Kaiser Permanente Health Plan Northern California Region

Kaiser Permanente Health Plan Northern California Region

Kaiser Permanente Health Plan Northern California Region

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

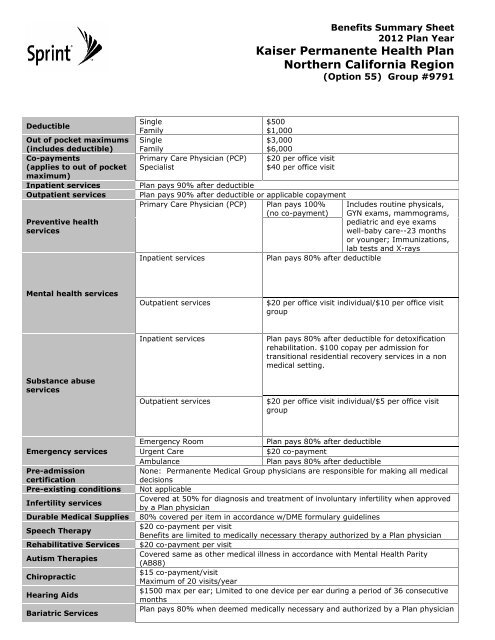

Benefits Summary Sheet<br />

2012 <strong>Plan</strong> Year<br />

<strong>Kaiser</strong> <strong>Permanente</strong> <strong>Health</strong> <strong>Plan</strong><br />

<strong>Northern</strong> <strong>California</strong> <strong>Region</strong><br />

(Option 55) Group #9791<br />

Deductible<br />

Single<br />

Family<br />

$500<br />

$1,000<br />

Out of pocket maximums Single<br />

$3,000<br />

(includes deductible) Family<br />

$6,000<br />

Co-payments<br />

Primary Care Physician (PCP) $20 per office visit<br />

(applies to out of pocket<br />

maximum)<br />

Specialist<br />

$40 per office visit<br />

Inpatient services <strong>Plan</strong> pays 90% after deductible<br />

Outpatient services <strong>Plan</strong> pays 90% after deductible or applicable copayment<br />

Primary Care Physician (PCP) <strong>Plan</strong> pays 100% Includes routine physicals,<br />

(no co-payment) GYN exams, mammograms,<br />

Preventive health<br />

pediatric and eye exams<br />

services<br />

well-baby care--23 months<br />

or younger; Immunizations,<br />

lab tests and X-rays<br />

Inpatient services<br />

<strong>Plan</strong> pays 80% after deductible<br />

Mental health services<br />

Substance abuse<br />

services<br />

Outpatient services $20 per office visit individual/$10 per office visit<br />

group<br />

Inpatient services<br />

<strong>Plan</strong> pays 80% after deductible for detoxification<br />

rehabilitation. $100 copay per admission for<br />

transitional residential recovery services in a non<br />

medical setting.<br />

Outpatient services $20 per office visit individual/$5 per office visit<br />

group<br />

Emergency Room <strong>Plan</strong> pays 80% after deductible<br />

Emergency services Urgent Care $20 co-payment<br />

Ambulance <strong>Plan</strong> pays 80% after deductible<br />

Pre-admission<br />

None: <strong>Permanente</strong> Medical Group physicians are responsible for making all medical<br />

certification<br />

decisions<br />

Pre-existing conditions Not applicable<br />

Infertility services<br />

Covered at 50% for diagnosis and treatment of involuntary infertility when approved<br />

by a <strong>Plan</strong> physician<br />

Durable Medical Supplies 80% covered per item in accordance w/DME formulary guidelines<br />

Speech Therapy<br />

$20 co-payment per visit<br />

Benefits are limited to medically necessary therapy authorized by a <strong>Plan</strong> physician<br />

Rehabilitative Services $20 co-payment per visit<br />

Autism Therapies<br />

Covered same as other medical illness in accordance with Mental <strong>Health</strong> Parity<br />

(AB88)<br />

Chiropractic<br />

$15 co-payment/visit<br />

Maximum of 20 visits/year<br />

Hearing Aids<br />

$1500 max per ear; Limited to one device per ear during a period of 36 consecutive<br />

months<br />

Bariatric Services<br />

<strong>Plan</strong> pays 80% when deemed medically necessary and authorized by a <strong>Plan</strong> physician

Choice of doctors and<br />

facilities<br />

Prescription drugs<br />

Customer service<br />

Member selects a Primary Care Physician (PCP)<br />

Generally no referrals are required. Please check with the plan regarding specialists.<br />

For provider listing, type www.kaiserpermanente.org in your web browser<br />

Retail $10 generic co-payment; $25 brand copayment/30<br />

day supply<br />

Mail $20 generic co-payment; $50 brand copayment/100<br />

day supply<br />

20% co-payment for testing supplies<br />

50% co-payment for drugs for the treatment of infertility (as part of and approved<br />

treatment) and sexual dysfunction (maximum dosage limit of 27 doses for 100-day<br />

supply)<br />

<strong>Kaiser</strong> Member Services:<br />

(800) 464-4000<br />

Life Events are events that affect or alter your life. It is important for you to<br />

understand the benefit choices that you make when you are first eligible and during<br />

subsequent annual enrollment periods, because your benefits are binding and cannot<br />

be changed unless you experience a qualified Life Event. These Qualified Life Events<br />

can be found in the Life Events Section of the Summary <strong>Plan</strong> Description, on i-<br />

Life Events<br />

Connect. To be eligible to make a Benefit Change, you must contact the Employee<br />

Help Line (EHL) to Request the Change during business hours CT, no later than the<br />

30 th calendar day after the date of the event (or 60 th calendar day after a<br />

Medicaid/CHIP-related Life Event). If you do not satisfy the enrollment<br />

requirements, coverage will not be added and no benefits for expenses incurred will<br />

be payable.<br />

Note: This represents a summary of coverage. Details in the Evidence of Coverage (EOC) govern in all cases.