www.citysquare.ie Section 23 Type Tax Incentives

www.citysquare.ie Section 23 Type Tax Incentives

www.citysquare.ie Section 23 Type Tax Incentives

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

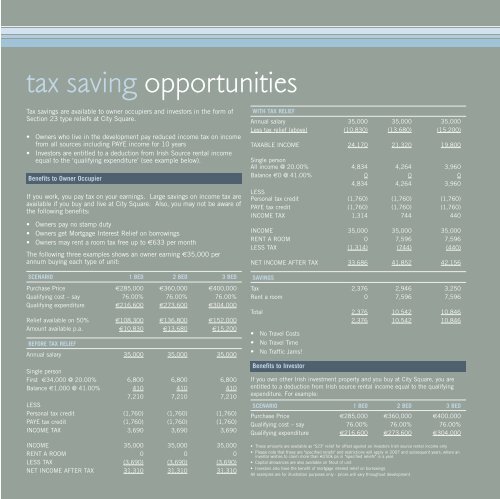

tax saving opportunit<strong>ie</strong>s<br />

<strong>Tax</strong> savings are available to owner occup<strong>ie</strong>rs and investors in the form of<br />

<strong>Section</strong> <strong>23</strong> type rel<strong>ie</strong>fs at City Square.<br />

• Owners who live in the development pay reduced income tax on income<br />

from all sources including PAYE income for 10 years<br />

• Investors are entitled to a deduction from Irish Source rental income<br />

equal to the ‘qualifying expenditure’ (see example below).<br />

Benefits to Owner Occup<strong>ie</strong>r<br />

If you work, you pay tax on your earnings. Large savings on income tax are<br />

available if you buy and live at City Square. Also, you may not be aware of<br />

the following benefits:<br />

• Owners pay no stamp duty<br />

• Owners get Mortgage Interest Rel<strong>ie</strong>f on borrowings<br />

• Owners may rent a room tax free up to €633 per month<br />

The following three examples shows an owner earning €35,000 per<br />

annum buying each type of unit:<br />

SCENARIO 1 BED 2 BED 3 BED<br />

Purchase Price €285,000 €360,000 €400,000<br />

Qualifying cost – say 76.00% 76.00% 76.00%<br />

Qualifying expenditure €216,600 €273,600 €304,000<br />

Rel<strong>ie</strong>f available on 50% €108,300 €136,800 €152,000<br />

Amount available p.a. €10,830 €13,680 €15,200<br />

BEFORE TAX RELIEF<br />

Annual salary 35,000 35,000 35,000<br />

Single person<br />

First €34,000 @ 20.00% 6,800 6,800 6,800<br />

Balance €1,000 @ 41.00% 410 410 410<br />

7,210 7,210 7,210<br />

LESS<br />

Personal tax credit (1,760) (1,760) (1,760)<br />

PAYE tax credit (1,760) (1,760) (1,760)<br />

INCOME TAX 3,690 3,690 3,690<br />

INCOME 35,000 35,000 35,000<br />

RENT A ROOM 0 0 0<br />

LESS TAX (3,690) (3,690) (3,690)<br />

NET INCOME AFTER TAX 31,310 31,310 31,310<br />

WITH TAX RELIEF<br />

Annual salary 35,000 35,000 35,000<br />

Less tax rel<strong>ie</strong>f (above) (10,830) (13,680) (15,200)<br />

TAXABLE INCOME 24,170 21,320 19,800<br />

Single person<br />

All income @ 20.00% 4,834 4,264 3,960<br />

Balance €0 @ 41.00% 0 0 0<br />

4,834 4,264 3,960<br />

LESS<br />

Personal tax credit (1,760) (1,760) (1,760)<br />

PAYE tax credit (1,760) (1,760) (1,760)<br />

INCOME TAX 1,314 744 440<br />

INCOME 35,000 35,000 35,000<br />

RENT A ROOM 0 7,596 7,596<br />

LESS TAX (1,314) (744) (440)<br />

NET INCOME AFTER TAX 33,686 41,852 42,156<br />

SAVINGS<br />

<strong>Tax</strong> 2,376 2,946 3,250<br />

Rent a room 0 7,596 7,596<br />

Total 2,376 10,542 10,846<br />

2,376 10,542 10,846<br />

• No Travel Costs<br />

• No Travel Time<br />

• No Traffic Jams!<br />

Benefits to Investor<br />

If you own other Irish investment property and you buy at City Square, you are<br />

entitled to a deduction from Irish source rental income equal to the qualifying<br />

expenditure. For example:<br />

SCENARIO 1 BED 2 BED 3 BED<br />

Purchase Price €285,000 €360,000 €400,000<br />

Qualifying cost – say 76.00% 76.00% 76.00%<br />

Qualifying expenditure €216,600 €273,600 €304,000<br />

• These amounts are available as "S<strong>23</strong>" rel<strong>ie</strong>f for offset against an Investors Irish source rental income only<br />

• Please note that these are "specif<strong>ie</strong>d rel<strong>ie</strong>fs" and restrictions will apply in 2007 and subsequent years, where an<br />

investor wishes to claim more than €250k pa in "specif<strong>ie</strong>d rel<strong>ie</strong>fs" in a year.<br />

• Capital allowances are also available on fitout of unit<br />

• Investors also have the benefit of mortgage interest rel<strong>ie</strong>f on borrowings<br />

All examples are for illustration purposes only - prices will vary throughout development