FNMA/FHLMC Condo & PUD Definitions - Wintrustmortgage.net

FNMA/FHLMC Condo & PUD Definitions - Wintrustmortgage.net

FNMA/FHLMC Condo & PUD Definitions - Wintrustmortgage.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

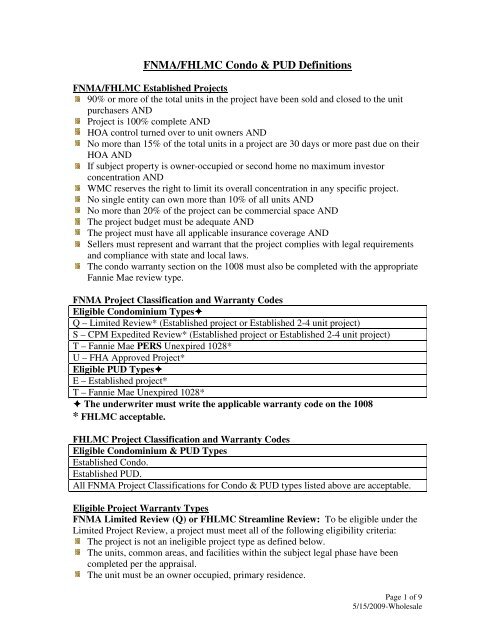

<strong>FNMA</strong>/<strong>FHLMC</strong> <strong>Condo</strong> & <strong>PUD</strong> <strong>Definitions</strong><br />

<strong>FNMA</strong>/<strong>FHLMC</strong> Established Projects<br />

90% or more of the total units in the project have been sold and closed to the unit<br />

purchasers AND<br />

Project is 100% complete AND<br />

HOA control turned over to unit owners AND<br />

No more than 15% of the total units in a project are 30 days or more past due on their<br />

HOA AND<br />

If subject property is owner-occupied or second home no maximum investor<br />

concentration AND<br />

WMC reserves the right to limit its overall concentration in any specific project.<br />

No single entity can own more than 10% of all units AND<br />

No more than 20% of the project can be commercial space AND<br />

The project budget must be adequate AND<br />

The project must have all applicable insurance coverage AND<br />

Sellers must represent and warrant that the project complies with legal requirements<br />

and compliance with state and local laws.<br />

The condo warranty section on the 1008 must also be completed with the appropriate<br />

Fannie Mae review type.<br />

<strong>FNMA</strong> Project Classification and Warranty Codes<br />

Eligible <strong>Condo</strong>minium Types<br />

Q – Limited Review* (Established project or Established 2-4 unit project)<br />

S – CPM Expedited Review* (Established project or Established 2-4 unit project)<br />

T – Fannie Mae PERS Unexpired 1028*<br />

U – FHA Approved Project*<br />

Eligible <strong>PUD</strong> Types<br />

E – Established project*<br />

T – Fannie Mae Unexpired 1028*<br />

The underwriter must write the applicable warranty code on the 1008<br />

* <strong>FHLMC</strong> acceptable.<br />

<strong>FHLMC</strong> Project Classification and Warranty Codes<br />

Eligible <strong>Condo</strong>minium & <strong>PUD</strong> Types<br />

Established <strong>Condo</strong>.<br />

Established <strong>PUD</strong>.<br />

All <strong>FNMA</strong> Project Classifications for <strong>Condo</strong> & <strong>PUD</strong> types listed above are acceptable.<br />

Eligible Project Warranty Types<br />

<strong>FNMA</strong> Limited Review (Q) or <strong>FHLMC</strong> Streamline Review: To be eligible under the<br />

Limited Project Review, a project must meet all of the following eligibility criteria:<br />

The project is not an ineligible project type as defined below.<br />

The units, common areas, and facilities within the subject legal phase have been<br />

completed per the appraisal.<br />

The unit must be an owner occupied, primary residence.<br />

Page 1 of 9<br />

5/15/2009-Wholesale

The maximum LTV/CLTV is dependent upon DU findings.<br />

The unit may not be secured by a manufactured home.<br />

Project is covered by required insurance.<br />

Must be established project.<br />

Attached <strong>Condo</strong> Unit – Established Projects<br />

DU Approve Recommendations:<br />

Occupancy:<br />

LTV/CLTV:<br />

Primary Residence 90%/90%<br />

Second Home 75%/75%<br />

Investment<br />

Not Allowed<br />

All other DU Recommendations including Expanded Approval Recommendations:<br />

Occupancy:<br />

LTV/CLTV:<br />

Primary Residence 80%/80%<br />

Second Home 75%/75%<br />

Investment<br />

Not Allowed<br />

Documentation needed:<br />

Completed HOA certification**<br />

Appraisal<br />

Master Certificate of Insurance*<br />

Fannie Mae’s General Warranty of Project Eligibility***<br />

Unexpired 1028 (T) (Fannie Mae Review) (see PERS section): Project acceptance<br />

relates to any condo project that Fannie Mae reviewed and issued a project approval for<br />

(form 1028). This list (Accepted <strong>Condo</strong>minium Development List) is found on Fannie<br />

Mae’s website (www.efanniemae.com). Proposed/New Construction Projects must be<br />

approved by Fannie Mae as documented by an Unexpired Fannie Mae Form 1028. This<br />

classification primarily applies to proposed or new projects that are still under<br />

construction. It also applies to projects that do not meet the presale requirements for<br />

Limited or Expedited Review.<br />

Documentation needed:<br />

Completed HOA certification**<br />

Appraisal<br />

Master Certificate of Insurance*<br />

A copy of the Unexpired Fannie Mae 1028 & printout from<br />

www.efanniemae.com – List of Accepted Projects showing the project acceptance<br />

has not expired and must be provided in the file at the time of submission.<br />

Fannie Mae’s General Warranty of Project Eligibility***<br />

How to check the List of Accepted Projects:<br />

Go to https://www.efanniemae.com/sf/refmaterials/approvedprojects/<br />

Click on state<br />

Page 2 of 9<br />

5/15/2009-Wholesale

Check state list for condo project<br />

Print out List of Accepted Projects and add to loan file<br />

FHA Approved <strong>Condo</strong> (U): A condo appearing on FHA’s approved condo list found on<br />

HUD’s website (www.hud.gov) is permitted.<br />

Documentation needed:<br />

Completed HOA certification**<br />

Appraisal<br />

Master Certificate of Insurance*<br />

Evidence of FHA approval (see blow)<br />

Processor certification<br />

Fannie Mae’s General Warranty of Project Eligibility***<br />

A copy of the <strong>Condo</strong>minium Detail screen showing FHA approval is required in the<br />

file at time of approval.<br />

Any Special Conditions or requirements in the Remarks must be met.<br />

In addition to the approval, the file must also contain a certification from the<br />

processor that the project is at least 70% owner occupied.<br />

Lastly, the project must meet Fannie Mae’s insurance requirements* as well as<br />

contain all required reps and warrants that the project meets Fannie Mae’s General<br />

Warranty of Project Eligibility***.<br />

How to check the List of Accepted Projects:<br />

Go to https://entp.hud.gov/idapp/html/condlook.cfm or access through CPM.<br />

Choose state from drop down.<br />

Can filter by condo name, city or state.<br />

Check list for condo project.<br />

Print out Approved <strong>Condo</strong> List and add to loan file.<br />

Page 3 of 9<br />

5/15/2009-Wholesale

Search for condo<br />

project<br />

Click on<br />

underlined link to<br />

display project<br />

.<br />

details<br />

Status must show<br />

approved<br />

Any approval conditions<br />

listed must be met.<br />

Note: FHA has standard<br />

condo conditions that<br />

must be met that Fannie<br />

Me requires for these<br />

approvals as well (e.g.<br />

70% owner-occupancy<br />

requirement)<br />

Page 4 of 9<br />

5/15/2009-Wholesale

CPM Expedited Review (S) (Established and all 2-4 unit projects): The Expedited<br />

Review process (for <strong>Condo</strong>s only) is followed when the transaction does not meet the<br />

Limited Review, the project is not on the FHA Approved Project List or the Fannie Mae<br />

Accepted <strong>Condo</strong>minium Development List. Fannie Mae’s CPM (<strong>Condo</strong> Project<br />

Manager) will be utilized by the underwriter to provide specific project acceptance for<br />

attached and detached, established, and 2-4 unit condominium projects. Underwriters<br />

will perform this function by searching for CPM for projects already entered and<br />

accepted by CPM or by adding a project to determine acceptance,<br />

Documentation needed:<br />

Completed HOA certification**<br />

Appraisal<br />

Master Certificate of Insurance*<br />

Current budget and legal documents<br />

Fannie Mae’s General Warranty of Project Eligibility***<br />

The following additional criteria will apply:<br />

For established projects, no more than 15% of condo/association fee payments<br />

can be more than one month delinquent.<br />

The homeowners’ association (HOA) budget (actual for established) must be<br />

reviewed for all projects (except 2-4 unit projects) to determine adequate funding<br />

of replacement reserves for capital expenditures and deferred maintenance (at<br />

least 10% of the budget) and provides adequate funding for insurance deductible<br />

amounts.<br />

Legal Documents meet Fannie Mae requirements as noted in section marked<br />

Legal Requirements.<br />

The project may not be comprised of manufactured homes.<br />

*Insurance Requirements:<br />

Liability Insurance<br />

General liability of $1,000,000 per occurrence is required for all condos.<br />

Borrowers are required to obtain a ‘walls-in’ Hazard Insurance coverage policy<br />

(commonly know as HO-6) unless the lender can document the master insurance<br />

policy of HOA covers the interior of the unit. The HO-6 policy must provide<br />

coverage in the amount of at least 20% of the appraised value. The standard<br />

requirement for a maximum 5% deductible also applies<br />

o HO-6 “Walls In Insurance” must be escrowed.<br />

Liability insurance is not required for properties located in a <strong>PUD</strong>.<br />

The following are not permitted with respect to master or blanket project<br />

insurance:<br />

A blanket policy that covers multiple unaffiliated condominium associations or<br />

projects, or;<br />

A self-insurance arrangement whereby the owners’ association is self-insured or<br />

has banded together with other unaffiliated associations to self insure all of the<br />

general and limited common elements of the various associations.<br />

Page 5 of 9<br />

5/15/2009-Wholesale

Fidelity Insurance<br />

Evidence of fidelity insurance coverage is required for Type R condos that have 21 or<br />

more units. Includes PERS, CPM expedited, Lender Full Review, FHA Approved and<br />

Limited Review. There is no requirement for <strong>PUD</strong> projects or condominiums approved<br />

under Type S and Limited Review project approval.<br />

The fidelity insurance policy should cover the maximum funds that will be in custody of<br />

the owners’ association or its management agent at any time, but no less than the sum of<br />

three months of assessments on all units in the project.<br />

Fidelity insurance is a type of insurance that a condominium obtains to protect itself<br />

against economic loss from dishonest acts (claims that allege employee dishonesty,<br />

embezzlement, forgery, robbery, computer fraud, wire transfer fraud, counterfeiting, and<br />

other criminal acts) of anyone who either handles (or is responsible for) funds that the<br />

association or corporation holds or administers, whether or not that individual receives<br />

compensation for services.<br />

**Legal Requirements:<br />

Compliance with laws: project has been created and exists in full compliance with all<br />

state law requirements where the project is located.<br />

Limitations on ability to sell or Right of First Refusal: Any right of first refusal in the<br />

condominium documents will not adversely impact the rights of a mortgagee or its<br />

assignee to:<br />

1. foreclose or take title to a unit pursuant to the remedies of the mortgage<br />

2. accept a deed or assignment in lieu of foreclosure in the event of default by the<br />

mortgagor<br />

3. sell or lease a unit acquired by the mortgagee or its assignee<br />

First mortgagee’s rights confirmed: No provision of the project documents gives unit<br />

owners or any other party priority rights over the first mortgagee.<br />

Unpaid dues: Any first mortgagee acquiring title to a unit through foreclosure will not<br />

be liable for more than 6 months of the unit’s unpaid regularly budgeted dues accrued<br />

before acquisition of title to the unit.<br />

Attorney’s Opinion Letter: A qualified attorney engaged by the lender must issue a<br />

written legal opinion based upon review of the project’s legal documents which states<br />

they are in compliance with all legal requirements as required per Fannie Mae. The<br />

attorney may be the same person who prepared the legal documents but he/she cannot be<br />

an employee, principal or officer of the developer or sponsor of the project.<br />

Page 6 of 9<br />

5/15/2009-Wholesale

***General Warranty<br />

The lender represents and warrants that it reviewed the project to determine that it met<br />

the required eligibility criteria within the three months that preceded the date of the note<br />

and mortgage for that unit. The lender also warrants that it is not aware of any change in<br />

circumstances since its review of the project that would result in the project not satisfying<br />

out eligibility criteria.<br />

Ineligible Project Types<br />

<strong>Condo</strong>minium hotels – any project that is managed and operated as a hotel or motel,<br />

even though the units are owned individually. Projects with any of the following<br />

characteristics to be hotel-type projects are ineligible:<br />

Projects that include registration services and offer rentals of units on a<br />

daily basis;<br />

Projects with names that include the words “hotel” or “motel”;<br />

Projects that restrict the owner’s ability to occupy the unit; and<br />

Projects with mandatory rental pooling agreements that require the unit<br />

owners to either rent their units or to give a management firm control over<br />

the occupancy of the units. These formal agreements between the<br />

developer, HOA, and/or the individual unit owners, obligate the unit<br />

owner to rent the property on a seasonal, monthly, weekly, or daily basis.<br />

In man cases, the agreements include blackout dates, continuous<br />

occupancy limitations, and other such use restrictions; In return, the unit<br />

owner receives a share of the revenue generated from the rental of the unit.<br />

Projects with non-incidental business operations owned or operated by the owners’<br />

association such as, but not limited to, a restaurant, spa, health club, etc.<br />

Investment securities – projects that have documents on file with Securities and<br />

Exchange Commission, or projects where unit ownership is characterized or<br />

promoted as an opportunity.<br />

Common interest apartments or community apartment projects - any project or<br />

building that is owned by several owners as tenants-in-common or by a HOA in<br />

which individuals have an undivided interest in a residential apartment building and<br />

land, and have the right of exclusive occupancy of a specific apartment in the<br />

building.<br />

Timeshare or segmented ownership projects.<br />

Houseboat projects.<br />

Multi-dwellings unit condominiums – projects that permit an owner to hold title (or<br />

stock ownership and the accompanying occupancy rights)to more than one dwelling<br />

unit, with ownership of all of his or her owned units (or shares) evidenced by a single<br />

deed and financed by a single mortgage (or share loan).<br />

<strong>Condo</strong>minium projects that represent a legal, but non-conforming, use of the land, if<br />

zoning regulations prohibit rebuilding the improvements to current density in the<br />

event of their partial or full destruction.<br />

Any project for which the owner’s association is named as a party to current<br />

litigations or, for any project that has not been turned over to association, for which<br />

Page 7 of 9<br />

5/15/2009-Wholesale

the project sponsor or developer is named as a party to current litigation that relates to<br />

the project.<br />

Project consisting of more than 20% commercial space.<br />

Cannot close or deliver for purchase more than 30% of the units in project.<br />

New construction where HOA is not in control.<br />

Owner-occupancy ratio calculation is updated to clarify that Real Estate Owned<br />

(REO) units for sale are treated as owner-occupied units.<br />

New condominium projects in which the property seller offers sales/financing<br />

structures in excess of the maximum allowable contributions for individual loans.<br />

<strong>FNMA</strong> PERS<br />

<strong>FNMA</strong> Project Eligibility Review Services<br />

Fannie Mae is reintroducing its condominium project review function under the name of<br />

Project Eligibility Review Service (PERS). Must be classified as Type (T) - Fannie Mae<br />

Review. Effective 01/15/09, all Florida condo projects that do not meet the "Established<br />

Project" guidelines must be submitted to PERS for approval; PERS is an optional service<br />

for other states and projects. There is a fee charged in connection with this review. The<br />

project must be on Fannie Mae's PERS approved list located on www.eFannieMae.com<br />

and the approval type must be indicated as "Final Project Approval", prior to loan<br />

closing. If the project was not approved prior to 1/15/09, Fannie Mae PERS approval is<br />

required.<br />

Evidence of project approval must be provided for all new or newly-converted projects in<br />

Florida. For any loan where the project was approved via Lender Full Review to be<br />

eligible for agency delivery, the originator must provide Wintrust with pipeline coverage<br />

as of 1/15/09; if the project was approved via CPM prior to 1/15/09, the project approval<br />

may be honored until the expiration date. Otherwise, Fannie Mae PERS approval is<br />

required<br />

Limited Reviews are not available if Wintrust Mortgage or the<br />

Invest/Correspondent is named as a preferred lender by either the developer or the<br />

HOA.<br />

For established attached projects where the subject is an investment property,<br />

financial institution-owned REO units that are for sale (not rented) may be<br />

counted as owner-occupied units to meet the 51% presale requirements.<br />

The following are not permitted with respect to master or blanket project<br />

insurance:<br />

A blanket policy that covers multiple unaffiliated condominium associations or<br />

projects, or;<br />

A self-insurance arrangement whereby the owners’ association is self-insured or<br />

has banded together with other unaffiliated associations to self insure all of the<br />

general and limited common elements of the various associations.<br />

Page 8 of 9<br />

5/15/2009-Wholesale

PERS Submission Process<br />

Review Request Preparation<br />

A basic review of to determine if the project satisfied eligibility requirements prior to<br />

PERS submission. Then a complete project submission package using the forms listed<br />

below.<br />

PERS Forms (Note: Interactive PDF versions of the forms that can be completed and saved<br />

electronically can be downloaded from the Forms page on www.efanniemae.com )<br />

1. Form 1026, Application for Project Approval<br />

2. Form 1029, Warranty of Project Presales<br />

3. Form 1054, Warranty of <strong>Condo</strong>minium Project Legal Documents<br />

4. Form 1051, Project Development / Master Association Plan<br />

5. Form 1081, Final Certification of Substantial Project Completion<br />

6. Form 1071, Statement of Insurance and Fidelity Coverage<br />

7. Form 1073A, Analysis of Annual Income and Expenses–Operating Budget<br />

(or complete copy of actual budget)<br />

8. Form 1030, PERS Document Checklist<br />

How to Submit<br />

Submit complete package via e-mail, including all relevant supporting<br />

documentation, to pers_project@fanniemae.com .<br />

PERS Fees<br />

Fee’s for any project submitted to Fannie Mae under PERS can be founded at<br />

www.efanniemae.com.<br />

Page 9 of 9<br />

5/15/2009-Wholesale