News Round Up - HLL Humberts Leisure

News Round Up - HLL Humberts Leisure

News Round Up - HLL Humberts Leisure

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

<strong>Leisure</strong><br />

In this issue:<br />

<strong>News</strong> round up<br />

All the latest stories from the<br />

leisure and hospitality sector,<br />

including the creation of<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

Focus<br />

An in-depth look at the latest<br />

available properties and issues<br />

affecting the sector, including<br />

an update on the hotel industry<br />

Planning<br />

All you need to know about<br />

planning issues, including the<br />

likely impact of localism<br />

Why choose<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

How we can help with our<br />

comprehensive services and<br />

areas of expertise. Find a<br />

contact near you<br />

Autumn/Winter 2011<br />

gva.co.uk/humbertsleisure

Relax...<br />

with GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

you’re in safe hands.<br />

02 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Foreword<br />

All businesses can benefit from a little bit of luck,<br />

or at least some happy coincidences, which<br />

enable trading to improve on expectations.<br />

The late Easter this year combined with the feel-good factor engendered by the<br />

Royal Wedding were expected to create favourable conditions for many leisure<br />

businesses. However what no-one expected, or dared to hope for, was wonderful<br />

weather we enjoyed over the first half of the year.<br />

The combined result has been one of the best starts to the summer season for leisure<br />

and tourism businesses. Through the multiplier effect this will create positive impact<br />

on other sectors of the economy, including agriculture, manufacturing, retail and<br />

support services. May 2011 also proved to be an important and exciting month for<br />

us at <strong>Humberts</strong> <strong>Leisure</strong>. We have now merged our business with GVA, one of the UK’s<br />

largest property advisory companies. We intend to use the skills of the combined<br />

teams, and the additional resources at our disposal, to broaden the range of<br />

services we provide.<br />

Our over-riding aim remains the same. It is to add value to our clients’ businesses and<br />

assets through skilful and creative advice, grounded in a deep-seated knowledge of<br />

the industry we work within. Please do not hesitate to contact me if you would like to<br />

discuss ways in which GVA <strong>Humberts</strong> <strong>Leisure</strong> may be able to assist your organisation.<br />

John Anderson,<br />

Director<br />

08449 02 03 04<br />

john.anderson@gva.co.uk<br />

10 Stratton Street,<br />

London W1J 8JR<br />

Autumn/Winter 2011<br />

4. <strong>News</strong><br />

Highlights<br />

5. Discover one of the UK’s strongest<br />

leisure offers in GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

10. How we’re helping big names to make<br />

big savings on their business rates<br />

Plus - the latest properties for sale or to let<br />

16. Focus<br />

Highlights<br />

17. We’re selling Brighton Pier, one of the<br />

UK’s best loved seaside attractions<br />

18. Discover the wide range of holiday<br />

parks/property we have on the market<br />

25. Leading children’s play centre<br />

operator, Kidspace, has ambitious<br />

expansion plans<br />

26. <strong>Up</strong>date on changes to the<br />

Licensing Act<br />

32. How will hotels fare in the coming<br />

months?<br />

36. Planning<br />

Highlights<br />

37. How will localism impact the leisure<br />

and tourism sector?<br />

39. Need help with planning issues? Just<br />

call GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

40. Why is there a greater acceptance<br />

of caravan developments in the<br />

Green Belt?<br />

42. Why choose<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

Review our areas of expertise and full<br />

range of services; plus find a contact<br />

near you<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 03

<strong>News</strong><br />

In this section:<br />

Discover one of<br />

the UK’s strongest<br />

leisure offers in<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

Find out how we’re<br />

helping big names to<br />

make huge savings on<br />

their business rates<br />

Plus the latest<br />

properties for sale or<br />

to let and our latest<br />

planning successes<br />

Our local teams offer<br />

specialist expertise,<br />

across a wealth of sectors<br />

including golf, marinas,<br />

hotels and licensed<br />

premises.<br />

04 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

<strong>News</strong><br />

The GVA <strong>Humberts</strong> <strong>Leisure</strong> story<br />

GVA secures leading UK<br />

leisure team<br />

On 31 May 2011<br />

GVA completed the<br />

acquisition of <strong>Humberts</strong><br />

<strong>Leisure</strong>, creating one of<br />

the UK’s strongest leisure<br />

offers.<br />

The new leisure unit, named GVA<br />

<strong>Humberts</strong> <strong>Leisure</strong>, brings together the<br />

specialist leisure advisory expertise of<br />

<strong>Humberts</strong> <strong>Leisure</strong>, GVA’s existing hotels<br />

and leisure capability and the resources<br />

and national network of one of the UK’s<br />

leading property consultants.<br />

This strategic acquisition marked a major<br />

statement of intent by GVA, currently the<br />

fifth largest commercial property adviser<br />

in the country, to establish the company<br />

as one of the UK’s leading leisure<br />

consultants, with in depth specialist<br />

expertise across all leisure sectors.<br />

GVA’s existing Hotels and <strong>Leisure</strong> team,<br />

led by James Williamson and Ian<br />

Thompson, was particularly focused<br />

on hotels, so the acquisition allows the<br />

company to effectively tap into the<br />

wider UK leisure sector. This will include<br />

pubs and licensed property, hotels,<br />

general leisure, holiday property and<br />

caravan parks, golf courses, sports<br />

complexes and venues, urban leisure,<br />

water-based leisure, visitor enterprises<br />

and institutional property.<br />

Rob Bould, Chief Executive of<br />

GVA, comments:<br />

“We’re delighted to have acquired such<br />

a prestigious business as <strong>Humberts</strong><br />

<strong>Leisure</strong>. At this stage in the economic<br />

cycle, this is a first class acquisition<br />

of what is undoubtedly one of the<br />

country’s leading specialists in its field,<br />

which builds on the hard work and<br />

determination of our existing team.<br />

It also illustrates our leading contracyclical<br />

approach to gaining market<br />

share through the acquisition of a robust<br />

business ready for further expansion.<br />

The move introduces a number of highly<br />

impressive specialist leisure chartered<br />

surveyors, planners and consultants to<br />

further supplement our existing team.<br />

The leisure sector requires a highly<br />

specialised skills set and it is important<br />

to us that we can deliver to our clients<br />

the best possible advice in these<br />

challenging times.”<br />

John Anderson, Executive<br />

Chairman of <strong>Humberts</strong> <strong>Leisure</strong><br />

comments:<br />

“We’re delighted to have completed the<br />

merger with GVA as this provides us with<br />

a strong platform from which to drive our<br />

growth strategy.<br />

Integration of the two complementary<br />

leisure teams is a tremendous<br />

enhancement to our national leisure<br />

service.”<br />

For further information on the merger<br />

please contact<br />

Tim Crossley-Smith, Senior Director and<br />

National Head of Valuation Services<br />

on 020 7911 2291 or<br />

tim.crossley-smith@gva.co.uk<br />

John Anderson, Director at<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> on 0113 280 8032<br />

or john.anderson@gva.co.uk<br />

GVA profile<br />

GVA is one of the<br />

UK’s leading property<br />

consultants operating<br />

from 12 offices with<br />

890 fee earners<br />

generating a turnover<br />

of £131.9 million in<br />

the year ending 30<br />

April 2011.<br />

The company provides a full range<br />

of property-related advisory led<br />

services including agency, planning,<br />

development and regeneration, rating,<br />

building consultancy, investment,<br />

management, valuation and<br />

corporate recovery.<br />

GVA also offers specialist advice in<br />

areas such as finance, economic<br />

and social policy, telecoms,<br />

education, healthcare, hotels<br />

and leisure, retail, sustainability,<br />

contamination, plant and machinery<br />

and the automotive and roadside<br />

sectors. For further information visit:<br />

www.gva.co.uk<br />

GVA is a founding member of<br />

GVA Worldwide, an international<br />

organisation serving key markets<br />

in over 25 countries. The organisation<br />

comprises over 2,500 real<br />

estate professionals in over 85<br />

markets worldwide.<br />

A leading adviser in commercial real<br />

estate, GVA Worldwide optimises client<br />

portfolios locally and around the world.<br />

It serves the real estate needs of clients<br />

including multinational corporations,<br />

major space users, developers, owners,<br />

institutions, lenders and investors.<br />

For more information visit:<br />

www.gvaworldwide.com<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 05

For sale/To let<br />

For sale<br />

For sale<br />

Ramada Park Hall Hotel and Spa,<br />

Wolverhampton<br />

On behalf of Joint Administrators - David Bennett and<br />

Joe McLean of Grant Thornton<br />

• Established 75 bedroom hotel situated within an attractive<br />

Listed building<br />

• Close to Wolverhampton, Walsall, Dudley and the UK<br />

motorway network<br />

• Large site area circa 2.14 ha (5.29 acres) providing private<br />

grounds and circa 300 parking spaces<br />

• Extensive conference/function facilities include a 600 cover<br />

ballroom with own bar/restaurant and separate entrance to<br />

car park and grounds<br />

• On-site leisure facilities include a gymnasium, swimming<br />

pool and spa<br />

Contact: James Williamson on 020 7911 2109<br />

james.williamson@gva.co.uk<br />

For sale<br />

Ramada Warwick Hotel,<br />

Kenilworth<br />

On behalf of Joint Administrators - David Bennett and<br />

Joe McLean of Grant Thornton<br />

• Established 68 bedroom hotel in the Warwickshire<br />

countryside on the banks of the River Avon<br />

• Easy access to Warwick, Kenilworth, Leamington Spa and<br />

the UK motorway network<br />

• Large site area circa 3.75 ha (9.75 acres) providing private<br />

grounds and circa 250 parking spaces<br />

• Conference/function facilities include a recently<br />

constructed 500 cover ballroom<br />

• Public areas include two restaurants and a residents’ lounge<br />

with own bar<br />

Contact: James Williamson on 020 7911 2109<br />

james.williamson@gva.co.uk<br />

Under offer<br />

Ramada, Oldbury<br />

On behalf of Joint Administrators - David Bennett and<br />

Joe McLean of Grant Thornton<br />

• Recently constructed purpose-built 81 bedroom hotel with<br />

modern appearance<br />

• Conveniently located on the A4132 Wolverhampton Road,<br />

close to Junction 2 of the M5 motorway<br />

• Site area circa 0.37 ha (0.92 acres) with c. 100 parking spaces<br />

• Conference/function facilities include a first floor 120<br />

cover function room/residents’ lounge and a 60 person<br />

meeting room<br />

• Public areas include a ground floor restaurant and<br />

entrance lobby<br />

Contact: James Williamson on 020 7911 2109<br />

james.williamson@gva.co.uk<br />

Treasure Island, Eastbourne<br />

On behalf of Joint Administrators JJ Beard and N Mather<br />

of Begbies Traynor<br />

• Popular entertainment centre in a prominent position on<br />

Eastbourne seafront<br />

• Opportunity to acquire the long leasehold interest with 71<br />

years unexpired<br />

• Attractions include 18 hole miniature golf course, external play area,<br />

games arcade, children’s indoor play area and party room<br />

• Unfinished first floor restaurant/café with a terrace onto the<br />

beach front<br />

Unconditional offers are invited subject to contract<br />

Contact: James Williamson on 020 7911 2109<br />

james.williamson@gva.co.uk<br />

06 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Under offer<br />

The Chelsea Yacht and Boat Company,<br />

Chelsea, London<br />

An iconic residential houseboat investment and<br />

profitable business with potential for further<br />

earnings uplift<br />

• The prime residential houseboat site in London<br />

accommodating approximately 20% of all the<br />

houseboats on the tidal River Thames<br />

• 59 residential berths paying an annual mooring fee<br />

and maintenance charge<br />

Under offer<br />

• Profitable boatyard with dry dock for the refit and repair<br />

of houseboats<br />

• Significant advertising hoarding on Cheyne Walk/<br />

Lots Road Junction<br />

• Management offices (part let) and car park<br />

Offers invited in the region of £4.75 million<br />

Contact: John Mitchell on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

Whitney-on-Wye Toll Bridge,<br />

Herefordshire<br />

Historic Herefordshire toll bridge offers income and<br />

capital tax free investment<br />

• Historic toll bridge with adjoining cottage<br />

• Ideal tax shelter from inheritance tax<br />

• Managed business<br />

• For sale Freehold. Guide price £450,000<br />

Contact: John Mitchell on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 07

To let<br />

Sold<br />

Wildlife centre, Norfolk<br />

Animal Ark, an existing wildlife based visitor<br />

attraction with significant scope for enhancement<br />

and redevelopment<br />

• Paddocks, enclosures and animals<br />

• Tea room, play areas and parking<br />

• 3 bedroom semi-detached traditional barn conversion<br />

and annexe<br />

• Approximately 15 hectares (37 acres) of mature parkland<br />

Contact: Richard Baldwin<br />

on 0113 280 8039<br />

richard.baldwin@gva.co.uk<br />

For sale<br />

Prime West End restaurant unit<br />

available in London’s<br />

Trocadero Centre<br />

A rare opportunity to develop a substantial<br />

restaurant unit in a prime location in the heart of<br />

London’s West End close to Rainforest Cafe, TGI<br />

Friday, Planet Hollywood, W-Hotel, M&M’s World<br />

plus many more big brand names<br />

• 9,364 sq ft (869.9 sq m) unit in the West End’s prime night-spot<br />

• High-value advertising opportunity<br />

• Daily footfall of 80,000<br />

• 200 plus covers<br />

• Ceiling height of 4.87 m (16 ft)<br />

• A3/A4 planning permission<br />

Guide rent on request<br />

Contact: Gavin Brent<br />

on 020 7911 2228<br />

gavin.brent@gva.co.uk<br />

Landmark seafront hotel,<br />

Blackpool<br />

• 107 bedroom hotel located in a prominent position on<br />

Blackpool seafront<br />

• Reputation as one of Blackpool’s most popular live<br />

entertainment hotels<br />

• Well-established business with proven trading over an<br />

extended period<br />

• Freehold<br />

Offers invited in the region of £2.6 million<br />

Contact: James Williamson<br />

on 020 7911 2109<br />

james.williamson@gva.co.uk<br />

08 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Under offer<br />

Retail unit, Soho<br />

• Secure tenancy with right to renew<br />

• Central Soho location, with very<br />

high footfall close to Piccadilly<br />

Underground station<br />

• 258.8 sq m (2,786 sq ft) with 8.2 m<br />

(27 ft) display frontage onto Wardour<br />

Street, with 4 m (13 ft) ceiling heights<br />

• Planning permission for A1 use<br />

• Close to Prêt a Manger, Starbucks and<br />

Byron Hamburgers<br />

• Passing rent £99,500 p.a. (exclusive)<br />

Contact: Gavin Brent<br />

on 020 7911 2228<br />

gavin.brent@gva.co.uk<br />

For sale<br />

Surbiton Town Sports<br />

Club, Surrey<br />

Acting on behalf of the Royal<br />

Borough of Kingston-upon-<br />

Thames, GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

has concluded lease renewal<br />

negotiations at Surbiton Town<br />

Sports Club and achieved a<br />

significant rent increase.<br />

The property comprises two football<br />

pitches, a go-kart track, clubhouse, six<br />

flats, together with 36 park homes.<br />

For rent review or lease renewal advice,<br />

please contact Gavin Brent<br />

Contact: Gavin Brent<br />

on 020 7911 2228<br />

gavin.brent@gva.co.uk<br />

For sale<br />

Cobdown Sports and<br />

Social Club, Maidstone<br />

Substantial sports and social<br />

club located at J4 of the M20<br />

motorway.<br />

• Two storey club house<br />

• Squash courts<br />

• Two tier stand<br />

• Two full size football pitches<br />

• 7-aside and 5-aside football pitches<br />

• Cricket and hockey pitches<br />

• Four croquet lawns with pavilion<br />

• 11.5 ha (28.4 acres)<br />

• Freehold (subject to lease to the<br />

Trustees of Cobdown Sports and Social<br />

Club - expiring April 2014)<br />

• Guide price £1.25 million<br />

Contact: Gavin Brent<br />

on 020 7911 2228<br />

gavin.brent@gva.co.uk<br />

Lodge investments<br />

for sale<br />

Faweather Grange<br />

premium holiday lodge<br />

investment opportunity<br />

Faweather Grange is an award<br />

winning lodge development that<br />

has been established for over<br />

16 years offering luxury holiday<br />

accommodation.<br />

• Stunning, tranquil surroundings in the<br />

heart of Yorkshire<br />

• Prices for individual lodges from £195,000<br />

• Various lodge types available<br />

• Occupancy levels of 90% +<br />

• 50 year transferable leaseholds<br />

• Managed on site and marketed<br />

through Hoseasons<br />

Faweather Grange is regarded as one of<br />

the most prestigious lodge resorts in the<br />

area winning the White Rose Award 2010<br />

‘Best lodge development in the North of<br />

England’, and is shortlisted for the VisitBritain<br />

‘Best Holiday Park in Britain’.<br />

For information on the individual lodges that<br />

are available for sale at Faweather Grange<br />

Contact: Richard Baldwin<br />

on 0113 280 8039<br />

richard.baldwin@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 09

Helping big names to make<br />

big savings<br />

GVA’s business rates team<br />

currently handles over<br />

200 hotels nationwide<br />

(assessed at over RV £100<br />

million) delivering across<br />

the wide spectrum of<br />

operations from budget<br />

through to luxury 5*. Our<br />

client base operates<br />

under many notable<br />

brands including Holiday<br />

Inn, Hilton, Radisson,<br />

Citidines, Crowne Plaza<br />

and Marriott.<br />

In the last few months we have delivered<br />

significant savings on behalf of two<br />

of London’s most prestigious hotels -<br />

The Savoy Hotel and The St Pancras<br />

Renaissance Hotel.<br />

GVA’s Business Rates team’s success<br />

is achieved by focussing on<br />

understanding the operation, reviewing<br />

trading patterns, cost profiling and<br />

competitor impact.<br />

David Jones, London Senior Director,<br />

who leads the specialist hotel rating<br />

team re-emphasises the impact of the<br />

2010 rating revaluation on the sector<br />

and the opportunities to mitigate.<br />

‘’The recent revaluation resulted in<br />

hotels experiencing the largest sector<br />

increase in rate bills. We are focussed<br />

on mitigating these levels of increase<br />

where possible, our work concentrating<br />

not solely on rateable value reduction<br />

but on maximising savings through<br />

the Government’s transitional phasing<br />

scheme and challenging historic rate<br />

bill calculations.<br />

It is important that hoteliers are mindful<br />

of the impact of new competition and<br />

opportunities to mitigate during their<br />

own hotel refurbishments. We strive to<br />

ensure that where operating profit is<br />

affected, rate liabilities are reduced.’’<br />

Contact: David Jones on<br />

020 7911 2389<br />

david.jones@gva.co.uk<br />

Ian Thompson on<br />

020 7911 2962<br />

ian.thompson@gva.co.uk<br />

10 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

<strong>News</strong><br />

Business<br />

rates<br />

Rateable value reduction<br />

for the renowned White<br />

Swan Inn, Pickering,<br />

North Yorkshire<br />

The White Swan Inn is located in the<br />

picturesque market town of Pickering on<br />

the edge of the North Yorkshire Moors<br />

National Park.<br />

‘The White Swan Inn embodies what every<br />

trendy gastropub striving to seem ‘real’ is<br />

trying to achieve’. (Delicious Magazine).<br />

‘This is the kind of comfortable, well run<br />

inn you always hope to find in market<br />

towns but rarely do’. (The Independent)<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> has successfully<br />

negotiated with the Valuation Office<br />

Agency, a significant (17%) reduction of<br />

the 2010 Rateable Value assessment of<br />

this renowned boutique 16th century<br />

coaching inn.<br />

If you require advice on your 2010<br />

Rateable Value assessment,<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> can assist.<br />

Contact: Richard Baldwin on<br />

0113 280 8039<br />

richard.baldwin@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

secures rating revaluation<br />

success for Homfray<br />

Hotels portfolio<br />

The Homfray Hotels portfolio comprises:<br />

• The Golden Fleece in Thirsk<br />

• The Unicorn in Ripon<br />

• The Feathers in Helmsley<br />

• The Jockey in Malton<br />

Following a strategic review of the<br />

2010 revaluation, GVA <strong>Humberts</strong><br />

<strong>Leisure</strong> successfully negotiated with the<br />

Valuation Office Agency and achieved<br />

substantial Rateable Value reductions on<br />

behalf of our clients.<br />

Contact: Richard Baldwin on<br />

0113 280 8039<br />

richard.baldwin@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 11

For sale<br />

For sale For sale For sale<br />

The Lamb and<br />

Flag, Rhayader<br />

A two storey public house<br />

with 2 bars, function room,<br />

beer terrace, 6 en-suite letting<br />

bedrooms and 3 bed flat<br />

Montpellier Hotel,<br />

Llandrindod Wells<br />

Substantial Victorian four storey<br />

hotel, with 11 en-suite bedrooms,<br />

2 bars, restaurant and function<br />

room. Terrace and parking<br />

The Hog and<br />

Hosper, Pontypool<br />

A detached two storey public<br />

house with bar, pool room<br />

and stage, first floor function<br />

room, plus 3 bed owners’<br />

accommodation<br />

The Newbridge Arms,<br />

North Wrexham<br />

A detached two storey public<br />

house with bar, snug and<br />

games room, plus 2 bed owners’<br />

accommodation and self contained<br />

2 bed flat. Beer terrace<br />

For sale - On the instruction of Prosperity Taverns Ltd<br />

A portfolio of 8 freehold pubs and hotels located throughout Wales,<br />

comprising a mix of managed, vacant and tenanted units<br />

For sale For sale For sale<br />

For sale<br />

The Aber Hotel,<br />

Abertredwr<br />

The Barley Mow,<br />

Builth Wells<br />

The Railway,<br />

Pentre<br />

Y Boblen,<br />

Cwmllynfell<br />

A detached three storey public<br />

house with bar, 2 function<br />

rooms with skittle alley, games<br />

room, plus 3 bed owners’<br />

accommodation and 7 former<br />

letting bedrooms<br />

Attractive two storey Victorian<br />

public house with bar,<br />

restaurant/lounge, plus 3 bed<br />

owners’ accommodation. Beer<br />

garden and outbuilding<br />

Detached three storey public<br />

house with 2 bars, pool/games<br />

room and first floor function<br />

room, plus 4 bed owners’<br />

accommodation<br />

Detached two storey public<br />

house with large open plan<br />

bar arranged around a central<br />

servery, plus 4 bed flat and<br />

storage rooms. Beer garden<br />

and parking<br />

For further information on the sale of this portfolio, contact:<br />

Monique Royle on 0121 609 8440<br />

monique.royle@gva.co.uk or<br />

Charles Kaminaris on 0292 024 8933<br />

charles.kaminaris@gva.co.uk<br />

12 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

For sale<br />

For sale<br />

The Bear Inn and Hotel, Alderwasley<br />

On behalf of Ian Gould and Brian Hamblin of<br />

PKF (UK) LLP Joint Administrators of the Bear Inn<br />

and Hotel Ltd<br />

• Attractive three storey Grade II Listed building<br />

• Public bar, restaurant, function room and residents’<br />

breakfast room<br />

• 8 en-suite letting rooms and a cottage<br />

• 1 bedroom flat used for lettings<br />

• Beer garden and 80 vehicle car park<br />

• Freehold 1.73 ha (4.27 acres)<br />

Guide price on request<br />

Contact: Monique Royle<br />

on 0121 609 8440<br />

monique.royle@gva.co.uk<br />

Contact: Andrew Moore<br />

on 0113 280 8071<br />

andrew.moore@gva.co.uk<br />

The Chainbridge Inn, Nr Usk<br />

A substantial two storey public house in an idyllic<br />

location on the banks of the River Usk<br />

• Detached pub with 4 double letting bedrooms and 4 bed<br />

owners’ accommodation<br />

• Small caravan park with electric hook ups<br />

• Parking for 40 cars<br />

• Situated in a popular tourist location just off the A40<br />

• Business currently closed<br />

• Freehold<br />

Offers invited in the region of £375,000<br />

Contact: Marcus Street<br />

on 029 2024 5204<br />

marcus.street@gva.co.uk<br />

For sale<br />

For sale<br />

The Barracuda Bar, Hull<br />

Freehold investment for sale<br />

• A three storey Grade II Listed building in Hull’s city centre<br />

• Let to Barracuda Pubs & Bars Limited (Credit Safe rating of 88%)<br />

• Approximately 19 years remaining of a 25 year term<br />

• Close to city centre retail outlets, other pub operators and a<br />

short distance from Hull College<br />

• Rental income following latest review agreed at £89,250 per<br />

annum exclusive<br />

Offers in excess of £1.3 million reflecting a net initial yield of<br />

circa 6.5% assuming purchaser’s costs at 5.76%<br />

Contact: Charles Kaminaris<br />

on 029 2024 8933<br />

charles.kaminaris@gva.co.uk<br />

Cross Keys Inn, Gloucester<br />

A three storey Grade II Listed pub in the heart of the<br />

historic city of Gloucester<br />

• 2 bars with servery and central lounge<br />

• 4 bed owners’ accommodation<br />

• 4 letting bedrooms (currently unused)<br />

• Patio and decking area<br />

• Freehold<br />

Offers invited in the region of £500,000<br />

Contact: Marcus Street<br />

on 029 2024 5204<br />

marcus.street@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 13

Planning and consulting<br />

Planning permission<br />

secured for 60<br />

eco-holiday cabins<br />

at Black Wood in<br />

Hampshire on behalf of<br />

Forest Holidays<br />

Forest Holidays commissioned GVA<br />

<strong>Humberts</strong> <strong>Leisure</strong>’s planning team to<br />

oversee this application for a major new<br />

eco-holiday centre in this plantation<br />

woodland, situated just off the M3<br />

between Basingstoke and Winchester.<br />

The application was submitted with a full<br />

environmental impact assessment, which<br />

concluded that the development would<br />

enhance the bio-diversity of the wood.<br />

For further information on this and similar<br />

holiday cabin schemes contact:<br />

Martin Taylor<br />

on 020 7911 2220<br />

martin.taylor@gva.co.uk<br />

Image courtesy of A and M Architectural Services<br />

Planning permission<br />

secured for 54<br />

static caravans at<br />

Landguard,<br />

Isle of Wight<br />

Acting on behalf of Park Resorts<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong>’s Planning<br />

Team has recently obtained<br />

planning permission for a major<br />

redevelopment of this established<br />

holiday park on the Isle of Wight.<br />

Landguard receives approximately<br />

40,000 holidaymakers each year<br />

and visitors alone contribute an<br />

estimated £10 million annually to<br />

the island’s economy.<br />

The application overcame issues<br />

relating to tree loss, density and<br />

layout.<br />

For further information on this<br />

project contact:<br />

Aimée Cannon<br />

on 020 7911 2143<br />

aimee.cannon@gva.co.uk<br />

14 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

<strong>News</strong><br />

Permission granted for 26 high quality holiday<br />

cottages at Lower Hyde Holiday Park, Shanklin<br />

on the Isle of Wight<br />

Park Resorts approached GVA <strong>Humberts</strong> <strong>Leisure</strong> to secure planning permission for<br />

the redevelopment of the site of a former cottage to enable the operator to offer<br />

holiday makers a wider range of high quality accommodation. To fit in with the<br />

surrounding countryside the redevelopment scheme was designed to emulate a<br />

former farmstead, including a manager’s house, coach house, stable block and<br />

mill house.<br />

Martin Taylor on 020 7911 2220<br />

martin.taylor@gva.co.uk<br />

Open Space Assessment<br />

supports permission for<br />

housing in Brighton<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong>’s planning<br />

team’s expertise on open space needs<br />

assessment and further advice on Section<br />

106 developer contributions has been<br />

utilised to secure planning permission for<br />

31 dwellings (12 affordable) on a disused<br />

private sports ground in Brighton.<br />

Following the granting of planning<br />

permission residential housing and<br />

apartments will occupy a third of the<br />

site, whilst the remainder will be laid<br />

out as public open space, play space,<br />

and sports pitches to be transferred to<br />

the local authority and a new scout hut<br />

which is to be transferred to the Scout<br />

Association.<br />

For advice on how open space<br />

assessment can play a pivotal role<br />

in obtaining consent for redevelopment<br />

contact:<br />

Peter Sharp on 020 7911 2201<br />

peter.sharp@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 15

Focus on<br />

In this section:<br />

We’re selling Brighton<br />

Pier, one of the UK’s<br />

best loved seaside<br />

attractions<br />

Got a taste for<br />

adventure? Discover<br />

the attractions of<br />

Stubbers Adventure<br />

Centre in Essex<br />

Anna Mathias of<br />

Joelson Wilson brings<br />

you up to date on<br />

changes to the<br />

Licensing Act<br />

A review of the hotel<br />

sector<br />

16 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Focus on Brighton Pier<br />

Probably the most iconic<br />

and renowned of all<br />

seaside piers<br />

On the market for the first time in<br />

25 years - Brighton Pier<br />

A magnificent symbol<br />

of Britain’s resurgent<br />

seaside and an<br />

important heritage<br />

attraction, Brighton Pier<br />

has a fine pedigree<br />

and established trading<br />

record.<br />

• Believed to be in the top 3 of Britain’s<br />

busiest attractions<br />

• Situated at a pivotal location in one of<br />

Britain’s premier seaside resorts<br />

• Substantial annual turnover and<br />

operating profit<br />

• Significant food and beverage<br />

offerings<br />

• 18 attraction rides<br />

• 2 modern amusement arcades<br />

• Sideshows and numerous retail units<br />

• Substantial concession income<br />

• Quality Coast Award Beaches<br />

• Renowned Grade II* Listed Pier<br />

• 524m (third of a mile) in length<br />

Contact:<br />

Richard Baldwin<br />

on 0113 280 8039<br />

richard.baldwin@gva.co.uk<br />

Ben Allen<br />

on 020 7911 2360<br />

ben.allen@gva.co.uk<br />

Nigel Talbot Ponsonby (Consultant)<br />

ntp@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 17

Focus on golf market<br />

For sale<br />

The Craythorne<br />

Burton-upon-Trent<br />

A well presented two<br />

storey pub-house ideally<br />

suited to weddings,<br />

conference and<br />

functions trade with an<br />

18 hole proprietary golf<br />

course and floodlit<br />

golf range.<br />

• Attractive two storey pub-house<br />

with extensive food and beverage<br />

facilities, furnished, fitted and<br />

equipped to the highest standard<br />

(including a former staff apartment)<br />

• Golf shop and proposed hair salon<br />

• Undulating 5,642 yard (par 68) golf<br />

course<br />

• 13 bay floodlit golf driving range<br />

• Practice facilities (irrigated practice<br />

putting green, short game area,<br />

practice bunker and pitching nets)<br />

• Modern greenkeeping complex<br />

• Circa 28.5 ha (70.5 acres)<br />

• Freehold<br />

Established business with<br />

true potential for further<br />

commercialisation:<br />

• Commercial trading location close to:<br />

Derby, Lichfield and Nottingham<br />

• Turnover circa £635,000 (4 yr avg)<br />

33% golf and range; 67% food and<br />

beverage income<br />

• 222 members<br />

Guide price £1.15 million<br />

Contact: Ben Allen<br />

on 020 7911 2360<br />

ben.allen@gva.co.uk<br />

18 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Focus on golf market<br />

Under offer<br />

Blacknest Golf & Country Club,<br />

Hampshire<br />

Freehold golf club situated in the South Downs<br />

National Park close to the Surrey / Hampshire border<br />

Ben Allen on 0207 911 2360<br />

ben.allen@gva.co.uk<br />

Sold<br />

• Attractive 18 hole 5,974 yard (par 69) golf course<br />

• 6 hole academy course, 13 bay golf driving range<br />

• Clubhouse with function room, health and fitness suite and<br />

planning permission for 10 en-suite hotel bedrooms<br />

• Established business offering good potential for<br />

commercialisation<br />

• Offers invited in the region of £1.25 million<br />

For sale<br />

Wyre Forest GC, Worcestershire<br />

On the instructions of Ryan Grant, Simon Wilson<br />

and Anne O’Keefe of Zolfo Cooper LLP,<br />

Joint Administrators of Wyre Forest Golf Centre Ltd<br />

• 18 hole pay and play golf course - 5,734 yard (par 69)<br />

• Practice facilities<br />

• Attractive clubhouse (circa 3,500 sq ft)<br />

• Pair of former cottages requiring modernisation<br />

• 84 year leasehold interest at ground rent<br />

• Turnover circa £350,000<br />

• Circa 56 ha (circa 138 acres)<br />

• Established business ripe for commercialisation<br />

Guide £450,000<br />

Contact: Ben Allen on 020 7911 2360<br />

ben.allen@gva.co.uk<br />

Lostwithiel Hotel GCC, Cornwall<br />

A freehold golf and leisure hotel nestling in<br />

the Fowey Valley<br />

• 27 bedroom courtyard style hotel<br />

• Clubhouse with leisure club and function facilities<br />

• 18 hole 5,907 yard (par 72) golf course<br />

• Indoor pool, tennis courts and fishing lakes<br />

• Established business - turnover circa £900,000<br />

• Good potential for growth/commercialisation<br />

• Renowned tourist location close to the Eden Project<br />

• Freehold<br />

Guide price on request<br />

Contact: Ben Allen on 020 7911 2360<br />

ben.allen@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 19

Focus on holiday parks market<br />

For sale<br />

For sale<br />

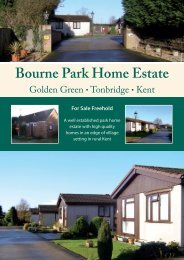

Four Horseshoes PHE, Kent<br />

Mature retirement park home estate situated on the<br />

edge of Graveney village<br />

• 46 privately owned park homes – 35 twins and 11 singles<br />

• 18 garages/24 parking spaces – with future development<br />

potential (STPP)<br />

• Amenity area<br />

• Circa 1.3 ha (3.13 acres) of mature grounds<br />

• Freehold<br />

Offers invited in the region of £1.19 million<br />

Contact: John Mitchell on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

Goulton Beck, North Yorkshire<br />

An easily managed holiday park with significant<br />

development potential<br />

• A secluded yet accessible countryside location close to the<br />

North Yorkshire Moors<br />

• Circa 1.8 ha (4.5 acres)<br />

• Site licence for 18 statics and 6 tourers<br />

• Currently 5 owner-occupied holiday statics and 1<br />

owner-occupied lodge<br />

• Freehold<br />

Guide price £475,000<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

For sale<br />

For sale<br />

Lakeside Park Home Estate, Somerset<br />

A rare town centre residential park redevelopment<br />

opportunity<br />

• Consent for 50 pitches – 9 private homes remaining,<br />

16 hire fleet<br />

• Excellent interim rental income<br />

• 2 large residential houses – currently let on ASTs<br />

• Block of 16 garages, shop and former bungalow<br />

• Potential for permanent housing in place of park homes<br />

• In all about 1.8 ha (4.4 acres) including pond feature<br />

• Freehold<br />

Offers invited in the region of £2.75 million<br />

Contact: John Mitchell on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

Lodge development site, Loch Lomond<br />

Unique leisure development opportunity in<br />

honeypot location<br />

• Land designated for recreation and tourism – circa 2.02<br />

hectares (5 acres)<br />

• Existing extant consent for 40 lodge units – site ripe for<br />

redevelopment<br />

• Adjoining Cameron House and The Carrick, with access from<br />

the A82 and adjacent to a lochside restaurant/wedding venue<br />

owned by vendors<br />

• Strong interest anticipated from holiday lodge and hotel<br />

developers alike<br />

Heritable interest for sale. Offers over £1.5 million invited<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

20 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Focus on holiday parks market<br />

For sale<br />

Under offer<br />

Pound Farm, Lake District<br />

Profitable holiday business in popular tourist area<br />

• Close to Kendal and Windermere<br />

• 14 holiday lodge pitches<br />

• 10 touring and 10 tenting pitches<br />

• 4 holiday apartments<br />

• Modern management offices<br />

• Freehold<br />

Guide price £1.15 million<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

Wansbeck Park,<br />

Northumberland<br />

An easily managed caravan<br />

park adjacent to the picturesque<br />

River Wansbeck<br />

• Currently 44 touring, 17 tenting pitches<br />

• Consent for holiday caravan park<br />

redevelopment<br />

• 12 month holiday use<br />

• 3 bed bungalow and reception/shop<br />

• Circa 3.64 ha (8.99 acres)<br />

• Freehold<br />

Guide price £400,000<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

For sale<br />

For sale<br />

Under offer<br />

Springhouse Holiday Park,<br />

County Durham<br />

A well located holiday park in<br />

woodland setting<br />

• 99 pitches comprising 79 static and 20<br />

touring pitches<br />

• 4 bedroom bungalow<br />

• Reception incorporating shop<br />

• Circa 6.88 ha (17 acres)<br />

• Freehold<br />

Guide price £1.65 million<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

Golden Imp,<br />

East Yorks Coast<br />

Easily-managed and profitable<br />

holiday chalet business with<br />

development potential<br />

• 28 detached chalets, plus consent for<br />

a further 6 chalets<br />

• Pitch fee income of £2,950 per pitch in<br />

2010, with substantial ‘block’ fee plus<br />

commission on assignment<br />

• 2010 ERV in excess of £82,500 pa,<br />

providing 8.9% gross return on<br />

investment (excluding commissions),<br />

with potential additional sales and<br />

pitch fee income<br />

• Circa 0.65 ha (1.6 acres)<br />

• Freehold<br />

Guide price £925,000<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

Sleepy Hollow PHE,<br />

Hampshire<br />

Immaculately presented modern<br />

park home estate<br />

• 24 private homes – 23 twin and<br />

1 single<br />

• High pitch fees<br />

• In all about 0.8 ha (2 acres) of mature<br />

grounds<br />

• For sale freehold as a going concern<br />

Offers in the region of £750,000<br />

Contact: John Mitchell on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 21

Focus on holiday parks market<br />

For sale<br />

For sale<br />

Oakwood Lodges,<br />

Powys<br />

Established, profitable lodge letting business and<br />

period farmhouse<br />

• Lot 1: Lodge letting business in popular tourism area.<br />

- 11 fully furnished holiday letting lodges<br />

- Total area about 4.86 ha (12 acres)<br />

- Consent for a further 5 lodges<br />

- 12 month holiday use<br />

• Lot 2: 6 bed farmhouse with large garage/workshop and<br />

2.83 ha (7 acres) of land<br />

• Freehold<br />

For sale as a whole or in lots. Lot 1 £975,000 / Lot 2 £345,000<br />

Joint Agent: Adams & Co 01752 493 002<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

For sale<br />

Porlock Caravan Park,<br />

Exmoor National Park<br />

An award winning, well capitalised mixed<br />

holiday park<br />

• 55 static caravans (45 private owner units), 9 modern static<br />

caravan hire fleet units (2007 to 2010 models), 40 touring<br />

pitches with electric hook-ups, 14 hard standings<br />

• 3.4 acre touring caravan rally field<br />

• Reception, workshop and park office, plus three bedroom<br />

park home and one bedroom staff unit<br />

• Planning consent for new reception with one bedroom holiday<br />

unit and three bedroom owner’s accommodation<br />

• In all about 3.09 ha (7.63 acres)<br />

• Freehold<br />

Guide price £1.95 million<br />

Contact: John Mitchell on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

Under offer<br />

Hill Farm Park Home Estate,<br />

Pembrokeshire<br />

Well established park home estate with a number of<br />

vacant pitches<br />

• 30 park home pitches with 25 private homes and 1 assured<br />

shorthold tenancy<br />

• 3 pitches with stock units<br />

• 1 vacant twin pitch<br />

• Elevated, mature site with views over Milford Haven<br />

• In all about 0.89 ha (2.21 acres)<br />

• Freehold<br />

Offers in the region of £750,000<br />

Contact: John Mitchell on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

22 I GVA <strong>Humberts</strong> <strong>Leisure</strong><br />

Crook O’ Lune Holiday Park,<br />

Lancashire<br />

A substantial, ideally located holiday park<br />

• An established and high quality development set in over<br />

8 ha (20 acres)<br />

• Site Licence for 179 holiday caravans<br />

• Currently 164 pitches, including 57 lodge pitches<br />

• 97 owners paying net pitch fees of £2,370 (statics) and £3,420<br />

(lodges) plus VAT<br />

• Reception office, 3 bed detached bungalow and additional<br />

land of about 2.02 ha (5 acres) with outline consent for a new<br />

dwelling<br />

• Freehold<br />

Offers invited<br />

Contact: Peter Smith on 0113 280 8075<br />

peter.smith@gva.co.uk

Focus on holiday parks market<br />

Under offer<br />

For sale<br />

For sale<br />

Stoneway PHE,<br />

Kent<br />

A well established and attractive<br />

park home estate<br />

• 29 private park homes – 28 private<br />

homes and 1 rental unit<br />

• High level pitch fees<br />

• Additional paddock<br />

• Circa 1.64 ha (4.05 acres) of mature<br />

grounds<br />

• For sale freehold as a going concern<br />

Offers in the region of £850,000<br />

Contact: John Mitchell<br />

on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

Silver Birches HP,<br />

Barton upon Humber<br />

Redeveloped holiday park ready<br />

for sales, with detached dwelling<br />

• Exceptional, high-quality<br />

development for 27 pitches – all<br />

currently vacant<br />

• Total site area circa 0.84 ha (2.07<br />

acres)<br />

• Significant holiday caravan sales<br />

opportunity<br />

• All year round holiday use<br />

• Substantial 4 bed house<br />

• Freehold<br />

Guide price £985,000<br />

Contact: John Mitchell<br />

on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

Heron Cottage CP,<br />

South Lincolnshire<br />

A beautiful touring and static<br />

park with an attractive cottage<br />

• 52 touring pitches with electric<br />

hook-ups – 12 month use<br />

• 9 newly developed static pitches,<br />

4 private owners<br />

• Modern toilet block and laundrette<br />

• Two bedroom cottage<br />

• In all about 1.4 ha (3.42 acres) fronting<br />

onto fishing water<br />

• Freehold<br />

Guide price £720,000<br />

Contact: Charlie Mason<br />

on 020 7911 2488<br />

charlie.mason@gva.co.uk<br />

Price reduction<br />

For sale<br />

Hill Top PHE,<br />

Cheshire<br />

Small park home estate in<br />

sought-after location<br />

• Planning permission and Site Licence<br />

for 8 residential pitches<br />

• 5 twin and 3 single park homes sited<br />

(1 twin and 1 single for sale privately)<br />

• Desirable Cheshire village location with<br />

excellent access to motorway links<br />

• Freehold<br />

Guide price £290,000<br />

Contact: Peter Smith<br />

on 0113 280 8075<br />

peter.smith@gva.co.uk<br />

Sunny Lyn Holiday Park,<br />

Exmoor National Park<br />

A mixed holiday park in a valley<br />

setting close to the coast<br />

• 13 lodges (8 private, 5 hire fleet),<br />

7 static hire fleet caravans,<br />

9 touring pitches, 28 tenting pitches<br />

• 2 holiday flats<br />

• Owner’s 4 bedroom penthouse flat<br />

• Licensed bistro / takeaway<br />

• Planning for one more lodge unit<br />

• Shop / reception, launderette and<br />

shower / WC facilities<br />

• Circa 1.32 ha (3.27 acres) beside a<br />

fishing stream<br />

• Freehold<br />

Offers in the region of £1.2 million<br />

Contact: John Mitchell<br />

on 020 7911 2489<br />

john.mitchell@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 23

Focus on Stubbers, <strong>Up</strong>minster<br />

Under offer<br />

Featured property Stubbers<br />

Adventure Centre, <strong>Up</strong>minster, Essex<br />

On behalf of the London<br />

Borough of Havering<br />

Stubbers Activity Centre,<br />

an educational and<br />

activity centre situated<br />

in the Green Belt to the<br />

south-east of Romford,<br />

represents a fine<br />

opportunity to acquire a<br />

significant landholding<br />

inside the M25 Motorway<br />

for continued leisure<br />

and recreation use, or<br />

long term alternative<br />

redevelopment (subject<br />

to planning permission).<br />

The property is currently operated under<br />

lease by Stubbers Adventure Centre Ltd,<br />

a private not for profit company and<br />

registered charity. The facilities, which<br />

are laid out over 47 hectares (117 acres),<br />

comprise:<br />

• 48 bed residential centre<br />

• Camping area<br />

• Two 3 bedroom cottages<br />

• Water sports lake (23 acres)<br />

• Sailing lake (18.5 acres) with boat<br />

storage area<br />

• 3 ponds<br />

• Climbing and abseiling tower<br />

• High ropes course<br />

• Motor sports area<br />

• Archery<br />

• Administration offices and<br />

ancillary facilities<br />

The primary objective of the company<br />

currently operating the Centre is ‘to<br />

develop by education, example<br />

and the provision of a disciplined<br />

environment, the physical, mental<br />

and spiritual capacities of children<br />

and young people to enable them to<br />

grow to full maturity as individuals and<br />

become respectable and responsible<br />

members of the community’.<br />

Stubbers typically attracts over 40,000<br />

visitors each year. Visitors are mainly<br />

from schools, youth organisations and<br />

the Essex Association of Boys Clubs, with<br />

the majority of visits occurring during the<br />

peak May to September period.<br />

Stubbers Adventure Centre Ltd occupies<br />

the property under the terms of a<br />

21 year FRI lease, granted on 25th<br />

September 1997 (6 years unexpired) at a<br />

rent of £1.00 per annum.<br />

Charlie Mason, who is handling the sale<br />

at GVA <strong>Humberts</strong> <strong>Leisure</strong> says ‘ Stubbers<br />

Adventure Centre is, locally, a much<br />

loved and highly regarded facility that<br />

offers year round indoor and outdoor<br />

adventure. It represents a rare and<br />

exciting opportunity.’<br />

For further information on Stubbers<br />

Activity Centre visit www.stubbers.co.uk<br />

Contact: Charlie Mason<br />

on 020 7911 2488<br />

charlie.mason@gva.co.uk<br />

24 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Focus on Kidspace expansion plans<br />

Kidspace plans further expansion<br />

Kidspace, the UK’s<br />

leading children’s play<br />

centre operator, has<br />

announced plans to<br />

open two new<br />

centres by 2012.<br />

The company’s existing centres in<br />

Romford (2006 - 20,000 sq ft) and<br />

Croydon (2008 - 30,000 sq ft) have<br />

attracted over 1.5 million visitors, held<br />

over 14,000 birthday parties and<br />

currently have over 4,000 annual<br />

pass members. Kidspace has<br />

continued to attract high customer<br />

volumes throughout the recession,<br />

demonstrating that the business<br />

is relatively immune to economic<br />

downturns.<br />

Gavin Brent, from GVA <strong>Humberts</strong> <strong>Leisure</strong>,<br />

comments: “The financial performance<br />

and sustainability of the Kidspace<br />

business model dispels the image<br />

investment institutions and landlords<br />

have of CPC’s being ‘Mom and Pop’<br />

operations. It should also assist them by way<br />

of gaining planning consent for mixeduse<br />

schemes and acting as an anchor for<br />

attracting retailers to any given scheme.”<br />

The proven success<br />

of Kidspace reflects<br />

a growing appetite<br />

for superior children’s<br />

entertainment and exercise<br />

attractions in the UK. It<br />

follows the success of<br />

projects such as Go-Ape,<br />

Butterfly World and the<br />

Deep. CPC sector targeting<br />

children under 12 allows<br />

for a consistent flow of new<br />

customers each year.<br />

“With increased concerns towards<br />

child obesity prevalent in the media,<br />

the centres provide entertainment<br />

and essential ‘exercise in disguise’<br />

for children who might otherwise not<br />

participate in physical activities either<br />

at home or school,” adds Brent.<br />

Kidspace requires new premises on<br />

a leasehold or freehold basis with a<br />

Gross Internal Area of 15,000 sq ft (D2<br />

use) with minimum eaves height of<br />

6.5m over circa 50%.<br />

Ideally sites are located in or<br />

adjacent to retail/leisure park units<br />

with high visibility and footfall. Car<br />

parking is essential.<br />

The leisure operator is urgently<br />

searching for new premises in<br />

Greater London, Birmingham and<br />

other major cities in the UK.<br />

Contact: Gavin Brent<br />

on 020 7911 2228<br />

gavin.brent@gva.co.uk<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 25

Focus on changes to the Licensing Act<br />

Half full<br />

or half<br />

empty?<br />

Licensing<br />

Act<br />

Last summer, the<br />

Coalition Government<br />

announced radical<br />

plans to overhaul the<br />

Licensing Act 2003. What<br />

many perceived to be<br />

a rushed consultation<br />

into its initial proposals<br />

has resulted in some<br />

initiatives being watered<br />

down and some<br />

abandoned altogether.<br />

Those that remain form Part 2 of the<br />

Police Reform and Social Responsibility<br />

Act (“the Act”) which received<br />

Royal Assent on 15 September. The<br />

Government has not yet announced the<br />

date for implementation of the licensing<br />

provisions within the Act, but many<br />

expect the changes to come into force<br />

on 1 January 2012. This article provides<br />

an update to that published in the<br />

Winter 2010/Spring 2011 bulletin. We look<br />

at the background to the reforms, which<br />

proposals were carried forward from the<br />

consultation and which were dropped,<br />

and what all this might mean in practice<br />

for the industry.<br />

Background<br />

On 21 July 2010 it was announced<br />

that the Home Office would be taking<br />

full responsibility for alcohol licensing<br />

and enforcement going forward,<br />

having previously shared this with the<br />

Department for Culture, Media and<br />

Sport. The move was aimed at reducing<br />

any duplication of effort, consistent<br />

with the current drive of cost-cutting in<br />

government and particularly with the<br />

stated aim of reducing the head-count<br />

at DCMS by a third.<br />

The alcohol licensing portfolio was<br />

handed to the Minister for Crime<br />

Prevention, James Brokenshire. At the<br />

time the announcement was made<br />

that he would be taking up the reins, the<br />

Minister issued a hard-hitting statement<br />

that harked back to the five pledges<br />

on alcohol contained in the May 2010<br />

Coalition Agreement. These were:<br />

• To overhaul the 2003 Act to give<br />

licensing authorities and police<br />

greater powers to refuse or revoke<br />

licences where premises are causing<br />

problems;<br />

• To allow licensing authorities and<br />

police permanently to close premises<br />

found to be persistently selling alcohol<br />

to children;<br />

• To double the maximum fine for<br />

underage alcohol sales to £20,000;<br />

• To permit licensing authorities to<br />

charge higher licensing fees for latenight<br />

licences, to pay for additional<br />

policing; and<br />

• To ban the sale of alcohol at below<br />

cost price.<br />

Brokenshire said:<br />

‘We continue to be concerned about<br />

the number of alcohol-related incidents<br />

and the drink-fuelled violence and<br />

disorder that blight many of our towns<br />

and cities.<br />

26 I GVA <strong>Humberts</strong> <strong>Leisure</strong>

Focus on changes to the Licensing Act<br />

The Government believes that the power<br />

to make licensing decisions needs<br />

to be rebalanced in favour of local<br />

communities, so that they can decide<br />

on the night time economy they want.’<br />

The proposals put out to<br />

consultation<br />

Only a week after this statement,<br />

the Home Office published its<br />

consultation paper, “Rebalancing<br />

the Licensing Act – a consultation<br />

on empowering individuals, families<br />

and local communities to shape and<br />

determine local licensing”, which<br />

contained the Government’s proposals<br />

for the promised overhaul of the<br />

system. Only six weeks were allowed<br />

for the consultation process, which<br />

closed on 8 September 2010. This in<br />

itself provoked fierce criticism, as the<br />

consultation period fell far short of that<br />

recommended in official guidance,<br />

particularly so when one considers<br />

that the exercise took place during the<br />

August holiday period.<br />

The proposals that went out to<br />

consultation certainly represented a<br />

radical overhaul of licensing law in<br />

record time. The main features were:<br />

• Making licensing authorities<br />

responsible authorities so that they<br />

can refuse and review licences<br />

themselves, even in cases where no<br />

representations have been made by<br />

residents or authorities such as the<br />

Police;<br />

• Reducing the evidential burden of<br />

proof resting on licensing authorities,<br />

so that they no longer have to<br />

demonstrate that their decisions<br />

are “necessary” for the promotion<br />

of the licensing objectives. Instead,<br />

they would be required to “consider<br />

more widely what actions are most<br />

appropriate to promote the licensing<br />

objectives in their area”;<br />

• Making it easier for licensing<br />

authorities to introduce a cumulative<br />

impact (or “stress area”) policy,<br />

whereby there is a presumption<br />

against granting new licences and<br />

extensions to existing licences;<br />

• Allowing residents to object to licence<br />

applications, regardless of where<br />

they live;<br />

• Designating health bodies as<br />

responsible authorities and making<br />

the prevention of health harm a new<br />

licensing objective;<br />

• Extending the category of “interested<br />

party” so that it includes bodies<br />

such as school governors, housing<br />

associations and registered social<br />

landlords;<br />

• Obliging licensing authorities to<br />

accept every relevant representation<br />

from police and to implement their<br />

every relevant recommendation;<br />

• Putting the burden of proof on to<br />

applicants to establish that their<br />

application will not have a negative<br />

impact on the area, or that any<br />

negative impact will be successfully<br />

mitigated;<br />

• Introducing a rule that magistrates will<br />

generally need to remit any matter<br />

that is appealed before them to the<br />

licensing authority for determination;<br />

• Stopping the practice whereby<br />

lodging an appeal suspends any<br />

measures that are imposed on<br />

a premises licence so that if, for<br />

example, a licence is revoked at<br />

review, the premises will not be<br />

allowed to trade unless and until an<br />

appeal succeeds;<br />

• Introducing a “late night levy” whereby<br />

premises trading after midnight pay a<br />

higher licence fee to contribute to the<br />

costs of extra policing, taxi marshals<br />

and street cleaning;<br />

• Allowing licensing authorities to<br />

increase their fees across the board<br />

and specifying that licences will<br />

automatically be revoked if the<br />

annual fee is not paid;<br />

• Publishing guidance encouraging<br />

licensing authorities to restrict licensed<br />

hours and use fixed and staggered<br />

closing times and zoning;<br />

• Encouraging licensing authorities to<br />

consult more widely when producing<br />

their statement of licensing policy;<br />

• Extending the use of Early Morning<br />

Restriction Orders (EMROs) so that they<br />

can be used at any time rather than,<br />

as currently, only between 3 and 6am;<br />

• Introducing stricter controls over<br />

temporary events: requiring a month’s<br />

notice to be given for a TEN; giving<br />

the police five days instead of two to<br />

object; allowing all the responsible<br />

authorities to object under any<br />

licensing objective; giving licensing<br />

authorities the discretion to extend<br />

any conditions on the premises<br />

licence so that they apply to the<br />

period of the TEN; limiting to 12 the<br />

number of TENs a personal licence<br />

holder can apply for in the course of<br />

a year and limiting each premises or<br />

vicinity, such as a field during a festival<br />

or fete, to one TEN at a time;<br />

• Doubling the maximum fine for<br />

underage sales to £20,000 and<br />

replacing the current maximum closure<br />

period under a closure notice of 48<br />

hours with a minimum period of 168<br />

hours; and<br />

• Requiring an automatic review of the<br />

licence of any premises that makes<br />

persistent (ie 2 in 3 months) underage<br />

sales.<br />

The revised proposals in<br />

the Act<br />

Some of the initiatives over which<br />

a question mark was raised, in the<br />

responses to consultation, in terms of<br />

their compatibility with human rights law<br />

have been scrapped. Perhaps the most<br />

significant example is the changes that<br />

were proposed to the appeals system.<br />

This is to be welcomed, since making<br />

the default position upon an appeal<br />

that it should be remitted back to the<br />

licensing authority would have had the<br />

effect of removing a crucial level of<br />

judicial supervision. Perhaps worse still,<br />

a situation where an appeal no longer<br />

has the effect of suspending a licensing<br />

authority’s decision would mean that,<br />

if a premises licence was revoked at a<br />

review, the premises would not be able to<br />

trade again unless and until the operator<br />

succeeded in an appeal – which rather<br />

begs the question of how that appeal<br />

would be funded!<br />

It seems, however, that in dropping its<br />

proposals for appeals, the Government<br />

has bowed to the advice of its lawyers,<br />

rather than experiencing some<br />

Damascene change of heart. It is<br />

pushing ahead with adding licensing<br />

authorities to the list of responsible<br />

authorities able to object to applications<br />

for premises’ licences and to call for<br />

reviews of existing licences. Some<br />

licensing authorities have been<br />

campaigning for this for some time,<br />

but the move will serve to blur the line<br />

between interested party and decisionmaker,<br />

which could cause bias, or at<br />

least give the appearance of such. An<br />

increase in the number of appeals and<br />

judicial reviews of decisions may be<br />

expected as a result, adding to the cost<br />

burden on operators.<br />

GVA <strong>Humberts</strong> <strong>Leisure</strong> I 27

Focus on changes to the Licensing Act<br />

The Act also contains the proposal to<br />

make Primary Care Trusts and Local<br />

Health Boards responsible authorities<br />

under the Licensing Act, although they<br />

will need to found their arguments<br />

on the existing licensing objectives<br />

of preventing crime and disorder,<br />

preventing public nuisance, promoting<br />

public safety and protecting children<br />

from harm. The idea of creating a new<br />

licensing objective of the promotion of<br />

public health has been abandoned,<br />

although there was some debate in the<br />

Lords about making “protecting and<br />

improving public health” one of the<br />

general duties of licensing authorities.<br />

There seems to have been little appetite<br />

for making school governors, housing<br />

associations and registered social<br />

landlords responsible authorities – that<br />

proposal has also been dropped.<br />

Similarly – and perhaps, again, on<br />

the advice of lawyers specialising in<br />

human rights – the idea that licensing<br />

authorities should be obliged to accept<br />

the evidence and recommendations of<br />

the police unless these are manifestly<br />

irrelevant has not been pursued.<br />

The Act abolishes the concept of<br />

“vicinity”, meaning that, for example,<br />

residents will be able to make<br />

representations to applications for any<br />

premises, regardless of their geographic<br />

proximity. This is the stuff of nightmares,<br />

conjuring up images of a residents’<br />

association making objection as a<br />

matter of policy to applications up and<br />

down the land. It must be said that this<br />

proposal met with some opposition in<br />

the Lords, with amendments tabled<br />

to reinstate a “vicinity test” that would<br />

only allow representations to be made<br />

by those who live or have a business<br />

interest sufficiently close to premises to<br />

be affected by them, or at least within<br />

the licensing authority’s area. However,<br />

these ideas have not been carried<br />

forward into law.<br />

The proposal to reduce the evidential<br />

burden by requiring licensing authorities<br />

to take action that is “appropriate”,<br />

rather than what is “necessary”, has<br />

survived. This departure from a strict<br />

necessity-based approach could<br />

lead to more speculation finding its<br />

way into decision-making, leading to<br />

more refusals of applications and the<br />

imposition of more stringent conditions.<br />

Again, this measure faced opposition in<br />

the Lords.<br />

The Government has departed<br />

significantly from its original proposals<br />

relating to TENs. The changes are now a<br />

bit of a mixed bag, but they will broadly<br />

be welcomed by the trade. Although<br />

Environmental Health officers, in addition<br />

to the police, will now be able to<br />

object, other responsible authorities will<br />

not. However, any of the four licensing<br />

objectives will be capable of forming<br />

grounds for an objection, as opposed<br />

to the prevention of crime and disorder<br />

only, as is presently the case. Issues of<br />

noise and nuisance will, for the first time,<br />

therefore have to be considered when<br />

applying for a TEN.<br />

In addition, licensing authorities will<br />

be able to impose one or more of the<br />

conditions that apply to the premises<br />

licence for the same premises on a<br />

TEN for those premises, where they<br />

feel it appropriate to do so for the<br />

promotion of one or more of the<br />

licensing objectives. The idea that any<br />

conditions on a premises licence will<br />

be automatically carried over to any<br />

TEN for the same premises has been<br />

dropped, although an amendment<br />

tabled for debate in the Lords aimed<br />

to reintroduce this. Another Lords’<br />

amendment proposed that licensing<br />

authorities be allowed to have a<br />

“bank” of standard conditions that<br />

they can apply to any TEN. Again, this<br />

amendment has not been carried<br />

forward<br />

The watering-down of the proposals<br />

relating to conditions on TENs has<br />

provoked howls of dismay from at least<br />

one London licensing authority, who<br />

would like to be able to apply conditions<br />

on a premises licence wholesale to any<br />

TEN for the same premises and is also<br />

concerned that the Act will not provide<br />

any mechanism whereby conditions<br />

can be attached to a TEN applied for by<br />

premises that are otherwise unlicensed.<br />

At the time of the consultation,<br />

many voiced concerns that, if the<br />

Government’s proposals on TENs went<br />

unchecked, they would drastically<br />

reduce their flexibility and fitness for<br />

purpose. In this regard, at least, the<br />

Government appears to have listened.<br />

The Act introduces the possibility of<br />

a “short-notice TEN” (5 as opposed<br />

to 10 working days before the event),<br />

extends the maximum period which<br />

may be covered by a TEN from 96 to<br />

168 hours and increases the number<br />

of days during which TENs can be<br />

used by a single premises in a twelve<br />

month period from 15 to 21. However<br />

the time for objecting to a TEN has been<br />

increased, not to 5 days, as in the original<br />

proposal, but to 3.<br />

One of the Government’s main<br />

commitments was to tackle underage<br />

sales, and the proposal that it consulted<br />

upon, to double the maximum fine for<br />

persistent underage sales to £20,000, has<br />

been enacted. Closure notices imposed<br />

on premises that persistently sell alcohol<br />

to children will, once the Act comes into<br />

force, last for anything from 48 to 336<br />

hours. An amendment tabled in the<br />

House of Lords suggested that those who<br />

are guilty of persistent under-age sales<br />

be made the subject of a “training order”<br />

involving the re-training of all their staff<br />

by a certain date and the suspension<br />

of alcohol sales for a period of 24 hours,<br />

as an alternative to a closure notice.<br />

Another Lords’ amendment proposed<br />

also doubling the maximum penalty for<br />

the offence of purchasing alcohol for a<br />

child to £10,000. Neither of these Lords’<br />

amendments has survived. The idea of<br />

introducing automatic licence reviews for<br />

those who persistently make under-age<br />

sales has also been scrapped.<br />

The EMRO has made its way into the law.<br />

These Orders will be available at any time<br />

between midnight and 6am, although<br />

certain classes of premises and certain<br />

days may be exempt. An amendment<br />

tabled in the Lords preferred that EMROs<br />

only be used after 1am but this has not<br />

been taken up. In any event, this debate<br />

might prove academic, as intelligence<br />

from licensing authorities indicates that<br />

they will be reluctant to embark on the<br />