Question Booklet - Sunway College

Question Booklet - Sunway College

Question Booklet - Sunway College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

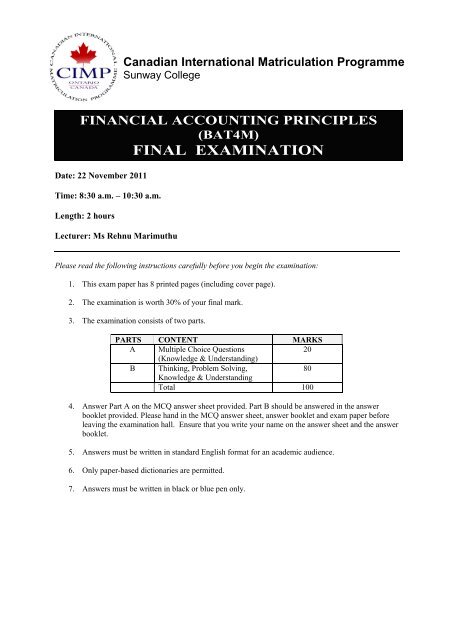

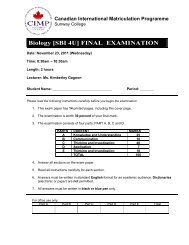

Canadian International Matriculation Programme<br />

<strong>Sunway</strong> <strong>College</strong><br />

FINANCIAL ACCOUNTING PRINCIPLES<br />

(BAT4M)<br />

FINAL EXAMINATION<br />

Date: 22 November 2011<br />

Time: 8:30 a.m. – 10:30 a.m.<br />

Length: 2 hours<br />

Lecturer: Ms Rehnu Marimuthu<br />

Please read the following instructions carefully before you begin the examination:<br />

1. This exam paper has 8 printed pages (including cover page).<br />

2. The examination is worth 30% of your final mark.<br />

3. The examination consists of two parts.<br />

PARTS CONTENT MARKS<br />

A Multiple Choice <strong>Question</strong>s<br />

20<br />

(Knowledge & Understanding)<br />

B Thinking, Problem Solving,<br />

80<br />

Knowledge & Understanding<br />

Total 100<br />

4. Answer Part A on the MCQ answer sheet provided. Part B should be answered in the answer<br />

booklet provided. Please hand in the MCQ answer sheet, answer booklet and exam paper before<br />

leaving the examination hall. Ensure that you write your name on the answer sheet and the answer<br />

booklet.<br />

5. Answers must be written in standard English format for an academic audience.<br />

6. Only paper-based dictionaries are permitted.<br />

7. Answers must be written in black or blue pen only.

PART A: MULTIPLE CHOICE QUESTIONS (K/U)<br />

-----------------------------------<br />

Please shade the correct answer on the answer sheet provided.<br />

(20 Marks)

-----Page 4<br />

PART B: THINKING, PROBLEM SOLVING, KNOWLEDGE & UNDERSTANDING<br />

-----------------------------------<br />

<strong>Question</strong> 1<br />

Basem operates Sweetie Boy Company. The trial balance of Sweetie Boy Company has the<br />

following accounts at its year-end, December 31, 2009:<br />

($)<br />

Accounts Payable 48,500<br />

Accounts Receivable 32,350<br />

Accumulated Depreciation – Building 23,600<br />

Accumulated Depreciation – Office Equipment 11,000<br />

Advertising Expense 15,930<br />

Allowance for Doubtful Accounts 350<br />

Bank 25,500<br />

Basem, Capital 113,000<br />

Basem, Drawings 9,000<br />

Building 102,640<br />

Interest Expense 5,880<br />

Interest Revenue 7,056<br />

Merchandise Inventory 17,100<br />

Office Equipment 71,640<br />

Prepaid Insurance 5,700<br />

Purchases 428,820<br />

Purchase Discounts 15,700<br />

Purchase Returns and Allowances 12,300<br />

Salaries Expense 43,200<br />

Sales 542,194<br />

Sales Discounts 2,500<br />

Sales Returns and Allowances 7,190<br />

Utilities Expense 6,250<br />

Adjusting data:<br />

1. The annual depreciation is $1,740 on the building and $4,400 on the office equipment.<br />

2. Insurance policy is for 1 year, dated October 1, 2009.<br />

3. Salaries of $1,840 are accrued at December 31, 2009.<br />

4. Sweetie Boy Company estimates its bad debts expense to be 4% of accounts<br />

receivable.

-----Page 5<br />

Other additional information:<br />

1. Merchandise inventory on December 31, 2009, is $22,220.<br />

2. Salaries expense is 50% selling and 50% administrative.<br />

3. Insurance expense is 60% selling and 40% administrative.<br />

4. Depreciation on building, depreciation on office equipment and utilities expense are<br />

administrative expenses.<br />

5. Advertising expense is a selling expense.<br />

6. Sweetie Boy Company uses a periodic inventory system.<br />

Instructions:<br />

a) Prepare the adjusting entries for the ended 31 December 2009. (Narration not<br />

required).<br />

(5 marks)<br />

b) Prepare the multiple-step income statement and owner equity’s statement for the year<br />

ended 31 December 2009 and a classified balance sheet as at 31 December 2009.<br />

(29 marks)<br />

<strong>Question</strong> 2<br />

On December 1, the accounts receivable control account balance in the general ledger of the<br />

Bernard Dental Store was $9,000. The accounts receivable subsidiary ledger contained the<br />

following detailed customer balances: Sakib $1,500, Ting $2,100, Hutomo $2,600, and Jeet<br />

$2,800. The following information is available from the company's special journals for the<br />

month of December:<br />

Cash Receipts Journal: Cash received from Hutomo $1,900, from Sakib $1,600, from Sung<br />

$1,700, and from Ting $1,800.<br />

Sales Journal: Sales to Sung $4,300, to Hutomo $1,700, to Sakib $2,300, and to Jeet $2,400.<br />

Additionally, Hutomo returned defective merchandise for credit for $900. Sakib returned<br />

defective merchandise for $600 which he had purchased for cash.<br />

Instructions:<br />

a) Post the above transactions to the appropriate control and subsidiary ledgers.<br />

(10 marks)<br />

b) Determine whether the subsidiary ledgers agree with the control account.<br />

c) List down two advantages of subsidiary ledgers.<br />

(4 marks)<br />

(1 marks)

-----Page 6<br />

<strong>Question</strong> 3<br />

Baby Yang Corporation’s fiscal year is on 31 August. In 2008, Baby Yang Corporation sold<br />

three of its assets and the information concerning the assets is summarized below:<br />

Asset Cost Purchase<br />

Date<br />

Useful<br />

Life<br />

Salvage<br />

Value<br />

Depreciation<br />

Method<br />

Disposal<br />

Date<br />

Disposal<br />

Amount<br />

Equipment $150,000 1/6/2005 5 $25,000 Straight line 31/5/2008 $55,000<br />

Delivery $120,000 1/5/2006 6 $6,500 Units-ofactivity<br />

31/5/2008 $38,000<br />

Truck<br />

Machinery $120,000 1/7/2006 8 $10,000 Declining<br />

balance<br />

30/11/2007 $100,000<br />

For the declining balance method, the company uses the double-declining rate. For the unitsof-activity<br />

method, total miles are expected to be 500,000. Actual miles of use in the first<br />

three years were: 2006: 25,000; 2007: 145,000; and 2008: 105,000.<br />

Instructions:<br />

a) Compute the amount of depreciation expense for the three assets above for each year<br />

to the date of disposal using the given method. (All answers rounded to nearest<br />

dollar).<br />

(8 marks)<br />

b) Prepare the adjusting entries for depreciation for 2008 and the journal entries for the<br />

sale of each asset.<br />

(9 marks)

-----Page 7<br />

<strong>Question</strong> 4<br />

The stockholders’ equity accounts of Cherris Corporation on January 1, 2008, were as<br />

follows:<br />

Common Stock, $5 par value, 500,000 shares<br />

authorized, 200,000 shares issued<br />

and outstanding $1,000,000<br />

Paid-in Capital in Excess of Par Value 200,000<br />

Retained Earnings 840,000<br />

During the year, the following transactions occurred:<br />

January 15 Issued 3,000 shares of common stock for $25,500.<br />

17 Declared a $1 cash dividend per share to stockholders of<br />

record on January 31, payable February 15.<br />

February 15 Paid the dividend declared in January.<br />

April 15 Declared a 10% stock dividend to stockholders of record on<br />

April 30, distributable May 15. On April 15, the market<br />

price of the stock was $15 per share.<br />

May 15 Issued the shares for the stock dividend.<br />

July 1 Announced a 2-for-1 stock split. The market price per share<br />

prior to the announcement was $17.<br />

20 Purchased 15,000 shares of common treasury stock at $8 per share.<br />

September 3 Sold 4,000 shares of treasury stock – common for $36,000.<br />

December 1 Declared a $0.50 per share cash dividend to stockholders of<br />

record on December 15, payable January 10, 2009.<br />

31 Determined the net income for the year was $350,000.<br />

Instructions:<br />

a) Journalize the above transactions.<br />

b) List down one advantage and one disadvantage of a corporation.<br />

(13 marks)<br />

(1 marks)