DolphinJuly-Aug 2012_LR.pdf - Jurong Shipyard Pte Ltd

DolphinJuly-Aug 2012_LR.pdf - Jurong Shipyard Pte Ltd

DolphinJuly-Aug 2012_LR.pdf - Jurong Shipyard Pte Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SCM : news<br />

Second Quarter <strong>2012</strong> Net Profit at $143 Million<br />

Sembcorp Marine reported a net profit of $143 million in the second quarter of <strong>2012</strong>, 5% lower from a year ago,<br />

due mainly to the timing in recognition of projects, the number of projects that achieved initial recognition as<br />

well as the value and design of the rig building projects.<br />

Turnover at $1,217 million in 2Q <strong>2012</strong> was 46% higher as<br />

compared to $831 million in 2Q 2011 due to the progressive<br />

recognition of projects. In particular, turnover from the rig building<br />

sector rose 66% from $400 million in 2Q 2011 to $664 million.<br />

The ship conversion and offshore segment turned in $364 million<br />

in revenue, 41% more year on year from $259 million. Turnover<br />

for the ship repair sector in 2Q <strong>2012</strong> at $179 million was 9%<br />

higher as compared with the corresponding period in 2011.<br />

<br />

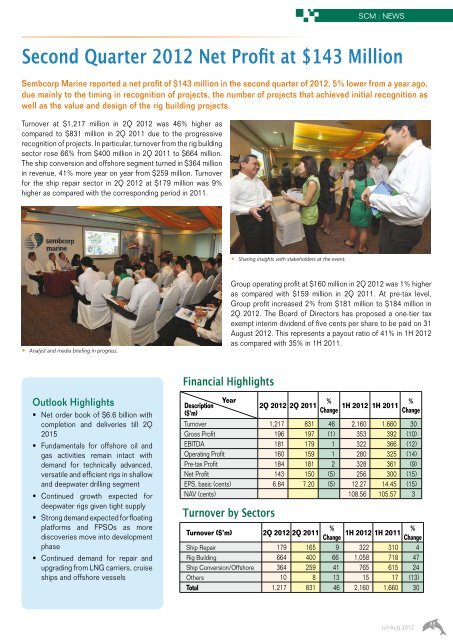

Sharing insights with stakeholders at the event.<br />

<br />

Analyst and media briefing in progress.<br />

Group operating profit at $160 million in 2Q <strong>2012</strong> was 1% higher<br />

as compared with $159 million in 2Q 2011. At pre-tax level,<br />

Group profit increased 2% from $181 million to $184 million in<br />

2Q <strong>2012</strong>. The Board of Directors has proposed a one-tier tax<br />

exempt interim dividend of five cents per share to be paid on 31<br />

<strong>Aug</strong>ust <strong>2012</strong>. This represents a payout ratio of 41% in 1H <strong>2012</strong><br />

as compared with 35% in 1H 2011.<br />

Outlook Highlights<br />

• Net order book of $6.6 billion with<br />

completion and deliveries till 2Q<br />

2015<br />

• Fundamentals for offshore oil and<br />

gas activities remain intact with<br />

demand for technically advanced,<br />

versatile and efficient rigs in shallow<br />

and deepwater drilling segment<br />

• Continued growth expected for<br />

deepwater rigs given tight supply<br />

• Strong demand expected for floating<br />

platforms and FPSOs as more<br />

discoveries move into development<br />

phase<br />

• Continued demand for repair and<br />

upgrading from LNG carriers, cruise<br />

ships and offshore vessels<br />

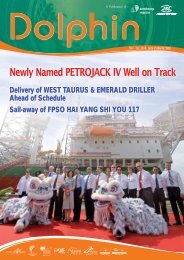

Financial Highlights<br />

Description<br />

($’m)<br />

Year<br />

2Q <strong>2012</strong> 2Q 2011<br />

%<br />

Change 1H <strong>2012</strong> 1H 2011 %<br />

Change<br />

Turnover 1,217 831 46 2,160 1,660 30<br />

Gross Profit 196 197 (1) 353 392 (10)<br />

EBITDA 181 179 1 322 366 (12)<br />

Operating Profit 160 159 1 280 325 (14)<br />

Pre-tax Profit 184 181 2 328 361 (9)<br />

Net Profit 143 150 (5) 256 300 (15)<br />

EPS, basic (cents) 6.84 7.20 (5) 12.27 14.45 (15)<br />

NAV (cents) 108.56 105.57 3<br />

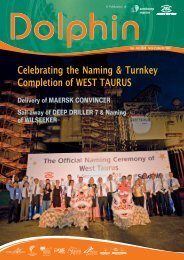

Turnover by Sectors<br />

Turnover ($’m) 2Q <strong>2012</strong> 2Q 2011<br />

%<br />

Change 1H <strong>2012</strong> 1H 2011 %<br />

Change<br />

Ship Repair 179 165 9 322 310 4<br />

Rig Building 664 400 66 1,058 718 47<br />

Ship Conversion/Offshore 364 259 41 765 615 24<br />

Others 10 8 13 15 17 (13)<br />

Total 1,217 831 46 2,160 1,660 30<br />

Jul-<strong>Aug</strong> <strong>2012</strong><br />

11