LEEKEE INDUSTRIES (M) SDN - teo seng capital berhad

LEEKEE INDUSTRIES (M) SDN - teo seng capital berhad

LEEKEE INDUSTRIES (M) SDN - teo seng capital berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TEO SENG CAPITAL BERHAD<br />

(Incorporated In Malaysia)<br />

Company No : 732762 - T<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE FINANCIAL YEAR ENDED 31 MARCH 2011<br />

4. ACCOUNTING POLICIES AND STANDARDS (CONT’D)<br />

4.3 Changes in Accounting Policies and Effects Arising from Adoption of New/Revised<br />

Financial Reporting Standards (“FRSs”) (Cont’d)<br />

(c)<br />

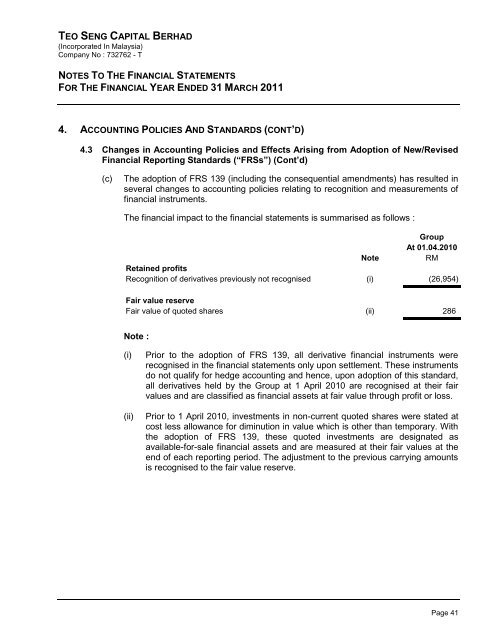

The adoption of FRS 139 (including the consequential amendments) has resulted in<br />

several changes to accounting policies relating to recognition and measurements of<br />

financial instruments.<br />

The financial impact to the financial statements is summarised as follows :<br />

Group<br />

At 01.04.2010<br />

Note<br />

RM<br />

Retained profits<br />

Recognition of derivatives previously not recognised (i) (26,954)<br />

Fair value reserve<br />

Fair value of quoted shares (ii) 286<br />

Note :<br />

(i)<br />

(ii)<br />

Prior to the adoption of FRS 139, all derivative financial instruments were<br />

recognised in the financial statements only upon settlement. These instruments<br />

do not qualify for hedge accounting and hence, upon adoption of this standard,<br />

all derivatives held by the Group at 1 April 2010 are recognised at their fair<br />

values and are classified as financial assets at fair value through profit or loss.<br />

Prior to 1 April 2010, investments in non-current quoted shares were stated at<br />

cost less allowance for diminution in value which is other than temporary. With<br />

the adoption of FRS 139, these quoted investments are designated as<br />

available-for-sale financial assets and are measured at their fair values at the<br />

end of each reporting period. The adjustment to the previous carrying amounts<br />

is recognised to the fair value reserve.<br />

Page 41