ARC China Investment Funds - Banque Privée Edmond de ...

ARC China Investment Funds - Banque Privée Edmond de ...

ARC China Investment Funds - Banque Privée Edmond de ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

VISA 2011/74859-6342-0-PC<br />

L'apposition du visa ne peut en aucun cas servir<br />

d'argument <strong>de</strong> publicité<br />

Luxembourg, le 2011-05-24<br />

Commission <strong>de</strong> Surveillance du Secteur Financier<br />

ISSUING DOCUMENT<br />

M<strong>ARC</strong>H 2011<br />

<strong>ARC</strong> <strong>China</strong> <strong>Investment</strong> <strong>Funds</strong><br />

Société d'investissement à capital variable - Fonds d'investissement spécialisé<br />

Avocats à la Cour<br />

0093346-0000001 LU:4016712.7

APPLICATIONS FOR SUBSCRIPTION ARE RESERVED TO WELL-INFORMED INVESTORS<br />

WHO, ON THE BASIS OF THIS CONFIDENTIAL ISSUING DOCUMENT, THE ARTICLES AND<br />

THE SUBSCRIPTION FORM, HAVE MADE THEIR OWN ASSESSMENT OF THE CONDITIONS<br />

OF THEIR PARTICIPATION IN THE COMPANY. ACCORDINGLY, IT IS THE<br />

RESPONSIBILITY OF PARTICIPATING INVESTORS TO DETERMINE WHETHER THEIR<br />

RIGHTS AND OBLIGATIONS AS MEMBERS ARE SUITABLE FOR THEM.<br />

Important Information<br />

<strong>ARC</strong> <strong>China</strong> <strong>Investment</strong> <strong>Funds</strong> (the Company) is offering Shares (the Shares) of several separate sub-funds<br />

(individually a Sub-Fund and collectively the Sub-<strong>Funds</strong>) on the basis of the information contained in this<br />

issuing document (the Issuing Document) and in the documents referred to herein. No person is authorised<br />

to give any information or to make any representations concerning the Company other than as contained in<br />

the Issuing Document and in the documents referred to herein, and any purchase ma<strong>de</strong> by any person on the<br />

basis of statements or representations not contained in or inconsistent with the information and<br />

representations contained in this Issuing Document will be solely at the risk of the purchaser.<br />

The Company is subject to the provisions of the act of 13 February 2007 on specialised investment funds<br />

(the 2007 Act). Hence, the sale of the Shares is reserved to well-informed investors as <strong>de</strong>fined by article 2 of<br />

the 2007 Act (the Well-Informed Investors). The Company will refuse to issue Shares to physical persons<br />

and companies that do not qualify as Well-Informed Investors. The Company will further refuse any transfer<br />

of Shares that would result in Shares being held by a non-Well-Informed Investor. The Company, at its sole<br />

discretion, may refuse the issue or transfer of Shares if there exists no sufficient evi<strong>de</strong>nce that the person or<br />

entity to which the Shares should be issued or transferred is a Well-Informed Investor. The Company may, at<br />

its sole discretion, reject any application for subscription of Shares and proceed, at any time, to the<br />

compulsory re<strong>de</strong>mption of all the Shares held by a non-Well-Informed Investor.<br />

This Issuing Document has been prepared solely for the consi<strong>de</strong>ration of prospective Well-Informed<br />

Investors in the Company and is circulated to a limited number of Well-Informed Investors on a confi<strong>de</strong>ntial<br />

basis solely for the purpose of evaluating an investment in the Company. This Issuing Document superse<strong>de</strong>s<br />

and replaces any other information provi<strong>de</strong>d by the initiators and its representatives and agents in respect of<br />

the Company. However, the Issuing Document is provi<strong>de</strong>d for information only, and is not inten<strong>de</strong>d to be<br />

and must not alone be taken as the basis for an investment <strong>de</strong>cision. By accepting this Issuing Document and<br />

any other information supplied to potential investors by the initiators the recipient agrees that such<br />

information is confi<strong>de</strong>ntial. Neither it nor any of its employees or advisers will use the information for any<br />

purpose other than for evaluating an investment in the Company or divulge such information to any other<br />

party and acknowledges that this Issuing Document may not be photocopied, reproduced or distributed to<br />

others without the prior written consent of the initiators. Each recipient hereof by accepting <strong>de</strong>livery of this<br />

Issuing Document agrees to keep confi<strong>de</strong>ntial the information contained herein and to return it and all related<br />

materials to the Company if such recipient does not un<strong>de</strong>rtake to purchase any of the Shares. The<br />

information contained in the Issuing Document and any other documents relating to the Company may not<br />

be provi<strong>de</strong>d to persons (other than professional advisers) who are not directly concerned with any investor's<br />

<strong>de</strong>cision regarding the investment offered hereby.<br />

By accepting this Issuing Document, potential investors in the Company are not to construe the contents of<br />

this Issuing Document or any prior or subsequent communications from the Company, the Company's board<br />

of directors (the Board), and director of the Board (the Director) the initiators or any of their respective<br />

officers, members, employees, representatives or agents as investment, legal, accounting, regulatory or tax<br />

advice. Prior to investing in the Shares, potential investors should conduct their own investigation and<br />

analysis of an investment in the Company and consult with their legal advisers and their investment,<br />

accounting, regulatory and tax advisers to <strong>de</strong>termine the consequences of an investment in the Shares and<br />

arrive at an in<strong>de</strong>pen<strong>de</strong>nt evaluation of such investment, including the applicability of any legal sales or<br />

0093346-0000001 LU:4016712.7 1

investment restrictions without reliance on the Company, the Board, the initiators or any of their respective<br />

officers, members, employees, representatives or agents. Neither the Company, the Board, the initiators nor<br />

any of their respective officers, members, employees, representatives or agents accepts any responsibility or<br />

liability whatsoever for the appropriateness of any potential investors investing in the Company. Prospective<br />

investors are urged to request any additional information they may consi<strong>de</strong>r necessary or <strong>de</strong>sirable in making<br />

an informed investment <strong>de</strong>cision. Each prospective investor is encouraged, prior to the consummation of<br />

their investment, to ask questions of, and receive answers from, the initiators concerning the Company and<br />

this offering and to request any additional information in or<strong>de</strong>r to verify the accuracy of the information<br />

contained in this Issuing Document or otherwise.<br />

The Shares have not been registered un<strong>de</strong>r the US Securities Act of 1933, as amen<strong>de</strong>d (the "US<br />

Securities Act") or the securities laws of any state or political subdivision of the United States, and<br />

may not be offered, sold, transferred or <strong>de</strong>livered, directly or indirectly, in the United States or to, or<br />

for the account or benefit of, any US person, except pursuant to an exemption from, or in a transaction<br />

not subject to the registration requirements of the Securities Act and any applicable US state securities<br />

laws. The Company is not registered nor does it intend to register (i) un<strong>de</strong>r the US <strong>Investment</strong><br />

Company Act of 1940, as amen<strong>de</strong>d (the "US <strong>Investment</strong> Company Act") as an investment company in<br />

reliance on the exemption from such registration pursuant to Section 3(cX7) thereun<strong>de</strong>r. Accordingly,<br />

the Shares are being offered and sold only (i) outsi<strong>de</strong> the United States to persons that are (a) other<br />

than US persons as <strong>de</strong>fined in Regulation S un<strong>de</strong>r the US Securities Act and (b) not US resi<strong>de</strong>nts<br />

(within the meaning of the <strong>Investment</strong> Company Act) in offshore transactions that meet the<br />

requirements of Regulation S un<strong>de</strong>r the US Securities Act or (ii) to US persons who are (a) "accredited<br />

investors" (as <strong>de</strong>fined in Rule 501 of Regulation D promulgated un<strong>de</strong>r the Securities Act) and (b)<br />

either (I) "qualified purchasers" (within the meaning of Section 2(a)(51) of the <strong>Investment</strong> Company<br />

Act) or (II) "knowledgeable employees" as such term is <strong>de</strong>fined in Rule 3c-5 of the <strong>Investment</strong><br />

Company Act.<br />

The text of the Articles is integral to the un<strong>de</strong>rstanding of this Issuing Document. Potential investors<br />

should review the Articles carefully. In the event of any inconsistency between this Issuing Document<br />

and the Articles, the Articles shall prevail.<br />

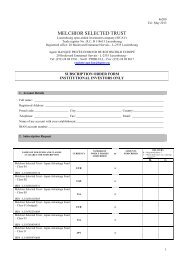

Prior to subscribe for Shares, potential investors should obtain a copy of the subscription form (the<br />

Subscription Form) which contains, inter alia, representations on which the Board may accept a potential<br />

investor's subscription. The Articles, the Subscription Form and related documentation are <strong>de</strong>scribed in<br />

summary form herein; these <strong>de</strong>scriptions do not purport to be complete and each such summary <strong>de</strong>scription<br />

is subject to, and qualified in its entirety by reference to, the actual text of the Articles, the Subscription<br />

Form and related documentation, including any amendment thereto.<br />

No action has been taken which would permit a public offering of the Shares in any jurisdiction where action<br />

for that purpose would be required. The Issuing Document and any other documents relating to the Company<br />

do not constitute an offer or solicitation in any jurisdiction in which an offer or solicitation is not authorised,<br />

or in which the person making the offer or solicitation is not qualified to do so, or to any person to whom it is<br />

unlawful to make such an offer or solicitation. Any representation to the contrary is unlawful. No action has<br />

been taken by the initiators or the Company that would permit a public offering of Shares or possession or<br />

distribution of information in any jurisdiction where action for that purpose is required.<br />

Investors should be aware that they may be required to bear the financial risk of their investment for a<br />

significant period of time as investors may not request re<strong>de</strong>mption of their Shares. Additionally, there will be<br />

no public market for the Shares. Accordingly, investors should have the financial ability and willingness to<br />

accept the risks of investing in the Company (including, without limitation, the risk of loss of their entire<br />

investment) and accept that they will have recourse only to the assets of the Compartment in which they<br />

invest as these will exist at any time.<br />

0093346-0000001 LU:4016712.7 2

Certain statements contained in this Issuing Document are forward-looking statements. These forwardlooking<br />

statements are based on current expectations, estimates and projections about the markets in which<br />

the Company will operate, and the beliefs and assumptions of the Company. Words such as "expects",<br />

"anticipates", "should", "intends", "plans", "believes", "seeks", "estimates", "forecasts", "projects", variations<br />

of such words and similar expressions are inten<strong>de</strong>d to i<strong>de</strong>ntify such forward-looking statements. These<br />

statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions<br />

which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is<br />

expressed or forecasted in such forward-looking statements. Among the factors that could cause actual<br />

results to differ materially are the general economic climate, inflationary trends, interest rate levels, the<br />

availability of financing, changes in tax and corporate regulations and other risks associated with the<br />

ownership and acquisition of investments and changes in the legal or regulatory environment or that<br />

operation costs may be greater than anticipated.<br />

An investment in the Shares involves significant risks and there can be no assurance or guarantee as to<br />

positive return on any of the Company's investments or that there will be any return on invested capital.<br />

Potential investors should in particular refer in this Issuing Document. The investment objectives are based<br />

on a number of assumptions which the Company believes reasonable, but there is no assurance that the<br />

investment objectives will be realised.<br />

The Board has taken all reasonable care to ensure that the information contained in this Issuing Document is<br />

accurate as of the date as stated herein. Other than as <strong>de</strong>scribed below, neither the Company, nor the<br />

initiators has any obligation to update this Issuing Document.<br />

Un<strong>de</strong>r no circumstances should the <strong>de</strong>livery of this Issuing Document, irrespective of when it is ma<strong>de</strong>, create<br />

an implication that there has been no change in the affairs of the Company since such date. The Board<br />

reserves the right to modify any of the terms of the offering and the Shares <strong>de</strong>scribed herein. This Issuing<br />

Document may be updated and amen<strong>de</strong>d by a supplement and where such supplement is prepared this<br />

Issuing Document will be read and construed with such supplement.<br />

No person has been authorised to give any information or to make any representation concerning the<br />

Company or the offer of the Shares other than the information contained in this Issuing Document and any<br />

other documents relating to the Company, and, if given or ma<strong>de</strong>, such information or representation must not<br />

be relied upon as having been authorised by the Company.<br />

Any translation of this Issuing Document or of any other transaction document into any other<br />

language will only be for convenience of the relevant investors having requested such translation. In<br />

the case of any discrepancy due to translation, the English version of the Issuing Document and of any<br />

other transaction document will prevail.<br />

Data protection<br />

Certain personal data of investors (including, but not limited to, the name, address and invested amount of<br />

each investor) may be collected, recor<strong>de</strong>d, stored, adapted, transferred or otherwise processed and used by<br />

the Company, the Board, the initiators or any of their respective officers, members, employees,<br />

representatives or agents. In particular, such data may be processed for the purposes of account and<br />

distribution fee administration, anti-money laun<strong>de</strong>ring and terrorism financing i<strong>de</strong>ntification, maintaining the<br />

register of investors, processing subscription, re<strong>de</strong>mption or<strong>de</strong>rs (if any) and payments of divi<strong>de</strong>nds to<br />

investors and to provi<strong>de</strong> client-related services. Such information shall not be passed on to any unauthorised<br />

third persons.<br />

The Company may sub-contract to another entity (the Processor) the processing of personal data. The<br />

Company un<strong>de</strong>rtakes not to transfer personal data to any third parties other than the Processor except if<br />

required by law or on the basis of a prior consent of the investors.<br />

0093346-0000001 LU:4016712.7 3

Each investor has a right of access to his/her/its personal data and may ask for a rectification thereof in case<br />

where such data is inaccurate or incomplete.<br />

By subscribing to the Shares, each investor consents to such processing of its personal data. This consent is<br />

formalised in writing in the Subscription Form used by the relevant intermediary.<br />

0093346-0000001 LU:4016712.7 4

DIRECTORY<br />

Registered Office<br />

20, boulevard Emmanuel Servais<br />

L-2535 Luxembourg, Grand Duchy of Luxembourg<br />

Board of Directors<br />

Adam Roseman, chairman of the Board, Shanghai<br />

Marco Becker, director, Luxembourg<br />

Franklin Craig, director, Paris<br />

Eu<strong>de</strong>s <strong>de</strong> Drouas, director, Shanghai<br />

Blaise Hatt-Arnold, director, Geneva<br />

Martin Key, director, Shanghai<br />

Stefan Müller, director, Frankfurt<br />

<strong>Investment</strong> Manager<br />

<strong>ARC</strong> <strong>China</strong> Ltd.<br />

87 Mary Street, George Town<br />

Grand Cayman KYI-9001, Cayman Islands<br />

Depositary Bank and Paying Agent<br />

<strong>Banque</strong> Privé <strong>Edmond</strong> <strong>de</strong> Rothschild Europe<br />

20, boulevard Emmanuel Servais<br />

L-2535 Luxembourg, Grand Duchy of Luxembourg<br />

Domiciliation Agent, Central Administrator, Registrar and Transfer Agent<br />

<strong>Banque</strong> Privé <strong>Edmond</strong> <strong>de</strong> Rothschild Europe<br />

20, boulevard Emmanuel Servais<br />

L-2535 Luxembourg, Grand Duchy of Luxembourg<br />

Auditor<br />

PricewaterhouseCoopers<br />

400, route d'Esch<br />

L-1014 Luxembourg, Grand Duchy of Luxembourg<br />

Legal Adviser as to Luxembourg Law<br />

Allen & Overy Luxembourg<br />

33, avenue John F. Kennedy<br />

L-1855 Luxembourg, Grand Duchy of Luxembourg<br />

0093346-0000001 LU:4016712.7 5

DEFINITIONS<br />

In this Issuing Document, the following terms have the following meanings:<br />

1915 Act the Luxembourg act of 10 August 1915 on commercial<br />

companies as amen<strong>de</strong>d from time to time<br />

1993 Act the Luxembourg act of 5 April 1993 on the financial sector, as<br />

amen<strong>de</strong>d<br />

2007 Act the Luxembourg act of 13 February 2007 on specialised<br />

investment funds (SIF)<br />

Administrator<br />

Articles<br />

Board<br />

Business Day<br />

Class<br />

Collateral<br />

Company<br />

CSSF<br />

Director<br />

Depositary<br />

EUR<br />

Experienced Investor<br />

the domiciliary agent, central administrator, registrar and<br />

transfer agent which is <strong>Banque</strong> <strong>Privée</strong> <strong>Edmond</strong> <strong>de</strong> Rothschild<br />

Europe with registered office at 20, boulevard Emmanuel<br />

Servais, L-2520 Luxembourg<br />

the articles of incorporation of the Company<br />

the board of directors of the Company<br />

each day on which the banks are open for general business in<br />

Luxembourg<br />

different types of Shares which are issued within a Sub-Fund<br />

where specific features with respect to placing or re<strong>de</strong>mption<br />

charge, minimum subscription amount, divi<strong>de</strong>nd policy or other<br />

specific features may be applicable<br />

investments of a relevant Sub-Fund held in custody by a<br />

relevant broker and which is subject to a security interest in<br />

favor of that broker, the beneficial ownership of investments<br />

given as Collateral may be transferred to the broker and may not<br />

be segregated from other investments belonging to that broker<br />

<strong>ARC</strong> <strong>China</strong> <strong>Investment</strong> <strong>Funds</strong> SA, SICAV-FIS<br />

the Commission <strong>de</strong> Surveillance du Secteur Financier, the<br />

financial services market authority in Luxembourg<br />

any director of the Board<br />

the <strong>de</strong>positary bank and paying agent which is <strong>Banque</strong> <strong>Privée</strong><br />

<strong>Edmond</strong> <strong>de</strong> Rothschild Europe SA with registered office at 20,<br />

boulevard Emmanuel Servais, L-2520 Luxembourg<br />

Euro, the single currency of the participating Member States of<br />

the European Economic and Monetary Union<br />

any investor who (i) adheres in writing to the status of<br />

experienced investor and (ii) either (a) commits to invest a<br />

minimum of EUR125,000 in the Company or (b) has obtained<br />

0093346-0000001 LU:4016712.7 6

an assessment by a credit institution within the meaning of<br />

Directive 2006/48/EC, by an investment firm within the<br />

meaning of Directive 2004/39/EC, or by a management<br />

company within the meaning of Directive 2001/107/EC<br />

certifying his/her/its expertise, experience and knowledge in<br />

a<strong>de</strong>quately appraising an investment in the Company<br />

General Meeting<br />

Initial Subscription Period<br />

Institutional Investor<br />

<strong>Investment</strong> Adviser<br />

<strong>Investment</strong> Manager<br />

Issuing Document<br />

Late Trading<br />

Liquid Asset<br />

any general meeting of Sharehol<strong>de</strong>rs of the Company or of a<br />

relevant Sub-Fund or Class<br />

the initial period where Shares can be subscribed at the Initial<br />

Subscription Price as <strong>de</strong>scribed for each Sub-Fund in its<br />

Schedule<br />

means any investor who qualifies as institutional investor in<br />

accordance with Luxembourg Law<br />

means such entity from time to time appointed as investment<br />

adviser of a particular Sub-Fund as disclosed in the relevant<br />

Schedule by the <strong>Investment</strong> Manager in accordance with<br />

Section 5 of this Issuing Document<br />

the investment manager which is <strong>ARC</strong> <strong>China</strong> Ltd., 87 Mary<br />

Street, George Town, Grand Cayman KYI-9001, Cayman<br />

Islands<br />

this issuing document, as amen<strong>de</strong>d from time-to-time<br />

the acceptance of a subscription or re<strong>de</strong>mption or<strong>de</strong>r after the<br />

time limit fixed for accepting or<strong>de</strong>rs (cut-off time) on the<br />

relevant day and the execution of such or<strong>de</strong>r at the price based<br />

on the net asset value applicable to such same day;<br />

any type of assets which embed a low level of risk and volatility<br />

and which ensures a high level of liquidity, e.g. cash, regularly<br />

tra<strong>de</strong>d money market instruments and cash equivalent<br />

instruments the residual maturity of which does not exceed 397<br />

days, notes and bonds issued or guaranteed by an OECD<br />

Member State, its local authorities or governmental agencies or<br />

any units or shares issued by a UCI which holds or invests in<br />

such assets<br />

Liquid Equity an equity security that tra<strong>de</strong>s on average more than USD 1<br />

million in value per day during the last period of six (6) months<br />

Lock-Up Period<br />

Luxembourg Law<br />

Management Fee<br />

a period during which no re<strong>de</strong>mption of Shares are admitted<br />

the law and regulations applicable in the Grand-Duchy of<br />

Luxembourg<br />

the fee calculated and payable by each Sub-Fund to the<br />

<strong>Investment</strong> Manager as <strong>de</strong>termined in the relevant Schedule of<br />

each Sub-Fund<br />

0093346-0000001 LU:4016712.7 7

Market Timing<br />

Mémorial C<br />

Net Asset Value<br />

OECD<br />

OTC Market<br />

Part A<br />

Part B<br />

Performance Fee<br />

Pre-IPO Securities<br />

Prime Broker<br />

Professional Investor<br />

Processor<br />

Prohibited Person<br />

Re<strong>de</strong>mption Day<br />

any market timing practice within the meaning of Circular<br />

04/146 or as that term may be amen<strong>de</strong>d or revised by the CSSF<br />

in any subsequent circular<br />

Mémorial C, Recueil <strong>de</strong>s Sociétés et Associations<br />

the net asset value of a Sub-Fund as <strong>de</strong>termined in accordance<br />

with the Articles and Section 15 of the Issuing Document<br />

the Organization for Economic Cooperation and Development<br />

the over-the-counter market<br />

the general part of the Issuing Document which <strong>de</strong>scribes the<br />

common characteristics and rules applicable for all Sub-<strong>Funds</strong><br />

the special part of the Issuing Document which contains for<br />

each Sub-Fund a Schedule <strong>de</strong>termining main features and rules<br />

of the relevant Sub-Fund<br />

the performance fee calculated and payable by a relevant Sub-<br />

Fund to the <strong>Investment</strong> Manager and which is <strong>de</strong>scribed for<br />

each Sub-Fund in its Schedule, if any<br />

an offering of a company's shares prior to that company's initial<br />

public offering<br />

a first class financial institution belonging to the categories<br />

listed un<strong>de</strong>r article 1 (2) of Directive 2002/47/EC on financial<br />

collateral arrangements (i.e. credit institution within the<br />

meaning of directive 2006/48/EC relating to the taking-up and<br />

pursuit of the business of credit institutions or an investment<br />

firm within the meaning of directive 2004/39/EC on markets in<br />

financial instruments) and who provi<strong>de</strong>s various financial<br />

services to the Company implying that the Company's assets are<br />

held in custody with that Prime Broker; the appointment of a<br />

Prime Broker, if any, is specified in the relevant Schedule<br />

any investor who qualifies as professional investors within the<br />

meaning of Annex III to the 1993 Act<br />

any entity such as the Administrator to which the processing of<br />

personal data may be sub-contracted by the Company<br />

any person which is not allowed to invest in the Company either<br />

due to a restriction by Luxembourg or foreign laws and<br />

regulations or due to a <strong>de</strong>cision of the Board; e.g. any investor<br />

who/which does not qualify as a Well-Informed Investor or a<br />

citizen of the United States of America are Prohibited Persons<br />

the Valuation Day as of which Shares are re<strong>de</strong>emed as more<br />

fully <strong>de</strong>scribed for each Sub-Fund in the relevant Schedule<br />

0093346-0000001 LU:4016712.7 8

Re<strong>de</strong>mption Price<br />

Reference Currency<br />

Regulated Market<br />

RMB<br />

Schedule<br />

Section<br />

Share<br />

Sharehol<strong>de</strong>r<br />

Si<strong>de</strong> Pocket <strong>Investment</strong>s<br />

SP Class<br />

Sub-Fund<br />

Subscription Form<br />

Subscription Price<br />

UCI<br />

USD<br />

Valuation Day<br />

the price at which shares are re<strong>de</strong>emed before <strong>de</strong>duction of any<br />

charges, costs, expenses, taxes and re<strong>de</strong>mption fee (if any) as<br />

<strong>de</strong>scribed for each Sub-Fund in its Schedule<br />

the currency that is used by the Administrator to establish the<br />

consolidated annual report; the Reference Currency is the EUR<br />

a market which operates regularly and which is open to the<br />

public<br />

Yuan Renminbi, the currency of the People's Republic of <strong>China</strong><br />

any schedule of Part B <strong>de</strong>dicated to the <strong>de</strong>scription of a relevant<br />

Sub-Fund<br />

any section of this Issuing Document<br />

a share with no par value which has been issued by the<br />

Company within a relevant Sub-Fund, and as the case may be,<br />

within a relevant Class<br />

an investor who has subscribed, received and who holds one or<br />

more Shares<br />

securities which turn out to be illiquid and/or hard to value due<br />

to market reasons<br />

specific class of Shares which may be created by the Board in<br />

or<strong>de</strong>r to isolate illiquid and/or hard to value securities from<br />

other assets of a relevant Sub-Fund<br />

separate portfolio of assets established for one or more Classes<br />

of Shares which is invested in accordance with a specific<br />

investment objective as <strong>de</strong>scribed in Part B; a Sub-Fund has no<br />

legal existence distinct of the Company; however each Sub-<br />

Fund is liable only for the <strong>de</strong>bts, liabilities and obligations<br />

attributable to it<br />

the agreement a relevant investor enters into with the Company<br />

in or<strong>de</strong>r to subscribe Shares to be issued by the Company<br />

the aggregate of the initial issue price and the subscription fee<br />

(if any) as <strong>de</strong>scribed for each Sub-Fund in its Schedule<br />

any type of un<strong>de</strong>rtakings for collective investment subject to<br />

Luxembourg Law or to any other law<br />

United States Dollars, the currency of the United States of<br />

America<br />

each day on which the Net Asset Value is <strong>de</strong>termined in<br />

accordance with the Articles and the Issuing Document<br />

0093346-0000001 LU:4016712.7 9

Well-Informed Investor<br />

an well-informed investor within the meaning of article 2 of the<br />

2007 Act; there exist three categories of well-informed investor,<br />

Institutional Investor, Professional Investor and Experienced<br />

Investor; Directors and other persons involved in the<br />

management of the Company are regar<strong>de</strong>d as Well-Informed<br />

Investors<br />

0093346-0000001 LU:4016712.7 10

CONTENTS<br />

DIRECTORY .....................................................................................................................................................5<br />

DEFINITIONS ...................................................................................................................................................6<br />

CONTENTS .....................................................................................................................................................11<br />

PART A: GENERAL INFORMATION ..........................................................................................................12<br />

1. <strong>Investment</strong> Objectives, <strong>Investment</strong> Restrictions and <strong>Investment</strong> Policies ..........................................13<br />

2. General Risk Consi<strong>de</strong>rations ...............................................................................................................15<br />

3. Board and <strong>Investment</strong> Team................................................................................................................21<br />

4. Conflict of Interests .............................................................................................................................24<br />

5. <strong>Investment</strong> Manager ............................................................................................................................25<br />

6. Depositary ...........................................................................................................................................25<br />

7. Domiciliation Agent, Central Administration, Register and Transfer Agent......................................26<br />

8. Prevention of Money Laun<strong>de</strong>ring and Terrorism Financing ...............................................................26<br />

9. Prevention of Market Timing and Late Trading..................................................................................27<br />

10. Shares ..................................................................................................................................................27<br />

11. Issue and Sale of Shares ......................................................................................................................28<br />

12. Re<strong>de</strong>mption of Shares..........................................................................................................................29<br />

13. Data Protection ....................................................................................................................................30<br />

14. Determination of the Net Asset Value.................................................................................................30<br />

15. Distribution Policy ..............................................................................................................................34<br />

16. Charges and Expenses .........................................................................................................................34<br />

17. Taxation...............................................................................................................................................35<br />

18. General Information ............................................................................................................................36<br />

19. Documents Available ..........................................................................................................................38<br />

PART B: SPECIFIC INFORMATION ............................................................................................................39<br />

Schedule 1 - <strong>ARC</strong> <strong>China</strong> <strong>Investment</strong> <strong>Funds</strong> – Fund I....................................................................40<br />

Schedule 2 - <strong>ARC</strong> <strong>China</strong> <strong>Investment</strong> <strong>Funds</strong> – Fund II ..................................................................47<br />

Page<br />

0093346-0000001 LU:4016712.7 11

PART A: GENERAL INFORMATION<br />

0093346-0000001 LU:4016712.7 12

1. INVESTMENT OBJECTIVES, INVESTMENT RESTRICTIONS AND INVESTMENT<br />

POLICIES<br />

1.1 <strong>Investment</strong> Objective<br />

The main objective of the Company is to achieve for its Sharehol<strong>de</strong>rs an optimum return from<br />

equity, <strong>de</strong>bt and/or a combination of both through investments in eligible assets un<strong>de</strong>r the 2007 Act,<br />

while reducing investment risk through diversification. The Company has as investment objective to<br />

achieve, within the investment policy specified for each Sub-Fund, an attractive return on invested<br />

assets and to generate returns through active management of the assets.<br />

A relevant Sub-Fund is entitled to invest in transferable securities including stock-listed equities<br />

(including Liquid Equities), bonds, notes as well as financial instruments and units issued by openen<strong>de</strong>d<br />

collective investment un<strong>de</strong>rtakings.<br />

Subject to Part B, a relevant Sub-Fund may also be entitled to invest in less liquid securities and<br />

financial instruments including but not limited to Pre-IPO Securities, units issued by closed-en<strong>de</strong>d<br />

collective investment un<strong>de</strong>rtakings, private equities and loans as well as any other type of<br />

investments, securitised or not, tra<strong>de</strong>d or not, as long as such investments are eligible in the meaning<br />

of the 2007 Act.<br />

A relevant Sub-Fund is entitled to invest in cash, regularly tra<strong>de</strong>d money market instruments and<br />

cash equivalent instruments the residual maturity of which does not exceed 397 days and which are<br />

issued by internationally recognised issuers.<br />

On a temporary basis, each Sub-Fund is allowed to hold liquid assets of up to 100% of its Net Asset<br />

Value. Liquid assets in the meaning of this Issuing Document may be any type of assets which<br />

embed a low level of risk and volatility and which ensures a high level of liquidity, e.g. cash,<br />

regularly tra<strong>de</strong>d money market instruments and cash equivalent instruments the residual maturity of<br />

which does not exceed 397 days, notes and bonds issued or guaranteed by an OECD Member State,<br />

its local authorities or governmental agencies or any units or shares issued by a collective investment<br />

un<strong>de</strong>rtakings which holds or invests in such assets (the Liquid Assets).<br />

A Sub-Fund may be subject to additional investment objectives as set out in the relevant Schedule of<br />

Part B.<br />

1.2 Common <strong>Investment</strong> Restrictions for all Sub-<strong>Funds</strong><br />

Each Sub-Fund has to comply with the following investment restrictions. Each Sub-Fund may be<br />

required to comply with additional investment restrictions as set out in its Schedule of Part B.<br />

Each Sub-Fund has to comply with its investment restrictions within a period of time <strong>de</strong>termined for<br />

each Sub-Fund in its Schedule of Part B.<br />

(a)<br />

Restrictions applicable to investments in securities and financial instruments<br />

A relevant Sub-Fund will, in principle, not invest more than 30% of its assets in securities and<br />

financial instruments of the same nature issued by the same entity. The relevant Schedule of a Sub-<br />

Fund may impose a restriction below 30% of its Net Asset Value.<br />

However, a relevant Sub-Fund is entitled to hold up to the entire issue of a specific security or<br />

financial instrument.<br />

0093346-0000001 LU:4016712.7 13

The restriction set forth in the previous paragraph is not applicable to securities or financial<br />

instruments issued or guaranteed by a member state of the OECD or by one of its local authorities or<br />

by supranational institutions and organisations with European, regional or worldwi<strong>de</strong> scope.<br />

(b)<br />

Restrictions applicable to other type of investments<br />

As more fully <strong>de</strong>scribed in the relevant Schedule, a relevant Sub-Fund may be authorised to invest in<br />

any other type of investments than securities and financial instruments subject to the condition that<br />

the relevant investment is eligible by the 2007 Act and that its value does in principle not exceed<br />

30% of the Net Asset Value of that relevant Sub-Fund. The relevant Schedule of a Sub-Fund may<br />

impose a restriction below 30% of its Net Asset Value.<br />

(c)<br />

Use of financial <strong>de</strong>rivative instruments and other techniques<br />

Each Sub-Fund may be authorised to make use of financial <strong>de</strong>rivative instruments and other<br />

techniques such securities lending transactions as well as sale with right of repurchase transactions<br />

and repurchase transactions (opérations à réméré and opérations <strong>de</strong> mise en pension).<br />

The financial <strong>de</strong>rivative instruments may inclu<strong>de</strong>, amongst others, options, futures and forward<br />

contracts on any type of assets including financial instruments and options on such contracts as well<br />

as swap contracts by private agreement on any type of financial instruments including credit <strong>de</strong>fault<br />

swaps.<br />

The maximum total leverage resulting from the use of these <strong>de</strong>rivative financial instruments or<br />

techniques will be set out for each Sub-Fund, if appropriate, in its Schedule. The financial <strong>de</strong>rivative<br />

instruments must be <strong>de</strong>alt on an organised market (the Regulated Market) or contracted by private<br />

agreement with first class professionals specialised in this type of transactions (the OTC Market).<br />

A Sub-Fund may not borrow to finance margin <strong>de</strong>posits and a Sub-Fund must ensure an a<strong>de</strong>quate<br />

spread of investment risks by sufficient diversification when opening positions in financial<br />

<strong>de</strong>rivative instruments.<br />

(d)<br />

Borrowings and leverage<br />

Subject to the relevant Schedule of Part B, a relevant Sub-Fund may be permitted to be leveraged by<br />

the use of financial <strong>de</strong>rivative instruments and/or by borrowing of cash and/or securities. Such<br />

leverage may be done temporarily or permanently with the purpose either to cover a shortage of cash<br />

or securities or with the purpose of investment. In all cases, the counterparty will be a first class<br />

professional specialised in this type of transactions.<br />

The borrowings of cash and/or securities are in principle limited to 100% of the net assets of a Sub-<br />

Fund. Consequently, the gross value of the assets of a Sub-Fund may in principle not exceed 200%<br />

of its net assets.<br />

The total leverage involved by the use of financial <strong>de</strong>rivative instruments should in principle not<br />

exceed 100% of the net assets of a relevant Sub-Fund. Consequently, the gross value of the assets of<br />

a relevant Sub-Fund may in principle not exceed by the use of <strong>de</strong>rivatives 200% of its net assets.<br />

The Schedule of a relevant Sub-Fund may impose stricter restrictions on leverage as those<br />

<strong>de</strong>termined in this Section.<br />

0093346-0000001 LU:4016712.7 14

(e)<br />

Rules for uncovered sales of securities<br />

Subject to the relevant Schedule of Part B, a relevant Sub-Fund may be allowed to short securities.<br />

In such a case, the Schedule of the relevant Sub-Fund will specified applicable rules and provi<strong>de</strong><br />

information on the Prime Broker and the relationship between the Company, the Depositary and the<br />

Prime Broker additional to those mentioned in Section 6 of Part A.<br />

The following rules shall always be followed.<br />

(i)<br />

Short sales shall, in principle, not result in a Sub-Fund holding:<br />

(A)<br />

(B)<br />

an uncovered position on securities which do not qualify as securities. However,<br />

each Sub-Fund may hold uncovered positions on securities which do not qualify as<br />

securities if such securities are liquid and do not represent more than 10% of the<br />

Sub-Fund's assets and<br />

an uncovered position on securities which represents more than 30% of the<br />

securities of the same nature issued by the same issuer.<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

The aggregate commitments of a relevant Sub-Fund resulting from the uncovered sales<br />

should in principle not exceed a percentage of the net assets of the relevant Sub-Fund<br />

specified in Part B. If a Sub-Fund enters into uncovered sales, it must hold sufficient assets<br />

enabling it at any time to close the open positions resulting from such uncovered sales.<br />

The uncovered positions of securities for which a Sub-Fund holds a<strong>de</strong>quate coverage are not<br />

consi<strong>de</strong>red for the purpose of calculating the total commitments referred to above. It is to be<br />

noted that the fact that a relevant Sub-Fund has granted a security, of whatever nature, on its<br />

assets to third parties to guarantee its obligations towards such third parties, is not to be<br />

consi<strong>de</strong>red as a<strong>de</strong>quate coverage for the Sub-Fund's commitments, from the point of view of<br />

that Sub-Fund.<br />

The granting to the Prime Broker of a right of use over the assets of a relevant Sub-Fund is<br />

conditional upon the inclusion of enforceable close-out netting provisions.<br />

The total value of assets over which a right of use may be granted in favour of the Prime<br />

Broker is limited to 140% of the <strong>de</strong>bt of the relevant Sub-Fund towards that Prime Broker.<br />

1.3 <strong>Investment</strong> Policy<br />

The investment policy of each Sub-Fund is set out in the relevant Schedule of Part B.<br />

2. GENERAL RISK CONSIDERATIONS<br />

An investment in a Sub-Fund involves certain risks relating to the particular Sub-Fund’s structure<br />

and investment objectives which investors should evaluate before making a <strong>de</strong>cision to invest in<br />

such Sub-Fund.<br />

The investments within each Sub-Fund are subject to market fluctuations and to the risks inherent in<br />

all investments; accordingly, no assurance can be given that the investment objective will be<br />

achieved.<br />

0093346-0000001 LU:4016712.7 15

The following is a brief <strong>de</strong>scription of certain factors which should be consi<strong>de</strong>red along with other<br />

matters discussed elsewhere in this Issuing Document. The following however, does not purport to<br />

be a comprehensive summary of all the risks associated with any Sub-Fund.<br />

2.1 Risks related to the Company's organisation and structure<br />

Risks linked to the <strong>de</strong>pen<strong>de</strong>nce on key persons of the Board, the <strong>Investment</strong> Team, the<br />

<strong>Investment</strong> Manager and the <strong>Investment</strong> Advisers: Decisions with respect to the management of<br />

the Company will be ma<strong>de</strong> by the Board, as the case may be, in consultation with the <strong>Investment</strong><br />

Team. The management of the portfolio of each Sub-Fund is <strong>de</strong>legated un<strong>de</strong>r the supervision of the<br />

Board to the <strong>Investment</strong> Manager. The Board and the <strong>Investment</strong> Manager may rely to a large extend<br />

on the advice of one or more <strong>Investment</strong> Advisers. As a result, the success of the management of a<br />

relevant Sub-Fund for the foreseeable future will <strong>de</strong>pend largely upon the abilities of the Directors,<br />

the members of the <strong>Investment</strong> Team, the <strong>Investment</strong> Manager and the <strong>Investment</strong> Advisers. Key<br />

persons of the Board, the <strong>Investment</strong> Team, the <strong>Investment</strong> Manager and the <strong>Investment</strong> Advisers<br />

may cease to provi<strong>de</strong> their services for the Company, the <strong>Investment</strong> Manager or the relevant<br />

<strong>Investment</strong> Adviser. As a result, the knowledge and experience of such a key person will no more be<br />

available for the Company. It can furthermore not be ensured that in such a situation a key person<br />

could timely be replaced.<br />

Risk of early termination: In the event of the early termination of a relevant Sub-Fund, the latter<br />

would have to distribute to the Sharehol<strong>de</strong>rs their pro-rata interest in the assets of that Sub-Fund. The<br />

Sub-Fund's investments would have to be sold by the Board or distributed in specie to the<br />

Sharehol<strong>de</strong>rs. It is possible that at the time of such sale or re<strong>de</strong>mption certain investments held by<br />

the Sub-Fund may be worth less than the initial cost of the investment, resulting in a loss to the Sub-<br />

Fund and to its Sharehol<strong>de</strong>rs. Moreover, in the event the Sub-Fund terminates prior to the complete<br />

amortisation of organisational expenses, any unamortised portion of such expenses will be<br />

accelerated and will be <strong>de</strong>bited (and thereby reduce) amounts otherwise available for distribution to<br />

Sharehol<strong>de</strong>rs.<br />

Risks involved by changes in applicable law: The Company must comply with various legal<br />

requirements, including securities laws and tax laws as imposed by the jurisdictions un<strong>de</strong>r which it<br />

operates. Should any of those laws change over the life of the Company, the legal requirement to<br />

which the Company and its Sharehol<strong>de</strong>rs may be subject, could differ materially from current<br />

requirements.<br />

Risk related to diverse interests of the investors: The investors may have conflicting investment,<br />

tax and other interests with respect to their investments in the Company. The conflicting interests of<br />

individual investors may relate to or arise from, among other things, the nature of investments ma<strong>de</strong><br />

by the Company, the structuring or the acquisition of investments and the timing of dispositions of<br />

investments. As a consequence, conflicts of interests may arise in connection with <strong>de</strong>cisions ma<strong>de</strong> by<br />

the Company, including with respect to the nature or structuring of investments, that may be more<br />

beneficial for one investor than for another investor. In selecting and structuring investments<br />

appropriate for a relevant Sub-Fund, the Board will consi<strong>de</strong>r the investment objectives, and as the<br />

case may be other objectives, of the Company and its investors as a whole, i.e. the body of the<br />

Sharehol<strong>de</strong>rs, not the investment, tax or other objectives of any investor individually.<br />

Counterparty risk: The obligations of the Company on behalf of a relevant Sub-Fund towards the a<br />

broker including, as the case may be, the duly appointed Prime Broker as regards credit and/or other<br />

facilities may be guaranteed by the transfer to the broker of Collateral in the form of securities, cash<br />

or other assets held by that Sub-Fund. The counterparty risk results from the difference between (i)<br />

the value of the assets transferred by the Company, on behalf of a Sub-Fund, to the broker as<br />

security in the context of securities lending or borrowing transactions and (ii) the <strong>de</strong>bt of the<br />

0093346-0000001 LU:4016712.7 16

Company owed, on behalf of a Sub-Fund, to such broker. The broker may sell, lend or use in any<br />

other way the Collateral for its own needs. Although the Company is entitled to receive from the<br />

broker assets equivalent to the Collateral, the Collateral may not be segregated from the other assets<br />

transferred to the broker and will be available for creditors of the broker in case of bankruptcy of the<br />

broker.<br />

Furthermore the Company may engage on behalf of a relevant Sub-Fund in OTC transactions with<br />

banks and/or brokers acting as counterparties. Participants to such markets are not protected against<br />

<strong>de</strong>faulting counterparties in their transactions because such contracts are not guaranteed by a<br />

clearinghouse.<br />

The Company may also have credit exposure to one or more counterparties by virtue of its<br />

investment positions including via the use of credit <strong>de</strong>fault swaps. To the extent that a counterparty<br />

<strong>de</strong>faults on its obligation and the Company is <strong>de</strong>layed or prevented from exercising its rights with<br />

respect to the investments in the portfolio of a relevant Sub-Fund, the latter may experience a <strong>de</strong>cline<br />

in the value of its position, loose income and incur costs associated with asserting its rights. Such<br />

risks will increase where the Company uses only a limited number of counterparties for a relevant<br />

Sub-Fund.<br />

Risks involved by performance incentives: The payment of a Performance Fee calculated on the<br />

basis of management results could encourage the <strong>Investment</strong> Manager to adopt a more risky and<br />

volatile investment approach than if such fees were not applicable.<br />

Custody risks: Securities and other assets of each Sub-Fund are in principle <strong>de</strong>posited with the<br />

Depositary (and its sub-custody network). Subject to the relevant Schedule of Part B, all or part of a<br />

relevant Sub-Fund's assets may also be safe-kept with a Prime Broker (and its sub-custody network)<br />

subject to the consent of the Company and of the Depositary. These securities and assets may not<br />

always be clearly i<strong>de</strong>ntified as belonging to the Sub-Fund. In case of <strong>de</strong>fault of the Depositary or of<br />

the Prime Broker, there might be problems in achieving the segregation of the Sub-Fund assets from<br />

those of other parties. This might create substantial losses for the Sub-Fund's Sharehol<strong>de</strong>rs.<br />

Furthermore, the Sub-Fund’s cash and cash equivalents is generally not segregated from the<br />

Depositary's or the Prime Broker’s cash and cash equivalents. Cash and cash equivalents may<br />

therefore be used in its ordinary course of business. Hence, a relevant Sub-Fund may become an<br />

unsecured creditor of the Depositary or the Prime Broker in relation thereto.<br />

Market participant risk: The institutions, including brokerage firms and banks, with which the<br />

Company execute tra<strong>de</strong>s, may encounter financial difficulties that impair the operational capabilities<br />

or the capital position of such counterpart. The Company will have no control whatsoever over the<br />

counterparties.<br />

Low level of liquidity: Investors should be aware about the fact that investment in the Company is<br />

long-term oriented and that the re<strong>de</strong>mption of Shares may be subject to specific conditions and<br />

significant constraints. In particular, the Board is entitled to establish within a relevant Sub-Fund or<br />

Class of Shares a Lock-up Period during which no re<strong>de</strong>mption of Shares are admitted. After the<br />

Lock-up Period, Shares may further only be re<strong>de</strong>emed on a pre-<strong>de</strong>termined frequency (e.g. quarterly)<br />

and subject to a certain number of conditions (e.g. cut-off time). Furthermore the Board is entitled to<br />

<strong>de</strong>fer applications of re<strong>de</strong>mption in the case where the aggregate number of Shares a re<strong>de</strong>mption has<br />

been applied for exceeds 10% of the outstanding Shares of a relevant Sub-Fund or Class. The Board<br />

is also entitled to create si<strong>de</strong> pockets if specific assets turned out to be illiquid and/or hard-to-value<br />

and proceed to a compulsory conversion of Shares into Shares issued by the si<strong>de</strong> pocket. In general,<br />

it is not possible to re<strong>de</strong>em Shares issued within a si<strong>de</strong> pocket.<br />

0093346-0000001 LU:4016712.7 17

2.2 Risks related to the Company's investments<br />

Foreign exchange/currency risk: A relevant Sub-Fund may invest in assets <strong>de</strong>nominated in a wi<strong>de</strong><br />

range of currencies. The Net Asset Value of each Class expressed in its respective currency will<br />

fluctuate in accordance with the changes in foreign exchange rate between its currency, the<br />

Reference Currency of the Sub-Fund and the currencies in which the Sub-Fund's investments are<br />

<strong>de</strong>nominated.<br />

Emerging markets: A relevant Sub-Fund may invest into and/or being strongly exposed to the<br />

specificities and evolution of emerging markets. If such an exposure is achieved by acquiring<br />

securities listed on Western Regulated Markets issued by companies located or mainly active in<br />

emerging markets, the performance of the relevant Sub-Fund will also be exposed to the risks linked<br />

to the specific emerging market as <strong>de</strong>scribed hereafter.<br />

In certain countries, there is the possibility of expropriation of assets, confiscatory taxation, political,<br />

economic or social instability (including risk of war) or diplomatic <strong>de</strong>velopments which could affect<br />

investment in those countries. There may be less publicly available information about certain<br />

financial instruments than some investors would find customary and entities in some countries may<br />

not be subject to accounting, auditing and financial reporting standards and requirements comparable<br />

to those to which certain investors may be accustomed. Certain financial markets, while generally<br />

growing in volume, have for the most part, substantially less volume than more <strong>de</strong>veloped markets,<br />

and securities of many companies are less liquid and their prices more volatile than securities of<br />

comparable companies in more sizable markets. There are also varying levels of government<br />

supervision and regulation of exchanges, financial institutions and issuers in various countries. In<br />

addition, the manner in which foreign investors may invest in securities in certain countries, as well<br />

as limitations on such investments, may affect the investment operations of a relevant Sub-Fund.<br />

Emerging country <strong>de</strong>bt will be subject to high risk and will not be required to meet a minimum<br />

rating standard and may not be rated for creditworthiness by any internationally recognised credit<br />

rating organisation. The issuer or governmental authority that controls the repayment of an emerging<br />

country’s <strong>de</strong>bt may not be able or willing to repay the principal and/or interest when due in<br />

accordance with the terms of such <strong>de</strong>bt. As a result of the foregoing, a government obligor may<br />

<strong>de</strong>fault on its obligations. If such an event occurs, the Company may have limited legal recourse<br />

against the issuer and/or guarantor. Remedies must, in some cases, be pursued in the courts of the<br />

<strong>de</strong>faulting party itself, and the ability of the hol<strong>de</strong>r of foreign government <strong>de</strong>bt securities to obtain<br />

recourse may be subject to the political climate in the relevant country. In addition, no assurance can<br />

be given that the hol<strong>de</strong>rs of commercial <strong>de</strong>bt will not contest payments to the hol<strong>de</strong>rs of other<br />

foreign government <strong>de</strong>bt obligations in the event of <strong>de</strong>fault un<strong>de</strong>r their commercial bank loan<br />

agreements.<br />

Settlement systems in emerging markets may be less well organised than in <strong>de</strong>veloped markets. Thus<br />

there may be a risk that settlement may be <strong>de</strong>layed and that cash or securities of the Company may<br />

be in jeopardy because of failures or of <strong>de</strong>fects in the systems. In particular, market practice may<br />

require that payment shall be ma<strong>de</strong> prior to receipt of the security which is being purchased or that<br />

<strong>de</strong>livery of a security must be ma<strong>de</strong> before payment is received. In such cases, <strong>de</strong>fault by a broker or<br />

bank through whom the relevant transaction is effected might result in a loss being suffered by the<br />

relevant Sub-Fund investing in emerging market securities.<br />

The Company will seek, where possible, to use counterparties whose financial status is such that this<br />

risk is reduced. However, there can be no certainty that the Company will be successful in<br />

eliminating this risk, particularly as counterparties operating in emerging markets frequently lack the<br />

substance or financial resources of those in <strong>de</strong>veloped countries.<br />

0093346-0000001 LU:4016712.7 18

There may also be a danger that, because of uncertainties in the operation of settlement systems in<br />

individual markets, competing claims may arise in respect of securities held by or to be transferred to<br />

the Company. Furthermore, compensation schemes may be non-existent or limited or ina<strong>de</strong>quate to<br />

meet the Company’s claims in any of these events.<br />

Risks related to investments in Pre-IPO Securities: Investing in Pre-IPO Securities tends to be<br />

very risky mainly because the planned initial public offering may never take place. In addition, Pre-<br />

IPO Securities are unregistered and are likely to be very difficult to sell until the public offering is<br />

completed. Pre-IPO Securities are difficult to value. The market risks for investments in Pre-IPO<br />

Securities are partly <strong>de</strong>pen<strong>de</strong>nt on the tra<strong>de</strong>-sale and the IPO market. A reduced level of activity on<br />

the tra<strong>de</strong>-sale and the IPO market may have an adverse on the performance of Pre-IPO Securities,<br />

overall influence on the implementation of exit strategies. In view of the different timing of the<br />

information provi<strong>de</strong>d to a Sub-Fund, it may be the case that from time to time the Net Asset Value<br />

per Share of a Sub-Fund does not correspond with the actual overall value of the investments.<br />

Consequently, there may be a <strong>de</strong>gree of <strong>de</strong>lay in terms of incorporating information that affects the<br />

valuation of a Pre-IPO Security within the valuation of the Sub-Fund’s assets.<br />

Risks due to a lack of control on the Company's investments: The investments of a relevant Sub-<br />

Fund may represent minority positions these companies, without power to exert significant control<br />

over such portfolio companies' governing or management bodies. Although the Board will monitor<br />

the performance of each investment, the Board will rely significantly on the management and<br />

governing bodies of invested companies, which may inclu<strong>de</strong> representatives of other investors with<br />

whom the Company is not affiliated and whose interests or views may conflict with those of the<br />

Company.<br />

Risks linked to futures, options and other financial <strong>de</strong>rivative instruments <strong>de</strong>alt or tra<strong>de</strong>d on a<br />

Regulated Market: Futures, options and other <strong>de</strong>rivatives are volatile and involve a high <strong>de</strong>gree of<br />

leverage. The profitability of the Company will <strong>de</strong>pend also on the ability of the General Partner to<br />

make a correct analysis of the market trends, influenced by governmental policies and plans,<br />

international political and economical events, changing supply and <strong>de</strong>mand relationships, acts of<br />

governments and changes in interest rates. In addition, governments may from time to time intervene<br />

on certain markets, particularly currency markets. Such interventions may directly or indirectly<br />

influence the market. Given that only a small amount of margin or a low amount of premium may be<br />

required or paid to tra<strong>de</strong> on futures and option markets, the operations of the portion of the Sub-Fund<br />

will be characterised by a high <strong>de</strong>gree of leverage. As a consequence, a relatively small variation of<br />

the price of the <strong>de</strong>rivative may result in substantial losses for the Sub-Fund and a correlated<br />

reduction of the Net Asset Value of the Sub-Fund.<br />

Risks linked to forwards, swaps, options or other financial <strong>de</strong>rivative instruments <strong>de</strong>alt or<br />

tra<strong>de</strong>d on the OTC Market: The Sub-Fund may enter into one or more forward rate agreements,<br />

forwards, swaps, OTC <strong>de</strong>rivatives in connection either with a hedge or an exposure. OTC <strong>de</strong>rivatives<br />

are not tra<strong>de</strong>d on exchanges but rather banks and <strong>de</strong>alers act as principals by entering into an<br />

agreement to pay and receive certain cash flow over a certain time period, as specified in the OTC<br />

<strong>de</strong>rivative. Consequently, the Sub-Fund is subject to the risk of the counterparty's inability or refusal<br />

to perform according to the terms of the OTC <strong>de</strong>rivative. The OTC <strong>de</strong>rivative market is generally<br />

unregulated by any governmental authority. To mitigate the counterparty risk resulting from such<br />

transactions, the Sub-Fund will enter into such transactions only with highly rated, first class<br />

financial institutions with which it has established ISDA agreements. The use of credit <strong>de</strong>rivative<br />

such as credit <strong>de</strong>fault swaps can be subject to higher risk than direct investment in securities. The<br />

market for credit <strong>de</strong>rivative may from time to time be less liquid than the markets for transferable<br />

securities. In relation to credit <strong>de</strong>fault swaps where the Sub-Fund buys protection, the Sub-Fund is<br />

subject to the risk of the counterparty of the credit <strong>de</strong>fault swaps <strong>de</strong>faulting. To mitigate the<br />

counterparty risk resulting from credit <strong>de</strong>fault swap transactions, the Sub-Fund will only enter into<br />

0093346-0000001 LU:4016712.7 19

credit <strong>de</strong>fault swaps with highly rated financial institutions specialised in this type of transaction and<br />

in accordance with the standard terms laid down by the ISDA.<br />

Risks linked to structured financial instruments: <strong>Investment</strong>s in structured financial instruments<br />

inclu<strong>de</strong> interests in entities organised solely for the purpose of restructuring the investment<br />

characteristics of certain other investments. These investments are purchased by the entities, which<br />

then issue transferable securities backed by, or representing interests in, the un<strong>de</strong>rlying investments.<br />

The cash flow on the un<strong>de</strong>rlying investments may be apportioned among the newly issued financial<br />

instruments to create transferable securities with different investment characteristics such as varying<br />

maturities, payment priorities or interest rate provisions, and the extent of the payments ma<strong>de</strong> with<br />

respect to structured investments <strong>de</strong>pends on the amount of the cash flow on the un<strong>de</strong>rlying<br />

investments. Structured financial instruments are subject to the risks associated with the un<strong>de</strong>rlying<br />

market or security, and may be subject to greater volatility than direct investments in the un<strong>de</strong>rlying<br />

market or security. Structured financial instruments may entail the risk of loss of principal and/or<br />

interest payments as a result of movements in the un<strong>de</strong>rlying market or security. In particular,<br />

valuation of structured financial instruments may be complex and biased by various factors such as<br />

the solvability level related to the un<strong>de</strong>rlying assets.<br />

Risks linked to the use of leverage: A relevant Sub-Fund may use of leverage, i.e. a borrowing<br />

facility for purchasing securities and assets in excess of the equity value which is available for the<br />

Sub-Fund. If the cost of borrowing is lower than the net return earned on the purchased asset, the<br />

Sub-Fund may increase its performance. However, if the use of leverage exposes the Sub-Fund to<br />

additional risks such as but not limited to (i) greater potential losses on the investment purchase by<br />

using the leverage; (ii) greater interest costs and lower <strong>de</strong>bt coverage in case of increasing interest<br />

rates and/or (iii) premature margin calls which may force the liquidation of some Sub-Fund’s<br />

investments (which may occur at a moment where the investments have been un<strong>de</strong>r pressure by the<br />

markets involving the liquidation at prices below the acquisition prices).<br />

Risks related to lending and borrowing of securities: The Company may borrow and lend<br />

securities as part of its investment strategy. In case of borrowing, the Company may have access to<br />

“hard-to-borrow” securities whose costs have to be born by the relevant Sub-Fund and which may<br />

have an impact on the performance of that Sub-Fund. Securities lending may have a positive impact<br />

on the performance of a relevant Sub-Fund in terms of yield enhancement. However, third parties<br />

that borrow securities from a relevant Sub-Fund may not be able to return these securities on first<br />

<strong>de</strong>mand which may cause the Sub-Fund to <strong>de</strong>fault on its obligation to other counterparties.<br />

Risks due to short sales: A Sub-Fund may be allowed to take short positions on securities. In such a<br />

case the Sub-Fund may be exposed to price movements in an opposite way as the expected one<br />

which may involved that the Fund is not able to cover the short position. As a result, the Sub-Fund<br />

may theoretically face an unlimited loss. The availability in the market of the borrowed securities<br />

cannot be ensured when necessary to cover such short position.<br />

Risks linked to commodities: the Company may invest indirectly in commodities. Investors should<br />

be aware that investments in commodities involve significant risks. Prices of commodities are<br />

influenced by, among other things, various macro economic factors such as changing supply and<br />

<strong>de</strong>mand relationships, weather conditions and other natural phenomena, agricultural, tra<strong>de</strong>, fiscal,<br />

monetary and exchange control programmes and policies of governments (including government<br />

intervention in certain markets) and other unforeseeable events.<br />

<strong>Investment</strong>s in commodities is countercyclical: the value of investments in commodities is moving in<br />

the opposite direction than the overall economic cycle. Most assets do not benefit from rising<br />

inflation, but commodities usually do. As <strong>de</strong>mand for goods and services increases, the price of<br />

those goods and services usually rises as well, as does the price of the commodities used to produce<br />

0093346-0000001 LU:4016712.7 20

those goods and services. By contrast, stocks and bonds tend to perform better when the rate of<br />

inflation is stable or growing.<br />

3. BOARD AND INVESTMENT TEAM<br />

3.1 Board<br />

The Board is in charge of the overall management and supervision of the Company including the<br />

management of its assets and the placing of the Shares issued by the Company.<br />

The Board has the broa<strong>de</strong>st powers to act in any circumstances on behalf of the Company, subject to<br />

the powers expressly assigned by law and the Articles to the General Meetings.<br />

In particular, the Board is responsible for the investment <strong>de</strong>cision process in relation of the<br />

management of the portfolio of each Sub-Fund. In accordance with Section 5 of Part A, the Board<br />

<strong>de</strong>legates the management of the portfolio to the <strong>Investment</strong> Manager. The <strong>Investment</strong> Manager is<br />

entitled to use the advisory services of one or more <strong>Investment</strong> Advisers as mentioned in the relevant<br />

Schedule of Part B.<br />

As of the date of this Issuing Document, the Board is composed by the following Directors.<br />

Adam Roseman, Chairman of the Board, Shanghai. Mr Roseman is foun<strong>de</strong>r and chairman of <strong>ARC</strong><br />

<strong>China</strong>, Inc., an investment advisory and private equity firm based in Shanghai. Prior to found <strong>ARC</strong><br />

<strong>China</strong>, Inc., Mr. Roseman served as a member of Lehman Brothers' <strong>Investment</strong> Banking Group and<br />

the Mergers & Acquisitions practice of Barrington Associates. He has executed investment banking<br />

transactions in numerous industries, including traditional and clean energy, media and hospitality,<br />

technology, consumer products, e-Commerce, business services, manufacturing and<br />

telecommunications. He also is a member of Advisory Board of US Doctors for Africa and the<br />

American Democracy Institute, a member of the Clinton Global Initiative, the Board of Governors of<br />

Cedars-Sinai Medical Center, the board of Big Brothers Big Sisters of Los Angeles and is an active<br />

supporter of various other charitable and political organisations. Mr Roseman appeared on numerous<br />

Chinese media outlets, including print and television, discussing <strong>China</strong> and its interaction with the<br />

international capital markets.<br />

Marco Becker, Director, Luxembourg. Since 2007, Mr Becker is CEO of Prometheus Immobilières<br />

Sàrl, a real estate <strong>de</strong>velopment and consulting firm in Luxembourg. In 1995, he foun<strong>de</strong>d and<br />

<strong>de</strong>veloped VEDA Consult, an advisory firm representing foreign companies in Luxembourg. Mr.<br />

Becker started his career in 1978 as an Eurobond tra<strong>de</strong>r with <strong>Banque</strong> Générale du Luxembourg SA<br />

(today BGL Société Anonyme) before joining Hypobank International SA (today Unicredit<br />

Luxembourg SA) where he has been in charge of the bond markets and the new issuers. From 1985<br />

to 1987, Mr. Becker manages the bond portfolio of the Compagnie Monégasque <strong>de</strong> <strong>Banque</strong> in<br />

Monaco before joining Shearson Lehman Hutton, a brokerage firm where he has been a financial<br />

consultant and portfolio manager. From 1992 to 1995, he was responsible for the investment fund<br />

division at Compagnie Financière <strong>Edmond</strong> <strong>de</strong> Rothschild in Monaco. From 1987 to 1992, Mr Becker<br />

has been registered as a broker for stocks, options and bonds with the New-York Stock Exchange<br />

(NYSE), for commodities, futures and options with the Chicago Board of Tra<strong>de</strong> (CBOT) and for<br />

currencies, metals and options with the Chicago Mercantile Exchange (CME).<br />

Franklin C. Craig, Director, Paris. Mr Craig is an in<strong>de</strong>pen<strong>de</strong>nt financial adviser to Sequoia<br />

Aggressive Growth Fund Limited as well as <strong>ARC</strong> Semper <strong>Investment</strong>s Limited. Mr. Craig is on the<br />

board of Fairview Asset Management, a Paris-based regulated investment firm. Mr. Craig is also an<br />

adviser to several venture stage companies and fund management firms. Mr. Craig started his career<br />

in 1982 as a broker and analyst with Fahnestock and Co. before joining Cerepfi SA/Alex Brown and<br />

0093346-0000001 LU:4016712.7 21

Sons, Inc. and founding Trinity Capital Partners, an investment bank and money management firm<br />

specialised in equity sales, structured corporate finance equity and distribution of funds. In 1996, he<br />

joined Yorkton Securities where he has been in charge for the sales of US and Canadian equities.<br />

From 2000 to 2008, Mr. Craig was a Senior Vice Presi<strong>de</strong>nt with Canaccord Adams Limited where<br />