Strategic Planning, Refinery and Aviation - SPC

Strategic Planning, Refinery and Aviation - SPC

Strategic Planning, Refinery and Aviation - SPC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28<br />

Year in Review<br />

<strong>Strategic</strong> <strong>Planning</strong>,<br />

<strong>Refinery</strong> <strong>and</strong> <strong>Aviation</strong><br />

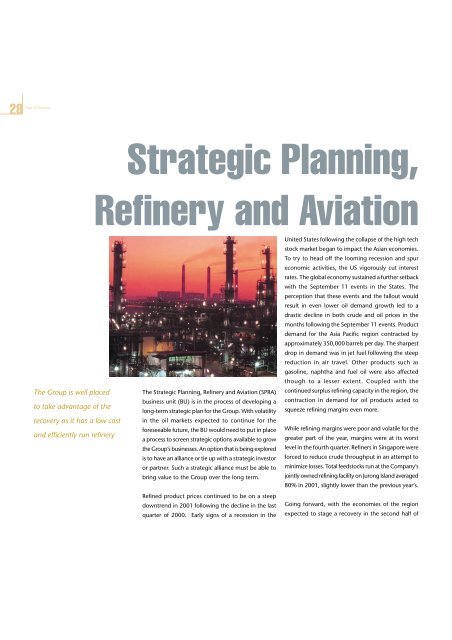

The Group is well placed<br />

to take advantage of the<br />

recovery as it has a low cost<br />

<strong>and</strong> efficiently run refinery<br />

The <strong>Strategic</strong> <strong>Planning</strong>, <strong>Refinery</strong> <strong>and</strong> <strong>Aviation</strong> (SPRA)<br />

business unit (BU) is in the process of developing a<br />

long-term strategic plan for the Group. With volatility<br />

in the oil markets expected to continue for the<br />

foreseeable future, the BU would need to put in place<br />

a process to screen strategic options available to grow<br />

the Group’s businesses. An option that is being explored<br />

is to have an alliance or tie up with a strategic investor<br />

or partner. Such a strategic alliance must be able to<br />

bring value to the Group over the long term.<br />

Refined product prices continued to be on a steep<br />

downtrend in 2001 following the decline in the last<br />

quarter of 2000. Early signs of a recession in the<br />

United States following the collapse of the high tech<br />

stock market began to impact the Asian economies.<br />

To try to head off the looming recession <strong>and</strong> spur<br />

economic activities, the US vigorously cut interest<br />

rates. The global economy sustained a further setback<br />

with the September 11 events in the States. The<br />

perception that these events <strong>and</strong> the fallout would<br />

result in even lower oil dem<strong>and</strong> growth led to a<br />

drastic decline in both crude <strong>and</strong> oil prices in the<br />

months following the September 11 events. Product<br />

dem<strong>and</strong> for the Asia Pacific region contracted by<br />

approximately 350,000 barrels per day. The sharpest<br />

drop in dem<strong>and</strong> was in jet fuel following the steep<br />

reduction in air travel. Other products such as<br />

gasoline, naphtha <strong>and</strong> fuel oil were also affected<br />

though to a lesser extent. Coupled with the<br />

continued surplus refining capacity in the region, the<br />

contraction in dem<strong>and</strong> for oil products acted to<br />

squeeze refining margins even more.<br />

While refining margins were poor <strong>and</strong> volatile for the<br />

greater part of the year, margins were at its worst<br />

level in the fourth quarter. Refiners in Singapore were<br />

forced to reduce crude throughput in an attempt to<br />

minimize losses. Total feedstocks run at the Company’s<br />

jointly owned refining facility on Jurong Isl<strong>and</strong> averaged<br />

80% in 2001, slightly lower than the previous year’s.<br />

Going forward, with the economies of the region<br />

expected to stage a recovery in the second half of

Year in Review<br />

29<br />

With the economies of the region<br />

expected to stage a recovery in the<br />

second half of 2002, there are signs<br />

that dem<strong>and</strong> for oil may improve<br />

2002, there are signs that dem<strong>and</strong> for oil may<br />

improve. The Group is well placed to take advantage<br />

of the recovery as it has a low cost <strong>and</strong> efficiently run<br />

refinery.<br />

In aviation sales, <strong>SPC</strong> managed to maintain its market<br />

share of around 19% of jet fuel sales at Singapore<br />

Changi Airport. Changi recorded an average<br />

throughput of approximately 73,200 barrels per day<br />

for 2001, about 3.1% higher than the previous year.<br />

This was despite passenger <strong>and</strong> air traffic volume in<br />

the Asia Pacific region suffering a double-digit decline<br />

in the aftermath of the September 11 events. Jet fuel<br />

volumes registered a marginal decline of 2.5% after<br />

the September 11 events due to a cutback in air<br />

flights through Changi. Interestingly, the decline was<br />

not steeper given the airlines’ decision to maximize<br />

their fuel off takes from Changi for reasons<br />

of economy, security <strong>and</strong> quality.<br />

Notwithst<strong>and</strong>ing the changes <strong>and</strong> recent<br />

development in the aviation industry, <strong>SPC</strong> continues<br />

to be a quality <strong>and</strong> competitive supplier of jet fuel at<br />

Changi. Reflecting its strengths in the market, <strong>SPC</strong><br />

secured five new jet fuel supply contracts at Changi,<br />

bringing the total number of airlines served to 23 in<br />

2001.<br />

At Taipei’s Chiang Kai Shek International Airport, <strong>SPC</strong><br />

supplied more than 30% of the jet fuel to<br />

foreign airlines at<br />

this air hub.<br />

At the Hong Kong<br />

International<br />

Airport,<strong>SPC</strong><br />

volumes for 2001 of<br />

2,900 barrels per<br />

day were slightly<br />

higher than the<br />

volumes for 2000<br />

due mainly to higher<br />

off takes by its<br />

existing customers.<br />

For 2002, the<br />

outlook for jet fuel<br />

sales is mixed. A drop in volume at Changi in the<br />

first quarter is expected as some major airlines have<br />

announced their intention to reduce flights. Airlines<br />

are however taking concerted action through tighter<br />

security measures <strong>and</strong> attractive ticket discounting<br />

to restore passenger traffic back to the pre-<br />

September level. Despite such efforts, it is<br />

envisaged that jet fuel volume at Changi is unlikely<br />

to be maintained at the 2001 levels. It would take<br />

some time to restore confidence in air travel<br />

hence industry opinion is that jet fuel volumes<br />

in Singapore is expected to show a slight decline<br />

of 3% to 5% for 2002.<br />

<strong>SPC</strong> continues to be<br />

a quality <strong>and</strong> competitive<br />

supplier of aviation fuel