Brunei Economic Bulletin Vol.3 Issue No.2 - Brunei Resources

Brunei Economic Bulletin Vol.3 Issue No.2 - Brunei Resources

Brunei Economic Bulletin Vol.3 Issue No.2 - Brunei Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BRUNEI ECONOMIC BULLETIN<br />

Volume 3, <strong>Issue</strong> 2<br />

Date : 9/2004<br />

THE EDITOR<br />

BRUNEI ECONOMIC BULLETIN (BEB)<br />

JPKE (DEPARTMENT OF ECONOMIC PLANNING AND DEVELOPMENT)<br />

PRIME MINISTER’S OFFICE<br />

Inside this issue:<br />

BRUNEI DARUSSALAM SECOND QUARTER 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

Gross Domestic Product<br />

THE EDITOR:<br />

BRUNEI ECONOMIC<br />

BULLETIN (BEB)<br />

JPKE (DEPARTMENT OF ECO-<br />

NOMIC PLANNING AND DEVELOP-<br />

MENT)<br />

PRIME MINISTER'S OFFICE<br />

Phone:<br />

+673-2-233344<br />

Fax: +673-2-230226<br />

Email: info@jpke.gov.bn<br />

BEB Panel of Advisors<br />

♦ Permanent Secretary<br />

Prime Minister’s Office<br />

♦ Director General JPKE,<br />

♦ Deputy Director Generals<br />

JPKE<br />

BEB Editors<br />

♦ Directors, JPKE<br />

♦ Assistant Directors, JPKE<br />

BEB Contributors<br />

♦ Hj Abd Razak Hj Angas<br />

♦ Abd Amin Hashim<br />

♦ Shahrom Hj Suhaimi<br />

♦ Hj Mazlan Hj Mohd Salleh<br />

♦ Mashor POKID Dato Paduka<br />

Hj Musa<br />

♦ Shamsul Bahrin Hj Mohd<br />

Hussain<br />

♦ Dk Hjh Siti Nirmala Pg Hj<br />

Mohammad<br />

♦ Zureidah Hj Abit<br />

♦ Pg Metussin Pg Hj Tuah<br />

♦ Hj Joharry Hj Karim<br />

♦ Hjh Aisah Hj Sani<br />

♦ Hjh Norfatiniwati Hj<br />

Muhammad<br />

BEB Publishers<br />

♦ Noor Jusmin Hj Abd Samad<br />

♦ Hairol Nizam Hj Abd Hamid<br />

<strong>Brunei</strong> Darussalam’s economy for this quarter is estimated to contract<br />

by 2.8 per cent from BND 1,172.9 in Q1 2004 to BND 1,140.2 in<br />

Q2 2004. Compared to the same quarter last year, it is also estimated<br />

to contract by 1.1 per cent (Chart 1.1).<br />

The oil and gas sector has registered contraction of 5.4 per cent in<br />

Q2 2004 year-on-year. It also contracted by 5.8 per cent in Q2 2004<br />

compared to Q1 2004. The average weighted oil production decreased<br />

by 3.8 per cent from 209,790 barrels per day in Q2 2003 to<br />

201,738 barrels per day in Q2 2004 (Table 1.1). The average<br />

weighted LNG production also dropped by 8.8 per cent from<br />

1,042,283.9 MMBtu 1 per day in Q2 2003 to 950,639.01 MMBtu per<br />

day in Q2 2004 (Table 1.2). The oil and gas sector in the first half of<br />

2004 declined by 2.9 per cent compared to the same period last year.<br />

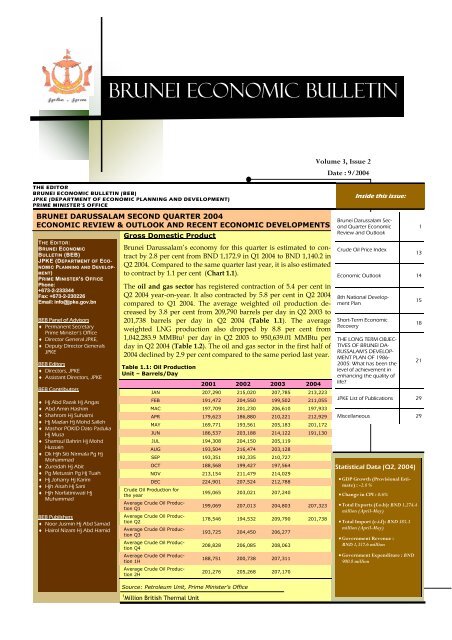

Table 1.1: Oil Production<br />

Unit – Barrels/Day<br />

2001 2002 2003 2004<br />

JAN 207,290 215,020 207,785 213,223<br />

FEB 191,472 204,550 199,502 211,055<br />

MAC 197,709 201,230 206,610 197,933<br />

APR 179,623 186,880 210,221 212,929<br />

MAY 169,771 193,561 205,183 201,172<br />

JUN 186,537 203,188 214,122 191,130<br />

JUL 194,308 204,150 205,119<br />

AUG 193,504 216,474 203,128<br />

SEP 193,351 192,335 210,727<br />

OCT 188,568 199,427 197,564<br />

NOV 213,154 211,479 214,029<br />

DEC 224,901 207,524 212,788<br />

Crude Oil Production for<br />

the year<br />

195,065 203,021 207,240<br />

Average Crude Oil Production<br />

Q1<br />

Average Crude Oil Production<br />

Q2<br />

Average Crude Oil Production<br />

Q3<br />

Average Crude Oil Production<br />

Q4<br />

Average Crude Oil Production<br />

1H<br />

Average Crude Oil Production<br />

2H<br />

1 Million British Thermal Unit<br />

199,069 207,013 204,803 207,323<br />

178,546 194,532 209,790 201,738<br />

193,725 204,450 206,277<br />

208,828 206,085 208,063<br />

188,751 200,738 207,311<br />

201,276 205,268 207,170<br />

Source: Petroleum Unit, Prime Minister’s Office<br />

<strong>Brunei</strong> Darussalam Second<br />

Quarter <strong>Economic</strong><br />

Review and Outlook<br />

Crude Oil Price Index<br />

Statistical Data (Q2, 2004)<br />

• GDP Growth (Provisional Estimate)<br />

: -2.8 %<br />

• Change in CPI : 0.6%<br />

• Total Exports (f.o.b): BND 1,274.4<br />

million (April-May)<br />

• Total Import (c.i.f): BND 385.3<br />

million (April-May)<br />

• Government Revenue :<br />

BND 1,357.6 million<br />

• Government Expenditure : BND<br />

900.8 million<br />

1<br />

13<br />

<strong>Economic</strong> Outlook 14<br />

8th National Development<br />

Plan<br />

Short-Term <strong>Economic</strong><br />

Recovery<br />

THE LONG TERM OBJEC-<br />

TIVES OF BRUNEI DA-<br />

RUSSALAM’S DEVELOP-<br />

MENT PLAN OF 1986-<br />

2005: What has been the<br />

level of achievement in<br />

enhancing the quality of<br />

life?<br />

15<br />

18<br />

21<br />

JPKE List of Publications 29<br />

Miscellaneous 29

P AGE 2<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

Table 1.2: LNG Production<br />

Unit - MMBtu/Day<br />

2001 2002 2003 2004<br />

JAN 1,033,542.9 1,046,388.0 1,118,431.0 1,117,753.6<br />

FEB 962,006.0 1,095,799.0 1,112,133.0 1,073,981.0<br />

MAC 1,141,934.0 990,443.0 1,165,771.0 1,063,286.8<br />

APR 864,858.0 750,836.0 1,037,552.0 1,126,284.33<br />

MAY 682,869.0 687,569.0 1,002,617.0 785,019.35<br />

JUN 960,671.0 915,497.0 1,088,055.0 946,134.00<br />

JUL 838,649.0 1,061,756.0 1,050,631.0<br />

AUG 936,035.0 1,061,236.0 948,691.0<br />

SEP 1,023,296.0 980,426.0 970,991.7<br />

OCT 1,048,142.0 1,062,589.0 992,310.7<br />

NOV 976,540.0 1,037,404.0 1,038,770.0<br />

DEC 1,146,837.0 1,059,582.0 1,062,209.0<br />

LNG Production for the<br />

Year 968,124.0 978,804.0 1,049,143.0<br />

Average LNG Production<br />

Q1 1,048,621.7 1,042,490.4 1,132,777.6 1,085,249.5<br />

Average LNG Production<br />

Q2 834,448.5 783,567.4 1,042,283.9 950,639.01<br />

Average LNG Production<br />

Q3 931,674.8 1,035,060.1 990,426.5<br />

Average LNG Production<br />

Q4 1,058,049.4 1,053,363.3 1,031,013.2<br />

Average LNG Production<br />

1H 940,943.4 912,243.8 1,087,280.5 1,017,944.23<br />

Average LNG Production<br />

2H 994,862.1 1,044,211.7 1,011,005.5<br />

Source: Petroleum Unit, Prime Minister's Office<br />

Table 1.3: Oil and Gas Production Index<br />

2000 2001 2002 2003 2004<br />

JAN 109.7 108.0 111.2 110.9 112.8<br />

FEB 113.1 100.0 109.0 107.7 110.6<br />

MAC 112.6 108.0 104.4 112.0 105.6<br />

APR 103.7 92.6 91.6 109.2 113.0<br />

MAY 98.7 83.2 92.0 106.2 97.8<br />

JUN 75.9 98.2 102.7 112.2 99.4<br />

JUL 93.3 97.1 107.8 107.8<br />

AUG 93.7 99.9 112.2 103.8<br />

SEP 91.6 102.6 100.9 107.2<br />

OCT 91.8 101.7 106.1 103.2<br />

NOV 107.0 108.3 109.6 110.6<br />

DEC 109.0 118.0 108.9 110.9<br />

Average Index for the Year 100.0 101.5 104.7 108.5<br />

Average Index for Q1 111.8 105.5 108.2 110.3 109.7<br />

Average Index for Q2 92.8 91.2 95.4 109.2 103.3<br />

Average Index for Q3 92.9 99.8 107.0 106.2<br />

Average Index for Q4 102.6 109.3 108.2 108.2<br />

Average Index for H1 102.3 98.3 101.7 109.7<br />

Average Index for H2 97.7 104.6 107.6 107.2<br />

Base year 2000=100<br />

Source: Petroleum Unit, Prime Minister’s Office<br />

Table 1.4: Agricultural Sector<br />

Crop Production<br />

Q2 03 Q1 04 Q2 04<br />

growth<br />

(%)<br />

(Q-O-Q)<br />

growth<br />

(%)<br />

(Y-O-Y)<br />

Vegetables (Tons) 2,564.02 2,023.0 3,012.0 48.9 17.5<br />

Fruits (Tons) 835.7 836.0 806.0 (3.6) (3.6)<br />

Ornamental horticulture (trees) 55,956.0 74,536.0 56,966.0 (23.6) 1.8<br />

Cut Flowers (unit) 29,693.0 31,258.0 34,459.0 10.2 16.1<br />

Various Plantations (Tons) 61.1 62.0 87.0 40.0 42.4<br />

Livestock Production<br />

Buffaloes (Tons) 50.4 16.1 30.0 86.3 (40.5)<br />

BRUNEI ECONOMIC BULLETIN<br />

The oil and gas production index (OGPI) contracted by 5.4 per<br />

cent from 109.2 in Q2 2003 to 103.3 in Q2 2004. On a quarteron-quarter<br />

basis the OGPI also contracted by 5.8 per cent from<br />

109.7 in Q1 2004 (Table 1.3).<br />

The price of crude oil averaged at US$38.20 per barrel in Q2<br />

2004 compared to US$27.33 per barrel a year ago and<br />

US$35.59 in Q1 2004. Meanwhile, the price of LNG averaged<br />

at US$4.71 per MMBtu compared to US$4.70 per MMBtu a<br />

year ago and US$4.67 in Q1 2004.<br />

The overall non-oil and gas sector is estimated to expand by<br />

3.9 per cent in Q2 2004 compared to the same period last year.<br />

Compared to Q1 2004, it is estimated to grow marginally by<br />

0.4 per cent. The year-on-year growth was supported by improvement<br />

in forestry; mining; quarrying and manufacturing;<br />

wholesale and retail; and transport and communication sectors.<br />

Activities in the agricultural sector are estimated to register a<br />

1.4 per cent growth in Q2 2004 compared to the same period a<br />

year ago. This was due to the increase in the production of<br />

vegetables; ornamental horticulture (trees); cut flowers; various<br />

plantations; and chicken eggs (Table 1.4). On a quarter-on<br />

quarter basis, this sector is also estimated to grow by 5.3 per<br />

cent in Q2 2004.<br />

The forestry sector grew at an estimated rate of 21.0 per cent<br />

in Q2 2004 year-on-year. Compared to Q1 2004, it registered a<br />

17.8 percent growth. The production of round timber increased<br />

by 32.3 per cent from 25.1 thousands cubic metres in<br />

Q2 2003 to 33.2 thousands cubic metres in Q2 2004 (Table 1.5).<br />

Compared to Q1 2004, it registered an increase of 5.4 per cent<br />

from 31.5 thousands cubic metres. The production of bakau<br />

poles also increased by 14.9 per cent from 28.2 thousand<br />

pieces in Q2 2003 to 32.4 thousand pieces in Q2 2004. Compared<br />

to Q1 2004, it increased by 26.6 per cent, from 25.6 thousand<br />

pieces during that quarter.<br />

Activities in the fishery sector are estimated to decline by 22.8<br />

per cent compared to the same period last year. Compared to<br />

Q1 2004, this sector also registered a decrease of 60.1 per cent.<br />

The largest downward effect was from the production of the<br />

capture industry. The production dropped by 24.8 per cent<br />

from 4,242.8 metric tonnes in Q2 2003 to 3,192.0 metric tonnes<br />

in Q2 2004 and on quarter on quarter basis the production<br />

dropped by 57.1 per cent from 7,440.6 metric tonnes in Q1<br />

2004 (Table 1.6).<br />

Chart 1.1: Growth of Gross Domestic Product Year-on-year<br />

Cattle (Tons) 0.4 3.1 0.3 (90.3) (25.0)<br />

Goats (Tons) 0.07 1.3 - - -<br />

Broiler Chicken (Tons) 4,166.2 4,242.0 3,967.0 (6.5) (4.8)<br />

Chicken Eggs (Millions) 26.1 27.7 28.4 8.8<br />

Fresh Milk (Litres) 22,939.0 24,519.0 16,900.0 (26.3)<br />

Source: Agricultural Department<br />

Table 1.5: Forestry Sector<br />

Q2 03 Q1 04 Q2 04 growth (%) growth (%)<br />

(Q-O-Q) (Y-O-Y)<br />

Round Timber ('000 Cubic Metres) 25.1 31.5 33.2 5.4 32.3<br />

Bakau Poles (Thousand Pieces) 28.2 25.6 32.4 26.6 14.9<br />

Source: Forestry Department<br />

%<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

Q1 03 Q2 03 Q3 03 Q4 03 Q1 04 Q2 04<br />

Total Oil Non-oil

BRUNEI ECONOMIC BULLETIN<br />

P AGE 3<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

Table 1.6: Fishery Sector<br />

Capture Industry (Metric Tonnes)<br />

Q2 03 Q1 04 Q2 04<br />

growth<br />

(%)<br />

(Q-O-Q)<br />

growth<br />

(%)<br />

(Y-O-Y)<br />

4,242.83 7,440.61 3,192.0 (57.10) (24.77)<br />

Commercial 1,016.96 662.99 875.15 32.0 (13.94)<br />

Small Scale Fishermen 3,225.87 6,777.62 2,316.83 (65.82) (28.18)<br />

Aquaculture Industry (Metric<br />

Tonnes)<br />

112.28 146.52 156.54 6.84 39.42<br />

Fish 17.45 19.71 21.01 6.60 20.40<br />

Prawn 70.90 97.53 106.59 9.29 50.34<br />

Fresh Water Fish 23.93 29.28 28.94 (1.16) 20.94<br />

Total Production 4,355.11 7,587.13 3,348.54 (55.87) (23.11)<br />

Source: Fishery Department<br />

Table 1.7: Mining/Quarrying/Manufacturing Sector<br />

Cement Production<br />

(Tonnes)<br />

Sawn Timber Production<br />

(Thousands cubic<br />

metre)<br />

Fish Processing Production<br />

(Tonnes)<br />

Charcoals Production<br />

(thousand Kg)<br />

Q2 03 Q1 04 Q2 04<br />

growth<br />

(%)<br />

(Q-O-Q)<br />

growth<br />

(%)<br />

(Y-O-Y)<br />

57,969.0 55,471.3 59,041.5 4.5 1.5<br />

13.3 11.0 15.0 36.4 12.8<br />

144.7 128.1 130.13 1.6 (10.1)<br />

6.3 4.4 6.7 52.3 6.3<br />

Cable Production (Kg) 158,662.0 165,388.2 202,682.9 22.5 27.7<br />

Roofing Production<br />

(Tonnes)<br />

Switchboard Production<br />

(Unit)<br />

Reverse-Osmosis Water<br />

Production (thousand<br />

litres)<br />

Source: Department of <strong>Economic</strong> Planning & Development<br />

%<br />

41<br />

39<br />

37<br />

35<br />

33<br />

31<br />

29<br />

27<br />

705.6 652.9 543.0 (16.8) (23.0)<br />

1,227.0 512.0 965.0 88.5 (21.4)<br />

112.0 115.0 117.0 1.7 4.5<br />

Chart 1.2: Hotel Occupancy Rate<br />

Q1 03 Q2 03 Q3 03 Q4 03 Q1 04 Q2 04<br />

Chart 1.3: Growth Rate of Communication Sector<br />

%<br />

20<br />

16<br />

12<br />

8<br />

4<br />

0<br />

Q1 03 Q2 03 Q3 03 Q4 03 Q1 04 Q2 04<br />

Chart 1.4: Seaborne Cargo Handled<br />

The mining, quarrying and manufacturing sector registered<br />

an estimated growth rate of 8.6 per cent in Q2 2004 compared<br />

to Q2 2003 due to the increase in production of cement, sawn<br />

timber, charcoals, reverse osmosis water, cable and bricks. On<br />

a quarter-on-quarter basis this sector grew by an estimated 4.1<br />

per cent compared to Q1 2004 (Table 1.7).<br />

The construction sector has shown improvement year-on-year<br />

and registered an estimated 5.7 per cent growth in Q2 2004. It<br />

is also estimated to expand by 7.4 per cent compared with the<br />

previous quarter.<br />

The wholesale and retail trade sector posted an estimated 8.5<br />

growth in Q2 2004 compared to Q2 2003. Compared with the<br />

previous quarter, this sector is estimated to have expanded by<br />

6.1 per cent. Survey on selected major wholesale companies<br />

registered a 4.6 per cent growth in the value of sales in Q2 2004<br />

year-on-year. On a quarter-on-quarter basis the value of sales<br />

also increased by 3.8 per cent. Meanwhile, survey on selected<br />

major retail companies registered a 14.4 per cent increased in<br />

the value of sales in Q2 2004 year-on-year. Likewise, on a<br />

quarter-on-quarter basis the value of retail sales rose by 8.4 per<br />

cent.<br />

The restaurants and hotels sector is estimated to contract by<br />

5.4 per cent in Q2 2004 compared to the same period last year.<br />

Compared with the previous quarter, it is estimated to have<br />

contracted by 1.5 per cent. The hotels occupancy rates have<br />

dropped by 7.7 per cent from 31.0 per cent in Q2 2003 to 28.6<br />

per cent in Q2 2004 (Chart 1.2). However, on a quarter-onquarter<br />

basis the rates have increased by 1.3 per cent compared<br />

to Q1 2004. Meanwhile, the value of sales from the selected<br />

major restaurants declined by 3.1 per cent compared to<br />

Q2 2003. On quarter-on-quarter basis the value of sales also<br />

dropped by 4.2 per cent.<br />

The transport and communication sector grew at an estimated<br />

17.1 per cent in Q2 2004 compared to a year ago. Compared<br />

with the previous quarter, this sector is estimated to have expanded<br />

by 5.4 per cent. The improved year-on-year growth<br />

was mainly attributed to better performance in the communication<br />

sector (Chart 1.3). The volume of cargo handled also<br />

increased by 33.1 per cent in Q2 2004 compared to a year ago<br />

(Chart 1.4).<br />

The banking and finance sector registered a contraction of 7.0<br />

per cent in Q2 2004 compared to Q2 2003. However, compared<br />

to Q1 2004 it grew by 3.8 per cent. Total interest income from<br />

loans and advances stood at BND 107.0 million in Q2 2004<br />

compared to BND 115.0 million and BND 114.8 million collected<br />

in Q2 2003 and Q1 2004 respectively (Chart 1.5).<br />

The insurance sector is estimated to register a contraction of<br />

0.4 per cent in Q2 2004 compared to the same period a year<br />

earlier. However, compared to Q1 2004, it expanded by 26.8<br />

per cent.<br />

Chart 1.5: Banks Loans and Advances<br />

13 0<br />

500,000<br />

12 5<br />

freight tonnes<br />

400,000<br />

300,000<br />

200,000<br />

100,000<br />

0<br />

Q1 03 Q2 03 Q3 03 Q4 03 Q1 04 Q2 04<br />

BNDmillion<br />

12 0<br />

115<br />

110<br />

10 5<br />

10 0<br />

Q1 03 Q2 03 Q3 03 Q4 03 Q1 04 Q2 04

P AGE 4<br />

BRUNEI ECONOMIC BULLETIN<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

Table 2.1 : Consumer Price Index Q2 2003, Q1 and Q2 2004<br />

I<br />

Commodity Group Weight Q2 03<br />

Source: Department of <strong>Economic</strong> Planning & Development<br />

Jan-<br />

June<br />

03<br />

Q1 04<br />

Q2<br />

04<br />

Jan-<br />

June<br />

04<br />

All 10,000 100.6 100.6 100.7 101.3 101.0<br />

Food & Non-Alcoholic<br />

Beverages<br />

2877 99.0 99.5 100.0 100.7 100.4<br />

II Clothing & Footwear 561 99.5 98.8 97.5 96.0 96.7<br />

III<br />

IV<br />

Housing, Water,<br />

Electricity & Maintenance<br />

Household Goods &<br />

Operations<br />

884 100.1 100.0 98.0 98.4 98.2<br />

860 100.4 100.1 95.7 95.0 95.4<br />

V Transport 2251 105.0 104.3 106.1 106.5 106.3<br />

VI Communication 548 95.5 96.1 94.2 93.3 93.8<br />

VII Education 471 99.4 99.8 99.9 99.9 99.8<br />

VIII Medical & Health 98 98.5 98.2 98.2 98.2 98.2<br />

IX<br />

X<br />

Recreation & Entertainment<br />

Miscellaneous Goods<br />

& Services<br />

814 100.0 100.1 103.5 108.3 105.9<br />

636 100.6 100.4 101.4 101.3 101.4<br />

Table 2.2: Consumer Price Index April-June 2004<br />

Commodity Group<br />

Weight<br />

2004<br />

April May June<br />

All 10,000 101.3 101.3<br />

I Food & Non-Alcoholic Beverages 2877 100.8 100.7 100.7<br />

II Clothing & Footwear 561 93.4 98.6 95.9<br />

III Housing, Water, Electricity & Maintenance 884 98.1 98.5 98.7<br />

IV Household Goods, Services & Operations 860 95.0 96.2 93.7<br />

V Transport 2251 106.8 106.2 106.6<br />

VI Communication 548 94.0 93.2 92.8<br />

VII Education 471 99.9 100.1 99.7<br />

VIII Medical & Health 98 98.1 98.3 98.3<br />

IX Recreation & Entertainment 814 109.5 106.9 108.4<br />

X Miscellaneous Goods & Services 636 100.6 101.7 101.6<br />

Chart 2.1: CPI Percentage Changes Between Q2 2004 and Q1 2004<br />

101.2<br />

Consumer Price Index<br />

The average Consumer Price Index (CPI) for the second quarter<br />

of 2004 was 101.3, an increase of 0.6 per cent from 100.7 in<br />

Q1 2004 (Table 2.1. The CPI for April, May and June 2003<br />

stood at 101.3, 101.3 and 101.2 respectively (Table 2.2). The<br />

CPI for January to June 2004 increased by 0.4 per cent compared<br />

to that of 100.6 in the same period last year. The average<br />

CPI for the second quarter 2004 compared to the same<br />

period last year recorded a marginal increase of 0.7 per cent<br />

from 100.6 to 101.3.<br />

CPI Changes for the Q2 2004 relative to Q1 of 2004<br />

The average CPI for Q2 2004 rose by 0.6 per cent compared<br />

to Q1 2004 due to the hike seen in Major Group indices of<br />

Recreation & Entertainment by 4.6 per cent; Food & Non-<br />

Alcoholic Beverages by 0.7 per cent; and Housing, Water,<br />

Electricity & Maintenance by 0.4 per cent.<br />

The Recreation & Entertainment index increased by 4.6 per<br />

cent due to higher price of Holiday Package Expenses which<br />

rose by 7.0 per cent.<br />

The increase in the price of Fresh Chicken by 13.2 per cent<br />

contributed to the increase in the Major Group Index of<br />

Food & Non-Alcoholic Beverages by 0.7 per cent.<br />

The Major Group Index of Transport rose by 0.4 per cent as a<br />

result of an increase in the Purchase of Vehicles Index by 2.4<br />

per cent.<br />

The Housing, Water, Electricity & Maintenance index rose to<br />

0.4 per cent due to the increase in Accommodation price by<br />

1.0 per cent.<br />

The largest downward effect on the CPI for this quarter<br />

came from Clothing and Footwear (Chart 2.1). This was due<br />

to the decline in the sub-group indices of Ready-Made<br />

Clothing Accessories by 1.2 per cent; Materials for<br />

Male/Female by 3.0 per cent; Wedding Dress, Accessories<br />

and Rental by 2.1 per cent; Tailoring Charges by 1.5 per cent;<br />

and Footwear by 1.2 per cent.<br />

Food & Non Alcoholic Beverages<br />

Clothing & Footwear<br />

Housing, Water, Electricity &<br />

M aint enance<br />

Household Goods, Services &<br />

Operat ions<br />

Transport<br />

Communicat ion<br />

Educat ion<br />

M edical & Health<br />

Recreation & Ent ertainment<br />

M iscellaneous Goods & Services<br />

0.7<br />

-1.5<br />

0.4<br />

-0.7<br />

0.4<br />

-0.9<br />

0<br />

0<br />

-0.1<br />

4.6<br />

-5 0 5<br />

CPI Changes for the Q2 of 2004 relative to the same<br />

period in 2003<br />

The average CPI for Q2 2004 increased by 0.7 per cent compared<br />

to 100.6 in the same period last year (Table 2.1). The<br />

Recreation & Entertainment Index advanced by 8.3 per cent<br />

which accounted for half of the increase in the overall CPI.<br />

The Major Group Indices of Food & Non-Alcoholic Beverages<br />

also increased by 1.7 per cent; Transport by 1.4 per cent;<br />

Education by 0.5 per cent; and Miscellaneous Goods and<br />

Services by 0.7 per cent respectively.<br />

The Recreation & Entertainment Index witnessed a sharp<br />

increase of 8.3 per cent when compared to the same period<br />

last year. This was mainly due to a 12.8 per cent rise in the<br />

price of Holiday Package Expenses which was a consequence<br />

of the increase in prices of Umrah Package which<br />

coincide with school holidays.<br />

The increase in prices of Beef (Cattle), Fresh and Frozen; and<br />

Fresh Chicken by 22.7 per cent and 17.8 per cent respectively

BRUNEI ECONOMIC BULLETIN<br />

P AGE 5<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

Chart 2.2: CPI Percentage Changes Between Q2 2004 and Q2<br />

2003<br />

Food & Non Alcoholic Beverages<br />

1.7<br />

Clothing & Footwear<br />

-3.5<br />

Housing, Water, Electricity &<br />

M aintenance<br />

Household Goods, Services &<br />

Operations<br />

Transport<br />

Communication<br />

Education<br />

Medical & Health<br />

Recreation & Entertainment<br />

Miscellaneous Goods & Services<br />

-5.4<br />

-1.7<br />

-2.3<br />

-0.3<br />

1.4<br />

0.5<br />

0.7<br />

8.3<br />

-10 0 10<br />

Chart 2.3: CPI Percentage Changes for the period of January-<br />

June 2004 relative to the same period in 2003<br />

Food & Non Alcoholic Beverages<br />

0.9<br />

Index<br />

Clothing & Footwear<br />

Housing, Water, Electricity &<br />

M aintenance<br />

Household Goods, Services &<br />

Operations<br />

Transport<br />

Communication<br />

Education<br />

M edical & Health<br />

Recreation & Entertainment<br />

M iscellaneous Goods & Services<br />

10 2 . 0<br />

10 1. 0<br />

10 0 . 0<br />

-4.7<br />

-2.1<br />

-1.8<br />

-2.4<br />

0.0<br />

0.0<br />

1.9<br />

1.0<br />

5.8<br />

-10.0 -5.0 0.0 5.0 10.0<br />

Consumer Pric e Index 2002=100<br />

(Jan-June 2004)<br />

100.1<br />

100.8<br />

101.2<br />

101.3<br />

101.3<br />

101.2<br />

accounted for the largest upward movement of the Major<br />

Group Index of Food & Non-Alcoholic Beverages.<br />

The Miscellaneous Goods and Services index rose by 0.7 per<br />

cent as a result of increases in sub-group indices of personal<br />

care by 0.4 per cent and Personal Effects and Other Personal<br />

Goods by 4.4 per cent.<br />

The largest downward influence was from the Household<br />

Goods and Operations Index (Chart 2.2). The index dropped<br />

by 5.4 per cent as a result of decreases in the prices of Furniture<br />

(11.9 per cent); Floor Covering (8.2 per cent); Household<br />

Furnishings (0.2 per cent); Audio, Video Equipments, Musical<br />

Instruments (4.5 per cent); Household Equipments and Electrical<br />

Appliances (7.1 per cent); Kitchen Appliances and Utensils<br />

(7.6 per cent); Crockery and Cutlery (6.8 per cent); Household<br />

Operation (0.7 per cent); and Other Household Services<br />

(0.4 per cent).<br />

CPI Changes for the period January-June 2004/2003<br />

The 0.4 per cent increase in the CPI was brought about by the<br />

increase observed in Major Group indices of Food and Non-<br />

Alcoholic Beverages by 0.9 per cent; Transport (1.9 per cent);<br />

Recreation and Entertainment (5.8 per cent); and Miscellaneous<br />

Goods and Services (1.0 per cent) (Chart 2.3).<br />

The 0.9 per cent increase in the index for Food and Non-<br />

Alcoholic Beverages was the result of increases in the subgroup<br />

indices of Meat and Meat Products (9.3 per cent); Dairy<br />

Products and Eggs (5.6 per cent); Cooking Oils and Fats (7.2 per<br />

cent); Vegetables (1.5 per cent); Sugar, Sugar Preserves and<br />

Confectionery (3.6 per cent); Coffee, Tea and Cocoa (0.6 per<br />

cent; and Food/Drink Away From Home (0.2 per cent).<br />

The Transportation index rose by 1.9 per cent reflecting an increase<br />

in the price of Private Road Transport by 1.9 per cent<br />

and Air Transport by 3.3 per cent.<br />

The Major Group Index of Recreation and Entertainment increased<br />

by 5.8 per cent due to the soaring prices of Holiday<br />

Package Expenses which rose by 9.8 per cent.<br />

The Miscellaneous Goods and Services index was up by 1.0 per<br />

cent due to the increases in sub-group indices of Personal Care;<br />

and Personal Effects and Other Personal Goods by 0.8 per cent<br />

and 5.4 per cent respectively.<br />

The largest downward effect was from the Major Group Index<br />

of Household Goods & Operation (Chart 2.3). The price dipped<br />

by 4.7 per cent as a result of decreases in the price of Furniture<br />

(10.2 per cent); Floor Covering (4.9 per cent); Audio, Video<br />

Equipments, Musical Instruments (4.4 per cent); Household<br />

Equipments and Electrical Appliances (7.0 per cent); Kitchen<br />

Appliances and Utensils (7.8 per cent); Crockery and Cutlery<br />

(6.5 per cent); and Household Operation (0.2 per cent).<br />

99.0<br />

98.0<br />

Jan Feb March Apr May June

P AGE 6<br />

BRUNEI ECONOMIC BULLETIN<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

Table 3.1:GOVERNMENT FINANCE (BND MILLION)<br />

Q1 2004 Q2 2004 Q2 2003<br />

Total Revenues 1,398.0 1,357.6 1,225.4<br />

Tax 824.7 726.9 640.7<br />

Non-tax 573.3 630.7 584.7<br />

Total Expenditure 1,429.5 900.8 986.0<br />

Current 1,202.5 768.5 781.0<br />

Capital 227.0 132.3 204.9<br />

Budget Surplus/ (Deficit) (31.5) 456.8 239.4<br />

Source: Treasury Department, Ministry of Finance<br />

Table 3.2: GOVERNMENT REVENUE & EXPENDITURE (BND MIL-<br />

LION)<br />

Q1 2004 Q2 2004 Q2 2003<br />

Total Revenue 1,398.0 1,357.6 1,225.4<br />

Tax revenue 824.7 726.9 640.7<br />

Taxes on net income and<br />

profits<br />

797.5 698.7 612.1<br />

Corporate taxes 796.5 698.0 611.0<br />

Oil & Gas production<br />

companies<br />

758.4 643.2 560.5<br />

Other companies 38.1 54.8 50.5<br />

Individuals (estate duty) 0.0 0.0 0.4<br />

Stamp 0.9 0.7 0.7<br />

Taxes on international trade 24.3 25.6 25.9<br />

Import duties 24.3 25.6 25.9<br />

Motor vehicles tax 14.1 14.2 14.2<br />

Tobacco 5.1 5.4 5.2<br />

Others 5.1 6.0 6.5<br />

Taxes on goods and services<br />

3.0 2.6 2.7<br />

Licences 3.0 2.6 2.7<br />

Financial companies 0.1 0.1 0.0<br />

Others 2.9 2.5 2.7<br />

Non-tax revenue 573.3 630.7 584.7<br />

Property income 497.8 570.4 513.3<br />

Oil sector 482.1 561.2 485.4<br />

Oil & Gas Royalties 160.0 121.9 106.3<br />

Dividend paid by oil<br />

companies<br />

322.1 439.3 379.1<br />

Other 15.7 9.2 27.9<br />

Other royalties 0.3 0.4 0.4<br />

Rent and interest 3.9 3.0 5.1<br />

Others 11.5 5.8 22.4<br />

Administrative fees and<br />

charges on sales of goods<br />

and fines 74.8 59.6 70.7<br />

Telecom & utilities 54.9 40.6 50.5<br />

Other 19.9 19.0 20.2<br />

Other non-tax revenue 0.7 0.8 0.7<br />

Total Expenditure 1,429.5 900.8 986.0<br />

Current 1,202.5 768.5 781.0<br />

Wages & Salaries 422.8 336.2 316.1<br />

OCAR 465.6 284.3 286.8<br />

Charged 314.1 148.0 178.1<br />

Capital 227.0 132.3 204.9<br />

OCSE 156.6 52.1 104.1<br />

Development Expenditure 70.4 80.2* 82.9<br />

Investment in Public Enterprise<br />

NA NA 18.0<br />

Budget Surplus/ Deficit (31.5) 456.8 239.3<br />

Source: Treasury Department, Ministry of Finance (includes latest entries<br />

for the Quarter) * Provisional<br />

NA - Not Available<br />

Fiscal Sector<br />

Fiscal Position<br />

In Q2 2004, the Government revenue of BND 1,357.6 million<br />

exceeded its expenditure of BND 900.8 million, which resulted<br />

in a budget surplus of BND 456.8 million compared<br />

to BND 239.4 million during the same quarter last year<br />

(Table 3.1). The budget surplus in Q2 2004 was primarily<br />

due to the decrease in government expenditure, when compared<br />

to the government finance in Q1 2004.<br />

Government Revenue<br />

The total revenue fell by 2.9 percent from BND 1,398.0 million<br />

in Q1 2004 to BND 1,357.6 million in Q2 2004. However,<br />

it was BND 132.3 million (10.8 percent) higher compared to<br />

BND 1,225.3 million collected in Q2 2003.<br />

As shown in Table 3.2, in Q2 2004, 53.5 percent of the total<br />

revenue collected was in the form of tax revenue and only<br />

46.5 percent was from non-tax sources. The former comprises<br />

of taxes on net income and profits, taxes on international<br />

trade, and taxes on goods and services, which decreased<br />

from BND 824.7 million in Q1 2004 to BND 726.9<br />

million in Q2 2004. The decrease was mainly due to the drop<br />

in oil and gas corporate taxes, from BND 758.4 million in Q1<br />

2004 to BND 643.2 million in Q2 2004. The increase in corporate<br />

taxes by 43.8 percent from other companies was not<br />

enough to compensate for the decrease in the oil and gas<br />

corporate taxes. Nevertheless, the tax collected in Q2 2004<br />

was BND 86.2 million higher than the amount collected in<br />

the same quarter last year.<br />

The non-tax revenue, which consists of property income,<br />

administrative fees and charges on sales of goods and fines<br />

including telecommunication and utilities, and others, recorded<br />

an increase of BND 57.4 million from BND 573.3<br />

million in Q1 2004 to BND 630.7 million in Q2 2004. The Q2<br />

2004 figure was also an increase of 7.9 per cent (BND 46.0<br />

million) compared to that in Q2 2003. The increase was<br />

mainly due to the increase in the dividends paid by the oil<br />

and gas companies, as shown in Table 3.2. This figure increased<br />

by 36.4 percent from BND 322.1 million in Q1 2004<br />

to BND 439.3 million in Q2 2004; and by 15.9 percent compared<br />

to that of Q2 2003.<br />

Government Expenditure<br />

The government expenditure, which comprises current and<br />

capital expenditures (CAPEX), decreased by 37.0 percent<br />

from BND 1,429.5 million in Q1 2004 to BND 900.8 million<br />

in Q2 2004 (Table 3.2). This was due to the decline in both<br />

current and capital expenditures over the period from BND<br />

1,202.5 million and BND 227.0 million in Q1 2004 to BND<br />

768.5 million and BND 132.3 million in Q2 2004 respectively.<br />

Of the total current expenditure during this quarter, 43.7<br />

percent was for personnel emoluments (Wages & Salaries).<br />

CAPEX, which includes Other Charges Special Expenditure<br />

(OCSE) and Development Expenditure (DE), decreased by<br />

41.7 percent compared to that recorded in Q1 2004. Compared<br />

to Q2 2003, CAPEX recorded a decrease of BND 72.6<br />

million (-35.4 percent) from BND 204.9 million. However,<br />

the DE increased by 13.9 percent from BND 70.4 million in<br />

Q1 2004 to BND 80.2 million in Q2 2004, but dropped<br />

slightly by 3.3 percent from the same quarter last year. The

BRUNEI ECONOMIC BULLETIN<br />

P AGE 7<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

12000<br />

Chart 4.1 Money Supply<br />

OCSE recorded a decrease of 66.7 percent from BND 156.6<br />

million in Q1 2004 to BND 52.1 million in Q2 2004. Compared<br />

to Q2 last year, OCSE also fell by half, from BND 104.1 million.<br />

10000<br />

BND million<br />

8000<br />

6000<br />

4000<br />

2000<br />

0<br />

2003 2004<br />

June July Aug Sep Oct Nov Dec Jan Feb M ar Apr M ay June<br />

Month<br />

CIC M1 Qm M2<br />

Monetary Sector<br />

Money Supply<br />

As shown in Chart 4.1, the domestic narrow money (M1)<br />

expansions increased by 1.8 percent, from BND2,481.3 million<br />

in March 2004 to BND2,525.2 million in June 2004. This<br />

expansion was affected by an increase in M1 components<br />

where currency in circulation increased by 0.9 percent from<br />

BND656.2 million to BND662.0 million and demand deposits<br />

increased by 2.1 percent from BND1,825.1 million to<br />

BND1,863.2 million. Within the same period, broad money<br />

(M2) increased marginally by 2.6 percent from BND10,856.7<br />

million to BND11,135.4 million due to the increase in quasi<br />

money. Fixed deposit increased by 3.3 percent from<br />

BND5,639.4 million in March 2004 to BND5,827.1 million in<br />

June 2004 and savings and others (current deposits and call<br />

money) increased by 1.7 percent from BND2,736 million in<br />

March 2004 to BND2,783.1 million in June 2004. On a yearon-year<br />

basis, broad money increased by only 9.7 percent<br />

from BND10,150.2 million in June 2003 to BND11,135.4 million<br />

in June 2004.<br />

Assets and Liabilities<br />

TABLE 4.1 – Assets and Liabilities<br />

Assets and Liabilities in the banking system are shown in<br />

Table 4.1. The commercial banks’ total assets and liabilities<br />

increased by 6.6 percent from BND13,690 million in March<br />

2004 to BND14,594 million in June 2004. This was due to an<br />

increase in domestic and foreign deposits with banks and<br />

other assets. Domestic and foreign deposits increased by 12.3<br />

percent from BND6,272 million in March 2004 to BND7,045<br />

million in June 2004. Similarly, loans and advances increased<br />

by 0.8 percent, from BND5,392 million to BND5,437 million<br />

and other assets also increased by 8.8 percent from BND909<br />

million to BND989 million. Liabilities in the banking system<br />

also increased where deposits rose by 2.7 percent from<br />

BND10,201 million to BND10,473 million. This was due to<br />

increases in demand deposits by 2 percent from BND1,825<br />

million to BND1,863 million, time deposits by 3.3 percent<br />

Assets / Liabilities 2003 2004<br />

June July Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun<br />

Assets 12,925 12,218 12,081 12,900 12,683 12,798 13,495 13146 13117 13,690 13,514 13,391 14,594<br />

Cash 169 163 165 138 174 208 245 176 171 175 145 154 146<br />

Due from bank : 5,907 5,225 4,979 5,737 5,508 5,557 6,204 5,738 5,715 6,272 6,110 5,920 7,045<br />

in BD 1,100 784 614.3 912 862 795 1023 1,048 1082 1,151 1,105 1,048 1,488<br />

outside BD 4,807 4,441 4364.5 4,825 4646 4,762 5181 4,690 4633 5,121 5,005 4,872 5,557<br />

Loans and Advances 5,259 5,269 5304 5,346 5351 5,392 5387 5,398 5383 5,392 5,373 5,385 5,437<br />

Investment 721 689 744 775 744 726 715 873 925 942 961 985 977<br />

Other assets 869 872 889 904 906 915 944 961 923 909 925 947 989<br />

Liabilities 12,925 12,218 12,081 12,900 12,683 12,798 13,495 13146 13117 13,690 13,515 13,390 14,593<br />

Deposits 9,504 9,255 9,313 9,768 9,659 9,825 10,205 9914 9861 10,201 10,075 9,973 10,473<br />

Demand 1,971 1,853 1837 1,986 1899 2,038 2149 1967 1932 1,825 1,686 1,739 1,863<br />

Time 4,998 4,902 4980 5,280 5214 5,218 5457 5257 5207 5,640 5,629 5,445 5,827<br />

Saving 2,535 2,500 2496 2,502 2546 2,569 2599 2690 2722 2,736 2,760 2,789 2,783<br />

Due to bank 1,541 1,077 877 1,240 1,111 1,023 1,394 1308 1319 1,538 1,445 1,400 2,060<br />

in BD 1,308 970 771 1,130 1016 931 1222 1182 1221 1,444 1,354 1,306 1,937<br />

outside BD 233 107 106 110 95 92 172 126 98 94 91 94 123<br />

Other liabilities 1,880 1887 1891 1892 1913 1950 1896 1924 1937 1,951 1,995 2,017 2,060<br />

Source: Financial Institution Division, Ministry of Finance

P AGE 8<br />

BRUNEI ECONOMIC BULLETIN<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

TABLE 4.2 – Direction of Lending<br />

2003<br />

2004<br />

Mar Jun Sep Dec Mar Jun<br />

Total 4347 4386 4486 5386 5391 5438<br />

Agriculture 34 35 33 33 41 33<br />

Credit & Finance 15 17 22 23 21 27<br />

Manufacturing 89 91 96 90 90 91<br />

Transportation 186 197 213 201 193 203<br />

Construction 467 457 471 460 450 484<br />

General Commerce 497 478 497 481 465 476<br />

Professional Services 107 115 94 100 94 43<br />

Personal Loans 2479 2528 2591 3517 3567 3621<br />

Mortgage 473 468 469 481 470 460<br />

Source: Financial Institution Division, Ministry of Finance<br />

Chart 4.2 Non-Performing Loans<br />

800<br />

700<br />

600<br />

500<br />

2003 2004<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Jun Jul Aug Sep Oct Nov Dec Jan Feb M ar Apr M ay Jun<br />

Month<br />

60-90 days 91-120 days >120 days Tot al<br />

Source: Financial Institution Division, Ministry of Finance<br />

BND Million<br />

from BND5,640 million to BND5,827 million and savings by 1.7<br />

percent from BND2,736 million to BND2,783 million during the<br />

same period.<br />

Other liabilities increased by 5.6 percent from BND1,951 million<br />

to BND2,060 million. On a year on year basis, the banking assets<br />

and liabilities rose by 12.9 percent from BND12,925 million in<br />

June 2003 to BND14,594 million in June 2004.<br />

Lending<br />

Lending aggregates, as shown in Table 4.2, rose by only 0.9<br />

percent from BND5,391 million in March 2004 to BND5,438<br />

million in June 2004. The main contributor to the increase was<br />

Personal Loan which comprised 66.6 percent (BND 3,621) of the<br />

total loans recorded in June 2004. Loans to Construction, General<br />

Commerce and Mortgage contributed 8.9 percent (BND484<br />

million), 8.6 percent (BND476 million), and 8.46 percent<br />

(BND460 million), respectively. Lower contributions from Agriculture<br />

(0.6 percent), Credit and Finance (0.5 percent), Manufacturing<br />

(1.67 percent), Professional Services (0.8 percent) and<br />

Transportation (3.7 percent) were also recorded<br />

As also observed in the first quarter, loan aggregates was still<br />

dominated by Personal Loans. In comparison, the share of loans<br />

to productive sectors such as Agriculture and Manufacturing to<br />

total loans was still minimal, when combined, represented only<br />

2.3 percent of total.<br />

Compared to lending direction in the first quarter’s, loans to<br />

several economic sectors were down by almost 25 percent on<br />

average. Loans to Agriculture dropped by 19.5 percent from<br />

BND41 million to BND33 million. Similarly loans to Mortgage<br />

decreased by 2.1 percent from BND470 million to BND460 million<br />

while loans to Professional Services decreased by 54.3 percent<br />

from BND94 million to BND43 million. However, loans to<br />

other sectors have recorded increases. Substantial increase was<br />

observed for loans to Credit and Finance which increased by<br />

28.6 percent from BND21 million to BND27 million. Loans to<br />

Construction increased by 7.6 percent from BND450 million to<br />

BND484 million while loans to General Commerce rose by 2.4<br />

percent from BND465 million to BND476 million. Loans to<br />

Manufacturing increased marginally by 1.1 percent from<br />

BND90 million to BND91 million while Personal Loans rose by<br />

1.5 percent from BND3,567 million to BND3,621 million. Loans<br />

to Transportation grew by 5.2 percent from BND193 million to<br />

BND203 million.<br />

Non-Performing Loans<br />

Non-performing loans (NPLs) declined further owing to the<br />

favourable economic conditions (the growth in non-oil GDP by<br />

3.9 per cent). Preliminary information in Chart 4.2, showed that<br />

NPLs based on 6-month classification moderated to BND7.63<br />

million in June 2004, down from BND14.88 million in March<br />

2004. NPLs based on 3-month classification fell to BND25.90<br />

million, down from BND29.09 million. Improvements in the<br />

level of NPLs were also due to lower incidence of new NPLs<br />

and write-offs of bad loans coupled with strong recoveries and<br />

reclassification of NPLs to performing loans.<br />

Non-performing loans aggregates decreased by 1.0 percent<br />

from BND651.74 million in March 2004 to BND645.52 million in<br />

June 2004. On a year-on-year basis, NPLs decreased by 7.5 percent<br />

from BND698.18 million in June 2003. The ratio of the NPL

BRUNEI ECONOMIC BULLETIN<br />

P AGE 9<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

%<br />

Chart 4.3 – Deposit Rates in<br />

<strong>Brunei</strong> Darussalam Banking System<br />

0.4<br />

0.35<br />

0.3<br />

0.25<br />

0.2<br />

0.15<br />

0.1<br />

0.05<br />

0<br />

Jun Aug Oct Dec Feb Apr Jun<br />

to loans aggregates decreased by 0.3 percentage points from 12.1 percent<br />

in March 2004 to 11.8 percent in June 2004 and decreased on a<br />

year-on-year basis by 4.1 percentage points from 15.9 percent in June<br />

2003 to 11.8 percent in June 2004. Although the decrease in the NPL<br />

was a positive sign to the banking system, the NPL was still a cause of<br />

concern and there was a need for greater domestic economic improvement<br />

and other financial tools to address the situation.<br />

On a positive note, the financial strength of the domestic banking system<br />

as a whole is still adequate to provide liquidity to finance real output<br />

expansions.<br />

Interest and Exchange Rates<br />

3 6 9 12<br />

Source: Hongkong and Shanghai Banking Corporation<br />

CHART 5.1: BRUNEI DARUSSALAM EXPORT, IMPORT<br />

& BALANCE OF TRADE, APRIL-MAY 2003 & APRIL-<br />

MAY 2004<br />

BND Million<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

-<br />

April 2003 April 2004 May 2003 May 2004<br />

Total Exports 584.0 655.4 617.5 619.0<br />

Total Imports 217.2 188.7 198.2 196.6<br />

Total Trade 801.2 844.1 815.6 815.5<br />

Balance of Trade 366.8 466.7 419.3 422.4<br />

CHART 5.2: BRUNEI DARUSSALAM EXPORT, IMPORT<br />

& BALANCE OF TRADE, JANUARY-MAY 2004<br />

BND Million<br />

150 0<br />

10 0 0<br />

500<br />

0<br />

Total Exports 689.4 627.4 714.4 655.4 619.0<br />

Total Imports 205.6 335.8 194.0 188.7 196.6<br />

Total Trade 895.1 963.2 908.4 844.1 815.5<br />

Balance of<br />

Trade<br />

Jan<br />

2004<br />

Feb<br />

2004<br />

Mar<br />

2004<br />

Apr<br />

2004<br />

May<br />

2004<br />

483.8 291.6 520.4 466.7 422.4<br />

The interest rates in the <strong>Brunei</strong> Darussalam banking system had declined<br />

continuously over the past five years through the end of 2003,<br />

apparently squeezed by a combination of regulatory and market pressure.<br />

Surprisingly the prime lending rates remained unchanged at 5.5<br />

percent per annum since September 2000. Deposits rates (Chart 4.3)<br />

were also unchanged as in last quarter of 2003 at 0.225 percent, 0.25<br />

percent and 0.3375 percent for the 3, 6 and 12-month deposits respectively.<br />

Savings deposit rates varied according to the amounts deposited.<br />

There is no interest for deposits of less than BND 499.99. The interest<br />

rates of 0.05 percent is specified for deposits of between BND500<br />

and BND99,999.99 and 0.1 percent for deposits of BND100,000.00 and<br />

above.<br />

Singapore’s lending rates of 5.3 percent also remained constant since<br />

the last quarter of 2003. The 3, 6 and 12-month deposits were still unchanged<br />

at 0.41 percent, 0.52 percent and 0.71 percent respectively.<br />

Similarly, the highest negotiated Singapore’s savings deposit rates of<br />

0.23 percent remained unchanged. Generally, the rates offered by<br />

banks in Singapore were more attractive for various investments than<br />

those offered by the domestic banking system.<br />

From January 2004 to June 2004, the <strong>Brunei</strong> Dollar depreciated against<br />

the US dollar from 1.6987 to 1.7120 on average and from 1.7020 to<br />

1.7243 at end of period. Based on past trend, the US dollar is expected<br />

to weaken and forecasted to prevail at 1.58 against the <strong>Brunei</strong> Dollar at<br />

the end of the year.<br />

Conclusion<br />

The growth momentum of the monetary sector as a whole were dependent<br />

on the progress in the domestic economic developments and<br />

activities and the indirect impact of the exchange rate volatility affecting<br />

demand and supply of domestic trades.<br />

External Sector<br />

Total and Balance of Trade<br />

In April 2004, the total trade was BND 844.1 million which was an increase<br />

of 5.4 per cent from BND 801.2 million in April 2003. However<br />

in May 2004, there was a slight reduction in total trade by 0.02 per cent<br />

from BND 815.6 million in May 2003 to BND 815.5 million. Similarly,<br />

total trade decreased by 3.4 per cent between April and May 2004.<br />

A trade surplus of BND 466.7 million was recorded in April 2004<br />

which was 27.2 per cent higher than April 2003 figure of BND 366.8<br />

million. In May 2004, a trade surplus was also recorded which was 0.7<br />

per cent higher from BND 419.3 million in May 2003 to BND 422.4 million.<br />

However, there was reductions in trade surplus by 9.5 per cent<br />

between April and May 2004 (Chart 5.1).<br />

Both the total trade and trade surplus showed downward trend for the<br />

period between January to May 2004 (Chart 5.2).

P AGE 10<br />

BRUNEI ECONOMIC BULLETIN<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

CHART 5.3: EXPORTS BY MAJOR COMMODITY, JAN-MAY 2004<br />

April<br />

2003<br />

BND Million<br />

April<br />

2004<br />

May<br />

2003<br />

May<br />

2004<br />

Apr '03 &<br />

Apr '04<br />

% Change<br />

May '03<br />

& May<br />

'04<br />

Apr '04 &<br />

May '04<br />

Oil and Gas 545.0 591.2 548.8 575.3 8.5 4.8 (2.7)<br />

Petroleum 301.3 336.3 308.2 387.2 11.6 25.6 15.1<br />

LNG 243.6 254.9 240.6 188.1 4.6 (21.8) (26.2)<br />

Non-Oil &<br />

Gas<br />

39.0 64.2 68.7 43.7 64.4 (36.4) (32.0)<br />

Garment 20.8 27.4 39.7 23.4 31.8 (41.2) (14.8)<br />

Machinery<br />

& Transport<br />

Equipment<br />

11.4 29.1 16.2 13.9 154.3 (14.1) (52.2)<br />

Others 6.8 7.7 12.8 6.4 13.0 (49.9) (16.5)<br />

Total Exports<br />

BND Million<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

Jan '04 Feb '04 Mar '04 Apr '04 May '04<br />

Total Exports 689.4 627.4 714.4 655.4 619.0<br />

Oil and Gas 624.6 544.6 659.0 591.2 575.3<br />

Non-Oil & Gas 64.8 82.8 55.4 64.2 43.7<br />

TABLE 5.1: EXPORTS BY MAJOR COMMODITY, APRIL-MAY 2003<br />

AND APRIL-MAY 2004<br />

584.0 655.4 617.5 619.0 12.2 0.2 (5.6)<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

BND Million<br />

Exports<br />

The total exports in April 2004 increased by 12.2 per cent from<br />

BND 584.0 million in April 2003 to BND 655.4 million. In May<br />

2004, total exports were BND 619.0 million which was an increase<br />

of 0.2 per cent from BND 617.5 million in May 2003.<br />

However there were reduction in total exports by 5.6 per cent<br />

between April and May 2004. Exports in April and May 2004<br />

were still dominated by oil and gas which contributed 90.2 per<br />

cent and 92.9 per cent of total exports respectively.<br />

With respect to the trend of total exports for the period between<br />

January and May 2004, it showed some correlation with<br />

the Oil and Gas exports since Oil and Gas were the major exports<br />

for <strong>Brunei</strong> Darussalam (Chart 5.3).<br />

Oil and Gas exports in April 2004 were BND 591.2 million<br />

which was an increase of 8.5 per cent from BND 545.0 million<br />

in April 2003. Oil and Gas exports in May 2004 also increased<br />

by 4.8 per cent from BND 548.8 million in May 2003 to BND<br />

575.3 million. However Oil and Gas exports decreased by 5.6<br />

per cent in May 2004 on a month-month basis.<br />

Petroleum exports (crude and condensate) in May 2004 was<br />

BND 387.2 million which was 25.6 per cent higher compared<br />

to May 2003. The increase was due to higher oil price which<br />

recorded average oil price per barrel of US$39.40 in May 2004<br />

compared to US$27.18 in May 2003. Similarly, the petroleum<br />

exports increased by 11.6 per cent in April 2004 from the same<br />

month of 2003 as a result of higher oil price which recorded<br />

average oil price per barrel of US$37.23 in April 2004 compared<br />

to US$27.69 in April 2003. On month on month basis,<br />

petroleum exports increased by 15.1 per cent in May 2004.<br />

The LNG exports in April 2004 was BND 254.9 million. This<br />

was an increase of 4.6 per cent compared to BND 243.6 million<br />

in April 2003. In contrast to April 2004, the LNG exports decreased<br />

by 21.8 per cent from BND 240.6 million in May 2003<br />

to BND 188.1 million in May 2004. Similarly, the LNG exports<br />

decreased by 26.2 per cent between April and May 2004. The<br />

decrease was due to lower LNG production for exports which<br />

recorded only 908,235.81 MMBtu/day in May 2004 compared<br />

to 1,036,790.0 MMBtu/day in May 2003. The average LNG<br />

price for April and May 2004 were US$4.68 per MMBtu and<br />

US$4.74 per MMBtu respectively.<br />

The Non-Oil and Gas exports in April 2004 were BND 64.2<br />

million. This was indeed an increase of 64.4 per cent from<br />

BND 39.0 million in April 2003. The increase was mainly due<br />

to higher exports of Machinery & Transport Equipment in<br />

April 2004 of BND 29.1 million which was an increase of 154.3<br />

per cent from BND 11.4 million in April 2003.<br />

In May 2004, Non-Oil and Gas exports decreased by 36.4 per<br />

cent from BND 68.7 million in May 2003 to BND 43.7 million.<br />

This was mainly due to lower exports of Garment in May 2004<br />

of BND 23.4 million which was a decrease of 41.2 per cent<br />

from BND 39.7 million in May 2003.<br />

Similarly, Non-Oil and Gas exports decreased by 32.0 per cent<br />

in May 2004 on a month-month basis. The decrease was<br />

mainly due to lower exports of Machinery & Transport Equipment<br />

by 52.2 per cent in May 2004 (Table 5.1).

BRUNEI ECONOMIC BULLETIN<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

P AGE 11<br />

AUSTRALIA<br />

12 .7%<br />

CHINA<br />

KOREA<br />

9.7%<br />

OTHERS<br />

26.9%<br />

8.3%<br />

AUSTRALIA<br />

6.0%<br />

CHART 5.4: EXPORT MARKET IN APRIL 2004<br />

CHINA<br />

0.0%<br />

OTHERS<br />

10 .8 %<br />

JAPAN<br />

44.4%<br />

CHART 5.5: EXPORT MARKET IN MAY 2004<br />

KOREA<br />

13.9%<br />

ASEAN<br />

9.9%<br />

ASEAN<br />

22.4%<br />

JAPAN<br />

35.0%<br />

TABLE 5.2: EXPORT MARKET FOR APRIL-MAY 2003 AND APRIL-MAY 2004<br />

April<br />

2003<br />

BND Million<br />

April<br />

2004<br />

May<br />

2003<br />

May<br />

2004<br />

Apr '03<br />

& Apr<br />

'04<br />

% Change<br />

May '03<br />

& May<br />

'04<br />

Apr '04 &<br />

May '04<br />

ASEAN 151.5 147.0 157.5 61.6 (3.0) (60.9) (58.1)<br />

JAPAN 238.9 290.9 267.2 216.4 21.8 (19.0) (25.6)<br />

KOREA 48.4 63.3 45.9 86.1 30.6 87.4 36.0<br />

AUSTRA-<br />

LIA<br />

52.1 83.2 50.8 36.9 59.7 (27.4) (55.6)<br />

CHINA 29.4 0.2 30.2 51.5 (99.4) 70.6 27,356.7<br />

OTHERS 63.8 70.9 65.8 166.6 11.2 153.1 135.0<br />

TOTAL<br />

EXPORTS<br />

584.0 655.4 617.5 619.0 12.2 0.2 (5.6)<br />

TABLE 5.3: IMPORTS BY COMMODITY, APRIL-MAY 2003 AND APRIL-MAY<br />

2004<br />

BND Million<br />

% Change<br />

April<br />

'03<br />

April<br />

'04<br />

May<br />

'03<br />

May<br />

'04<br />

Apr<br />

'03 &<br />

Apr<br />

'04<br />

May<br />

'03 &<br />

May<br />

'04<br />

Apr<br />

'04 &<br />

May<br />

'04<br />

Food & live animals 30.1 23.4 23.6 31.7 (22.4) 34.3 35.5<br />

Beverages & tobacco 4.0 6.0 3.6 4.3 49.9 19.1 (28.3)<br />

Crude material inedible<br />

5.5 2.0 1.8 1.4 (63.5) (20.4) (29.2)<br />

Mineral fuels 1.7 1.3 1.6 1.6 (23.5) (0.5) 17.8<br />

Animal & vegetable<br />

oils and fats<br />

1.3 1.3 1.4 1.3 (3.4) (8.6) 1.0<br />

Chemicals 14.9 16.5 16.8 16.7 10.2 (0.8) 1.2<br />

Manufactured goods 64.7 55.7 61.1 49.9 (14.0) (18.4) (10.4)<br />

Machinery & transport<br />

equipments<br />

70.5 61.2 68.2 68.5 (13.2) 0.4 12.0<br />

Miscellaneous manufactured<br />

articles<br />

23.7 20.5 19.0 20.7 (13.5) 8.7 1.1<br />

Miscellaneous transactions<br />

and commodities,<br />

n.e.cmanufactured<br />

articles<br />

0.7 0.8 1.0 0.5 24.6 (48.5) (41.8)<br />

Total imports (c.i.f) 217.2 188.7 198.2 196.6 (13.1) (0.8) 4.2<br />

With respect to the destination of exports, in April 2004, 44.4<br />

per cent of the total exports were to Japan, followed by<br />

ASEAN countries (22.4 per cent), Australia (12.7 per cent) and<br />

Korea (9.7 per cent) (Chart 5.4). Compared to April 2003,<br />

<strong>Brunei</strong>’s exports to Australia, Korea and Japan in April 2004<br />

increased by 59.7 per cent, 30.6 per cent and 21.8 per cent respectively.<br />

Exports to China and ASEAN countries declined by<br />

99.4 per cent and 3.0 per cent respectively. The huge decrease<br />

of <strong>Brunei</strong> Darussalam’s exports to China was due to no Petroleum<br />

exports in April 2004.<br />

In May 2004, Japan remained the dominant exports market<br />

which accounted for 35.0 per cent of total exports, followed by<br />

Korea (13.9 per cent), ASEAN countries (9.9 per cent), China<br />

(8.3 per cent) and Australia (6.0 per cent) (Chart 5.5). Compared<br />

to May 2003, <strong>Brunei</strong>’s exports to Korea and China in<br />

May 2004 increased by 87.4 per cent and 70.6 per cent respectively.<br />

Exports to ASEAN countries, Australia and Japan declined<br />

by 60.9 per cent, 27.4 per cent and 19.0 per cent respectively.<br />

In comparison to April 2004, <strong>Brunei</strong> Darussalam’s exports in<br />

May 2004 to Korea increased by 36.0 per cent from BND 63.3<br />

million to BND 86.1 million. There was also a significant increase<br />

in exports to China from BND 187,492 in April 2004 to<br />

BND 51,479,048 in May 2004 due to exports of mineral fuels<br />

recorded at BND 51,476,041 in May 2004. However, there were<br />

reductions in exports to ASEAN Countries, Australia and Japan<br />

by 58.1 per cent, 55.6 per cent and 25.6 per cent respectively<br />

(Table 5.2).<br />

Imports<br />

In April 2004, total imports were BND 188.7 million, which<br />

was a decrease of 13.1 per cent compared to April 2003 imports<br />

of BND 217.2 million. The decrease in imports was due<br />

to the decline in the imports of Crude Material Inedible by 63.5<br />

per cent, Mineral Fuels (23.5 per cent), Food & Live Animals<br />

(22.4 per cent), Manufactured Goods (14.0 per cent), Miscellaneous<br />

Manufactures Articles (13.5 per cent), Machinery &<br />

Transport Equipment (13.2 per cent) and Animal & Vegetable<br />

Oils and Fats (3.4 per cent). Such decreases were moderated by<br />

the increases in Beverages & Tobacco by 49.9 per cent, Miscellaneous<br />

Transactions and Commodities (24.6 per cent) and<br />

Chemicals (10.2 per cent).<br />

In May 2004, total imports decreased slightly by 0.8 per cent<br />

from BND 198.2 million in May 2003 to BND 196.6 million due<br />

to the reduction in the imports of Miscellaneous Transactions<br />

and Commodities by 48.5 per cent, Crude Material Inedible<br />

(20.4 per cent), Manufactured Goods (18.4 per cent), Animal &<br />

Vegetables Oils & Fats (8.6 per cent), Chemicals (0.8 per cent)<br />

and Mineral Fuels (0.5 per cent). The increases in Food & Live<br />

Animals by 34.3 per cent, Beverages & Tobacco (19.1 per cent),<br />

Miscellaneous Manufactured Articles (8.7 per cent) and Machinery<br />

& Transport Equipment (0.4 per cent) were insufficient<br />

to offset the total reduction in imports.<br />

On the contrary, total imports increased by 4.2 per cent in May<br />

2004 on a month-on-month basis due mainly to high imports<br />

of Food & Live Animals by 35.5 per cent and also imports of<br />

Machinery & Transport Equipment by 12.0 per cent in May<br />

2004 (Table 5.3).

P AGE 12<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

BRUNEI ECONOMIC BULLETIN<br />

CHART 5.6: TOTAL IMPORTS, JANUARY-MAY 2004<br />

350<br />

BND Million<br />

CHART 5.7: MAJOR COMMODITY IMPORTS IN<br />

APRIL 2004<br />

M iscellaneous<br />

manufactured<br />

articles<br />

10.9%<br />

Machinery &<br />

transport<br />

equipments<br />

32.4%<br />

Others<br />

6.1%<br />

Food & live<br />

animals<br />

12.4%<br />

Chemicals<br />

8.7%<br />

M anufactured<br />

goods<br />

29.5%<br />

CHART 5.8: MAJOR COMMODITY IMPORTS IN MAY<br />

2004<br />

M iscellaneous<br />

manufactured<br />

articles<br />

10.5%<br />

Machinery &<br />

transport<br />

equipments<br />

34.9%<br />

10 0 %<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

300<br />

250<br />

200<br />

150<br />

11.3<br />

6.1<br />

14.1<br />

10.5<br />

29.2<br />

23.6<br />

17.7<br />

104.6<br />

Others<br />

4.6%<br />

15.1<br />

3.9<br />

11.2<br />

10.3<br />

20.4<br />

17.9<br />

17.5<br />

92.3<br />

12.2<br />

6.1<br />

9.8<br />

8.6<br />

17.8<br />

19.7<br />

24.4<br />

99.5<br />

Trend Line<br />

Jan 2004 Feb 2004 M ac 2004 Apr 2004 M ay 2004<br />

Total Imports 205.6 335.8 194.0 188.7 196.6<br />

Food & live<br />

animals<br />

16.1%<br />

Chemicals<br />

8.5%<br />

M anufactured<br />

goods<br />

25.4%<br />

CHART 5.9: ORIGIN OF IMPORTS, APRIL-MAY 2003 AND<br />

APRIL-MAY 2004<br />

BND<br />

M illion<br />

11.7<br />

6.7<br />

10.3<br />

12.2<br />

23.7<br />

21.6<br />

17.1<br />

93.2<br />

April '03 April '04 May '03 May '04<br />

ASEAN EU JAPAN USA CHINA HONG KONG AUSTRALIA OTHERS<br />

Total imports showed a downward trend for the period between<br />

January and May 2004 (Chart 5.6). The high total imports<br />

in February 2004 was due to high imports of Machinery<br />

& Transport Equipment from the European Union.<br />

In April 2004, Machinery and Transport Equipment constituted<br />

32.4 per cent of total imports, followed by Manufactured<br />

Goods (29.5 per cent), Food & live animals (12.4 per cent), Miscellaneous<br />

Manufactured Articles (10.9 per cent) and Chemicals<br />

(8.7 per cent) (Chart 5.7).<br />

In May 2004, Machinery and Transport Equipment remained<br />

the major imports commodity which accounted for 34.9 per<br />

cent of total imports, followed by Manufactured Goods (25.4<br />

per cent), Food & live animals (16.1 per cent), Miscellaneous<br />

Manufactured Articles (10.5 per cent) and Chemicals (8.5 per<br />

cent) (Chart 5.8).<br />

With regards to the origin of imports, in April 2004, 48.9 per<br />

cent of total imports were from ASEAN countries, followed by<br />

the USA (10.8 per cent), Japan (9.5 per cent), the European<br />

Union (9.3 per cent), Hong Kong (5.9 per cent), China (5.4 per<br />

cent) and Australia (2.1 per cent) (Chart 5.9).<br />

Compared to April 2003, <strong>Brunei</strong> Darussalam’s imports in April<br />

2004 from Australia, the USA, Japan, Hong Kong, ASEAN<br />

countries, China and the European Union decreased by 37.0<br />

per cent, 30.1 per cent, 24.1 per cent, 20.2 per cent, 11.7 per<br />

cent, 2.6 per cent and 1.0 per cent respectively.<br />

In May 2004, ASEAN countries remained the main source of<br />

imports which accounted for 47.4 per cent of total imports,<br />

followed by the USA (12.1 per cent), Japan (11.0 per cent), the<br />

European Union (8.7 per cent), China (6.2 per cent), Hong<br />

Kong (5.2 per cent) and Australia (3.4 per cent).<br />

In comparison to May 2003, <strong>Brunei</strong> Darussalam’s imports in<br />

May 2004 from China increased by 42.5 per cent, followed by<br />

the USA (33.2 per cent), Australia (9.9 per cent), Japan (9.6 per<br />

cent) and Hong Kong (5.2 per cent). However, imports from<br />

the European Union and ASEAN countries declined by 29.9<br />

per cent and 6.3 per cent respectively.<br />

Compared to April 2004, <strong>Brunei</strong> Darussalam’s May 2004 imports<br />

from Australia increased by 72.7 per cent, followed by<br />

Japan (20.6 per cent), China (19.0 per cent), the USA (16.0 per<br />

cent) and ASEAN countries (1.0 per cent). However, imports<br />

from Hong Kong and the European Union declined by 8.2 per<br />

cent and 2.6 per cent respectively (Table 5.4).<br />

TABLE 5.4: ORIGIN OF IMPORTS, APRIL-MAY 2003 AND APRIL-MAY 2004<br />

BND Million<br />

April '03 April '04 May '03 May '04<br />

April '03<br />

& April<br />

'04<br />

% Change<br />

May '03<br />

& May<br />

'04<br />

April '04<br />

& May<br />

'04<br />

ASEAN 104.6 92.3 99.5 93.2 (11.7) (6.3) 1.0<br />

EU 17.7 17.5 24.4 17.1 (1.0) (29.9) (2.6)<br />

JAPAN 23.6 17.9 19.7 21.6 (24.1) 9.6 20.6<br />

USA 29.2 20.4 17.8 23.7 (30.1) 33.2 16.0<br />

CHINA 10.5 10.3 8.6 12.2 (2.6) 42.5 19.0<br />

HONG<br />

KONG<br />

14.1 11.2 9.8 10.3 (20.2) 5.2 (8.2)<br />

AUSTRALIA 6.1 3.9 6.1 6.7 (37.0) 9.9 72.7<br />

OTHERS 11.3 15.1 12.2 11.7 32.9 (4.7) (22.5)<br />

TOTAL<br />

IMPORTS<br />

217.2 188.7 198.2 196.6 (13.1) (0.8) 4.2

BRUNEI ECONOMIC BULLETIN<br />

P AGE 13<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

Chart 6.1: <strong>Brunei</strong> Darussalam Average Weighted Crude Oil<br />

Prices<br />

US$/Barrel<br />

45<br />

40<br />

35<br />

30<br />

25<br />

33.41<br />

32.39<br />

32.27 32.73<br />

31.02<br />

30.98<br />

30.03<br />

31.35<br />

28.64 30.02<br />

30.35 29.35<br />

27.85<br />

27.69<br />

25.73<br />

27.07<br />

26.31 26.51 27.18<br />

24.60<br />

26.60<br />

24.76<br />

39.4<br />

38.47<br />

37.23<br />

36.22 37.83<br />

Average Weighted Crude Oil Price Index<br />

The average weighted Crude Oil Price Index (COPI) for Q2 2004 increased<br />

by 39.8 per cent year-on-year from 92 to 128.6. On a quarteron-quarter<br />

basis, the COPI increased by 7.3 per cent from 119.8 (Table<br />

6.1).<br />

<strong>Brunei</strong> Darussalam’s average weighted crude oil price decreased by<br />

3.2 per cent from US$38.47 per barrel in March 2004 to US$37.23 per<br />

barrel in April 2004 (Table 6.1 and Chart 6.1). Then it rose by 5.8 per<br />

cent to US$39.4 in May 2004. However, it decreased again by 4 per cent<br />

to US$37.83 per barrel in June 2004. The average weighted crude oil<br />

price stood at US$38.2 per barrel in Q2 2004 compared to US$27.33 per<br />

barrel in Q2 2003 and US$35.59 per barrel in Q1 2003.<br />

20<br />

APR 2002 JUL OCT JAN 2003 APR JULY OCT JAN 2004 APR<br />

Source: Petroleum Unit, Prime Minister's Office<br />

Table 6.1 : Average Weighted Price of Crude Oil<br />

Unit - US$/Barrel<br />

2001 2002 2003 2004<br />

JAN 26.24 19.67 30.02 32.73<br />

FEB 27.27 20.17 30.98 36.22<br />

MAC 26.79 22.99 33.41 38.47<br />

APR 27.75 24.76 27.69 37.23<br />

MAY 28.99 25.73 27.18 39.40<br />

JUN 28.05 24.60 27.07 37.83<br />

JUL 25.99 26.31 30.03<br />

AUG 24.91 27.85 30.35<br />

SEP 24.96 28.64 29.35<br />

OCT 20.19 26.60 32.39<br />

NOV 18.79 26.51 32.27<br />

DEC 18.60 31.02 31.35<br />

Average W.Crude Oil Price for the<br />

Year<br />

24.67 25.33 30.17<br />

Average W.Crude Oil Price Q1 26.73 20.87 33.41 35.59<br />

Average W.Crude Oil Price Q2 28.23 25.03 27.30 38.20<br />

Average W.Crude Oil Price Q3 25.29 27.59 29.33<br />

Average W.Crude Oil Price Q4 19.19 28.02 32.00<br />

Average W.Crude Oil Price 1H 27.45 22.95 30.33 36.89<br />

Average W.Crude Oil Price 2H 23.19 27.51 30.71<br />

Average Weighted Crude Oil Price Index<br />

2001 2002 2003 2004<br />

JAN 88.3 66.2 101.0 110.2<br />

FEB 91.8 67.9 104.3 121.9<br />

MAC 90.2 77.4 112.5 129.5<br />

APR 93.4 83.3 93.2 125.3<br />

MAY 97.6 86.6 91.5 132.6<br />

JUN 94.4 82.8 91.1 127.3<br />

JUL 87.5 88.6 101.1<br />

AUG 83.8 93.7 102.2<br />

SEP 84.0 96.4 98.8<br />

OCT 68.0 89.5 109.0<br />

NOV 63.2 89.2 108.6<br />

DEC 62.6 104.4 105.5<br />

Average Index for the Year 83.0 85.3 101.5<br />

Average Index for Q1 90.0 70.2 106.1 119.8<br />

Average Index for Q2 95.0 84.2 91.9 128.6<br />

Average Index for Q3 85.1 92.9 98.7<br />

Average Index for Q4 64.6 94.3 107.7<br />

Average Index for 1H 92.4 77.2 102.1<br />

Average Index for 2H 78.1 92.6 103.4<br />

Base year 2000=100<br />

Source: Petroleum Unit, Prime Minister's Office<br />

World oil prices closed at around US$35.45 per barrel at the end of Q1<br />

2004. Prices remained stable above US$33.45 per barrel throughout<br />

April 2004. May 5 then saw oil prices hit a fresh 13-year high reaching<br />

US$39.40 per barrel due to tight supplies in the US and the fear that<br />

violence in the Middle East would intensify. A day later, prices rose<br />

further to US$39.40 per barrel amid renewed violence in the Middle<br />

East.<br />

On May 13, oil prices hit an all-time high reaching US$40.60 per barrel<br />

following worries about global demand and gasoline supplies. Prices<br />

rose further on May 17 to a new record high (around US$41.40 per<br />

barrel) on concern that rapid fuel demand growth would outpace<br />

global supplies at a time when traders feared an attack on the Middle<br />

East oil infrastructure. Prices eventually fell a day later to around<br />

US$40.10 per barrel on signs that the oil producers' cartel, the Organization<br />

of Petroleum Exporting Countries (OPEC), would vote to increase<br />

production when it was due to meet in June 2004.<br />

May 24 however saw oil prices rose again to around US$41.30 per barrel<br />

due to soaring oil demand caused by global economic expansion.<br />

There has been higher than expected oil demand in industrialized<br />

countries. China’s rapidly expanding economy also has created a huge<br />

demand boost. Prices then remained stable around US$40.90 per barrel<br />

throughout the end of May 2004.<br />

On June 1, oil prices struck a new record high (around US$41.70 per<br />

barrel) on concerns that a violence campaigns by Islamic militants in<br />

Saudi Arabia could destabilize the world’s biggest crude exporter. The<br />

next two weeks subsequently saw oil prices on a falling trend to<br />

around US$38.39 per barrel amid expectations that higher OPEC production<br />

and rising imports of the United States of America (USA)<br />

would increase inventories in the USA, the world's largest energy consumer.<br />

Prices however increased again on June 18 to around US$38.50 per<br />

barrel after attacks on pipelines in Iraq. The next two weeks then saw<br />

oil prices declined gradually and eventually closed at around US$37.50<br />

per barrel at the end of June 2004.

P AGE 14<br />

BRUNEI ECONOMIC BULLETIN<br />

BRUNEI DARUSSALAM Q2 2004<br />

ECONOMIC REVIEW & OUTLOOK AND RECENT ECONOMIC DEVELOPMENTS<br />

<strong>Economic</strong> Outlook for Q2 2004<br />

The economy of <strong>Brunei</strong> Darussalam is expected to grow further in Q3<br />

2004 and again the non-oil private sector is likely to provide the momentum.<br />

On the production side, the oil and gas sector may not show<br />

significant increase due to “capacity constraint”. However, the higher<br />

oil price may contribute to higher export revenue and the resulting<br />

general spill-over effects. Furthermore, economic expansion of regional<br />

economies may help boost business confidence in this country.<br />

The non-oil private sector will be enhanced by expansions in mining,<br />

quarrying and manufacturing, construction, wholesale and retail<br />

trades, transportation and communication and other services sectors.<br />

These are the sectors which have revealed significant growth during<br />

the first half of 2004. The restaurant and hotel sector in particular, will<br />

be boosted by the upcoming royal birthday and wedding functions.<br />

Furthermore, an examination of job vacancies 1 in the private sector has<br />

revealed a significant increment over the past two quarters, especially<br />

in the services sector. With better economic outlook and more investment,<br />

job opportunities are also anticipated to increase further along<br />

with non-oil sector growth.<br />

As expected, the government financial position (budget surplus) has<br />

improved in Q2 2004 compared to Q1 2004 but this was largely due to<br />

the decline in government current expenses. During the same period,<br />

the government development expenditure is expected to increase<br />

again in Q3 2004.<br />