Diapositiva 1 - Comisión Chilena del Cobre

Diapositiva 1 - Comisión Chilena del Cobre

Diapositiva 1 - Comisión Chilena del Cobre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

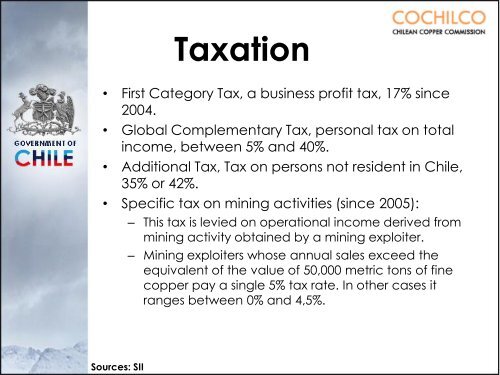

Taxation<br />

• First Category Tax, a business profit tax, 17% since<br />

2004.<br />

• Global Complementary Tax, personal tax on total<br />

income, between 5% and 40%.<br />

• Additional Tax, Tax on persons not resident in Chile,<br />

35% or 42%.<br />

• Specific tax on mining activities (since 2005):<br />

– This tax is levied on operational income derived from<br />

mining activity obtained by a mining exploiter.<br />

– Mining exploiters whose annual sales exceed the<br />

equivalent of the value of 50,000 metric tons of fine<br />

copper pay a single 5% tax rate. In other cases it<br />

ranges between 0% and 4,5%.<br />

Sources: SII