Antihypertensive Therapeutics Market Size, Share, Growth & Analysis Report 2020: Radiant Insights, Inc

GBI Research, the leading business intelligence provider, has released its latest research, ''Antihypertensive Therapeutics in Major Developed Markets to 2020 - Increased Uptake of Combination Therapies to Offset Effects of Key Patent Expiries'', which provides in-depth analysis of hypertension therapeutics market within the eight major geographies of the US, the top five European countries (the UK, France, Germany, Spain and Italy), Japan and Canada. The report provides an estimation of market size for 2013, along with market forecast until 2020. It also covers disease epidemiology, treatment algorithms, treatment patterns, in-depth analysis of the pipeline, and deal analysis. Browse Full Report With TOC @ http://www.radiantinsights.com/research/antihypertensive-therapeutics-in-major-developed-markets-to-2020-increased-uptake-of-combination-therapies-to-offset-effects-of-key-patent-expiries The value of the hypertension market in the major developed markets amounted to an estimated $40.0 billion in 2013 and is expected to decline during the forecast period at a negative Compound Annual Growth Rate (CAGR) of 0.9% to $37.6 billion in 2020, with growth expected from 2013 to 2017 at a CAGR of 2.6% and a decline thereafter. The initial growth will be due to the increased penetration of fixed-dose combination drugs (Amturnide, Exforge Tribenzor, Azor, Tekturna HCT, Edarbyclor, Twynsta, Benicar HCT, Micardis Plus, Tekamlo, Valturna), a rise in the prevalence population from 181 million to 190 million at a CAGR of 0.6%, and two new expected launches in the pipeline (azilsartan + amlodipine, and AHU377+ valsartan). However, due to the expiry of the exclusivity of major drugs both before and during the forecast period (Cozaar in 2010; Diovan, Avapro and Atacand in 2012; Exforge in 2014; Benicar in 2016; and Tekturna and Tekturna HCT in 2018), increased generic penetration and a low diagnosis rate, the market will decline from 2017.

GBI Research, the leading business intelligence provider, has released its latest research, ''Antihypertensive Therapeutics in Major Developed Markets to 2020 - Increased Uptake of Combination Therapies to Offset Effects of Key Patent Expiries'', which provides in-depth analysis of hypertension therapeutics market within the eight major geographies of the US, the top five European countries (the UK, France, Germany, Spain and Italy), Japan and Canada. The report provides an estimation of market size for 2013, along with market forecast until 2020. It also covers disease epidemiology, treatment algorithms, treatment patterns, in-depth analysis of the pipeline, and deal analysis.

Browse Full Report With TOC @ http://www.radiantinsights.com/research/antihypertensive-therapeutics-in-major-developed-markets-to-2020-increased-uptake-of-combination-therapies-to-offset-effects-of-key-patent-expiries

The value of the hypertension market in the major developed markets amounted to an estimated $40.0 billion in 2013 and is expected to decline during the forecast period at a negative Compound Annual Growth Rate (CAGR) of 0.9% to $37.6 billion in 2020, with growth expected from 2013 to 2017 at a CAGR of 2.6% and a decline thereafter. The initial growth will be due to the increased penetration of fixed-dose combination drugs (Amturnide, Exforge Tribenzor, Azor, Tekturna HCT, Edarbyclor, Twynsta, Benicar HCT, Micardis Plus, Tekamlo, Valturna), a rise in the prevalence population from 181 million to 190 million at a CAGR of 0.6%, and two new expected launches in the pipeline (azilsartan + amlodipine, and AHU377+ valsartan). However, due to the expiry of the exclusivity of major drugs both before and during the forecast period (Cozaar in 2010; Diovan, Avapro and Atacand in 2012; Exforge in 2014; Benicar in 2016; and Tekturna and Tekturna HCT in 2018), increased generic penetration and a low diagnosis rate, the market will decline from 2017.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

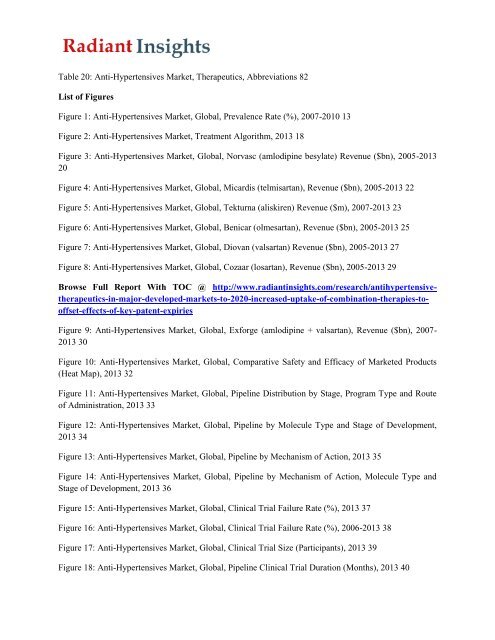

Table 20: Anti-Hypertensives <strong>Market</strong>, <strong>Therapeutics</strong>, Abbreviations 82<br />

List of Figures<br />

Figure 1: Anti-Hypertensives <strong>Market</strong>, Global, Prevalence Rate (%), 2007-2010 13<br />

Figure 2: Anti-Hypertensives <strong>Market</strong>, Treatment Algorithm, 2013 18<br />

Figure 3: Anti-Hypertensives <strong>Market</strong>, Global, Norvasc (amlodipine besylate) Revenue ($bn), 2005-2013<br />

20<br />

Figure 4: Anti-Hypertensives <strong>Market</strong>, Global, Micardis (telmisartan), Revenue ($bn), 2005-2013 22<br />

Figure 5: Anti-Hypertensives <strong>Market</strong>, Global, Tekturna (aliskiren) Revenue ($m), 2007-2013 23<br />

Figure 6: Anti-Hypertensives <strong>Market</strong>, Global, Benicar (olmesartan), Revenue ($bn), 2005-2013 25<br />

Figure 7: Anti-Hypertensives <strong>Market</strong>, Global, Diovan (valsartan) Revenue ($bn), 2005-2013 27<br />

Figure 8: Anti-Hypertensives <strong>Market</strong>, Global, Cozaar (losartan), Revenue ($bn), 2005-2013 29<br />

Browse Full <strong>Report</strong> With TOC @ http://www.radiantinsights.com/research/antihypertensivetherapeutics-in-major-developed-markets-to-<strong>2020</strong>-increased-uptake-of-combination-therapies-tooffset-effects-of-key-patent-expiries<br />

Figure 9: Anti-Hypertensives <strong>Market</strong>, Global, Exforge (amlodipine + valsartan), Revenue ($bn), 2007-<br />

2013 30<br />

Figure 10: Anti-Hypertensives <strong>Market</strong>, Global, Comparative Safety and Efficacy of <strong>Market</strong>ed Products<br />

(Heat Map), 2013 32<br />

Figure 11: Anti-Hypertensives <strong>Market</strong>, Global, Pipeline Distribution by Stage, Program Type and Route<br />

of Administration, 2013 33<br />

Figure 12: Anti-Hypertensives <strong>Market</strong>, Global, Pipeline by Molecule Type and Stage of Development,<br />

2013 34<br />

Figure 13: Anti-Hypertensives <strong>Market</strong>, Global, Pipeline by Mechanism of Action, 2013 35<br />

Figure 14: Anti-Hypertensives <strong>Market</strong>, Global, Pipeline by Mechanism of Action, Molecule Type and<br />

Stage of Development, 2013 36<br />

Figure 15: Anti-Hypertensives <strong>Market</strong>, Global, Clinical Trial Failure Rate (%), 2013 37<br />

Figure 16: Anti-Hypertensives <strong>Market</strong>, Global, Clinical Trial Failure Rate (%), 2006-2013 38<br />

Figure 17: Anti-Hypertensives <strong>Market</strong>, Global, Clinical Trial <strong>Size</strong> (Participants), 2013 39<br />

Figure 18: Anti-Hypertensives <strong>Market</strong>, Global, Pipeline Clinical Trial Duration (Months), 2013 40