

<strong>Zilla</strong> Parishad

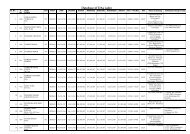

Annual <strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong> of Zila Parishad ……………for the year………… <strong>For</strong>m-1<br />

RECEIPTS PAYMENTS<br />

Opening Balance<br />

i) Cash in h<strong>and</strong><br />

ii) Balance in Bank<br />

iii) Balance in treasury<br />

iv) Investments<br />

Heads of <strong>Account</strong><br />

Part -1 PANCHAYAT FUND<br />

Budget<br />

estimates for<br />

Current year<br />

(Rs.)<br />

Previous<br />

Year's<br />

<strong>Account</strong>…<br />

(Rs.)<br />

Reporting<br />

Year's<br />

<strong>Account</strong>…<br />

(Rs.) Heads of <strong>Account</strong><br />

Part -1 PANCHAYAT FUND<br />

Budget<br />

estimates for<br />

Current year<br />

(Rs.)<br />

P NP Total<br />

Previous<br />

Year's<br />

<strong>Account</strong>…<br />

(Rs.)<br />

P NP Total<br />

REVENUE ACCOUNT - RECEIPTS<br />

REVENUE ACCOUNT - EXPENDITURE<br />

0028<br />

107<br />

800<br />

0029<br />

101<br />

102<br />

800<br />

0035<br />

800<br />

xx<br />

0041<br />

800<br />

xx<br />

0042<br />

102<br />

xx<br />

106<br />

xx<br />

800<br />

Tax <strong>Receipts</strong><br />

Other Taxes on Income & Expenditure<br />

Taxes on Professions, Trades, Callings <strong>and</strong><br />

Employment<br />

Other <strong>Receipts</strong><br />

Total - 0028<br />

L<strong>and</strong> Revenue<br />

L<strong>and</strong> Revenue/Tax<br />

Taxes on Plantations<br />

Other <strong>Receipts</strong><br />

Total - 0029<br />

Taxes on Immovable Property other than<br />

agricultural l<strong>and</strong><br />

Other <strong>Receipts</strong><br />

House Tax<br />

Total - 0035<br />

Taxes on Vehicles<br />

Other <strong>Receipts</strong><br />

Taxes on cycles, cars <strong>and</strong> other vehicles<br />

Total - 0041<br />

Taxes on Goods <strong>and</strong> Passengers<br />

Tolls on Roads<br />

Tolls on Roads levied under Section….<br />

Taxes on entry of goods into Local Areas<br />

Octroi<br />

Other <strong>Receipts</strong><br />

Total - 0042<br />

2049<br />

01<br />

03<br />

104<br />

xx<br />

04<br />

101<br />

104<br />

60<br />

101<br />

701<br />

2059<br />

01<br />

053<br />

xx<br />

xx<br />

60<br />

051<br />

xx<br />

xx<br />

053<br />

xx<br />

xx<br />

Interest <strong>Payments</strong><br />

Interest <strong>Payments</strong> on Internal debt (minor heads as per<br />

requirement)<br />

Interest on Small Savings Provident Funds Etc.<br />

Interest on provident Funds<br />

Interest on Panchayat employees Provident Fund<br />

Interest on Loans & Advances from State/Central Govt.<br />

(Minor head as applicable -Details to be given at sub-head<br />

level)<br />

Interest on Loans for Plan Schemes<br />

(Details to be given at sub-head level)<br />

Interest on Loans for Non-Plan schemes<br />

(Details to be given at sub-head level)<br />

Interest on Other Obligations (Sub-major head)<br />

Interest on deposits<br />

Miscellaneous<br />

Total - 2049<br />

Public Works<br />

<strong>Of</strong>fice Buildings (Sub-major head)<br />

Maintenance <strong>and</strong> Repairs<br />

Work Charged establishment (sub head)<br />

Other maintenance expenditure (sub head)<br />

Other Buildings (Sub-major head)<br />

Construction<br />

Construction of sheds, Godowns, Warehouses<br />

(works expenditure <strong>and</strong> work charged expenditure to be<br />

shown separately)<br />

Construction of Drains, lavatories, Fish Ponds<br />

Maintenance <strong>and</strong> Repairs<br />

Work Charged establishment (sub-head)<br />

Other maintenance expenditure (sub-head)<br />

Total - 2059<br />

Reporting<br />

Year's<br />

<strong>Account</strong>….<br />

(Rs.)<br />

P NP Total<br />

1

0045<br />

101<br />

111<br />

112<br />

115<br />

800<br />

xx<br />

xx<br />

Other Taxes <strong>and</strong> Duties on Commodities <strong>and</strong><br />

Services<br />

Entertainment Tax<br />

Taxes on Advertisement<br />

<strong>Receipts</strong> from cesses under other Acts.<br />

<strong>For</strong>est Development Tax<br />

Other <strong>Receipts</strong><br />

Registration of boats<br />

Levy of Ferry rent<br />

Total - 0045<br />

Total - Tax <strong>Receipts</strong><br />

0049<br />

04<br />

110<br />

xx<br />

190<br />

800<br />

0059<br />

01<br />

011<br />

xx<br />

800<br />

0071<br />

01<br />

101<br />

0202<br />

01<br />

101<br />

xx<br />

xx<br />

800<br />

03<br />

800<br />

04<br />

102<br />

800<br />

Non -Tax <strong>Receipts</strong><br />

Interest <strong>Receipts</strong><br />

Interest <strong>Receipts</strong> of Village Panchayats/Panchayat<br />

Samities<br />

Interest realised on investment of cash balances<br />

Interest on investment with ……<br />

Interest from Panchayat Samities/ GPs<br />

Other <strong>Receipts</strong> (will include interest from bank<br />

accounts)<br />

Total - 0049<br />

Public Works<br />

<strong>Of</strong>fice Building<br />

Rents<br />

Rent from non-residential buildings (Panchayat<br />

Bhavans etc.)<br />

Other <strong>Receipts</strong><br />

Total - 0059<br />

Contributions <strong>and</strong> Recoveries towards Pension<br />

<strong>and</strong> Other Retirements Benefits.<br />

Civil<br />

Subscriptions <strong>and</strong> Contributions.<br />

(Pension contribution, leave salary & pension<br />

contribution if not levied separately shall be<br />

taken to this head)<br />

Total - 0071<br />

Education, Sports, Art <strong>and</strong> Culture<br />

General Education<br />

Elementary Education<br />

Fees<br />

Fines<br />

Other <strong>Receipts</strong><br />

Sports <strong>and</strong> Youth Services<br />

Other <strong>Receipts</strong><br />

Art <strong>and</strong> Culture<br />

Public Libraries<br />

Other <strong>Receipts</strong><br />

Total - 0202<br />

Note: 'yy' represents detailed head<br />

'xx' represents Sub-head or Scheme<br />

2071<br />

01<br />

101<br />

xx<br />

04<br />

107<br />

108<br />

800<br />

2202<br />

01<br />

101<br />

xx<br />

yy<br />

01<br />

21<br />

102<br />

104<br />

107<br />

109<br />

800<br />

xx<br />

21<br />

02<br />

104<br />

105<br />

107<br />

109<br />

04<br />

103<br />

200<br />

Pension <strong>and</strong> Other Retirement Benefits<br />

Civil (Sub-major head)<br />

Superannuation <strong>and</strong> Retirement allowances<br />

Payment of Pension & other retirement benefits<br />

Pensionary Charges (Object head)<br />

Contribution to Pensions <strong>and</strong> Gratuities<br />

Contribution to Provident Funds<br />

Other expenditure<br />

Total - 2071<br />

General Education<br />

Elementary Education (Sub-major head)<br />

Primary Schools<br />

Opening of new Primary schools/ Conversion of Basic<br />

Schools into Primary Schools<br />

Provision of additional teachers/ Teachers (detail head)<br />

Salaries (Teachers)<br />

Supplies & Materials (Object head)<br />

Assistance to Voluntary Organisation for Primary Schools<br />

Inspection<br />

Teachers Training<br />

Scholarships & Incentives<br />

Other Expenses<br />

School Lunch/ Mid-Day-Meal Programmes<br />

Supplies & Materials<br />

Secondary Education (Sub-major head)<br />

Teachers & other services)<br />

Teacher's Training<br />

Scholarships<br />

Secondary Schools<br />

Adult Education (Sub-major head)<br />

Rural Functional Literary programmes<br />

Other Adult Education Programmes<br />

Total 2202 - General Education<br />

2

0210<br />

02<br />

101<br />

xx<br />

xx<br />

xx<br />

xx<br />

800<br />

04<br />

102<br />

104<br />

800<br />

0211<br />

101<br />

800<br />

0215<br />

01<br />

104<br />

501<br />

800<br />

02<br />

104<br />

501<br />

800<br />

0216<br />

03<br />

800<br />

0401<br />

103<br />

104<br />

105<br />

108<br />

800<br />

0403<br />

102<br />

103<br />

105<br />

106<br />

800<br />

Medical <strong>and</strong> Public Health<br />

Rural Health Services<br />

<strong>Receipts</strong> from Patients<br />

Accommodation<br />

Supply of medicines<br />

Cost of tests<br />

Supply of blood<br />

Other <strong>Receipts</strong><br />

Public Health<br />

Sales of Serum/vaccine<br />

Fees <strong>and</strong> Fines<br />

Other <strong>Receipts</strong><br />

Total - 0210<br />

Family Welfare<br />

Sale of Contraceptives<br />

Other <strong>Receipts</strong><br />

Total - 0211<br />

Water Supply <strong>and</strong> Sanitation<br />

Water Supply<br />

Fees <strong>and</strong> Fines<br />

Services <strong>and</strong> Service fees<br />

Other <strong>Receipts</strong><br />

Sewerage <strong>and</strong> Sanitation<br />

Fees <strong>and</strong> Fines<br />

Services <strong>and</strong> Service Fees<br />

Other <strong>Receipts</strong><br />

Total - 0215<br />

Housing<br />

Rural Housing<br />

Other <strong>Receipts</strong><br />

Total - 0216<br />

Crop Husb<strong>and</strong>ry<br />

Seeds<br />

<strong>Receipts</strong> from Agricultural Farms<br />

Sale of manure <strong>and</strong> fertilizers<br />

<strong>Receipts</strong> from commercial crops<br />

Other <strong>Receipts</strong><br />

Total - 0401<br />

Animal Husb<strong>and</strong>ry<br />

<strong>Receipts</strong> from Cattle & Buffalo development<br />

<strong>Receipts</strong> from Poultry Development<br />

<strong>Receipts</strong> from Piggery Development<br />

<strong>Receipts</strong> from Fodder & Feed Development<br />

Other receipts<br />

Total 0403<br />

2203<br />

103<br />

xx<br />

01<br />

14<br />

20<br />

50<br />

107<br />

800<br />

xx<br />

2204<br />

101<br />

xx<br />

xx<br />

xx<br />

103<br />

xx<br />

xx<br />

xx<br />

104<br />

xx<br />

xx<br />

2205<br />

101<br />

xx<br />

102<br />

105<br />

2210<br />

03<br />

101<br />

102<br />

103<br />

110<br />

06<br />

101<br />

xx<br />

yy<br />

01<br />

02<br />

xx<br />

Technical Education<br />

Technical Schools (Sub head for training <strong>and</strong> education in<br />

various trades to pre-matric or middle School students may<br />

be opened)<br />

Craft Centers (sub-head)<br />

Salaries (to Instructors)<br />

Rent, Rates & Taxes<br />

Other Administrative Expenditure(Cash Incentives to<br />

trainees <strong>and</strong> training material)<br />

Other charges (Prizes etc.)<br />

Scholarships<br />

Other expenditure<br />

Vocational Education (sub head)<br />

Total - 2203<br />

Sports <strong>and</strong> Youth Services<br />

Physical Education<br />

Assistance to Primary Schools<br />

Assistance to Secondary schools<br />

Assistance to non-Govt. Schools<br />

Youth Welfare Programmes for non-students<br />

Youth Camps<br />

Youth Hostels<br />

N.C.C.<br />

Sports <strong>and</strong> Games<br />

Maintenance of play grounds<br />

Maintenance of Gymnasium<br />

Total - 2204<br />

Art <strong>and</strong> Culture<br />

Fine Arts Education<br />

Assistance to private institutions<br />

Promotion of Arts <strong>and</strong> Culture<br />

Public Libraries<br />

Total - 2205<br />

Medical <strong>and</strong> Public Health<br />

Rural Health Services- Allopathy<br />

Health Sub-Centers<br />

Subsidiary Health Centers<br />

Primary Health Centers<br />

Hospital <strong>and</strong> Dispensaries<br />

Public Health (sub major head)<br />

Prevention & Control of diseases<br />

National Anti Malaria Programme (NAMP)/ Trachoma &<br />

Blindness control Programme (TBC)/ National Aids Control<br />

Programme (NAC)<br />

Directorate of NAMP/TBC cell/NAC cell<br />

Salaries<br />

Wages<br />

Medical relief Camps<br />

Total - 2210<br />

3

0405<br />

102<br />

103<br />

501<br />

800<br />

0406<br />

01<br />

101<br />

104<br />

800<br />

xx<br />

0515<br />

101<br />

xx<br />

xx<br />

xx<br />

102<br />

800<br />

0702<br />

01<br />

102<br />

xx<br />

800<br />

02<br />

101<br />

800<br />

0801<br />

06<br />

800<br />

Fisheries<br />

License fees, Fines etc.<br />

Sales of fish, Fish seeds etc.<br />

Services <strong>and</strong> Service fees.<br />

Other <strong>Receipts</strong><br />

Total - 0405<br />

<strong>For</strong>estry <strong>and</strong> Wild Life<br />

<strong>For</strong>estry<br />

Sale of timber <strong>and</strong> other forest produce<br />

<strong>Receipts</strong> from forest plantations<br />

Other <strong>Receipts</strong><br />

Sale of grazing rights<br />

Total - 0406<br />

Other Rural Development Programmes<br />

<strong>Receipts</strong> under Panchayati Raj Acts<br />

Registration charges <strong>and</strong> surcharge on stamp<br />

duty.<br />

Fees for use of quarries<br />

Rent for use of l<strong>and</strong> vested in <strong>Zilla</strong> Parishads<br />

<strong>Receipts</strong> from community development projects.<br />

Other <strong>Receipts</strong><br />

Total - 0515<br />

Minor Irrigation<br />

Surface Water<br />

<strong>Receipts</strong> from lift irrigation Scheme<br />

Irrigation charges<br />

Other <strong>Receipts</strong><br />

Ground water<br />

Receipt from tube-wells<br />

Other <strong>Receipts</strong><br />

Power<br />

Rural Electrification<br />

Other <strong>Receipts</strong><br />

Total - 0801<br />

Total - Non Tax <strong>Receipts</strong><br />

TOTAL - REVENUE RECEIPTS<br />

2211<br />

101<br />

xx<br />

103<br />

xx<br />

2215<br />

01<br />

001<br />

01<br />

11<br />

13<br />

102<br />

xx<br />

xx<br />

2216<br />

03<br />

102<br />

2235<br />

02<br />

101<br />

102<br />

103<br />

104<br />

2236<br />

02<br />

102<br />

2225<br />

01<br />

277<br />

xx<br />

xx<br />

xx<br />

xx<br />

282<br />

283<br />

02<br />

03<br />

Family Welfare<br />

Rural Family Welfare Services<br />

Family Welfare Camps<br />

Maternity <strong>and</strong> Child Health<br />

Immunisation of infants <strong>and</strong> pre-school children<br />

Total - 2211<br />

Water Supply <strong>and</strong> Sanitation<br />

Water Supply<br />

Directions <strong>and</strong> Administration<br />

Salaries<br />

Travel Expenses<br />

<strong>Of</strong>fice Expenses<br />

Rural Water Supply Programmes<br />

Drinking Water Supply Schemes<br />

Maintenance & Repairs of Water Supply lines, tube wells<br />

etc. (works <strong>and</strong> work charged establishment to be shown<br />

separately)<br />

Total - 2215<br />

Housing<br />

Rural Housing<br />

Provision of House site to the l<strong>and</strong>less<br />

Total - 2216<br />

Social Security <strong>and</strong> Welfare<br />

Social Welfare<br />

Welfare of H<strong>and</strong>icapped<br />

Child Welfare<br />

Women’s Welfare<br />

Welfare of Aged, infirm <strong>and</strong> destitute<br />

Total - 2235<br />

Nutrition<br />

Distribution of nutritious foods <strong>and</strong> beverages<br />

Mid-day meals<br />

Total - 2236<br />

Welfare of scheduled Castes, Scheduled Tribes <strong>and</strong> Other<br />

Backward Classes<br />

Welfare of Scheduled Castes<br />

Education<br />

Scholarships to SC Students in Primary or secondary or<br />

non-govt. Schools<br />

Other concessions to SC students in Primary or secondary or<br />

non-govt. Schools<br />

Maintenance of Hostels for SC Students<br />

Health<br />

Housing<br />

Provision of house site to l<strong>and</strong>less SC<br />

Welfare of Scheduled Tribes(Same minor heads & subheads<br />

as welfare of SC)<br />

Welfare of Backward Classes(Same minor heads & subheads<br />

as welfare of SC)<br />

Total - 2225<br />

4

1601<br />

1604<br />

200<br />

xx<br />

GRANTS-IN-AID & CONTRIBUTIONS<br />

Grants-in-aid/Assistance from Central/State<br />

Govt.<br />

(a) Grants-in-aid from Central Govt.<br />

(Minor heads corresponding to programme minor<br />

heads in the section “Expenditure Heads<br />

(Revenue <strong>Account</strong>)” to which the assistance from<br />

Central Government relates may be opened under<br />

the sub-major heads.)<br />

(b) Assistance from State Govt.<br />

(Minor heads corresponding to programme minor<br />

heads in the section “Expenditure Heads<br />

(Revenue <strong>Account</strong>)” to which the assistance from<br />

State Government relates may be opened under the<br />

sub-major heads. Refer to List of Codes for<br />

Functions, Programmes & Activities for PRIs for<br />

example))<br />

Less-Transfer to Panchayat Samiti/ Village<br />

Panchayat<br />

Total - 1601<br />

Compensation <strong>and</strong> Assignments from State<br />

Govt.<br />

Other Miscellaneous Compensation <strong>and</strong><br />

Assignments<br />

Share of Compensation <strong>and</strong> Assignments from<br />

State Govt.<br />

(Minor heads corresponding to programme minor<br />

heads in the section “Expenditure Heads<br />

(Revenue <strong>Account</strong>)” to which the compensation<br />

& assignments from State Government relates<br />

may be opened. Refer to List of Codes for<br />

Functions, Programmes & Activities for PRIs for<br />

example)<br />

Less-Transfer to Panchayat Samiti/ Village<br />

Panchayat<br />

Total - 1604<br />

TOTAL - GRANTS-IN-AID &<br />

CONTRIBUTIONS<br />

2401<br />

109<br />

110<br />

115<br />

119<br />

xx<br />

xx<br />

195<br />

800<br />

2402<br />

102<br />

xx<br />

xx<br />

800<br />

2403<br />

101<br />

xx<br />

102<br />

xx<br />

xx<br />

103<br />

107<br />

108<br />

800<br />

2406<br />

01<br />

102<br />

xx<br />

2408<br />

01<br />

101<br />

xx<br />

yy<br />

yy<br />

2501<br />

01<br />

003<br />

xx<br />

02<br />

102<br />

03<br />

04<br />

104<br />

06<br />

101<br />

800<br />

Crop Husb<strong>and</strong>ry<br />

Extension <strong>and</strong> Farmers’ Training<br />

Crop Insurance<br />

Scheme of Small/Marginal Farmers & Agricultural<br />

Labourers<br />

Horticulture & Vegetable Crops<br />

Kitchen gardens & orchards<br />

Fruits & Vegetables Nursery<br />

Assistance to Farming Cooperation<br />

Other expenditure<br />

Total - 2401<br />

Soil <strong>and</strong> Water Conservation<br />

Soil Conservation<br />

Reclamation of ravines<br />

Water Conservation<br />

Other expenditure<br />

Total - 2402<br />

Animal Husb<strong>and</strong>ry<br />

Veterinary services <strong>and</strong> Animal Health<br />

Prevention <strong>and</strong> control of animal diseases<br />

Cattle <strong>and</strong> Buffalo Development<br />

Cattle shows<br />

Cattle breeding<br />

Poultry Development<br />

Fodder <strong>and</strong> Feed Development<br />

Insurance of Live Stock <strong>and</strong> Poultry<br />

Other expenditure<br />

Total - 2403<br />

<strong>For</strong>estry <strong>and</strong> Wild Life<br />

<strong>For</strong>estry<br />

Social <strong>and</strong> Farm <strong>For</strong>estry<br />

Rural <strong>For</strong>estry<br />

Total - 2406<br />

Food, Storage <strong>and</strong> Warehousing<br />

Food<br />

Procurement <strong>and</strong> Supply<br />

Public Distribution System (Sub major head)<br />

Fair Price Shops<br />

Cooperative Societies<br />

Total - 2408<br />

Special Programmes for Rural Development<br />

Integrated Rural Development Programme<br />

Training<br />

TRYSEM Training of Rural Youth<br />

Draught Prone Areas Development Programme<br />

Afforestation<br />

Desert Development Programme<br />

Integrated Rural Energy Planning Programme<br />

Project Implementation<br />

Self Employment Programmes<br />

Swarnajayanti Gram Swarozgar Yojana<br />

Other expenditure<br />

Total - 2501<br />

5

2505<br />

01<br />

702<br />

2515<br />

101<br />

xx<br />

yy<br />

06<br />

11<br />

yy<br />

06<br />

11<br />

yy<br />

01<br />

11<br />

13<br />

14<br />

20<br />

28<br />

32<br />

yy<br />

20<br />

21<br />

26<br />

27<br />

2702<br />

01<br />

101<br />

xx<br />

102<br />

xx<br />

yy<br />

02<br />

103<br />

xx<br />

Rural Employment<br />

National Programmes<br />

Jawahar Gram Samridhi Yojana<br />

Total - 2505<br />

Other Rural Development Programmes<br />

Panchayati Raj<br />

<strong>Zilla</strong> Parishad Administration (Sub-head)<br />

Allowances <strong>and</strong> Honorarium of Chairman/ Vice-<br />

Chairman (detailed head)<br />

Honorarium<br />

Domestic Travel Expenses<br />

(Chairman & Vice Chairman will be shown separately)<br />

Allowances & Honoraria of Members<br />

Honorarium<br />

Domestic Travel Expenses<br />

<strong>Zilla</strong> Parishad Establishment (This will include all<br />

wings/sections including Engineering wing)<br />

Salaries (DA, HRA, CCA, Bonus, LTC)<br />

Domestic Travel expenses<br />

<strong>Of</strong>fice Expenses (Postage, Stationery, etc.)<br />

Rent, Rates & Taxes<br />

Other Administrative Expenses (Panchayat Election<br />

Expenses)<br />

Professional Services (Fees for preparation of Annual<br />

<strong>Account</strong>s)<br />

Contributions<br />

Civic Services (Detailed Head)<br />

Other Administrative Expenses (Social & Cultural<br />

Activities)<br />

Supplies & Materials<br />

Advertising & Publicity (Public TV, Radio)<br />

Minor Works (Maintenance of Burial Grounds, Akharas,<br />

Public Lavatories, Street Lighting etc.)<br />

Total- 2515<br />

Minor Irrigation<br />

Surface Water<br />

Water Tanks<br />

Maintenance <strong>and</strong> Repairs of Water tanks/ponds (works<br />

expenditure <strong>and</strong> work charged expenditure to be shown<br />

separately)<br />

Lift Irrigation schemes<br />

Canals<br />

Maintenance & Repairs (works expenditure <strong>and</strong> W.C.<br />

expenditure to be shown separately)<br />

Ground Water<br />

Tubewells<br />

Maintenance & Repairs (Works expenditure <strong>and</strong> W.C.<br />

expenditure to be shown separately)<br />

Total - 2702<br />

6

2801<br />

06<br />

800<br />

xx<br />

2810<br />

01<br />

102<br />

xx<br />

02<br />

101<br />

xx<br />

2851<br />

102<br />

103<br />

104<br />

105<br />

106<br />

107<br />

111<br />

200<br />

xx<br />

3054<br />

03<br />

102<br />

xx<br />

337<br />

xx<br />

04<br />

337<br />

xx<br />

yy<br />

xx<br />

yy<br />

Power<br />

Rural electrification<br />

Other expenditure<br />

Maintenance of Street Lights<br />

Total - 2801<br />

Non-Conventional Sources of Energy<br />

Bio-energy<br />

Community <strong>and</strong> Institutional Bio-gas Development<br />

Maintenance of Bio-gas Plants<br />

Solar<br />

Solar Thermal Energy Programme<br />

Maintenance of Solar lights, cookers etc.<br />

Total - 2810<br />

Village <strong>and</strong> Small Industries<br />

Small Scale Industries(Cottage Industries)<br />

H<strong>and</strong>loom Industries<br />

H<strong>and</strong>icraft Industries<br />

Khadi <strong>and</strong> Village Industries<br />

Coir Industries<br />

Sericulture Industries<br />

Employment Scheme for Unemployed Educated Youths<br />

Other Village Industries<br />

Food Processing Industries (Any other Scheme as per<br />

local need)<br />

Total - 2851<br />

Roads <strong>and</strong> Bridges<br />

State Highways<br />

Bridges<br />

Maintenance <strong>and</strong> Repairs (Works expenditure & work<br />

charged expenditure to be shown separately)<br />

Road Works<br />

Maintenance <strong>and</strong> Repairs (Works expenditure & work<br />

charged expenditure to be shown separately)<br />

District <strong>and</strong> other Roads<br />

Road Works<br />

District Roads<br />

Maintenance <strong>and</strong> Repairs (Works expenditure & work<br />

charged expenditure to be shown separately)<br />

Rural Roads<br />

Maintenance <strong>and</strong> Repairs (Works expenditure & work<br />

charged expenditure to be shown separately)<br />

Total - 3054<br />

TOTAL – REVENUE EXPENDITURE<br />

7

4000<br />

800<br />

CAPITAL ACCOUNT - RECEIPTS<br />

Capital Receipt<br />

Other <strong>Receipts</strong><br />

(To be included as per local needs)<br />

TOTAL - CAPITAL RECEIPTS<br />

4059<br />

01<br />

051<br />

xx<br />

201<br />

60<br />

051<br />

xx<br />

201<br />

80<br />

201<br />

4202<br />

01<br />

201<br />

xx<br />

xx<br />

xx<br />

03<br />

101<br />

xx<br />

102<br />

xx<br />

xx<br />

04<br />

105<br />

xx<br />

xx<br />

CAPITAL ACCOUNT-EXPENDITURE<br />

Capital Outlay on Public Works<br />

<strong>Of</strong>fice Buildings<br />

Construction<br />

Construction of <strong>Of</strong>fice etc. (details of each construction to<br />

be given separately)<br />

Acquisition of L<strong>and</strong><br />

Other Buildings<br />

Construction<br />

Construction of sheds, Tanga St<strong>and</strong>s, Bus Stops, Bathing<br />

Ghats<br />

Acquisition of L<strong>and</strong><br />

General<br />

Acquisition of L<strong>and</strong><br />

Total - 4059<br />

Capital Outlay on Education, Sports, Art <strong>and</strong> Culture<br />

General Education<br />

Elementary Education<br />

Buildings<br />

Construction of Primary Schools/Pathshalas etc.<br />

Assistance for Construction of Primary Schools<br />

Sports <strong>and</strong> Youth Services<br />

Youth Hostels<br />

Construction of Youth Hostels<br />

Sports Stadia<br />

Construction of Sports Stadium<br />

Construction of Play Grounds<br />

Art <strong>and</strong> Culture<br />

Public Libraries<br />

Construction of District Library<br />

Assistance for construction of Libraries<br />

Total - 4202<br />

8

4210<br />

02<br />

101<br />

102<br />

103<br />

xx<br />

xx<br />

21<br />

52<br />

104<br />

xx<br />

xx<br />

21<br />

52<br />

110<br />

xx<br />

yy<br />

yy<br />

21<br />

52<br />

4211<br />

103<br />

xx<br />

106<br />

xx<br />

21<br />

Capital Outlay on Medical <strong>and</strong> Public Health<br />

Rural Health Services<br />

Health Sub-Centres<br />

Subsidiary Health Centres<br />

Primary Health Centers<br />

Construction of Primary Health Centres<br />

Purchase of Equipment, Linens etc.<br />

Supplies <strong>and</strong> Materials<br />

Machinery & Equipment<br />

Community Health Centres<br />

Construction of Community Health Centres<br />

Purchase of Equipment, Linens etc.<br />

Supplies <strong>and</strong> Materials<br />

Machinery & Equipment<br />

Hospital <strong>and</strong> Dispensaries<br />

District Health Centres<br />

Construction of District Health Centres<br />

Purchase of Equipment, Linen etc.<br />

Supplies <strong>and</strong> Materials<br />

Machinery & Equipment<br />

Total - 4210<br />

Capital Outlay on Family welfare<br />

Maternity <strong>and</strong> Child Welfare<br />

Construction of.............(to be indicated separately in<br />

respect of each centre)<br />

Services <strong>and</strong> Supplies<br />

(Details of Centre)<br />

Supplies <strong>and</strong> Material (to be shown centre-wise)<br />

Total - 4211<br />

9

10<br />

4215<br />

01<br />

102<br />

xx<br />

xx<br />

yy<br />

4225<br />

01<br />

277<br />

282<br />

283<br />

800<br />

02<br />

277<br />

282<br />

283<br />

800<br />

03<br />

277<br />

282<br />

283<br />

800<br />

4235<br />

02<br />

101<br />

102<br />

103<br />

104<br />

4405<br />

101<br />

xx<br />

4408<br />

01<br />

101<br />

02<br />

101<br />

xx<br />

xx<br />

xx<br />

Capital Outlay on Water Supply <strong>and</strong> Sanitation<br />

Water Supply<br />

Rural Water supply<br />

Laying of Water Supply Scheme at.............<br />

Tube wells/wells<br />

Drilling of tube well/ well at..................<br />

Total - 4215<br />

Capital Outlay on Welfare of Scheduled Castes,<br />

Scheduled Tribes <strong>and</strong> Other Backward Classes<br />

Welfare of Scheduled Castes<br />

Education<br />

Health<br />

Housing<br />

Other Expenditure<br />

Welfare of Scheduled Tribes<br />

Education<br />

Health<br />

Housing<br />

Other Expenditure<br />

Welfare of Other Backward Classes<br />

Education<br />

Health<br />

Housing<br />

Other Expenditure<br />

Total - 4225<br />

Capital Outlay on Social Security <strong>and</strong> Welfare<br />

Social Welfare<br />

Welfare of H<strong>and</strong>icapped<br />

Child Welfare<br />

Women’s Welfare<br />

Welfare of aged, infirm <strong>and</strong> destitute<br />

Total - 4235<br />

Capital Outlay on Fisheries<br />

Inl<strong>and</strong> Fisheries<br />

Construction of Fish Pond at.................<br />

Total - 4405<br />

Capital Outlay on Food Storage <strong>and</strong> Warehousing<br />

Food<br />

Procurement <strong>and</strong> supply<br />

Storage <strong>and</strong> Warehousing<br />

Rural Godown Programmes<br />

Schemes for development of rural godowns<br />

Buildings-Construction of Godowns<br />

Development of M<strong>and</strong>is, Warehouses<br />

Total - 4408

11<br />

4515<br />

800<br />

4702<br />

051<br />

xx<br />

xx<br />

xx<br />

052<br />

799<br />

4801<br />

06<br />

800<br />

xx<br />

4810<br />

101<br />

xx<br />

102<br />

xx<br />

5054<br />

03<br />

101<br />

xx<br />

xx<br />

337<br />

xx<br />

xx<br />

04<br />

337<br />

xx<br />

xx<br />

xx<br />

xx<br />

xx<br />

xx<br />

Capital Outlay on Other Rural development<br />

programmes<br />

Other Expenditure<br />

Total - 4515<br />

Capital Outlay on Minor Irrigation<br />

Construction<br />

Each Scheme to be shown separately under:-<br />

Canals<br />

Tube wells<br />

Tanks<br />

Machinery <strong>and</strong> Equipment<br />

Suspense<br />

Total - 4702<br />

Capital Outlay on Power Projects<br />

Rural Electrification<br />

Other expenditure<br />

Fixing of Street Lights<br />

Total - 4801<br />

Capital Outlay on Non-Conventional Sources of Energy<br />

Bio-energy<br />

Bio gas Plants<br />

Solar<br />

Construction of Solar energy Project<br />

Total - 4801<br />

Capital Outlay on Roads <strong>and</strong> Bridges<br />

State Highways<br />

Bridges<br />

Construction of................<br />

Acquisition of L<strong>and</strong><br />

Road Works<br />

Construction of.............<br />

Acquisition of L<strong>and</strong><br />

District <strong>and</strong> Other Roads<br />

Road Works<br />

District Roads<br />

Construction of.............<br />

Acquisition of L<strong>and</strong><br />

Rural Roads<br />

Construction of .................<br />

Assistance to......................for construction of<br />

(Note:’Suspense’ <strong>and</strong> ‘Machinery <strong>and</strong> Equipment’ to be<br />

opened as per requirement<br />

Total - 5054<br />

TOTAL- CAPITAL EXPENDITURE

6003<br />

109<br />

xx<br />

800<br />

6004<br />

01<br />

800<br />

02<br />

101<br />

800<br />

7610<br />

LOANS & ADVANCES<br />

DEBT<br />

Internal Debt<br />

Loans from other Institutions<br />

Loans from ….(Each Institution to be shown as<br />

sub-head)<br />

Other loans<br />

Total - 6003<br />

Loans <strong>and</strong> Advances from Central Govt./State<br />

Govt.<br />

Non-Plan loans<br />

Other Loans (Details to be given at sub-head<br />

level)<br />

Loans for Plan Schemes<br />

Block Loans<br />

Other Loans (Details to be given at sub-head<br />

level)<br />

Total - 6004<br />

TOTAL DEBT<br />

Loans to Panchayat employees etc.<br />

(Repayment of loans by employees to be<br />

indicated purpose-wise)<br />

TOTAL - LOANS & ADVANCES<br />

TOTAL PART - 1: PANCHAYAT FUND<br />

6003<br />

109<br />

xx<br />

800<br />

6004<br />

01<br />

800<br />

02<br />

101<br />

800<br />

6202<br />

01<br />

201<br />

6401<br />

110<br />

xx<br />

6515<br />

101<br />

xx<br />

800<br />

xx<br />

7610<br />

202<br />

xx<br />

203<br />

xx<br />

204<br />

800<br />

xx<br />

12<br />

LOANS AND ADVANCES<br />

DEBT<br />

Internal Debt*<br />

Loans from other Institutions<br />

Repayment of loans to Other Institutions (each<br />

institution to be shown separately as sub-head)<br />

Other loans<br />

Total - 6003<br />

Loans <strong>and</strong> Advances from Central/State<br />

Government*<br />

Non-Plan Loans<br />

Other Loans (Repayment of Loans to Central<br />

Govt./State Govt. to be shown at sub-head level)<br />

Loans for Plan Schemes<br />

Block Loans<br />

Other Loans (Repayment of loans to Central<br />

Govt./State Govt. to be shown at sub-head level)<br />

Total - 6004<br />

TOTAL DEBT<br />

Loans for Education, Sports, Art <strong>and</strong> Culture<br />

General Education<br />

Elementary Education<br />

(Loans for educational purpose)<br />

Total - 6202<br />

Loans for Crop Husb<strong>and</strong>ry<br />

Scheme for small <strong>and</strong> marginal farmers <strong>and</strong><br />

Agricultural labourers<br />

Loans to Cultivators<br />

Total - 6401<br />

Loans for other Rural Development Programmes<br />

Panchayati Raj<br />

Loans for Village Panchayat for afforestation<br />

Other Loans<br />

Other Miscellaneous loans<br />

Total - 6515<br />

Loans to Panchayat employees etc.<br />

Advances for purchase of Motor conveyances<br />

Motor Cycle/Scooter advance<br />

Advances for purchase of other conveyances<br />

Cycle Advance<br />

Advances for purchase of computers<br />

Other Advances<br />

Marriage advance<br />

(Note: pay advance, Festival advance to be shown<br />

under object head ‘Salaries’ below the concerned<br />

functional head).<br />

Total - 7610<br />

TOTAL - LOANS AND ADVANCES<br />

TOTAL PART - I : PANCHAYAT FUND<br />

* These depict disbursals

8009<br />

01<br />

101<br />

xx<br />

60<br />

8011<br />

107<br />

8443<br />

103<br />

xx<br />

xx<br />

108<br />

xx<br />

xx<br />

124<br />

126<br />

800<br />

8448<br />

109<br />

xx<br />

xx<br />

xx<br />

8550<br />

103<br />

Part - II<br />

PROVIDENT FUNDS etc.<br />

Provident Funds<br />

Civil<br />

General Provident Funds<br />

Panchayat employees Provident Funds<br />

Other Provident Funds<br />

(Each Provident Fund to be shown<br />

separately)<br />

Total - 8009<br />

Insurance <strong>and</strong> Pension Funds<br />

Employees Group Insurance Scheme<br />

Total - 8011<br />

TOTAL - PROVIDENT FUNDS etc.<br />

DEPOSITS & ADVANCES<br />

DEPOSITS<br />

Civil Deposits<br />

Security Deposits(other than PWD)<br />

Security from Subordinates<br />

Earnest Money made by intending tenderers<br />

Public Works Deposits<br />

Deposits by Contractors<br />

Deposits of earnest money by successful<br />

tenderers in PWD<br />

Unclaimed Deposits in Provident Funds<br />

Unclaimed Deposits in other provident Funds<br />

Other Deposits<br />

Total - 8443<br />

Deposits of Local Funds<br />

Panchayat Bodies Funds<br />

Panchayat Samiti Funds<br />

Village Panchayat Funds<br />

<strong>Zilla</strong> Parishad Funds<br />

Total - 8448<br />

Total - Deposits<br />

ADVANCES<br />

Civil Advances<br />

Other Departmental Advances<br />

Total - 8550 -Advances<br />

TOTAL - DEPOSITS & ADVANCES<br />

Actuals<br />

during the<br />

Year…Rs<br />

Upto the end of<br />

the year….Rs.<br />

8009<br />

01<br />

101<br />

xx<br />

60<br />

102<br />

8011<br />

107<br />

xx<br />

xx<br />

8443<br />

103<br />

108<br />

xx<br />

xx<br />

124<br />

126<br />

800<br />

8550<br />

103<br />

13<br />

Part - II<br />

PROVIDENT FUNDS ETC.<br />

Provident Fund (Advances & withdrawals)<br />

Civil<br />

General Provident Fund<br />

Panchayat Employees Funds (Scheme head)<br />

Other Provident Funds<br />

Contributory Provident Pension Fund<br />

(each Provident Fund to be shown separately)<br />

Total - 8009<br />

Insurance <strong>and</strong> Pension Funds<br />

Employees’ Group Insurance Scheme<br />

Insurance Fund<br />

Savings Fund<br />

Total - 8011<br />

TOTAL -PROVIDENT FUNDS ETC.<br />

DEPOSITS AND ADVANCES<br />

DEPOSITS<br />

Civil Deposits<br />

Security Deposits<br />

Note: Refund of Security Deposits from Subordinates<br />

(other than PWD) including earnest money made by<br />

intending tenderers to be recorded as sub head.<br />

Public Works Deposits<br />

Deposit by Contractors<br />

Deposit of earnest money by successful tenderers in<br />

PWD.<br />

Unclaimed deposits in the GP Fund<br />

Unclaimed deposits in other Provident Funds<br />

Other Deposits<br />

Total - 8443 Deposits<br />

ADVANCES<br />

Civil Advances<br />

Other Departmental advances (each type of advance<br />

to be shown distinctly.)<br />

Total - 8550 Advances<br />

TOTAL - DEPOSITS AND ADVANCES<br />

Actual during<br />

the year…Rs<br />

Upto the end of the<br />

year… Rs

8782<br />

102<br />

REMITTANCES<br />

Cash Remittances between <strong>Zilla</strong> Parishad &<br />

Panchayat Samiti/ Village Panchayat<br />

Remittances between <strong>Zilla</strong> & Panchayat Samities /<br />

Village Panchayat<br />

TOTAL - 8782 REMITTANCES<br />

Total- Part - II<br />

GRAND TOTAL<br />

8782<br />

102<br />

14<br />

REMITTANCES<br />

Cash remittances between <strong>Zilla</strong> Parishad <strong>and</strong><br />

Panchayat Samities/Village Panchayat<br />

Public Remittances between <strong>Zilla</strong> Parishad <strong>and</strong> Panchayat<br />

Samities/Village Panchayat<br />

TOTAL - 8782 - REMITTANCES<br />

Total - Part II<br />

Closing Balance<br />

Cash in H<strong>and</strong><br />

Cash in Bank<br />

Cash in Treasury<br />

Investment<br />

GRAND TOTAL

15<br />

Annual <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong> for <strong>Zilla</strong> Parishad/Block Panchayat/Village Panchayat<br />

Statement of Capital Expenditure during <strong>and</strong> upto the end of the year………<br />

Heads of <strong>Account</strong> - Nature of Expenditure Expenditure during the year……..<br />

<strong>For</strong> example:<br />

4515<br />

800<br />

Capital Outlay on Other Rural development<br />

programmes<br />

Other Expenditure<br />

Total - 4515<br />

Non-Plan<br />

(Rs.)<br />

Plan<br />

(Rs.)<br />

Centrally<br />

sponsored<br />

Schemes (Rs.)<br />

State<br />

sponsored<br />

Schemes (Rs.)<br />

Total<br />

(Rs.)<br />

4225<br />

01<br />

277<br />

282<br />

283<br />

800<br />

02<br />

277<br />

282<br />

283<br />

800<br />

03<br />

277<br />

282<br />

283<br />

800<br />

Capital Outlay on Welfare of Scheduled Castes,<br />

Scheduled Tribes <strong>and</strong> Other<br />

Backward Classes<br />

Welfare of Scheduled Castes<br />

Education<br />

Health<br />

Housing<br />

Other Expenditure<br />

Welfare of Scheduled Tribes<br />

Education<br />

Health<br />

Housing<br />

Other Expenditure<br />

Welfare of Other Backward Classes<br />

Education<br />

Health<br />

Housing<br />

Other Expenditure<br />

Total - 4225<br />

(Similarly for other capital heads wherever<br />

applicable)<br />

Gr<strong>and</strong> Total<br />

<strong>For</strong>m-2<br />

Expenditure upto the<br />

end of the year ……<br />

(progressive)<br />

(Rs.)

16<br />

Annual <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong> for <strong>Zilla</strong> Parishad/Block Panchayat/Village Panchayat<br />

Statement of Receivables & Payables at the end of the year………<br />

Heads of<br />

<strong>Account</strong><br />

Receivables Payables<br />

Particulars Amount<br />

Rs.<br />

Heads of <strong>Account</strong> Particulars Amount<br />

Rs.<br />

Tax <strong>Receipts</strong><br />

0028 Other Taxes on Income & Expenditure 2049 Interest <strong>Payments</strong><br />

0029 L<strong>and</strong> Revenue 2059 Public Works<br />

0035 Taxes on Immovable Property other than<br />

2071 Pension & Other Retirement Benefits<br />

agricultural L<strong>and</strong><br />

0041 Taxes on Vehicles 2202 General Education<br />

0042 Taxes on Goods <strong>and</strong> Passengers 2203 Technical Education<br />

0045 Other Taxes <strong>and</strong> Duties on Commodities<br />

2204 Sports & Youth Services<br />

<strong>and</strong> Services<br />

Total Tax receipts 2210 Medical & Public Health<br />

Non Tax <strong>Receipts</strong> 2215 Water Supply & sanitation<br />

0049 Interest <strong>Receipts</strong> 2216 Housing<br />

0059 Public Works 2225 Welfare of SC,ST, & OBSs<br />

0202 Education, Sports, Art& culture 2235 Social Security & Welfare<br />

0210 Medical & Public Health 2401 Crop Husb<strong>and</strong>ry<br />

0211 Family Welfare 2402 Soil & Water Conservation<br />

0215 Water Supply & Sanitation 2403 Animal Husb<strong>and</strong>ry<br />

0216 Housing 2406 <strong>For</strong>estry & Wildlife<br />

0401 Crop Husb<strong>and</strong>ry 2408 Food Storage & Warehousing<br />

0405 Fisheries 2501 Special Programmes for Rural development<br />

0406 <strong>For</strong>estry & Wild Life 2505 Rural Employment<br />

0515 Other Rural Development Programmes 2515 Other Rural Development Programmes<br />

0702 Minor Irrigation 2702 Minor Irrigation<br />

0801 Power 2801 Power<br />

Total - Non Tax <strong>Receipts</strong> 3054 Roads & Bridges<br />

Gr<strong>and</strong> Total Gr<strong>and</strong> Total<br />

Note: 1. The above heads of account are only illustrative. Details may be given as per actual local needs.<br />

2 Receivables & Payables shown major head wise above may be further shown minor head, scheme & detail head wise.<br />

<strong>For</strong>m-3

17<br />

8443<br />

103<br />

108<br />

XX<br />

XX<br />

124<br />

126<br />

800<br />

8550<br />

103<br />

Annual <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong> for <strong>Zilla</strong> Parishad/Block Panchayat/Village Panchayat<br />

Statement of Balances under Deposits <strong>and</strong> Advances & Loans at the end of the year ……..<br />

Heads of <strong>Account</strong> Opening Balance<br />

(Rs.)<br />

Deposits<br />

Civil Deposits<br />

Security Deposits<br />

Public Works Deposits<br />

Deposits by Contractors<br />

Deposits of earnest money by successful Tenderes in PWD<br />

Unclaimed deposits in GP Fund<br />

Unclaimed deposits in other provident funds<br />

Other deposits<br />

Total- 8443- Deposits<br />

Advances<br />

Civil Advances<br />

Other Departmental Advances (each type of<br />

Advance to be shown separately)<br />

Total - 8550-Advances<br />

<strong>Receipts</strong><br />

(Rs.)<br />

Disbursement<br />

(Rs.)<br />

Closing Balance<br />

(Rs.)<br />

6003<br />

109<br />

xx<br />

xx<br />

800<br />

6004<br />

01<br />

800<br />

02<br />

101<br />

800<br />

7610<br />

Loans<br />

Debt<br />

Internal Debt<br />

Loans from other Institutions<br />

Loans from ….(Each Institution to be shown as sub-head)<br />

Loans from Zila Parishad/ Block Panchayat (Programme wise)<br />

Other loans<br />

Total - 6003<br />

Loans <strong>and</strong> Advances from Central Govt./State Govt.<br />

Non-Plan loans<br />

Other Loans (Details to be given at sub-head level<br />

Loans for Plan Schemes<br />

Block Loans<br />

Other Loans (Details to be given at sub-head level)<br />

Total - 6004 - Debt<br />

Loans to Panchayat employees etc.<br />

(Repayment of loans by employees to be indicated purpose-wise)<br />

Total - Loans<br />

Gr<strong>and</strong> Total<br />

Note: 1. The nature of balances, credit or debit may be indicated in the head of account column for opening balance as well as closing balance.<br />

2.Adverse or minus balances may be explained.<br />

<strong>For</strong>m-4<br />

Details of<br />

Investments (Rs.)

18<br />

Annual <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong> for <strong>Zilla</strong> Parishad/Block Panchayat/Village Panchayat<br />

Statement of Provident Funds etc. <strong>and</strong> Investments at the end of the year …….<br />

8009<br />

01<br />

101<br />

xx<br />

60<br />

102<br />

Heads of <strong>Account</strong> Opening<br />

Balance<br />

(Rs.)<br />

Provident Funds<br />

Civil<br />

General Provident Fund<br />

Panchayat Employees Provident Funds<br />

Other Provident Funds<br />

Contributory Provident Pension Fund<br />

(each PF to be shown separately)<br />

Total-8009-Provident Fund<br />

<strong>Receipts</strong><br />

(Rs.)<br />

Disbursements<br />

(Rs.)<br />

Interest<br />

(Rs.)<br />

Closing<br />

Balance<br />

(Rs.)<br />

8011<br />

107<br />

XX<br />

XX<br />

Insurance & Pension Funds<br />

Employees Group Insurance Scheme<br />

Insurance Fund<br />

Savings Fund<br />

Total-8011<br />

Gr<strong>and</strong> Total<br />

Note: The nature of balances, credit or debit may be indicated under head of account column after the description of the head, for opening balance<br />

as well as closing balance.<br />

<strong>For</strong>m-5<br />

Details of<br />

Investments<br />

(Rs.)

Monthly<br />

<strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong><br />

of<br />

<strong>Zilla</strong> Parishad

21<br />

Monthly <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong>s of <strong>Zilla</strong> Panchayat/Block Panchayat/Village Panchayat<br />

<strong>For</strong> the month……………..year………………..<br />

<strong>For</strong>m-6<br />

RECEIPTS PAYMENTS<br />

Opening Balance<br />

i) Cash in h<strong>and</strong><br />

ii) Balance in Bank<br />

iii) Balance in treasury<br />

iv) Investments<br />

Heads of <strong>Account</strong><br />

Budget<br />

estimates<br />

for the<br />

Year …<br />

(Rs.)<br />

Actuals<br />

during<br />

the<br />

month<br />

of…<br />

(Rs.)<br />

Upto the<br />

end of<br />

the<br />

month<br />

of….<br />

(Rs.)<br />

Heads of <strong>Account</strong> Budget<br />

estimates for<br />

the Year<br />

…….<br />

(Rs.)<br />

Actuals<br />

during the<br />

month of<br />

…….<br />

(Rs.)<br />

Upto the end<br />

of month ..<br />

(Rs.)<br />

0028<br />

0029<br />

0035<br />

0041<br />

0042<br />

0045<br />

Part-I PANCHAYAT FUND<br />

REVENUE ACCOUNT-RECEIPTS<br />

Tax <strong>Receipts</strong><br />

Other Taxes on Income & Expenditure<br />

L<strong>and</strong> Revenue<br />

Taxes on Immovable Property other than<br />

agricultural L<strong>and</strong><br />

Taxes on Vehicles<br />

Taxes on Goods <strong>and</strong> Passengers<br />

Other Taxes <strong>and</strong> Duties on Commodities<br />

<strong>and</strong> Services<br />

Total- Tax <strong>Receipts</strong><br />

2049<br />

2059<br />

2071<br />

2202<br />

2203<br />

2204<br />

2205<br />

2210<br />

Part-I PANCHAYAT FUND<br />

REVENUE ACCOUNT-<br />

EXPENDITURE<br />

Interest <strong>Payments</strong><br />

Public Works<br />

Pension <strong>and</strong> Other Retirement<br />

Benefits<br />

General Education<br />

Technical Education<br />

Sports <strong>and</strong> Youth Services<br />

Art <strong>and</strong> Culture<br />

Medical <strong>and</strong> Public Health<br />

P NP Total P NP Total P NP Tota<br />

l

0049<br />

0059<br />

0071<br />

0202<br />

0210<br />

0211<br />

0215<br />

0216<br />

0401<br />

0405<br />

0406<br />

0515<br />

0702<br />

0801<br />

Non Tax <strong>Receipts</strong><br />

Interest <strong>Receipts</strong><br />

Public Works<br />

Contribution <strong>and</strong> Recoveries towards Pension<br />

<strong>and</strong> Other Retirements Benefits.<br />

Education, Sports, Art <strong>and</strong> Culture<br />

Medical <strong>and</strong> Public Health<br />

Family Welfare<br />

Water Supply <strong>and</strong> Sanitation<br />

Housing<br />

Crop Husb<strong>and</strong>ry<br />

Fisheries<br />

<strong>For</strong>estry <strong>and</strong> Wild Life<br />

Other Rural Development Programmes<br />

Minor Irrigation<br />

Power<br />

Total- Non Tax <strong>Receipts</strong><br />

TOTAL- REVENUE RECEIPTS<br />

22<br />

2211<br />

2215<br />

2216<br />

2225<br />

2235<br />

2236<br />

2401<br />

2402<br />

2403<br />

2406<br />

2408<br />

2501<br />

2505<br />

2515<br />

2702<br />

2801<br />

2810<br />

2851<br />

3054<br />

Family Welfare<br />

Water Supply <strong>and</strong> Sanitation<br />

Housing<br />

Welfare of Scheduled Castes,<br />

Scheduled Tribes <strong>and</strong> Other<br />

Backward Classes.<br />

Social Security <strong>and</strong> Welfare<br />

Nutrition<br />

Crop Husb<strong>and</strong>ry<br />

Soil <strong>and</strong> Water Conservation<br />

Animal Husb<strong>and</strong>ry<br />

<strong>For</strong>estry <strong>and</strong> Wild Life<br />

Food Storage <strong>and</strong> Warehousing<br />

Special Programmes for Rural<br />

Development<br />

Rural Employment<br />

Other Rural Development<br />

Programmes<br />

Minor Irrigation<br />

Power<br />

Non Conventional Sources of Energy<br />

Village <strong>and</strong> Small Industries<br />

Roads <strong>and</strong> Bridges<br />

TOTAL-REVENUE EXPENDITURE

1601<br />

1604<br />

4000<br />

GRANTS-IN-AID & CONTRIBUTION<br />

Grants-in-aid/Assistance from Central/State<br />

Government.<br />

(Scheme wise details may be given under this head)<br />

Less Transfer to Block Panchayat/ Village Panchayat in<br />

case of <strong>Zilla</strong> Parishads<br />

Compensation <strong>and</strong> Assignments from state<br />

Government.<br />

(Minor head, scheme & detail head may also be shown<br />

under this head)<br />

Less Transfer to Block Panchayat/ Village Panchayat in<br />

case of <strong>Zilla</strong> Parishads<br />

Total Grants-in-aid & Contribution.<br />

CAPITAL ACCOUNT - RECEIPTS<br />

Capital <strong>Receipts</strong><br />

(To be included as per local needs. This would include<br />

proceeds from sale from Panchayat L<strong>and</strong>s etc.)<br />

TOTAL - CAPITAL RECEIPTS<br />

23<br />

4059<br />

4202<br />

4210<br />

4211<br />

4215<br />

4225<br />

4235<br />

4405<br />

4408<br />

4515<br />

4702<br />

4801<br />

4810<br />

5054<br />

CAPITAL ACCOUNT-<br />

EXPENDITURE<br />

Capital Outlay on Public Works<br />

Capital Outlay on Education, Sports,<br />

Art <strong>and</strong> Culture<br />

Capital Outlay on Medical <strong>and</strong> Public<br />

Health<br />

Capital Outlay on Family Welfare<br />

Capital Outlay on Water Supply <strong>and</strong><br />

Sanitation<br />

Capital Outlay on Welfare of SCs/STs<br />

& Other Backward Classes<br />

Capital Outlay on Social Security <strong>and</strong><br />

Welfare<br />

Capital outlay on Fisheries<br />

Capital outlay on Food Storage <strong>and</strong><br />

Warehousing<br />

Capital Outlay on Other Rural<br />

development programmes<br />

Capital outlay on Minor Irrigation<br />

Capital outlay on Power Projects<br />

Capital Outlay on Non-Conventional<br />

Sources of Energy<br />

Capital Outlay on Roads <strong>and</strong> Bridges<br />

TOTAL-CAPITAL EXPENDITURE

LOANS & ADVANCES<br />

DEBT<br />

6003<br />

Internal Debt<br />

6004<br />

Loans <strong>and</strong> Advances from Central Govt./ State<br />

Govt.<br />

TOTAL DEBT<br />

7610<br />

Loans to Panchayat employees etc.<br />

TOTAL-LOANS & ADVANCES<br />

TOTAL:PART-I PANCHAYAT FUND<br />

* These depict disbursals<br />

24<br />

6003<br />

6004<br />

6202<br />

6401<br />

6515<br />

7610<br />

LOANS AND ADVANCES<br />

DEBT<br />

Internal Debt*<br />

Loans <strong>and</strong> Advances from Central<br />

Govt./State Government*<br />

TOTAL DEBT<br />

Loans for Education, Sport, Art<br />

<strong>and</strong> Culture<br />

Loans for Crop Husb<strong>and</strong>ry<br />

Loans for other Rural<br />

Development Programmes<br />

Loans to Panchayat Employees<br />

etc.<br />

TOTAL-LOANS AND ADVANCES<br />

TOTAL PART I - PANCHAYAT<br />

FUND

8009<br />

8011<br />

8443<br />

8448<br />

8550<br />

8782<br />

25<br />

PART-II<br />

PROVIDENT FUNDS ETC.<br />

Actuals During<br />

the Month<br />

…..Rs.<br />

Upto the end of<br />

Month…. Rs.<br />

PART - II<br />

PROVIDENT FUNDS ETC.<br />

Provident Funds<br />

8009<br />

Provident Fund<br />

Insurance <strong>and</strong> Pension Funds<br />

8011<br />

Insurance <strong>and</strong> Pension Funds<br />

Total: Provident Funds etc.<br />

TOTAL: PROVIDENT FUNDS ETC.<br />

DEPOSITS & ADVANCES<br />

DEPOSITS AND ADVANCES<br />

Deposits<br />

Deposits<br />

8443<br />

Civil Deposits<br />

Civil Deposits<br />

Deposits of Local Funds<br />

Total: Deposits<br />

ADVANCES<br />

Civil Advances<br />

TOTAL:DEPOSITS & ADVANCES<br />

REMITTANCES<br />

Cash Remittances between <strong>Zilla</strong> Parishad &<br />

Panchayat Samiti/Village Panchayat<br />

8550<br />

8782<br />

Advances<br />

Civil Advances<br />

TOTAL:DEPOSITS AND ADVANCES<br />

REMITTANCES<br />

Cash remittances between <strong>Zilla</strong><br />

Parishad <strong>and</strong> Panchayat Samiti/<br />

Village Panchayat<br />

TOTAL:REMITTANCES<br />

TOTAL : PART-II<br />

Closing Balance<br />

TOTAL REMITTANCES<br />

Cash in H<strong>and</strong><br />

TOTAL - PART-II<br />

Cash in Bank<br />

Cash in Treasury<br />

Investments<br />

GRAND TOTAL GRAND TOTAL<br />

Actuals During the<br />

Month …..Rs<br />

Upto the end of<br />

Month…. Rs.

26<br />

Closing Balance as intimated by the Bank/Treasury vide<br />

No………..… dated ……..…..<br />

Add :<br />

(i) Details of Cheques etc. received <strong>and</strong> on h<strong>and</strong> but<br />

not deposited with Treasury/Bank.<br />

(ii) Details of Cheques etc. issued but not yet encashed<br />

from Bank/treasury.<br />

Monthly Reconciliation Statement<br />

ZP/PS/VP for Month of …..year….<br />

With Bank (Rs.) With Treasury (Rs.)<br />

<strong>For</strong>m - 7<br />

Deduct :<br />

Details of Cheques etc. credited directly into the Bank/<br />

Treasury but not taken into the Cash Book<br />

Balance as per Cash Book as derived<br />

Closing Balance as per Cash Book in actual<br />

Amount of Difference<br />

Details of Difference<br />

Details of difference between the Actual Cash Book Balance <strong>and</strong> the Cash Book Balance as per reconciliation has been personally<br />

verified <strong>and</strong> satisfied or personally verified <strong>and</strong> follow up action has been initiated <strong>and</strong> all concerned authorities intimated.<br />

Cashier <strong>Of</strong>ficer in charge

27<br />

<strong>For</strong>m-8<br />

Zila Parishad/ Panchayat Samiti/ Village Panchayat<br />

Cash Book of ……………… for the month of ………………<br />

<strong>For</strong>m-8<br />

Date No. of<br />

Item(s)<br />

(Voucher<br />

No.)<br />

<strong>Receipts</strong> <strong>Payments</strong><br />

Amount<br />

Particulars with<br />

reference to<br />

receipts,<br />

challans,<br />

cheques, etc.<br />

Classification Date No. of<br />

Items(s)<br />

(voucher<br />

No.)<br />

Particulars Amount<br />

Classification<br />

(Rs.)<br />

Cash Treasury<br />

PL<br />

<strong>Account</strong><br />

( Rs. )<br />

Bank Cash No.of<br />

Cheque<br />

Total Receipt Total Disbursement<br />

To opening balance By Closing Balance<br />

Gr<strong>and</strong> Total Gr<strong>and</strong> Total<br />

Treasury<br />

PL<br />

<strong>Account</strong><br />

Bank<br />

Cashier <strong>Of</strong>ficer in-charge of the Cash Book<br />

Note : 1. Cash Book to be closed daily.<br />

2. Denomination details of physical balance at the end of the day to be indicated.<br />

3. Certificate that "Closing balance of the cash physically verified <strong>and</strong> found to tally with the closing balance as per "Cash Book" to be<br />

recorded by the officer in charge at the end of the day.

28<br />

Register of Immovable Property<br />

<strong>For</strong>m-9<br />

<strong>Zilla</strong> Parishad/ Panchayat Samiti/ Village Panchayat<br />

Sl.<br />

No.<br />

Date of<br />

acquisition,<br />

purchase,<br />

construction or<br />

transfer<br />

No. <strong>and</strong> date of orders<br />

under which the<br />

property was acquired,<br />

purchased,<br />

constructed/transferred<br />

Description<br />

<strong>and</strong> situation<br />

of property<br />

Purpose for<br />

which utilised<br />

Valuation at the<br />

beginning of the<br />

year*<br />

Revaluation if<br />

any, the date<br />

<strong>and</strong> the actual<br />

amount of<br />

revaluation*<br />

#Depreciation<br />

at the<br />

beginning of<br />