annual report 2005 - Arab Banking Corporation, ALGERIA

annual report 2005 - Arab Banking Corporation, ALGERIA

annual report 2005 - Arab Banking Corporation, ALGERIA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Credit division completed its reorganisation in <strong>2005</strong> that resulted in a more efficient and<br />

reliable method for the credit files processing.<br />

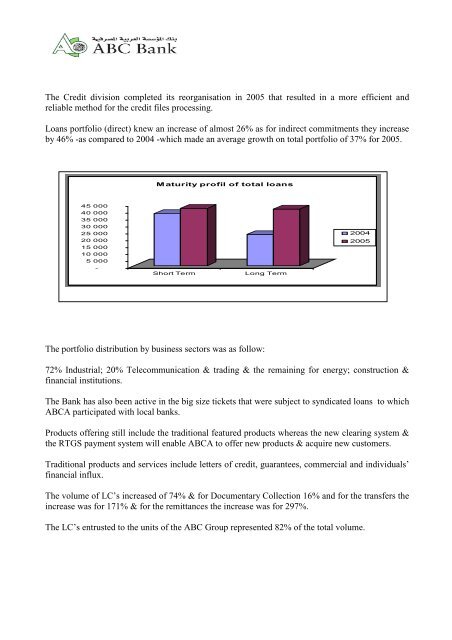

Loans portfolio (direct) knew an increase of almost 26% as for indirect commitments they increase<br />

by 46% -as compared to 2004 -which made an average growth on total portfolio of 37% for <strong>2005</strong>.<br />

Maturity profil of total loans<br />

45 000<br />

40 000<br />

35 000<br />

30 000<br />

25 000<br />

20 000<br />

15 000<br />

10 000<br />

5 000<br />

-<br />

Short Term<br />

Long Term<br />

2004<br />

<strong>2005</strong><br />

The portfolio distribution by business sectors was as follow:<br />

72% Industrial; 20% Telecommunication & trading & the remaining for energy; construction &<br />

financial institutions.<br />

The Bank has also been active in the big size tickets that were subject to syndicated loans to which<br />

ABCA participated with local banks.<br />

Products offering still include the traditional featured products whereas the new clearing system &<br />

the RTGS payment system will enable ABCA to offer new products & acquire new customers.<br />

Traditional products and services include letters of credit, guarantees, commercial and individuals’<br />

financial influx.<br />

The volume of LC’s increased of 74% & for Documentary Collection 16% and for the transfers the<br />

increase was for 171% & for the remittances the increase was for 297%.<br />

The LC’s entrusted to the units of the ABC Group represented 82% of the total volume.