Stochastic Calculus, Week 9 Applications of risk-neutral valuation

Stochastic Calculus, Week 9 Applications of risk-neutral valuation

Stochastic Calculus, Week 9 Applications of risk-neutral valuation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

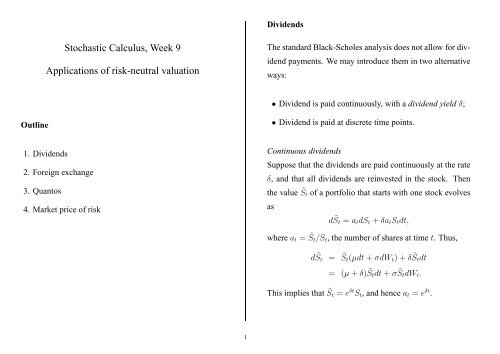

Dividends<br />

<strong>Stochastic</strong> <strong>Calculus</strong>, <strong>Week</strong> 9<br />

<strong>Applications</strong> <strong>of</strong> <strong>risk</strong>-<strong>neutral</strong> <strong>valuation</strong><br />

The standard Black-Scholes analysis does not allow for dividend<br />

payments. We may introduce them in two alternative<br />

ways:<br />

• Dividend is paid continuously, with a dividend yield δ;<br />

Outline<br />

• Dividend is paid at discrete time points.<br />

1. Dividends<br />

2. Foreign exchange<br />

3. Quantos<br />

4. Market price <strong>of</strong> <strong>risk</strong><br />

Continuous dividends<br />

Suppose that the dividends are paid continuously at the rate<br />

δ, and that all dividends are reinvested in the stock. Then<br />

the value ˜S t <strong>of</strong> a portfolio that starts with one stock evolves<br />

as<br />

d ˜S t = a t dS t + δa t S t dt,<br />

where a t = ˜S t /S t , the number <strong>of</strong> shares at time t. Thus,<br />

d ˜S t = ˜S t (µdt + σdW t )+δ ˜S t dt<br />

= (µ + δ) ˜S t dt + σ ˜S t dW t .<br />

This implies that ˜S t = e δt S t , and hence a t = e δt .<br />

1

A strategy (φ t ,ψ t ) in terms <strong>of</strong> (S t ,B t ) may be written as<br />

a corresponding strategy (˜φ t ,ψ t ) in terms <strong>of</strong> ( ˜S t ,B t ), with<br />

˜φ t = e −δt φ t . The self-financing restriction now is (with V t =<br />

˜φ t ˜St + ψ t B t )<br />

dV t<br />

= ˜φ t d ˜S t + ψ t dB t<br />

= φ t dS t + φ t δS t dt + ψ t dB t .<br />

The essential point is that, whereas the replicating portfolio<br />

is in terms <strong>of</strong> ˜S t , the derivative is in terms <strong>of</strong> S t . Note that<br />

the measure Q which makes ˜Z t = Bt<br />

−1 ˜S t a martingale, does<br />

not make Bt<br />

−1 S t a martingale.<br />

We find<br />

This yields, via <strong>risk</strong>-<strong>neutral</strong> <strong>valuation</strong>:<br />

• The forward price <strong>of</strong> S t : setting e −r(T −t) E Q [(S T −<br />

F t )|F t ]=0and solving for F t gives<br />

F t = e (r−δ)(T −t) S t .<br />

• The price <strong>of</strong> a call option struck at K. Following the<br />

same steps as in the standard Black-Scholes model, we<br />

find<br />

V t = e −r(T −t) E Q [(S T − K) + |F t ]<br />

= e −δ(T −t) S t Φ( ˜d 1 ) − e −r(T −t) KΦ( ˜d 2 )<br />

= e<br />

{F −r(T −t) t Φ( ˜d 1 ) − KΦ( ˜d<br />

}<br />

2 )<br />

d ˜Z t = (µ + δ − r) ˜Z t dt + σ ˜Z t dW t<br />

= σ ˜Z t d ˜W t ,<br />

where ˜W t = W t + γt, with γ = µ + δ − r , which is a<br />

σ<br />

Brownian motion under the measure Q defined by dQ/dP =<br />

exp(−γW T − 1 2 γ2 T ). Hence<br />

dS t = (r − δ)S t dt + σS t d ˜W t ,<br />

= S 0 exp<br />

([r − δ − 1 2 σ2 ]t + σ ˜W<br />

)<br />

t<br />

S t<br />

with<br />

˜d 1,2 = log(S t/K)+[(r − δ) ± 1 2 σ2 ](T − t)<br />

σ √ T − t<br />

= log(F t/K) ± 1 2 σ2 (T − t)<br />

σ √ .<br />

T − t<br />

2

Discrete dividends<br />

When dividends are paid at discrete time points T 1 ,...,T n ,<br />

then the stock goes ex-dividend, which means its price falls<br />

instantaneously by the amount <strong>of</strong> the dividend. When these<br />

dividends are immediately reinvested, the value ˜S t <strong>of</strong> that<br />

strategy <strong>of</strong> course does not display these discontinuities; i.e.,<br />

we simply may assume<br />

d ˜S t = µ ˜S t dt + σ ˜S t dW t .<br />

(Note: µ here should be compared with µ + δ in the continuous<br />

dividend model).<br />

When the dividend payments are δS t , we obtain<br />

S t =(1− δ) n[t] ˜St ,<br />

where n[t] is the number <strong>of</strong> dividend payments made by<br />

time t.<br />

This implies<br />

F t =(1− δ) n[T ]−n[t] e r(T −t) S t ,<br />

Foreign exchange<br />

Let C t denote the exchange rate, in US dollar per pound<br />

sterling. We’ll assume a geometric Brownian motion for<br />

C t :<br />

dC t = µC t dt + σC t dW t .<br />

Next, consider a US cash bond B t = e rt and a UK cash bond<br />

D t = e ut ; i.e., the interest rates r and u may be different.<br />

From the perspective <strong>of</strong> the US investor, there are two assets:<br />

the domestic cash bond with price B t , and the foreign<br />

cash bond with price S t = C t D t . Note that the latter is a<br />

<strong>risk</strong>y asset; its SDE is<br />

dS t = C t dD t + D t dC t<br />

= (µ + u)S t dt + σS t dW t<br />

= rS t dt + σS t d ˜W t ,<br />

where ˜W t = W t + γt, γ = µ + u − r . This again defines<br />

σ<br />

Q, the <strong>risk</strong>-<strong>neutral</strong> measure.<br />

and the value <strong>of</strong> a call option remains the same in terms <strong>of</strong><br />

F t .<br />

3

Notice that under this measure,<br />

E Q [C T |F t ] = e −uT E Q [S T |F t ]<br />

= e −uT e r(T −t) S t<br />

= e (r−u)(T −t) C t ,<br />

which yields the uncovered interest rate parity:<br />

(r − u)(T − t) = log E Q[C T |F t ]<br />

,<br />

C t<br />

where the right-hand side is the conditionally expected continuous<br />

depreciation.<br />

The forward exchange rate (for delivery at time T ) F t should<br />

solve<br />

e −r(T −t) E Q [(C T − F t )|F t ]=0,<br />

(<br />

and since C T = C t exp [r − u − 1 2 σ2 ](T − t)+σ[ ˜W T − ˜W<br />

)<br />

t ] ,<br />

this will yield<br />

F t = e (r−u)(T −t) C t ,<br />

which gives the covered interest rate parity:<br />

Again, the value <strong>of</strong> a call option on the exchange rate struck<br />

at K is the same as before, when expressed in terms <strong>of</strong> F t .<br />

Change <strong>of</strong> numeraire<br />

The entire analysis could be repeated from the perspective<br />

<strong>of</strong> the UK investor, who has the choice between a sterling<br />

cash bond D t and the sterling value <strong>of</strong> a dollar cash bond,<br />

˜S t = Ct<br />

−1 B t . The discounted price then is Dt<br />

−1 Ct −1 B t =<br />

Z −1<br />

t<br />

, where Z t = Bt<br />

−1 S t . The martingale measure is not<br />

the same as before: a measure which makes Z t a martingale<br />

does not make Zt<br />

−1 a martingale. However, the prices and<br />

hedge ratios are the same, regardless <strong>of</strong> the choice <strong>of</strong> the<br />

measure.<br />

Similarly, in the standard Black-Scholes model we may also<br />

work with a measure Q ∗ which makes St<br />

−1 B t a martingale.<br />

The important thing is to make relative prices martingales –<br />

the choice <strong>of</strong> the numeraire is not important.<br />

(r − u)(T − t) = log F t<br />

C t<br />

.<br />

4

Quantos<br />

Quantos are derivatives which have a pay<strong>of</strong>f in another currency<br />

than the underlying asset, using a fixed, prespecified<br />

exchange rate ¯C (e.g., one dollar per pound sterling). For<br />

example, when S t is a sterling stock price and K is a corrresponding<br />

strike price, then a quanto call has the dollar<br />

pay<strong>of</strong>f<br />

¯C(S T − K) + .<br />

In order to price such a derivative, one has to set up a joint<br />

process for (S t ,C t ), which is a vector diffusion with two<br />

independent Brownian motions (W 1 (t),W 2 (t)):<br />

dS t<br />

= µdt + σ 1 dW 1 (t),<br />

S t<br />

dC t<br />

C t<br />

= νdt + σ 2 dW ∗ 2 (t)<br />

= νdt + ρσ 2 dW 1 (t)+ √ 1 − ρ 2 σ 2 dW 2 (t),<br />

where W2 ∗ (t) = ρW 1 (t) + √ 1 − ρ 2 W 2 (t) is a standard<br />

Brownian motion, which has correlation ρ with W 1 (t), i.e.,<br />

E P [W 1 (t)W2 ∗ (t)] = ρt.<br />

The equivalent martingale measure now should turn both<br />

dollar assets Bt<br />

−1 C t S t and Bt<br />

−1 C t D t into martingale, which<br />

now involves a vector γ =(γ 1 ,γ 2 ) ′ , with<br />

dQ<br />

dP = exp ( −γ ′ W T − 1 2 γ′ γT ) ,<br />

where W T = (W 1 (T ),W 2 (T )) ′ . The actual definition <strong>of</strong><br />

γ follows from deriving the SDE for the discounted dollar<br />

assets and setting the drifts to zero.<br />

Note that ¯CSt is not a tradable dollar asset; hence its discounted<br />

value need not be a martingale. In fact its drift is<br />

(u − ρσ 1 σ 2 ) ¯CS t dt, which in general does not equal r ¯CS t dt.<br />

It can be derived that the dollar forward price on ¯CS t will<br />

be<br />

F Qt = ¯C exp(−ρσ 1 σ 2 [T − t])F t ,<br />

where F t is the sterling forward price. The quanto call value<br />

then is the usual, with F t replaced by F Qt , K replaced by<br />

¯CK, and σ replaced by σ 1 .<br />

5

Market price <strong>of</strong> <strong>risk</strong><br />

The fundamental theorem <strong>of</strong> asset pricing states that the absence<br />

<strong>of</strong> arbitrage opportunities is equivalent to the existence<br />

<strong>of</strong> a measure Q under which all asset prices relative<br />

to some numeraire are martingales. The equivalent martingale<br />

measure is unique if markets are complete, i.e., if any<br />

claim is replicable.<br />

Note that only tradable asset need to be martingales under<br />

Q; the previous examples all had a pay<strong>of</strong>f in terms <strong>of</strong> a nontradable<br />

asset, which was an explicit function <strong>of</strong> another<br />

tradable.<br />

The existence <strong>of</strong> Q implies a common market price <strong>of</strong> <strong>risk</strong><br />

γ t , which determines the change <strong>of</strong> measure via the CMG<br />

theorem. For example, if two tradable asset prices S 1 (t) and<br />

S 2 (t) are driven by the same Brownian motion W t :<br />

then<br />

dS 1 (t) = µ 1t S 1 (t)dt + σ 1t S 1 (t)dW t ,<br />

dS 2 (t) = µ 2t S 2 (t)dt + σ 2t S 2 (t)dW t ,<br />

γ t = µ 1t − r t<br />

σ 1t<br />

= µ 2t − r t<br />

σ 2t<br />

,<br />

where r t is the <strong>risk</strong>-free interest rate. In models with more<br />

than one driving Brownian motion, there is a vector <strong>of</strong> market<br />

prices <strong>of</strong> <strong>risk</strong>, one for each source <strong>of</strong> <strong>risk</strong> (i.e., each<br />

Brownian motion).<br />

Exercises<br />

1. Consider a bivariate geometric Brownian motion <strong>of</strong> the<br />

form<br />

dS 1 (t) = S 1 (t) {µ 1 dt + σ 11 dW 1 (t)+σ 12 dW 2 (t)} ,<br />

dS 2 (t) = S 2 (t) {µ 2 dt + σ 21 dW 1 (t)+σ 22 dW 2 (t)} ,<br />

where W 1 (t) and W 2 (t) are independent Brownian motions,<br />

and µ i and σ ij are constants, i, j = 1, 2. Find<br />

the vector γ <strong>of</strong> market prices <strong>of</strong> <strong>risk</strong>s, and check that<br />

e −rt S 1 (t) and e −rt S 2 (t) are both martingales under the<br />

measure Q defined by this γ.<br />

2. Suppose that S 1 and S 2 are geometric Brownian motions,<br />

driven by the same Brownian motion W t . Show that if<br />

both are tradable asset prices, but with a different market<br />

price <strong>of</strong> <strong>risk</strong>, then an arbitrage opportunity exists.<br />

6