RATE SHEET CALCULATIONS - REVISED 5-21-10

RATE SHEET CALCULATIONS - REVISED 5-21-10

RATE SHEET CALCULATIONS - REVISED 5-21-10

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

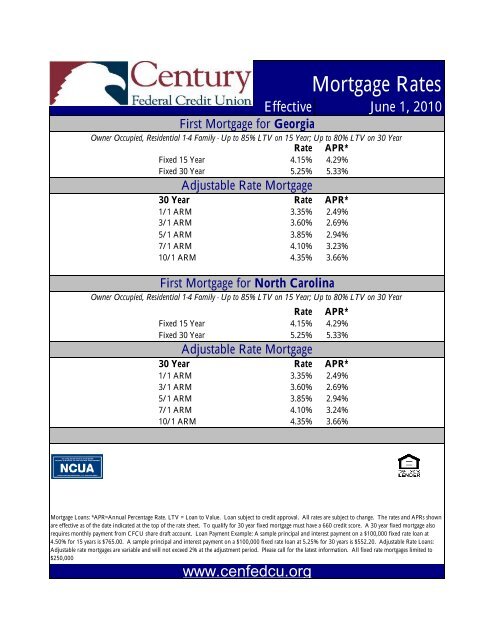

Owner Occupied, Residential 1-4 Family - Up to 85% LTV on 15 Year; Up to 80% LTV on 30 Year<br />

Rate APR*<br />

Fixed 15 Year 4.15% 4.29%<br />

Fixed 30 Year 5.25% 5.33%<br />

30 Year<br />

1/1 ARM<br />

3/1 ARM<br />

5/1 ARM<br />

7/1 ARM<br />

<strong>10</strong>/1 ARM<br />

Effective<br />

First Mortgage for Georgia<br />

Adjustable Rate Mortgage<br />

Rate APR*<br />

3.35% 2.49%<br />

3.60% 2.69%<br />

3.85% 2.94%<br />

4.<strong>10</strong>% 3.23%<br />

4.35% 3.66%<br />

Rate APR*<br />

Fixed 15 Year 4.15% 4.29%<br />

Fixed 30 Year 5.25% 5.33%<br />

30 Year<br />

1/1 ARM<br />

3/1 ARM<br />

5/1 ARM<br />

7/1 ARM<br />

<strong>10</strong>/1 ARM<br />

Mortgage Rates<br />

First Mortgage for North Carolina<br />

Owner Occupied, Residential 1-4 Family - Up to 85% LTV on 15 Year; Up to 80% LTV on 30 Year<br />

Adjustable Rate Mortgage<br />

Rate APR*<br />

3.35% 2.49%<br />

3.60% 2.69%<br />

3.85% 2.94%<br />

4.<strong>10</strong>% 3.24%<br />

4.35% 3.66%<br />

June 1, 20<strong>10</strong><br />

Mortgage Loans: *APR=Annual Percentage Rate. LTV = Loan to Value. Loan subject to credit approval. All rates are subject to change. The rates and APRs shown<br />

are effective as of the date indicated at the top of the rate sheet. To qualify for 30 year fixed mortgage must have a 660 credit score. A 30 year fixed mortgage also<br />

requires monthly payment from CFCU share draft account. Loan Payment Example: A sample principal and interest payment on a $<strong>10</strong>0,000 fixed rate loan at<br />

4.50% for 15 years is $765.00. A sample principal and interest payment on a $<strong>10</strong>0,000 fixed rate loan at 5.25% for 30 years is $552.20. Adjustable Rate Loans:<br />

Adjustable rate mortgages are variable and will not exceed 2% at the adjustment period. Please call for the latest information. All fixed rate mortgages limited to<br />

$250,000<br />

www.cenfedcu.org

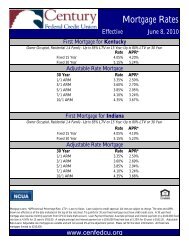

Owner Occupied, Residential 1-4 Family - Up to 85% LTV on 15 Year; Up to 80% LTV on 30 Year<br />

Rate APR*<br />

Fixed 15 Year 4.15% 4.29%<br />

Fixed 30 Year 5.25% 5.34%<br />

30 Year<br />

1/1 ARM<br />

3/1 ARM<br />

5/1 ARM<br />

7/1 ARM<br />

<strong>10</strong>/1 ARM<br />

Rate APR*<br />

3.35% 2.50%<br />

3.60% 2.70%<br />

3.85% 2.95%<br />

4.<strong>10</strong>% 3.24%<br />

4.35% 3.67%<br />

Mortgage Rates<br />

Effective June 1, 20<strong>10</strong><br />

First Mortgage for Texas<br />

Adjustable Rate Mortgage<br />

Mortgage Loans: *APR=Annual Percentage Rate. LTV = Loan to Value. Loan subject to credit approval. All rates are subject to change. The rates and APRs shown are<br />

effective as of the date indicated at the top of the rate sheet. To qualify for 30 year fixed mortgage must have a 660 credit score. A 30 year fixed mortgage also requires<br />

monthly payment from CFCU share draft account. Loan Payment Example: A sample principal and interest payment on a $<strong>10</strong>0,000 fixed rate loan at 4.50% for 15<br />

years is $765.00. A sample principal and interest payment on a $<strong>10</strong>0,000 fixed rate loan at 5.25% for 30 years is $552.20. Adjustable Rate Loans: Adjustable rate<br />

mortgages are variable and will not exceed 2% at the adjustment period. Please call for the latest information. All fixed rate mortgages limited to $250,000.<br />

www.cenfedcu.org

First Mortgage for Kentucky<br />

Owner Occupied, Residential 1-4 Family - Up to 85% LTV on 15 Year; Up to 80% LTV on 30 Year<br />

Rate APR*<br />

Fixed 15 Year 4.15% 4.30%<br />

Fixed 30 Year 5.25% 5.34%<br />

30 Year<br />

1/1 ARM<br />

3/1 ARM<br />

5/1 ARM<br />

7/1 ARM<br />

<strong>10</strong>/1 ARM<br />

Effective<br />

Adjustable Rate Mortgage<br />

Mortgage Rates<br />

Rate APR*<br />

3.35% 2.50%<br />

3.60% 2.70%<br />

3.85% 2.95%<br />

4.<strong>10</strong>% 3.24%<br />

4.35% 3.67%<br />

June 1, 20<strong>10</strong><br />

First Mortgage for Indiana<br />

Owner Occupied, Residential 1-4 Family - Up to 85% LTV on 15 Year; Up to 80% LTV on 30 Year<br />

Rate APR*<br />

Fixed 15 Year 4.15% 4.29%<br />

Fixed 30 Year 5.25% 5.33%<br />

30 Year<br />

1/1 ARM<br />

3/1 ARM<br />

5/1 ARM<br />

7/1 ARM<br />

<strong>10</strong>/1 ARM<br />

Adjustable Rate Mortgage<br />

Rate APR*<br />

3.35% 2.50%<br />

3.60% 2.69%<br />

3.85% 2.94%<br />

4.<strong>10</strong>% 3.24%<br />

4.35% 3.66%<br />

Mortgage Loans: *APR=Annual Percentage Rate. LTV = Loan to Value. Loan subject to credit approval. All rates are subject to change. The rates and APRs<br />

shown are effective as of the date indicated at the top of the rate sheet. To qualify for 30 year fixed mortgage must have a 660 credit score. A 30 year fixed<br />

mortgage also requires monthly payment from CFCU share draft account. Loan Payment Example: A sample principal and interest payment on a $<strong>10</strong>0,000 fixed<br />

rate loan at 4.50% for 15 years is $765.00. A sample principal and interest payment on a $<strong>10</strong>0,000 fixed rate loan at 5.25% for 30 years is $552.20. Adjustable<br />

Rate Loans: Adjustable rate mortgages are variable and will not exceed 2% at the adjustment period. Please call for the latest information. All fixed rate<br />

mortgages limited to $250,000.<br />

www.cenfedcu.org