Payee Disclosure Report 2012 - Crown Investments Corporation

Payee Disclosure Report 2012 - Crown Investments Corporation

Payee Disclosure Report 2012 - Crown Investments Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

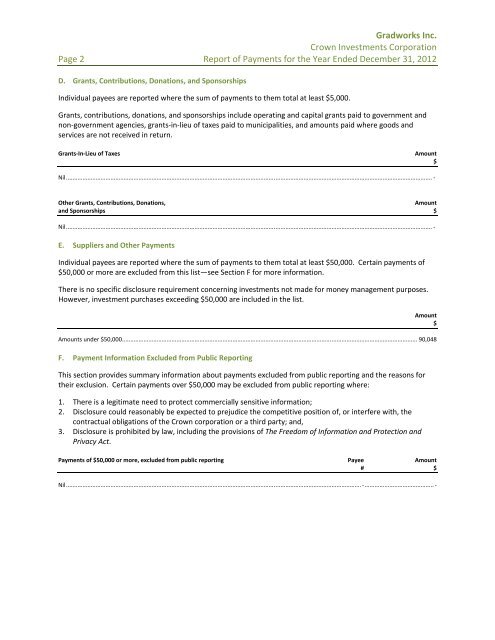

Gradworks Inc.<br />

<strong>Crown</strong> <strong>Investments</strong> <strong>Corporation</strong><br />

Page 2 <strong>Report</strong> of Payments for the Year Ended December 31, <strong>2012</strong><br />

D. Grants, Contributions, Donations, and Sponsorships<br />

Individual payees are reported where the sum of payments to them total at least $5,000.<br />

Grants, contributions, donations, and sponsorships include operating and capital grants paid to government and<br />

non‐government agencies, grants‐in‐lieu of taxes paid to municipalities, and amounts paid where goods and<br />

services are not received in return.<br />

Grants‐In‐Lieu of Taxes<br />

Amount<br />

$<br />

Nil .............................................................................................................................................................................................................................. ‐<br />

Other Grants, Contributions, Donations,<br />

Amount<br />

and Sponsorships $<br />

Nil .............................................................................................................................................................................................................................. ‐<br />

E. Suppliers and Other Payments<br />

Individual payees are reported where the sum of payments to them total at least $50,000. Certain payments of<br />

$50,000 or more are excluded from this list—see Section F for more information.<br />

There is no specific disclosure requirement concerning investments not made for money management purposes.<br />

However, investment purchases exceeding $50,000 are included in the list.<br />

Amount<br />

$<br />

Amounts under $50,000 ................................................................................................................................................................................... 90,048<br />

F. Payment Information Excluded from Public <strong>Report</strong>ing<br />

This section provides summary information about payments excluded from public reporting and the reasons for<br />

their exclusion. Certain payments over $50,000 may be excluded from public reporting where:<br />

1. There is a legitimate need to protect commercially sensitive information;<br />

2. <strong>Disclosure</strong> could reasonably be expected to prejudice the competitive position of, or interfere with, the<br />

contractual obligations of the <strong>Crown</strong> corporation or a third party; and,<br />

3. <strong>Disclosure</strong> is prohibited by law, including the provisions of The Freedom of Information and Protection and<br />

Privacy Act.<br />

Payments of $50,000 or more, excluded from public reporting <strong>Payee</strong> Amount<br />

# $<br />

Nil ................................................................................................................................................................................... ‐ .......................................... ‐