Advocate Benefits - Advocate Health Care

Advocate Benefits - Advocate Health Care

Advocate Benefits - Advocate Health Care

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Bottom line: More tax free dollars, more<br />

protection for you<br />

If you take full advantage of <strong>Health</strong>e Measures,<br />

you can have total tax-free dollars from<br />

<strong>Advocate</strong>—through a combination of <strong>Advocate</strong>’s<br />

DRA contribution and <strong>Health</strong>e Measures reward—<br />

equal to:<br />

$1,200—if you have single coverage<br />

$1,800—if you have associate + child(ren)<br />

coverage, or<br />

$2,400—if you have associate + spouse/<br />

domestic partner or family coverage.<br />

That’s more tax-free dollars than ever before<br />

to pay medical expenses that apply against<br />

your annual deductible before you have to start<br />

spending any money of your own. And even<br />

with higher annual deductibles in 2011 (see PPO/<br />

DRP annual deductibles for 2011), the amount<br />

you would actually pay out of your own pocket<br />

toward the annual deductible—the “deductible<br />

gap”—will be the same amount as in 2010:<br />

$400—if you have single coverage, or<br />

$800—if you have any other coverage level.<br />

HMO<br />

The HMO coverage option—administered by<br />

Humana—pays:<br />

90% of the cost (through coinsurance) for<br />

certain services—inpatient hospital, outpatient<br />

surgery and outpatient diagnostic imaging<br />

tests (such as MRIs, CAT scans and PET scans)<br />

and you pay 10% of the cost of these services<br />

100% of the cost of office visits after you pay a<br />

copayment, and<br />

100% of the cost of covered services once you<br />

reach the annual out-of-pocket expense limit.<br />

The annual out-of-pocket expense limit is:<br />

$2,000—if you have single coverage, or<br />

$4,000—if you have any other coverage level.<br />

Important! This plan will pay benefits only for<br />

services received from—or provided based<br />

on a referral from—a Primary <strong>Care</strong> Physician.<br />

Except in an emergency, no benefits will be<br />

paid for services received without your PCP’s<br />

authorization or from a provider who is not a<br />

participant in the HMO network.<br />

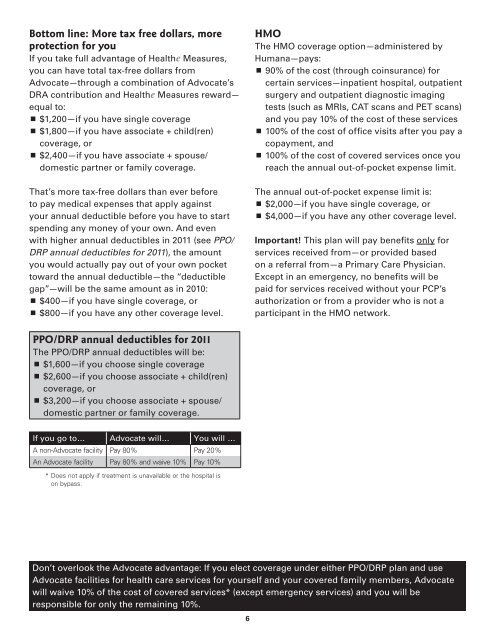

PPO/DRP annual deductibles for 2011<br />

The PPO/DRP annual deductibles will be:<br />

$1,600—if you choose single coverage<br />

$2,600—if you choose associate + child(ren)<br />

coverage, or<br />

$3,200—if you choose associate + spouse/<br />

domestic partner or family coverage.<br />

If you go to… <strong>Advocate</strong> will… You will …<br />

A non-<strong>Advocate</strong> facility Pay 80% Pay 20%<br />

An <strong>Advocate</strong> facility Pay 80% and waive 10% Pay 10%<br />

* Does not apply if treatment is unavailable or the hospital is<br />

on bypass.<br />

Don’t overlook the <strong>Advocate</strong> advantage: If you elect coverage under either PPO/DRP plan and use<br />

<strong>Advocate</strong> facilities for health care services for yourself and your covered family members, <strong>Advocate</strong><br />

will waive 10% of the cost of covered services* (except emergency services) and you will be<br />

responsible for only the remaining 10%.<br />

6