credit cards - SchoolsFirst Federal Credit Union

credit cards - SchoolsFirst Federal Credit Union

credit cards - SchoolsFirst Federal Credit Union

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

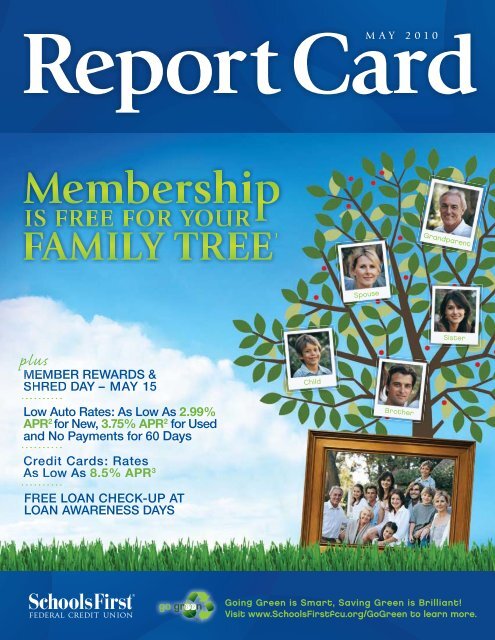

MAY 2010<br />

0<br />

<br />

<br />

plus<br />

MEMBER REWARDS &<br />

SHRED DAY – MAY 15<br />

Low Auto Rates: As Low As 2.99%<br />

APR 2 for New, 3.75% APR 2 for Used<br />

and No Payments for 60 Days<br />

<strong>Credit</strong> Cards: Rates<br />

As Low As 8.5% APR<br />

3<br />

FREE LOAN CHECK-UP AT<br />

LOAN AWARENESS DAYS<br />

<br />

<br />

<br />

go green

Membership Is FREE<br />

For Your Family Tree 1<br />

<br />

<br />

This month, all your eligible family members can join<br />

<strong>SchoolsFirst</strong> FCU for FREE 1 . That’s a $15 savings! Plus,<br />

they’ll receive a complimentary eco-friendly grocery bag<br />

as our special thank you. Visit www.<strong>SchoolsFirst</strong>fcu.org/<br />

GoGreen to learn more.<br />

DRIVE PAYMENT-FREE<br />

FOR 60 DAYS!<br />

Save green when you go green with a lower-emission vehicle<br />

and a great rate from <strong>SchoolsFirst</strong> FCU. If you finance a<br />

new or used vehicle, model year 2007 or newer, you’ll get:<br />

60 Days No Payments<br />

New Cars: Rates as low as 2.99% APR 2<br />

Used Cars: Rates as low as 3.75% APR 2<br />

FREE GIFT FOR<br />

NEW MEMBERS<br />

WHO CAN JOIN?<br />

0 Spouse<br />

0 Child<br />

0 Parent<br />

0 Grand parent<br />

0 Grand child 1<br />

0 Brother<br />

0 Sister<br />

<br />

<br />

<br />

<br />

<strong>SchoolsFirst</strong> FCU<br />

Bank Average<br />

Bank Of America<br />

Chase<br />

Wells Fargo<br />

36 Mo. New Auto (APR)<br />

2.99% 2<br />

6.51%<br />

3.20%<br />

4.21%<br />

6.34%<br />

36 Mo. Used Auto (APR)<br />

3.75% 2<br />

6.91%<br />

3.70%<br />

4.26%<br />

6.59%<br />

Rates as of 04/08/2010<br />

CREDIT CARDS: GREAT RATES, GREAT VALUE<br />

Reduce your rate and the fees you pay when you transfer your balance to a <strong>SchoolsFirst</strong> FCU Visa <strong>credit</strong> card. We offer rates as<br />

low as 8.5% APR 3 , and we won’t nickel and dime you with burdensome fees. But best of all, when you have our <strong>credit</strong> card, you<br />

can rest assured we will NEVER treat you like just another customer. We can work with you in times of need and find a solution<br />

that’s right for you—that’s the value of Membership at <strong>SchoolsFirst</strong> FCU. Why settle for anything less?<br />

COMPARE AND SAVE WITH OUR LOW TO NO FEE CREDIT CARD<br />

<strong>SchoolsFirst</strong> FCU<br />

Platinum Visa<br />

Wells Fargo<br />

Platinum Visa<br />

Bank of America<br />

BankAmericard Visa<br />

Citibank Platinum<br />

Select MasterCard<br />

Capital One<br />

Platinum Prestige<br />

Chase<br />

Freedom<br />

Purchase APR<br />

8.50% 3<br />

9.15%<br />

10.99%<br />

9.15%<br />

11.90%<br />

12.99%<br />

Balance Transfer Fee<br />

0%<br />

3%<br />

4%<br />

3%<br />

3%<br />

5%<br />

Cash Advance Fee<br />

0%<br />

4%<br />

4%<br />

4%<br />

3%<br />

5%<br />

Over the Limit Fee<br />

$0<br />

$35<br />

$39<br />

$39<br />

$29*<br />

$39<br />

Late Fee<br />

$25<br />

$15-$39**<br />

$15-$39**<br />

$15-$39**<br />

$15-$39**<br />

$15-$39**<br />

*<br />

If <strong>credit</strong> limit is $500 or more.<br />

**<br />

Based on the amount of your account balance at the time the fee is applied. $15 for $0-100, $29 for $100-250, $39 for >$250<br />

The value is undeniable. Apply today at www.<strong>SchoolsFirst</strong>fcu.org >> Loans & <strong>Credit</strong> Cards.

Member rewards & shred day<br />

Saturday, May 15<br />

10 a.m. to 1 p.m.<br />

4204 Riverwalk Parkway,<br />

Riverside *<br />

*<br />

Mapquest and most GPS systems direct Members to an incorrect location.<br />

Please visit www.<strong>SchoolsFirst</strong>fcu.org/GoGreen for a map and directions.<br />

SHRED DAY AND E-WASTE RECYCLING<br />

<br />

<br />

<br />

<br />

<br />

MEMBER REWARDS DAY<br />

Come for the shred, stay for the rewards! Discover the<br />

truly rewarding value of Membership at <strong>SchoolsFirst</strong> FCU<br />

and get the chance to win an Apple iPad 4 ! Representatives<br />

will be on-hand to discuss:<br />

Low to No Fee <strong>Credit</strong> Cards<br />

Free Memberships for Eligible Family Members 1<br />

Loan Check-ups<br />

Free Insurance Quotes 5<br />

Investment and Retirement Services 6<br />

BALANCE Financial Fitness Program 7<br />

Real Estate Agent Rebate Program 8<br />

go green<br />

BRING THE WHOLE FAMILY!<br />

¸ <br />

¸ <br />

¸ <br />

¸ <br />

¸ <br />

¸ <br />

FREE GIFT!<br />

Visit www.<strong>SchoolsFirst</strong>fcu.org/GoGreen for details.<br />

NEXT MONTH: GET READY TO GET AWAY!<br />

Need an escape from daily life? Let us whisk you away to Paradise! This<br />

summer, three lucky winners will receive a dream vacation for two to the<br />

beautiful Hawaiian Islands. Plus: we’ll be giving away other escapes<br />

all summer long. Look for details in the June issue of Report Card.

FREE LOAN CHECK–UPs<br />

DURING LOAN AWARENESS DAYS<br />

Are you certain you have the best rates on your mortgage and consumer<br />

loans with other lenders? Not knowing could cost you hundreds and even<br />

thousands of dollars in unnecessary interest over the life of your loans.<br />

We invite you to visit us at select branches during our Loan Awareness Days<br />

to speak with specialists from our real estate and consumer loan departments.<br />

Let us conduct a complimentary loan “check-up” to quickly see if you can save<br />

money by refinancing your non-<strong>SchoolsFirst</strong> FCU loans with us. Just bring<br />

along information about your current mortgage, vehicle, or other personal loan<br />

and we’ll do the rest.<br />

Web Site<br />

www.<strong>SchoolsFirst</strong>fcu.org<br />

Telephone Service Center<br />

800.462.8328<br />

Monday – Friday 7 a.m. to 7 p.m.<br />

Saturday 9 a.m. to 3 p.m.<br />

Teller Phone<br />

800.540.4546<br />

Emergency Card Support<br />

Available 365 days a year from<br />

5 a.m. to 12 a.m.<br />

LOAN AWARENESS DAYS<br />

Date<br />

Branches<br />

Mailing Address<br />

P.O. Box 11547<br />

Santa Ana, CA, 92711-1547<br />

Friday, May 7<br />

Friday, May 14<br />

Friday, May 21<br />

Friday, May 28<br />

Garden Grove; La Habra<br />

Riverside-University; Santa Ana<br />

Murrieta; Newport Mesa; West Covina<br />

Anaheim<br />

No appointment necessary. To learn more, visit www.<strong>SchoolsFirst</strong>fcu.org.<br />

NEW SUPER SATURDAYS! AYS!<br />

Beginning June 5, our Placentia and Mission Viejo<br />

branches will be open Saturdays from 9 a.m. - 2 p.m.<br />

to better serve you. We also offer Saturday hours at<br />

our Fountain Valley, Rancho Cucamonga, Riverside-University,<br />

and Santa Ana full-service branches, as well as at all of our Express Centers.<br />

Visit www.<strong>SchoolsFirst</strong>fcu.org >> ATM/Branch Finder to find the branch<br />

or Express Center nearest you.<br />

GET IN THE GAME<br />

LAKERS SUITE WINNER!<br />

Congratulations to Shirley Pigman! She won<br />

accommodations in a luxury suite at a Los Angeles<br />

Lakers game in the <strong>SchoolsFirst</strong> FCU Get in the<br />

Game Sweepstakes.<br />

Branch Hours<br />

Monday – Thursday 9 a.m. to 5 p.m.<br />

Friday 9 a.m. to 6 p.m.<br />

Saturday* 9 a.m. to 2 p.m.<br />

*<br />

See our Web site for select locations<br />

New Saturday Hours<br />

Begining June 5, 2010<br />

Mission Viejo and Placentia branches<br />

Open 9 a.m. to 2 p.m.<br />

Express Center Hours<br />

Monday – Friday 10 a.m. to 6 p.m.<br />

Saturday 10 a.m. to 3 p.m.<br />

Campus Branches<br />

Call for hours<br />

ATM Locations<br />

Visit our Web site for a complete listing<br />

of <strong>SchoolsFirst</strong> FCU and<br />

CO-OP Network ATMs.<br />

HOLIDAY HOURS<br />

Memorial Day<br />

Monday, May 31, 2010<br />

All <strong>SchoolsFirst</strong> FCU locations will be closed.<br />

Please recycle.<br />

<strong>Federal</strong>ly insured by NCUA. Share insurance coverage<br />

increased from $100,000 to $250,000 through 12/31/13.<br />

Disclosures<br />

1. Family Membership fee of $15 is waived 4/1/2010 – 5/31/2010. $5 minimum deposit required to establish and maintain Membership. Grandchildren of Members are eligible; however, the<br />

child's Membership must be opened by the child's parent or legal guardian. Eligibility subject to verification. 2. Rates range from 2.99% APR to 18% APR on new autos and 3.75% to 18% APR<br />

on used autos, and are based on various factors, including the applicant’s <strong>credit</strong> rating. Lowest rate quoted includes a 0.75% automatic payment transfer discount. 3. Cash advance rate is<br />

13.5% APR. <strong>SchoolsFirst</strong> FCU has a loan program which features a range of interest rates for some consumer loans. A rate is based on a variety of factors, including the applicant's <strong>credit</strong> rating.<br />

<strong>Credit</strong> card rates as of 05/01/10 range from 8.5% to 17.9% APR for purchases and balance transfers and 13.5% to 17.9% APR for cash advances. Foreign transaction fee 2% of the transaction<br />

amount in U.S. Dollars. Variable rate, subject to change after account opening. Rewards card program available, ask for details. 4. NO PURCHASE NECESSARY. Enter during the event (10:00<br />

a.m.-1:00 p.m. on May 15, 2010). Entry forms and official rules available at the event. Apple is not a participant in or sponsor of this promotion. 5. Offered through Member Insurance Services.<br />

CA Insurance License 0581192. 6. Representatives are registered, securities are sold, and investment advisory services are offered through CUNA Brokerage Services, Inc. (CBSI), member<br />

FINRA/SIPC, a registered broker/dealer and investment advisor, 2000 Heritage Way, Waverly, Iowa 50677, toll-free (866) 512-6109. Nondeposit investment and insurance products are not<br />

federally insured, involve investment risk, may lose value, and are not obligations of or guaranteed by <strong>SchoolsFirst</strong> FCU. CBSI is under contract with <strong>SchoolsFirst</strong> FCU, through the financial<br />

services program, to make securities available to Members. CUNA Brokerage Services, Inc. is a registered broker/dealer in all fifty states of the United States of America. 7. BALANCE is not<br />

affiliated with <strong>SchoolsFirst</strong> FCU. 8. Rebates are paid by the program administrator (1-2-3 HomeKeys) after the close of transaction. Rebate offer is not available in states where prohibited by<br />

law. 1-2-3 HomeKeys is not affiliated with <strong>SchoolsFirst</strong> <strong>Federal</strong> <strong>Credit</strong> <strong>Union</strong>.