Guggenheim StylePlus Large Core A - Security Benefit

Guggenheim StylePlus Large Core A - Security Benefit

Guggenheim StylePlus Large Core A - Security Benefit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

®<br />

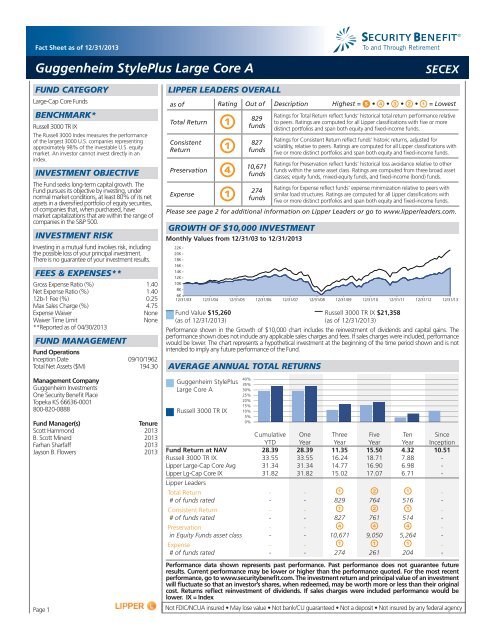

Fact Sheet as of 12/31/2013<br />

<strong>Guggenheim</strong> <strong>StylePlus</strong> <strong>Large</strong> <strong>Core</strong> A<br />

To and Through Retirement<br />

SECEX<br />

FUND CATEGORY<br />

<strong>Large</strong>-Cap <strong>Core</strong> Funds<br />

BENCHMARK*<br />

Russell 3000 TR IX<br />

The Russell 3000 Index measures the performance<br />

of the largest 3000 U.S. companies representing<br />

approximately 98% of the investable U.S. equity<br />

market. An investor cannot invest directly in an<br />

index.<br />

INVESTMENT OBJECTIVE<br />

The Fund seeks long-term capital growth. The<br />

Fund pursues its objective by investing, under<br />

normal market conditions, at least 80% of its net<br />

assets in a diversified portfolio of equity securities,<br />

of companies that, when purchased, have<br />

market capitalizations that are within the range of<br />

companies in the S&P 500.<br />

INVESTMENT RISK<br />

Investing in a mutual fund involves risk, including<br />

the possible loss of your principal investment.<br />

There is no guarantee of your investment results.<br />

FEES & EXPENSES**<br />

Gross Expense Ratio (%) 1.40<br />

Net Expense Ratio (%) 1.40<br />

12b-1 Fee (%) 0.25<br />

Max Sales Charge (%) 4.75<br />

Expense Waiver<br />

None<br />

Waiver Time Limit<br />

None<br />

**Reported as of 04/30/2013<br />

FUND MANAGEMENT<br />

Fund Operations<br />

Inception Date 09/10/1962<br />

Total Net Assets ($M) 194.30<br />

Management Company<br />

<strong>Guggenheim</strong> Investments<br />

One <strong>Security</strong> <strong>Benefit</strong> Place<br />

Topeka KS 66636-0001<br />

800-820-0888<br />

Fund Manager(s)<br />

Tenure<br />

Scott Hammond 2013<br />

B. Scott Minerd 2013<br />

Farhan Sharfaff 2013<br />

Jayson B. Flowers 2013<br />

Page 1<br />

LIPPER LEADERS OVERALL<br />

as of Rating Out of Description<br />

Total Return<br />

1 829<br />

funds<br />

Consistent<br />

Return 1 827<br />

funds<br />

Preservation<br />

4 10,671<br />

funds<br />

Expense<br />

1 274<br />

funds<br />

GROWTH OF $10,000 INVESTMENT<br />

Monthly Values from 12/31/03 to 12/31/2013<br />

22K<br />

20K<br />

18K<br />

16K<br />

14K<br />

12K<br />

10K<br />

8K<br />

6K<br />

12/31/03 12/31/04 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13<br />

Fund Value $15,260<br />

(as of 12/31/2013)<br />

AVERAGE ANNUAL TOTAL RETURNS<br />

<strong>Guggenheim</strong> <strong>StylePlus</strong><br />

<strong>Large</strong> <strong>Core</strong> A<br />

Russell 3000 TR IX<br />

Cumulative One Three Five Ten Since<br />

YTD Year Year Year Year Inception<br />

Fund Return at NAV 28.39 28.39 11.35 15.50 4.32 10.51<br />

Russell 3000 TR IX 33.55 33.55 16.24 18.71 7.88 -<br />

Lipper <strong>Large</strong>-Cap <strong>Core</strong> Avg 31.34 31.34 14.77 16.90 6.98 -<br />

Lipper Lg-Cap <strong>Core</strong> IX 31.82 31.82 15.02 17.07 6.71 -<br />

Lipper Leaders<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Highest = 5 • 4 • 3 • 2 • 1 = Lowest<br />

Ratings for Total Return reflect funds’ historical total return performance relative<br />

to peers. Ratings are computed for all Lipper classifications with five or more<br />

distinct portfolios and span both equity and fixed-income funds.<br />

Ratings for Consistent Return reflect funds’ historic returns, adjusted for<br />

volatility, relative to peers. Ratings are computed for all Lipper classifications with<br />

five or more distinct portfolios and span both equity and fixed-income funds.<br />

Ratings for Preservation reflect funds’ historical loss avoidance relative to other<br />

funds within the same asset class. Ratings are computed from three broad asset<br />

classes; equity funds, mixed-equity funds, and fixed-income (bond) funds.<br />

Ratings for Expense reflect funds’ expense minimization relative to peers with<br />

similar load structures. Ratings are computed for all Lipper classifications with<br />

five or more distinct portfolios and span both equity and fixed-income funds.<br />

Please see page 2 for additional information on Lipper Leaders or go to www.lipperleaders.com.<br />

Russell 3000 TR IX $21,358<br />

(as of 12/31/2013)<br />

Performance shown in the Growth of $10,000 chart includes the reinvestment of dividends and capital gains. The<br />

performance shown does not include any applicable sales charges and fees. If sales charges were included, performance<br />

would be lower. The chart represents a hypothetical investment at the beginning of the time period shown and is not<br />

intended to imply any future performance of the Fund.<br />

Total Return - - 1 2 1 -<br />

# of funds rated - - 829 764 516 -<br />

Consistent Return - - 1 2 1 -<br />

# of funds rated - - 827 761 514 -<br />

Preservation - - 4 4 4 -<br />

in Equity Funds asset class - - 10,671 9,050 5,264 -<br />

Expense - - 1 1 1 -<br />

# of funds rated - - 274 261 204 -<br />

Performance data shown represents past performance. Past performance does not guarantee future<br />

results. Current performance may be lower or higher than the performance quoted. For the most recent<br />

performance, go to www.securitybenefit.com. The investment return and principal value of an investment<br />

will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original<br />

cost. Returns reflect reinvestment of dividends. If sales charges were included performance would be<br />

lower. IX = Index<br />

Not FDIC/NCUA insured • May lose value • Not bank/CU guaranteed • Not a deposit • Not insured by any federal agency

<strong>Guggenheim</strong> <strong>StylePlus</strong> <strong>Large</strong> <strong>Core</strong> A<br />

RISK MEASURES - 3 YEAR<br />

Standard<br />

Deviation<br />

Sharpe<br />

Ratio<br />

13.56<br />

0.85<br />

Alpha 1 -0.45<br />

Standard deviation is a measure of risk that gauges the variability of actual returns from<br />

their expected values and the dispersion of these variations over time.<br />

Sharpe ratio is a measure that uses standard deviation and excess return to determine<br />

reward per unit of risk. The greater a portfolio’s Sharpe ratio, the better its risk-adjusted<br />

performance has been.<br />

Alpha measures a manager’s contribution to performance due to security selection or<br />

market timing relative to the benchmark.<br />

Beta 1 1.07 Beta measures a portfolio’s sensitivity to market movements relative to the benchmark.<br />

R-Squared 1 0.97<br />

R-squared is a measure that indicates the extent to which fluctuations in portfolio<br />

returns are correlated with those of the benchmark.<br />

1<br />

Statistics are measured against the Fund’s benchmark: Russell 3000 TR IX.<br />

TOP INDUSTRIES 2<br />

as of 11/30/13<br />

Industry Sector . . . . . . . . . . . . . . . . . . . . . .% of TNA<br />

Industrials. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.64<br />

Health Care . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.59<br />

Technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.52<br />

Consumer Services . . . . . . . . . . . . . . . . . . . . . . . . . 3.05<br />

Oil & Gas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.67<br />

Consumer Goods . . . . . . . . . . . . . . . . . . . . . . . . . . 1.87<br />

Financials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.84<br />

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.53<br />

Telecommunications . . . . . . . . . . . . . . . . . . . . . . . . 0.07<br />

Basic Materials. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.06<br />

2<br />

Sector weightings are based on ICB Industries.<br />

TOP TEN HOLDINGS<br />

as of 11/30/13<br />

Fund Holdings. . . . . . . . . . . . . . . . . . . . . . . % of TNA<br />

GEER MTN FING LTD / GEER MTN FING CORP 0 . 2.06<br />

<strong>Guggenheim</strong> Floating Rate Strategies Fund . . . . . 1.74<br />

<strong>Guggenheim</strong> Macro Opportunities Fund;Inst . . . . 1.69<br />

<strong>Guggenheim</strong> Invest BulletShares 2015 HY C . . . . 1.67<br />

<strong>Guggenheim</strong> Invest BulletShares 2016 HY C . . . . 1.67<br />

<strong>Guggenheim</strong> Invest BulletShares 2014 HY C . . . . 1.65<br />

Other Assets and Liabilities . . . . . . . . . . . . . . . . . . . 1.52<br />

NEW YORK N Y CITY MUN WTR FIN AUTH WTR & . .<br />

1.35<br />

DUANE STREET CLO, LTD FRN 14-Nov-2021 4. . . 1.31<br />

HSI ASSET SECURITIZATION CORPORATION TRU. 1.27<br />

PORTFOLIO CHARACTERISTICS<br />

as of 11/30/13<br />

Number of Holdings . . . . . . . . . . . . . . . . . . . . . . . .228<br />

Portfolio Turnover (%) . . . . . . . . . . . . . . . . . . . . . .217<br />

Avg Market Capitalization ($M) . . . . . . . . . . 122791.2<br />

Price to Earnings . . . . . . . . . . . . . . . . . . . . . . . . . 18.78<br />

Price to Book. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.31<br />

Top Holdings, Asset Allocation, and Sector Weightings<br />

data is based on information collected from the investment<br />

company, is updated as of the date shown in the section’s<br />

title, and will vary over time. Asset Allocation may equal<br />

less than or greater than 100% due to hedged funds or<br />

leveraged cash positions by the fund.<br />

ASSET ALLOCATION<br />

as of 11/30/13<br />

Fixed Income 66.22<br />

Equity 20.84<br />

Cash 11.62<br />

Other 1.31<br />

Lipper Leaders Overall ratings DO NOT take into account the effects of sales charges.<br />

The Lipper Leader Overall ratings are subject to change every month and are based<br />

on an equal-weighted average of percentile ranks for the Total Return, Consistent<br />

Return, Preservation, and Expense metrics over three-, five-, and ten-year periods (if<br />

applicable). The highest 20% of funds in each peer group are named Lipper Leaders<br />

or a 5, the next 20% receive a rating of 4, the middle 20% receive a rating of 3, the<br />

next 20% receive a rating of 2, and the lowest 20% receive a rating of 1. For more<br />

information on Lipper Leaders, go to www.lipperleaders.com.<br />

*Lipper Best Fit Index - A variety of market indices are available to benchmark fund<br />

performance. The Lipper Best-Fit Index is the market index that best correlates to a<br />

fund’s performance. Lipper Best-Fit indices are not available for funds with less than 3<br />

years of performance history.<br />

Lipper Services are not affiliated with <strong>Security</strong> Distributors, Inc. its subsidiaries and<br />

affiliates (<strong>Security</strong> <strong>Benefit</strong>). <strong>Security</strong> <strong>Benefit</strong> has no responsibility for the management<br />

operations of Lipper Services or any of its affiliates.<br />

This investment option may be available to you through the purchase of a variable<br />

annuity OR through a retirement plan or individual retirement account.<br />

Variable Annuity Contract Disclosures<br />

This fact sheet must be accompanied by the variable annuity performance report<br />

for the most recent calendar quarter end which contains standardized performance<br />

information at the variable annuity contract level.<br />

Certain of these annual returns pre-date the offering of the fund as an underlying<br />

investment option in the variable annuity. Pre-dated performance is hypothetical.<br />

Annuities are long-term investments suitable for retirement planning. Investing in<br />

variable annuities involves risk and there is no guarantee of investment results.<br />

Variable annuities are issued by <strong>Security</strong> <strong>Benefit</strong> Life Insurance Company (SBL) in all<br />

states except New York. In New York, variable annuities are issued by First <strong>Security</strong><br />

<strong>Benefit</strong> Life Insurance and Annuity Company of New York (FSBL), Rye Brook, New<br />

York. SBL is not authorized in the state of New York and does not transact insurance<br />

business in New York.<br />

Retirement Plan or Individual Retirement Account Disclosures (Retirement<br />

Program)<br />

Sales loads are waived by the funds for purchases made through such programs. If<br />

you purchased the fund outside your Retirement Program, you may be subject to<br />

these charges. Sales charges would reduce the performance quoted.<br />

You may also be subject to certain account level charges. The performance numbers<br />

quoted do not reflect the account charges of your Retirement Program, and would be<br />

lower if such charges were deducted. Refer to your retirement plan documentation or<br />

your individual account agreement for account level charges.<br />

Investing in mutual funds involves risk, including loss of principal, and there is no<br />

guarantee of investment results.<br />

General Disclosures<br />

Triple-digit or high double-digit performance is attributable, in part, to unusually<br />

favorable market conditions and may not be repeated or consistently achieved in the<br />

future. Recent market volatility may affect performance so that current performance<br />

may be lower. Performance, especially for short time periods, should not be the sole<br />

factor in making your investment decisions.<br />

You should carefully consider the investment objectives, risks, and charges<br />

and expenses of the Variable Annuity and its underlying investment options<br />

before investing. You may obtain a prospectus for the variable annuity and<br />

prospectuses or summary prospectuses (if available) for the underlying<br />

investment options by calling our Service Center at 1-800-888-2461. You<br />

should read the prospectuses carefully before investing. Investing in variable<br />

annuities involves risk and there is no guarantee of investment results.<br />

Securities are distributed by <strong>Security</strong> Distributors, Inc. (SDI). SDI is a wholly-owned<br />

subsidiary of SBL. SBL and FSBL are affiliates and wholly-owned subsidiaries of <strong>Security</strong><br />

<strong>Benefit</strong> Corporation (<strong>Security</strong> <strong>Benefit</strong>).<br />

Lipper Fund Fact Sheet Service a Lipper, a Thomson Reuters Company. Copyright<br />

2014 Thomson Reuters. All rights reserved. Any copying, republication or<br />

redistribution of Lipper content is expressly prohibited without the prior written<br />

consent of Lipper. Lipper Fund Fact Sheets Service; Product ID: SBEQOE<br />

<strong>Security</strong> Distributors, Inc.<br />

Page 2