Basel II and Credit Ratings - UBA Plc

Basel II and Credit Ratings - UBA Plc

Basel II and Credit Ratings - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Basel</strong> <strong>II</strong> <strong>and</strong> <strong>Credit</strong> <strong>Ratings</strong><br />

Andre J. Blaauw<br />

tools, etc. He was also a member<br />

of the Barclays Group Risk<br />

Technical committee, the<br />

oversight body in the Barclays<br />

group for all technical risk<br />

management frameworks<br />

implementation. During the 4<br />

years of <strong>Basel</strong> <strong>II</strong> implementation<br />

in South Africa he served as the<br />

chairman of the credit risk task<br />

identities. More recently, the fraudsters have become more sophisticated in<br />

creating authentic looking email IDs of the Central Bank of Nigeria <strong>and</strong><br />

Interswitch. They have also created websites that appear genuine to the ordinary<br />

consumer.<br />

Consumers must be aware that, BANKS AND CARD COMPANIES WOULD NEVER<br />

ASK FOR A CARDHOLDER'S PIN NUMBER <strong>and</strong> are therefore urged to call their<br />

bank on the BANK'S customer service line (not on the number provided on the<br />

fraudulent email!) <strong>and</strong> confirm the authenticity of the request. Consumers are<br />

advised to immediately delete such emails <strong>and</strong> advise friends to do the same.<br />

group of the accord<br />

implementation structure, lead by<br />

the SA central bank. Andre has<br />

been a regular presenter at<br />

conferences <strong>and</strong> international<br />

risk industry events. The World<br />

Bank invited him on two<br />

occasions to share his experience<br />

of <strong>Basel</strong> <strong>II</strong> implementation in<br />

South Africa with the central<br />

banks of other emerging markets<br />

at <strong>Basel</strong> <strong>II</strong> implementation<br />

planning events in Colombia <strong>and</strong><br />

Turkey.<br />

ASSET CLASSES<br />

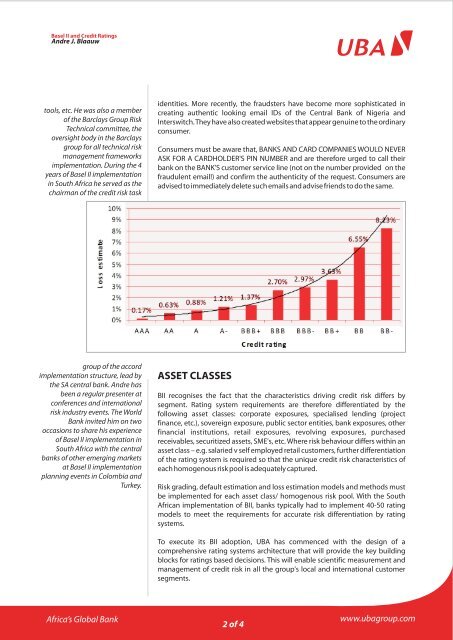

B<strong>II</strong> recognises the fact that the characteristics driving credit risk differs by<br />

segment. Rating system requirements are therefore differentiated by the<br />

following asset classes: corporate exposures, specialised lending (project<br />

finance, etc.), sovereign exposure, public sector entities, bank exposures, other<br />

financial institutions, retail exposures, revolving exposures, purchased<br />

receivables, securitized assets, SME's, etc. Where risk behaviour differs within an<br />

asset class – e.g. salaried v self employed retail customers, further differentiation<br />

of the rating system is required so that the unique credit risk characteristics of<br />

each homogenous risk pool is adequately captured.<br />

Risk grading, default estimation <strong>and</strong> loss estimation models <strong>and</strong> methods must<br />

be implemented for each asset class/ homogenous risk pool. With the South<br />

African implementation of B<strong>II</strong>, banks typically had to implement 40-50 rating<br />

models to meet the requirements for accurate risk differentiation by rating<br />

systems.<br />

To execute its B<strong>II</strong> adoption, <strong>UBA</strong> has commenced with the design of a<br />

comprehensive rating systems architecture that will provide the key building<br />

blocks for ratings based decisions. This will enable scientific measurement <strong>and</strong><br />

management of credit risk in all the group's local <strong>and</strong> international customer<br />

segments.<br />

Africa’s Global Bank<br />

2 of 4<br />

www.ubagroup.com