ANZSCO: 2414 - AWPA

ANZSCO: 2414 - AWPA

ANZSCO: 2414 - AWPA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

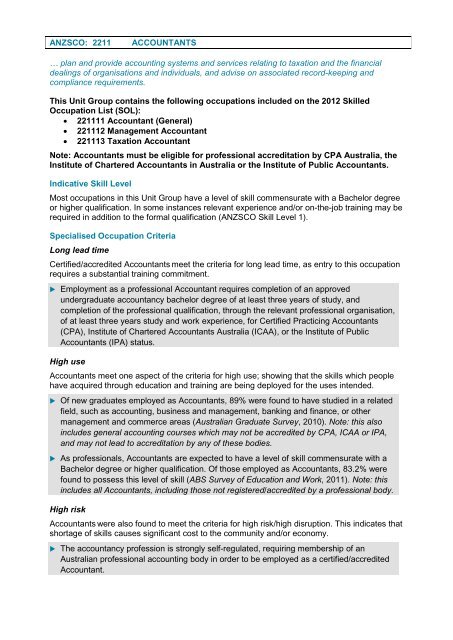

<strong>ANZSCO</strong>: 2211<br />

ACCOUNTANTS<br />

… plan and provide accounting systems and services relating to taxation and the financial<br />

dealings of organisations and individuals, and advise on associated record-keeping and<br />

compliance requirements.<br />

This Unit Group contains the following occupations included on the 2012 Skilled<br />

Occupation List (SOL):<br />

221111 Accountant (General)<br />

221112 Management Accountant<br />

221113 Taxation Accountant<br />

Note: Accountants must be eligible for professional accreditation by CPA Australia, the<br />

Institute of Chartered Accountants in Australia or the Institute of Public Accountants.<br />

Indicative Skill Level<br />

Most occupations in this Unit Group have a level of skill commensurate with a Bachelor degree<br />

or higher qualification. In some instances relevant experience and/or on-the-job training may be<br />

required in addition to the formal qualification (<strong>ANZSCO</strong> Skill Level 1).<br />

Specialised Occupation Criteria<br />

Long lead time<br />

Certified/accredited Accountants meet the criteria for long lead time, as entry to this occupation<br />

requires a substantial training commitment.<br />

Employment as a professional Accountant requires completion of an approved<br />

undergraduate accountancy bachelor degree of at least three years of study, and<br />

completion of the professional qualification, through the relevant professional organisation,<br />

of at least three years study and work experience, for Certified Practicing Accountants<br />

(CPA), Institute of Chartered Accountants Australia (ICAA), or the Institute of Public<br />

Accountants (IPA) status.<br />

High use<br />

Accountants meet one aspect of the criteria for high use; showing that the skills which people<br />

have acquired through education and training are being deployed for the uses intended.<br />

Of new graduates employed as Accountants, 89% were found to have studied in a related<br />

field, such as accounting, business and management, banking and finance, or other<br />

management and commerce areas (Australian Graduate Survey, 2010). Note: this also<br />

includes general accounting courses which may not be accredited by CPA, ICAA or IPA,<br />

and may not lead to accreditation by any of these bodies.<br />

As professionals, Accountants are expected to have a level of skill commensurate with a<br />

Bachelor degree or higher qualification. Of those employed as Accountants, 83.2% were<br />

found to possess this level of skill (ABS Survey of Education and Work, 2011). Note: this<br />

includes all Accountants, including those not registered/accredited by a professional body.<br />

High risk<br />

Accountants were also found to meet the criteria for high risk/high disruption. This indicates that<br />

shortage of skills causes significant cost to the community and/or economy.<br />

The accountancy profession is strongly self-regulated, requiring membership of an<br />

Australian professional accounting body in order to be employed as a certified/accredited<br />

Accountant.

SOL Summary<br />

The number employed in this Unit Group is expected to grow by 9.3% to 2015-16, while<br />

domestic commencements in accounting specialisations have decreased by 8.3% over the past<br />

five years, signalling a downturn in domestic supply.<br />

Unemployment rates for Accountants continue to remain below the ‘all occupations’ average.<br />

Each of the professional Accounting bodies provided submissions highlighting a number of<br />

issues which support the view that migration will continue to be required to supplement<br />

domestic supply in this occupation over the medium term.<br />

The evidence indicates that the demand for Accountant (General), Management Accountant<br />

and Taxation Accountant is expected to exceed supply over the medium to longer term.<br />

Accountant (General), Management Accountant and Taxation Accountant are included on the<br />

2012 SOL but continue to be flagged for further monitoring of labour market conditions to<br />

ensure the economy maintains its strong capacity to absorb the high level of independent<br />

migrants in this occupation.

Occupation trends<br />

<strong>ANZSCO</strong>: 2211<br />

Accountants<br />

Employment level<br />

6 digit employment<br />

(2006 Census)<br />

Employment growth<br />

Unemployment rate<br />

Educational profile<br />

Vacancies<br />

Gender<br />

Labour turnover<br />

Age profile<br />

158 100 A high proportion of workers (83.5%) are employed full-time.<br />

2211-11 Accountant (General) 112 790<br />

2211-12 Management Accountant 2910<br />

2211-13 Taxation Accountant 7510<br />

Over the five years to November 2011, employment in this occupation<br />

increased by 6.9% (compared with growth of 10.4% for all occupations).<br />

Employment over the next five years is expected to increase by 9.3%.<br />

2.0% compared with 3.1% for all occupations.<br />

83.2% have a Bachelor degree or higher qualification.<br />

The Internet Vacancy Index (IVI) fell by 4.7% over the 12 months to<br />

November 2011. Vacancies for all occupations fell by 7.1%.<br />

49.0% of workers in this occupation are female (compared with 45.5% for all<br />

occupations).<br />

Annually, 10.3% of Accountants, Auditors and Company Secretaries (which<br />

includes Accountants) leave their occupation group, creating some potential<br />

job openings (this compares with 14.2% across all occupations).<br />

The median age is 37 years and 30.5% of workers are aged 45 years and<br />

over (compared with 38.5% for all occupations).<br />

Earnings Median full-time weekly earnings (before tax) are $1265 compared with $1050<br />

for all occupations.<br />

Graduate outcomes<br />

Data from Graduate Careers Australia (GCA) indicate that 78.6% of students<br />

completing a Bachelor degree in the field of accounting in 2010 (and who<br />

were available for full-time work) were in full-time employment four months<br />

after graduating. This is slightly above the average for all Bachelor degree<br />

graduates (76.6%).<br />

GCA data indicate that labour market outcomes for these 2010 accounting<br />

graduates are weaker than those recorded for 2008 graduates (more than<br />

85% of whom secured full-time employment four months after graduating).<br />

Outcomes for Masters (by coursework) graduates are particularly weak, with<br />

69.2% of those available for full-time employment working full-time four<br />

months after graduation (compares with 84.6% of all Masters coursework<br />

graduates).<br />

Skill shortages Shortages of Accountants were relatively persistent until 2008.<br />

Labour market<br />

Shortages of Accountants were persistent until the onset of the global recession when demand fell markedly.<br />

There has not been a significant pick-up in demand since then and the labour market remains subdued.<br />

Recruitment experiences in 2011 suggest the labour market has eased further over the past year and that<br />

there is some surplus supply of qualified Accountants. There is no evidence of shortages re-emerging.<br />

Almost 90% of surveyed vacancies in late 2011 were filled and there were large fields of candidates (an<br />

average of 28 per vacancy), with 4.5 suitable applicants per vacancy overall, significantly above the number<br />

of suitable applicants per vacancy across all surveyed occupations of 1.7.<br />

Metropolitan employers were more successful than regional employers; filling 96% of surveyed vacancies<br />

and attracting an average of 31 applicants per vacancy, with five per vacancy considered to be suitable.<br />

Significant numbers of those applicants considered to be unsuitable held relevant qualifications (some at the<br />

Department of Education, Employment and Workplace Relations (DEEWR) January 2012

post-graduate level) but were unsuitable for other reasons, including low levels of written and oral<br />

communication skills.<br />

Regional employers filled 76% of vacancies; receiving an average of 21 applicants, of whom three were<br />

suitable.<br />

Management Accountant, Taxation Accountant and Accountant (General) were not disaggregated prior to<br />

2009 (they were a single six digit occupation under the title Accountant). It is therefore difficult to provide a<br />

historical perspective of these separate accounting streams.<br />

2211-11 Accountant (General)<br />

DEEWR research in late 2011 shows employers filled vacancies for General Accountants with ease. About<br />

85% of general accountant vacancies were filled, with unfilled vacancies primarily being for senior positions,<br />

although a small number remained unfilled because the preferred candidate withdrew. Vacancies attracted<br />

an average of 28 applicants, five of whom were considered by employers to be suitable.<br />

In 2011, the average number of applicants and suitable applicants rose markedly compared with 2010,<br />

suggesting some excess supply of these professionals and strong competition for vacancies among qualified<br />

accountants.<br />

2211-12 Management Accountant<br />

There are no shortages of Management Accountants. Employers contacted by DEEWR in 2011, who had<br />

advertised for Management Accountants, filled all advertised vacancies across sectors and experience levels<br />

in both metropolitan and regional areas. Advertised positions attracted an average of 25 applicants per<br />

vacancy, with five per vacancy considered by employers to be suitable.<br />

2211-13 Taxation Accountant<br />

DEEWR research shows employers recruiting Taxation Accountants attracted slightly fewer suitable<br />

applicants per vacancy than those recruiting for the other two Accountant occupations in this unit group,<br />

although there is no evidence of shortages and they had relatively large fields of qualified applicants from<br />

whom to chose. About 85% of taxation accountant vacancies were filled. Employers received an average of<br />

21 applications per vacancy with three candidates per position considered to be suitable.<br />

Department of Education, Employment and Workplace Relations (DEEWR) January 2012

Department of Education, Employment and Workplace Relations (DEEWR) January 2012