RABDF farmer questionnaire

RABDF farmer questionnaire

RABDF farmer questionnaire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

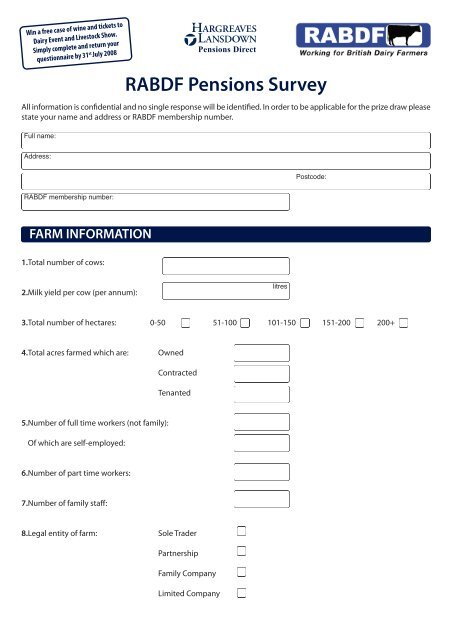

Win a free case of wine and tickets to<br />

Dairy Event and Livestock Show.<br />

Simply complete and return your<br />

<strong>questionnaire</strong> by 31 st July 2008<br />

<strong>RABDF</strong> Pensions Survey<br />

All information is confidential and no single response will be identified. In order to be applicable for the prize draw please<br />

state your name and address or <strong>RABDF</strong> membership number.<br />

Full name:<br />

Pensions Direct<br />

Address:<br />

Postcode:<br />

<strong>RABDF</strong> membership number:<br />

FARM INFORMATION<br />

1.Total number of cows:<br />

2.Milk yield per cow (per annum):<br />

litres<br />

3.Total number of hectares: 0-50 51-100 101-150 151-200 200+<br />

4.Total acres farmed which are:<br />

Owned<br />

Contracted<br />

Tenanted<br />

5.Number of full time workers (not family):<br />

Of which are self-employed:<br />

6.Number of part time workers:<br />

7.Number of family staff:<br />

8.Legal entity of farm:<br />

Sole Trader<br />

Partnership<br />

Family Company<br />

Limited Company

ABOUT YOU<br />

YOU<br />

YOUR SPOUSE<br />

1. Sex:<br />

Male Female Male Female<br />

2. What is your date of birth?<br />

/ / / /<br />

3. Are you currently:<br />

Employed<br />

Self-employed<br />

Employed<br />

Self-employed<br />

EXISTING SAVINGS<br />

1 A. What kind of pensions do you already have?<br />

YOU<br />

Final Salary<br />

Personal Pension<br />

Stakeholder<br />

SIPP<br />

Other (please state)<br />

YOUR SPOUSE<br />

Final Salary<br />

Personal Pension<br />

Stakeholder<br />

SIPP<br />

Other (please state)<br />

None<br />

(please go to question 2)<br />

None<br />

(please go to question 2)<br />

B. What annual income do you expect this pension will<br />

provide at retirement?<br />

C. Is this pension funded solely from your farm income?<br />

2.What are your current annual earnings after costs?<br />

£ £<br />

Yes No Yes No<br />

£ £<br />

3.What percentage of your earnings do you personally<br />

pay into your current pension?<br />

4.What percentage does your employer/ farm pay into<br />

your current pension?<br />

% %<br />

% %<br />

5.If contributions are made from the farm, where do you<br />

incorporate this in the accounts (eg- Labour)?<br />

6.How old were you when you joined your first pension<br />

plan ?

YOU<br />

YOUR SPOUSE<br />

7 A. If you are an employer do you offer a pension<br />

scheme for employees?<br />

Yes No<br />

Not applicable<br />

B. If so what level of contributions do you make as a<br />

percentage of earnings?<br />

C. What percentage of earnings do you require your<br />

employees to pay?<br />

%<br />

%<br />

8. Which of the following vehicles do you use for saving<br />

now and which would you consider for the future?<br />

Now Future Now Future<br />

a. Personal pension scheme<br />

b. Invest in the stock market by buying stocks or shares<br />

c. Commercial property<br />

d. Buy to let property<br />

e. High rate savings account<br />

f. ISA (or other tax-free savings account)<br />

g. Premium Bonds<br />

h. Other (please specify)<br />

9.Which of the above options would you consider the<br />

safest way to save for your retirement?<br />

10. If you do not have a pension (other than state) please<br />

state why:<br />

a. Will continue to take wage / drawings from the farm<br />

after retirement<br />

b. The farm will provide an income through letting<br />

c. I plan to sell the farm to provide an income<br />

d. I do not expect to live long enough<br />

e. I expect to rely on inherited funds<br />

f. I cannot afford to make contributions<br />

g. Other (please state)

11. How much knowledge do you have on pensions?<br />

a. I have a good knowledge of pensions issues<br />

b. I have a reasonable, basic knowledge of pensions -<br />

I know how they work generally but do not<br />

understand the details.<br />

c. My knowledge on pensions issues is very patchy -<br />

I know a bit about what concerns me but no more.<br />

d. Pensions confuse me and I know little or nothing<br />

about pensions issues<br />

RETIREMENT PLANS<br />

1. At what age do you plan to retire from full-time<br />

farming (please state if already retired)<br />

2. If you plan to retire after the age of 65 please state why?<br />

Age<br />

YOU<br />

Already retired<br />

YOUR SPOUSE<br />

Age<br />

Already retired<br />

3. At what age do you expect to be able to afford to retire<br />

from all work ?<br />

Age<br />

Never<br />

Age<br />

Never<br />

4 A. What annual income from your private pension do you<br />

think you could just about make do with in retirement?<br />

B. What annual income do you think you will need from<br />

your private pension to live comfortably in retirement?<br />

- What percentage of your pre-retirement salary do<br />

you think this will be?<br />

5. How much do you expect to receive from your state<br />

pension?<br />

6.Do you know where to get a forecast for you state pension?<br />

£ £<br />

£ £<br />

% %<br />

£<br />

£<br />

Don’t know<br />

Don’t know<br />

Yes No Yes No<br />

FINALLY<br />

1.Recently updated <strong>RABDF</strong> figures suggest the value of unpaid family labour to be £38,079 for the <strong>farmer</strong><br />

and £6,662 for the spouse. How much do you include into your dairy costings?<br />

Farmer<br />

Spouse<br />

Do not include Unpaid family labour<br />

Do not include Unpaid family labour<br />

< 15,000<br />

< 1,000<br />

15,000 – 24,999<br />

1,000-2,499<br />

25,000-29,999<br />

2,500-4,999<br />

30,000-34,999<br />

5,000-6,499<br />

35,000-39,999<br />

6,500-7,999<br />

> 40,000<br />

> 8,000<br />

2. Do you have any other comments you would like to make:<br />

From time to time we like to send complimentary information about our services to interested people. If you would prefer not to receive any<br />

information from Hargreaves Lansdown please tick here If you would prefer not to receive anything from the <strong>RABDF</strong> please tick here