Wealth Management 10-11.pmd - inditrade

Wealth Management 10-11.pmd - inditrade

Wealth Management 10-11.pmd - inditrade

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

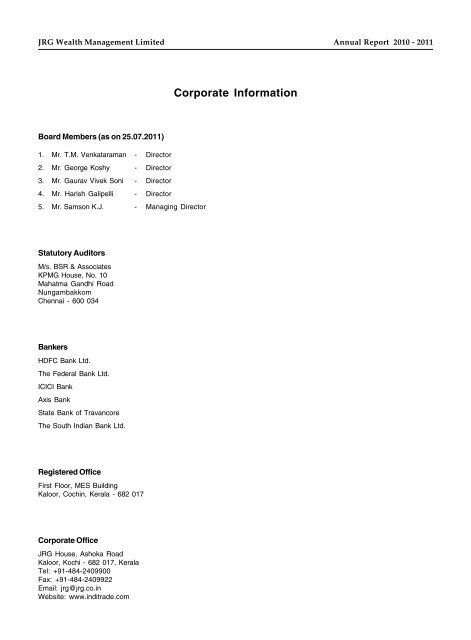

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Corporate Information<br />

Board Members (as on 25.07.2011)<br />

1. Mr. T.M. Venkataraman - Director<br />

2. Mr. George Koshy - Director<br />

3. Mr. Gaurav Vivek Soni - Director<br />

4. Mr. Harish Galipelli - Director<br />

5. Mr. Samson K.J. - Managing Director<br />

Statutory Auditors<br />

M/s. BSR & Associates<br />

KPMG House, No. <strong>10</strong><br />

Mahatma Gandhi Road<br />

Nungambakkom<br />

Chennai - 600 034<br />

Bankers<br />

HDFC Bank Ltd.<br />

The Federal Bank Ltd.<br />

ICICI Bank<br />

Axis Bank<br />

State Bank of Travancore<br />

The South Indian Bank Ltd.<br />

Registered Office<br />

First Floor, MES Building<br />

Kaloor, Cochin, Kerala - 682 017<br />

Corporate Office<br />

JRG House, Ashoka Road<br />

Kaloor, Kochi - 682 017, Kerala<br />

Tel: +91-484-2409900<br />

Fax: +91-484-2409922<br />

Email: jrg@jrg.co.in<br />

Website: www.<strong>inditrade</strong>.com<br />

- 1 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

NOTICE<br />

Notice is hereby given that the Fifteenth Annual General Meeting of the Members of the Company will be held on Wednesday,<br />

the 28 th day of September 2011 at the Corporate Office of the Company at ‘JRG House’, Ashoka Road, Kaloor, Cochin -<br />

682017, at 3 p m to transact the following business:<br />

ORDINARY BUSINESS<br />

1. To receive, consider and adopt the audited Balance Sheet as at March 31, 2011 and the Profit and Loss Account for the<br />

year ended on that date together with the report of the Directors’ and the Auditors’ thereon.<br />

2. To appoint a Director in place of Mr. Gaurav Vivek Soni who retires by rotation and being eligible, offers himself for reappointment.<br />

3. To appoint Auditors and fix their remuneration.<br />

SPECIAL BUSINESS<br />

4. To consider and, if thought fit, to pass with or without modification(s), the following resolution as an Ordinary Resolution:<br />

RESOLVED THAT Mr. Harish Galipelli who was appointed as an Additional Director of the Company pursuant to Section<br />

260 of the Companies Act, 1956 in the Board meeting held on 25.07.2011 with effect from that date and who holds the<br />

said office up to the date of this Annual General Meeting and a Notice in respect of whom has been received by the<br />

Company from a Member signifying his intention to propose the candidature of Mr. Harish Galipelli for the Office of<br />

Director under Section 257 of the Companies Act, 1956, be and is hereby appointed as the Director of the Company with<br />

effect from the date of Annual General Meeting whose office shall be liable to retirement by rotation.<br />

RESOLVED FURTHER THAT the Board of Directors of the Company be and are hereby authorized to do such acts,<br />

deeds and things as may be necessary and to file necessary forms with the statutory authority to give effect to the above<br />

resolution.<br />

5. To consider and, if thought fit, to pass with or without modification(s), the following resolution as an Special Resolution:<br />

RESOLVED THAT pursuant to the provisions of Section 198, Section 269 and Section 309 and other applicable provisions,<br />

if any, of the Companies Act, 1956, (“the Act”) read with Schedule XIII to the Act, or any amendment or modification or reenactment<br />

thereof and subject to such approvals as may be necessary, the consent of the shareholders be and is hereby<br />

accorded for appointment of Mr. Samson KJ as Managing Director for a period of 2 Years with effect from 04.05.2011 on<br />

maximum remuneration of Rs 15 lakhs per annum including ESOP and Bonus if any.<br />

RESOLVED FURTHER THAT subject to such approval as may be necessary in the event of inadequacy of profit, the<br />

consent of the Company be and is hereby accorded to pay such maximum remuneration payable under Para B section<br />

II Part II of the Schedule XIII of the Companies Act, 1956, depending upon effective capital of the Company as the<br />

minimum remuneration payable to him during the period of his tenure.<br />

RESOLVED FURTHER THAT the Board of Directors of the Company be and are hereby authorized to do such acts,<br />

deeds and things as may be necessary and to file necessary forms with the statutory authority to give effect to the above<br />

resolution.<br />

By order of the Board<br />

Place : Kochi Samson KJ<br />

Date : 25.07.2011 Managing Director<br />

Notes:<br />

a) The Explanatory Statement pursuant to section 173(2) of the Companies Act, 1956 in respect of the special<br />

business is annexed hereto.<br />

b) A MEMBER ENTITLED TO ATTEND AND VOTE IS ENTITLED TO APPOINT PROXY (IES) TO ATTEND AND<br />

VOTE INSTEAD OF HIMSELF AND THE PROXY NEED NOT BE A MEMBER.<br />

c) Proxies in order to be effective must be received by the Company at the registered office not less than 48 hours<br />

before the commencement of the meeting.<br />

d) Members are advised to bring their copy of the annual report for reference and discussion. The attendance slip<br />

duly signed by the member or proxy should be deposited at the venue of the meeting.<br />

e) The Register of Directors’ Shareholding, maintained under Section 307 of the Companies Act, 1956, will be<br />

available for inspection by the members at the AGM.<br />

f) The Register of Contracts, maintained under Section 301 of the Companies Act, 1956, will be available for inspection<br />

by the members at the registered office of the Company during working hours.<br />

- 2 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Explanatory statement pursuant to section 173(2) of the Companies act, 1956<br />

Item No 4<br />

Mr. Harish Galipelli was appointed as an Additional Director pursuant to Sec 260 of the Companies Act 1956 and his term of<br />

office expires at this Annual General Meeting.<br />

He holds a degree of masters in business administration in finance and has got over ten years of experience in various<br />

functional areas of commodity and currency markets including research, business development and corporate advisory. He<br />

has worked with companies like IL & FS Investment Commodity Brokers and Karvy Comtrade Limited.<br />

The Company has received a separate nomination from a member pursuant to Sec 257 of the Companies Act 1956 proposing<br />

his candidature along with the requisite deposit. None of the Directors except Mr. Harish Galipelli is concerned or interested<br />

in the resolution.<br />

Item No 5<br />

Mr. Samson K J was appointed as a whole time Director for a period of 2 years with effect from 4 th May 2009. At the Board<br />

meeting held on 23.01.20<strong>10</strong> he was redesignated as Managing Director, all other terms and conditions remaining the same.<br />

The present term of appointment of Mr Samson K J expires on 03.05.2011. The Board had at its meeting held on 9 th May 2011<br />

reappointed him as the Managing Director for a further period of 2 years from 04.05.2011 subject to the shareholders approval.<br />

Mr. Samson K J is a graduate in commerce with over 24 years of experience in commodity operations. He has represented<br />

India on pepper in various international forums. He was Instrumental in formulation of International Pepper contract and<br />

Developed IPSTA into an international Exchange. He was also associated with World Bank for commodity awareness program<br />

across India. Mr. Samson has attended various training programs in and outside India and is also a Leading trainer for<br />

commodity derivates & expertise has been provided even to the foreign nationals. Mr. Samson has been in the employment<br />

of the Company since November 2007. He was the head of commodity operations of the Company before being appointed as<br />

a director. Considering his experience and his expertise in managing the affairs of the Company the Board had reappointed<br />

him w.e.f 04.05.2011 on a remuneration of not exceeding 15 lakhs per annum, including ESOPs and bonus, if any, subject to<br />

the shareholders approval.<br />

The appointment is pursuant to Para A Section II Part II of Schedule XIII of the Companies Act 1956. As per the provisions of<br />

Companies Act 1956 his appointment requires the approval of shareholders and hence the resolution.<br />

None of the Directors except Mr Samson K J is interested in the resolution<br />

By order of the Board<br />

Place : Kochi Samson KJ<br />

Date : 25.07.2011 Managing Director<br />

Particulars<br />

Mr. Gaurav Vivek Soni<br />

Age & Date of Birth 41 & 06.07.1970<br />

Date of First Appointment<br />

as a Director 04.05.2009<br />

Educational Qualification<br />

Experience / expertise<br />

Functional Areas<br />

B Com, ACA<br />

He is a qualified Chartered Accountant with over 19 years experience both in India &<br />

overseas in the areas of Finance, Accounts, Auditing and Commercial Operations.<br />

Experience of working both as an independent external reviewer (auditor) and as the<br />

Head of the Finance & Accounting function, has lead to a well-balanced approach in<br />

handling financial & control issues.<br />

He has vast experience in Budgeting, Strategic Planning, Financial Reviews, Fund<br />

Raising & <strong>Management</strong>, Finalisation & Consolidation of Accounts, Administration,<br />

Business Process Reviews, MIS Development, Project Appraisals, Auditing &<br />

Commercial Operations.<br />

Directorships of other a) JRG Securities Limited b) JRG Fincorp Limited<br />

companies c) JRG Insurance Broking Pvt. Limited<br />

Memberships of committees<br />

Shares held in the company Nil<br />

Any other important information -<br />

BRIEF PARTICULARS OF DIRECTOR SEEKING RE-APPOINTMENT<br />

Remuneration Committee<br />

- 3 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Particulars<br />

DIRECTORS’ REPORT<br />

Your Directors’ have great pleasure in presenting the Fifteenth Annual Report together with the audited statement of Accounts<br />

of your Company for the year ended 31st March, 2011.<br />

1. Operations & Financial Results<br />

Amount in Rs.<br />

20<strong>10</strong>-11 2009-<strong>10</strong><br />

Total Revenue 201,315,320) 125,821,276)<br />

Profit/(Loss)Before Tax & prior period expenses (7,823,317) 1,476,987)<br />

Prior period Expenses -) -)<br />

Provision For Taxes <strong>10</strong>,624,533) 34,52,155)<br />

Profit /(Loss) After Tax (18,447,850) (19,75,168)<br />

Balance in Profit & Loss Account Brought Forward (6,373,690) (4,398,521)<br />

Balance in Profit & loss A/c carried forward (24,821,539) (6,373,689)<br />

Your Company recorded revenue of Rs. 20.13 crores as against Rs. 12.58 crores in the previous year. The total<br />

expenditure incurred was Rs. 20.91 crores resulting in a loss of Rs 0.78 crores before prior period items and taxes, as<br />

against profit of Rs. 0.15 crores in the previous year. After provision for taxes the loss for the year is at Rs1.84 crores as<br />

against Rs 0.19 lakhs in the previous year.<br />

2. Subsidiary and its operations<br />

During the year the subsidiary company JRG Insurance Broking Private Limited has recorded revenue of Rs 71.82 lakhs<br />

as against Rs 146.25 lakhs in the previous year. The expenditure during the period was Rs 76.30 lakhs which has<br />

resulted in a loss of Rs 4.56 lakhs as against <strong>10</strong>.78 lakhs during the previous year.<br />

3. Directors<br />

The term of appointment of Mr Samson KJ, as Managing Director expires on 03.05.2011.The Board reappointed him for<br />

a further period of two years on a maximum remuneration of Rs 15 lakhs per annum, including bonus and ESOPs if any,<br />

subject to the approval of shareholders in the ensuing Annual General Meeting.<br />

During the year, Mr Srirama Chandran.N, Director, has resigned from the Board of the Company w.e.f 18.03.2011.Board<br />

has appointed Mr Harish Galipelli as Additional Director at its meeting held on 26.07.2011. He will hold office only up to<br />

the conclusion of the ensuing Annual General Meeting. Company has received nomination from a member pursuant to<br />

Sec 257 of the Companies Act 1956 proposing the candidature of Mr. Harish Galipelli along with the requisite deposit.<br />

Board recommends his appointment in the ensuing AGM.<br />

Mr. Gaurav Vivek Soni, Director is retiring by rotation in the forthcoming Annual General Meeting. Being eligible, he<br />

offers himself for re-appointment. The Board of Directors of your Company recommends his reappointment.<br />

4. Directors’ Responsibility Statement<br />

As required under Section 217(2AA) of the Companies Act,1956, the directors hereby confirm that:<br />

a) In the preparation of the annual accounts, the applicable accounting standards had been followed and there are<br />

no material departures therefrom.<br />

b) the Directors had selected such accounting policies and applied them consistently and made judgments and<br />

estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company<br />

at the end of the financial year and of the loss of the company for that year;<br />

c) The Directors had taken proper and sufficient care for the maintenance of adequate accounting records in accordance<br />

with the provisions of the act for safeguarding the assets of the Company and for preventing and detecting fraud<br />

and other irregularities;<br />

d) The Directors had prepared the annual accounts on a going concern basis.<br />

- 4 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

5. Auditors<br />

The present Statutory Auditors M/s BSR & Associates, KPMG House, No. <strong>10</strong>, Mahatma Gandhi Road, Nungambakkam,<br />

Chennai- 600034, will hold office up to the conclusion of the ensuing Annual General Meeting. Being eligible they offer<br />

themselves for reappointment. Board recommends their reappointment for the financial year 2011-12.<br />

6. Fixed deposits<br />

The Company has not accepted any fixed deposits from public during the year.<br />

7. Conservation of Energy, Technology absorption, Foreign Exchange Earnings and outgo:<br />

In terms of Section 217(1) (e) of the Companies Act, 1956 (as amended) and the Companies (Disclosure of particulars<br />

in report of Directors’) Rules, 1988, your directors furnish hereunder the additional information as required:<br />

A. Conservation of Energy - The operations of your Company are not energy sensitive in nature. However, measures<br />

are introduced to reduce the energy consumption at all levels in the organisation by optimal use of technology.<br />

B. Technology absorption - The Company has adopted the latest state-of-the-art software and hardware tools<br />

available in the market for rendering the commodity trading and other services more efficiently and effectively.<br />

C. Foreign Exchange Earnings and outgo - NIL<br />

8. Particulars of employees<br />

No employee of the Company was in receipt of remuneration exceeding the amount prescribed under Section 217(2A)<br />

of the Companies Act, 1956, read with the Companies (Particulars of Employees) Rules, 1975, during the financial year<br />

20<strong>10</strong>-11.<br />

9. Comments in CARO 2003<br />

Auditors have in their report under CARO 2003 commented that the system in respect of controls related to rendering of<br />

services to the employees of the Company / group needs to be strengthened and that the internal audit system of the<br />

Company needs to be strengthened to be commensurate with the size and nature of its business.<br />

<strong>10</strong>. <strong>Management</strong>s response<br />

The Board has noted the same and is taking adequate steps to strengthen the internal controls related to rendering of<br />

services to the employees of the Company / group. The Company has also initiated steps to improve the internal Audit<br />

system of the Company commensurate with the size and nature of its business.<br />

11. Acknowledgement<br />

The directors place on record their appreciation for the support and services rendered by the shareholders, exchanges,<br />

bankers, business associates and the employees of the company.<br />

For and on behalf of the Board<br />

Place : Kochi Samson KJ Gaurav Vivek Soni<br />

Date : 25.07.2011 MANAGING DIRECTOR DIRECTOR<br />

- 5 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Auditors’ report to the members of JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

We have audited the attached Balance Sheet of JRG <strong>Wealth</strong> <strong>Management</strong> Limited (“the Company”) as at 31 March 2011, the<br />

Profit and Loss Account and also the Cash Flow Statement for the year ended on that date annexed thereto. These financial<br />

statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial<br />

statements based on our audit.<br />

We conducted our audit in accordance with auditing standards generally accepted in India. Those Standards require that we<br />

plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material<br />

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial<br />

statements. An audit also includes assessing the accounting principles used and significant estimates made by management,<br />

as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for<br />

our opinion.<br />

As required by the Companies (Auditor’s Report) Order, 2003 (‘the Order’) as amended, issued by the Central Government of<br />

India in terms of sub-section (4A) of Section 227 of the Companies Act, 1956, we enclose in the Annexure a statement on the<br />

matters specified in paragraphs 4 and 5 of the said Order.<br />

Further to our comments in the annexure referred to above, we report that:<br />

a) we have obtained all the information and explanations, which to the best of our knowledge and belief, were necessary<br />

for the purpose of our audit;<br />

b) in our opinion, proper books of account as required by law have been kept by the Company, so far as appears from our<br />

examination of those books;<br />

c) the balance sheet, the profit and loss account and the cash flow statement dealt with by this report are in agreement with<br />

the books of account;<br />

d) in our opinion, the balance sheet, profit and loss account and the cash flow statement dealt with by this report comply with<br />

the accounting standards referred to in sub-section (3C) of Section 211 of the Companies Act, 1956,<br />

e) on the basis of written representations received from the directors, as at 31 March 2011 and taken on record by the Board<br />

of Directors, we report that none of the directors is disqualified as on 31 March 2011 from being appointed as director in<br />

terms of clause (g) of sub-section (1) of Section 274 the Companies Act, 1956;<br />

(f) in our opinion and to the best of our information and according to the explanations given to us, the said accounts give the<br />

information required by the Act in the manner so required, and give a true and fair view, in conformity with the accounting<br />

principles generally accepted in India:<br />

(i) in the case of the balance sheet, of the state of affairs of the Company as at 31 March 2011; and<br />

(ii) in the case of the profit and loss account, of the loss of the Company for the year ended on that date.<br />

(iii) in the case of the cash flow statement, of the cash flows of the Company for the year ended on that date.<br />

For B S R & Associates<br />

Chartered Accountants<br />

Firm Registration No.: 116231W<br />

S Sethuraman<br />

Partner<br />

Membership No: 203491<br />

Chennai<br />

Date: 9 May 2011<br />

- 6 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Annexure to the Auditors’ Report<br />

(Referred to our report of even date)<br />

(i) (a) The Company has maintained proper records showing full particulars including quantitative details and situation<br />

of fixed assets. However the Company is in process of updating its records so as to include quantitative details in<br />

relation to certain class of fixed assets.<br />

(b) The Company has a regular programme of physical verification of its fixed assets by which all fixed assets are<br />

verified in a phased manner over a period of two years. In our opinion, this periodicity of physical verification is<br />

reasonable having regard to the size of the Company and the nature of its assets. In accordance with this programme<br />

certain fixed assets were verified during the year and no material discrepancies were noticed on such verification.<br />

(c) Fixed assets disposed of during the year were not substantial, as to affect the going concern assumption.<br />

(ii)<br />

The Company is a service company, primarily rendering services as brokers to various commodity exchanges. Accordingly<br />

it does not hold any physical inventories. Thus, paragraph 4(ii) of the Order is not applicable.<br />

(iii) According to the information and explanations given to us, we are of the opinion that there are no companies, firms or<br />

other parties covered in the register required under section 301 of the Companies Act, 1956. Accordingly, paragraph<br />

4(iii) of the Order is not applicable.<br />

(iv) In our opinion and according to the information and explanations given to us, and having regard to the explanation that<br />

the purchases of certain items of fixed assets are for the Company’s specialized requirements and similarly services<br />

rendered are for the specialized requirements of the buyers and suitable alternative sources are not available to obtain<br />

comparable quotations, there is an adequate internal control system commensurate with the size of the Company and<br />

the nature of its business with regard to purchase of fixed assets and sale of services, except in respect of controls related<br />

to rendering of services to the employees of the Company / group, which need to be strengthened. In our opinion and<br />

according to the information and explanations given to us, there is no continuing failure to correct major weaknesses in<br />

internal control system. The activities of the Company do not involve purchase of inventory and sale of goods.<br />

(v) In our opinion, and according to the information and explanations given to us, there are no contracts and arrangements<br />

the particulars of which need to be entered into the register maintained under section 301 of the Companies Act, 1956.<br />

(vi) The Company has not accepted any deposits from the public.<br />

(vii) In our opinion, the Company has an internal audit system. However the same need to be strengthened to be commensurate<br />

with the size and nature of its business.<br />

(viii) The Central Government has not prescribed the maintenance of cost records under section 209(1)(d) of the Companies<br />

Act, 1956 for any of the services rendered by the Company.<br />

(ix) a) According to the information and explanations given to us and on the basis of our examination of the records of<br />

the Company, amounts deducted/accrued in the books of account in respect of undisputed statutory dues including,<br />

Income-tax, Service tax, Provident fund, Employees’ State Insurance, <strong>Wealth</strong> tax and other material statutory dues<br />

have generally been regularly deposited during the year by the Company with the appropriate authorities. As<br />

explained to us, the Company did not have any dues on account of Customs duty, Investor Education and Protection<br />

Fund, Sales tax and Excise duty. There were no dues on account of cess under section 441A of the Companies Act,<br />

1956 since the aforesaid section has not yet been made effective by the Central Government.<br />

According to the information and explanations given to us, no undisputed amounts payable in respect of Provident<br />

Fund, Employees’ State Insurance, Income tax, Service tax, <strong>Wealth</strong> tax and other material statutory dues were in<br />

arrears as at 31 March 2011 for a period of more than six months from the date they became payable.<br />

b) According to the information and explanations given to us, there are no dues of Income tax, Sales tax, <strong>Wealth</strong> tax,<br />

Service tax, Customs duty, Excise duty and Cess which have not been deposited with the appropriate authorities<br />

on account of any dispute.<br />

(x) The Company does not have accumulated losses at the end of the financial year which has exceeded fifty percent of its<br />

net worth. It has not incurred cash losses in the current financial year and has also not incurred cash losses in the<br />

immediately preceding financial year.<br />

(xi) The Company did not have any outstanding dues to any financial institution, banks or debenture holders during the year.<br />

(xii)<br />

The Company has not granted any loans and advances on the basis of security by way of pledge of shares, debentures<br />

and other securities.<br />

(xiii) In our opinion and according to the information and explanations given to us, the Company is not a chit fund or a nidhi<br />

/ mutual benefit fund/society.<br />

- 7 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

(xiv) In our opinion and according to the information and explanations given to us, the Company is not dealing or trading in<br />

shares, securities, debentures or other instruments.<br />

(xv) In our opinion and according to the information and explanations given to us, the Company has not given any guarantee<br />

for loans taken by others from banks or financial institutions.<br />

(xvi) The Company did not have any term loans outstanding during the year.<br />

(xvii) According to the information and explanations given to us and on an overall examination of the balance sheet of the<br />

Company, we are of the opinion that there have been no funds raised on a short-term basis that has been used for long<br />

term investment by the Company.<br />

(xviii)The Company has not made any preferential allotment of shares to companies covered in the register maintained under<br />

Section 301 of the Companies Act, 1956.<br />

(xix) The Company did not have any outstanding debentures during the year.<br />

(xx) The Company has not raised any money by public issue.<br />

(xxi) According to the information and explanations given to us, no fraud on or by the Company has been noticed or reported<br />

during the course of our audit.<br />

For B S R & Associates<br />

Chartered Accountants<br />

Firm Registration No.: 116231W<br />

S Sethuraman<br />

Partner<br />

Membership No: 203491<br />

Chennai<br />

Date: 9 May 2011<br />

- 8 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

BALANCE SHEET<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

Schedule As at As at<br />

No. 31 March 2011 31 March 20<strong>10</strong><br />

SOURCES OF FUNDS<br />

Shareholders’ funds<br />

Share capital 1 92,624,270 92,624,270<br />

Reserves and surplus 2 4,000,000 4,000,000<br />

96,624,270 96,624,270<br />

APPLICATION OF FUNDS<br />

Fixed asset 3<br />

Gross block 41,<strong>10</strong>9,912 45,816,604<br />

Less: Depreciation / amortization (26,181,618) (25,735,289)<br />

Net block 14,928,294 20,081,315<br />

Capital work in progress 1,032,131 -<br />

15,960,425 20,081,315<br />

Investments 4 15,000,000 55,350,000<br />

Deferred tax asset ( net ) 15 C (c) 2,844,531 1,836,704<br />

Current assets, loans and advances<br />

Sundry debtors 5 3,196,028 2,375,038<br />

Cash and bank balances 6 180,993,488 <strong>10</strong>5,477,521<br />

Loans and advances 7 48,575,518 59,731,722<br />

232,765,034 167,584,281<br />

Current liabilities and provisions<br />

Current liabilities 8 192,252,259 152,086,719<br />

192,252,259 152,086,719<br />

Net Current Assets 40,512,775 15,497,562<br />

Debit balance in profit and loss account 9 22,306,539 3,858,689<br />

96,624,270 96,624,270<br />

Significant accounting policies and notes to the financial statements 15<br />

The schedules referred to above and the notes thereon form an integral part of the financial statements<br />

As per our report attached<br />

For B S R & Associates<br />

Chartered Accountants<br />

Firm registration No.:116231W<br />

For and on behalf of Board of Directors<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

S Sethuraman Samson KJ Gaurav Vivek Soni<br />

Partner Managing Director Director<br />

Membership No.: 203491<br />

Place : Chennai<br />

Place : Kochi<br />

Date: 9 May 2011 Date: 9 May 2011<br />

- 9 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

PROFIT AND LOSS ACCOUNT<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

Schedule For the year ended For the year ended<br />

No. 31 March 2011 31 March 20<strong>10</strong><br />

INCOME<br />

Broking income 184,870,927 117,211,987<br />

Other income <strong>10</strong> 16,444,393 8,609,289<br />

201,315,320 125,821,276<br />

EXPENDITURE<br />

Operating costs 11 82,593,354 48,424,206<br />

Personnel costs 12 43,040,126 36,157,058<br />

Trading and other administrative expenses 13 34,368,608 21,366,341<br />

Provision for diminution other than<br />

temporary in the value of investments 15 C (m) 40,350,000 9,650,000<br />

Depreciation /amortization 3 6,869,701 6,930,734<br />

Interest and finance charges 14 1,916,848 1,815,950<br />

209,138,637 124,344,289<br />

Profit / ( loss ) before taxes (7,823,317) 1,476,987<br />

Provision for tax<br />

- Current tax 11,632,360 -<br />

- Deferred tax charge / ( benefit ) (1,007,827) 3,452,155<br />

Profit / ( loss ) after tax (18,447,850) (1,975,168)<br />

Balance in profit and loss account brought forward (6,373,689) (4,398,521)<br />

Balance in profit and loss account carried forward (24,821,539) (6,373,689)<br />

Earnings per share:<br />

Basic and diluted 15 C ( i ) (13.15) (3.07)<br />

Weighted average number of equity shares<br />

outstanding during the year 1,800,000 1,800,000<br />

Nominal value of equity shares (Rs) <strong>10</strong> <strong>10</strong><br />

Significant accounting policies and notes to the financial statements 15<br />

The schedules referred to above and the notes thereon form an integral part of the financial statements<br />

As per our report attached<br />

For B S R & Associates<br />

Chartered Accountants<br />

Firm registration No.:116231W<br />

For and on behalf of Board of Directors<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

S Sethuraman Samson KJ Gaurav Vivek Soni<br />

Partner Managing Director Director<br />

Membership No.: 203491<br />

Place : Chennai<br />

Place : Kochi<br />

Date: 9 May 2011 Date: 9 May 2011<br />

- <strong>10</strong> -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

As at<br />

As at<br />

31 March 2011 31 March 20<strong>10</strong><br />

1. Share capital<br />

Authorised capital<br />

Equity Share capital<br />

4,000,000 ( Previous year: 4,000,000 )<br />

equity shares of Rs <strong>10</strong> each 40,000,000 40,000,000<br />

Preference share capital<br />

8,000,000 ( Previous year: 8,000,000 )<br />

equity shares of Rs <strong>10</strong> each 80,000,000 80,000,000<br />

Issued, subscribed and fully paid-up<br />

1,800,000 ( Previous Year: 1,800,000 )<br />

equity shares of Rs <strong>10</strong> each fully paid up 18,000,000 18,000,000<br />

Of the above paid up equity shares 1,647,<strong>10</strong>0<br />

( Previous year: 1,647,<strong>10</strong>0 ) shares are held by the<br />

holding Company JRG Securities Limited including<br />

5 shares held under trust by various individuals.<br />

7,462,427 ( Previous Year: 7,462,427) 6 %<br />

preference shares of Rs <strong>10</strong> each fully paid up 74,624,270 74,624,270<br />

All the above paid up preference shares<br />

7,462,427 ( Previous year: 7,462,427) are held by<br />

the holding Company JRG Securities Limited . 92,624,270 92,624,270<br />

2. Reserves and surplus<br />

Securities Premium 4,000,000 4,000,000<br />

General Reserve 2,515,000 2,515,000<br />

Less: Debit balance in profit and loss account<br />

(As per contra - Schedule 9) (2,515,000) (2,515,000)<br />

4,000,000 4,000,000<br />

- 11 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

3. Fixed assets<br />

Particulars<br />

As at<br />

01 April 20<strong>10</strong><br />

Additions<br />

Gross block Depreciation /Amortization Net block<br />

Deletions /<br />

Writeoff<br />

As at<br />

31 March 2011<br />

As at<br />

01 April 20<strong>10</strong><br />

For the Year<br />

On deletions /<br />

Writeoff<br />

As at<br />

31 March 2011<br />

As at<br />

31 March 2011<br />

As at<br />

31 March 20<strong>10</strong><br />

Tangible Assets<br />

Furniture and fixtures 14,714,469 851,445 1,082,785 14,483,129 6,531,948 2,413,733 1,048,591 7,897,090 6,586,039 8,182,521<br />

Office Equipments<br />

including computers 14,717,483 943,614 3,779,465 11,881,632 9,367,282 1,976,797 3,679,187 7,664,892 4,216,740 5,350,201<br />

Electrical fittings 5,563,862 400,527 766,989 5,197,400 1,8<strong>10</strong>,830 899,914 422,556 2,288,188 2,909,212 3,753,032<br />

Vehicles 500,219 - - 500,219 47,315 98,511 - 145,826 354,393 452,904<br />

V-SAT equipments 4,974,940 - - 4,974,940 3,492,862 700,379 - 4,193,241 781,699 1,482,078<br />

Intangible Assets<br />

Computer software 5,345,631 - 1,273,039 4,072,592 4,485,052 780,368 1,273,039 3,992,381 80,211 860,579<br />

Total 45,816,604 2,195,586 6,902,278 41,<strong>10</strong>9,912 25,735,289 6,869,702 6,423,373 26,181,618 14,928,294 20,081,315<br />

Previous year 43,952,067 2,590,817 726,280 45,816,604 19,038,<strong>10</strong>1 6,930,734 233,546 25,735,289 20,081,315<br />

- 12 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

As at<br />

As at<br />

31 March 2011 31 March 20<strong>10</strong><br />

4. Investments<br />

Long term investment ( Unquoted , At cost )<br />

Investment in Subsidiary company<br />

JRG Insurance Broking Private Limited 65,000,000 65,000,000<br />

6,500,000 ( Previous year: 6,500,000 )<br />

equity shares of Rs <strong>10</strong> each<br />

Less: Provision for diminution other than<br />

temporary in the value of investments (50,000,000) (9,650,000)<br />

( Also refer note (C ) m of Schedule 15 )<br />

15,000,000 55,350,000<br />

5. Sundry debtors<br />

Secured<br />

Debts outstanding for a period exceeding six months<br />

- Considered good - 265,129<br />

Other Debts<br />

- Considered good 32,802 1,445,842<br />

Unsecured<br />

Debts outstanding for a period exceeding six months<br />

- Considered good - 53,146<br />

- Considered doubtful 2,038,273 1,255,692<br />

Other Debts<br />

- Considered good 3,163,226 6<strong>10</strong>,921<br />

- Considered doubtful - -<br />

5,234,301 3,630,730<br />

Less : Provision for bad and doubtful debts (2,038,273) (1,255,692)<br />

3,196,028 2,375,038<br />

Debts due from companies under the same mangement<br />

JRG Business Investment Consultants Limited (Maximum amount<br />

outstanding during the year Rs.38,252,419 (Previous year : Nil) 2,575,004 -<br />

6. Cash and bank balances<br />

Cash in hand 58,268 47,701<br />

Balances with scheduled banks<br />

- in current account 80,157,505 38,650,422<br />

- in deposit account (fixed deposits amounting to Rs.73,890,314<br />

(Previous year: Rs. 60,<strong>10</strong>7,690) are pledged with banks as security<br />

for guarantees issued by banks in favour of various exchanges) <strong>10</strong>0,777,715 66,779,398<br />

180,993,488 <strong>10</strong>5,477,521<br />

- 13 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

7. Loans and Advances<br />

Schedules forming part of the financial statements<br />

Unsecured and considered good<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

As at<br />

As at<br />

31 March 2011 31 March 20<strong>10</strong><br />

Loan to JRG Insurance Broking Private Limited<br />

(wholly owned subsidiary company)* - 983,575<br />

Deposits with exchanges 35,550,000 45,050,000<br />

Interest accrued 2,914,2<strong>10</strong> 529,582<br />

Rental and other deposit 4,116,687 7,126,088<br />

Advances recoverable in cash or in kind or for value to be received** 5,078,153 3,816,563<br />

Advance tax (net of provisions) 916,468 2,225,914<br />

48,575,518 59,731,722<br />

Unsecured and considered doubtful<br />

Advances recoverable in cash or in kind or for value to be received 2,476,193 2,476,193<br />

Rental and other deposits 492,372 -<br />

Less: Provision for doubtful loans and advances (2,968,565) (2,476,193)<br />

48,575,518 59,731,722<br />

* Maximum amount outstanding at any time during the year 983,575 1,321,487<br />

** Includes dues from director (Refer note C( e ) of schedule 15) <strong>10</strong>0,000 -<br />

Maximum amount outstanding during the year from directors <strong>10</strong>0,000 -<br />

8. Current liabilities<br />

Sundry Creditors<br />

- Micro enterprises and small enterprises * - -<br />

- Others<br />

- Client 155,426,400 129,062,533<br />

- Expenses 25,933,546 <strong>10</strong>,731,703<br />

- Payable to exchange 798,785 1,734,512<br />

Security deposit 8,033,930 8,609,085<br />

Other liabilities 2,059,598 1,948,886<br />

192,252,259 152,086,719<br />

* Refer note C( k ) of schedule 15<br />

9. Profit and loss account<br />

Debit balance in profit and loss account 24,821,539 6,373,689<br />

Less: As per contra in general reserve - Schedule 2 (2,515,000) (2,515,000)<br />

22,306,539 3,858,689<br />

- 14 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

<strong>10</strong> Other income<br />

Interest received on fixed deposits ( Tax deducted at source :<br />

Rs.713,192 ,Previous year : Rs. 966,767 ) 5,443,917 5,433,501<br />

Interest / penal charges for delayed payment<br />

(Tax deducted at source : Rs Nil ,Previous year : Rs Nil) 3,251,601 2,220,439<br />

Interest on loan given to Group Companies ( Tax deducted at source :<br />

Rs.114,880 ,Previous year : Rs. Nil ) 1,164,275 -<br />

Service tax refunded 5,831,293 -<br />

Liability no longer required written back 390,167 189,874<br />

Miscellaneous income 363,140 765,475<br />

16,444,393 8,609,289<br />

11 Operating costs<br />

Business incentive 56,159,833 30,158,742<br />

Turnover charges 23,283,252 15,411,913<br />

Connectivity charges 2,319,282 2,004,559<br />

Other Trading expenses 830,987 848,992<br />

82,593,354 48,424,206<br />

12 Personnel costs<br />

Salaries, wages and bonus 38,054,617 30,781,642<br />

Contributions to provident and other funds 1,7<strong>10</strong>,560 1,718,614<br />

Staff welfare expenses 3,274,949 3,656,802<br />

43,040,126 36,157,058<br />

13 Trading and other administrative expenses<br />

Power and fuel 1,868,865 1,743,205<br />

Rent 11,168,912 7,516,298<br />

Repair and maintenance- others 4,822,714 1,048,430<br />

Traveling expenses 2,483,888 1,151,058<br />

Communication expenses 2,762,520 2,209,711<br />

Printing and Stationery 620,858 763,525<br />

Office expenses 2,533,213 1,718,378<br />

Advertisement and business promotion 2,253,232 652,551<br />

Registration and renewals 1,535,079 1,805,863<br />

Professional and consultancy charge 2,325,716 1,552,579<br />

Directors sitting fees 70,000 80,000<br />

Provision for doubtful loans and advances 492,372 -<br />

Provision for bad and doubtful debts 782,581 705,378<br />

Loss on sale of fixed assets 352,005 254,834<br />

Miscellaneous expenses 296,653 164,531<br />

34,368,608 21,366,341<br />

14 Interest and finance charges<br />

Interest 247,966 113,813<br />

Other charges 1,668,882 1,702,137<br />

1,916,848 1,815,950<br />

- 15 -<br />

As at<br />

As at<br />

31 March 2011 31 March 20<strong>10</strong>

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

CASH FLOW STATEMENT<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

Schedule For the year ended For the year ended<br />

No. 31 March 2011 31 March 20<strong>10</strong><br />

Cash flow from operating activities<br />

Net profit / (loss) before tax (7,823,317) 1,476,987<br />

Adjustments for:<br />

Depreciation /amortization 6,869,701 6,930,734<br />

Provision for doubtful debts 782,581 705,378<br />

Provision for doubtful loans and advances 492,372 -<br />

Provision for diminution other than temporary in the value of investments 40,350,000 9,650,000<br />

Loss on sale of assets (net) 352,005 254,834<br />

Interest income (9,859,793) (7,653,940)<br />

Liabilities/ provisions no longer required (390,167) (189,874)<br />

Interest expense 247,966 113,813<br />

Operating profit before working capital changes 31,021,348 11,287,932<br />

Adjustments for:<br />

(Increase) / decrease in sundry debtors (1,603,571) 2,686,851<br />

(Increase) /decrease in loans and advances 11,216,<strong>10</strong>1 (25,142,185)<br />

(Decrease) / increase in current liabilities and provisions 40,555,707 40,<strong>10</strong>0,899<br />

Cash generated from operations 50,168,237 17,645,565<br />

Tax paid 9,800,000 -<br />

40,368,237 17,645,565<br />

Net cash generated from operating activities ( A ) 71,389,585 28,933,497<br />

Cash flow from investing activities<br />

Purchase of fixed assets (3,227,717) (2,590,817)<br />

Proceeds from sale of fixed assets 126,900 237,900<br />

Interest income 7,475,165 11,329,387<br />

Net cash used in investing activities ( B ) 4,374,348 8,976,470<br />

Cash flow from financing activities<br />

Interest paid (247,966) (113,813)<br />

Net cash from financing activities ( C ) (247,966) (113,813)<br />

Net increase/(decrease) in cash and cash equivalents (A+B+C) 75,515,967 37,796,154<br />

Cash and cash equivalents at the beginning of the year <strong>10</strong>5,477,521 67,681,367<br />

Cash and cash equivalents at the end of the year 6 180,993,488 <strong>10</strong>5,477,521<br />

Significant accounting policies and notes to the financial statements 15<br />

The schedules referred to above and the notes thereon form an integral part of the financial statements<br />

As per our report attached<br />

For B S R & Associates<br />

Chartered Accountants<br />

Firm registration No.:116231W<br />

For and on behalf of Board of Directors<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

S Sethuraman Samson KJ Gaurav Vivek Soni<br />

Partner Managing Director Director<br />

Membership No.: 203491<br />

Place : Chennai<br />

Place : Kochi<br />

Date: 9 May 2011 Date: 9 May 2011<br />

- 16 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

15. (A) Background<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited (“JRG <strong>Wealth</strong>” or “the Company”) was incorporated on 29 February 1996. The<br />

Company is a subsidiary of JRG Securities Limited (“parent company”) and is primarily engaged in the business as<br />

brokers for commodities trading in various commodity exchanges.<br />

15. (B) Significant Accounting Policies<br />

a. Basis of preparation of financial statements<br />

The financial statements of the Company have been prepared and presented in accordance with Indian Generally<br />

Accepted Accounting Principles (GAAP) under the historical cost convention on the accrual basis. GAAP comprises<br />

accounting standards notified by the Central Government of India under Section 211 (3C) of the Companies Act,<br />

1956, other pronouncements of Institute of Chartered Accountants of India and the provisions of Companies Act,<br />

1956.<br />

b. Use of estimates<br />

The preparation of financial statements in conformity with GAAP requires management to make estimates and<br />

assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities on the<br />

date of the financial statements and reported amounts of income and expenses during the period. Actual figures<br />

may differ from these estimates. Any revision to accounting estimates is recognized prospectively in current and<br />

future periods.<br />

c. Fixed assets and depreciation<br />

Fixed Assets are carried at cost of acquisition or construction less accumulated depreciation and impairment, if<br />

any. Cost comprises the purchase price and any attributable cost of bringing the asset to its working condition for<br />

its intended use.<br />

Depreciation on fixed assets is provided on Straight Line method. The rates of depreciation prescribed in Schedule<br />

XIV to the Companies Act, 1956 are considered as the minimum rates. If the management’s estimate of the useful<br />

life of a fixed asset at the time of acquisition of the asset or of the remaining useful life on a subsequent review is<br />

shorter than that envisaged in the aforesaid schedule, depreciation is provided at a higher rate based on the<br />

management’s estimate of the useful life/remaining useful life. The rates of depreciation followed by the Company<br />

are as follows:<br />

Asset group Depreciation rates (%)<br />

Furniture and fittings 20.00%<br />

Electrical fittings 20.00%<br />

Office equipments 20.00%<br />

Computers 16.21%<br />

Softwares 20.00%<br />

V- Sat equipments 16.21%<br />

Vehicle 20.00%<br />

Depreciation in respect of office furnishing (primarily in the nature of leasehold improvements) is provided on the<br />

straight-line method over a period of 5 years since the management is reasonably certain of renewal of lease<br />

terms.<br />

Individual assets costing Rs 5,000/- or less are depreciated at <strong>10</strong>0% in the year of purchase.<br />

d. Impairment of Assets<br />

The Company assesses at each balance sheet date whether there is any indication that an asset may be impaired.<br />

If any such indication exists, the Company estimates the recoverable amount (higher of net realizable value and<br />

value in use) of the asset. If such recoverable amount of the asset or the recoverable amount of the cash generating<br />

unit to which the asset belongs is less than the carrying amount, the carrying amount is reduced to its recoverable<br />

amount. The reduction is treated as an impairment loss and is recognized in the profit and loss account. If at the<br />

balance sheet date there is an indication that a previously assessed impairment loss no longer exists, the recoverable<br />

amount is reassessed and the asset is reflected at the recoverable amount subject to a maximum of depreciable<br />

historical cost.<br />

- 17 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

e. Revenue<br />

Brokerage income in relation to commodities broking activity is recognised on the trade date of transaction (net of<br />

service tax), upon confirmation of trade by the commodity exchange. Interest income is recognized on time proportion<br />

basis.<br />

f. Investments<br />

Investments are either classified as current or long-term based on the management’s intention. Current investments<br />

are carried at the lower of cost and fair value. Long-term investments are carried at cost and provisions recorded<br />

to recognize any decline, other than temporary, in the carrying value of each investment.<br />

g. Operating Lease<br />

Operating lease payments are recognized as an expense in the profit and loss account on a straight line basis over<br />

the lease term.<br />

h. Employee benefits<br />

I. Short term employee benefit plans<br />

All short term employee benefit plans such as salaries, wages, bonus, special awards and, medical benefits<br />

which fall due within 12 months of the period in which the employee renders the related services which<br />

entitles him to avail such benefits are recognized on an undiscounted basis and charged to the profit and loss<br />

account.<br />

II.<br />

Defined Contribution Plan<br />

Contributions to the provident funds are made monthly at a predetermined rate to the Regional Provident<br />

Fund Commissioner and debited to the profit and loss account on an accrual basis.<br />

III.<br />

Defined Benefit Plan<br />

Provision is made for gratuity based on actuarial valuation, carried out by an independent actuary as at the<br />

balance sheet date using the projected unit credit method. All actuarial gains and losses arising during the<br />

year are recognized in the Profit and Loss Account of the year.<br />

i. Taxation<br />

Income-tax expense comprise current tax (i.e. amount of tax for the period determined in accordance with the<br />

income-tax law) and deferred tax charge or credit (reflecting that tax effects of timing differences between accounting<br />

income and taxable income for the period). The deferred tax charge or credit and the corresponding deferred tax<br />

liabilities or assets are recognized using the tax rates and tax laws that have been enacted or substantively<br />

enacted by the balance sheet date. Deferred tax assets are recognized only to the extent there is a reasonable<br />

certainty that the assets can be realized in future; however, where there is unabsorbed depreciation or carried<br />

forward loss under taxation laws, deferred tax assets are recognized only if there is a virtual certainty of realization<br />

of such assets. Deferred tax assets are reviewed as at the balance sheet date and written down or written up to<br />

reflect the amount that is reasonably/virtually certain (as the case may be) to be realized. Current tax and deferred<br />

tax assets and liabilities are offset to the extent to which the Company has a legally enforceable right to set off and<br />

they relate to taxes on income levied by the same governing taxation laws.<br />

j. Provisions, contingent liabilities and contingent assets<br />

The Company creates a provision when there is present obligation as a result of past event that probably requires<br />

an outflow of resources and a reliable estimate can be made of the amount of the obligation. A disclosure for a<br />

contingent liability is made when there is a possible obligation or a present obligation that may, but probably will<br />

not, require an outflow of resources. Where there is a possible obligation or a present obligation in respect of which<br />

the likelihood of outflow of resources is remote, no provision or disclosure is made. Contingent assets are neither<br />

recognised nor disclosed in the financial statements.<br />

k. Cash flows<br />

Cash flows are reported using the indirect method, whereby profit before tax is adjusted for the effects of transactions<br />

of a non–cash nature and any deferrals or accruals of past or future cash receipts or payments. The cash flows from<br />

regular revenue generating, financing and investing activities of the Company are segregated.<br />

- 18 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

l. Earnings per share<br />

Basic earnings per share is computed by dividing net profit or loss for the period attributable to equity shareholders<br />

by the weighted average number of shares outstanding during the year. Diluted earnings per share amounts are<br />

computed after adjusting the effects of all dilutive potential equity shares. The number of shares used in computing<br />

diluted earnings per share comprises the weighted average number of shares considered for deriving basic<br />

earnings per share, and also the weighted average number of equity shares, which could have been issued on the<br />

conversion of all dilutive potential shares. In computing dilutive earnings per share, only potential equity shares<br />

that are dilutive and that decrease profit per share are included.<br />

15 (C) Notes to the financial statements<br />

a. Capital commitments and contingencies:<br />

· Bank guarantees outstanding Rs 121,500,000 (Previous Year: Rs. 86,673,000).<br />

· Estimated amount of contracts remaining to be executed on capital account net of capital advances and not<br />

provided for, amounts to Rs. Nil, (Previous Year: Rs. Nil).<br />

· Claims against not acknowledged as debts Rs <strong>10</strong>,432,462 (Previous Year: Rs. 8,726,163)<br />

The arrears of cumulative preference dividends (including tax thereon) on 6% cumulative convertible preference<br />

shares as at 31 March 2011 is Rs.8,775,832 (Previous Year: 3,554,726).<br />

b. Auditor’s remuneration ( included in legal and professional expenses )<br />

Particulars Year ended 31 March 2011 Year ended 31 March 20<strong>10</strong><br />

Statutory audit 500,000 500,000<br />

Tax audit 50,000 50,000<br />

Out of pocket expenses 46,250 95,140<br />

Total * 596,250 645,140<br />

*excludes service tax<br />

c. Deferred Taxes<br />

The major components of deferred tax assets and liabilities are outlined below:<br />

Particulars As at 31 March 2011 As at 31 March 20<strong>10</strong><br />

Deferred tax assets<br />

Arising from timing difference in respect of carry<br />

forward of unabsorbed depreciation. - 973,822<br />

Arising from timing difference in respect of provisions<br />

for doubtful debts and loans and advances. 1,663,146 1,153,152<br />

Arising from timing difference in respect of Depreciation 1,213,075 -<br />

Deferred tax liabilities<br />

Arising from timing difference in respect of Depreciation - (290,270)<br />

Others (31,690) -<br />

Net deferred tax asset 2,844,531 1,836,704<br />

- 19 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

d. Related party disclosures.<br />

Names of related parties and nature of relationship:<br />

Holding Company<br />

Subsidiary Company<br />

Fellow Subsidiary Company<br />

JRG Securities Limited<br />

JRG Insurance Broking Private Limited<br />

JRG Business Investment Consultants Limited<br />

JRG Fincorp Limited<br />

Key Managerial Personnel Samson K J (Managing Director) (From 23 January 20<strong>10</strong>)<br />

Whole Time Director ( From 04 May 2009 till 22 January 20<strong>10</strong>)<br />

Giby Mathew (Managing Director) (Resigned on 04 May 2009)<br />

Transactions and balance with related parties<br />

Particulars<br />

Equity contribution from parent company<br />

Transaction<br />

during year ended<br />

31 March 2011<br />

Amount (payable) /<br />

receivable as at<br />

31 March 2011<br />

JRG Securities Limited (Preference shares) -) (74,624,270)<br />

Loan given to subsidiary ( net ) (983,575) -)<br />

Loan given to fellow subsidiary (net)<br />

JRG Business Investment Consultants Limited (255,<strong>10</strong>5) -)<br />

Reimbursement of expenses<br />

JRG Securities Limited 2,094,418) (59,500)<br />

JRG Insurance Broking Private Ltd 88,902) -)<br />

JRG Business Investment Consultants Limited (13,618) -)<br />

Interest paid (net)<br />

JRG Fincorp Limited 42,799) -)<br />

JRG Securities Limited 61,471) -)<br />

Shared service expenses (including service tax)<br />

JRG Securities Limited 9,375,500) (9,375,500)<br />

Interest received from JRG Business<br />

Investment Consultants Limited 1,114,182) -)<br />

Amount receivable from JRG Business Investment<br />

Consultants Limited in relation to trading in commodities 2,575,004) 2,575,004)<br />

Remuneration<br />

Salaries and other allowances -<br />

Samson K J 842,720) -)<br />

- 20 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

Particulars<br />

Equity contribution from parent company<br />

Transaction<br />

during year ended<br />

31 March 20<strong>10</strong><br />

Amount (payable) /<br />

receivable as at<br />

31 March 20<strong>10</strong><br />

JRG Securities Limited (Preference shares) 74,624,270 (74,624,270)<br />

Loan given to subsidiary ( net ) 983,575 983,575)<br />

Reimbursement of expenses - -)<br />

JRG Securities Limited 2,530,964 -)<br />

JRG Insurance Broking Pvt Ltd 83,575 -)<br />

JRG Business Investment Consultants Limited 1,048,668 255,<strong>10</strong>5)<br />

Interest paid (net)<br />

JRG Fincorp Limited 586,111 -)<br />

JRG Securities Limited - -)<br />

Remuneration<br />

Salaries and other allowances -<br />

Giby Mathew 175,000 -)<br />

Samson K J 690,135 -)<br />

e. Managerial remuneration<br />

Remuneration to Directors Year ended 31 March 2011 Year ended 31 March 20<strong>10</strong><br />

Salaries and allowances* 842,720 865,135<br />

842,720 865,135<br />

*The directors are covered under the Company’s group gratuity scheme along with other employees of the Company.<br />

Contribution to gratuity is based on actuarial valuation done on an overall Company basis and hence is excluded<br />

above.<br />

The remuneration payable to the managing director of the company is in excess of the limits approved by the share<br />

holders at the Annual General Meeting by Rs.<strong>10</strong>0,000. Pending such recovery, the excess amount of Rs.<strong>10</strong>0,000<br />

paid to him has been shown as recoverable under loans and advances.<br />

f. Security margins from clients<br />

In order to secure the performance by the clients of their obligations, commitments and liabilities to the Company,<br />

bank guarantees are placed as margins in favour of the Company. Such bank guarantees are held by the Company<br />

in a fiduciary capacity on behalf of its clients and are not recognised in the financial statements. In case such<br />

margins are received in cash, the same are disclosed under creditors.<br />

- 21 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

g. Employee benefit<br />

The following table set out the status of the gratuity plan as required under AS 15 (Revised 2005) and the<br />

reconciliation of opening and closing balances of the present value of the defined benefit obligation:<br />

Particulars<br />

Year ended<br />

31 March 2011<br />

Year ended<br />

31 March 20<strong>10</strong><br />

Change in present value of obligations<br />

Obligations at beginning of the year/ period 1,052,685 937,627<br />

Current service cost 319,412 375,443<br />

Interest Cost 88,892 79,652<br />

Actuarial (gain) / loss (241,900) (340,037)<br />

Benefits paid (385,<strong>10</strong>5) -<br />

Obligations at the end of the year 833,984 1,052,685<br />

Change in Plan assets<br />

Fair value of plan assets at beginning of the year 1,341,339 1,230,586<br />

Prior year adjustment<br />

Expected return on plan assets <strong>10</strong>0,869 <strong>10</strong>4,600<br />

Actuarial gain / (loss) 6,325 6,153<br />

Contributions 75,815 -<br />

Benefits paid (385,<strong>10</strong>5) -<br />

Fair value of plan assets at end of the year 1,139,243 1,341,339<br />

Reconciliation of present value of the<br />

obligation and the fair value of plan assets<br />

Present value of the defined benefit obligation at the end of the year 833,984 1,052,685<br />

Fair value of plan assets at the end of the year 1,139,243 1,341,339<br />

Amount of (asset ) / liability recognized in the balance sheet (305,259) (288,654)<br />

Gratuity cost for the year<br />

Current service cost 319,412 375,443<br />

Interest cost 88,892 79,652<br />

Expected return on plan assets (<strong>10</strong>0,869) (<strong>10</strong>4,600)<br />

Actuarial (gain) / loss (248,225) (346,190)<br />

Net gratuity cost (included in Contribution to<br />

provident and other funds of Schedule 12) 59,2<strong>10</strong> 4,305<br />

Assumptions<br />

Interest rate 8.50% 8.50%<br />

Estimated rate of return on plan assets 8.50% 8.50%<br />

Rate of growth in salary levels 7.50% 7.50%<br />

Investment details of plan assets<br />

Funds managed by Insurer <strong>10</strong>0.00% <strong>10</strong>0.00%<br />

h. Segment reporting<br />

a) Primary Segment Information (by Business Segments)<br />

The Company is engaged only in the business of acting as brokers of various commodity exchanges. Thus,<br />

it operates in a single Primary Segment.<br />

b) Secondary Segment Reporting (by Geographical Segments)<br />

The Company only caters to the needs of the domestic market. Hence there are no reportable geographical<br />

segments.<br />

- 22 -

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

Schedules forming part of the financial statements<br />

(All amounts are in Indian Rupees except share data or as stated)<br />

i. Earnings per share<br />

Particulars<br />

As at<br />

31 March 2011<br />

As at<br />

31 March 20<strong>10</strong><br />

Net (loss) after taxation (18,447,850) (1,975,168)<br />

Unpaid preference dividend (including tax thereon) (5,221,<strong>10</strong>6) (3,554,726)<br />

Net (loss) considered for computing earnings / (loss) per share (23,668,956) (5,529,894)<br />

Number of equity shares considered as basic weighted<br />

average shares outstanding 1,800,000) 1,800,000)<br />

Basic and diluted earnings / (loss) per share (in Rs) (13.15) (3.07)<br />

j. Quantitative particulars<br />

As the Company is engaged in service activity, provision of information relating to quantitative details of sales and<br />

certain information as required under paragraphs 3, 4C and 4D of part II of Schedule VI to the Companies Act, 1956<br />

are not applicable.<br />

k. Micro, Small and Medium Enterprises Development Act, 2006<br />

The management has identified enterprises which have provided goods and services to the Company and which<br />

qualify under the definition of “Micro and Small Enterprises” as defined under Micro, Small and Medium Enterprises<br />

Development Act, 2006 (“the Act”). Accordingly, the disclosure in respect of the amounts payable to such enterprises<br />

as at 31 March 2011 has been made in the financial statements based on the information received and available<br />

with the Company. There are no overdue amounts payable to such enterprises as at 31 March 2011.<br />

l. Foreign currency forward contracts<br />

The Company has no receivable and payable in foreign currency as at the balance sheet date. Hence the Company<br />

has not entered into any foreign currency forward contract to hedge its risk associated with foreign currency<br />

fluctuations.<br />

m. JRG Insurance Broking Private Limited (‘JIBPL’) is a wholly owned subsidiary of the Company. As at 31 March<br />

2011, JIBPL has incurred accumulated losses aggregating to Rs.49.79 million which have significantly eroded the<br />

share capital of JIBPL. During the previous year, the management of JIBPL have commenced various steps<br />

including rationalization of the number of employees, changes to the revenue model, streamlining of the sales<br />

force etc. After considering the revised business plans in the context of the aforesaid changes, the management<br />

had made a provision of Rs.9.65 million towards a diminution other than temporary in the value of the investment<br />

during the previous year. However during the current year the above mentioned steps commenced during the<br />

previous year, were not able to be achieve the expected results. Accordingly the management has made a further<br />

provision of Rs.40.35 million towards a diminution other than temporary in the value of the investment after<br />

considering the revised budgets and business plans.<br />

n. Prior year comparatives<br />

Prior year figures have been reclassified / regrouped wherever necessary to conform to the current year’s<br />

classification.<br />

For B S R & Associates<br />

Chartered Accountants<br />

Firm registration No.:116231W<br />

For and on behalf of Board of Directors<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

S Sethuraman Samson KJ Gaurav Vivek Soni<br />

Partner Managing Director Director<br />

Membership No.: 203491<br />

Place : Chennai<br />

Place : Kochi<br />

Date: 9 May 2011 Date: 9 May 2011<br />

- 23 -

Annual Report 20<strong>10</strong> - 2011<br />

JRG <strong>Wealth</strong> <strong>Management</strong> Limited<br />

BALANCE SHEET ABSTRACT & GENERAL BUSINESS PROFILE<br />

I<br />

Registration Details<br />

Registration No. 09-<strong>10</strong>093<br />

Balance sheet Date 31/03/2011<br />

II<br />

Capital Raised during the year<br />

(Amount in Rs. Thousands)<br />

Right Issue<br />

Bonus Issue<br />

Private Placement<br />

Nil<br />

Nil<br />

Nil<br />

III<br />

Position of Mobilisation and Deployment of Funds<br />

(Amount in Rs. Thousands)<br />

Total Liabilities 96,624<br />

Total Assets 96,624<br />

Sources of Funds<br />

Paid-up Capital 92,624<br />

Reserves & Surplus 4,000<br />

Secured Loans -<br />

Unsecured Loans -<br />

Deferred Tax Liability -<br />

Applications of Funds<br />

Net Fixed Assets 2,844<br />

Intangible Assets -<br />

Investments 15,000<br />

Net Current Assets 40,513<br />

Miscellaneous Expenditure -<br />

Accumulated Losses 22,306<br />

Deferred Tax Asset 1,837<br />

IV<br />

Performance of Company<br />

(Amount in Rs. Thousands)<br />

Turnover 201,315<br />

Total Expenditure 201,315<br />

Profit/Loss Before Tax 7,823<br />

Profit/Loss After Tax (18,443)<br />

Earnings per share (in Rs.) (13.15)<br />

Dividend Rate (%)<br />

Nil<br />

Item Code No. (ITC Code)<br />

Product Description<br />

NA<br />

COMMODITY BROKING<br />

Place : Kochi Samson KJ Gaurav Vivek Soni<br />

Date : 09.05.2011 Managing Director Director<br />

- 24 -

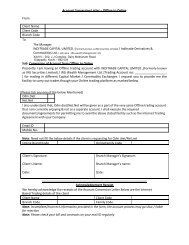

JRG Insurance Broking Private Limited<br />

Annual Report 20<strong>10</strong> - 2011<br />

DIRECTORS’ REPORT<br />

Your Directors have great pleasure in presenting the eleventh annual report together with the audited statement of accounts<br />

of your Company for the year ended 31 st March, 2011.<br />

1. Operations & Financial Results<br />

Particulars<br />

Total Revenue 7,182,459 14,625,366<br />

Total Expenditure 7,638,897 15,703,708<br />

Profit/(Loss)Before Tax & prior period expenses (456,438) (1,078,342)<br />

Prior Period Items Nil Nil<br />

Provision For Taxes/(Deferred tax benefit and FBT) Nil Nil<br />

Profit /(Loss) After Tax (456,438) (1,078,342)<br />

Balance in Profit & Loss Account Brought Forward (49,328,653) (48,250,311)<br />

Balance in Profit & loss A/c carried forward (49,785,091) (49,328,653)<br />

During the year the Company has recorded revenue of Rs 71.82 lakhs as against Rs 146.25 lakhs in the previous year.<br />

The expenditure during the period was Rs 76.38 lakhs which has resulted in a loss of Rs 4.56 lakhs as against <strong>10</strong>.78<br />

lakhs during the previous year. The Company is rapidly expanding the insurance broking business and has a vision to<br />

be a leader in south India for distributing life and general insurance products.<br />

2. Directors<br />

During the year, Board has appointed Mr. Vijayakumaran V K, Principal Officer Cum CEO of the Company as its Manager<br />

w.e.f 25.05.20<strong>10</strong> on a remuneration of not exceeding Rs 4 lakhs per annum, including bonus payable, if any, Subject to<br />

the approval of the shareholders in the ensuing Annual General Meeting by way of special resolution<br />

Mr Srirama Chandran.N, Director, has resigned from the Board of the Company w.e.f 31.03.2011.Board has appointed<br />

Mr Syam Kumar R as Additional Director by way of circular Resolution, w.e.f 01.04.2011. He will hold office only up to the<br />

conclusion of the ensuing Annual General Meeting. Company has received nomination from a member pursuant to Sec<br />

257 of the Companies Act 1956 proposing the candidature of Mr Syam Kumar R along with the requisite deposit. Board<br />

recommends his appointment in the ensuing AGM.<br />

Mr. Sanjeev Kumar G, Director, would be liable to retire by rotation at the forthcoming Annual General Meeting and being<br />

eligible offers himself for reappointment.<br />

3. Compliance to IRDA Regulations<br />

During the year under review the Company has complied with all the provisions of IRDA Regulations.<br />

4. Directors’ Responsibility Statement<br />

In accordance with the provisions of Section 217 (2AA) of the Companies Act, 1956, the Board of Directors affirm<br />

(a) That in the preparation of the Accounts for the year ending March 31, 2011 the applicable Accounting Standards<br />

were followed and there are no material departures therefrom.<br />

(b) That the accounting policies have been selected and applied consistently and have made judgments and estimates<br />

that were reasonable and prudent so as to give a true and fair view of the state of affairs of the Company as on<br />

March 31, 2011 and of the loss of the Company for the year ended on that date.<br />

(c) That proper and sufficient care was taken for the maintenance of adequate accounting records in accordance with<br />

the provisions of the Act for safeguarding the assets of the Company and for preventing and detecting fraud and<br />

other irregularities.<br />

(d) That the accounts for the year ended March 31, 2011 were prepared on a going concern basis.<br />

5. Auditors<br />

M/s BSR & Associates, KPMG House, No <strong>10</strong>, Mahatma Gandhi Road, Nungambakkam, Chennai- 600034, were appointed<br />

as the statutory auditors for the financial year 20<strong>10</strong>-11. Board recommended their reappointment as Company’s statutory<br />

auditors for the financial year 2011-12.<br />

- 25 -<br />

Amount in Rs.<br />

20<strong>10</strong>-11 2009-<strong>10</strong>

Annual Report 20<strong>10</strong> - 2011<br />

JRG Insurance Broking Private Limited<br />

6. Information under Sec 217(1) (e) of the Companies Act 1956<br />

In terms of Section 217(1) (e) of the Companies Act, 1956 (as amended) and the Companies (Disclosure of particulars<br />

in Report of Directors) Rules, 1988, your Directors furnish hereunder the additional information as required:<br />

A. Conservation of Energy – All possible steps are being taken at the design and implementation for reducing the<br />