crisil report - Diamines And Chemicals Limited

crisil report - Diamines And Chemicals Limited

crisil report - Diamines And Chemicals Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Diamines</strong> and <strong>Chemicals</strong> Ltd<br />

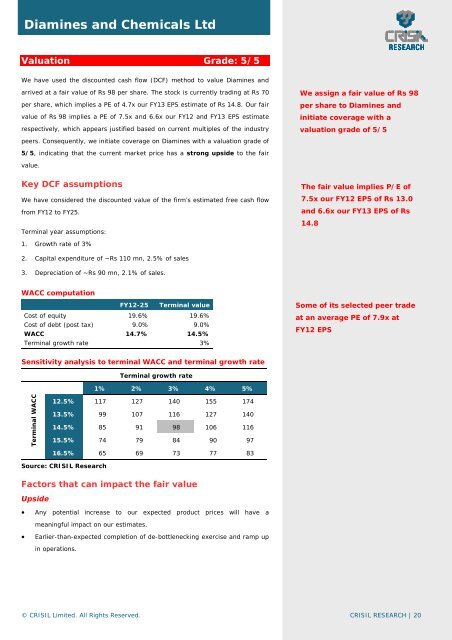

Valuation Grade: 5/5<br />

We have used the discounted cash flow (DCF) method to value <strong>Diamines</strong> and<br />

arrived at a fair value of Rs 98 per share. The stock is currently trading at Rs 70<br />

per share, which implies a PE of 4.7x our FY13 EPS estimate of Rs 14.8. Our fair<br />

value of Rs 98 implies a PE of 7.5x and 6.6x our FY12 and FY13 EPS estimate<br />

respectively, which appears justified based on current multiples of the industry<br />

peers. Consequently, we initiate coverage on <strong>Diamines</strong> with a valuation grade of<br />

We assign a fair value of Rs 98<br />

per share to <strong>Diamines</strong> and<br />

initiate coverage with a<br />

valuation grade of 5/5<br />

5/5, indicating that the current market price has a strong upside to the fair<br />

value.<br />

Key DCF assumptions<br />

We have considered the discounted value of the firm’s estimated free cash flow<br />

from FY12 to FY25.<br />

Terminal year assumptions:<br />

The fair value implies P/E of<br />

7.5x our FY12 EPS of Rs 13.0<br />

and 6.6x our FY13 EPS of Rs<br />

14.8<br />

1. Growth rate of 3%<br />

2. Capital expenditure of ~Rs 110 mn, 2.5% of sales<br />

3. Depreciation of ~Rs 90 mn, 2.1% of sales.<br />

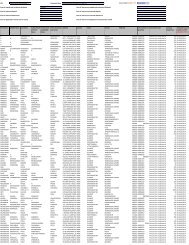

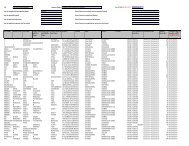

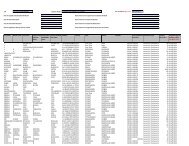

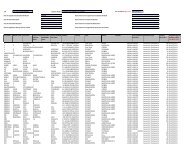

WACC computation<br />

FY12-25 Terminal value<br />

Cost of equity 19.6% 19.6%<br />

Cost of debt (post tax) 9.0% 9.0%<br />

WACC 14.7% 14.5%<br />

Terminal growth rate 3%<br />

Some of its selected peer trade<br />

at an average PE of 7.9x at<br />

FY12 EPS<br />

Sensitivity analysis to terminal WACC and terminal growth rate<br />

Terminal growth rate<br />

1% 2% 3% 4% 5%<br />

Terminal WACC<br />

12.5% 117 127 140 155 174<br />

13.5% 99 107 116 127 140<br />

14.5% 85 91 98 106 116<br />

15.5% 74 79 84 90 97<br />

16.5% 65 69 73 77 83<br />

Source: CRISIL Research<br />

Factors that can impact the fair value<br />

Upside<br />

• Any potential increase to our expected product prices will have a<br />

meaningful impact on our estimates.<br />

• Earlier-than-expected completion of de-bottlenecking exercise and ramp up<br />

in operations.<br />

© CRISIL <strong>Limited</strong>. All Rights Reserved. CRISIL RESEARCH | 20