IFRS for SMEs Implementation Guidance 2009.fm

IFRS for SMEs Implementation Guidance 2009.fm

IFRS for SMEs Implementation Guidance 2009.fm

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

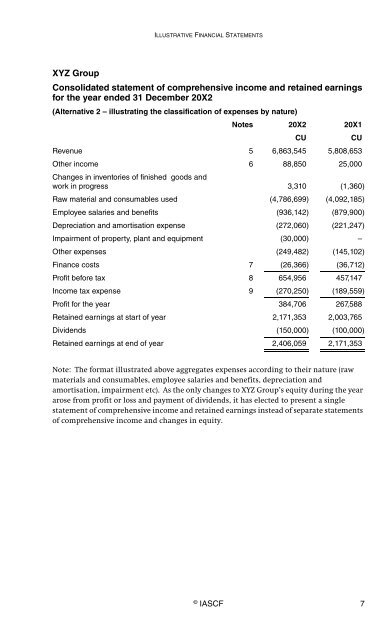

ILLUSTRATIVE FINANCIAL STATEMENTS<br />

XYZ Group<br />

Consolidated statement of comprehensive income and retained earnings<br />

<strong>for</strong> the year ended 31 December 20X2<br />

(Alternative 2 – illustrating the classification of expenses by nature)<br />

Notes 20X2 20X1<br />

CU<br />

CU<br />

Revenue 5 6,863,545 5,808,653<br />

Other income 6 88,850 25,000<br />

Changes in inventories of finished goods and<br />

work in progress 3,310 (1,360)<br />

Raw material and consumables used (4,786,699) (4,092,185)<br />

Employee salaries and benefits (936,142) (879,900)<br />

Depreciation and amortisation expense (272,060) (221,247)<br />

Impairment of property, plant and equipment (30,000) –<br />

Other expenses (249,482) (145,102)<br />

Finance costs 7 (26,366) (36,712)<br />

Profit be<strong>for</strong>e tax 8 654,956 457,147<br />

Income tax expense 9 (270,250) (189,559)<br />

Profit <strong>for</strong> the year 384,706 267,588<br />

Retained earnings at start of year 2,171,353 2,003,765<br />

Dividends (150,000) (100,000)<br />

Retained earnings at end of year 2,406,059 2,171,353<br />

Note: The <strong>for</strong>mat illustrated above aggregates expenses according to their nature (raw<br />

materials and consumables, employee salaries and benefits, depreciation and<br />

amortisation, impairment etc). As the only changes to XYZ Group’s equity during the year<br />

arose from profit or loss and payment of dividends, it has elected to present a single<br />

statement of comprehensive income and retained earnings instead of separate statements<br />

of comprehensive income and changes in equity.<br />

©<br />

IASCF 7