Request for Annuity Service - NestEgg Builders

Request for Annuity Service - NestEgg Builders

Request for Annuity Service - NestEgg Builders

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

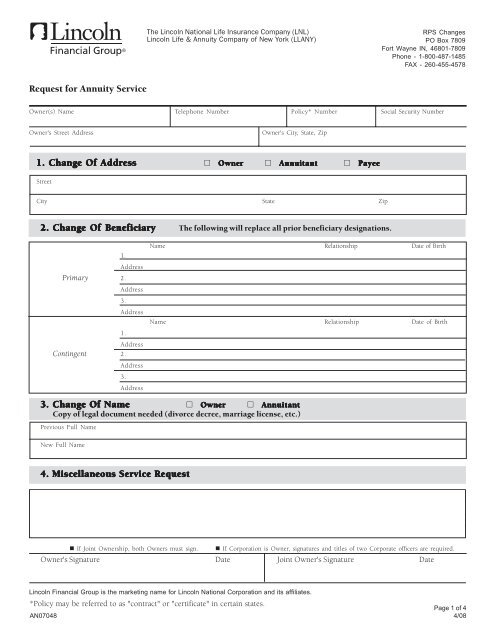

The Lincoln National Life Insurance Company (LNL)<br />

Lincoln Life & <strong>Annuity</strong> Company of New York (LLANY)<br />

RPS Changes<br />

PO Box 7809<br />

Fort Wayne IN, 46801-7809<br />

Phone - 1-800-487-1485<br />

FAX - 260-455-4578<br />

<strong>Request</strong> <strong>for</strong> <strong>Annuity</strong> <strong>Service</strong><br />

Owner(s) Name Telephone Number Policy* Number Social Security Number<br />

Owner's Street Address<br />

Owner's City, State, Zip<br />

1. Change Of Address<br />

Owner<br />

Annuitant<br />

Payee<br />

Street<br />

City State Zip<br />

2. Change Of Beneficiary<br />

The following will replace all prior beneficiary designations.<br />

Name Relationship Date of Birth<br />

1.<br />

Address<br />

Primary 2.<br />

Address<br />

3.<br />

Address<br />

Name Relationship Date of Birth<br />

1.<br />

Address<br />

Contingent 2.<br />

Address<br />

3.<br />

Address<br />

3. Change Of Name Owner<br />

Annuitant<br />

Copy of legal document needed (divorce decree, marriage license, etc.)<br />

Previous Full Name<br />

New Full Name<br />

4. Miscellaneous <strong>Service</strong> <strong>Request</strong><br />

• If Joint Ownership, both Owners must sign. • If Corporation is Owner, signatures and titles of two Corporate officers are required.<br />

Owner's Signature Date Joint Owner's Signature Date<br />

Lincoln Financial Group is the marketing name <strong>for</strong> Lincoln National Corporation and its affiliates.<br />

*Policy may be referred to as "contract" or "certificate" in certain states.<br />

Page 1 of 4<br />

AN07048 4/08

The Lincoln National Life Insurance Company (LNL)<br />

Lincoln Life & <strong>Annuity</strong> Company of New York (LLANY)<br />

RPS Changes<br />

PO Box 7809<br />

Fort Wayne IN, 46801-7809<br />

Phone - 1-800-487-1485<br />

FAX - 260-455-4578<br />

Owner(s) Name Telephone Number Policy* Number Social Security Number<br />

Owner's Street Address<br />

Owner's City, State, Zip<br />

5. Withdrawal or Surrender<br />

(also complete #7 below)<br />

Please withdraw the maximum free partial surrender available.<br />

Please withdraw the amount necessary to net _______________ after any applicable surrender charges and/or taxes.<br />

Please fully surrender my policy. As consideration <strong>for</strong> this payment:<br />

• I am attaching my policy and releasing the Company from any and all claims or demands which arise under the policy.<br />

• I state that my policy has been lost or destroyed and that I have no knowledge as to its whereabouts. No person or persons, corporation<br />

or association, has any claim or interest in said annuity, by virtue of any sales, assignment or pledge thereof; and no bankruptcy<br />

proceedings are pending or threatened against me; except as follows: (Give names and addresses. If no exceptions,<br />

insert, "No Exceptions.")<br />

‣ ____________________________________________________________________________________________<br />

6. Systematic Withdrawals<br />

(also complete #7 below)<br />

Please note this feature is not available on all annuity plans and may be<br />

subject to policy limitations.<br />

The minimum account value must be $20,000 to process on a monthly basis. The minimum account value must be $10,000 to<br />

process on a quarterly, semi-annual or annual basis.<br />

Payment Amount: Interest Only _________ % of accumulated value Other $ ______________<br />

Payment Frequency: Monthly Quarterly Semi-Annual Annual<br />

Begin Date:<br />

______________________ (cannot be 29th, 30th or 31st of the month)<br />

Payment Method: Check Direct Deposit: Checking (attach voided check) Savings (attach voided deposit slip)<br />

All interest rates are expressed as annual effective interest rates. Options other than annual will total less than annual withdrawals<br />

because of the interruption of interest compounding.<br />

7. Tax In<strong>for</strong>mation and Withholding Election<br />

Required be<strong>for</strong>e any distribution is made.<br />

The Federal Tax Law provides that any distribution to you from an annuity policy is subject to Federal income tax withholding. There will be<br />

no withholding on the portion of distribution that represents the return of your non-qualified premium payments. Please Note: If no election is<br />

indicated, we are required to withhold 10% of the taxable amount <strong>for</strong> Federal income taxes.<br />

You may elect to have no withholding apply to your distribution; however, you may be responsible <strong>for</strong> payment of any estimated tax due on<br />

the distribution. You may also incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient.<br />

Anyone under the age of 59 1/2 may be subject to a 10% Federal tax penalty on the taxable portion of the distribution.<br />

Instructions: Check Box A, B, C or D below to indicate whether you want Income Tax withheld from your withdrawal.<br />

A. I do not want to have any Income Tax withheld from my withdrawal.<br />

B. I want Federal Income Tax withheld from my withdrawal at the 10% rate.<br />

C. I want Federal Income Tax withheld from my withdrawal but not at the 10% rate. Withhold $ ______________ or _________ % <strong>for</strong><br />

Federal Income Tax from my withdrawal.<br />

Note: If you are a resident of any state requiring withholding, by checking B or C, you are electing to also withhold state income<br />

taxes, unless you specifically indicate otherwise below.<br />

D. Do NOT withhold STATE income tax.<br />

• If Joint Ownership, both Owners must sign. • If Corporation is Owner, signatures and titles of two Corporate officers are required.<br />

Owner's Signature Date Joint Owner's Signature Date<br />

Lincoln Financial Group is the marketing name <strong>for</strong> Lincoln National Corporation and its affiliates.<br />

*Policy may be referred to as "contract" or "certificate" in certain states.<br />

Page 2 of 4<br />

AN07048 4/08

The Lincoln National Life Insurance Company (LNL)<br />

Lincoln Life & <strong>Annuity</strong> Company of New York (LLANY)<br />

RPS Changes<br />

PO Box 7809<br />

Fort Wayne IN, 46801-7809<br />

Phone - 1-800-487-1485<br />

FAX - 260-455-4578<br />

Owner(s) Name Telephone Number Policy* Number Social Security Number<br />

Owner's Street Address<br />

Owner's City, State, Zip<br />

8. Annuitization<br />

Payment: Income <strong>for</strong> Fixed Period (5 to 15 years) Guaranteed <strong>for</strong> __________ Years<br />

Life Only Income<br />

Life Income with Guaranteed Period (5, 10, 15, 20 years) Guaranteed <strong>for</strong> __________ Years<br />

Other _______________________________________________________<br />

_______________________________________________________<br />

Begin Date:<br />

___________________________________________ (cannot be 29th, 30th or 31st of the month)<br />

Frequency: Monthly Quarterly Semi-Annual Annual<br />

Payment Method:<br />

Check<br />

Direct Deposit _______________________________________________________<br />

_______________________________________________________<br />

_______________________________________________________<br />

_______________________________________________________<br />

The Federal Tax Law provides that any distribution to you from an annuity policy is subject to Federal income tax withholding.<br />

There will be no withholding on the portion of distribution that represents the return of your non-qualified premium payments.<br />

You may elect to have no withholding apply to your distribution; however, you may be responsible <strong>for</strong> payment of any estimated<br />

tax due on the distribution. You may also incur penalties under the estimated tax rules if your withholding and estimated tax<br />

payments are not sufficient. Anyone under the age of 59 1/2 may be subject to a 10% Federal tax penalty on the taxable portion<br />

of the distribution.<br />

I elect not to have any income tax withheld from any distributions made from my annuity.<br />

I want my withholding from each periodic pension or annuity payment to be calculated using the number of allowances<br />

and marital status shown. Number of allowances: ___________<br />

Marital status: Single Married<br />

• If Joint Ownership, both Owners must sign. • If Corporation is Owner, signatures and titles of two Corporate officers are required.<br />

Owner's Signature Date Joint Owner's Signature Date<br />

Lincoln Financial Group is the marketing name <strong>for</strong> Lincoln National Corporation and its affiliates.<br />

*Policy may be referred to as "contract" or "certificate" in certain states.<br />

Page 3 of 4<br />

AN07048 4/08

The Lincoln National Life Insurance Company (LNL)<br />

Lincoln Life & <strong>Annuity</strong> Company of New York (LLANY)<br />

RPS Changes<br />

PO Box 7809<br />

Fort Wayne IN, 46801-7809<br />

Phone - 1-800-487-1485<br />

FAX - 260-455-4578<br />

Owner(s) Name Telephone Number Policy* Number Social Security Number<br />

Owner's Street Address<br />

Owner's City, State, Zip<br />

9. Change of Owner(s)<br />

Owner Full Name<br />

The following will replace all prior Owner and Joint Owner designations.<br />

Joint Owner Full Name<br />

Street<br />

Street<br />

City, State, Zip<br />

City, State, Zip<br />

Social Security Number Date of Birth Male Social Security Number Date of Birth Male<br />

Female<br />

Female<br />

Please note, a change of ownership may result in tax consequences.<br />

Certification:<br />

Under penalties of perjury, I certify that: (1) The number shown on this <strong>for</strong>m is my correct Social Security Number or Taxpayer<br />

Identification Number (or I am waiting <strong>for</strong> one to be issued to me) and (2) I am not subject to backup withholding either because I have not<br />

been notified by the Internal Revenue <strong>Service</strong> ("IRS") that I am subject to backup withholding as a result of failure to report all interest or<br />

dividends, or the IRS has notified me that I am no longer subject to backup withholding.<br />

Certification Instructions:<br />

You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup<br />

withholding because of under reporting interest or dividends on your tax return.<br />

Owner's Signature Date Joint Owner's Signature Date<br />

New Owner Signature<br />

Date<br />

10. Change of Annuitant(s) The following will replace all prior Annuitant and Joint Annuitant designations.<br />

Annuitant Full Name<br />

Joint Annuitant Full Name<br />

Street<br />

Street<br />

City, State, Zip<br />

City, State, Zip<br />

Social Security Number Date of Birth Male Social Security Number Date of Birth Male<br />

Female<br />

Female<br />

Annuitant's Signature Date Joint Annuitant's Signature Date<br />

• If Joint Ownership, both Owners must sign.<br />

• If Corporation is Owner, signatures and titles of two Corporate officers are required.<br />

Owner's Signature Date Joint Owner's Signature Date<br />

Lincoln Financial Group is the marketing name <strong>for</strong> Lincoln National Corporation and its affiliates.<br />

*Policy may be referred to as "contract" or "certificate" in certain states.<br />

Page 4 of 4<br />

AN07048 4/08