PFRS newsletter - detroit police & fire retirement system

PFRS newsletter - detroit police & fire retirement system

PFRS newsletter - detroit police & fire retirement system

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Membership Newsletter Fall 2012<br />

Police and Fire Retirement System Investments in Detroit<br />

properties spark growth, buildings fully occupied.<br />

Chairman’s Message<br />

from Matt<br />

DETROIT, MI – The Police and Fire<br />

Retirement System of the City of Detroit has<br />

received full payment on its investment in the<br />

One Kennedy Square building and other key<br />

properties are seeing stable returns and record<br />

occupancies, a report shows.<br />

Just a few years ago few banks would lend<br />

money for renovation or new construction<br />

projects in the City of Detroit. If it were not<br />

for the investments made by the Police and<br />

Fire Retirement System many of these buildings<br />

would remain vacant and the One Kennedy<br />

Square project may never have been built.<br />

“The Police and Fire Retirement System is<br />

proud of its record of investing in commercial<br />

properties within the City of Detroit,” said<br />

Chairman Matt Gnatek. “The majority of<br />

the commercial properties in our Targeted<br />

Investment Fund are generating good yields<br />

and the entire $3 million loan made to the One<br />

Kennedy Square project has been repaid in full.<br />

No other pension <strong>system</strong> has made these types of<br />

investments to help grow businesses in the City.”<br />

Gnatek said the Pension Fund investments were<br />

highlighted by the Wall Street Journal and a<br />

real estate investment consultant. The Pension<br />

Fund’s Detroit Targeted Investment Fund<br />

had invested up to $25 million in revolving<br />

loans prior to the loan repayment from One<br />

Kennedy Square. Many of the development<br />

projects, Gnatek noted, could not have been<br />

done without financing from the Fund. The<br />

investment report was prepared by Alex Brown<br />

Realty, Inc. and presented to the Board by<br />

advisor Marty West at a recent meeting.<br />

“For a long time one of the few capital sources<br />

available to developers in the City of Detroit<br />

was the Police and Fire Pension Fund,” said<br />

West. “They had a plan to help stimulate growth<br />

in key areas of the city and it has resulted in<br />

performing loans and nearly fully occupied office<br />

and apartment buildings.”<br />

The <strong>PFRS</strong> invested in the Kales Building,<br />

One Kennedy Square, Lafer Building, Union<br />

at Midtown, Beethoven Apartments and the<br />

College Park Medical Building – all within the<br />

City of Detroit. The pension fund is receiving<br />

minimum interest rates ranging from 7.25<br />

percent to 8.5 percent.<br />

“The Police and Fire Pension Board has taken a<br />

lot of heat for so-called bad investments,” said<br />

Gnatek. “While there have been some isolated<br />

projects that went awry, the vast majority<br />

– even with the benefit of hindsight – were<br />

excellent investments for financial reasons and<br />

to help build density in the core city areas and<br />

underserved areas of the City and that was<br />

(continued on page 4)<br />

It’s fall in the Motor<br />

City and your Board of<br />

Trustees of the Police and<br />

Fire Retirement System<br />

and staff are diligently<br />

at work protecting the<br />

assets you have worked so<br />

hard for. Please allow me<br />

to make this very clear,<br />

this Board is about doing<br />

the right thing, investing<br />

your money wisely and<br />

prudently and protecting the pension funds that<br />

will pay for our <strong>retirement</strong>s (those of us still on<br />

the job) and provide stability for our retirees and<br />

beneficiaries perpetually into the future.<br />

This is a tough job and all of us – Trustees and<br />

Staff – agree on one thing to preserve and protect<br />

the fund. Having said that, you can be assured<br />

that there is a lot of give and take in reaching<br />

Board decisions and I have pledged to run the<br />

meetings with transparency, openness and full<br />

communication with all Trustees, Staff and our<br />

key vendors. Other than legally required closeddoor<br />

sessions, mainly for personnel matters, ALL<br />

of our business is conducted for everyone to see.<br />

Further, we have a new website www.<br />

<strong>PFRS</strong>Detroit.org and it provides everything<br />

you would want to know about the Pension<br />

Fund and our actions. We list meeting minutes<br />

and you can even calculate your <strong>retirement</strong><br />

benefits on-line.<br />

(continued on page 3)

Leadership changes, transitions at<br />

Police and Fire Board and Staff<br />

Cynthia A. Thomas was named by the General<br />

and Police and Fire Retirement System Boards<br />

as the replacement for Walter Stampor this<br />

summer after Mr. Stampor decided to retire<br />

after 44 years of service to the Pension Funds.<br />

Ms. Thomas had served for 8 years as the<br />

Assistant Executive Secretary to the Police<br />

and Fire Retirement System under Mr.<br />

Stampor and 26 years in varying roles with the<br />

Retirement Systems. Ms. Thomas is the first<br />

woman, first African American and one of<br />

the youngest ever to assume the duties of<br />

Executive Director of the City of Detroit<br />

Retirement Systems.<br />

Filling Ms. Thomas’ former position as<br />

Assistant Executive Director or assistant<br />

chief administrator for the Police and Fire<br />

Retirement System is David Cetlinski.<br />

David has been with the <strong>PFRS</strong> in varying<br />

roles since 1994.<br />

<strong>PFRS</strong> Board Chairman Matt Gnatek said<br />

that Ms. Thomas was the “obvious and best”<br />

choice to replace Mr. Stampor. Both the<br />

<strong>PFRS</strong> and GRSD Boards voted in favor of her<br />

appointment to the expanded role of overseeing<br />

the administration of the General Retirement<br />

System and its 6,800 active and 11,900 retired<br />

members as well as the 4,000 active and 8,000<br />

<strong>PFRS</strong> <strong>system</strong> members.<br />

The Police and Fire Retirement System is<br />

currently comprised of a 14-member Board<br />

of Trustees that oversees the $3.5 billion fund<br />

serving 8,000 retired <strong>police</strong> and <strong>fire</strong> and 4,000<br />

active duty first responders.<br />

“Cynthia is very bright, highly organized,<br />

dedicated and very effective in administering<br />

the day-to-day business of the Retirement<br />

Systems and we are delighted that she will step<br />

into the shoes of Walter Stampor who served<br />

the <strong>system</strong> well for all these years. We wish<br />

Walter a well-earned <strong>retirement</strong> and welcome<br />

Cynthia to this expanded role,” Gnatek said.<br />

Facts, Did you know that…<br />

While the General Retirement System and<br />

Police and Fire Retirement System of the City<br />

of Detroit are two separate and independent<br />

entities established under the City of Detroit<br />

Charter, on select and specific opportunities they<br />

may choose to invest in the same investment<br />

opportunities presented to and approved by<br />

their respective boards.<br />

The Police and Fire Retirement System of the City<br />

of Detroit was founded under City Charter and<br />

is the fiduciary for the pensions of all <strong>police</strong> and<br />

<strong>fire</strong> personnel. As of 2012 there are some 4,000<br />

active members and more than 8,000 retirees in<br />

the <strong>system</strong>. The <strong>PFRS</strong> is a separate entity from<br />

the city’s General Retirement System. For more<br />

information please visit www.<strong>PFRS</strong>Detroit.org.<br />

The General Retirement System is currently<br />

comprised of a 10-member board of trustees<br />

that has oversight for a $2.4 billion trust<br />

representing 6,800 active members and more<br />

than 11,500 retirees. The General Retirement<br />

System of the City of Detroit is the fiduciary<br />

for the trust that pays the pensions of all<br />

general City of Detroit employees. There are<br />

currently 6,800 active members and more<br />

than 11,900 retirees in the General Retirement<br />

System. For more information, please visit<br />

www.rscd.org.<br />

Board Chairman Matt Gnatek and<br />

outgoing Chairman Sean Neary<br />

In mid-summer, incoming Chairman Matt<br />

Gnatek took the gavel from outgoing Chairman<br />

Sean Neary, who continues to serve on the Board<br />

as a Trustee. Gnatek’s term runs through June of<br />

2013. The Vice Chairman of the Board is George<br />

Orzech, an elected trustee who represents active<br />

duty <strong>fire</strong> fighters. Gnatek is a Detroit Police<br />

Detective and Orzech is a Batallion Chief in the<br />

Fire Department.<br />

Newly elected Trustees include retiree<br />

representatives Michael Simon, <strong>fire</strong> department;<br />

and Louis Sinagra, <strong>police</strong> department, each of<br />

whom were elected by their respective retiree<br />

members in a formal election process this summer.<br />

Also joining the Board as Trustees by<br />

appointment from Mayor Dave Bing are:<br />

Medina Noor, Michael Bridges, Angela James<br />

and Lamont Satchel.

Chairman’s Message from Matt cont.<br />

We welcome anyone to attend our weekly meetings every Thursday at 9 a.m.<br />

and encourage everyone to visit the website and learn the facts about your<br />

Pension Fund.<br />

outright defrauded. We are working with advisors and legal counsel to<br />

recover any assets in these cases. Make no mistake, we are being relentless in<br />

the pursuit of asset recovery and bringing any wrongdoers to justice.<br />

“...all of us – Trustees<br />

and Staff – agree on<br />

one thing to preserve<br />

and protect the fund”<br />

There are as many<br />

issues facing the Board<br />

this season as there are<br />

leaves falling from the<br />

trees. We are utilizing<br />

our in-house investment<br />

resources and staff and<br />

have secured the best<br />

financial advisors in the<br />

industry after a lengthy Request For Proposal process. We are raking through<br />

every aspect of the fund to make certain it is operating in your best interests.<br />

We are dealing with the global economic crisis as well as our own troubled<br />

city financial issues. As Police and Fire Fighters, we are dealing with<br />

imposed new City work rules and their impact. As your elected professional<br />

representatives you should know that we have your back.<br />

I am often asked about “bad investments” and newspaper articles of the<br />

past citing scandalous material. Let me say this, the Board had made a few<br />

isolated investments in the past that did not meet with our expectations.<br />

It’s fair to say that in even rarer cases the Board may have been misled or<br />

While these few matters of the past made headlines, the overwhelming<br />

majority of good investments and good news doesn’t seem to be of news<br />

interest. Example, our Targeted Investment Fund received substantial<br />

positive media exposure around the country but only a few publications in<br />

Detroit even mentioned it. We seem to be pretty good at focusing on the<br />

negative here and ignoring the positive altogether.<br />

Your Board and staff is operating in the most transparent manner possible.<br />

We are operating under a very stringent Ethics Policy, Governance Policy<br />

and have zero tolerance for any unethical behavior. The good news is that<br />

we are 99% funded and the annuity rate for the current year is 5.5%. Our<br />

investments are yielding good returns in a tough economy. We are doing<br />

better than most of the public pension funds in Michigan and those of other<br />

cities, counties and states. We pledge to keep this high standard of conduct<br />

and good investments going and welcome your comments and questions.<br />

Please write me at MGnatek@rscd.org if you have any specific questions that<br />

need to be addressed, visit us at www.pfrs.org or contact our staff directly at<br />

313-224-3362.<br />

<strong>PFRS</strong> Board of Trustees<br />

Elected Employee Members:<br />

Matthew Gnatek - Chairman<br />

Police Sergeant<br />

Term Expires June 30, 2013<br />

George Orzech<br />

Battalion Fire Chief<br />

Vice Chair<br />

Term Expires June 30, 2014<br />

Sean Neary<br />

Fire Sergeant<br />

Term Expires June 30, 2015<br />

Jeffrey Pegg<br />

Fire Fighter<br />

Term Expires June 30, 2013<br />

James Moore<br />

Police Lieutenant<br />

Term Expires June 30, 2014<br />

Mark Diaz<br />

Police Officer<br />

Term Expires June 30, 2015<br />

Elected Retired Members:<br />

Louis Sinagra<br />

Retired Police Trustee<br />

Term Expires June 30, 2015<br />

Michael Simon<br />

Retired Fire Trustee<br />

Term Expires June 30, 2015<br />

Ex-Officio Members:<br />

Dave Bing<br />

Mayor<br />

Angela James<br />

Mayor Appointee<br />

Lamont Satchel<br />

Mayor Appointee<br />

Alternate - Kirk Lewis<br />

Deputy Mayor<br />

Brenda Jones<br />

Council Designate<br />

City Council<br />

<strong>PFRS</strong> Executive Staff and Consultants<br />

Executive Director: Cynthia Thomas<br />

Assistant Executive Director: David Cetlinski<br />

Recording Secretary: Janet Lenear<br />

Medical Director: Reginald E. O’Neal, D.O.<br />

Legal Counsel: Joe Turner, Clark Hill<br />

Public Relations: Bruce Babiarz,<br />

BAB Associates, LLC<br />

Cheryl R. Johnson<br />

Finance Director<br />

Alternate - Tanya Stoudemire<br />

Michael Bridges<br />

Deputy Treasurer<br />

Medina Noor, Esq.<br />

Director Administrative Hearings<br />

Krystal Crittendon, Esq.<br />

Corporation Counsel<br />

Alternate - James Edwards, Esq<br />

Corporation Counsel

U.S. POSTAGE<br />

PAID<br />

DETROIT, MI 48201<br />

PERMIT NO. 788<br />

Police and Fire Retirement System Investments in Detroit<br />

properties sparks growth, buildings fully occupied cont.<br />

exactly what the intent of these investments were at a time when no one<br />

would touch City properties.”<br />

“Everyone is praising Dan Gilbert and Quicken Loans and other companies<br />

for moving downtown and they should,” said Gnatek. “We would<br />

appreciate acknowledgement that with Pension Fund monies wisely invested<br />

these buildings represent more than 40 stories of buildings with commercial<br />

space and apartments now occupied in the City. We are very proud of<br />

helping make this happen at a time when no one else would and the Board<br />

was criticized for throwing good money after bad.”<br />

Redico, owners of One Kennedy Square, refinanced the 10 story building<br />

paying a $3 million mezzanine loan off to the <strong>PFRS</strong> five months early. The<br />

building was refinanced for $27.3 million or $112 per square foot.<br />

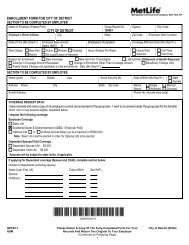

$ Millions<br />

$5,000<br />

How <strong>PFRS</strong> Pension Fund Compares<br />

Pension Funding Level:<br />

Wayne County..50%<br />

MERS................74.5%<br />

*<br />

D<strong>PFRS</strong>..............99.9%<br />

**<br />

(Your fund)<br />

*MERS stands for Michigan Employment Retirement System for the State of Michigan. Information is from December 31, 2010<br />

** Funding Levels as of June 30, 2011 (last fully audited fiscal year)<br />

“This building has been a great addition to the city skyline adjacent to<br />

Campus Martius Park,” said Redico CEO Dale Watchowski. “It likely<br />

would never have happened without the mezzanine financing from<br />

Invest Detroit and the Detroit Police and Fire Retirement System. We are<br />

very grateful for their vision and foresight in establishing their Targeted<br />

Investment Fund.”<br />

An added bonus to the <strong>PFRS</strong>, a news release on the success of the<br />

Targeted Investment Fund generated positive media coverage locally and in<br />

newspapers and on-line media throughout the country. It should be noted<br />

that the <strong>PFRS</strong> and GRS are among the few funds that have invested in local<br />

properties to stimulate growth in the City of Detroit.<br />

$4,500<br />

$4,000<br />

$3,500<br />

$3,000<br />

$2,500<br />

$2,000<br />

$1,500<br />

$1,000<br />

$500<br />

$0<br />

80<br />

Actuarial Accurued<br />

Liability<br />

82 84 86 80 88 90 92 94 96 98 00 02 04 06 08 10 11