Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

passion<br />

TO DELIVER<br />

SUNTEC REAL ESTATE INVESTMENT TRUST<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

1<br />

About <strong>Suntec</strong> <strong>REIT</strong><br />

Listed on 9 December 2004 on Singapore Exchange Securities Trading Limited (the “SGX-ST”),<br />

<strong>Suntec</strong> Real Estate Investment Trust ("<strong>Suntec</strong> <strong>REIT</strong>") is the first composite <strong>REIT</strong> in Singapore, owning<br />

income-producing real estate that is primarily used <strong>for</strong> retail and/or office purposes.<br />

As at 31 December <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong>’s portfolio comprises office and retail properties in <strong>Suntec</strong><br />

City, Park Mall, Chijmes, a one-third interest in One Raffles Quay and a one-third interest in<br />

Marina Bay Financial Centre Towers 1 and 2 and the Marina Bay Link Mall, all strategically located<br />

in the growth corridors of Marina Bay and the Civic and Cultural District within Singapore’s central<br />

business district. <strong>Suntec</strong> <strong>REIT</strong> also owns a 20 percent interest in <strong>Suntec</strong> Singapore International<br />

Convention & Exhibition Centre.<br />

<strong>Suntec</strong> <strong>REIT</strong> is managed by an external manager, ARA Trust Management (<strong>Suntec</strong>) Limited<br />

(the "Manager"). The Manager is focused on delivering regular and stable distributions to <strong>Suntec</strong><br />

<strong>REIT</strong>’s unitholders, and to achieve long-term growth in the net asset value per unit of <strong>Suntec</strong> <strong>REIT</strong>,<br />

so as to provide unitholders with a competitive rate of return on their investment.<br />

About ARA Trust Management<br />

(<strong>Suntec</strong>) Limited<br />

The Manager is a wholly-owned subsidiary of ARA Asset Management Limited (“ARA”), a real<br />

estate fund management company listed on the Main Board of the SGX-ST, and is an affiliate of<br />

the multinational conglomerate Cheung Kong Group.<br />

ARA currently manages <strong>REIT</strong>s listed in Singapore, Hong Kong and Malaysia with a diversified<br />

portfolio spanning the office, retail and industrial/office sectors, as well as private real estate<br />

funds investing in real estate in Asia. ARA also provides real estate management services,<br />

including property management services, convention & exhibition services and corporate<br />

finance advisory services. As at 31 December <strong>2010</strong>, ARA's total assets under management was<br />

approximately S$16.9 billion.<br />

The Manager is responsible <strong>for</strong> the management and administration of <strong>Suntec</strong> <strong>REIT</strong>, as well as the<br />

implementation of <strong>Suntec</strong> <strong>REIT</strong>’s strategic long-term growth.<br />

Contents<br />

01 About <strong>Suntec</strong> <strong>REIT</strong><br />

02 Mission Statement<br />

04 Year In Review<br />

06 Chairman’s <strong>Report</strong><br />

08 Financial Highlights<br />

09 Unit Per<strong>for</strong>mance<br />

12 Board Of Directors<br />

18 Management Team<br />

24 Manager’s <strong>Report</strong><br />

30 Property Portfolio<br />

50 Market <strong>Report</strong><br />

52 Investor Communications<br />

54 Corporate Governance<br />

64 Financial Contents

2<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

Our Mission<br />

Forging ahead to create, provide<br />

and deliver premium value to all<br />

stakeholders of <strong>Suntec</strong> <strong>REIT</strong>

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

3<br />

In another landmark year, <strong>Suntec</strong> <strong>REIT</strong> has<br />

demonstrated its strength and its<br />

passion to deliver. With the strategic investment<br />

in one of Singapore’s iconic commercial properties,<br />

<strong>Suntec</strong> <strong>REIT</strong> has successfully grown its portfolio<br />

of premier real estate assets to be<br />

one of Singapore’s largest commercial <strong>REIT</strong>s.<br />

This marks a new milestone in our continuing<br />

growth and is a clear testament to our commitment<br />

in delivering long-term value <strong>for</strong> our unitholders.

4<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

Year in Review<br />

S$7.0b<br />

ASSETS UNDER<br />

MANAGEMENT<br />

3.5m sq ft<br />

Portfolio NET<br />

LETTABLE AREA<br />

January<br />

<strong>2010</strong><br />

February<br />

<strong>2010</strong><br />

• Change of address of Unit<br />

Registrar.<br />

June<br />

<strong>2010</strong><br />

• Issue of fifth tranche of<br />

34,500,362 deferred units.<br />

April<br />

<strong>2010</strong><br />

July<br />

<strong>2010</strong><br />

• Achieved distribution income<br />

of S$45.9 million <strong>for</strong> the period<br />

1 April <strong>2010</strong> to 30 June <strong>2010</strong>.<br />

DPU <strong>for</strong> the quarter amounted<br />

to 2.528 cents.<br />

• Achieved distribution income<br />

of S$47.8 million <strong>for</strong> the<br />

period 1 October 2009 to<br />

31 December 2009. Distribution<br />

per unit ("DPU") <strong>for</strong> the quarter<br />

amounted to 2.886 cents.<br />

• Advance distribution of 2.568<br />

cents pursuant to the private<br />

placement of 128,500,000 new<br />

units in <strong>Suntec</strong> <strong>REIT</strong> (“New<br />

Units”) at an issue price of<br />

S$1.19 per New Unit.<br />

• Unitholders approved all<br />

resolutions tabled at the <strong>Suntec</strong><br />

<strong>REIT</strong>’s inaugural annual general<br />

meeting held on 15 April <strong>2010</strong>.<br />

• Unitholders approved the<br />

resolution tabled at the <strong>Suntec</strong><br />

<strong>REIT</strong>’s extraordinary general<br />

meeting held on 15 April <strong>2010</strong><br />

in relation to the <strong>for</strong>m of the<br />

payment of the Manager's asset<br />

management fee.<br />

• Achieved distribution income<br />

of S$45.4 million <strong>for</strong> the period<br />

1 January <strong>2010</strong> to 31 March <strong>2010</strong>.<br />

DPU <strong>for</strong> the quarter amounted<br />

to 2.513 cents.<br />

October<br />

<strong>2010</strong><br />

• <strong>Suntec</strong> <strong>REIT</strong> conferred SIAS<br />

“Most Transparent Company”<br />

award <strong>2010</strong> (Runner-Up,<br />

<strong>REIT</strong>s Category).<br />

• <strong>Suntec</strong> <strong>REIT</strong> secured S$700 million<br />

term loan facility.<br />

• Announced the proposed<br />

acquisition of a one-third interest<br />

in Marina Bay Financial Centre<br />

Towers 1 and 2 and the Marina Bay<br />

Link Mall (the “MBFC Properties”).

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

5<br />

98.8%<br />

office committed<br />

occupancy<br />

98.0%<br />

retail committed<br />

occupancy<br />

• Achieved distribution income<br />

of S$46.2 million <strong>for</strong> the period<br />

1 July <strong>2010</strong> to 30 September<br />

<strong>2010</strong>. DPU <strong>for</strong> the quarter<br />

amounted to 2.502 cents.<br />

December<br />

<strong>2010</strong><br />

• Appointment of Mr. Chen<br />

Wei Ching, Vincent as<br />

Independent Director and<br />

audit committee member.<br />

November<br />

<strong>2010</strong><br />

• Completion of the acquisition of<br />

a one-third interest in the MBFC<br />

Properties on 9 December <strong>2010</strong>.<br />

• Issue of the last tranche of<br />

34,500,360 deferred units.<br />

• Moody's corporate family rating<br />

<strong>for</strong> <strong>Suntec</strong> <strong>REIT</strong> revised to Baa2,<br />

with Rating Outlook restored<br />

to Stable.<br />

• Unitholders approved the<br />

resolution tabled at the <strong>Suntec</strong><br />

<strong>REIT</strong>’s extraordinary general<br />

meeting held on 26 November<br />

<strong>2010</strong> in relation to the proposed<br />

acquisition of the MBFC Properties.<br />

• Launch of private placement<br />

of 313,000,000 new units in<br />

<strong>Suntec</strong> <strong>REIT</strong> (the “Private<br />

Placement”), which was 3.1 times<br />

oversubscribed.<br />

• Advance distribution of<br />

1.723 cents pursuant to<br />

the private placement of<br />

313,000,000 new units in<br />

<strong>Suntec</strong> <strong>REIT</strong> (“Placement Units”)<br />

at an issue price of S$1.37 per<br />

Placement Unit.<br />

• Change in Company Secretary.

6<br />

PASSION <strong>Suntec</strong> reit TO DELIVER<br />

<strong>Suntec</strong> annual reit report annual <strong>2010</strong>report <strong>2010</strong><br />

With the distribution per unit of 9.859 cents <strong>for</strong><br />

<strong>FY</strong> <strong>2010</strong>, the average annual return <strong>for</strong> <strong>Suntec</strong> <strong>REIT</strong><br />

unitholders was 14.7% since listing

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

7<br />

Chairman’s <strong>Report</strong><br />

We have further strengthened our foothold in the Marina Bay<br />

precinct, underpinned by a strong 2.4 million sq ft office portfolio<br />

and 1.1 million sq ft retail portfolio strategically located in the<br />

heart of Singapore’s Central Business District<br />

Dear Unitholders,<br />

On behalf of the Board of ARA Trust<br />

Management (<strong>Suntec</strong>) Limited, the<br />

manager of <strong>Suntec</strong> <strong>REIT</strong> (the “Manager”),<br />

I am pleased to present the annual report<br />

of <strong>Suntec</strong> <strong>REIT</strong> <strong>for</strong> the financial year<br />

ended 31 December <strong>2010</strong> ("<strong>FY</strong> <strong>2010</strong>").<br />

<strong>2010</strong> marked yet another significant<br />

year <strong>for</strong> <strong>Suntec</strong> <strong>REIT</strong>. During the year we<br />

acquired a one-third interest in the Marina<br />

Bay Financial Centre Towers 1 and 2 and<br />

the Marina Bay Link Mall (the “MBFC<br />

Properties”) and successfully secured more<br />

than S$2.2 billion of financing.<br />

With the strong recovery of the Singapore<br />

economy in <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong>’s distribution<br />

income <strong>for</strong> <strong>FY</strong> <strong>2010</strong> was S$182.5 million,<br />

giving unitholders a distribution per unit<br />

of 9.859 cents or an annual yield of 6.6%<br />

<strong>for</strong> the year.<br />

Acquisition of an Iconic Landmark<br />

Development<br />

In December <strong>2010</strong>, we acquired a onethird<br />

interest in the MBFC Properties at a<br />

purchase price of S$1,495.8 million with<br />

income support (the “MBFC Acquisition”).<br />

The net effective price was S$2,400 psf<br />

excluding income support.<br />

The Marina Bay Financial Centre is an<br />

iconic landmark development located in<br />

the heart of Singapore’s new business<br />

and financial district. With the MBFC<br />

Acquisition, we have further strengthened<br />

our foothold in the Marina Bay precinct,<br />

underpinned by a strong 2.4 million sq ft<br />

office portfolio and 1.1 million sq ft retail<br />

portfolio strategically located in the heart<br />

of Singapore’s central business district.<br />

In <strong>FY</strong> <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong> has grown its assets<br />

under management from approximately<br />

S$5.2 billion to approximately S$7.0<br />

billion, to be one of Singapore’s largest<br />

commercial <strong>REIT</strong>s.<br />

Prudent and Proactive Capital<br />

Management<br />

In October <strong>2010</strong>, we entered into a S$700<br />

million term loan facility to refinance<br />

existing loans to further improve<br />

<strong>Suntec</strong> <strong>REIT</strong>’s overall financing cost and<br />

strengthened our debt maturity profile.<br />

In addition, <strong>Suntec</strong> <strong>REIT</strong> successfully raised<br />

S$1.5 billion <strong>for</strong> the financing of the<br />

acquisition of the MBFC Properties in<br />

December <strong>2010</strong>. This comprised a S$1.1<br />

billion term loan facility and S$428.8 million<br />

raised through a private placement at a<br />

tight discount of 2.88% to the adjusted<br />

volume weighted average price.<br />

As at 31 December <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong>’s<br />

total debt portfolio amounted to S$2.58<br />

billion, and our gearing ratio was 38.4%<br />

with an average all-in financing cost of<br />

3.49% <strong>for</strong> the year.<br />

Resilient Financial and Operating<br />

Per<strong>for</strong>mance<br />

The underlying income streams from our<br />

properties remained resilient. As at end<br />

<strong>FY</strong> <strong>2010</strong>, we achieved strong committed<br />

portfolio occupancy of 98.8% <strong>for</strong> our<br />

office properties and 98.0% <strong>for</strong> our retail<br />

properties. In particular, <strong>Suntec</strong> City<br />

office occupancy recorded six straight<br />

quarters of growth since June 2009 to<br />

achieve a committed occupancy of 99.1%<br />

as at 31 December <strong>2010</strong>.<br />

Notwithstanding the continuing<br />

challenges of the office and retail sectors,<br />

<strong>Suntec</strong> <strong>REIT</strong> achieved a distribution<br />

income of S$182.5 million <strong>for</strong> the year.<br />

With the distribution per unit of 9.859<br />

cents <strong>for</strong> <strong>FY</strong> <strong>2010</strong>, the average annual<br />

return <strong>for</strong> <strong>Suntec</strong> <strong>REIT</strong> unitholders was<br />

14.7% since listing.<br />

Well-positioned amid Positive<br />

Outlook<br />

Going <strong>for</strong>ward, the economic outlook<br />

<strong>for</strong> Singapore is expected to remain<br />

positive <strong>for</strong> 2011. The Ministry of Trade<br />

and Industry expects Singapore’s 2011<br />

economic growth to be between 4.0%<br />

and 6.0%, which will continue to support<br />

a steady recovery in the Singapore<br />

commercial property market.<br />

For 2011, with the strengthening office<br />

market, we expect the negative rental<br />

reversions of our office portfolio to<br />

bottom-out by the year-end.<br />

Barring any un<strong>for</strong>eseen circumstances, we<br />

expect to deliver the <strong>for</strong>ecast distribution<br />

per unit <strong>for</strong> the financial year 2011 as<br />

stated in the circular to <strong>Suntec</strong> <strong>REIT</strong><br />

unitholders dated 8 November <strong>2010</strong>.<br />

Awards and Accolades<br />

During the year, <strong>Suntec</strong> <strong>REIT</strong> received<br />

a Runner-up Award <strong>for</strong> the “Most<br />

Transparent Company Award <strong>2010</strong>”<br />

under the <strong>REIT</strong>s category in the SIAS<br />

Investors’ Choice Awards <strong>2010</strong>. This is the<br />

fifth year that <strong>Suntec</strong> <strong>REIT</strong> has achieved<br />

the award in recognition of its good<br />

corporate transparency practices.<br />

We have also achieved a Gold Award at<br />

the International GALAXY <strong>2010</strong> Awards<br />

competition <strong>for</strong> the <strong>Suntec</strong> <strong>REIT</strong> <strong>Annual</strong><br />

<strong>Report</strong> 2009.<br />

In Appreciation<br />

I would like to convey my appreciation<br />

to the members of the Board <strong>for</strong> their<br />

invaluable contributions during the year<br />

and to welcome Mr. Chen Wei Ching,<br />

Vincent, who has joined the Board as an<br />

Independent Director with effect from<br />

1 October <strong>2010</strong>. I would also like to thank<br />

the management team of the Manager<br />

<strong>for</strong> their hard work and dedication in<br />

the year in delivering the per<strong>for</strong>mance of<br />

the <strong>REIT</strong>. Last but not least, I am grateful<br />

to our unitholders, tenants, business<br />

partners and stakeholders <strong>for</strong> your<br />

strong support.<br />

Chiu Kwok Hung, Justin<br />

Chairman and Director<br />

28 February 2011

8<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

Financial Highlights<br />

Consolidated Profit and Loss Statement <strong>for</strong> the Financial YEAR <strong>2010</strong> 2009<br />

Gross Revenue S$249.5m S$253.1m<br />

Net Property Income S$193.1m S$192.2m<br />

Income Contribution from Jointly Controlled Entities 1 S$45.3m S$49.9m<br />

Income Available For Distribution S$182.5m S$189.6m<br />

Distribution Per Unit ("DPU") 2 9.86¢ 11.70¢<br />

Fully Diluted DPU 3 9.61¢ 10.92¢<br />

Notes:<br />

1<br />

Comprises other income, dividend income and interest income from the jointly controlled entities.<br />

2<br />

For financial year ("<strong>FY</strong>") 2009, DPU does not take into account 69,000,722 deferred units payable to <strong>Suntec</strong> City Development Pte Ltd, the remaining two equal instalments<br />

which have been issued on 9 June <strong>2010</strong> and 9 December <strong>2010</strong>.<br />

3<br />

The deferred units totaling 207,002,170 units have been issued in six equal half-yearly instalments, with the first instalment issued on 9 June 2008 and the last instalment<br />

issued on 9 December <strong>2010</strong>. The deferred units were issued at the <strong>Suntec</strong> <strong>REIT</strong> initial public offering price of S$1.00 per unit. The "Fully Diluted DPU" illustrates the pro-<strong>for</strong>ma<br />

DPU assuming that all the deferred units had been issued on 9 December 2004.<br />

Consolidated Balance Sheet as at 31 Dec <strong>2010</strong> 31 DEC 2009<br />

Investment Properties S$4,452.0m S$4,202.0m<br />

Interest In Jointly Controlled Entities 1 S$2,039.7m S$ 881.0m<br />

Total Assets S$6,652.1m S$5,169.9m<br />

Debt At Amortised Cost S$2,554.6m S$1,721.7m<br />

Total Liabilities S$2,667.4m S$1,842.0m<br />

Unitholders’ Funds S$3,984.6m S$3,327.9m<br />

Net Asset Value Per Unit S$1.80 S$1.78<br />

Debt-to-Asset Ratio 2 38.4% 33.3%<br />

Notes:<br />

1<br />

Arising from the acquisition of a one-third interest in One Raffles Quay through the purchase of the entire issued share capital of Comina Investment Limited in 2007, the<br />

acquisition of a 20 percent interest in <strong>Suntec</strong> Singapore International Convention & Exhibition Centre through the its wholly-owned subsidiary <strong>Suntec</strong> Harmony Pte. Ltd.<br />

in 2009 and the acquisition of a one-third interest in the Marina Bay Financial Centre Towers 1 and 2 and the Marina Bay Link Mall through the purchase of one-third of<br />

the issued share capital of BFC Development Pte. Ltd. in <strong>2010</strong>.<br />

2<br />

Based on debt at amortised cost. <strong>Suntec</strong> <strong>REIT</strong>’s “Aggregate Leverage Ratio”, which refers to the ratio of the value of borrowings (inclusive of proportionate share of<br />

borrowings of jointly controlled entities) and deferred payments (if any) to the value of the Deposited Property in accordance with Appendix 2 of the Code on Collective<br />

Investments Schemes issued by the Monetary Authority of Singapore was 40.4% and 34.6% as at 31 December <strong>2010</strong> and 31 December 2009 respectively.<br />

STRONG GROWTH AND PERFORMANCE TRACK RECORD SINCE LISTING<br />

S$ b<br />

Assets Under Management<br />

S$ m<br />

Income Available <strong>for</strong> Distribution<br />

8.0<br />

7.0<br />

7.0<br />

200<br />

167.7<br />

189.6<br />

182.5<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

2.2 2.3<br />

3.2<br />

4.6<br />

5.4<br />

5.2<br />

150<br />

100<br />

50<br />

87.1<br />

99.8<br />

122.1<br />

1.0<br />

0<br />

Dec 04 Sep 05 Sep 06 Sep 07 Dec 08 Dec 09 Dec 10<br />

0<br />

<strong>FY</strong> 2005 <strong>FY</strong> 2006 <strong>FY</strong> 2007 <strong>FY</strong> 2008 <strong>FY</strong> 2009 <strong>FY</strong> <strong>2010</strong>

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

9<br />

Unit Per<strong>for</strong>mance<br />

Unit Per<strong>for</strong>mance as at 1 <strong>2010</strong> 2009 2008 2007 2006<br />

Last Done Unit Price S$1.50 S$1.35 S$0.71 S$1.71 S$1.82<br />

Highest Unit Price S$1.56 S$1.37 S$1.69 S$2.10 S$1.82<br />

Lowest Unit Price S$1.23 S$0.495 S$0.575 S$1.55 S$1.08<br />

Market Capitalisation 2 (m) S$3,308 S$2,426 S$1,116 S$2,542 S$2,588<br />

Traded Volume <strong>for</strong> the Financial Year (m) 1,618 2,244 1,782 2,149 1,198<br />

Notes:<br />

1<br />

Unit per<strong>for</strong>mance statistics are <strong>for</strong> the financial years ended 31 December.<br />

2<br />

Based on 1,422 million units, 1,487 million units, 1,571 million units, 1,797 million units and 2,205 million units in issue as at 31 December 2006, 2007, 2008, 2009<br />

and <strong>2010</strong> respectively.<br />

Comparative Yield Statistics (%)<br />

<strong>for</strong> the Financial Year <strong>2010</strong> 2009 2008 2007 2006<br />

Traded Yield (based on DPU 1 ) 6.57 8.67 15.53 4.95 4.15<br />

Traded Yield (based on Fully Diluted DPU 1,2 ) 6.40 8.09 13.84 4.33 3.59<br />

Singapore Government 10-Year Bond 3 2.71 2.66 2.05 2.68 3.05<br />

Notes:<br />

1<br />

Based on the last done unit price (as stated in the table above) and the full year DPU based on the period from 1 January to 31 December. Calculations were based on a DPU<br />

of 7.56 cents, 8.47 cents, 11.02 cents, 11.70 cents and 9.86 cents, and a Fully Diluted DPU of 6.53 cents, 7.40 cents, 9.83 cents, 10.92 cents and 9.61 cents <strong>for</strong> <strong>FY</strong> 2006, <strong>FY</strong> 2007,<br />

<strong>FY</strong> 2008, <strong>FY</strong> 2009 and <strong>FY</strong> <strong>2010</strong> respectively.<br />

2<br />

The deferred units totaling 207,002,170 units have been issued in six equal half-yearly instalments, with the first instalment issued on 9 June 2008 and the last instalment issued<br />

on 9 December <strong>2010</strong>. The deferred units were issued at the <strong>Suntec</strong> <strong>REIT</strong> initial public offering price of S$1.00 per unit. The "Fully Diluted DPU" illustrates the pro-<strong>for</strong>ma DPU<br />

assuming that all the deferred units had been issued on 9 December 2004.<br />

3<br />

As at 31 December <strong>for</strong> the respective financial years.<br />

As at 31 December <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong>’s unit price stood at S$1.50, with a market capitalisation of S$3.3 billion. <strong>Suntec</strong> <strong>REIT</strong>’s<br />

<strong>FY</strong> <strong>2010</strong> DPU yield of 6.57% has also outper<strong>for</strong>med the Singapore Government 10-year bond yield at 2.71%. As at end<br />

<strong>FY</strong> <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong> unitholders would have achieved an average annual return of 14.7% since listing. As one of Singapore’s<br />

most liquid listed <strong>REIT</strong>s, the overall traded volume was 1,618 million units <strong>for</strong> the 12 months ended 31 December <strong>2010</strong>.<br />

As at 31 December <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong> is a constituent member of major global indices such as the FTSE NA<strong>REIT</strong>/EPRA Global<br />

Real Estate Index and the Global Property Research (GPR) 250 Index series. It is also a constituent of the FTSE Straits Times<br />

Mid Cap Index (“FSSTI Index”) and FTSE Straits Times Real Estate Index (“FSTRE Index”) in Singapore. <strong>Suntec</strong> <strong>REIT</strong>’s unit price<br />

per<strong>for</strong>mance has marginally outper<strong>for</strong>med both Singapore market indices in <strong>FY</strong> <strong>2010</strong>, at 111% index value compared with<br />

110% and 108% <strong>for</strong> the FSSTI Index and FSTRE Index respectively as at 31 December <strong>2010</strong>.<br />

Relative per<strong>for</strong>mance indices <strong>for</strong> the financial year <strong>2010</strong><br />

Index Value (base 100%)<br />

120%<br />

110%<br />

100%<br />

90%<br />

80%<br />

Dec 09 Jan 10 Feb 10 Mar 10 Apr 10 May 10 Jun 10 Jul 10 Aug 10 Sep 10 Oct 10 Nov 10 Dec 10<br />

<strong>Suntec</strong> <strong>REIT</strong><br />

FSSTI Index<br />

FSTRE Index

10<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong>

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

11<br />

Dedicated to create lasting value<br />

and generate sustainable returns

12<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

Board of Directors<br />

CHIU KWOK HUNG, JUSTIN<br />

Chairman and Director<br />

Mr. Chiu Kwok Hung, Justin is the<br />

Chairman of the Manager. He is also the<br />

Chairman and Non-executive Director of<br />

ARA Asset Management Limited (“ARA”),<br />

the holding company of the Manager,<br />

the Chairman of ARA Asset Management<br />

(Fortune) Limited (the ”manager of<br />

Fortune <strong>REIT</strong>”) and the Chairman of ARA<br />

Asset Management (Prosperity) Limited<br />

(the ”manager of Prosperity <strong>REIT</strong>”). ARA<br />

is listed on Singapore Exchange Securities<br />

Trading Limited (the ”SGX-ST”), Fortune<br />

<strong>REIT</strong> is dual-listed on SGX-ST and the Main<br />

Board of The Stock Exchange of Hong<br />

Kong Limited (”SEHK”), and Prosperity<br />

<strong>REIT</strong> is listed on the Main Board of SEHK.<br />

Mr. Chiu is also a Director of ARA Fund<br />

Management (Asia Dragon) Limited as<br />

the manager of the ARA Asia Dragon<br />

Fund. Mr. Chiu is a member of the 11 th<br />

Shanghai Committee of the Chinese<br />

People's Political Consultative Conference<br />

of the People's Republic of China, a Fellow<br />

of The Hong Kong Institute of Directors,<br />

a Fellow of Hong Kong Institute of Real<br />

Estate Administrators and a member of<br />

the Board of Governors of Hong Kong<br />

Baptist University Foundation.<br />

Mr. Chiu has more than 30 years of<br />

international experience in real estate<br />

in Hong Kong and various countries<br />

and is one of the most respected<br />

professionals in the property industry<br />

in Asia. Mr. Chiu is an Executive Director<br />

of Cheung Kong (Holdings) Limited<br />

(“Cheung Kong”), a company listed on<br />

the Main Board of SEHK. He joined<br />

Cheung Kong in 1997 and has been an<br />

Executive Director since 2000, heading<br />

the real estate sales, marketing and<br />

property management teams. Prior to<br />

joining Cheung Kong, Mr. Chiu was with<br />

Sino Land Company Limited from 1994<br />

to 1997 and Hang Lung Development<br />

Company, Limited (now known as Hang<br />

Lung Group Limited) from 1979 to 1994<br />

responsible <strong>for</strong> the leasing and property<br />

management in both companies. Both<br />

Sino Land Company Limited and Hang<br />

Lung Group Limited are listed on the<br />

Main Board of SEHK.<br />

Mr. Chiu holds Bachelor degrees in<br />

Sociology and Economics from Trent<br />

University in Ontario, Canada.<br />

LIM HWEE CHIANG, JOHN<br />

Director<br />

Mr. Lim is a Director of the Manager.<br />

He is also the Group Chief Executive<br />

Officer and an Executive Director of<br />

ARA, the holding company of the<br />

Manager, which is listed on the SGX-ST.<br />

He has been the Group Chief Executive<br />

Officer and a Director of ARA since<br />

its establishment in 2002. He is also a<br />

Director of the manager of Fortune <strong>REIT</strong>,<br />

the manager of Prosperity <strong>REIT</strong>, Am ARA<br />

<strong>REIT</strong> Managers Sdn Bhd, the manager of<br />

Malaysia-listed AmFIRST <strong>REIT</strong>, ARA-CWT<br />

Trust Management (Cache) Limited,<br />

the manager of Singapore-listed Cache<br />

Logistics Trust and the Chairman of APM<br />

Property Management Pte. Ltd., <strong>Suntec</strong><br />

Singapore International Convention<br />

& Exhibition Services Pte. Ltd and the<br />

management council of Management<br />

Corporation Strata Title Plan No. 2197<br />

(<strong>Suntec</strong> City). In addition, Mr. Lim is an<br />

Independent Director and member of<br />

the audit committee of Singapore-listed<br />

Teckwah Industrial Corporation Limited.<br />

He is also the Vice President of the Hong<br />

Kong-Singapore Business Association,<br />

the Senior Vice President of the Asian<br />

Public Real Estate Association, a council<br />

member of the Singapore Chinese<br />

Chamber of Commerce & Industry and a<br />

member of the Valuation Review Board<br />

of the Ministry of Finance of Singapore.<br />

Mr. Lim has close to 30 years of experience<br />

in real estate. Prior to founding ARA,<br />

from 1997 to 2002, he was an Executive<br />

Director of GRA (Singapore) Pte. Ltd., a<br />

wholly-owned subsidiary of Prudential<br />

(US) Real Estate Investors. From 1996 to<br />

1997, he founded and was the Managing<br />

Director of The Land Managers (S)<br />

Pte. Ltd., a Singapore-based property<br />

and consulting firm specialising in<br />

feasibility studies, marketing and leasing<br />

management in Singapore, Hong Kong<br />

and China. He was the General Manager<br />

of the Singapore Labour Foundation<br />

Management Services Pte. Ltd. from<br />

1991 to 1995, and was with DBS Land<br />

Limited (now part of CapitaLand<br />

Limited) from 1981 to 1990.<br />

Mr. Lim holds a Bachelor of Engineering<br />

(First Class Honours) in Mechanical<br />

Engineering, a Master of Science in<br />

Industrial Engineering, as well as a<br />

Diploma in Business Administration,<br />

each from the National University<br />

of Singapore.

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

13<br />

IP TAK CHUEN, EDMOND<br />

Director<br />

Mr. Ip Tak Chuen, Edmond is a Director of<br />

the Manager. He is also a Non-executive<br />

Director of ARA, the holding company<br />

of the Manager, and a Director of the<br />

manager of Fortune <strong>REIT</strong>. ARA is listed<br />

on SGX-ST and Fortune <strong>REIT</strong> is duallisted<br />

on SGX-ST and the Main Board<br />

of SEHK.<br />

Mr. Ip has been an Executive Director<br />

of Cheung Kong since 1993 and<br />

Deputy Managing Director since 2005,<br />

responsible <strong>for</strong> overseeing all financial<br />

and treasury functions of Cheung Kong<br />

and its subsidiaries, particularly in the<br />

fields of corporate and project finance.<br />

He has been an Executive Director of<br />

Cheung Kong Infrastructure Holdings<br />

Limited (“CK Infrastructure”) since<br />

its incorporation in 1996 and Deputy<br />

Chairman since 2003, and the Senior Vice<br />

President and Chief Investment Officer<br />

of CK Life Sciences Int’l., (Holdings)<br />

Inc. (“CK Life Sciences”) since 2002. He<br />

oversees matters relating to corporate<br />

finance, strategic acquisition and<br />

investment of both CK Infrastructure<br />

and CK Life Sciences. Mr. Ip is also a<br />

Non-executive Director of TOM Group<br />

Limited (“TOM”), AVIC International<br />

Holding (HK) Limited ("AVIC"), Excel<br />

Technology International Holdings<br />

Limited ("Excel"), Ruinian International<br />

Limited ("Ruinian") and Shougang<br />

Concord International Enterprises<br />

Company Limited ("Shougang").<br />

Cheung Kong, CK Infrastructure, CK<br />

Life Sciences, TOM, AVIC, Ruinian and<br />

Shougang are listed on the Main Board<br />

of SEHK. Excel is listed on the Growth<br />

Enterprise Market (GEM) of SEHK. Prior<br />

to joining Cheung Kong, Mr. Ip held a<br />

number of senior financial positions<br />

in major financial institutions and<br />

has extensive experience in the Hong<br />

Kong financial market covering diverse<br />

activities such as banking, capital<br />

markets, corporate finance, securities<br />

brokerage and portfolio investments.<br />

Mr. Ip holds a Bachelor of Arts degree<br />

in Economics and a Master of Science<br />

degree in Business Administration.<br />

TAN KIAN CHEW<br />

Independent Director<br />

Mr. Tan is an Independent Director<br />

and Chairman of the audit committee<br />

of the Manager. He is currently the<br />

Group Chief Executive Officer of NTUC<br />

FairPrice. He served in the Republic<br />

of Singapore’s Navy from 1976 to<br />

1983 and held the position of head<br />

of naval operations from 1980 – 1983.<br />

He left the Navy to join the Singapore<br />

Government’s elite Administrative<br />

Service in 1983 and served in the<br />

Ministry of Trade and Industry. At that<br />

time he was also appointed to the<br />

board of directors of NTUC FairPrice<br />

Co-operative Ltd. In 1988, he was<br />

posted to the Prime Minister’s Office<br />

where he served as the Principal Private<br />

Secretary to the then Deputy Prime<br />

Minister, Mr. Ong Teng Cheong.<br />

Mr. Tan left the Administrative Service<br />

to join NTUC FairPrice in 1992 as its<br />

Assistant General Manager and was<br />

subsequently promoted to Chief<br />

Executive Officer in 1997.<br />

Mr. Tan obtained an Honours degree (First<br />

Class) in Mechanical Engineering from<br />

the University of Aston in Birmingham,<br />

UK. He has also completed the Advance<br />

Management Program at Harvard<br />

University in 2000. Mr. Tan was awarded<br />

a SAF (Overseas) Scholarship in 1972<br />

and was a recipient of the Singapore<br />

Public Administration Medal (Silver)<br />

in 1991.

14<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

Board of Directors<br />

SNG SOW MEI (ALIAS POON SOW MEI)<br />

Independent Director<br />

Mrs. Sng is an Independent Director<br />

and member of the audit committee of<br />

the Manager. Mrs. Sng, who has been<br />

appointed as the Independent Nonexecutive<br />

Director and member of the audit<br />

committee of Cheung Kong Infrastructure<br />

Limited, is also an Independent Director<br />

and member of the audit committee of<br />

the manager of Fortune <strong>REIT</strong>, the manager<br />

of Prosperity <strong>REIT</strong>, a Director of Hutchison<br />

Port Holdings Management Pte. Limited<br />

and a Director of INFA Systems Ltd, a<br />

subsidiary of Singapore Technologies<br />

Electronics Ltd. Since 2001, she has been<br />

the Senior Consultant (International<br />

Business) of Singapore Technologies<br />

Electronics Ltd. Concurrently she is the<br />

Advisor of InfoWave Pte Ltd.<br />

Prior to her appointments with Singapore<br />

Technologies Pte Ltd, where she was<br />

Director, Special Projects (North East Asia)<br />

in 2000 and a Consultant in 2001, Mrs. Sng<br />

was the Managing Director of CapitaLand<br />

Hong Kong Ltd <strong>for</strong> investment in Hong<br />

Kong and the region including Japan and<br />

Taiwan. In Hong Kong from 1983 to 1997,<br />

Mrs. Sng was the Centre Director and<br />

then Regional Director of the Singapore<br />

Economic Development Board and Trade<br />

Development Board respectively. She<br />

was Singapore’s Trade Commissioner in<br />

Hong Kong from 1990 to 1997.<br />

Mrs. Sng, with a Bachelor of Arts<br />

degree from the Nanyang University of<br />

Singapore, has wide experience in various<br />

fields of industrial investment, business<br />

development, strategic and financial<br />

management, especially in property<br />

investment and management. In 1996,<br />

Mrs. Sng was conferred the title of PPA(P)<br />

– Pingat Pentadbiran Awam (Perak),<br />

the Singapore Public Administration<br />

Medal (Silver).<br />

LIM LEE MENG<br />

Independent Director<br />

Mr. Lim is an Independent Director and<br />

member of the audit committee of<br />

the Manager. He is currently a Senior<br />

Partner of RSM Chio Lim LLP, a member<br />

firm of RSM International. Mr. Lim<br />

is also an Independent Director of<br />

Teckwah Industrial Corporation Ltd<br />

(“Teckwah”), Datapulse Technology<br />

Limited (“Datapulse”), Tye Soon Ltd,<br />

Europtronic Group Ltd (“Europtronic”)<br />

and the manager of Fortune <strong>REIT</strong>. He<br />

also serves as the Chairman of the<br />

audit committee of each of Teckwah,<br />

Datapulse, Europtronic and the manager<br />

of Fortune <strong>REIT</strong>.<br />

Mr. Lim is a practising member of the<br />

Institute of Certified Public Accountants<br />

of Singapore, an associate member of<br />

the Institute of Chartered Secretaries<br />

and Administrators and a member of<br />

the Singapore Institute of Directors.<br />

He is also the Chairman of Yio Chu Kang<br />

Citizen Consultative Committee and the<br />

Chairman of the finance committee of<br />

Ang Mo Kio - Yio Chu Kang Town Council.<br />

Mr. Lim graduated from the Nanyang<br />

University of Singapore with a Bachelor of<br />

Commerce (Accountancy) degree in May<br />

1980. He also has a Master of Business<br />

Administration degree from the University<br />

of Hull (1992), a Diploma in Business Law<br />

from the National University of Singapore<br />

(1989) and an ICSA qualification from the<br />

Institute of Chartered Secretaries and<br />

Administrators.<br />

CHEN WEI CHING, VINCENT<br />

Independent Director<br />

Mr. Chen is an Independent Director and<br />

member of the audit committee of the<br />

Manager. Mr. Chen has been managing<br />

his personal and family investments since<br />

1993, and has been an Independent<br />

Director of Transpac Industrial Holdings<br />

Ltd since 2003, currently serving as<br />

Chairman of the audit committee and<br />

Chairman of the nominating committee.<br />

Mr. Chen has more than 20 years of<br />

experience in the banking and finance<br />

industry, having spent 17 years with the<br />

First National Bank of Chicago, Bank<br />

of America, and Banque Francaise du<br />

Commerce Exterieur, and subsequently<br />

co-founded a financial consulting firm<br />

in 1988.<br />

Mr. Chen holds a Bachelor of Science<br />

degree in Industrial Engineering from<br />

Cornell University, and a Master of<br />

Business Administration degree from the<br />

University of Pennsylvania.

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

15<br />

CHOW WAI WAI, JOHN<br />

Non-executive Director<br />

Mr. Chow is a Non-executive Director<br />

of the Manager. He is currently the<br />

Managing Director of Hong Konglisted<br />

Winsor Properties Holdings<br />

Limited, which has operations in Hong<br />

Kong, China and Singapore. He is<br />

also the Managing Director of Winsor<br />

Industrial Corporation Limited, which<br />

has international operations spanning<br />

countries in the US, Europe and Asia,<br />

and he holds directorships in the various<br />

subsidiaries and associated companies of<br />

the Winsor companies. He is an Executive<br />

Director of Hong Kong-listed Wing Tai<br />

Properties Limited and is also a Nonexecutive<br />

Director of Hong Kong-listed<br />

Dah Sing Financial Holdings Limited.<br />

Mr. Chow has more than 30 years of<br />

experience in the property, textile and<br />

clothing businesses. He has served as<br />

Chairman of the Hong Kong Garment<br />

Manufacturers Association and as a<br />

member of the Textile Advisory Board of<br />

the Hong Kong Government.<br />

Mr. Chow received his Bachelor of Arts<br />

(Economics) degree from the University<br />

of British Columbia.<br />

YEO SEE KIAT<br />

Director and Chief Executive Officer<br />

Mr. Yeo is the Chief Executive Officer and<br />

an Executive Director of the Manager.<br />

Mr. Yeo has more than 30 years of<br />

experience in the real estate industry,<br />

managing and overseeing various projects<br />

with Hwa Hong Corporation Limited, The<br />

Wharf Group, Parkway Holdings Limited,<br />

and CapitaLand Limited. He has held<br />

senior management positions over the<br />

last 20 years. Mr. Yeo started his career<br />

in Turquand Young (now Ernst & Young)<br />

and was with the firm from 1976 to 1980.<br />

Mr. Yeo holds a Bachelor of Accountancy<br />

from the University of Singapore and a<br />

Graduate Diploma in Management<br />

Studies from the Singapore Institute of<br />

Management. He is also a fellow of the<br />

Institute of Certified Public Accountants<br />

of Singapore.<br />

Ma Lai Chee, Gerald<br />

Alternate Director<br />

Mr. Ma is an Alternate Director to Mr. Ip<br />

Tak Chuen, Edmond, a Director of the<br />

Manager and the manager of Fortune<br />

<strong>REIT</strong>. He is also a Director of AMTD<br />

Financial Planning Limited, iBusiness<br />

Corporation Limited, CK Communications<br />

Limited, Beijing Net-Infinity Technology<br />

Development Company Limited and<br />

mReferral Corporation (HK) Limited.<br />

He also serves as a Non-executive<br />

Director of the manager of Prosperity<br />

<strong>REIT</strong>, and is an Alternate Director to<br />

Mr. Dominic Lai, Non-executive Director<br />

of Hutchison Telecommunications Hong<br />

Kong Holdings Limited.<br />

Mr. Ma is currently Director, Corporate<br />

Strategy Unit and Chief Manager,<br />

Corporate Business Development at<br />

Cheung Kong. He has over 21 years<br />

of experience in banking, investment<br />

and portfolio management, real estate<br />

development and marketing, as well<br />

as managing IT related ventures and<br />

services. He is a member of the Hospitality<br />

Services Committee of Caritas Hong<br />

Kong and a member of the Finance<br />

Committee of The Scout Association of<br />

Hong Kong. He is also a member of the<br />

President’s Circle of the University of<br />

British Columbia, Canada (“UBC”) and a<br />

member of the Dean’s advisory board <strong>for</strong><br />

the Faculty of Arts of UBC.<br />

Mr. Ma holds a Bachelor of Commerce<br />

degree in Finance and a Master of Arts<br />

degree in Global Business Management.

16<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

driven to per<strong>for</strong>m

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

17<br />

drive

18<br />

<strong>Suntec</strong> reit<br />

annual report <strong>2010</strong><br />

ARA Trust Management (<strong>Suntec</strong>) Limited<br />

Management Team<br />

Onsite photography at rooftop of <strong>Suntec</strong> Tower Four with One Raffles Quay<br />

and Marina Bay Financial Centre in the background.

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

19<br />

From left to right<br />

Janice Phoon - Manager, Asset Management<br />

Elaine Leong - Senior Accountant, Finance<br />

Tan Cheng Cheng - Assistant Manager, Finance<br />

Ng Ee San - Senior Manager, Finance<br />

Richard Tan - Director, Finance<br />

Yeo See Kiat - Chief Executive Officer<br />

Yip Kam Thai - Chief Operating Officer<br />

Marilyn Tan - Manager, Investor Relations<br />

Julia Koh - Manager, Special Projects<br />

Lim Kim Loon - Manager, Asset Management<br />

Chan Chuey Leng - Manager, Asset Management<br />

Jaclyn Chan - Senior Manager, Asset Management

20<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

ARA Trust Management (<strong>Suntec</strong>) Limited<br />

Management Team<br />

Yeo See Kiat<br />

Chief Executive Officer<br />

Mr. Yeo is responsible <strong>for</strong> the<br />

per<strong>for</strong>mance and direction of <strong>Suntec</strong><br />

<strong>REIT</strong>. He leads his team of managers<br />

to achieve the key mission of creating,<br />

adding and delivering premium value to<br />

all stakeholders of <strong>Suntec</strong> <strong>REIT</strong>.<br />

With single-minded focus, he leads<br />

and supports his team of experienced<br />

professionals with a passion and drive<br />

to deliver.<br />

His experience is highlighted in the<br />

section on the Board of Directors.<br />

Yip Kam Thai<br />

Chief Operating Officer<br />

Mr. Yip assists the Chief Executive Officer<br />

on operational matters pertaining to<br />

<strong>Suntec</strong> <strong>REIT</strong>, including asset management,<br />

investment, investor relations and asset<br />

enhancement initiatives.<br />

Mr. Yip has been with the real estate<br />

industry since 1993, and has been with<br />

the ARA Group (“ARA”) since 2004.<br />

Within ARA, he has held various senior<br />

positions in the listed <strong>REIT</strong>s and funds<br />

under management, including Executive<br />

Director of the manager of Fortune <strong>REIT</strong>,<br />

and Acting Chief Executive Officer of<br />

the manager of Prosperity <strong>REIT</strong>. Prior to<br />

his current appointment, he was based<br />

in Hong Kong as the Director and Head<br />

of Asset Management, as well as the<br />

China and Hong Kong Representative<br />

<strong>for</strong> the ARA Asia Dragon Fund.<br />

Mr. Yip holds a Bachelor of Science<br />

(Honours) Degree in Estate Management<br />

from the National University of Singapore.<br />

Richard Tan<br />

Director, Finance<br />

Mr. Tan heads the finance team and<br />

assists the Chief Executive Officer on all<br />

accounting, finance treasury and capital<br />

management functions <strong>for</strong> <strong>Suntec</strong> <strong>REIT</strong>.<br />

Mr. Tan has more than 30 years of<br />

financial management experience in<br />

the banking and IT industries. Prior to<br />

joining the Manager, Mr. Tan was a<br />

Vice President with Wearnes Group,<br />

and previous to that, he was Finance<br />

Director and Business Manager <strong>for</strong><br />

South East Asia in Hewlett-Packard Sales<br />

& Marketing Division.<br />

Mr. Tan also held various senior<br />

positions both in the banking industry<br />

in Singapore and Hong Kong <strong>for</strong><br />

over 18 years. He was the Regional<br />

Finance Director in Schroders and was<br />

the Country Operations Manager <strong>for</strong><br />

American Express Bank Singapore and a<br />

Hong Kong-based investment bank.<br />

Mr. Tan holds a Bachelor of Accountancy<br />

Degree from the University of Singapore.<br />

Jaclyn Chan<br />

Senior Manager, Asset Management<br />

Ms. Chan is a member of the Asset<br />

Management team and assists the Chief<br />

Operating Officer in the monitoring of<br />

the per<strong>for</strong>mance of the assets within the<br />

existing portfolio, and in strategising<br />

and implementing asset enhancement<br />

initiatives.<br />

Ms. Chan has more than 20 years of real<br />

estate experience in areas of property<br />

management and maintenance,<br />

marketing and lease management<br />

of commercial and retail properties.<br />

Prior to joining the Manager, she was<br />

the Centre Manager of a shopping<br />

mall under the management of<br />

CapitaLand Retail Management Pte<br />

Ltd where she was responsible <strong>for</strong><br />

the day-to-day management of the<br />

mall, including leasing, marketing,<br />

operations, asset enhancement and its<br />

financial per<strong>for</strong>mance. She previously<br />

held positions as Vice President of the<br />

Property Department at The Great<br />

Eastern Life Assurance Co Limited,<br />

Marketing Manager of SLF Management<br />

Services Pte Ltd and a Planner with the<br />

Development Control Division of Urban<br />

Redevelopment Authority.<br />

Ms. Chan holds a Bachelor of Science<br />

(Honours) Degree in Estate Management<br />

from the National University of Singapore.<br />

Ng Ee San<br />

Senior Manager, Finance<br />

Ms. Ng is a member of the Finance team,<br />

responsible <strong>for</strong> the finances of <strong>Suntec</strong><br />

<strong>REIT</strong> and provides support in areas of<br />

secretariat compliance, taxation and<br />

treasury.<br />

Ms. Ng has more than 12 years of<br />

experience in accounting and finance.<br />

Prior to joining the Manager, she was<br />

the Finance Manager at Ascott Residence<br />

Trust Management Limited, the Manager<br />

of Ascott Residence Trust. She was<br />

also previously an Accountant at Wing<br />

Tai Holdings Limited and The Hour<br />

Glass Limited, and had held various<br />

positions with PSA Corporation Limited<br />

and Deloitte And Touche.<br />

Ms. Ng holds a Bachelor of Accountancy<br />

(Accounting) Degree from Nanyang<br />

Technological University, Singapore,<br />

and is a Certified Public Accountant.<br />

Janice Phoon<br />

Manager, Asset Management<br />

Ms. Phoon is a member of the Asset<br />

Management team, responsible <strong>for</strong><br />

overseeing and driving the per<strong>for</strong>mance<br />

of the office portfolio of <strong>Suntec</strong> <strong>REIT</strong>.<br />

Ms. Phoon has more than 15 years of<br />

experience in marketing and leasing.<br />

Prior to joining the Manager, she was<br />

the Assistant Marketing Manager of<br />

Riverwalk Promenade Pte Ltd where she<br />

played a key role in marketing and leasing<br />

the TradeMart Singapore complex.<br />

Ms. Phoon holds a Bachelor of<br />

Commerce Degree in Marketing and<br />

Management from Murdoch University,<br />

Western Australia and a Diploma in<br />

Building Management from Ngee Ann<br />

Polytechnic, Singapore.

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

21<br />

Chan Chuey Leng<br />

Manager, Asset Management<br />

Ms. Chan is a member of the Asset<br />

Management team, responsible <strong>for</strong><br />

monitoring the per<strong>for</strong>mance of the retail<br />

assets and overseeing the advertising<br />

and promotional activities and branding<br />

initiatives of the retail portfolio.<br />

Ms. Chan has more than 15 years of<br />

experience in marketing and leasing<br />

of commercial, retail, industrial and<br />

residential properties. Prior to joining<br />

the Manager, she was the Marketing and<br />

Leasing Manager at Cathay Cineleisure<br />

International Pte Ltd. She was previously<br />

the Assistant Marketing Manager with<br />

Tuan Sing Holdings Limited and prior<br />

to that, was the Assistant Marketing<br />

Manager with Riverwalk Promenade<br />

Pte Ltd.<br />

Ms. Chan holds a Bachelor of Science<br />

(Honours) Degree in Estate Management<br />

from the National University of Singapore.<br />

Marilyn Tan<br />

Manager, Investor Relations<br />

Ms. Tan is responsible <strong>for</strong> overseeing the<br />

Investor Relations activities of <strong>Suntec</strong><br />

<strong>REIT</strong>. This includes facilitating the timely<br />

communication of quality in<strong>for</strong>mation to<br />

unitholders, potential investors and key<br />

stakeholders, and providing the Manager<br />

with key market updates. She also provides<br />

support to the Finance team.<br />

Ms. Tan has more than 10 years of work<br />

experience in the areas of investor<br />

relations and equities research in<br />

various sectors including the property<br />

sector. Prior to joining the Manager, she<br />

was an Associate Vice President with<br />

an independent research firm Amba<br />

Research Singapore, and had previously<br />

held an investor relations position with<br />

Keppel Land Limited.<br />

Ms. Tan holds a Bachelor of Business<br />

(Honours) Degree, (Financial Analysis)<br />

from Nanyang Technological University,<br />

Singapore.<br />

Lim Kim Loon<br />

Manager, Asset Management<br />

Ms. Lim is a member of the Asset<br />

Management team, responsible <strong>for</strong><br />

monitoring the per<strong>for</strong>mance of the<br />

retail assets, and in strategising and<br />

implementing asset enhancement<br />

initiatives.<br />

Ms. Lim has close to 15 years of real<br />

estate experience in areas of property<br />

management and maintenance,<br />

marketing and lease management of<br />

commercial and retail properties. Prior<br />

to joining the Manager, she was with<br />

CapitaLand Retail Management Pte<br />

Ltd where she was responsible <strong>for</strong> the<br />

day-to-day management of a shopping<br />

mall. Her responsibilities included<br />

the leasing, marketing, operations,<br />

asset enhancement and financial<br />

per<strong>for</strong>mance. She previously held<br />

positions as Manager of the Property<br />

Department at The Great Eastern Life<br />

Assurance Co Limited and Marketing<br />

Officer of SLF Management Services<br />

Pte Ltd.<br />

Ms. Lim holds a Bachelor of Science<br />

(Honours) Degree in Estate Management<br />

from the National University of Singapore.<br />

Julia Koh<br />

Manager, Special Projects<br />

Ms. Koh is a member of the Special<br />

Projects team who is involved in asset<br />

enhancement works, with more than 15<br />

years of working experience in Quantity<br />

Surveying and Project Management.<br />

Prior to joining the Manager, she<br />

was the Senior Project Executive at<br />

CapitaLand Retail Limited involving<br />

in the redevelopment of Clarke Quay,<br />

reconstruction of Sembawang Shopping<br />

Centre as well as the upgrading of<br />

LOT One Shoppers’ Mall. She was also<br />

the Senior Quantity Executive at Tiong<br />

Seng Contractor Limited involved in<br />

the construction of Guilin View<br />

Condominium.<br />

Ms. Koh holds a Diploma in Building<br />

(Quantity Surveying) from the Singapore<br />

Polytechnic.<br />

Tan Cheng Cheng<br />

Assistant Manager, Finance<br />

Ms. Tan is a member of the Finance<br />

team, assisting in managing the monthly<br />

accounts and preparation of financial<br />

statements and providing support<br />

in areas of secretariat compliance,<br />

taxation and treasury.<br />

Ms. Tan has more than 20 years of<br />

commercial/industrial experience.<br />

Prior to joining the Manager, she<br />

was the Accountant responsible <strong>for</strong><br />

the finance operations of propertyrelated<br />

subsidiaries of United Industrial<br />

Corporation Limited. Ms. Tan also<br />

previously held finance positions in Euro-<br />

Asia Realty Pte Ltd, JDC Holdings (S) Pte<br />

Ltd and Singapore Shipping Corporation<br />

Pte Ltd.<br />

Ms. Tan holds an ACCA Certificate (UK)<br />

and is a Certified Public Accountant.<br />

Elaine Leong<br />

Senior Accountant, Finance<br />

Ms. Leong is a member of the Finance<br />

team, assisting in managing the monthly<br />

accounts and preparation of financial<br />

statements and providing support in<br />

areas of secretariat compliance, taxation<br />

and treasury.<br />

Ms. Leong has over 4 years of experience<br />

in accounting and finance. Prior to<br />

joining the Manager, she was the<br />

Accountant at Mapletree Investments<br />

Pte Ltd where she was responsible <strong>for</strong><br />

the finance operations of its commercial<br />

property subsidiaries. She was also<br />

previously an Auditor with KPMG LLP.<br />

Ms. Leong holds a Bachelor of Business<br />

Management (Finance and Accounting)<br />

Degree from Singapore Management<br />

University and an ACCA Certificate (UK).

22<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

Our single-minded focus<br />

to deliver premium value<br />

<strong>for</strong> our unitholders

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

23

24<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

Manager’s <strong>Report</strong><br />

YEAR IN REVIEW<br />

<strong>Suntec</strong> <strong>REIT</strong> achieved a distribution<br />

income of S$182.5 million and<br />

distribution per unit ("DPU") of 9.859<br />

cents in the year ended December <strong>2010</strong><br />

(“<strong>FY</strong> <strong>2010</strong>”). In <strong>FY</strong> <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong><br />

acquired a one-third interest in the<br />

Marina Bay Financial Centre Towers 1<br />

and 2 and the Marina Bay Link Mall<br />

(the “MBFC Properties”), and secured<br />

a S$700 million term loan facility to<br />

prepay the S$575 million 3-year loan<br />

maturing in <strong>FY</strong> 2012, and to refinance<br />

part of the S$400 million club loan<br />

maturing in <strong>FY</strong> 2011.<br />

As at end <strong>FY</strong> <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong>’s<br />

assets under management has grown<br />

to approximately S$7.0 billion,<br />

underpinned by a strong 2.4 million sq ft<br />

office portfolio and 1.1 million sq ft retail<br />

portfolio strategically located in the heart<br />

of Singapore’s central business district.<br />

FINANCIAL PERFORMANCE<br />

<strong>Suntec</strong> <strong>REIT</strong> achieved gross revenue of<br />

S$249.5 million in <strong>FY</strong> <strong>2010</strong>, a marginal<br />

decline of 1.4% compared to the<br />

corresponding period in 2009 (“<strong>FY</strong> 2009”).<br />

Office revenue achieved <strong>for</strong> <strong>FY</strong> <strong>2010</strong> was<br />

S$117.7 million, a dip of 0.3% compared<br />

to <strong>FY</strong> 2009, whilst retail revenue achieved<br />

was S$131.8 million, which was 2.5%<br />

lower than in <strong>FY</strong> 2009.<br />

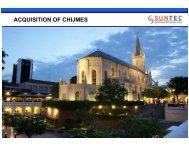

In terms of revenue contribution<br />

by asset, <strong>Suntec</strong> City contributed<br />

S$216.7 million in gross revenue in <strong>FY</strong><br />

<strong>2010</strong>, whilst Park Mall and Chijmes<br />

contributed S$22.5 million and S$10.3<br />

million respectively.<br />

The net property income achieved in<br />

<strong>FY</strong> <strong>2010</strong> was S$193.1 million, up 0.4%<br />

compared to <strong>FY</strong> 2009.<br />

GROSS Revenue<br />

Contribution by Asset<br />

<strong>FY</strong> <strong>2010</strong><br />

<strong>Suntec</strong> City 86.9%<br />

Park Mall 9.0%<br />

Chijmes 4.1%<br />

Net Property Income<br />

Contribution by Asset<br />

<strong>FY</strong> <strong>2010</strong><br />

<strong>Suntec</strong> City 87.7%<br />

Park Mall 8.6%<br />

Chijmes 3.7%<br />

The income contribution from the jointly<br />

controlled entities achieved <strong>for</strong> <strong>FY</strong> <strong>2010</strong><br />

was S$45.3 million. This comprised the<br />

income contribution of S$40.6 million<br />

from the one-third interest in One Raffles<br />

Quay, S$2.2 million from the 20 percent<br />

interest in <strong>Suntec</strong> Singapore International<br />

Convention and Exhibition Centre and<br />

S$2.5 million from the one-third interest<br />

in the MBFC Properties which was<br />

acquired on 9 December <strong>2010</strong>.<br />

The income available <strong>for</strong> distribution<br />

achieved <strong>for</strong> <strong>FY</strong> <strong>2010</strong> was S$182.5<br />

million, 3.8% lower year-on-year. The<br />

DPU achieved <strong>for</strong> <strong>FY</strong> <strong>2010</strong> amounted<br />

to 9.859 cents, which translated to an<br />

annual yield of 6.57% <strong>for</strong> the year.<br />

On 9 December <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong><br />

issued 34,500,360 units in <strong>Suntec</strong> <strong>REIT</strong><br />

to <strong>Suntec</strong> City Development Pte Ltd, the<br />

last of six instalments of deferred units<br />

in <strong>Suntec</strong> <strong>REIT</strong> in part satisfaction of the<br />

purchase consideration <strong>for</strong> <strong>Suntec</strong> <strong>REIT</strong>’s<br />

initial portfolio of properties in its initial<br />

public offering.<br />

Property PORTFOLIO AUM<br />

On 9 December <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong><br />

successfully acquired a one-third interest<br />

in the MBFC Properties at a purchase<br />

price of S$1,495.8 million. The MBFC<br />

Properties were acquired with income<br />

support from the vendor amounting<br />

to S$113.9 million over a period of 60<br />

months, at a net property income yield<br />

of 4%.<br />

The MBFC Properties were valued at<br />

S$1,496 million and S$1,497 million by<br />

Knight Frank Pte Ltd and CB Richard Ellis<br />

(Pte) Ltd respectively. The valuations<br />

were based on the income capitalisation<br />

approach and discounted cash flow<br />

analysis.<br />

With the acquisition, <strong>Suntec</strong> <strong>REIT</strong>’s office<br />

portfolio net lettable area has increased<br />

from approximately 1.9 million sq ft<br />

to approximately 2.4 million sq ft, and<br />

its total assets under management<br />

(“AUM”) has increased to approximately<br />

S$7.0 billion as at 31 December <strong>2010</strong>,<br />

up from approximately S$5.2 billion<br />

in the preceding year. The net asset<br />

value stood at S$1.804 per unit as at<br />

31 December <strong>2010</strong>.<br />

Distribution per unIT <strong>FY</strong> <strong>2010</strong> <strong>FY</strong> 2009<br />

DPU 1 9.859 11.703<br />

Fully Diluted DPU 2 9.607 10.915<br />

Notes:<br />

1<br />

For <strong>FY</strong> 2009, DPU does not take into account 69,000,722 deferred units payable<br />

to <strong>Suntec</strong> City Development Pte Ltd, the remaining two equal instalments<br />

which were issued on 9 June <strong>2010</strong> and 9 December <strong>2010</strong>.<br />

2<br />

The deferred units totaling 207,002,170 units were issued in six equal half<br />

yearly instalments, with the first instalment issued on 9 June 2008 and the<br />

rest semi-annually thereafter. The deferred units were issued at the <strong>Suntec</strong><br />

<strong>REIT</strong> initial public offering price of S$1.00 per unit. The "Fully Diluted DPU"<br />

illustrates the pro-<strong>for</strong>ma DPU assuming that all the deferred units had been<br />

issued on 9 December 2004.<br />

Property 31 Dec 31 DEC<br />

Valuation (S$m) <strong>2010</strong> 2009<br />

<strong>Suntec</strong> City 1 3,980 3,750<br />

Park Mall 2 338 321<br />

Chijmes 1 134 131<br />

One Raffles Quay 3 1,023 934.9<br />

<strong>Suntec</strong> Singapore International<br />

Convention & Exhibition Centre 1 57.6 48<br />

MBFC Properties 4 1,511 –<br />

Total 7,043.6 5,184.9<br />

Notes:<br />

1<br />

Based on the valuation by Knight Frank Pte Ltd. <strong>Suntec</strong> Singapore International<br />

Convention & Exhibition Centre reflects the value of <strong>Suntec</strong> <strong>REIT</strong>'s 20 percent<br />

interest in the property.<br />

2<br />

Based on the valuation by CB Richard Ellis (Pte) Ltd.<br />

3<br />

Based on the valuation by Colliers International Consultancy & Valuation<br />

(Singapore) Pte Ltd, reflecting the value of <strong>Suntec</strong> <strong>REIT</strong>'s one-third interest in<br />

One Raffles Quay.<br />

4<br />

Based on the valuation by Knight Frank Pte Ltd, reflecting the value of <strong>Suntec</strong><br />

<strong>REIT</strong>'s one-third interest in the MBFC Properties.

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

25<br />

Assets Under Management<br />

DEBT MATURITY PROFILE<br />

S$ b<br />

S$ m<br />

8.0<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

2.3<br />

3.2<br />

4.6<br />

5.4<br />

5.2<br />

7.0<br />

132.5<br />

<strong>FY</strong> 2011<br />

25<br />

200<br />

<strong>FY</strong> 2012<br />

50<br />

270<br />

350<br />

<strong>FY</strong> 2013<br />

773.5<br />

<strong>FY</strong> 2014<br />

331.5<br />

350<br />

<strong>FY</strong> 2015<br />

100<br />

<strong>FY</strong> 2016<br />

0<br />

Sep 05<br />

Sep 06 Sep 07 Dec 08 Dec 09 Dec 10<br />

<strong>FY</strong> 2011 - S$132.5m MTN<br />

<strong>FY</strong> 2012 - S$25m MTN<br />

<strong>FY</strong> 2012 - S$200m Term loan<br />

<strong>FY</strong> 2013 - S$50m Bi-lateral loan<br />

<strong>FY</strong> 2013 - S$270m Convertible loan<br />

<strong>FY</strong> 2013 - S$350m (from S$700m loan facility)<br />

<strong>FY</strong> 2014 - S$773.5m (from S$1.1b loan facility)<br />

<strong>FY</strong> 2015 - S$331.5m (from S$1.1b loan facility)<br />

<strong>FY</strong> 2015 - S$350m (from S$700m loan facility)<br />

<strong>FY</strong> 2016 - S$100m Term loan<br />

CAPITAL STRUCTURE<br />

<strong>Suntec</strong> <strong>REIT</strong>’s total debt stood at<br />

S$2,582.5 million, with a debt-toassets<br />

ratio and aggregate leverage of<br />

38.4% and 40.4% respectively as at 31<br />

December <strong>2010</strong>. The average all-in cost<br />

of <strong>Suntec</strong> <strong>REIT</strong>’s debt portfolio <strong>for</strong> <strong>FY</strong><br />

<strong>2010</strong> was 3.49%.<br />

On 4 October <strong>2010</strong>, <strong>Suntec</strong> <strong>REIT</strong> entered<br />

into a S$700 million term loan facility<br />

to prepay the S$575 million 3-year loan<br />

maturing in <strong>FY</strong> 2012, and to refinance<br />

part of the S$400 million club loan<br />

maturing in <strong>FY</strong> 2011. The new loan<br />

facility is secured by <strong>Suntec</strong> City Mall,<br />

and comprises a S$350 million 3-year<br />

loan and a S$350 million 5-year loan, at<br />

a blended all-in interest margin of 1.5%<br />

from a panel of nine banks.<br />

The S$700 million term loan facility was<br />

obtained at a lower interest margin<br />

which has further improved <strong>Suntec</strong> <strong>REIT</strong>’s<br />

overall financing cost and strengthened<br />

its debt maturity profile.<br />

On 9 December <strong>2010</strong> <strong>Suntec</strong> <strong>REIT</strong> raised<br />

approximately S$1.5 billion <strong>for</strong> the<br />

financing of the acquisition of the MBFC<br />

Properties. This comprised a S$1.105<br />

billion term loan facility entered into<br />

with Citibank, DBS Bank and Standard<br />

Chartered Bank, and gross proceeds<br />

of S$428.8 million raised through a<br />

private placement of 313 million new<br />

units in <strong>Suntec</strong> <strong>REIT</strong> at an issue price<br />

of S$1.37 per new unit in <strong>Suntec</strong> <strong>REIT</strong><br />

(“Private Placement”) carried out on<br />

29 November <strong>2010</strong>. The Private<br />

Placement was 3.1 times oversubscribed,<br />

and was priced at a discount of 4.02% to<br />

the volume weighted average price of<br />

S$1.4274 per unit in <strong>Suntec</strong> <strong>REIT</strong> and<br />

2.88% to the adjusted volume weighted<br />

average price of S$1.4106 per unit in<br />

<strong>Suntec</strong> <strong>REIT</strong> <strong>for</strong> trades done <strong>for</strong> the full<br />

market day on 26 November <strong>2010</strong>.<br />

The placement units were issued on<br />

9 December <strong>2010</strong> and 100% of the net<br />

proceeds of approximately S$417.9<br />

million have been used to partly finance<br />

the acquisition of the MBFC Properties.<br />

Such use is in accordance with the<br />

stated use and in accordance with the<br />

percentage of the net proceeds of the<br />

private placement allocated to such use.<br />

On 15 December <strong>2010</strong>, Moody’s<br />

Investors Service carried out a rating<br />

review of <strong>Suntec</strong> <strong>REIT</strong> subsequent to<br />

the completion of the acquisition of the<br />

MBFC Properties, and revised <strong>Suntec</strong><br />

<strong>REIT</strong>’s corporate family rating to Baa2,<br />

and unsecured debt rating to Baa3.<br />

Moody’s has also restored <strong>Suntec</strong> <strong>REIT</strong>’s<br />

rating outlook to stable.<br />

<strong>Suntec</strong> <strong>REIT</strong> holds derivative financial<br />

instruments to hedge its interest rate<br />

risk exposure. The fair value derivative<br />

<strong>for</strong> <strong>FY</strong> <strong>2010</strong>, which was included as<br />

Financial Derivatives in total assets and<br />

total liabilities were S$1.2 million and<br />

S$9.0 million respectively. The net fair<br />

value derivative represented 0.196%<br />

of the net assets of <strong>Suntec</strong> <strong>REIT</strong> as at<br />

31 December <strong>2010</strong>.<br />

Note:<br />

1<br />

The adjusted volume weighted average price was<br />

computed based on the volume weighted average<br />

price of all trades in the <strong>Suntec</strong> <strong>REIT</strong> units on Singapore<br />

Exchange Securities Trading Limited (the “SGX-ST”)<br />

on the full market day on 26 November <strong>2010</strong> and<br />

subtracting an advanced distribution <strong>for</strong> the period<br />

1 October <strong>2010</strong> to 8 December <strong>2010</strong> of approximately<br />

1.677 cents per unit in <strong>Suntec</strong> <strong>REIT</strong>. This advanced<br />

distribution of approximately 1.677 cents per Unit<br />

was based on the Manager’s pro-rated estimate of<br />

<strong>Suntec</strong> <strong>REIT</strong>’s revenue and expenses <strong>for</strong> the quarter<br />

ending 31 December <strong>2010</strong>, and the amount was an<br />

estimate based on in<strong>for</strong>mation then available to<br />

the Manager as at 29 November <strong>2010</strong>. The actual<br />

advanced distribution amounted to 1.723 cents.

26<br />

PASSION TO DELIVER<br />

<strong>Suntec</strong> reit annual report <strong>2010</strong><br />

STRONG PORTFOLIO<br />

OCCUPANCY<br />

<strong>Suntec</strong> <strong>REIT</strong>’s asset portfolio per<strong>for</strong>mance<br />

continued to remain strong. As at<br />