Amity SRI Company Profile - Halma & Smith

Amity SRI Company Profile - Halma & Smith

Amity SRI Company Profile - Halma & Smith

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Sustainability Assured<br />

In 2011/12 DS <strong>Smith</strong> recovered 1.8m tonnes of waste packaging from contracts with the likes of Tesco, Sainsbury M&S and Wm.<br />

Morrison. The company’s integrated model sees it collect and process waste direct from customers, which provides the raw material<br />

for its paper mills. In the UK, all raw fibre used in the manufacture of its corrugated case material (CCM) is sourced from waste product<br />

and this model is being replicated in continental Europe. Approximately 1.1 tonnes of waste are required to produce 1 tonne of new<br />

product, so there is very little waste. In plastic packaging, DS <strong>Smith</strong> has developed environmentally friendly liquids packaging, with the<br />

outer shell made from 100% recycled fibre and uses up to 70% less plastic than regular ‘blow-moulded’ jugs. The bottle is 100%<br />

recyclable and compostable.<br />

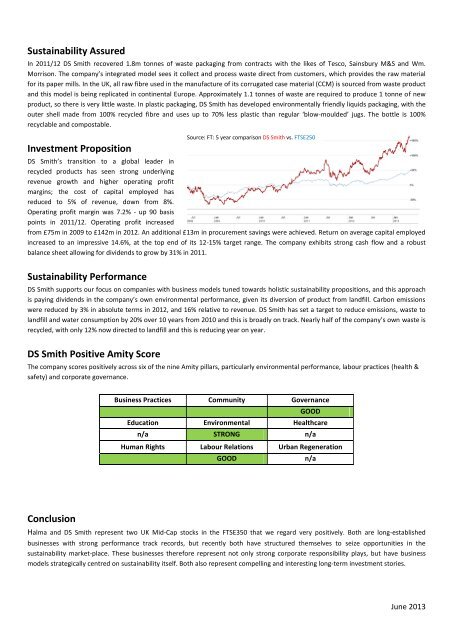

Investment Proposition<br />

DS <strong>Smith</strong>’s transition to a global leader in<br />

recycled products has seen strong underlying<br />

revenue growth and higher operating profit<br />

margins; the cost of capital employed has<br />

reduced to 5% of revenue, down from 8%.<br />

Operating profit margin was 7.2% - up 90 basis<br />

points in 2011/12. Operating profit increased<br />

from £75m in 2009 to £142m in 2012. An additional £13m in procurement savings were achieved. Return on average capital employed<br />

increased to an impressive 14.6%, at the top end of its 12-15% target range. The company exhibits strong cash flow and a robust<br />

balance sheet allowing for dividends to grow by 31% in 2011.<br />

Sustainability Performance<br />

DS <strong>Smith</strong> supports our focus on companies with business models tuned towards holistic sustainability propositions, and this approach<br />

is paying dividends in the company’s own environmental performance, given its diversion of product from landfill. Carbon emissions<br />

were reduced by 3% in absolute terms in 2012, and 16% relative to revenue. DS <strong>Smith</strong> has set a target to reduce emissions, waste to<br />

landfill and water consumption by 20% over 10 years from 2010 and this is broadly on track. Nearly half of the company’s own waste is<br />

recycled, with only 12% now directed to landfill and this is reducing year on year.<br />

DS <strong>Smith</strong> Positive <strong>Amity</strong> Score<br />

Source: FT: 5 year comparison DS <strong>Smith</strong> vs. FTSE250<br />

The company scores positively across six of the nine <strong>Amity</strong> pillars, particularly environmental performance, labour practices (health &<br />

safety) and corporate governance.<br />

Business Practices Community Governance<br />

GOOD<br />

Education Environmental Healthcare<br />

n/a STRONG n/a<br />

Human Rights Labour Relations Urban Regeneration<br />

GOOD<br />

n/a<br />

Conclusion<br />

<strong>Halma</strong> and DS <strong>Smith</strong> represent two UK Mid-Cap stocks in the FTSE350 that we regard very positively. Both are long-established<br />

businesses with strong performance track records, but recently both have structured themselves to seize opportunities in the<br />

sustainability market-place. These businesses therefore represent not only strong corporate responsibility plays, but have business<br />

models strategically centred on sustainability itself. Both also represent compelling and interesting long-term investment stories.<br />

June 2013